Local Government Budget at Province in Indonesia

Dy Ilham Satria, Sri Mulyati, Muhammad Yusra, Nur Afni Yunita, and Indrayani

Department of Accounting Faculty of Economic and Bussiness Malikussaleh University, Aceh,

Indonesia

myusra@unimal.ac.id,nurafni.yunita@unimal.ac.id,

indrayani@unimal.ac.id

Abstract. This Research aims to to know how influence of Local Own Source

Revenue, Fiscal Balance Transfers from the Central Goverment to Regions, and

Others Legal Incomes to Local Budget at Provinve in Indonesia. Source of data

at this research is Report on Local Government Finances which in obtaining from

Local Government Budget which in the form of data about Local Government

Budget at 34 Province in Indonesia from 2013 to 2017 totally perception counted

170 Report on Local Government Finances with a period of perception during 5

year. Data analysis method used method analysis linear regression. Result of this

research indicate that Local Own Source Revenue, Fiscal Balance Transfers from

the Central Goverment to Regions, and Others Legal Incomes have an effect on

signifikan to Local Budget at Provinsi in Indonesia.

Keyword: Local budget · Local own source revenue · Fiscal balance transfers

from the central goverment to regions · Others legal incomes

1 Introduction

Indonesia is a developing country that is aggressively developing infrastructure in all

fields to increase the nation's economic growth. These various infrastructures continue

to be built and developed in all provinces in Indonesia. This of course requires a large

amount of regional expenditure. Regional expenditure itself is sourced from various

sectors, one of which is sourced from the balance fund, which consists of the General

Allocation Fund, Revenue Sharing Fund, Special Allocation Fund and the regional

portion of the central tax revenue sharing .

The balancing fund is a manifestation of the financial relationship between the

central government and the regions. Applicability of UU No. 33 Tahun 2004 [1]

concerning Fiscal Balance between the Central and Regional Governments, brought

about fundamental changes to the systems and mechanisms of regional government

management. This law confirms that for the implementation of the authority of the

Regional Government, Central Government will transfer the balance funds to the

Regional Government.

Transfers from the central government are often used as the main funding source

for regional governments to finance their main day-to-day operations, which the local

government reports in the Local Goverment Budget calculations. The purpose of this

transfer is to reduce (if not eliminate) fiscal gap between governments and ensure the

achievement of minimum public service standards.

Satria, D., Mulyati, S., Yusra, M., Yunita, N. and Indrayani, .

Local Government Budget at Province in Indonesia.

DOI: 10.5220/0010521000002900

In Proceedings of the 20th Malaysia Indonesia Inter national Conference on Economics, Management and Accounting (MIICEMA 2019), pages 585-592

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

585

Based on this description, it is possible for local governments to improve welfare

and services to the community, through the regional budget which is in favor of the

people's interests. This means that the role of local governments in influencing poverty

through the Local Goverment Budget policy is expected to be able to solve the existing

poverty problem by allocating budgets that are closely related to these problems.

Others Legal Income is expected to increase regional government investment in

regional spending so that the quality of public services is better. Each region has

different financial capabilities in funding its activities, this causes fiscal imbalance

between one region and another. Therefore, to overcome this fiscal imbalance the

Government allocates funds sourced from the State Budget to fund regional needs in

the implementation of decentralization. This balancing fund from the government

whose allocation emphasizes aspects of equity and justice that are aligned with the

administration of government affairs UU No. 32 Tahun 2004 [2]. With the transfer of

funds from the center, it is hoped that the regional government can allocate other

legitimate income that it receives to finance regional expenditures in the region.

2 Literatur Review

2.1 Local Budget

Local Budget according to Government Regulation No. 58 Tahun 2005 [3], are all

expenditures from general cash accounts that reduce the equity of current funds, which

are regional obligations within one fiscal year that will not be repaid by the region.

Mardiasmo (2002) [4] defines local budget as all regional expenditures in a certain

fiscal year period that is a burden on the region. As an organization or household, the

government does a lot of expenditure (expenditure) to finance its activities. These

expenditures are not only to run the daily administration but also to finance economic

activities. Based on Permendagri No.13 Tahun 2006[5] shopping is grouped into two

namely indirect shopping and direct shopping. Indirect expenditure is spending that is

considered not directly related to the implementation of programs and activities.

