Awareness on Islamic Accounting among First Year Accountancy

Students in Marawi City, Philippines

Papala P. Masorong

Mindanao State University, Main Campus, Philippines

Keywords: Awareness, Islamic Accounting, Accountancy Students, Marawi City, Philippines.

Abstract: The purpose of this study is to examine the level of awareness of first year accountancy students in Marawi

City, Philippines towards Islamic accounting. A cross- sectional survey design was utilized and uses

descriptive approach in the interpretation of the data by administering a survey questionnaire to one hundred

twenty two first year accountancy students, who serve as the respondents of the study. The setting is the two

higher education institutions in Mawawi City. The data was analyzed, interpreted and were statistically

treated using frequency, percentage, and weighted mean. The results of the study indicate that all the

respondents were not aware of Islamic accounting. It also indicates that the respondents are not aware on the

difference between Islamic accounting and conventional accounting. With regards to the importance of

Islamic accounting and ethics attached to the practice of accounting, results indicate that the respondents are

less aware of it. With this findings, it is suggested that Islamic accounting be offered in the accountancy

program so as to armed future accountant with awareness on the concept and scheme of Islamic accounting

thereby producing a well-rounded and holistic workforce in the field of accounting. It is further

recommended that a comparative study on the scheme of Islamic accounting in other Asian countries be

conducted so that the findings of the study on how the Islamic accounting operates are validated.

1 INTRODUCTION

1.1 Background of the Study

Most people do not know that Islamic accounting

have been in existence for a long period of time.

Regrettably, Islamic accounting was relegated to the

background because of the dominance of modern

economic system which dictates the global scene

nowadays.

Consequently, the development of Islamic financial

institution where Islamic accounting is applicable

was stalled. Nevertheless, Islamic economic bounces

back and existed alongside the conventional

economics due to Islamization of some Muslim

countries like Pakistan and Iran. This gives rise to

the development of Islamic financial institution.

Along with this development is the introduction of

economic transactions, transactions that are within

the bounds of Shari’ah laws and principles. These

pave the way for Islamic accounting since

conventional accounting is inappropriate and not

applicable to Islamic financial institutions.

Although, he accounting process of both accounting

is the same in some aspect, they differ in the aspect

information needed, how the information is

recorded, measured, valued and communicated.

Conventional accounting focuses on individual who

control the entity’s resources (investors and

creditors) and is based on maximization of profit

principle; Islamic accounting is more concerned

with profit sharing and risk sharing principles. It is

more concern with accountability and transparency,

hence, information provided to the community is

free from bias and manipulations. It provides

information regardless of whether the information is

beneficial or not to the community. Furthermore, as

cited by Abdullah (2018) the accounting system in

Islamic society is based on Islamic ethics and laws,

along with other necessary principles and postulates

which are not in conflict with Islamic law.

1.2 Objectives

Due to the nonexistence of Islamic accounting

course in the high learning institution in Marawi

City, this study was conducted to identify the

awareness of the respondents in Islamic accounting,

Masorong, P.

Awareness on Islamic Accounting among First Year Accountancy Students in Marawi City, Philippines.

DOI: 10.5220/0010120900002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 231-239

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

231

the difference between Islamic accounting and

conventional accounting, its importance and the

ethics that is associated with the practice of Islamic

accounting. The finding of the study is expected to

give information as to the status of the awareness of

the respondents on Islamic accounting and to serve

as the basis of whether Islamic accounting should be

offered as part of the curriculum of the accountancy

program either as a compulsory subject or at the

very least as elective course..

2 LITERATURE REVIEW

2.1 Background Theory

This section provides the theoretical context that

provides blueprint in conceptualizing the study. This

theory is anchored on David Ausubel’s Learning

Theory. It also includes literature related to the

study.

David Ausubel’s Learning Theory gives an idea on

the strategies to be adopted in seeking additional

knowledge. This theory believes that learning of

new knowledge is related to what is already known.

That is, construction of knowledge begins with our

observation and recognition of events and objects

through concepts we already have. Meaning, new

knowledge must interact with the learner’s

knowledge structure. Aus ubel also believes that

knowledge is hierarchically organized; that new

information is meaningful to the extent that it can be

related (attached, anchored) to what is already

known. But, the most crucial element in meaningful

learning is how the new information is integrated

into the old knowledge structure.

