Critical Thinking Framework of Zakat Regulation to Support Tax

Compliances: Comparison of Indonesia and Malaysia

Provita Wijayanti

1

, Wahyu Setyawan

1

, Dian Esa Nugrahini

1

, Nurul Syuhada Baharuddin

2

and Nur Raihana Mohd Sallem

3

1

Faculty of Economics, Universitas Islam Sultan Agung, Semarang, Indonesia

2

Faculty of Business and Management, Universiti Teknologi MARA Cawangan Terengganu, Dungun, Indonesia

3

Faculty of Accountancy, Universiti Teknologi MARA Cawangan Terengganu, Dungun, Indonesia

Keywords: Zakat Regulation, Zakat and Tax Compliance.

Abstract: Indonesia and Malaysia have applied zakat regulation as an income tax deduction, but whether it has been

effectively implemented or not, it has still a big question mark. This study aims to develop framework of zakat

regulation to optimize zakat and tax compliances. Therefore, this study tries to deepen about how does the

implementation of zakat regulation as an income tax deduction in Indonesia and Malaysia, and how does the

response of people who are obliged to pay zakat and tax compliance with this regulation. The population in

this study were academicians in the field of Islamic accounting and finance, Committee of Islamic Economic

Society and Zakat management organization. Future research will include validating the proposal framework

using an empirical data.

1 INTRODUCTION

Indonesia is the largest Muslim country in the world.

Based on the data of Global Religious Future, the

Indonesian population of Muslims in 2010 reached

209.12 million people or about 87% of the total

population. Indonesian Muslims are expected to reach

229.62 million in 2020 and will be the world's largest

possible zakat acceptance for 280 trillion Rupiah

according to BAZNAS (zakat receiving institution).

It was delivered by Wahyu to Kompas.com when the

World Zakat Forum in Bandung, Tuesday

(Kompas.com 5/11/2019).

Based the Ministry of Religious Affairs data, the

potential of zakat in Indonesia reached Rp 217

trillion, but only accumulated Rp 6 trillion per year or

0.2 percent in 2018. On the other hand, as a good

citizen, besides being a muzakki (zakat payer)

Muslims also have an obligation to pay taxes

(taxpayers). In the APBN (state budget) 2018, tax as

the main source of targeted state revenue is

accumulated at Rp 1,681.1 trillion. Both Zakat and

tax, have an important role in community, that is to

improve people's welfare and prosperity. However,

people consider that if they have paid zakat, then they

are no longer required to pay taxes. Indeed, the

position

of zakat and tax is not a substitute for each

other, but they actually complement each other.

Islam has clear and strict rules to be implemented

throughout the ages for government to govern the

country fairly and wisely, in order to achieve the

society welfare. Not only with zakat, but Islam also

allows the government to obtain a source of funds to

manage the country with taxes (Suprayitno, et al.,

2013).

Tax is a source of the country’s revenue that is

very important to support the financing of

development sourced from domestic. Zakat and tax

have the same opportunities as state tools to achieve

the country’s goals. Both of them are significant for

society welfare, because of the fact that the majority

of Indonesian are Muslim and the other fact that the

tax is the excellent revenue (Logawali, et al., 2018).

Many people try to equate between zakat and tax.

So the consequence is when someone has paid the tax,

it is considered a as paying zakay as well. In fact,

zakat is one of the pillars of Islam and must be done

by Muslims for those who meet the necessary criteria

of wealth. Meanwhile tax is the obligation

administered by the Government to the eligible

person being taxed. Both payments in Islam must be

paid to the government. Zakat is used to develop the

Islamic economy and help poor people to live as they

should. Taxes are used for the development of

Wijayanti, P., Setyawan, W., Nugrahini, D., Baharuddin, N. and Sallem, N.

Critical Thinking Framework of Zakat Regulation to Support Tax Compliances: Comparison of Indonesia and Malaysia.

DOI: 10.5220/0010116000002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 145-151

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

145

countries such as infrastructure development and

others.