2.2 Local Own Source Revenue

Halim (2001)[6] defines Local Own Source Revenue as revenue obtained by the region

from sources within its own region that are levied based on Regional Regulations and

in accordance with applicable regulations. According to UU No. 34 Tahun 2000 [7] the

Local Own Source Revenue is all regional revenue that comes from the original

economic resources of the region. Regional Revenue according to UU no. 33 Tahun

2004 [1] Article 1 is the right of a Regional Government which is recognized as adding

value to net assets in the period of the year concerned.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

586

3 Fiscal Balance Transfers from the Central Goverment to

Regions

3.1 Revenue Sharing Fund

Revenue Sharing Funds is a potential source of regional income and is one of the basic

capital of regional governments in obtaining development funds and meeting regional

expenditures that are not from

Local Own Source Revenue other than General Allocation

Fund and Special Allocation Fund. The revenue sharing pattern is carried out with a

certain percentage based on the producing region. Revenue Sharing Fund tax revenue.

While revenue from Revenue Sharing Fund natural resources comes from: Forestry,

General Mining, Fisheries, Petroleum Mining, Natural Gas Mining, Geothermal

Mining (Wahyuni & Adi, 2009) [8].

3.2 General Allocation Funds

According to UU No. 32 tahun 2004 [2], it is stated that for the exercise of regional

government authority, Center of Government will transfer the Balancing Fund

consisting of General Allocation Fund, Special Allocation Fund, and Revenue Sharing

Fund consisting of taxes and Natural Resources. In addition, the Regional Government

has its own funding sources in the form of Fiscal Balance Transfers from the Central

Goverment to Regions, financing, and other legal income. Policy on the use of all funds

is submitted to the Regional Government. Transfer funds from the Central Government

are expected to be used effectively and efficiently by the Regional Government to

improve its services Governments, the General Allocation Fund needs of an area are

determined using the Fiscal Gap approach, where the General Allocation Fund needs

of an area are determined by the needs of the region with regional potential. General

Allocation Fund is used to close the gap that occurs because the needs of the region

exceeds the potential of existing regional revenues (Cornia, 2010) [9].

3.3 Special Allocation Funds

Special Allocation Funds is funds sourced from the State Budget which are allocated

to regional governments to finance special activities which are regional affairs and

national priorities. The purpose of Special Allocation Funds is to reduce the burden of

special activity costs that must be borne by local governments. The use of Special

Allocation Funds is directed towards investment activities in the development,

procurement, improvement, improvement of physical facilities and infrastructure of

public services with a long economic life, with the directed use of Special Allocation

Funds for these activities is expected to improve public services realized in capital

expenditure (Forrester 1992) [10].

Local Government Budget at Province in Indonesia

587

3.4 Other Legal Incomes

Other Legal Incomes according to UU 32 Tahun 2004 [2] article 164 paragraph 1

concerning regional governments are all regional revenues other than Local Own

Source Revenue, Balancing Funds, which include grants, emergency funds, and other

income determined by the government. Any regional expenditure that will be issued by

the regional government is first budgeted in the Local Goverment Budget. In

Permendagri No. 13 Tahun 2006 [5] Article 122 states that expenditures cannot be

charged to the budget if these expenditures are not available or not sufficiently available

in the Local Goverment Budget. Local Own Source Revenue, balance funds and other

legal income are sources of regional income. This means that the regional government

will adjust the regional expenditure that will be issued with the

Local Own Source

Revenue

received, the balance funds transferred from the center and other legitimate

regional revenues.

3.5 The Effect of Local Own Source Revenue to Local Budget

Several studies have been conducted to see the effect of regional income on spending.