Definition of Islamic Accounting and

Conventional. Accounting Most stakeholders

believe that Islamic accounting is not different from

conventional accounting. While there may be

similarities, the concept of Islamic accounting is

entirely different from the conventional one.

Hameed (2003) defines Islamic accounting as the

“accounting process which provides appropriate

information (not necessarily limited to financial

data) to stakeholders of an entity which will enable

them to ensure that the entity is continuously

operating within the bounds of Shariah law and

principles and delivering on its socioeconomics

objectives to evaluate their own accountabilities not

only to Allah but to fellow human being also.

However, its conventional counterpart is defined by

the American Accounting Association (AAA, 1966)

as "conventional accounting refers to the process of

identifying, measuring and communicating

economic information to permit informed judgments

and decisions by users of the information."

These definitions clearly present the similarities and

differences of both accounting. The similarities lie

on the financial information that is provided to

stakeholders for them to make a sound economic

decision beneficial to an entity as well as to various

stakeholders. While both provide financial

information, the differences lie on the type of

information needed, how the information is

recorded, measured, valued and communicated.

Financial information provided by conventional

accounting focuses on individual who control the

entity’s resources (investors and creditors) , Islamic

accounting information emphasizes on the

community who take part in realizing resources.

Islamic accounting is all inclusive as it does not only

provide financial information but also non-financial

information such as social, environmental and

religious aspect of the transactions. It minimizes

exploitative contract and unjust transactions.

Furthermore, underpinning Islamic accounting is the

Shariah laws and principles.

Moreover, Hameed (2003) stated that Islamic

accounting ensures that Islamic organizations abide

by the principles of Shariah or Islamic law in their

dealings and enable the assessment of whether the

objectives of the organization are being met. Shariah

law is a broad concept comprising divine law

governing the life of individual Muslims in their

relationship with Allah (swt), human being and

others. The rule in Shari’ah is based on the Qur’an,

Hadith, Ijma nad Qiyas. Islamic accounting

(Syari’ah based accounting) is designed to be

consistent with the Shari’ah law underpinning the

main principles from the Qur’an and Hadith. He

further states that there are certain transactions were

conventional accounting are not suitable. Hence,

there is really a need to standardize the accounting

report for Islamic product and services.

Definition of Islamic Accounting and

Conventional. Globally, Islamic banking and

finance is gaining popularity. However, Islamic

accounting which is part and parcel of Islamic

banking and finance with respect to accounting

processes such as identifying, recording, measuring

and communicating business activities through

financial statements is left behind. This is mainly

because Islamic accounting is still at its infancy

stage.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

232

In the Philippines, Islamic accounting education is

not even in its embryo stage because very few

individual including those in the accountancy

profession have knowledge or even aware on the

workings of Islamic accounting. The most popular

prohibition that is being practice in the Philippines

aside from maysir and gharar is riba or usury. In

Islam, dealing with riba or usury is one of the major

sins, which entail severe punishment by Allah (swt).

Prophet Mohammad (saw) cursed the parties involve

in riba, one who accepts, the one who pays, the one

who records and the one who stands as witness to

the transaction. Even co-operation dealing for which

interest is involved is an incitement to the spell and

wrath of Allah (swt). The reason for such severity in

matter of interest is that Islam wants to create a

society founded on compassion, generosity and

sacrifice. If someone is in need of money, the rich

should fulfill his needs for the shake of Allah’s

pleasure or to give him a loan without interest. The

Prophet (saw) said that the equivalent reward for

those who give loan to the needy without interest is

eight times better of that giving of Zakat or Sadaqah.

In relation to riba or interest, Abdullah (2018) cited

that another key aspect of conventional accounting is

the time value of money. The concept of time value

of money in the conventional parlance is that the

value of money today is more than the value of the

same amount of money in the future. In Islamic

accounting, interest is prohibited and it is viewed as

a tool of the capital owner to oppress the borrower

which is strictly prohibited in Islam because of its

un-Islamic form, selfishness, exploitative and

oppressive nature. However, there are cases where

time value of money is acceptable in Shari’ah as

long as the increase occurs to an exchange between

money and commodity not money for money as it is

practice in the conventional.

2.2 Previous Studies

According to the study conducted by Hameed (2000)

which was cited by Talib et al. (2014) identified two

factors that will justify the need of Islamic

accounting. These are the push and the pull factors.

