The Acceptability of Cryptocurrencies as Mode of Payment among

Millennial Certified Public Accountants in the Philippines

Julius Ray E. Rentoy

Graduate School of Business, San Beda University, Philippines

Keywords: Cryptocurrencies, UTAUT, Payment Systems, Millennial CPAs in the Philippines.

Abstract: A flourishing number of literatures have investigated on the acceptability of diverse technologies around the

globe. Yet, limited studies have explored on a growing technological phenomenon – the Cryptocurrencies.

The central motivation of cryptocurrencies is to work as a medium of exchange and to take the power out of

the hands of the government and central bankers (Gilpin, 2014, as cited in Rose, 2015). Using an extended

UTAUT model, this research aims to investigate on the factors that could influence the behavioral intention

(BI) to accept cryptocurrencies as a mode of payment among millennial Certified Public Accountants in the

Philippines. The Multiple Linear Regression was utilized on this research, which was administered on 386

millennial CPAs. Performance Expectancy was still found to be the strongest predictor of BI, while

Government Regulation was interestingly found to have no significant relationship with BI. This is the first

study on this field to have incorporated the existence of Accounting Model as a predictor variable. The results

of this study are significant in creating a more informed business environment for professionals, owners, and

managers.

1 INTRODUCTION

Change management is imperative in a business

environment because change happens more rapidly

today than we have expected yesterday (Kotter,

2012). Change is inevitable; and monetary systems

are no exception. Throughout centuries, the monetary

system has evolved from the traditional bartering to

the money that we use today. The evolution was

predominantly brought by the introduction and later

development of technology. In today’s Age of

Internet, a wide array of possibilities has again been

unfolded with the introduction of cryptocurrencies. In

its simplest terms, Cryptocurrency is designed to

work as medium of exchange. The central question

and motivation of Bitcoin, the first known

cryptocurrency, was to replace fiat money. Gilpin

argued that cryptocurrencies “…were created to take

power out of the hands of the government and central

bankers and put it back into the hands of the people”

(Gilpin, 2014, as cited in Rose, 2015). However, the

time when cryptocurrencies completely replace fiat

money is most likely a lifetime away. While change

is inevitable, it is for a fact that it doesn’t happen

overnight.

Cryptocurrency uses ‘cryptography’ in order to

secure and verify transactions, as well as to control

the creation of new units of currency. Cryptography,

in the modern age, involves the “study of

mathematical techniques for securing digital

information, systems, and distributed computations

against adversarial attacks” (Katz & Lindell, 2014).

In other words, “cryptocurrencies use cryptographic

protocols, or extremely complex code systems that

encrypt sensitive data transfers, to secure its units of

exchange. These protocols are built on advanced

mathematical and computer engineering principles

that render them virtually impossible to break,

making cryptocurrencies hardly possible to be

duplicated or counterfeited” (Martucci, 2018).

There are over 1,000 cryptocurrencies on the

market. Bitcoin, the first known cryptocurrency, is

still the largest cryptocurrency by market

capitalization, followed by Ethereum and Ripple.

Until now, the financial worth and destiny of

cryptocurrencies have been ferociously debated.

Nouriel Roubini, a noted American economist,

predicted that Bitcoin would crash to zero. American

business magnate Warren Buffett has also hit a

negative note against cryptocurrencies – that it will

come to a bad ending with virtual certainty (Kharpal,

2018).

490

Rentoy, J.

The Acceptability of Cryptocurrencies as Mode of Payment among Millennial Certified Public Accountants in the Philippines.

DOI: 10.5220/0008432804900497

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 490-497

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Cryptocurrencies, particularly Bitcoin, are widely

used in most developed countries such as the United

States, Canada, Netherlands, and Australia (Scott,

2016). While evidence shows that Bitcoin has been

extensively accepted in these developed countries, the

same level of acceptance in developing economies

like the Philippines has not yet been found. Therefore,

this research intends to understand the acceptability

of cryptocurrencies as mode of payment by

investigating the factors that are considered essential

to its adoption in the Philippines.

2 REVIEW OF RELATED

LITERATURE

2.1 Technology Acceptance Literatures

With the continuous expansion of technology and its

incorporation into user’s everyday private and

professional life, a decision concerning its adoption

or refutation still remains to be an open issue. As a

result of this continuous search for knowledge,

abundant number of technology acceptance theories

and models have been established and used to

investigate on the determinants and mechanisms of

user’s adoption decisions and behaviors. Among

these theories and models is the UTAUT model, also

known as the Unified Theory of Acceptance and Use

of Technology Model.

