The Impact of CGPI Award towards Financial Performance of

LQ45 Firms

Mochammad Fahlevi and Nendi Juhandi

Kusuma Negara Business School, Jakarta, Indonesia

Keywords: CGPI, ROA, GCG, LQ45.

Abstract: Corporate governance is highly recommended by the government for large companies in Indonesia. Very few

companies that have IPOs in Indonesia apply corporate governance, so there is still little research that

addresses the impact of corporate governance on corporate performance. The researcher tried to analyze the

impact of corporate governance on the financial performance of companies listed on LQ45. Analysis uses

company samples taken from 2015-2017. From previous research, it can be indicated that the implementation

of corporate governance has a positive and significant influence on company performance. However, from

this analysis, the results show that the Corporate Governance Perception Index (CGPI) Award has no effect

on ROA, this is different from other variables such as the percentage of independent commissioners and the

size of the board that have a positive effect on ROA of companies registered with LQ45.

1 INTRODUCTION

Basically, the issue of corporate governance is

motivated by the agency theory which states agency

problems arise when the management of a company

is separate from its ownership. Owner as company

capital suppliers delegates their authority to the

management of the company to professionals

managers. As a result, the authority to use the

resources owned by the company is entirely in

executive hand. This raises the possibility of a moral

hazard where management does not act the best for

the interests of the owner because of a conflict of

interest. Manager with the information they have can

act only to benefit themselves at the expense owner's

interests because the manager has company

information that the owner does not have (asymmetry

information). This will affect the company's

performance and eliminate investor confidence in

return on the investment they have invested in the

company. Examples of deep cases the banking

industry like the case of Bank Bali Indonesia in 1997

where bank managers transferred investment funds

existing to fund certain political parties.

Research on the relationship of good corporate

governance and company performance has been

carried out, both studies that use corporate

governance assessment indexes and corporate

structures (mechanisms) governance. Darmawati et

al. (2005) examined the relationship between

corporate governance and company performance.

According to Iskandar & Chamlao (2000) in

Lastanti (2004), mechanisms in corporate supervision

Governance is divided into two groups, namely

internal and external mechanisms. The internal

mechanism is a way to control the company by using

internal structures and processes such as the general

meeting of holders shares, the composition of the

board of directors, composition of the board of

commissioners and meeting with the board of

directors. While the external mechanism is a way to

influence companies other than by using internal

mechanisms, such as company control and the market

mechanism.

In the study Zulkafli and Samad, 2007 (cited by

Praptiningsih, 2009) examined about corporate

governance mechanism in measuring the

performance of banking companies through the

Monitoring Mechanism Ownership, Internal Control

Monitoring Mechanisms, Regulatory Monitoring

Mechanisms, and Disclosure Monitoring Mechanism.

In this study more in-depth study of the mechanism

corporate governance conducted by Zulkifli and

Samad (2007) in his research. Variable that will be

studied including the Ownership Monitoring

Mechanism including Controlling Shareholder

Ownership, Government Ownership, and Foreign

Ownership. The Internal Control Monitoring

Fahlevi, M. and Juhandi, N.

The Impact of CGPI Award towards Financial Performance of LQ45 Firms.

DOI: 10.5220/0008433605550561

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 555-561

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

555

Mechanism includes Size Board of Directors, Board

of Commissioners, size of Independent

Commissioners.

According to the Corporate Governance on

Indonesia (FCGI) forum, corporate governance is a

set of rules that govern the relationship between

shareholders, management (manager) of the

company, creditors, government, employees and

stakeholders other internal and external matters

relating to their rights and obligations or in other

words a system that controls the company where the

term corporate This governance arises because of the

agency theory, where the management of a company

separate from ownership. This separation allows a

conflict of interest between a company owner with

company management (management or directors). In

this case it is possible to have a different attitude

between company owners and internal directors

company management includes different attitudes in

the face of risk. Conflict these interests can be

minimized by the mechanism of good governance

(corporate governance). Corporate governance will

be a bridge between interests management with the

interests of shareholders in the management of a

company and provide a mechanism for controlling,

managing and conducting business management

including risk management.