The fact that the largest tax subjects are Muslim

that amounts to 75% of Indonesia's total population,

the government seeks to minimize the incriminated

double obligation. In order to solve this issue, the

government makes tax and zakat as obligations that

can be carried out by the Muslim without give them

any burden. The government created a rule that could

be a solution for the double obligation of zakat and

tax. This is listed in article 22 of law number 23 of

year 2011 on amendment of article 14 paragraph (3)

of law No. 38 year 1999 about zakat management, as

follows:

“Zakat that has been paid to the body of zakat

receiving institution is deducted from the

profit/income of taxable waste from the taxpayers in

accordance with the prevailing laws and

regulations”

This law shows that the government tries to play

an active role in creating the implementation of its

people's religious obligations by making the element

of zakat as one of tax relief at the income tax (PPh) in

Indonesia (Ghaffari, 2017).

In Malaysia, the government has also tried to

integrate zakat and income tax by providing tax

deductions on zakat that has been paid by Muslims,

and it is unlimited. The amount of zakat paid will be

deducted from the tax due, on condition, the zakat is

paid in the same year of assessment and the proof /

receipt is from the State Islamic Religious

Department / Council in Malaysia (Suprayitno, et al.,

2013).

Zakat in Malaysia is managed by the federal state

with full rights and authority. So Zakat is not

compiled and distributed centrally, each federal state

has a private company-of zakat private management

and Baitull Maal or zakat institution under the state

Islamic religious council. In some states the zakat

collection and channelling is implemented by these

two institutions. Zakat collection is done by a private

company that is under the Minister of Islamic

religion, while the distribution is done by Baitull

Maal.

The regulation of zakat as an income tax

deduction conducted by the Government of Indonesia

and Malaysia is expected to attract people to deposit

zakat and taxes to the government and official zakat

receiving institutions. So, the funds from zakat and

taxes can be managed well for the benefit of the

community.

Both Indonesia and Malaysia have adopted the

regulation of zakat as an income tax deduction, but it

has been effective or not in terms of its

implementation is still a big question mark.

Therefore, this research is trying to explore how does

the implementation of zakat regulation as an income

tax deduction in Indonesia and Malaysia, as well as

how does the response of zakat payer toward this

regulation.

The objective of this critical review is to analyze

the zakat regulation as an income tax deduction

towards the compliance of zakat payers and taxpayers

in Indonesia and Malaysia.

2 LITERATURE REVIEW

2.1 Zakat

In terms of language, the word Zakat is the basic word

(Mashdar) of Zakaa which means blessing, growing,

clean, and good. The other meaning of the word

zakaa, as used in the Qur'an is "chaste of sin". Zakat

is a certain right that is obliged by God obliged toward

some of the Muslims’ wealth, that are allocated for

the poor and Mustahik (people who are entitled to

accept zakat) according to provisions that have been

established by Islamic rules. Zakat is a sign of

Gratitude for God's favour, a way for a servant to be

closer to God and cleanse himself from his wealth

(Ghaffari, 2017).

In general, Zakat is divided into two kinds: first,

zakat related to the body or called Zakat Fitrah. Zakat

Fitrah is an expense that must be done by every

Muslim who has excess wealth, issued from the

beginning of Ramadhan month until before Idul Fitri.

Second, zakat related to property or Zakat Maal. A

wealth must be issued for Zakat when fulfilling the

obligatory provisions of zakat (when it fulfils nisab,

rate, and time). The target of Zakat is addressed to

eight groups or called asnaf. It is explained in the

Qur'an (QS. 9: At-Tawbah: 60). The passage

describes the target of zakat. Zakat is addressed to

eight groups. The 8 groups are the needy, the poor,

the Amil (people who administer zakat), the Muallaf

(people who newly embraced Islam), the Riqab

(people who are free from slavery), the Garim (people

who suffer debt and need help), Sabilillah (people

who strive for Allah for community) and Ibn Sabil

(travellers on a permissible journey).

This writing focuses more on Zakat Maal

(especially zakat income or profession) that has

undergone development in the modern economy.