About more than a decade ago, authors

Venkatesh, Morris, Davis, and Davis (2003)

combined models such as the TAM and other models

based on the Theory of Planned Behavior (TPB) to

expound and forecast user acceptance and use of

information technology. The UTAUT model

identifies four key factors and four moderators related

to the prediction of behavioral intention to use a

technology and actual technology use in the context

of an organization (Venkatesh, Thong, & Xu, 2016).

Figure 1 shows a diagram of the UTAUT model.

According to Venkatesh et al. (2003),

“performance expectancy, effort expectancy, and

social influence were theorized and found to influence

behavioral intention to use a technology, while

behavioral intention and facilitating conditions

determine the use of technology”. The moderating

factors were theorized and discovered to moderate

various UTAUT relationships. The UTAUT model,

applied in a longitudinal field studies of employees’

acceptance of technology, was able to explain 77% of

the variance in behavioral intention to use a

technology and 52% of the variance in technology

use. While the UTAUT model was considered to have

stretched its practical boundary of predicting

individual technology acceptance and use decision,

researches based on the UTAUT model has still

increased by number. The sustained development of

UTAUT-based researches has proliferated because of

recent developments in information technology in the

organization and society.

Majority of the researchers extended the UTAUT

model by incorporating various mechanisms to fit the

model into the context of their studies and/or the

technology used. The mechanisms added were either

new exogenous, endogenous, moderating or outcome

mechanisms, or a mixture of any of the four. The most

common extension to the UTAUT model is by adding

new endogenous mechanisms. New endogenous

mechanisms refer to new predictor constructs that

could impact the dependent variables. For instance,

Venkatesh et al. (2012) infused hedonic motivation

and price value as additional predictors of behavioral

intention and habit as a new predictor of both

behavioral intention and technology use. Other

common endogenous mechanisms were perceived

risk (Martins et al., 2014; Slade et al., 2015) and trust

(Oh & Yoon, 2014).

2.2. Cryptocurrency Acceptance

Literatures

While there are a number of academic literatures

investigating on the acceptance of a certain

technology, extremely few researches have used

technology acceptance models in the context of

cryptocurrencies. Gunawan & Novendra (2017)

questioned the acceptance level of Bitcoin in

Indonesia, and what are the influencing factors for

such acceptance. Results of the study showed that

Performance Expectancy affects positively and

significantly behavioral intentions to use Bitcoin, and

that Facilitating Condition has a positive effect on the

Figure 1: The UTAUT Model.

The Acceptability of Cryptocurrencies as Mode of Payment among Millennial Certified Public Accountants in the Philippines

491

use behavior. On the other hand, Social Influence and

Effort Expectancy have no positive relationship with

intentional behavior. The study concludes that in

order for Bitcoins to be accepted in Indonesia,

transaction security processes must be increased, and

additional Bitcoin facilities must be provided.

Silinskyte (2014) examined the factors that affect

Bitcoin acceptance using the UTAUT model applied

in an exploratory quantitative study. The results

indicated that Performance Expectancy (0.707) and

Effort Expectancy (0.473) have significant positive

relationship with Intentional Behavior to use

Bitcoins, while Facilitating Conditions (0.448) and

Intentional Behavior (0.487) have significant positive

relationship with Use Behavior. Social Influence was

found to have relationship with Intentional Behavior

but not at a significant level. Jung, Park, Phan, Bo, &

Gim (2018) found out that government regulation has

a negative effect on social influence, and thus

intention to use cryptocurrencies, in South Korea but

not in Vietnam. Vietnam government neither cautions

using cryptocurrencies nor issues policies limiting the

use of such currencies, explaining why government

regulation has no negative effect on social influence

regarding the intention to use cryptocurrencies.

Roos (2016) investigated on the merchant

acceptability of cryptocurrencies using the extended

UTAUT model, also known as UTAUT2. UTAUT2

includes additional predictor variables such as

Hedonic Motivation, Price Value, and Habit. The

author believed that the addition of Trust as a new

construct to UTAUT2 was imperative to measure

technology adoption in the context of

cryptocurrencies. Among all the constructs tested,

results showed that trust had the most significant

influence on the behavioral intention to use

cryptocurrencies, together with price value,

performance expectancy, and habit. The author

suggested to conduct the study in a developing

economy, such as the Philippines, and compare it

with the findings of the study.