The push factors resulted from the factors that make

conventional accounting inappropriate for Islamic

organizations and Muslim users. The pull factors on

the other hand are factors related to

decisionusefulness framework, social and

environmental issues, public interest arguments and

etc. which conventional accounting fails to

recognize. The result of the inappropriateness of

conventional accounting as the accounting system

and practices to be used by Islamic financial

institution necessitates the pull factors of introducing

Islamic accounting.

This is where the education sector will play a major

role. Education is a continuous and neverending

process. In the field of Islamic accounting much has

to be learned by many. The undergraduate student’s

acceptance level of Islamic accounting course study

made by Amin, Rahman and Ramayah (2000) using

the Theory of Reasoned Action (TRA) emphasizes

the factors affecting the acceptance of students into

the Islamic accounting course in Malaysian

universities. The understanding of Muslims on

Islamic accounting and Shari’ah law, business and

financial dealings needs to be further enriched

through education, training, development and greater

publicity.

Likewise, in the study conducted by Halim

(2014) on the understanding and awareness of

Islamic accounting among Malaysian accounting

undergraduates revealed that though accounting

students awareness on Islamic accounting is high, it

is still insufficient. It is suggested that it is important

for the Islamic accounting course be integrated in

the accounting program in order to produce a

holistic future accountants who are equip with skills

and knowledge not only with conventional

accounting but Islamic accounting as well. This was

reinforced by the study of Talib, Abdullah and

Abdullah (2014) on the awareness of Malaysian

accounting academician on Syari’ah-Based

Accounting (SbA). The study indicates that there is a

high degree of awareness among academicians who

agree that SbA is needed to account for Islamic

products and that it should be offered in the higher

learning institutions so as to equip future

accountants with SbA knowledge for them to be

more competent and competitive in the job market.

In the same way, Karim (2005) emphasizes in his

study that that Islamic financial service industry

faces several challenges and one of the challenges is

the absence of talent and human capital. This

deficiency must be developed in order to strengthen

the industry through innovation and sophistication.

Shortage of skilled, well-trained and high caliber

workforce is major impediments to its future growth.

An insufficiently equipped pool of scholars of both

Islamic laws and modern finance to serve on the

Shari’ah Supervisory Board of International Islamic

Financial Services (IIFS), for instance, may hinder

the proper development of the market.

Islamic accounting courses are proposed to enhance

the knowledge of accounting students and

accounting practitioners in preparation of accounting

Awareness on Islamic Accounting among First Year Accountancy Students in Marawi City, Philippines

233

reports and financial statements of the Islamic

institutions, in particular, Islamic Banking and

Finance, Takaful (Insurance), Zakat (Obligatory

Levy) and ArRahnu (Islamic Pawn). Such Islamic

accounting courses will include, among others, zakat

accounting, mua’malat and Shari’ah law, property

valuation from the Islamic perspective, the current

value concept on Income Statement and the Balance

Sheet, Shari’ahbased auditing concept, Islamic

business ethics, Islamic Contracts and Islamic

accounting theory based on the Quran, Hadith, Ijmah

and Qias (Abdullah et al., 2014).

Finally, Ibrahim (2004) in his study states that it is

apparent that there have been attempts to develop

normative theories of social accounting and social

reporting. This is not surprising as they reflect the

firm’s implicit contract with the society. The

disclosure in the annual report is expected to include

the entity’s contribution to employee well-being,

product quality, public health and safety,

environment protection, and related social aspects.

These social reporting areas are also relevant for the

Islamic perspective of accounting but it is likely to

be more detailed than what is currently prevalent in

Western societies because greater attention should

be paid in demonstrating responsibility,

accountability and transparency beyond society to

include Allah (swt) and the environment. In

addition, the report should also indicate that profits

generated are in conformance with the principles of

Moderation (i’tidal) and permissible (halal) and that

business activities are ecologically sustainable

(Haniffa, 2002). Manipulation of asset values and

performance results should be avoided at all cost. In

short, apart from the emphasis on the profit and loss

statement, balance sheet, and cash flow statement, a

considerable amount of social reporting information

should also be provided. Last, but not the least,

detailed account is likely to be provided about the

zakat fund, qard, and charitable contributions.

