Implementation of Agile Methodologies in Developing Upstream

Land and Properties Tax Reporting System to Mitigate Tax Sanction

Risk: Case Study: KKKS XYZ

Cesar Zehan Camille and Christine

Faculty of Economics and Business, Universitas Indonesia, Jakarta-Indonesia

Keywords: Upstream Land and Properties Tax, System Development, Agile Methodologies, Tax Reporting System,

Model-Driven Approach.

Abstract: This thesis aims to develop upstream land and properties tax reporting system to mitigate tax sanction using

a case study of KKKS XYZ, an upstream company which signs oil and gas production sharing contract under

pre-PP No. 79 Tahun 2010 regime. Under this regime, the company has an obligation to report its land and

properties tax every year and to pay the tax due using overbooking procedure. In recent year, KKKS XYZ

receives several Notice of Tax Underpayment Assessment after the tax examination by the fiscus found

incorrect land and properties reported data in KKKS XYZ's tax report. The company should bear the tax fine

by its own liability since it cannot be charged as an operating cost that can be recovered by the government.

A complete and accurate land and properties reporting system are needed to mitigate the risk of future tax

sanctions. In this study, we will develop a tax reporting system using six steps of system development

developed by Satzinger et al. (2012) through agile methodologies and model-driven approach. Specifically,

we use process modelling technique and system tools such as interview and Flowchart. The system

development process will be implemented iteratively.

1 INTRODUCTION

Oil and gas are a strategic natural resource that has a

significant role in Indonesia’s economy. Besides

being an important non-renewable energy source for

people, oil and gas mining provides income for the

state in the form of taxes and non-tax revenues.

Government Act No. 22 of 2001 regarding Oil and

Gas states that revenues from oil and gas in the form

of taxes include taxes from oil and gas, import duties

and other levies on imports and excise, as well as

regional taxes and regional retributions. Non-tax state

revenues include the state's share, state levies in the

form of permanent contributions and exploration and

exploitation contributions, and bonuses.

Oil and gas mining include exploration and

exploitation activities (Pudyantoro, 2012). Oil and

gas exploration and exploitation activities are carried

out within the working area on the ground and inside

the land using production facilities. According to the

Ministry of Finances Regulation No.

76/PMK.03/2013, land and properties tax on the oil

and gas sector (ULP Tax) is subjected to people or

entities that have a right to the land, and/or benefit

from the land, and/or have, control, and/or obtain

benefits for properties that are objects of the ULP

Tax.

ULP Tax according to the tax collection

mechanism can be grouped into an official

assessment system, a collection system that

authorizes the tax officer to determine the amount of

tax payable (Waluyo, 2011). However, the taxpayer

of ULP Tax is not entirely passive because the

taxpayer is given the authority, trust, and

responsibility to report data in the Notification of Tax

Objects along with the Appendix of Tax Object

Notification to the Tax Office determined by the

Director General of Taxes. The taxpayer then waits

for the Payable Tax Notification Letter for the tax

object that is owned, controlled, and/or obtained per

January 1.

KKKS XYZ is one of the production-sharing

contract's contractors for oil and gas mining with

work areas spread across several districts and cities in

Indonesia. KKKS XYZ received a mining contract

from the government before the enactment of

640

Camille, C. and Christine, .

Implementation of Agile Methodologies in Developing Upstream Land and Properties Tax Reporting System to Mitigate Tax Sanction Risk: Case Study: KKKS XYZ.

DOI: 10.5220/0008434806400650

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 640-650

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Government Regulation No. 79 of 2010, which

means that the payment of the ULP Tax for KKKS

XYZ is made through overbooking procedure. In

accordance with the regulations mentioned above,

KKKS XYZ compiles and reports Notification of Tax

Objects to Tax Office where KKKS XYZ operates

every year.

Data from the Tax KKKS XYZ Division shows

that from 2014 until 2017 there are 25 Underpayment

Tax Assessment Letters from 6 Tax Offices where

KKKS XYZ report the Notification of Tax Objects

with a total principal value of IDR 83.07 billion and

tax fine of IDR 20.77 billion. Issuance of

Underpayment Tax Assessment Letters from Tax

Office is due to differences in land and properties data

between tax authorities and KKKS XYZ. The

Underpayment Tax Assessment Letters recapitulation

received by KKKS XYZ from Tax Office can be seen

in Table 1.