3 METHODOLOGIES AND

RESEARCH HYPOTHESES

3.1 Research Design & Methodology

The research was correlational in nature and used

quantitative details and analysis. With the increasing

familiarity and interest of millennials over

cryptocurrencies, the researcher finds it hard to ignore

the significance of millennials in understanding the

factors that determine the acceptability of

cryptocurrencies in the Philippines. Millennials have

proven to be a resilient generation and are known to

be fast adopters of new ideas and technologies

(Martin, 2018). Given the tremendous developments

in the global financial systems, accountants will need

to develop related foresights, this includes knowledge

and understanding of cryptocurrencies. Therefore, the

online survey was administered to 386 Millennial

Certified Public Accountants in the Philippines,

yielding an 89.4% response rate. To draw correlation

between variables, the Multiple Linear Regression

was utilized.

3.2 Research Hypotheses

Venkatesh et al. (2003) found that Performance

Expectancy (PE), Effort Expectancy (EE), and Social

Influence (SI) to significantly influence Behavioral

Intention (BI) to use a technology. Venkatesh et al.

(2012) argued that facilitation outside an

organizational environment can vary significantly

across users. Hence, FC will act more like perceived

behavioral control in the Theory of Planned Behavior

(TPB) and influence both BI and USE. Therefore, the

following hypotheses:

H1: PE has significant influence on the BI to

accept cryptocurrencies.

H2: EE has significant influence on the BI to

accept cryptocurrencies.

H3: SI has significant influence on the BI to

accept cryptocurrencies.

H4: FC has significant influence on the BI to

accept cryptocurrencies.

Venkatesh et al. (2012) infused Price Value (PV)

as one of the additional predictors of BI. Roos (2016)

found that Trust (TR) had the most significant

influence on BI. Al-Qasa et al. (2013) found that

Cultural Belief (CB) proved to have significant

relationship with BI. However, the relationship posed

inverse direction. Since the market of cryptocurrency

is not yet matured and the Philippine economy is still

in its development stages, people increasingly rely

more on government regulation (GR) for protection

(Al-Ghamdi et al., 2007). Thus, the following

hypotheses:

H5: PV has significant influence on the BI to

accept cryptocurrencies.

H6: TR has significant influence on the BI to

accept cryptocurrencies.

H7: CB has significant influence on the BI to

accept cryptocurrencies.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

492

H8: GR has significant influence on the BI to

accept cryptocurrencies.

The researcher argues that knowledgeable

business professional, particularly CPAs, must first

consider the accounting implications of

cryptocurrencies before accepting it. If

cryptocurrencies will be used as mode of payment in

business, there must be an existing Accounting Model

(AM) governed by the IFRS. As of date of writing,

there are no accounting standards that clearly and

specifically deal with cryptocurrencies. Thus:

H9: AM has significant influence on the BI to

accept cryptocurrencies.

