Recommendation on Valuation and Budgeting in Start-Up

Company PT X

Agnes Kristiani Ong

1

and Budi Frensidy

2

1

Candidate Master of Accounting, Magister of Accounting University of Indonesia, Salemba, Jakarta, Indonesia

2

Doctor of Finance, Faculty of Economics and Business (FEB) University of Indonesia, Depok, Jakarta, Indonesia

Keywords: Business Valuation, Start-Up Company, Participative Budgeting, Variance Analysis.

Abstract: This research aims to get and give a recommendation on valuation calculation at PT X, a start-up company

that mainly does management consultation with technology-based, also to suggest on financial planning and

control to achieve the projected financial result with the desired valuation. With valuation on hand, PT X can

explore the possibility get fund from the investor or even to go public. Financial planning is very crucial for

PT X that is currently only having sales target without having profit and loss budgeting or cash flow

projection. Financial control is also urgently required by PT X that is presently facing an extremely high burn

rate. After assessed use multiple valuation methods, it resulted mostly on positive valuation, which means PT

X has the potential to take funding option, either from a loan or additional capital from the investor. However,

PT X need to do proper financial planning and control to achieve that valuation result. Financial planning

through participative budgeting is the alternatives that PT X can use to build their financial budget.

Meanwhile, monthly financial control through variance analysis both on cash flow and profit and loss

statement is required to do.

1 INTRODUCTION

In these past decades, the number of start-up

companies has been raising. Indonesia has been one

of the countries with a high contribution of start-up

companies. According to Startup Ranking, as of June

2018, Indonesia has been one of the big ten countries

that has the most start-up companies.

Start-up companies generally can be classified

into four stages, which are the seed, early stage, later

stage, and initial public offering (IPO).

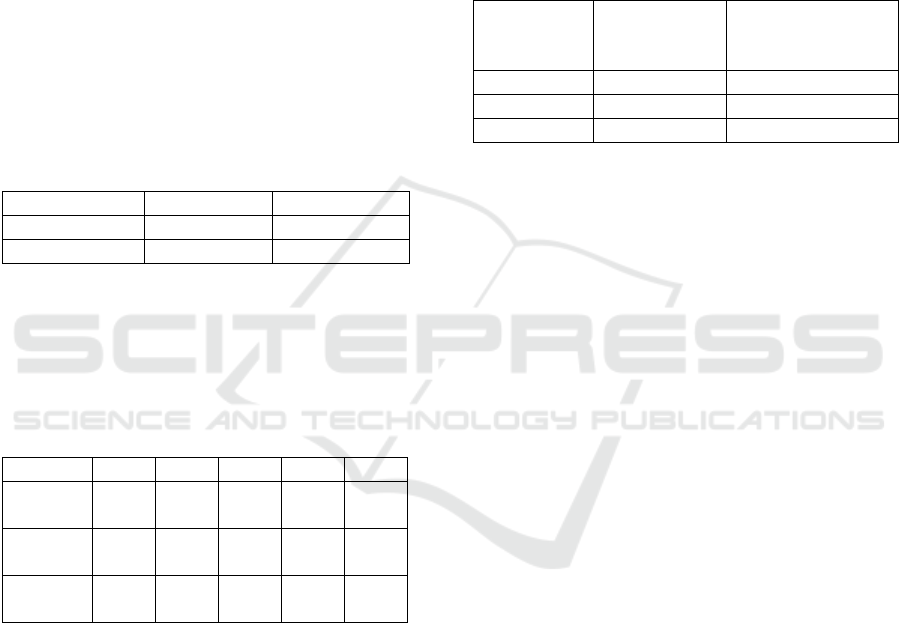

Table 1: Start-up Companies Classification.

Stage

Product

Funding

Source

Risk

Invest-

ment

Budget

Seed

Shaping

concept

Angels

Very

high

Low

Early

Stage

Concept

ready

Venture

Capital

High

Medium

Later

Stage

Product

ready

Venture

Capital

Med

ium

High

IPO

Product

verified

Stock

Exchange

Low

Very

high

Source: “Corporate Venture Capital Variable for

Investing on Startup in Indonesia”. International Journal

of Innovation and Research in Educational Sciences (2017)

Start-up companies that face financial loss and

negative cash flow in their first few years operations

have been a common phenomenon. However, three

out of four start-ups were failed (Gosh, 2012).