The end product for both conventional accounting

and its Islamic accounting counterpart is the

financial statements presented to the end-users

(investors and creditors) for decision making

process. While it is true that conventional

accounting has long been practice worldwide,

Islamic accounting as an alternative accounting for

Islamic financial institutions is now gaining

acceptance worldwide.

3 METHODOLOGY

3.1 Data

The study used the descriptive cross-sectional study

to determine the awareness of Islamic accounting in

the select Accountancy schools in the BARMM and

Region 10. This kind of research design is used to

estimate the occurrence of risk factors in segments

of the population characterized by age, sex, race or

socioeconomic status. The manner of description

was done by distributing set of survey questionnaires

in order to collect data on the awareness, perspective

and prospect of integrating Islamic accounting. This

kind of research design is used to estimate the

occurrence of risk factors in segments of the

population characterized by age, sex, race or

socioeconomic status. The manner of description

was done by distributing set of survey questionnaires

in order to collect data on the

awareness of Islamic accounting.

The respondents is composed of one hundred twenty

two (122) students from two (2) higher education

institution in the locale of the study offering

accountancy program.

3.2 Model Development

The study uses a research-made questionnaire

patterned from other researchers with similar

purpose and validated by a group composed of five

panels before its distribution to the respondents. The

questionnaire is divided into two (2) parts. The first

part was put in a way to collect information

regarding the profile of the respondents in terms of

age and sex. The second part comprises statements

that were based on the respondents’ awareness on

Islamic accounting. This includes four (4) variables

using a scale format ranging from 3 indicating

awareness, 2 indicates less aware and 1 indicates not

aware in measuring the awareness on Islamic

accounting.

3.3 Method

Questionnaire is vital and important instrumental

process that takes part in the achievement of the

study. It is the easiest and most applicable method

when dealing with the huge number of respondents.

Comparing it with other method of conducting

research, questionnaire is most suitable when it

comes to time and cost. Apart from that, this method

of conducting research enabled the researcher to get

back and collected the completed responses from the

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

234

respondents in a short period of time. Therefore, in

order to get prompt responses from the respondents,

the survey questionnaire was used in this study.

4 RESULTS AND DISCUSSIONS

4.1 Results

This section showcases all findings of the study.

Tables are displayed according to the flow of the

specific questions posed in the study.