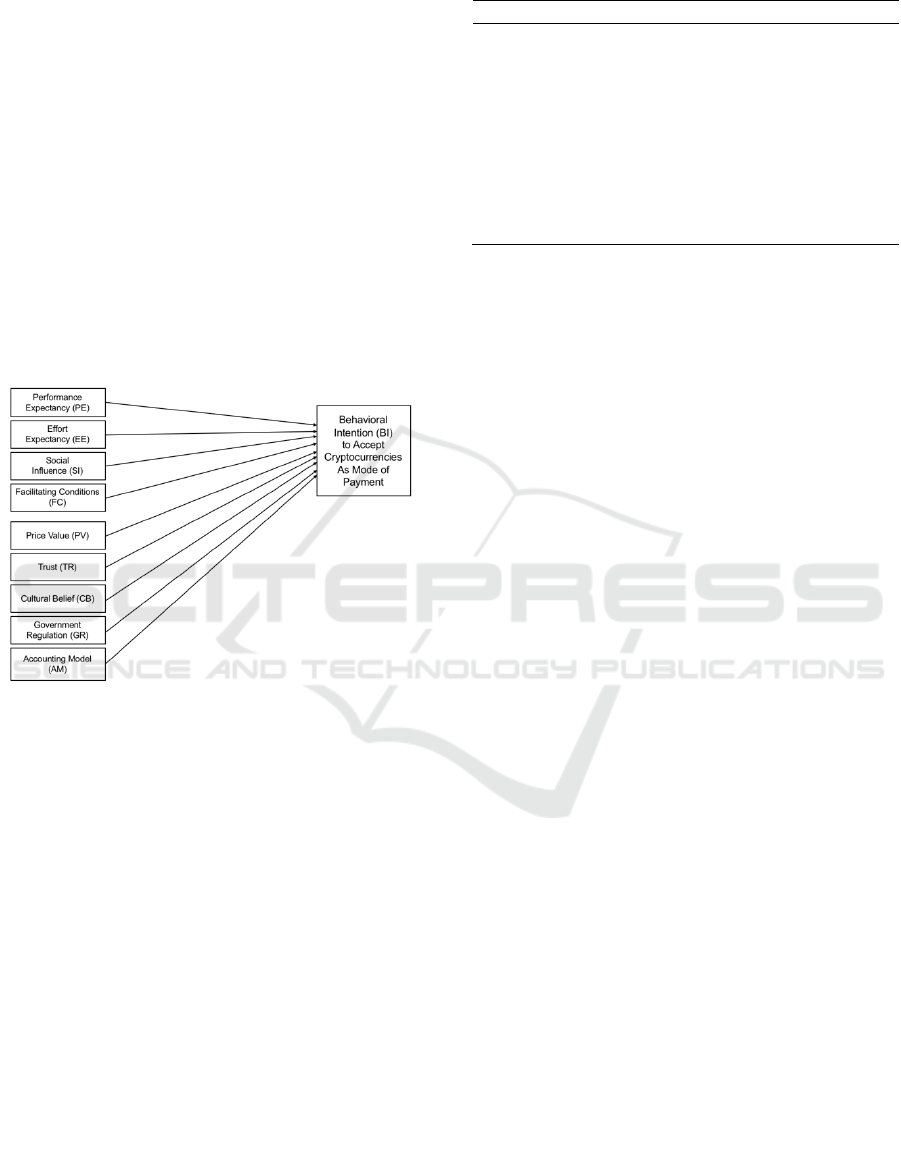

To summarize the hypotheses and to give an

overview of the framework by which this research

will operate, Figure 2 is presented below.

Figure 2: Operational Framework.

4 RESULTS AND

RECOMMENDATIONS

Before the online questionnaire was distributed to the

target respondents, it was first piloted to ten (10)

Certified Public Accountants for test of internal

consistency. In assessing the questionnaire’s internal

consistency, the Cronbach’s Alpha was used.

Nunnally (1978) recommends a minimum level alpha

coefficient of 0.70. If a research question decreases

the alpha coefficient because of poor correlation with

other questions, then that question must be discarded,

and a new alpha coefficient should be computed. The

results of Cronbach’s Alpha for each of the constructs

to be studied are presented in Table 1.

Table 1: Cronbach's Alpha Coefficient.

Variable

Cronbach’s alpha

Interpretation

BI

0.9260

Accepted

PE

0.9090

Accepted

EE

0.8351

Accepted

SI

0.9056

Accepted

FC

0.8733

Accepted

PV

0.7563

Accepted

TR

0.9154

Accepted

CB

0.8530

Accepted

GR

0.7130

Accepted

AM

0.7009

Accepted

The female respondents represented 54.15% of

the total number of respondents, which is greater

compared to the 45.85% of male respondents. As to

Age, all respondents were within the age range of 18

– 38. Only 24.09% of the respondents are practicing

their profession and at the same time engage

themselves in business and entrepreneurship. The

differences between demographics were also tested

for any possible moderation of relationships between

variables. Results of descriptive analysis found out

that there was no significant difference between male

and female (gender) and those who were engaged and

not engaged in business (business engagement) on all

variables. Therefore, the possibility of any

moderation on the relationships between the variables

was not supported.

Descriptive statistics in Table 2 show that BI to

accept cryptocurrencies yielded a 2.64 overall mean,

interpreted as neither high nor low behavioral

intention to accept cryptocurrencies as a mode of

payment among millennial CPAs in the Philippines.