Abdullah and Halim (2003)[11] found that the tax-spend hypothesis applies to the case

of regional goverment in several Latin American countries, namely Columbia, the

Dominican Republic, Honduras, and Paraguay. Friendman (1978)[12] states that the

tax will increase regional spending, so that it will increase the deficit. Hoover and

Sheffrin (1992)[13] empirically found differences in relations in two different time

frames. They found that for the data sample before the mid-1960s taxes affected

spending, while for the sample data after the 1960s taxes and expenditure did not affect

each other (causally independent). Satria & Munandar (2013)[14] states that changes

in the target of Regional Original Revenue can affect the allocation of expenditure

changes in the same year. From the perspective of agency theory, at the time of pure

Local Goverment Budget compilation, the executive (and possibly also with the

knowledge and or legislative agreement) Local Own Source Revuenue targets are set

below the potential, then carried out adjusment when the budget changes are made.

H1: The Local Own Source Revenue influences to Local Budget in Provinces in

Indonesia

3.6 Effect of Fiscal Balance Transfers from the Central Goverment to

Regions to Local Budget

Local Goverment Budget which includes local government revenue and expenditure

can be used as a reflection of the policies taken by the government. Government policy

in every purchase of goods and services for the implementation of a program reflects

the amount of costs that will be incurred by the government to implement the program.

Mardiasmo (2004: 63) [15]states that there are several reasons for the importance of

the public sector budget, namely: (a) The budget is a tool for the government to direct

socio-economic development, ensure sustainability, and improve the quality of life of

the community, (b) the budget is needed because of the problem of limited resources.

The budget composition should ideally be reversed, where direct spending can be

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

588

greater. The composition of the budget that is not ideal can make it difficult for local

governments to carry out development because of the lack of funds to finance

infrastructure development needed by the community in an effort to increase economic

growth, whereas in the regional budget, regional governments also receive budget

support from the central government.

H2: Fiscal Balance Transfers from the Central Goverment to Regions influences to

Local Budget Provinces in Indonesia

3.7 The Effect of Others Legal Income to Local Budget

Others Legal Income are other revenues from the central government and / or from

central agencies, as well as from other regions. The greater the revenue Other

Legitimate Revenues the more it reflects a region or province capable of being

independent to offset budgeted regional expenditure expenditures, Sumarni (2008)[16].

H3: Others Legal Income influences to Local Budget in Provinces in Indonesia

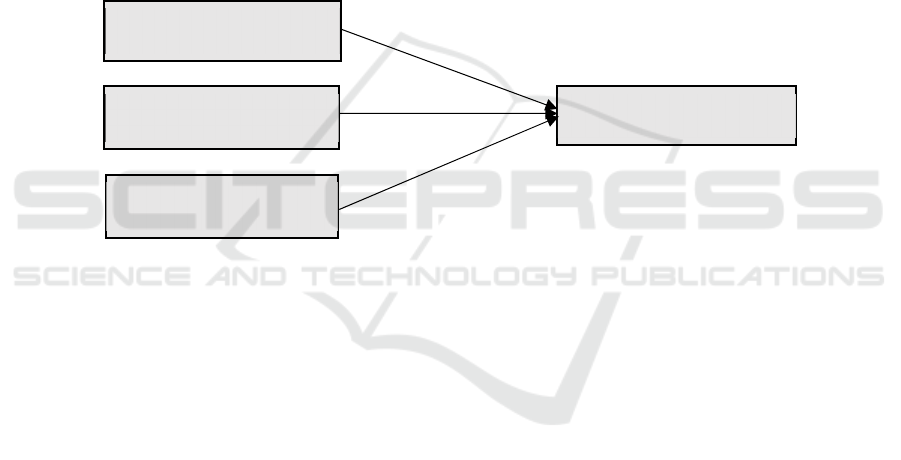

Fig.1. Research Framework.

4 Research Methods

The population in this study is the Report on Local Government Finances which in

obtaining from Local Government Budget which in the form of data about Local

Government Budget at Province in Indonesia. In this study using the census method,

namely by taking the entire population. The object of research is the Regional Budget

in Indonesia. In this study, the location of the study is the center of financial data for

provinces in Indonesia with a data center obtained from the Directorate General of

Fiscal Balance, Ministry of Finance of the Republic of Indonesia.