Zakat income or profession is a zakat that is issued

from a profession income (the profession) when it

reaches the minimum amount of wealth to be eligible

to pay zakat (nisab.) The examples of profession are

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

146

civil servants, private employees, consultants,

doctors, notary, accountants, artists, and

entrepreneurs.

The rate of zakat of profession is based on the

zakat of gold and silver, which is 2.5% of all gross

income. The hadith that states the rate of zakat of gold

and silver is: "If you have 20 gold dinar, and have

reached one year, then the Zakat is a half of dinar

(2.5%)" narrated by Ahmad, Abu Dawud, and Al-

Bayhaqi.

2.2 Tax

Taxes are mandatory dues paid by taxpayers (people

who pay tax) to the government under law and the

results are used to finance the public expenditure of

the government with no retaliation shown directly.

According to sharia, tax in Arabic is called Dharibah,

which means obliging, assigning, determining. The

scholars used the expressions of Dharibah to refer to

the wealth collected as liability. The two scholars who

define tax are Yusuf Qardhawi in his books Fiqh az-

Zakah and Gazi Inayah in his books Al-Iqtishad

azZakah wa az-Dharibah, which is briefly described

as follows:

1. Yusuf Qardhawi stated:

Tax is an obligation towards the taxpayer, which

must be deposited to the State in accordance with

the provisions, without without getting reciprocity

from the state, and the outcome is to finance the

general expenditures on the one party and to

economic, social, political and other objectives

that the country wants to achieve.

2. Gazi Inayah suggested:

Tax is the obligation to pay cash which is

determined by the Government without any

particular reward. These government provisions

are in accordance with the ability of the wealth

owner and allocated to suffice food needs in

general and to meet financial political demands

for the government.

2.3 The Comparison between Zakat

and Tax

From the previous explanation about the definition of

tax and zakat, it can be concluded that between zakat

and tax there are similarities and differences.

According to Ghaffari (2017), the similarity between

zakat and tax are:

1. The element of coercion and obligation, which is

a way to generate tax also exists in zakat which

must be paid annually. If a Muslim is late in

paying zakat because his faith and Islam are not

yet strong, Islam will force him. Besides, Islam

will fight those who are reluctant to pay zakat if

they have power.\

2. The tax must be paid to the government through a

central or regional institution. Zakat is also the

case because it must be submitted to the

government through amil zakat.

3. One of the tax provisions is the absence of certain

benefits. Taxpayers only get various facilities to

be able to carry out their business activities. Zakat

is also the case. Zakat payers do not get a reward.

They pay zakat as Muslims and only get

protection, guarding and solidarity from the

community. Zakat payers must give their wealth

to help the community in overcoming poverty,

weakness and life suffering. Also, zakat benefits

for the sake of the upholding of Allah's sentence

and truth on the face of the earth.

4. Tax in the modern era has social, economic, and

political objectives in addition to financial goals.

Zakat has farther and broader goals that are farther

and broader on personal and community life.

2.4 Previous Research

In this study, researchers used several related

references from previous researchers. These are

summarized in table 2 below:

Table 1: Previous Research.

No Re-

searcher

Variable Results

11

Logawali, et

al. (2018)

Zakat as a

deduction of

taxable income

The implementation of zakat

as a deduction of taxable

income in the Ministry of

Religion in the district of

Gowa increases awareness

and honesty of the society

for paying zakat. Therefore,

it has a beneficial impact on

the state revenue.

22

Ghaffari,

Muhammad

Audi (2017)

Taxpayer’s

response

Zakat as a

deduction of

taxable income

Taxpayer’s response has a

significant positive impact

on zakat as a deduction of

taxable income.

33

Obaidullah,

Mohammed

(2016)

An alternative

method of

calculating zakat

in business

It does not require any

transformation on issues of

zakat incentives and

disharmony between

accounting and zakat-taxes

in business because these

issues have equally strong

sharia fundamental.

44

Suprayitno,

et al. (2013)

Zakat

administration

policy

Tax revenue

Zakat has a significant

positive impact on tax

revenue.