This may be an implication that while

cryptocurrencies pose an inferior level of

acceptability compared to traditional money today,

there is still a probability to shift the perspective of

millennial CPAs to replace fiat money by

cryptocurrencies in the future. Among all the

independent variables, variable TR yielded the lowest

mean of 2.44. The result indicates that there is

disagreement in the level of confidence on the

existing technology behind cryptocurrencies. The

respondents, in general, disagreed that

cryptocurrencies must be trusted, and that they are not

secured, dependable, and reliable at all times. On the

other hand, the variable CB yielded the highest mean

at 3.86. The researcher argued that as long as

resistance to change brought about by CB is

prevalent, the BI to accept cryptocurrencies will

continually be challenged.

The Acceptability of Cryptocurrencies as Mode of Payment among Millennial Certified Public Accountants in the Philippines

493

Table 2: Descriptive Statistics – Mean.

Variables

Mean

BI

2.64

PE

2.82

EE

2.88

SI

2.45

FC

2.90

PV

3.05

TR

2.44

CB

3.86

GR

3.84

AM

3.57

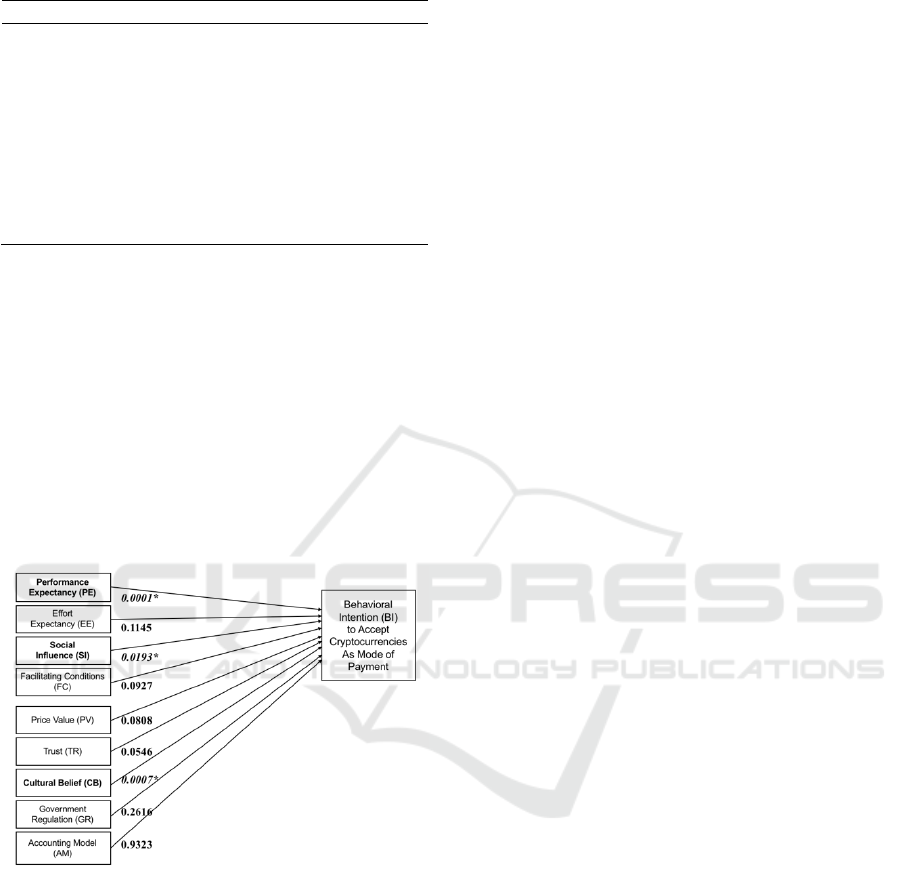

PE (r=0.821, p <.05) still remained to have the

strongest relationship with BI. EE (r=0.770, p <.05),

SI (r=0.747, p <.05), FC (r=0.741, p<.05), PV

(r=0.755, p<.05), and TR (r=0.704, p<.05) were all

found to have significant positive relationship with

BI. CB (r=-0.280, p<.05) was found to also

significantly affect BI but posed an inverse

relationship. Existence of AM (r=0.530, p<.05) was

also found to positively influence BI. Interestingly,

GR (r=-0.037, p>.05) was found to have no

significant relationship with BI. Figure 3 summarizes

the results.

Figure 3: Summary of Results - Multiple Linear Regression.