In addition to the above, corporate governance

also provides a structure facilitate the determination

of the goals of a company, and as a means for

determine performance monitoring techniques

(Darmawati et al., 2004). Also presented by Newel

and Wilson (in Sabrina, 2010) in an article entitled A

Premium for Good Governance which states that

theoretically good corporate governance practices can

improve financial performance, reduce the risks that

arise due to managerial actions that tend benefit

yourself.

The results of a study conducted by Bozz-Allen &

Hamilton in 1998 showed that the index of Good

Corporate Governance (GCG) in Indonesia is the

lowest in other East Asian countries. Survey of

International Transparency 2005 about the

Corruption Perception Index placing Indonesia at

number 140 out of 159 countries surveyed with a

value of 2.2. This shows that the international

community's perception of corruption in Indonesia is

still high. CLSA Asia Survey Markets Markets 2005,

the Asian CG Association placed Indonesia at the

bottom (ranked 37th out of ranked 40 in 2004) among

10 other Asian countries under Malaysia, Thailand

and the Philippines (Hidayah, 2008).

Research conducted previously both in developed

countries and in developing countries uses corporate

implementation measurement different governance.

For example research conducted in European

countries, variables used to measure corporate

governance is Deminor's Corporate Governance

Rating which consists of 300 criteria grouped into 4

parts, namely Rights and Obligations of

Shareholders, Range Defense Takeover, Disclosure

Corporate Governance and Structure and Board

Function (Bauer et al., 2003). Wulandari (2005) uses

one characteristic of corporate governance namely

internal corporate governance mechanism (number of

board directors, the proportion of the board

independent commissioner) and mechanism external

corporate governance (institutional ownership) in

measuring corporate governance variables.

Measurement level of corporate governance

implementation in this study using size developed by

Indonesian Institute of Corporate Governance /

IICG).

The measurement is called Corporate The

Governance Perception Index (CGPI) in the form of

a score. CGPI is an assessment the implementation of

corporate governance based on 7 dimensions of GCG,

namely: commitment to corporate governance,

governance of the board of commissioners,

committees functional, board of directors, treatment

towards shareholders, treatment towards other

stakeholders and transparency, integrity and

independence.

2 LITERATURE REVIEW

Good Corporate Governance (GCG) is a set of

systems regulate and control the company to create

added value for stakeholders. GCG spurs the

formation of professional management patterns,

transparent, clean and sustainable. General Corporate

Good Guidelines Indonesia's governance in 2006

compiled by KNKG mention five principles GCG,

namely transparency, accountability, responsibility,

independence and fairness, and equality. There are

two principles main in GCG. First, clarity of rights

shareholders to obtain correct (accurate) information

time. Second, the company's intention to disclosure

accurately, timely and transparently to all

performance information company, ownership, and

stakeholders.

Corporate governance is guidelines for managers

to manage company best practice. Manager will make

financial decisions can benefit all parties

(stakeholders). Managers work effectively and

efficient so that it can reduce capital costs and able to

minimize risk. The effort is expected to produce high

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

556

profitability. Investors will earn income (return) in

line with expectations. Profit per shares increase so

shares the company is much in demand by investors.

This will result in a value company increases.

Agency relations perspective is the basis used to

understand corporate governance. Concept Corporate

governance arises as an effort to control or overcome

management behavior that matters yourself

especially those related to rights residual control

right. GCG implementation within the company

expected to be able to avoid it disgraceful practices

carried out by directors and other parties who have

relationship or interest in the company. Corporate

governance is a series of mechanisms that can protect

minority parties (investor outsider or minority

shareholders) from the expropriation carried out by

managers and holders controlling share with

emphasis on the legal mechanism (Shleifer and

Vishny, 1997 in Darmawati, et al., 2005).

In the book (Brigham and Erhardt, 2005),

corporate governance is defined as a set of rules and

procedures that guarantee managers to apply value-

based management principles. Bass The Committee

on Banking Supervision-Federal Reserve stipulates

that the bank is a critical component economy. They

provide commercial company financing, basic

financial services for a broad segment and access to

payment systems (Brigham and Erhardt, 2005). The

importance of national economic banks is underlined

by the fact that universal banking is an industry

regulator and banks have access to safety nets

government. This is very important. Therefore banks

must have strong corporate governance.