Smallbiztrends launched less than 50% of start-up

companies failed in their first 4 years. Smallbiztrend

has also indicated more than half of those failed

companies are due to the cashflow problem.

Although most of the start-up companies have a

negative cash flow, some of them still manage to

generate a positive valuation. Example of those is

companies like Go-Jek, Tokopedia, Traveloka, and

Bukalapak that currently become Unicorn with a

market capitalization worth more than 1 million USD.

PT X as start-up companies in Indonesia has been

facing financial loss for the past two years of

operation. Their extremely high burn rate has been a

problem. Furthermore, currently, they have no

financial budgeting and only yearly sales target. High

burn rate is high risk for new start-up companies that

need to be managed accordingly to avoid continuous

lost and even worse, bankruptcy.

Ong, A. and Frensidy, B.

Recommendation on Valuation and Budgeting in Start-Up Company PT X.

DOI: 10.5220/0008433905770583

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 577-583

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

577

2 LITERATURE REVIEW

2.1 Financial Distress

Continuous negative cash flow occurrence can lead to

financial distress. Financial distress described as a

condition where operating cash flows of a company

are not sufficient to pay their liability, especially the

short-term. Financial distress can further lead to

bankruptcy probability. (Ross, 2015)

2.2 Financial Decision

To maximize a firm’s value, Damodaran (2015)

describes there are three decisions that need to be

considered, which are the investment, financial, and

dividend decision. The financial decision itself mean

to choose either additional equity, debt, or mix of both

– to fund the operation cost.

2.3 Funding Alternatives

According to Ross (2015), one of the alternatives that

a newly born company might seek is venture capital

(VC) market. VCs basically is intermediaries between

investor and investee. They are looking, monitoring,

and trying to get the best deal for an investor.

Damodaran (2010) also said that valuation player for

a young growth company is either venture capital or

Initial Public Offering (IPO).

Ross (2015) mentioned that stages of financing

in venture capital could be broken down into:

1. seed money stage

2. start-up

3. first-round financing

4. second-round financing

5. third-round financing

6. fourth-round financing

2.4 Signalling Theory

Ross (1977) as quoted by Markopoulou (2009)

describes signaling theory as the usage of information

made by the company for an external party outside

the company to take an investment decision.

Information, -or signal-, that given to outsider can be

the announcement of the company is going to take a

debt, spin off, merger or acquisition, and others.

2.5 Multiple Valuation Methods in

Early-Stage Company

Valuation is one of the essential tools where investor

as an outsider can get a sense of a company's worth.

However, it’s not that easy to value young companies

due to less or no historical data available, few or no

existing assets, no clue of potential margin and

returns to be generated in the future, and hard to

measure the risk (Damodaran, 2010).

Behrmann (2016) made a comparison of some

valuation techniques to value young internet-based

companies. The research comes from the background

that no single valuation technique is perfectly suitable

for different kind of companies, business model, or

development stage (Bartov, Mohanram &

Seethamraju, 2001 ; Hand, 2000). Conventional

valuation method like Discounted Cash Flow (DCF)

quoted that are heavily relying on assumptions

(Steiger, 2008) as well as subject to error (Desmet,

D., Francis, T., Hu,A., Koller, T.M., & Riedel, 2000;

Festel, Wuermseher, & Cattaneo, 2013).

2.5.1 Discounted Cash Flows

Valuation using Discounted Cash Flows (DCF)

method is mainly to get the sense of how much the

company’s future worth to present. This is done by

calculating expected future cash flows in a certain

period and discount it with specific rate to convert it

to present value (Ross, 2015).

2.5.2 Venture Capital Method

Sahlman (2012) describes a way of valuing an early-

stage company using the venture capital method as

follow:

1. Determine the terminal value or exit value,

which is the estimate worth if the company is

going bankrupt and being sold. Terminal value

can be a benchmark to a similar company.

Other way is to multiple sales with sales

multiplier, computed by dividing market

capitalization to net sales.

2. Discount terminal to present value using

investor target IRR to get post financing

valuation (V post). Next is to deduct V post

with the amount of Capital (C) to get pre-

financing valuation (V pre)

Terminal value can be determined to use the price-

earning ratio to future projected earnings. Meanwhile,

target return rates are ranged that generally accepted

for each stage of the company’s development.