Using Multiple Linear Regression, only PE, SI,

and CB were found to be significant predictors of BI

to accept cryptocurrencies. The recommended model,

Behavioral Intention

i

= 0.3933 + 0.7055(PE

i

) +

0.2791(SI

i

) – 0.1116(CB

i

), yielded a 69.61% adjusted

R

2

. The result of this study confirms the findings of

Venkatesh et al. (2016) that PE is the strongest

predictor of BI. More importantly, previous studies

about cryptocurrency acceptance have discovered

similar results despite difference in economic settings

(Gunawan & Novendra, 2017; Roos, 2016;

Silinskyte, 2018).

The findings on SI from previous researches were

in disagreement with the results of this study. An

increase in value of SI would most likely result to an

increase in value of BI, at least in the context of the

Philippines. The significant relationship between SI

and BI may be explained by the strong traditional

values among Filipino families. Filipinos tend to be

loyal to their families and those whom they consider

as family, and simply obey their elders and authorities

on essential decisions. As long as there is high level

of resistance to accept cryptocurrencies from the

members of community to which a millennial CPA

belongs, the researcher argues that the BI to accept

cryptocurrencies as mode of payment will still be

challenged.

Intriguingly, the significance of CB as a predictor

of BI may be explained by the demography of the

research respondents – the Millennials CPAs.

Millennials have proven to be a resilient generation

and are known to be fast adopters of new ideas and

technologies. Therefore, Millennials are uniquely

positioned to drive a fundamental shift in cultural

belief, specifically with how cryptocurrencies could

affect the business landscape. Consequently, CPAs

were trained in school and in work to maintain

professional skepticism at all times. Professional

skepticism is an attitude that includes a questioning

mind and critical assessment of evidence. It is

therefore expected that CPAs are more welcoming to

new developments in technology, rather than being

fenced by the restrictions of cultural belief.

The findings of this research give rise to a number

of practical recommendations. The researcher

supports the idea that the neutrality in the behavioral

intention to accept cryptocurrencies poses an

advantage rather than disadvantage. It would be

tactical to focus first on influencing the choices of

millennial CPAs in terms of cryptocurrencies. Also,

CPAs usually play decision-making roles in a

business enterprise. Influencing their choices could

result to a more strategic advantage and targeted

interventions, considering that Social Influence had

been found to be a predictor of behavioral intention.

It is suggested that awareness campaigns and

trainings should highlight aspects related to PE, EE,

FC, and PV. These variables are considered to be the

easiest variables to control by disseminating

information and educating target groups. In designing

programs, audience must be given the opportunity to

work on cryptocurrencies hands-on, rather than just

give them purely theoretical presentations.

Accredited professional organizations, such as the

Philippine Institute of Certified Public Accountants

(PICPA), must be tapped by cryptocurrency

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

494

educating organizations to administer seminars that

would tackle the aspects of cryptocurrencies in a

manner earlier suggested by the researcher.

Cryptocurrency wallet developers should put

more attention on aspects such as EE, FC, and TR. It

would likely be helpful for wallet developers to

assume liability in case of lost or stolen

cryptocurrencies due to massive breach or hacking.

This is to ensure that wallet developers forward its

best foot in protecting their clients. A wallet that

could establish specifications unique to Filipinos

would most likely increase the acceptance of

cryptocurrencies.

The government must continue to regulate

cryptocurrencies since it has overall power to break

cultural belief on such currencies. The Philippine

government, by not banning cryptocurrencies, is a

move towards acceptance. However, an express

rather than implied support of cryptocurrencies could

result to a more holistic acceptance. Ideally, the

government could also develop its own

cryptocurrencies someday to fully replace fiat money.

While an accounting standard for

cryptocurrencies would not contribute to its overall

credibility, the former could still be at the core of

igniting international understanding. When

cryptocurrencies are recognized by the Accountancy

profession and its related accounting standard-setting

bodies, its strategic advantages shall be incorporated

on accounting syllabi and programs. This would

accelerate knowledge about cryptocurrencies and

could further facilitate acceptance.

Given the results of this study, coupled with the

research delimitations, the following areas for future

research are hereby recommended:

• To come up with a theoretically valid and

acceptable Cryptocurrency Acceptance Model,

using the recommended model in this study as a

starting point for model development;

• The finding on CB merits another study to

further investigate on the significant yet

negative relationship between CB and BI; and

• To study the behavioral intention to use

cryptocurrencies in a business exchange rather

than just focusing on its acceptance as a mode

of payment.