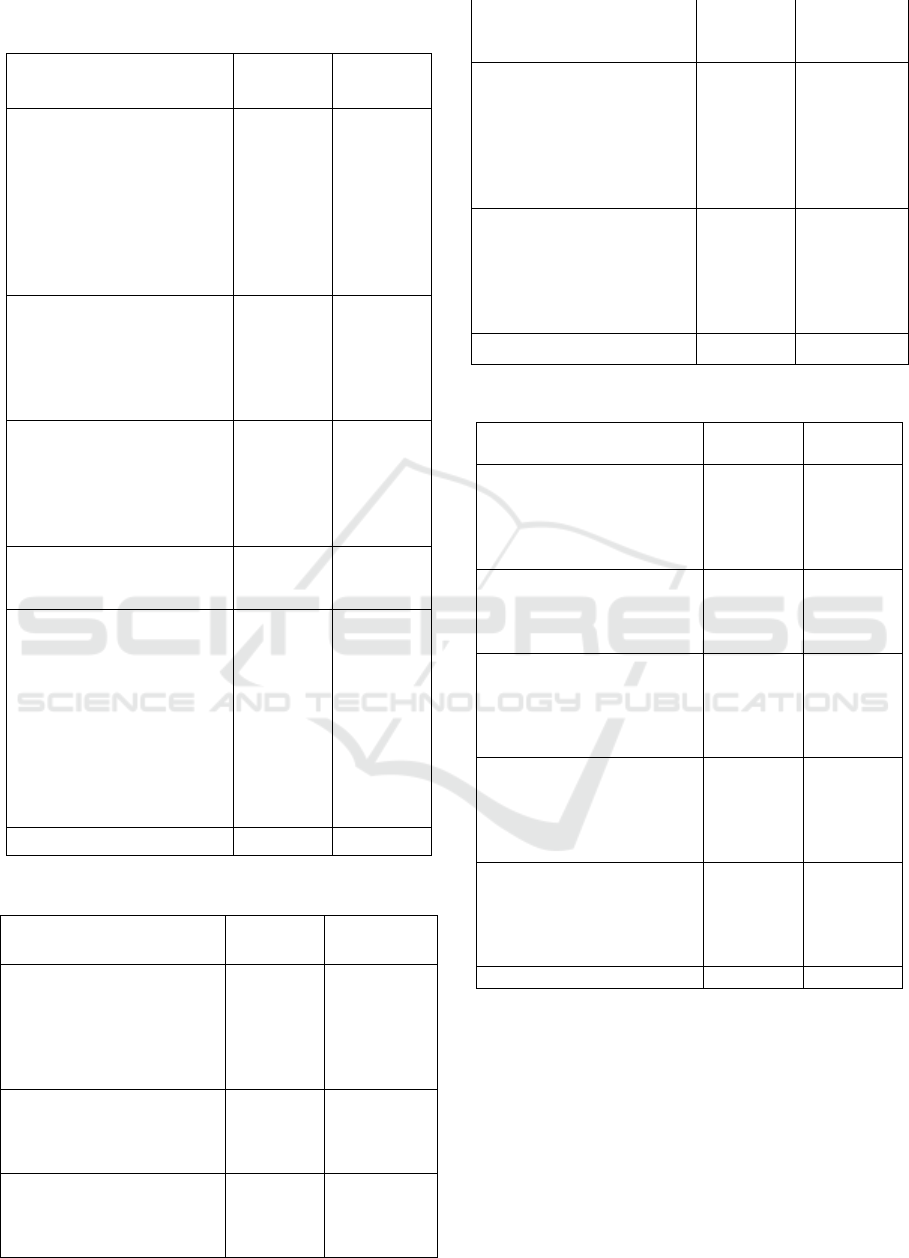

Table 1: Profiles of the Respondents.

Age Frequency Percentage

20-21 23 18.85

17-19 97 79.95

Total 122 100

Sex

Male 29 23.77

Female 93 76.23

Total 122 100

Table 2: Awareness on Islamic Accounting.

Indicators

Weighted

Mean

Descriptive

Rate

The key elements prohibited

by Islamic law

are uncertainty (gharar),

gambling (maysir) and

interest (riba).

2.89 Aware

Islamic accounting offers

faithful representation of

the economic transaction

of the business entity

1.22 Not Aware

Islamic accounting is an

alternative accounting

system which aims to

provide users with

information enabling

them to operate

businesses and

organizations according

to Shariah, or Islamic law

1.11 Not Aware

The accounting standards

on Presentation of

Financial Statements of

Islamic Financial

Institutions (FRSi-1) is

developed because in

some cases Islamic

financial institutions

encounter accounting

problems due to existing

accounting standards

being developed based

on conventional

institutions and may be

perceived to be

insufficient to account for

and report Islamic

financial transactions

1,0 Not Aware

The Accounting and

Auditing Organization

for Islamic Financial

Institutions (AAOIFI) is

an Islamic international

autonomous non-for

profit corporate body that

prepares accounting,

auditing, governance,

ethics and Shariah

standards for Islamic

financial institutions and

the industry

1,0 Not Aware

Concept of accounting

was found in Muslim

practices in seventh

century

1.0 Not Aware

Islamic accounting is the

process of identifying,

measuring and

communicating economic

and other relevant

information inspired by

Islamic law

1.0 Not Aware

Shariah can help standards.

harmonizing the Islamic

society by following

Islamic accounting

1.0 Not Aware

AVERAGE 1.28 Not Aware

Awareness on Islamic Accounting among First Year Accountancy Students in Marawi City, Philippines

235

Table 3: Awareness on the Difference between

Conventional Accounting and Islamic Accounting.

Indicators

Weighted

Mean

Descriptive

Rate

Investment in Islamic

financial institutions must be

guided by Shariah guidelines

whereas investments in

conventional stitutions are

profit motive – can invest in

liquor, tobacco, gambling

companies (non-shariah

ompliant).

2.71 Aware

Islamic financial institutions

are those that are based on

Quranic principles and are

different from conventional

nstitutions which have no

such religious reoccupations.

1.39 Not Aware

The conceptual framework is

similar to that of

conventional accounting but

with different views and

concepts in Islamic

teaching.

1.19 Not Aware

Islamic accounting

investment is called sukuk

(similar to bond).