2.5.3 Relative/Market Comparison

Valuation

Damodaran (2010) mentioned that usage of a relative

method in valuing company's equity is easy yet can

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

578

be misuse because each company has different risk,

growth potential, and cash flows.

Further, Damodaran (2010) explained how to do

a relative valuation in two steps. First is to find a

similar company. The specific ratio will be used as a

multiplier to calculate the valuation (the example of

these ratios are price to earnings ratio, EBITDA, price

to sales ratio).

2.5.4 Step Up Model

Poland (2014) explained Step Up model as further

exploration of Berkus Method. Step Up model has ten

valuation factors. Pre-money valuation is calculated

by giving $250,000 for each valuation method that is

applicable for the company.

2.6 Budgeting

Hansen (2015) highlights the importance of

budgeting in financial planning and control. As a

planning tool, the budget is used to translate the

organization's goal and strategies into operational

terms. As a control tool, the budget will help to see

the actual performance and the deviation towards the

plan.

2.6.1 Income Statement Budgeting

Hansen (2015) explained to first build sales and

operations budget to make a budgeted income

statement. Operations budget includes marketing

expense, administrative expense, and other

operational expenses.

2.6.2 Cash Flow Budgeting

Ross (2015) describe cash budget as a primary tool to

do short-term financial planning. There are a few

things that need to be considered during the cash

budgeting process:

1. Cash collection

2. Cash outflow

3. Cash balance

Hansen (2015) defined cash budget as a detailed

plan of cash source and expenditure. Further Hansen

explains how to calculate ending cash balance as

follow:

Beginning cash balance

+ Cash receipts

= Cash Available

- Cash disbursement

- minimum cash balance

Excess or deficiency of cash

- repayment

+ loans

+ minimum cash balance

Ending cash balance

Account receivable aging schedule can help to

build cash receipts budget. While account payable

aging schedule help to build cash disbursement

budget (Hansen, 2015)

2.6.3 Good Budgetary

According to Hansen (2015), good budgetary should

be able to drive the manager to achieve the

organization's goal. Characteristics of good budgetary

are:

1. Have frequent feedback on performance;

2. Have monetary and nonmonetary

incentives;

3. Participative budgeting;

4. Realistic standards;

5. Have multiple performance's measures.

3 METHOD

This study is a case study. Case study being chosen

given the phenomena that were researched, and the

proposed solution might be only well suitable for

specific unit analysis, PT X.

The mixed method is being used given the data

collection is combining between qualitative and

quantitative, as well as data processing. An interview

has occurred to get the information about the current

situation and practice in PT X. Further, the financial

statement is being analysed using document review.

The data mainly used in this study were primary

data obtained from the Chief of Staff in PT X that

supervises finance, accounting, human resource, and

general and affair department. Secondary data is also

used as complementary, which are the financial

statements for compared public listed companies.

The unit analysis in this study is PT X, start-up

companies that have established in Indonesia for only

two years and currently face a high burn rate. PT X

does not have any budgeting process in place, and

they just have a sales target for the whole year. At the

moment they are using external parties accounting

vendor to manage their financial and accounting

statement.

Recommendation on Valuation and Budgeting in Start-Up Company PT X

579

4 RESULT

4.1 Valuation use Multiple Methods

Using multiple methods, PT X can either resulted in

positive or negative valuation, regardless of the

negative cash flow that they had for the financial year

of 2017 and 2018.

4.1.1 Discounted Cash Flow (DCF) Method

Using the DCF method can result in PT X to have

either positive or negative cashflow, depend on the

variables that were used as assumptions.

Sales Growth Target

PT X has significant growth of 417% from 2017 to

2018.

Table 2: Sales Growth PT X.

2017

2018

Sales (in IDR)

353.425.249

1.828.815.129

Sales growth

N/A

417%

Source: PT X financial report

Based on the assumption given the information from

Chief of Staff PT X and some other factors taken into

consideration, the growth for each year for five years

period as follow:

Table 3: Sales Growth PT X Use Three Scenarios.

2019

2020

2021

2022

2023

Pessi-

mistic

300%

200%

150%

100%

100%

Most

Likely

350%

250%

200%

150%

150%

Opti-

mistic

400%

300%

250%

200%

200%

Source: Interview with Chief of Officer PT X (data further

processed)

Expenses and Tax Assumptions

Expenses assumption is according to current

expenses as a baseline, yearly growth, and further

reasonability analysis. Corporate income tax applied

is 25% as used in Indonesia if any profit occurs during

the respective financial year. Loss carryover of five

years is taken into consideration.