Source: Previous research (2019)

Critical Thinking Framework of Zakat Regulation to Support Tax Compliances: Comparison of Indonesia and Malaysia

147

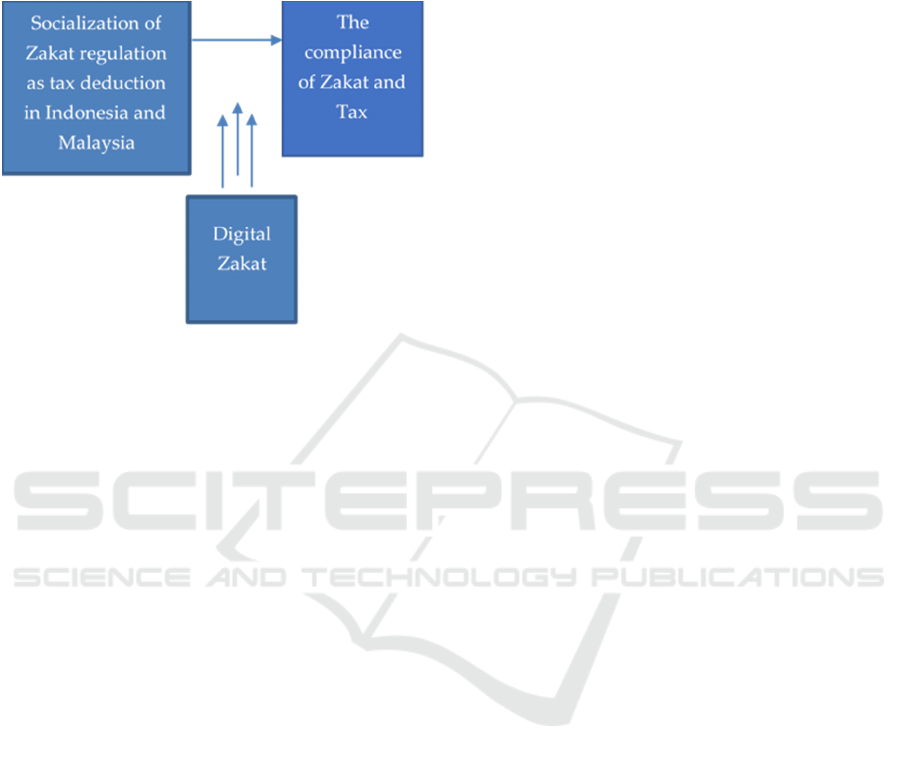

2.5 Research Framework

Following is the research model in developing the

optimization framework of zakat and tax compliance

in Indonesia and Malaysia.

Figure 1: Research Model.

3 DISCUSSION

3.1 The Development of Zakat in

Indonesia

According to Law No. 23 of 2011 about zakat

management, there are two institutions in Indonesia

which have the task of managing, distributing, and

utilizing zakat, namely the National Amil Zakat

Agency/ Badan Amil Zakat Nasional (BAZNAS) and

the Amil Zakat Institution/ Lembaga Amil Zakat

(LAZ).

BAZNAS is an institution formed by the central

government to carry out the task of managing zakat

nationally. It is institutionally independent, non-

structural, domiciled in Jakarta and responsible to the

President through the Minister of Religion. Provincial

and district BAZNAS were formed to support the

implementation of zakat management at the

provincial and district/ city level. In carrying out its

duties and functions, BAZNAS, provincial

BAZNAS, and district BAZNAS can establish a

Zakat Management Unit/ Unit Pengelola Zakat (UPZ)

in government agencies, state-owned enterprises,

regionally owned enterprises, private companies, and

representatives of the Republic of Indonesia abroad.

They can also form UPZ at the sub-districts, villages,

and other places.

On the other hand, LAZ is a zakat management

institution that formed on the initiative of the

community. Currently, there are 17 national scale

LAZs that have obtained licenses from the Ministry

of Religion, including NU CARE LAZISNU (amil

zakat institution under the auspices of NU), Lazismu

(amil zakat institution under the auspices of

Muhammadiyah), Dompet Dhuafa, DT Peduli, and

Rumah Zakat.