The data collection technique uses documentation. In this study, the data used are times

series data in the form of Local Goverment Budget data, the time period from 2013 to

2017. The analytical method used in this study is simple linear regression which aims

to test and analyze the effect of the Local Own Source Revenue to Local Budget in the

provinces in Indonesia. The linear regression model in this study is as follows:

Y = α + β

1

X

1

+ β

2

X

2

+ β

3

X

3

+ e (1)

Local Own Source Revenue

Local Budget

Fiscal Balance Transfers

from the Central

Others Legal Income

Local Government Budget at Province in Indonesia

589

5 Results

Descriptive statistical results for Local Budget (LB), Local Own Source Revenue

(LOSR), Fiscal Balance Transfers from the Central Goverment to Regions (FBTCGR),

and Others Legal Incomes (OLI), can be seen in the following Table 1:

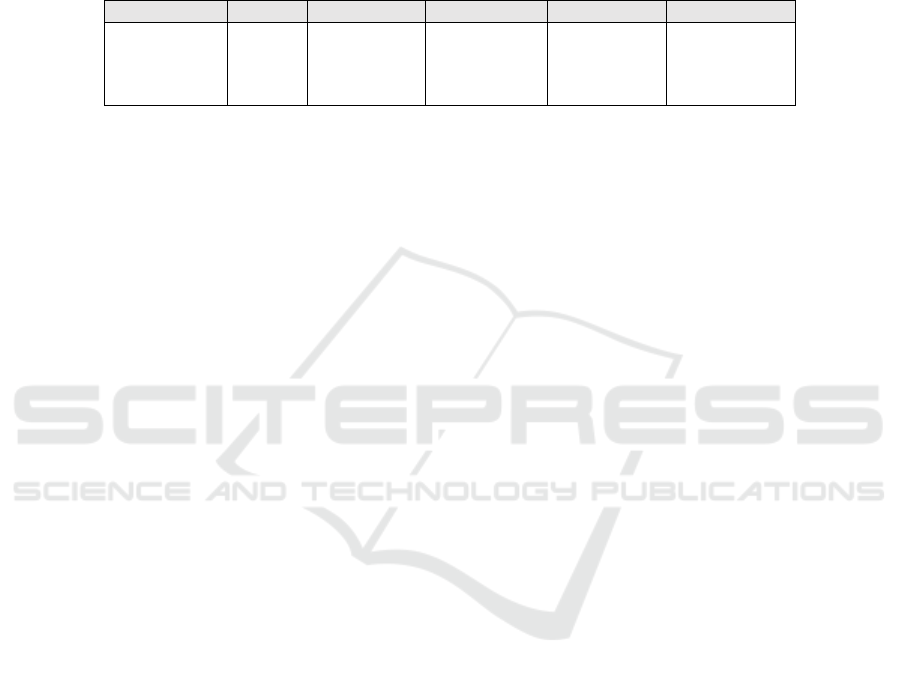

Table 1. Descriptive Research Data.

Va

r

N Min Max Mean Std. Dev

LB

LOSR

FBTCGR

OLI

170

170

170

170

77,8

1,3

87,8

1,1

51.066,0

43.901,5

18.969,2

11.819,5

7,2

3,7

2.5

1.1

8,4

6,6

2,5

2,0

Based on table 1, the Regional Expenditure Budget Results for 5 years, from 2013

to 2017, the mean value of 7.2 trillion Rupiahs, the minimum value of regional

expenditures of 77.8 billion for North Kalimantan Province in 2013 whereas the

maximum value for Regional Expenditures is 51.0 Trillion Rupiahs for DKI Jakarta

Province in 2017. The standard deviation value for 3 years of observation is 8.4. The

next variable is Regional Original Revenue obtained a mean value for 5 years

amounting to 3.7 trillion Rupiahs, with a minimum value of 1.3 billion Rupiahs for

North Kalimantan Province in 2013, and a maximum value of 43.9 trillion Rupiahs

obtained by DKI Jakarta Province in 2017. The standard deviation value for 5 years of

observation was 6.6.