Required Rate of Return/Discount Factor

The discount factor being used in this study 70%.

This rate is used as some studies show that the

required rate of return for start-up companies varies

between 50% and 70%, some even requires 100%

(Carver, 2012). Damodaran (2010) mentioned that

venture capital requires 50% to 70% rate of return for

the company under the start-up stage.

Discounted Cash Flow Use Three Scenarios

Table 4: Valuation PT X Use DCF Three Scenarios.

Probability

to Happened

(assumption)

Valuation (IDR)

use 70% discount

rate

Pessimistic

25%

-3,674,950,917

Most Likely

50%

-1,242,513,746

Optimistic

25%

2,654,615

Source: PT X financial statement FY 2018 (Data

further processed)

Based on the above calculation, PT X will get positive

valuation only if the optimistic scenario happens.

Further, if three scenarios combined together with the

probability, it will generate a negative valuation of

(IDR 876,340,752).

Given the high required rate of return by an

investor for a start-up company, it is tough to get a

positive valuation for PT X in five years timeline.

Provided that a lot of assumption is being used in the

calculation, they can be easily modified to get

positive valuation result. However, it does not serve

the purpose of reasonable valuation.

4.1.2 Venture Capital (VC) Method

Use the VC method, calculation for PT X’s valuation

as follow:

1. Terminal value or exit value = sales x sales

multiplier

a. Use KIOS sales multiplier 0.55

TV = 0.55 x 12,723,308,962

= 3,475,888,687

b. Use MCAS sales multiplier 1.73

TV = 1.73 x 12,723,308,962

= 22,023,771,219

c. Use 50% x (a) and 50% x (b)

TV = (50%x3,475,888,687) +

(50%x22,023,771,219)

= 14,487,774,296

2. V post = TV discounted by 75%

V post = 14,487,774,296 / (1+75%)

5

= 882,696,548

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

580

4.1.3 Relative/Market Comparison

Valuation

Comparison Companies

Companies that were used as a comparison to PT X

are PT Kioson Indonesia (KIOS) and PT M Cash

Integrasi (MCAS). Both companies were chosen for

having the closest characteristic with PT X, which are

: start-up companies, technology-based and located in

Indonesia. Further, Kioson and M-Cash have been

going public for less than 5 years, hence all financial

data is publicly available.

Comparison between PT X and PT Kioson and PT

M Cash as follow:

Table 5: Start-Up Attributes PT X, KIOS, MCAS.

Start-Up

Attributes

PT X

KIOS

MCAS

Industry

Manage

ment

consultat

ion with

technolo

gy based

Online

trading

with

technolog

y based

Digital

and e-

commerc

e trading

with

technolog

y based

Founder

leading

experience

First time

Experienc

ed before

Experienc

ed before

Company

location

Jakarta,

Indonesi

a

Jakarta,

Indonesia

Jakarta,

Indonesia

B2B/B2C

B2B

B2B

B2B

Stage of

developme

nt

Early-

stage

IPO

IPO

Funding

From

headquar

ter

Public

Public

Team

Full team

Full team

Full team

Valuation*

(Billion

IDR)

To be

calculate

1,072

3,185

*Source: Financial statement KIOS 30 September 2018

unaudited, financial statement MCAS 30 June 2018

unaudited.

Sales Multiplier

Given the fact that PT X has not gone public yet, some

multipliers that contain stock price or dividend can

not be used. The most possible multiplier that can be

used is sales multiplier. It calculated by dividing

market capitalization with net sales.

Table 6: Valuation PT X Use Relative Method.

In Billion IDR

KIOS

MCAS

Market

Capitalization *

1,072

3,185

Net Sales **

1,962

1,840

Sales Multiplier

0.55

1,73

*) Source: Yahoo January 18,2019 (market capital KIOS

& MCAS)

**) Source: Financial statement KIOS 30 September 2018

unaudited, financial statement MCAS 30 June 2018

unaudited.