Amil Zakat Institutions were confirmed, fostered

and protected by the government. In carrying out its

duties, LAZ must provide reports to the government

according to their level. Inauguration of LAZ is

carried out by the central government through the

Ministry of Religion based on the proposal of LAZ,

who has fulfilled the inaugural requirements.

Differences between LAZ and BAZNAS also

shows on their operations. BAZNAS is funded by

APBN/ APBD and amil rights to carry out its

operations. Whereas LAZ is only financed by amil

rights from the total collected zakat.

Zakat in Indonesia does not manage effectively

yet. The Indonesian society, particularly the Muslim

community, is still less aware of the role of zakat for

the economy. According to Dompet Dhuafa, the

potential of zakat in Indonesia to reaching Rp. 217

trillion. However, the realization of zakat is only

around Rp. 2.73 trillion. It means that only about 1%

of zakat is collected from the potential zakat in

Indonesia. (Kompas.com 2/7/16). Therefore, the

community must be re-encouraged regarding their

understanding of zakat. Most of the community

members understood that zakat is only in the form of

zakat fitrah, which is issued only during Ramadan. In

fact, types and purposes of zakat are more critical to

be educated to the community.

3.2 The Development of Zakat in

Malaysia

Malaysia is a unique example in the zakat

management system, where the authority to collect

and distribute zakat is placed in each region.

According to the regional constitution, all religious

issues, including the management of zakat are handed

over to the jurisdiction of each of the 13 regions

managed by a regional Islamic Religious Council.

Thus, each region has different zakat management

law from other regions (Suprayitno, et al, 2013). This

turned out to cause some problems of coordination

between regions. There were differences in the

determination of nishb, zakah compulsory assets, and

even the definition of eight ashnaf who were entitled

to receive zakat. Nevertheless, judicially zakat

legislation in Malaysia is one of the best in terms of

clarity and detail regarding various methods and

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

148

procedures that must be taken in the management of

zakat.

Before 1980, zakat was only required for

agricultural products such as rice, although the weight

of the nishab was not equal in all areas of the

fellowship. In 1989, the first zakat agency was

established for 13 regional governments. In 1986, the

implementation of zakat regulation was issued and

became the foundation of zakat management for all

regions of Malaysia.

Then Malaysia established the Zakat Collection

Center (PPZ) in 1991. It aims not only to socialize

zakat but also to foster public awareness of the

importance and impact of zakat. The results were

impressive, where zakat receipts jumped six times the

amount previously collected. This result shows that

the approach used is very effective. Before the PPZ,

the community considered that the obligation to pay

zakat had been paid off with the payment of zakat

fitrah.

The campaign and socialization of zakat

intensively result in the rise in the level of collection

of zakat maal. Nevertheless, there is an opinion that

the government should apply a penalty mechanism to

optimize the collection of zakat maal. In general, the

Law imposes a penalty of 1,000 ringgit and/ or

imprisonment for six months if it is proven that there

is fraudulent payment of zakat. However, the results

of a study show that people are more likely to choose

to pay penalties rather than pay zakat periodically.

This certainly needs to be overcome with a variety of

policy frameworks and more effective law

enforcement. Therefore, in 2004, Malaysia

inaugurated the Department of Zakat and Hajj

(JAWHAR) under the auspices of the Prime

Minister's Department.

In Malaysia, zakat is managed by each state with

full rights and authority. It is not collected and

distributed centrally. Each state has an institution of

zakat in the form of a private company and baitul mall

or zakat power agency. These institutions are under

the authority of the State Islamic Religious Council

with their respective basis, objectives and functions.

In some states, the collection and distribution of zakat

are carried out by these two institutions. Zakat

collection is carried out by a private company under

the Ministry of Religion, while the distribution is

carried out by Baitull Maal.

The zakat management system in Malaysia can be

categorized into three types. First, the corporate

system, where the collection and distribution of zakat

is managed by a corporation. This system was

implemented in the regions of Selangor, Sarawak and

Penang. Second, the semi-corporate system, where

the company only manages the zakat collection

process, while the distribution process is handled by

the state government. This mechanism is applied in

Malacca, Negeri Sembilan, Pahang, and the federal

region. Third, the full management of zakat by the

state government or the Islamic Religious Majlis.