5 CONCLUSION

This research found out that Millennial CPAs are

neutral in terms of acceptability of cryptocurrencies

as mode of payment in the Philippines. Among the

nine independent variables investigated in this study,

only Performance Expectancy (PE), Social Influence

(SI), and Cultural Belief (CB) were found to have

significant influence on the behavioral intention to

accept cryptocurrencies. In order to increase the level

of acceptability of cryptocurrencies, the importance

of these three variables are paramount. Therefore,

corporate and business strategy formulations must

delve on focusing on the three significant variables to

enhance the influence of the Behavioral Intent (BI) to

accept cryptocurrencies as a mode of payment.

Given the nature and flexibility of the UTAUT

model, its adoption and modification were found to

be extremely suitable in understanding technological

advancement and innovation that may not yet be fully

acceptable at present times. Together with the

constructs investigated in this study along with the

original UTAUT constructs, business professionals,

owners, and managers may use the results of this

study as a strategic compass to direct through the

qualms carried about by technological innovations

such as cryptocurrencies.

REFERENCES

Al-Ghamdi, S., Sohail, M., & Al-Khaldi, A. 2007.

Measuring consumer satisfaction with consumer

protection agencies: some insights from Saudi Arabia.

Journal of Consumer Marketing, 24(2), 71-79.

Al-Qasa, K., Isa, F, Othman, S. 2013. Factors Affecting

Intentions to Use Banking Services in Yemen. Journal

of Internet Banking and Commerce.

Gunawan, F. E., & Novendra, R. 2017. An Analysis of

Bitcoin Acceptance in Indonesia. ComTech: Computer,

Mathematics and Engineering Applications, 8(4), 241-

247.

Jung, K. J., Park, J. B., Phan, N. Q., Bo, C., & Gim, G. Y.

2018, June. An International Comparative Study on the

Intension to Using Crypto-Currency. In International

Conference on Applied Computing and Information

Technology (pp. 104-123). Springer, Cham.

Katz, J., & Lindell, Y. 2014. Introduction to modern

cryptography. CRC press.

Kharpal, A. 2018, May 2. Cryptocurrencies are heading for

a 90 percent correction in 'mass market wipe out,'

investment bank warns. CNBC Business News.

Kotter, J. 2012. How the most innovative companies

capitalize on today's rapid - fire strategic challenges –

and still make their numbers. Harvard Business

Review, 90(11), 43-58.

Martin, T. H. 2018. Investing in Millennials.

Martins, C., Oliveira, T., & Popovic, A. 2014.

Understanding the internet banking adoption: A unified

theory of acceptance and use of technology and

perceived risk application. International Journal of

Information Management, 34(1), 1-13.

The Acceptability of Cryptocurrencies as Mode of Payment among Millennial Certified Public Accountants in the Philippines

495

Martucci, B. 2018. What is Cryptocurrency – how it Works,

History & Bitcoin Alternatives [Blog post].

Nunnally, J.C. 1978 Psychometric theory. 2nd Edition,

McGraw-Hill, New York.

Oh, J. C., & Yoon, S. J. 2014. Predicting the use of online

information services based on a modified UTAUT

model. Behavior & Information Technology, 33(7),

716-729.

Roos, C. 2016. The motivation and factors driving crypto-

currency adoption in SMEs (Unpublished Doctoral

dissertation, University of Pretoria).

Rose, C. 2015. The evolution of digital currencies: Bitcoin,

A cryptocurrency causing A monetary revolution. The

International Business & Economics Research Journal

(Online), 14(4), 617.

Scott, A. 2016, May 29. These are the world’s top 10

Bitcoin-friendly countries.

Silinskyte, J. 2014. Understanding Bitcoin adoption:

Unified Theory of Acceptance and Use of Technology

(UTAUT) application (Master Thesis). University

Leiden

Slade, E. L., Dwivedi, Y. K., Piercy, N. C., & Williams, M.

D. 2015. Modeling consumers’ adoption intentions of

remote mobile payments in the United Kingdom:

extending UTAUT with innovativeness, risk, and

trust. Psychology & Marketing, 32(8), 860-873.

Venkatesh, V., Morris, M., Davis, G., & Davis, F. 2003.