Valuation for PT X can be computed as below:

- Benchmark to KIOS

Market capitalization PT X = sales multiplier KIOS x

net sales PT X YTD Sep’18

= 0.55 x IDR 1.37 billion = IDR 0.75 billion

- Benchmark to MCAS

Market capitalization PT X = sales multiplier MCAS

x net sales PT X YTD Jun’18

= 1.73 x IDR 0.91 billion = IDR 1.58 billion

Using the percentage of 50% for both companies,

valuation for PT X will be:

(50% x IDR 0.75 billion) +(50% x IDR 1.583 billion)

= IDR 1.17 billion

4.1.4 Step Up Model

Poland (2014) proposes to give $250.000 for each yes

of step-up factors.

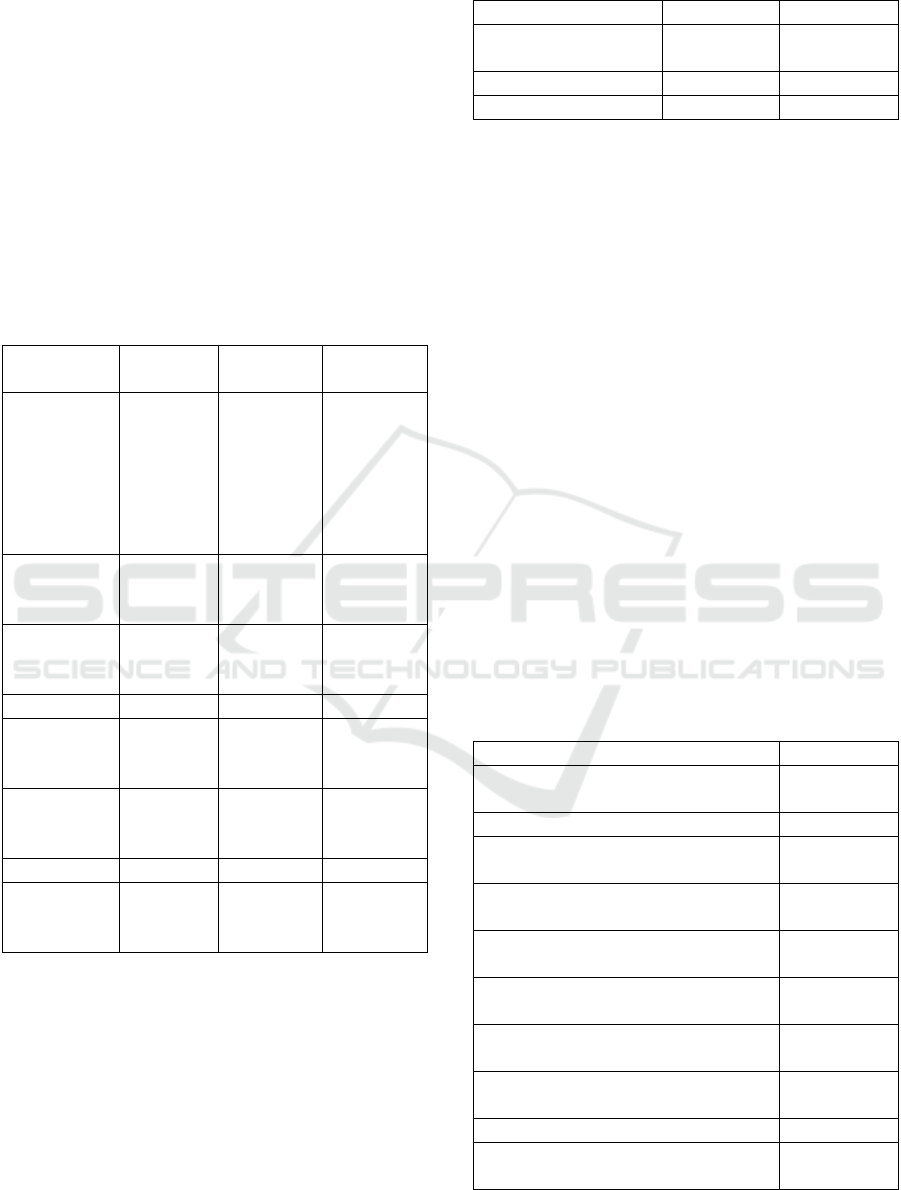

Table 7: Start-Up Attributes PT X Use Step Up Model.

Step-Up factors

Yes

1.Total market size over $500

million

√

2.Business model scales well

3.Founders have previous exits or

significant experience

4.More than one founder

committed full time

5.MVP developed, customer

development underway

6.Business model validated by

paying customers

7.Significant industry partnerships

signed

8.Execution roadmap developed

and being achieved

9.IP issued or technology protected

√

10.Competitive environment

favourable

Recommendation on Valuation and Budgeting in Start-Up Company PT X

581

Given the checklist above, valuation for PT X is

computed as:

2 factors x $250.000 = $500.000 = IDR 7 billion.