This system is applied to areas other than those

mentioned. In the past few years, the regions of

Selangor, Sarawak and Pahang have shown

improvements in various aspects concerning the

management of zakat. This shows that the zakat

management system in the form of the corporate

system is the most successful in Malaysia

(Suprayitno, et al, 2013)

3.3 Taxation System Development in

Indonesia and Malaysia

Since 1983, the Indonesian government has changed

the tax collection system which initially used an

official assessment system (used during the Dutch

colonial era) into a self-assessment system. In

Indonesia, tax is categorized based on three aspects.

First, based on the class/ method of collection (direct

tax and indirect tax). Second, based on their nature

(subjective tax and objective tax). Third, based on the

collection institution (central tax and regional tax).

Whereas in Malaysia, the initial tax collection

system was the official assessment system. The

government uses the concept of Preceding Year Base

of Assessment to calculate the amount of tax. In this

concept, the amount of income used as the basis for

imposing a tax for the current year is the previous year

income. In 1999 the tax collection system changed to

the self-assessment system. Since 1 January 2000, the

Malaysian government has replaced Preceding Year

Base of Assessment with Current Year Base of

Assessment.

Malaysia has 2 (two) authorized institutions to

take care of tax issues, namely the Malaysian

National Property Results Agency/ Lembaga Hasil

Dalam Negri Malaysia (LHDN) and the Customs and

Excise Department under the Ministry of Finance.

LHDN is authorized to manage the types of direct tax

such as corporate and individual income tax, income

tax from oil and gas, tax on profits from the sale of

land and buildings, and stamp duty. While, the

Customs and Excise Department manages indirect

tax, which consists of customs, import duties, sales

tax, services tax, entertainment tax and several other

types of tax.

Malaysia has experienced a rapid change in the

country's taxation system through the introduction of

a self-assessment system. The system has applied to

Critical Thinking Framework of Zakat Regulation to Support Tax Compliances: Comparison of Indonesia and Malaysia

149

limited liability companies (PT) and individuals since

2001 and to self-employed, CV and Cooperatives

since 2004. In this system, the calculating of debt tax

was transferred to taxpayers. It is different from the

previous system where the calculating of debt tax is

obliged to LHDN or tax office. The implementation

of the self-assessment system influences the changes

in the issue of compliance payment and late fees.

The tax rate applied to an individual depends on

the individual status, which is determined by the

period of stay within Malaysia (as stated in the 1967

Income Tax Deed). Permanent residents are subject

to income tax at a rate between 2% and 30% after

deducting from tax deduction fees. The tax rate

imposed for an individual who has an income of less

than RM 2,500 is 0%, while for those who have an

income of more than RM 250,000 is 27%.

3.4 Zakat as Tax Deduction in

Indonesia and Malaysia

In Indonesia, zakat paid to BAZNAS and LAZIZ will

be deducted from profits/ taxable income based on

Law No. 23 of 2011. In other words, zakat on income

can be deducted from net income as stipulated in the

decision of the General Director of Taxation No KEP-

542 / PJ / 2001.

Whereas in Malaysia, the government ruled that

individual zakat payment could be a tax deduction in

1978. In 1990, zakat as a tax deduction given to

companies that pay zakat with very small deductions.

If an individual zakat payment could be a 100% of tax

deduction, in 2005, the Malaysian government issued

a decision to accept corporate zakat as a tax deduction

of only 25%. The Malaysian government still has not

received a proposal for zakat companies as 100% of

tax deduction.