Internal control is very important for companies

due to the existence of internal controls then it can

direct, supervise, and measure the resources of a

company to make it better. Internal control can

prevent loss or waste of processing of company

resources. other than that can also provide

information about how to assess company

performance and company management as well as

provide information that will be used as a guideline

in planning.

2.1 Benefits of Corporate Governance

Corporate governance as a control mechanism

(disciplinary forces) which effectively harmonizes

interests shareholders with interests management.

Every management decision was taken based on

interests existing shareholders and resources used

solely for the sake of interest growth and increase in

value company. Managers work effectively and

efficient so that it can reduce capital costs and able to

minimize risk. This action will result in high

profitability. Therefore the application of good

corporate governance in the company affects

positively company operational performance.

Investors will get a high return if profitability

generated by the company high. High profitability

will have an impact on the earnings per share increase

so that the company shares attracted many investors.

Therefore the application of good corporate

governance good will make investors give a positive

response to performance company and increase

market value company.

Good corporate implementation governance is a

necessity for every company. Company reason

implementing good corporate governance not

because of a small or large company (company size),

not because the company has a composition of assets

heterogeneous or not because of companies have the

opportunity to grow high in general need external

funds to expand thus encouraging the company to

make improvements in implementation corporate

governance.

2.2 CG on Financial Performance

Financial Performance is a display the whole

condition of the company during certain period of

time which is results or achievements that are

influenced by company operational activities within

utilizing the resources that are owned (Helfert, 1996).

Company performance reviewed from a financial

perspective typical associated with profitability.

Corporate strategy in perspective long-term finance

will affect shareholder value.

Companies tend to depend on capital from

external parties to finance their operational activities.

Companies must be able to convince them the capital

owner that investment is they plant it has been placed

precise and efficient and ensure that management acts

the best for company interests

Benefits for companies that are implementing

good corporate governance as stated by Achmad

Daniri quoted by Djatmiko (2002) is that the essence

of good corporate This governance will be

economical maintain business continuity, fine

profitability, and growth. Corporate governance is a

guideline for managers to manage the company best

practice. The manager will make financial decisions

that can benefit all parties (stakeholders). Managers

work effectively and efficiently so that they can

reduce the cost of capital and able to minimize risk.

Business it is expected to produce high profitability.

Investors will get income (return) accordingly with

expectations. Impact of implementing good corporate

The Impact of CGPI Award towards Financial Performance of LQ45 Firms

557

governance besides being able to eliminate KKN and

create and accelerate the working climate more

healthy also increases trust investors and creditors.

Here is the link between applying good corporate

governance with company performance.

Implementation of good corporate governance will

make investors respond which is positive for

company performance and increase the market value

of the company.

2.3 Corporate Governance Perception

Index (CGPI)

The Indonesian Institute of Corporate Governance

(IICG) is an independent institution that conducts

corporate dissemination and development

governance in Indonesia. CGPI is research and

application ranking program good corporate

governance at Indonesia in public companies that are

organized by IICG. This program implemented since

2001 based on the thought of the importance of

knowing so far where public companies have applied

the principles of good corporate governance. The

participation of this program voluntary.

Definition of corporate governance used to

compile the framework methodology of CGPI for

companies whose shares are listed on the JSX. The

aim of the CGPI program is to stimulate the company

to race to implement good corporate governance in

the interest of the term company length. Next to that

too awarded company so that the company is

motivated implementing corporate governance and to

map specific problems faced by companies in

Indonesia in applying the good concept of corporate

governance (SWA, 2001). Index this perception is

obtained through three approach namely: share

ownership minority, interview with representatives

company and public information analyst includes

financial reports, corporate sites, and mass media

news.

CGPI ranking research is conducted by using the

survey method through a questionnaire filled with

self-assessment by issuers. Preparation of

questionnaires based on corporate principles

governance applied by the agency namely the OECD

and the KNKG covering Accountability,

Responsibility, Fairness and Transparency.