User Acceptance of Information Technology: Toward a

Unified View. MIS Quarterly, 27(3), 425-478.

doi:10.2307/30036540

Venkatesh, V., Thong, J. Y. L., & Xu, X. 2012. Consumer

acceptance and use of information technology:

Extending the unified theory of acceptance and use of

technology. MIS Quarterly, 36(1), 157-178.

Venkatesh, V., Thong, J. Y., & Xu, X. 2016. Unified theory

of acceptance and use of technology: A synthesis and

the road ahead [PDF]. Journal of Association for

Information Systems, 17(5), 328-376. Retrieved from

http://www.vvenkatesh.com/wp-

content/uploads/dlm_uploads/2016/01/2016_JAIS_Ve

nkatesh-et-al.-UTAUT.pdf

APPENDIX

Research Questions

Questions

Variable

BI1

If possible, I intend to use

Bitcoins instead of the traditional

money.

Behavioral

Intention to

accept

Cryptocurrencies

BI2

If I want to own Bitcoins, I will

accept it as payment instead of

purchasing it with cash.

BI3

I will accept Bitcoin as a mode of

payment.

BI4

If I have Bitcoins, I plan to use it

in my daily purchases / business

operations.

PE1

Bitcoin would be useful in my

profession/business.

Performance

Expectancy

PE2

Bitcoin would enable faster and

more efficient processing of

payment transactions.

PE3

Accepting Bitcoin as payment

would lead to more profit for my

profession/business.

PE4

Accepting Bitcoin as payment

would be a strategic advantage

for my profession/business.

EE1

Learning about Bitcoin and how

it works would be easy for me to

understand.

Effort Expectancy

EE2

Skills training about Bitcoin

would easily be available for me

without spending too much.

EE3

Accepting Bitcoin as payment

would be as easy as accepting

cash.

EE4

My clients/customers would find

it easy to pay in Bitcoin.

SI1

My valuable clients/customers

think that I should accept

Bitcoin.

Social Influence

SI2

People who are important to me

think that I should accept

Bitcoin.

SI3

There is high probability that my

fellow CPAs would start

accepting Bitcoin anytime soon.

SI4

Our society strongly supports the

acceptance of Bitcoins.

FC1

I could acquire the resources

necessary to accept Bitcoin.

Facilitating

Conditions

FC2

I could have enough knowledge

and skills to facilitate acceptance

of Bitcoin.

FC3

The Bitcoin community would be

enthusiastic to help me with

Bitcoin related issues.

FC4

I could accept Bitcoin with the

devices I currently have without

the need for major upgrades.

PV1

Bitcoin would provide significant

savings in payment processing

costs.

Price Value

PV2

If I accept Bitcoin, transaction

charges would be minimal and

reasonably priced.

PV3

I would accept Bitcoin if I don't

have to pay for any device or

software.

PV4

For my clients/customers, the

cost of using Bitcoin must be

comparable with other forms of

payments.

TR1

The technology behind Bitcoin

could be trusted completely.

Trust

TR2

Accepting Bitcoin is more

secured than credit card

transactions.

TR3

The technology behind Bitcoin

could not be easily hacked and

fraudulently altered.

TR4

My client's/customers' personal

information would be safe and

secured when they use Bitcoin.

CB1

Cash payment is still the most

convenient payment method.

Cultural Belief

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

496

CB2

If not required, I would not

accept Bitcoin as payment.

CB3

When accepting payment, I feel

more comfortable receiving cash

right away rather than virtual

payment.

CB4

I feel more Filipino whenever I

use our paper bills and coins.

RF1

I am accepting the Philippine

Peso because its purchasing

power is backed by the

government.

Regulatory

Framework

RF2

I would accept Bitcoin if the

government tells me so.

RF3

The government should regulate

the use of Bitcoins in the

Philippines.

RF4

I would still accept Bitcoin even

if the government bans its use in

the Philippines.

AM1

There should be an existing

accounting treatment for Bitcoins

around the world.

Existence of

Accounting

Model

AM2

I would accept Bitcoin if I could

be able to account for it clearly

and easily.

AM3

The Accountancy profession

should endorse the acceptability

of Bitcoins.

AM4

Accounting for Bitcoin should

first be established before I

accept it.

The Acceptability of Cryptocurrencies as Mode of Payment among Millennial Certified Public Accountants in the Philippines

497