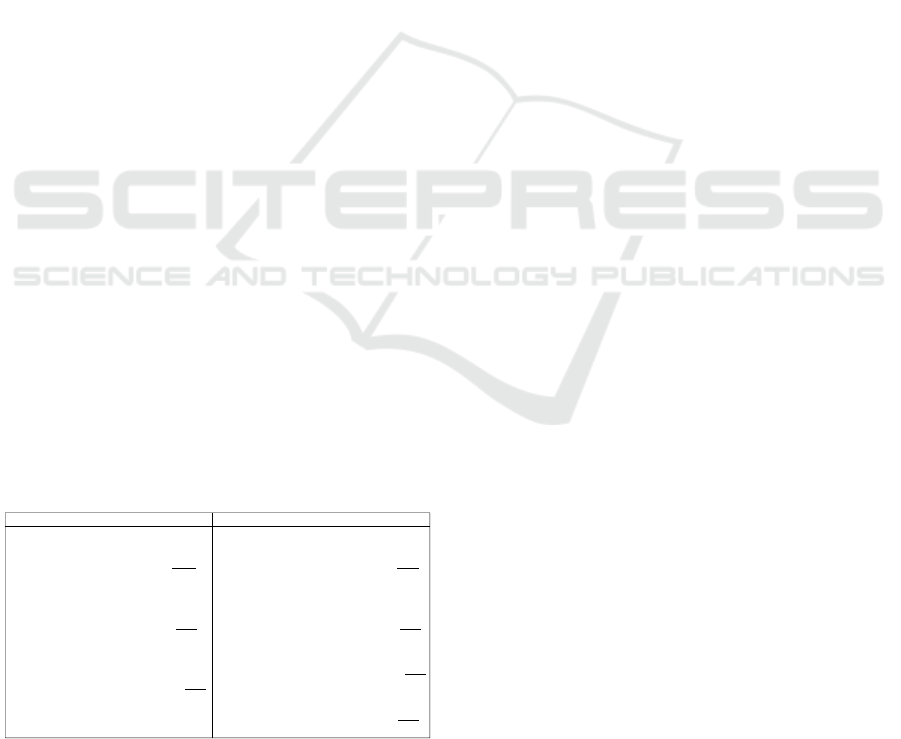

The difference in the calculation of zakat as a tax

deduction between Indonesia and Malaysia can be

illustrated as follows:

Figure 2: Zakat Calculation as Tax Deduction.

4 CONCLUSION

In Indonesia and Malaysia, the role of zakat and tax

is very potential so that it requires strategies to

enhance the compliance of taxpayers and zakat

payers. Zakat and tax revenue in Indonesia are lower

than Malaysia. One of the factors is the different rules

of zakat as a tax deduction. In Indonesia, zakat paid

can be used as a deduction for taxable income, while

in Malaysia the zakat paid can not only reduce taxable

income, but also can be a deduction or tax credit.

The strategy to increase zakat and tax revenue in

Indonesia has several factors which become

obstacles. The factors are first, lack of socialization

from both the tax officer and zakat officer that zakat

can be used to reduce taxable income. When reporting

the annual tax return, the tax officer often does not

ask the taxpayer whether the income reported has

been paid for zakat or not. Moreover, when

submitting the proof of Zakat deposit, the zakat

officers does not explain to muzakki that the proof

can be used to reduce the taxable income.

Second is the psychological factor in Indonesia

society. There are still many Muslims who feel

reluctant to disclose the amount of zakat that they

paid. It is because they are fearful that it will affect

the level of sincerity in carrying out one of the Islamic

pillars. Instead of including the Taxpayer

Identification Number (NPWP) in the Zakat Proof

Form, the taxpayers tend to not reveal their real name

to avoid riya’ (show off).

Third, there is no clear statement about the type

of zakat that can be deducted by taxable income. In

the explanation of the income tax law, it is explained

that the meaning of "zakat" is as referred to in law

governing zakat. Meanwhile, in the law about zakat

management, it is mentioned that zakat which can be

deducted from taxable income covers all types of

zakat, both Zakat Maal and Zakat Fitrah. While in

practice, the type of zakat that can be deducted from

taxable income is only the type of zakat on income

(zakat profession). Therefore, it needs to implement

rules which confirm about zakat profession that can

be used as a deduction. It also needs example of the

correct calculation to minimize doubts in the

community.

Fourth, zakat has not been managed as modern

as tax revenue. All the time, any tax paid by the

taxpayer is recorded in the State Acceptance module

(MPN) and obtain a national acceptance number

(NTPN), then it is expected that the zakat fund paid

by Muzakki is recorded in the Admission of Zakat

Module (MPZ). The muzakki can monitor where the

zakat funds they have paid.