Description these principles into question items are

carried out in accordance with the Act No. 1 of 1995

concerning PT, Law No. 8 1998 concerning the

Capital Market, guide GCG implementation, OECD

principles, good business practices (best practices)

and rating criteria has been carried out in various

countries like Australia, Germany and the

Philippines. Question items are formulated can be

classified in several groups called criteria

implementation of GCG or implementation

dimensions GCG is a commitment to governance

company, the board of commissioners governance,

functional committees, the board of directors,

treatment of shareholders, treatment of other

stakeholders as well transparency, integrity and

independence.

So far, things have been the different

implementation of CGPI from year to year is the

development of methodologies and tools measure in

assessing the application of GCG. This matter done

to minimize limitations happened in previous years

and fight for the index presented CGPI is truly

credible. Results CGPI Outputs and Ratings in the

form of research and rating reports CGPI, the

publication of research results and CGPI Award and

Publishing ranking Best Practices Book by IICG.

3 METHODOLOGY

This study seeks to find the effect of corporate

governance on financial performance. The sampling

technique in this study used the purposive sampling

sample chosen was the companies listed as companies

included in the LQ45 list and classified based on

CGPI awards.

1. The company has the largest capitalization in

the last 12 months

2. has the highest transaction value for the past

year

3. the company is on the stock exchange for 3

months

4. The company has good financial aspects

5. From 60 companies, 45 companies were

selected with the largest capitalization and the

best performance

6. shares listed on the joint stock price index

The researcher determines the criteria of the company

which will be used as the research sample as follows:

1. Must have an annual report

2. Publish annual report at IDX website

3. Listed in LQ45

This study uses secondary data as data to measure

variables and look for influence. This study will also

collect other additional data which are normal logs of

total assets as a proxy for company size.

This study will use regression analysis to examine

the relationship between LQ45 corporate governance

and company performance. The use of regression

analysis is to ensure that there are independent

variables and control variables that are used to test

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

558

teir influence on the dependent variable.

The equation below will be used to test the

hypothesis:

FPi,t= a + IC1i,t + BSi,t + CGPI + Sizei,t (1)

Where:

FPi,t : Financial performance (ROA)

IC1i,t : Independent Commissioner (percentage)

BSi,t : Board Size (Number of Director)

CGPI : Awardee (dummy variable)

SIZEi,t: Total Asset

4 RESULT

This chapter will analyze the relationship and the

effect of independent variables to the dependent

variable.