The next variable is the Fiscal Balance Transfers from the Central Goverment to

Regions a mean value for 5 years of 2.5 trillion Rupiahs, with a minimum value of 87.8

billion Rupiahs for East Nusa Tenggara Province in 2017, and a maximum value of

18.9 trillion Rupiahs obtained by DKI Jakarta Province in 2017. The standard deviation

value for 5 years of observation was 2.5. Other Legal Incomes obtained a mean value

for 5 years of 1.2 trillion Rupiahs, with a minimum value of 1.2 billion Rupiahs for the

Kepulauan Riau Province in 2017, and a maximum value of 11.8 trillion Rupiahs

obtained by Aceh Province in 2017. The standard deviation value for 5 years of

observation was 2.0.

The results of hypothesis testing using linear regression from the influence of the

Local Own Source Revenue, Fiscal Balance Transfers from the Central Goverment to

Regions, and Others Legal Incomes to Local Budget in Provinces in Indonesia can be

seen in the following:

Y = 4,605 + 0,891 X1 + 0,858 X2 + 1,034 X3 + e (2)

The Local Own Source Revenue had a positive effect on Local Budget in Provinces

in Indonesia. This means that the Local Own Source Revenue also increase Local

Budget. These results explain that provinces that get large Local Own Source Revenue

will tend to have large Local Budget as well. These results provide a strong indication

that the behavior of regional spending will be strongly influenced by sources of

revenue, one of which is from local own source revenue. The greater the acceptance of

the Local own source revenue, the more it reflects a region or province capable of being

independent to offset budgeted local budget expenditures.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

590

In Indonesia, in general, Local Own Source Revenue are allocated to Capital

Expenditure, Local Own Source Revenue Budgets are also allocated for employee

operational expenditure. That is because personnel expenditure will be expected to

improve the performance of the regional apparatus to continue trying to improve public

services, the provision of adequate infrastructure facilities. Furthermore, it can also

improve the administrative capabilities of tax collection and levies in the region so that

an important source of regional revenue namely the Local Own Source Revenue can be

used to finance both physical and non physical development (Satria & Mnandar,

2017)[14].

This was also expressed by Abdullah (2013) [14] who stated that changes in income,

especially Local Own Source Revenue, could be based on the opportunism of decision

makers, especially the bureaucracy in regional work unit. But not infrequently the

changes in the Local Government Budget also contain the political preferences of

politicians in the Assembly at Provincial.

The Balancing Fund has a positive effect on Regional Expenditure in Provinces in

Indonesia. This means that the Balancing Fund also increases Regional Expenditure.

This result explains that provinces that receive a large Balancing Fund will tend to have

large Regional Expenditures as well. These results provide a strong indication that the

behavior of regional spending will be strongly influenced by sources of revenue, one

of which is from regional own-source revenue. The greater the acceptance of the

original regional income, the more it reflects a region or province capable of being

independent to offset budgeted regional expenditure expenditures.

The Balancing Fund in addition to being allocated for Capital Expenditure, the

allocation of the Regional Original Revenue Budget is also for employee operating

expenses. That is because personnel expenditure will be expected to improve the

performance of the regional apparatus to continue trying to improve public services,

the provision of adequate infrastructure facilities.

The results of this study are in accordance with the results of Dougherty, et al.

(2003)[17] where changes in the budget were made to be more useful in the long-term

implementation of the budget cycle both before and in the future, adjustments were

made in the current fiscal year due to economic income growth which contributed to an

increase in the surplus against adjustments especially in the field of capital expenditure.

This is also in line with the results of research conducted by Sumarni (2008) [16] where

the General Allocation Fund has a positive effect on Regional Expenditures. The results

of this study are also consistent with the results of research conducted by Syukriy &

Halim (2003) [18] which states that general allocation funds affect regional government

spending. In accordance with research conducted by Sumarni (2008)[16] which shows

that general allocation funds affect regional spending.

The results showed that Other Legitimate Revenues have a positive effect on

Regional Expenditure in Provinces in Indonesia. This means that Other Legitimate

Income also increases Regional Expenditure. This result explains that provinces that

get Other Legitimate Revenues that are large will tend to have large Regional

Expenditures as well. These results provide a strong indication that the behavior of

regional spending will be strongly influenced by revenue sources, one of which is from

Other Legal Revenues. Other Legal Revenues are other revenues from the central

government and / or from central agencies, as well as from other regions. The greater

the revenue Other Legitimate Revenues the more it reflects a region or province capable

of being independent to offset budgeted regional expenditure ex

penditures.