The proposal to include zakat in the structure of

the State Budget (APBN) still faces many obstacles,

Indonesia Malaysia

SalaryPer‐monthxxx

Allowancexxx

Insurancexxx+

GrossIncome(GI)xxx

Deduction:

- Positionallowance(5%GI)xxx

- Duesxxx‐

MonthlyNetIncomexxx

AnnualNetIncomexxx

(‐)Zakat(2,5%xannualGI)xxx

(‐)Annualnon‐taxableincome(PTKP)xxx‐

TaxableIncome(PKP)xxx

AnnualIncomeTaxxxx

Monthlyincomexxx

Allowancexxx

Insurancexxx+

GrossIncome(GI)xxx

Deduction:

- Positionallowance(5%*GI)xxx

- Premiumxxx‐

MonthlyNetIncomexxx

AnnualNetIncomexxx

(‐)Annualnon‐taxableincome(PTKP)xxx‐

TaxableIncome(PKP)xxx

AnnualIncomeTaxxxx

(‐)Zakat(2,5%xannualGI)xxx‐

FinalAnnualIncomeTaxxxx

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

150

because the allocation of zakat funds is limited to only

eight groups: the needy, the poor, the Amil (people

who administer zakat), the Muallaf (people who

newly embraced Islam), the Riqab (people who are

free from slavery), the Garim (people who suffer debt

and need help), Sabilillah (people who strive for

Allah for community) and Ibn Sabil (travellers on a

permissible journey). However, the complementary

synergy between zakat and tax must be continued in

order to improve the welfare of the Indonesian

people.

REFERENCES

Gazy Inayah, Al- Iqtishad az- Zakah wa az- Dharibah

Op.cit, h.24 dan Qardhawi, Fiquz Zakah, Op.cit.

Ghaffari, Muhammad Audi. (2017). Respon Wajib Pajak

Terhadap Zakat Sebagai Pengurang Penghasilan Kena

Pajak (Studi Di Kantor Pelayanan Pajak (KPP)

Pratama Jakarta Kebayoran Baru Tiga). Jurnal ilmiah

UIN Syarif Hidayatullah Jakarta.

Ghozali, Imam. (2006). Analisis Multivariate Lanjutan

dengan Program SPSS. Semarang: Badan

Penerbit Universitas Diponegoro.

https://www.kompasiana.com/ainulikhsan/5a0c43ca9f91ce

55e62268e2/sistem-zakat-dan-pajak-di-

malaysia?page=all. Accessed on 27 April 2019.

https://www.kompasiana.com/zaelani_ma/5b1e0221ab12a

e3f0b3e0f32/mengenal-lembaga-pengelola-zakat-di-

indonesia. Accessed on 27 April 2019.

Jogiyanto, Hartono. (2004). Metodologi Penelitian Bisnis.

Edisi 2004-2005, BPFE, Yogyakarta.

Law No 23 of 2011 about zakat management.

Logawali, et al. (2018). Peranan Zakat Sebagai Pengurang

Penghasilan Kena Pajak Di Kantor Kementerian

Agama Kabupaten Gowa. LAA MAYSIR, Volume 5,

Nomor 1, June 2018: 146-171.

Obaidullah, Mohammed. (2016). Revisiting Estimation

Methods of Business Zakat and Related Tax Incentives.

Journal of Islamic Accounting and Business Research,

Vol. 7 Iss 4 pp. –

Qardhawi, Yusuf. (1988). Hukum Zakat. Bogor: PT Pustaka

Litera Antar Nusa.

Suprayitno, et al. (2013). Zakat Sebagai Pengurang Pajak

Dan Pengaruhnya Terhadap Penerimaan Pajak Di

Semenanjung Malaysia. INFERENSI, Jurnal Penelitian

Sosial Keagamaan, Vol. 7, No. 1, June 2013: 1-28.

Critical Thinking Framework of Zakat Regulation to Support Tax Compliances: Comparison of Indonesia and Malaysia

151