1.0 Not Aware

Islamic financial institutions

are based on profit-and-loss

sharing principle promotes

risksharing between the

investors and entrepreneur,

unlike the interest-based

commercial system that

assured the investors of

pre-determined rate of

interest.

1.1 Not Aware

AVERAGE 1.46 Not Aware

Table 4: Awareness on Importance of Islamic Accounting.

Indicators

Weighted

Mean

Descriptive

Rate

Islamic accounting serves as

a tool which enables

Muslims to evaluate their

accountability to God (Allah)

and to his fellow

human being.

1.86 Less Aware

Islamic accounting holds

firmly those Islamic values

such as honesty, fairness and

truth in dealing with others.

1.86 Less Aware

Islamic accounting ismost

significant part in business

which rocessesin formation

of businessactivities into

1.74 Less Aware

financial statements to be

presented to the decision

makers.

Islamic accounting provides

appropriate information to

stakeholders of an entity by

ensuring them that the entity

is continuously operating

within the bounds of Islamic

Shari’ah.

1.68 Less Aware

Islamic accounting is

important because recording

and presentation of financial

reports using conventional

accounting is not Shari’ah

compliant.

1.56 Less Aware

AVERAGE 1.74 Less Aware

Table 5: Awareness on Ethics of Islamic Accounting.

Indicators

Weighted

Mean

Descriptive

Rate

Accountants and auditors are

expected to behave ethically

since they are commonly

thought of as watchdog and

gatekeepers of the business.

2.34 Aware

Accountants and auditors are

expected to adhere to the rules

of confidentia-lity, objectivity

and independence.

2.09 Less Aware

Present and communicate

relevant financial and non-

financial information

honestly, truthfully and with

adequate transparency.

2.02 Less Aware

Acquire appropriate level of

academic and professional

competence, sufficient

knowledge of Shari’ah related

to financial transactions.

1.77 Less Aware

Ensure reports are complete,

clear and supported by

ppropriate

analyses of relevant and

reliable information.

1.56 Less Aware

AVERAGE 1.46 Less Aware

4.2 Robustness Test

The data gathered were analysed and interpreted

using the following statistical tools: in terms of the

profile of the respondents, frequency counts and

percentage were used and with regards to the level

of awareness, weighted mean was utilized.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

236

4.3 Analysis

On the Profiles of the Respondents As regards the

profiles of the respondents the following findings

surfaced: the bulk of the respondents in terms of age

were between 18-19 years of age which is equivalent

to 79.95%. Usually, the average age of students

entering college is between 16 to 17 years old,

however, with the adoption of K–12 Enhanced Basic

Education Program, another two years is added to

basic education, hence, the typical age to head off to

college education nowadays is between 18 to 19

years old.

In terms of sex, data revealed that female

outnumbered male respondents as 76.23% of the

respondents are female. This information implies

that it is not surprising that the study have more

female than male respondents. In a speech made by

former Commission on Higher Education (CHED)

Chairperson Hon. Patricia Licuanan during the 55 th

Session of the Commission on the Status of Women

(2011) in New York, said that in almost every aspect

of education in the Philippines women and girls

outnumbered men and boys. Girls fare better in

terms of enrollment indicators. She further states

that girls continue their advantage in tertiary or

higher education where women make up of 54% of

the total enrollment and 57% of the total graduates.

On the Level of Awareness on Islamic

Accounting. The data show that respondents were

not aware of Islamic accounting in terms of

developing accounting standards that are necessary

for the Presentation of Financial Statements of

Islamic Financial Institutions (FRSi-1) as in some

cases, problems arises in this area because most of

the accounting standards are based on conventional

accounting which may be perceived to be

insufficient to account for and report of Islamic

financial institutions. Likewise, the respondents are

not aware of the existence of AAOIFI; the concept

of Islamic accounting founded in the 7 th century, as

well as the definition of Islamic accounting. They

are not even aware that following accounting

standard according to Shariah can help harmonizing

the Islamic society. Furthermore, majority of the

respondents are not aware that Islamic accounting as

an alternative to accounting systems offers faithful

representation of the economic transaction of a

business entity and that information provided is in

accordance with Shariah or Islamic law.

The only information that indicates awareness of

the respondents on Islamic accounting are the

prohibition of uncertainty (gharar), gambling

(maysir) and interest (riba) under the Islamic law.