Local Government Budget at Province in Indonesia

591

References

1. Undang-Undang No. 33 Tahun 2004 tentang Perimbangan Keuangan antara Pemerintah

Pusat dengan Daerah

2. Undang-Undang No.32 Tahun 2004 tentang Pemerintah Daerah

3. Peraturan Pemerintah No 58 tahun 2005 tentang Pengelolaan Keuangan Daerah

4. Mardiasmo ,2002. Akuntansi Sektor Publik, Penerbit Andi, Yogyakarta.

5. Peraturan Menteri Dalam Negeri No. 13 tahun 2006 tentang Pedoman Pengelolaan keuangan

Daerah.

6. Halim, Abdul. 2001. Manajemen Kuangan Daerah. Yogyakarta: UPP AMP YKPN.

7. Undang-Undang No.34 Tahun 2000 tentang Pajak dan Retribusi Daerah.

8. Wahyuni & Priyo, H. A. 2009. Analisis Pertumbuhan dan Analisis Dana Bagi Hasil

Terhadap Pendapatan Asli Daerah. Sumber: The 3

rd

National Conference UKWMS.

Page 1. Surabaya. Artikel Online melalui http://priyohari.fles.wordpress.com.

9. Cornia, Gray C, Ray D. Nelson & Andera Wilko. 2004. Fiskal Planning, Budgeting, and

Rebudgeting Using Revenue Semaphores. Public Administration Review. Vo.64, No. 2 (Mar

– Apr): 164 – 179.

10. Forrester, Jhon P. & Daniel R. Mullins. 1992. Rebudgeting: The Serial Nature of Municipal

Budgetary Proceses. Public Administration Review. Vol. 52 No. 5 (Sept – Oct): 467 – 473.

11. Abdullah, Syukriy dan Abdul Halim. 2003. Pengaruh Dana Alokasi Umum (DAU) dan

Pendapatan Asli Daerah (PAD) terhadap Belanja Pemerintah Daerah: Studi Kasus

Kabupaten/Kota di Jawa dan Bali. Simposium Nasional Akuntansi, Oktober. Surabaya:

Universitas Airlangga.

12. Forrester, Jhon P. & Daniel R. Mullins. 1992. Rebudgeting: The Serial Nature of Municipal

Budgetary Proceses. Public Administration Review. Vol. 52 No. 5 (Sept – Oct): 467 – 473.

13. Hoover, Kevin D. & Sheffrin, Steven M. 1992. Causation, Spending, and Taxes: Sand in The

Sandbox or Tax Collector for the Welfare State. The American Economic Review. Vol. 82

No. 1. Mar 1992. Pp. 225-248.

14. Satria, Dy Ilham dan Munandar. 2017. Model Pemanfaatan Pendapatan Asli Daerah dan

Dana Alokasi Khusus dalam APBD Kabupaten/Kota Di Provinsi Aceh. Jurnal Visoner &

Strategis. Vol. 6 No. 2. September 2017 p 1-7.

15. Mardiasmo. 2004. Otonomi & Manajemen Keuangan Daerah, Penerbit Andi, Yogyakarta.

16. Sumarni, Saptaningsih. 2008. Pengaruh Pendapatn Asli Daerah, Dana Alokasi Umum dan

Dana Alokasi Khusus terhadap Alokasi Belanja Modal Daerah Kabupaten/Kota di Provinsi

D.I. Yogyakarta.

17. Dougherty, Michael John, Kenneth A. Klase & Soo Geun Song. 2003. Managerial Necessity

and The Art of Creating Surpluses: The Budget-Execution Process in West Virginia Cities.

Public Administration Review. Vol. 63, No. 4 (Jul – Aug): 484 – 497.

18. Abdullah, Syukriy dan Abdul Halim. 2003. Pengaruh Dana Alokasi Umum (DAU) dan

Pendapatan Asli Daerah (PAD) terhadap Belanja Pemerintah Daerah: Studi Kasus

Kabupaten/Kota di Jawa dan Bali. Simposium Nasional Akuntansi, Oktober. Surabaya:

Universitas Airlangga.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

592