4.2 Budgeting

4.2.1 Profit and Loss Budget

The proposed process of profit and loss budgeting in

PT X is as follows:

1. Breakdown the sales target into a monthly

target.

Currently they have one yearly sales target.

2. Review all the expenses that have happened

in 2017 and 2018

3. Adjusted accordingly to build expenses in

2019.

4. Combine the sales target and expenses

budget to be profit and loss budget.

5. All these budgeting steps should involve

managers from multiple departments, not

only finance (participative budgeting).

6. Compare actual sales and expenses every

month end and analyse the gap (variance

analysis).

4.2.2 Cash Flow Budget

The proposed process of cash flow budgeting in PT X

is as follows:

1. Make cash income schedule by mapping

customer’s sales generated and customer

terms of payment. For example, with 60

days terms of payment, sales generated in

January should be paid by March. Make

adjustment accordingly by looking at

historical data from bank account statement.

2. Make cash outcome schedule by mapping

expenses forecasted and supplier terms of

payment. For example, expenses booked in

January book will due in February. Make

adjustment accordingly by looking at

historical disbursement data from bank

account statement.

3. Combine both schedules to get cash balance

for each month.

4. All these budgeting steps should involve

managers from multiple departments, not

only finance (participative budgeting).

5. Compare actual cash income and

disbursement with the budget every month

end and analyze the gap in monthly basis

(variance analysis).

5 CONCLUSIONS

Using multiple valuation methods can result in PT X

either to have positive or negative valuation. It varies

due to different assumptions and estimations used.

Table 8: Valuation PT X Use Multiple Methods.

Valuation Method

Valuation (IDR)

DCF

-876 Million

VC method

882 Million

Relative/market

comparison

1.17 Billion

Step up method

7 Billion

However, the fact that PT X can generate positive

valuation with some of the methods are opening their

view that they have potential to explore for external

funding option from the investor, either from Venture

Capital or Initial Public Offering.

Apart from the chance of having a positive

valuation, more fundamental things that PT X need to

be a concern is that positive valuation can be achieved

if they have financial budgeting. The budget for Profit

and Loss statement as well as cash flow projection

need to be established and tightly monitored.

ACKNOWLEDGEMENTS

This research paper is an output from: Thesis

University of Indonesia 2019.

REFERENCES

Behrmann, Glenn. 2016. Internet Company Valuation – A

Study of Valuation Method and Their Accuracy. Thesis

: EBS Universitat fur Wirtschaft und Recht.

Damodaran, Aswath. 2010. Dark Side of Valuation :

Valuing Young, Distressed, and Complex Businesses.

New Jearsey : Pearson Education, Inc.

Damodaran, Aswath. 2015. Applied Corporate Finance

Forth Edition. USA : Wiley.

Ghosh, Shikhar. 2012. The Venture Capital Secret : 3 Out

of 4 Start-Ups Fail. Harvard Business School

Newsroom.

Hansen, Don R. Moewn, Maryanne M. (2015).

Cornerstones of Cost Management (3

rd

ed.). USA :

Southwestern-Cencage Learning.

Mansfield, Matt. “Startup Statistics : The Numbers You

Need to Know”. 15 Mei 2018.

<https://smallbiztrends.com/2016/11/startup-statistics-

small-business.html>.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

582

Markopolou, Maria K. 2009. Capital Structure Signaling

Theory : Evidence From The Greek Stock Exchange.

Poland, Stephen R. 2014. Founder’s Pocket Guide : Startup

Valuation Markopolou, Maria K. 2009. Capital

Structure Signaling Theory : Evidence From The Greek

Stock Exchange.

Ross, Stephen A. Westerfield, Ramdolph W. Jaffie, Jeffrey.

Lim, Joseph. Tan, Ruth. Wong, Helen. (2005).

Corporate Finance Tenth Edition (10

th

ed.). New York

: McGraw-Hill Education.

Harvard Business Review. 2012. Early-Stage Companies

and Financing Valuation : The Venture Capital Method.

IESE Business School-University of Navarra.

Recommendation on Valuation and Budgeting in Start-Up Company PT X

583