This non-awareness indicator of the respondents

on Islamic accounting has negative implication.

While Marawi City is a Muslim dominated place in

the country that offers Madrasa schools, no

institutions of higher learning in the place offer

course involving Islamic banking and finance as

well as Islamic accounting. Known Islamic teaching

popular in the place aside from the five pillars of

Islam are the prohibition of interest (riba), gambling

(maysir) and uncertainties (gharar), selling and

eating prohibited products and being accountable to

one’s action among others. However, regarding the

recording of business activities using Islamic

accounting, nothing is heard of.

On the Awareness of the Difference between

Conventional Accounting and Islamic

Accounting. The findings indicate a negative

bearing as majority of the respondents are not aware

that Islamic accounting is different from

conventional accounting. Specifically, they are not

aware of sukuk (similar to bonds) and the

differential benefits that will accrue to the investors

and the entrepreneurs. Profit and loss sharing and

risksharing between the investors and the

entrepreneur is what is being used by Islamic

financial institutions while the conventional one is

more concern with the investors benefit as it is

interest based assuring investors’ income regardless

of the result of operation.

However, with respect to investment matters,

respondents are aware that business activities of

Islamic financial institutions must be guided by

Shariah guidelines whereas in conventional

institution, they can engage in transactions which

include selling of liquor and tobacco, engage in

interest based transactions, gambling and other non-

Shariah compliant economic activities. The

conventional institutions are profit motive that they

can engage in economic activities that are not

Shariah compliant.

On the Awareness on Importance of Islamic

Accounting. The data shows that the less aware

indicator was regarding the awareness of the

respondents on the importance of Islamic accounting

results to a negative implication. They are less aware

with regards to Islamic accounting as the tool in

evaluating their accountability to God and their

fellow human being. The less awareness on Islamic

values such as honesty, fairness and truth in dealing

with others is disturbing as this is what is expected

Awareness on Islamic Accounting among First Year Accountancy Students in Marawi City, Philippines

237

to everybody. Less awareness on information

presented in the financial statement for decision

making purposes is disheartening because as future

accountants, they must know the financial

information presented in the financial statements is

very important for a sound decision. Moreover, the

respondents are less aware on the information that

can be provided by Islamic accountants regarding

the continuity of operationwithin the bounds of

Islamic accounting. This isunderstandable as the

respondents have no knowledge about Shariah

principle. Additionally, respondents are less aware

that conventional accounting cannot be used because

it lacks Shariah compliant matters. In totality, the

less aware of the respondents on the importance of

Islamic accounting is that the Islamic law in the

country is focus on family matters and not on

business activities.

On the Awareness on Ethics of Islamic

Accounting. The less awareness of the respondents

regarding ethical issues on Islamic accounting is

alarming. Accountants are very important in any

organization, be it Islamic or conventional as they

are responsible in preparing the financial statements

necessary for decision making process. They are

expected to have high moral values and able to

enlighten ethical issues.

They are expected to behave ethically, must be

honest, trustworthy, objectives, competent, credible,

accountable, with integrity, independent in rendering

opinion, have knowledge of Shariah related financial

transactions and free from bias. Without having

these characteristics, the danger of doing fraudulent,

malpractices, misconduct, wrongful and unwanted

activities is very high. The accounting profession

has been involved on matters concerning ethical

issue. The trust and confidence given to the

accounting profession weakens due to the

malpractices, misconduct and fraudulent acts

committed by some members of the profession. The

scandal that rocked multinational companies like

Enron, Worldcom and others lessen the

independence and integrity of the profession. With

these, accountants have to do something to regain

the trust and confidence expected of them.

5 CONCLUSIONS

5.1 Conclusion

In-depth analysis of the data gathered brings forth

the following major conclusions to wit:

A critical look on the respondents profile reveals

hat the majority of the respondents were between

18-19 years old implying that the respondents were

at their mid-teenage years when they head-off to

college education. As far as sex is concerned, female

outnumber their male counterparts, implying the

dominance of female in the Philippine education in

terms of enrollment indicator. Female dominance as

far as enrollment and those who finished college is

still the norm (Licuanan, 2011).

Generally, the responses of the respondents have

negative implication in the sense that they are not

aware and less aware of the variable presented in the

study.