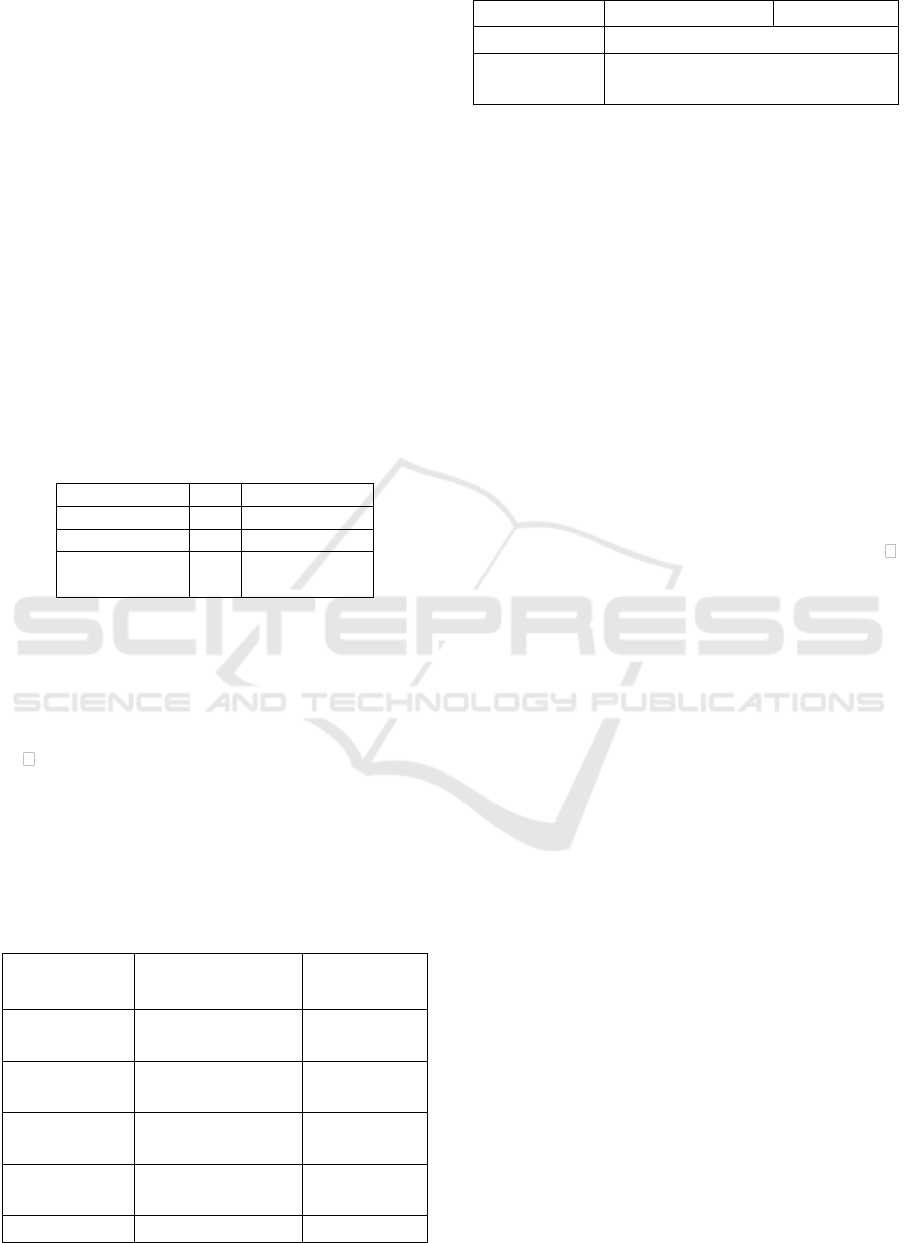

Table 2: ROA Mean of CGPI and non-CGPI.

Sub-sample

N

ROA Mean

CGPI

25

4.44

Non-CGPI

110

8.47

Means

-4.30

(0.006)

We can observe the results above the LQ45 index

that gets ROA for those who get the 4.4% CGPI

award. and those who do not get 8.4% ROA, which is

higher than the recipient. These results indicate that

ROA is lower for companies that get awards, and the

average difference test shows a significant difference

at = 0.01. Explanation of facts will be presented in

the discussion of regression results.This section will

discuss about the regression analysis of this research.

The researcher has formulated the regression

equation, as follows,

FPi,t= a + IC1i,t + BSi,t + CGPI + Sizei,t (2)

Table 4: Regression Coefficient.

Variable

Coefficient

T-stat

(Sig.)

Constant

27.6

3.9

(.000)

CGPI

-1.05

-.47

(.638)

BS

.87

1.9

(0.050)

IC

.07

1.234

(.219)

Size

-6.478

-3.724

(.000)

R-square

.107

F-stat

(Sig.)

5.025

(.001)

1. CGPI has Sig. value of 0.638. Sig. the

probability value of 0.05, or 0.6> 0.05, then

H1 is rejected and Ho is accepted

2. Board Size has Sig. value of 0.050. Sig. the

probability value of 0.05, or 0.50 = 0.05,

which means H1 is accepted and Ho is

rejected.

3. the Independent Commissioner has a Sig. value

of 0.2. Sig. the probability value of 0.05, or

0.2> 0.05, then H1 is rejected, and Ho is

accepted.

4. Company Size has Sig. value of 0,000. Sig. the

probability value of 0.05, or 0,000 <0.05, then

H1 is accepted, and Ho is rejected.

5. The Adjusted R-square this shows that 10.7%

of the variation in ROA is explained by all

independent variables and controls in the

model

6. F-test results in Sig. value of 0.001 (less than

= 0.01), it can be concluded that this model is

valid for use in predicting ROA.