In terms of the awareness on Islamic accounting,

the respondents are not aware of it. The same is true

with the difference between Islamic accounting and

its conventional counterpart. This has negative

bearing as the respondents show to have no

knowledge at all with Islamic accounting.

In terms of the importance of Islamic accounting,

the respondents are less aware of this variable. This

implies that the respondent have no knowledge

about Shariah laws and principles and its usefulness

in the preparation of financial statement in order to

make the right economic decision.

Finally, in the case of ethics in Islamic

accounting, again the respondents replied negatively

due to less aware responses. This implies that the

respondents being accountancy students’ shows little

knowledge on the ethical issues attached to the

profession.

5.2 Recommendation

Taking cognizant on the finding of the study, the

researcher saw it fit to advance the following

recommendations:

The respondents were not aware or less aware on

Islamic accounting mainly because Islamic

accounting is not being taught in the higher

education institution because of the lack of local

experts in this field of endeavor. Hence, before

equipping these students towards working of Islamic

accounting, accountancy profession of different field

of expertise should be equipped first. They should be

sent for further education, trainings, seminars,

conferences, and conventions for them to acquire

knowledge and awareness on Islamic accounting and

Shariah laws and principles. Through them, students

will be developed thereby producing a more holistic

accountancy graduates who will be the future

workforce. In developing their potentials, Islamic

accounting coure should be offered as a compulsory

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

238

course or at least an elective course in the

accountancy program. This way the gap between the

needs of the accountancy profession and the content

of Islamic accounting course are narrowed down to a

minimum. In addition, this will provide an avenue

for the students to acquire necessary knowledge on

Shariah laws and principles and the applicability and

appropriateness of Islamic accounting not only in

Islamic financial institutions but to conventional

institutions as well.

It is further recommended that a comparative

study on the scheme of Islamic accounting in other

Asian countries be conducted so that the findings of

the study on how the Islamic accounting operates are

validated.

Lastly, future researchers interested in

conducting similar studies are encourage to increase

the number of research sample so as to gain more

diverse data results because the larger the sample,

the more wide-ranging the findings and the greater

the likelihood of generalizability of the finding.

REFERENCES

Ausubel, D. (1963). The Psychology of Meaningful

Verbal Learning. New York: Grune & Stratton.

Hameed, S. (2003). Islamic Accounting - A New Push,

Akauntan Nasional, Kuala Lumpur

Abdullah, S. (2018). Conventional and Islamic Perspective

in Accounting: Potential for Alternative Reporting

Framework. World Academy of Science, Engineering

and Technology, International Journal of Economics

and Management Engineering Vol:12, No:2, 2018

Amin, Rahman and Ramayah (2000). What makes

undergraduate students enroll into an elective

course?", International Journal of Islamic and Middle

Eastern Finance and Management, Vol. 2 No. 4, pp.

289-304.

Hameed, S. and Ibrahim, S. (2000). The Need for Islamic

Accounting: Perception of Its Objectives and

Characteristics by Malaysian Accountants and

Academics, Ph.D. Dissertation, University of Dundee,

Scotland.

Talib, M. A., Abdullah, A, and Abdullah, A. (2014).

Syari’ah Based Accounting(SbA) Awareness of

Accounting Academicians in Malaysia, Pertanika

Journal of Social Sciences & Humanities . Dec 2014

Special Issue Accounting & Finance, Vol. 22 Issue S,

p175-196. 22p.

Abdul Rahman, A. Islamic Accounting Theory and

Practice,https://www.academia.edu/34794532/1_Islam

ic_Accounting_Theory_n_Practice_Abdul_Rahim_Ab

d_Rahman.pdf

AAA (1966). A Statement of Basic Accounting Theory:

Illinois, USA: Committee to Prepare a Statements of

Basic Accounting Theory, American Accounting

Association.

Halim, H. A. (2017). Understanding and Awareness of

Islamic Accounting: The Case of Malaysian

Accounting undergraduates, International Journal of

Academic Research in Accounting, Finance and

Management Sciences, Vol. 7, No. 4, pp. 33-39.

Retrieve from http://hrmars.com/hrmars

papers/Articles 04 Understanding and Awareness of

Islamic Accounting.pdf

Licuanan, P. (2011). Speech During 55 th Session of the

Commission on the Status of Women, New York.

Awareness on Islamic Accounting among First Year Accountancy Students in Marawi City, Philippines

239