From the result in the table above, we can make

the regression formula equation as follows:

FPi,t= (27.664)+ 0.874 BS2 – 6.478 Size

Conclusions from the regression results:

CGPI on ROA negative this is consistent with

previous research conducted by Cahyaningtyas &

Hadiprajitno (2015), and Prasinta (2012), who claim

that the implementation of good corporate

governance certainly has an effect on operational

performance, however, GCG implementation still

does not affect the improvement of financial

performance and market response.

Board size is positively related to ROA. This is

consistent with previous research conducted by

Ozcan & Riza (2016), Belkhir (2009), and Coles

(2008). the results show that it is significant.

Therefore it can be concluded that the size of the

board contributes to financial performance because it

has a significant positive effect on ROA.

5 CONCLUSION

This study shows that CGPI awards and companies

that implement corporate governance do not have a

direct effect on profits. we can see that companies that

are registered in the LQ45 index have a smaller

The Impact of CGPI Award towards Financial Performance of LQ45 Firms

559

percentage of profits when the company gets the

CGPI award, because the application of corporate

governance is not something easy and cheap, so the

impact of corporate governance is to sustain the

company in the long term not profit in the short term,

because the value of a company is more important

than a profit.

REFERENCES

Abbadi, S. S., Hijazi, Q. F., & Al-Rahahleh, A. S. (2016).

Corporate Governance Quality and Earnings

Management: Evidence from Jordan. Australasian

Accounting, Business and Finance Journal.

Abdullah, H., & Valentine, B. (2009). Fundamental and

Ethics Theories of Corporate Governance. Middle

Eastern Finance and Economic, Issue: 4, pp.1450-2889.

Alnaser, N., Shaban, O. S., & Al-Zubi, Z. (2014). The

Effect of Effective Corporate Governance Structure in

Improving Investors' Confidence in the Public

Financial Information. International Journal of

Academic Research in Business and Social Sciences,

Vol. 4, No. 1 ISSN: 2222-6990.

Andriana, A., & Panggabean, R. R. (2017). The Effect of

Good Corporate Governance and Environmental

Performance on Financial Performance of the Proper

Listed Company on Indonesia Stock Exchange. Binus

Business Review, 8(1), 1-8.

Assih, P., Ambar, H. W., & Parawiyati. (2005). Pengaruh

Manajemen Laba Pada Nilai dan Kinerja Perusahaan.

Jurnal Akuntansi dan Keuangan Indonesia.

Belkhir, M. (2009). ‘Board of Directors’ Size and

Performance in the Banking Industry. International

Journal of Managerial Finance, 5(2), 201-221.

http://dx.doi.org/10.1108/17439130910947903

Brahmasari , I. A., & Suprayetno, A. (2008). Pengaruh

Motivasi Kerja, Kepemimpinan dan Budaya Organisasi

Terhadap Kepuasan Kerja Karyawan serta Dampaknya

pada Kinerja Perusahaan (Studi kasus pada PT. Pei Hai

International Wiratama Indonesia). Jurnal Manajemen

dan Kewirausahaan.

Cahyaningtyas, Arfianty Reka & Hadiprajitno, Basuki,

(2015). Pengaruh Corporate Governance Perception

Index dan Profitabilitas Perusahaan Terhadap Nilai

Perusahaan, Diponegoro Journal Accounting, 4(3).

Christi, Stefania & Nugroho, Bernardus. Y, (2013).

Pengaruh Board Size dan Independent Commisioner

Terhadap Kinerja Perusahaan Perbankan Yang

Terdaftar di BEI Periode 2007-2011, FISIP-UI.

Coles, J. L., Naveen D. D., & Lalitha, N. (2008). Boards:

Does One Size Fit All? Journal of Financial Economics,

87, 329-356.

Cornett, (2009). Corporate governance and earnings

management at large U.S. bank holding companies,

Journal of Corporate Finance, 15.

Dechow, P. M., Sloan, R. G., & Sween, A. P. (1995).

Detecting Earnings Management. The Accounting

Review.

Deloitte. (2016). Good Governance driving Corporate

Performance. A meta-analysis of academic research &

invitation to engage in the dialogue

Emirzon, J. (2006). Regulatory Driven dalam Implementasi

Prinsip-Prinsip Good Corporate Governance Pada

Perusahaan di Indonesia. Jurnal Manajemen & Bisnis

Sriwijaya.

Emmons, W. R., & Schmid, F. A. (n.d). Corporate

Governance and Corporate Performance. Corporate

Governance and Globalization: Long Range Planning

Issues, pp. 59-64.

Fattahi, R., MoeinAddin, M., & Abtahi, Y. (2014). Impact

of earning management on value-relevance of

accounting information of the Firms Listed on the

Tehran Stock Exchange. Interdisciplinary Journal of

Contemporary Research in Business.

Gibson, M. S. (1999). Is Corporate Governance Ineffective

in Emerging Markets. Finance and Economics

Discussion Series.

Halimatusadiah, E., Sofianty, D., & Ermaya, H. N. (2015).

Effects of the Implementation of Good Corporate

Governance on Profitability. European Journal of

Business and Innovation Research, Vol.3, No.4, pp.19-

35.

Heenetigala, Kumi & Armstrong, Anona. (2011). The

Impact of Corporate Governance on Firm Performance

in an Unstable Economic and Political Environment:

Evidence from Sri Lanka. Electronic Journal.

10.2139/1971927.

Juniarty & Natalia, L. (2012). Corporate Governance

Perception Index (CGPI) and Cost of Debt.

International Journal of Business and Social Science

Vol. 3 No. 18.

Klein, April, (2002). Audit Committee, Board of Director

Characteristics, and Earnings Management. Journal of

Accounting and Economics, 33(3).

KNKG. (2006). Pedoman Umum Good Corporate

Governance Indonesia. Komite Nasional Kebijakan

Governance

Li, S., & Nair, A. (2009). Asian Corporate Governance or

Corporate Governance in Asia?, Corporate

Governance: An International Review, 17(4): 407–410

Malelak, M., & Basana, S. R. (2015). The Effect of

Corporate Governance on Firm Performance: Empirical

Evidence from Indonesia. Global Journal of Business

and Social Science Review 3 (1) 33 – 39

Ozcan & Riza, Ali, (2016). Board Size, Board Composition

and Performance: An Investigation on Turkish Banks,

International Business Research, 9(2).

Porter, M. E. (1991). Towards A Dynamic Theory.

Strategic Management Journal.

Prasinta, Dian, (2012). Pengaruh Corporate Governance

Terhadap Kinerja Keuangan, Accounting Analysis

Journal, 1(2).

Prasojo. (2015). Pengaruh Penerapan Good Corporate

Governance terhadap Kinerja Keuangan Bank Syariah.

Jurnal Dinamika Akuntansi dan Bisnis.

Riwayati, H. E., Markonah, & Siladjadja, M. (2016).

Implementation of Corporate Governance Influence to

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

560

Earnings Management. Procedia - Social and

Behavioral Sciences.

Rogers, M. (2008). Corporate Governance and Financial

Performance of Selected Commercial Banks in Uganda.

Queen's University Belfast.

Sanchia, M. I., & Zen, T. S. (2015). Impact of Good

Corporate Governance in Corporate Performance.

International Journal of Management and Applied

Science, 2394-7926 Vol. 1, Issue-9

Shleifer, A., & Vishny, R. W. (1997). Survey of Corporate

Governance. The Journal of Finance.

Sun, L. (n.d). Why is Corporate Governance Important?

Business Dictionary. Retrieved from http://www

.businessdictionary.com/article/618/why-is-corporate-

governance-important/

Tabassum, N., Kaleem, A., & Nazir, M. S. (2014). Real

Earnings Management and Future Performance. Global

Business Review.

Wahyudin, A., & Solikhah, B. (2017). Corporate

governance implementation rating in Indonesia and its

effects on financial performance. Corporate

Governance: The International Journal of Business in

Society, Vol. 17 Issue: 2, pp.250-265

Watts, R. L., & Zimmerman, J. L. (1990). Positive

Accounting Theory: A Ten-Year Perspective. The

Accounting Review.

The Impact of CGPI Award towards Financial Performance of LQ45 Firms

561