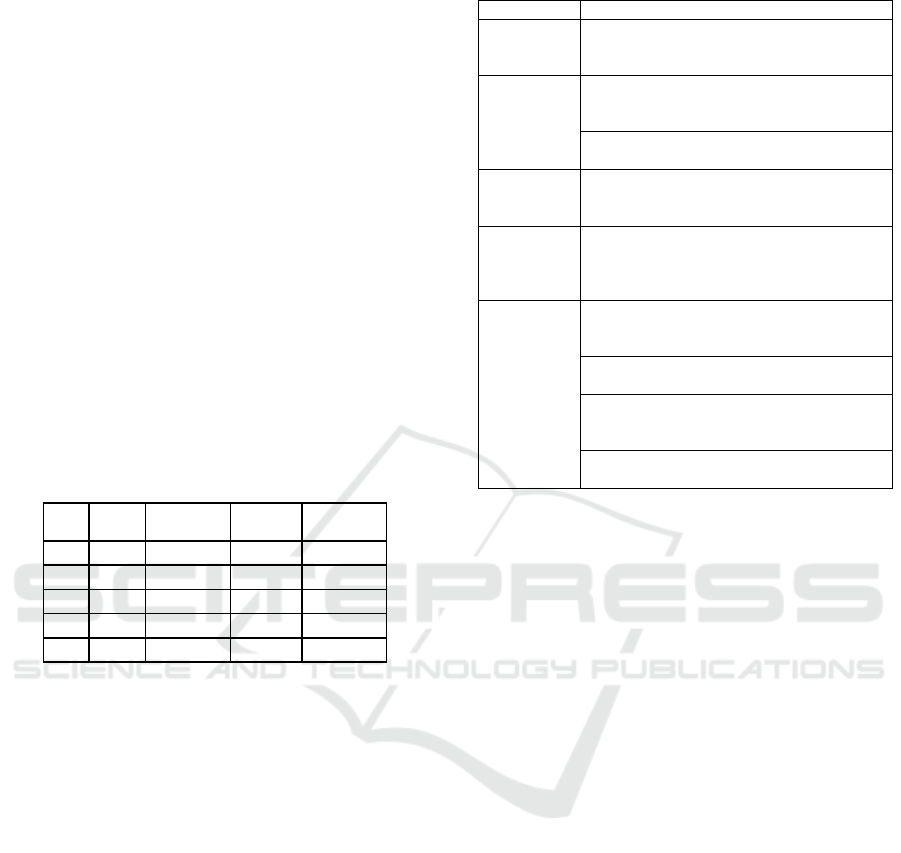

Table 1: Recapitulation of KKKS XYZ’s ULP Tax

Underpayment Tax Assessment Letters 2013-2017 (in

million rupiah).

Year

No of

UTAL

Principal

Value

Tax Fine

Total

2013

1

662

165

827

2014

10

38,031

9,507

47,539

2015

10

42,847

10,711

53,559

2016

4

2,185

546

2,731

Total

25

83,065

20,766

103,831

Article 13 Government Regulation No. 79 of 2010

states that administrative sanctions in the form of

interest, fines and increases as well as criminal

sanctions in the form of penalties associated with the

implementation of laws and regulations in taxation

and claims or fines arising out of contractor's fault

due to willful misconduct or negligence cannot be

calculated as a recoverable operating cost. Thus, from

2013 to 2017 KKKS XYZ bore its own tax penalty of

IDR 20.77 billion.

Based on discussions with the Tax Division of

KKKS XYZ, there are several factors that cause

differences in data on land and properties assets in the

ULP Tax report that can be grouped into several

factors: material, people, methods, tools, and

environment. These factors can be seen in Table 2.

Actions are needed to reduce the risk of fines from the

issuance of Underpayment Tax Assessment Letters

due to differences in land and properties data between

the tax authorities and KKKS XYZ in ULP Tax report

by identifying the causes of the problems. This study

seeks to overcome these factors by making

improvements to the ULP Tax reporting system.

Table 2: Root Cause Analysis of Data Differential.

Root Cause

Analysis

Materials

The preparation of the ULP Tax Report collects

a large amount of data on land and building

assets.

People

Work overload in the Treasury Function as the

responsible function for preparing the ULP Tax

Report.

Lack of knowledge in compiling the ULP Tax

Report.

Methods

The preparation of the ULP Tax Report requires

intensive coordination between the functions of

users/owners of data on land and building assets.

Tools

The working paper on asset inventory is

different/out of sync with the working paper of

Notification of Tax Objects along with the

Appendix of Tax Object Notification.

Environment

The DGT staff does not have sufficient

knowledge of the assets used in the oil and gas

mining industry.

Tax intensification by DGT to pursue tax

targets.

Changes in the condition of the Regency and

City areas which are the reporting bases of the

ULP Tax.

The extensive KKKS XYZ working area covers

many regencies and cities throughout Indonesia.

This is a case study research by raising the issues

above. This study designed the ULP Tax reporting

system using the system design process proposed by

Satzinger et al. (2012) with the agile methodologies

approach and model-driven approach. Specifically,

system design uses process modeling techniques with

documentation and system design tools used are

interviews and flowcharts. System design is

implemented iteratively. At the end of this study a

proposal for a new work instruction will be presented

which is used as a solution to the problem.

In this study, the data collected were qualitative

data and quantitative data. Qualitative data used in the

form of tax regulation documents and regulatory

documents related to upstream oil and gas business

activities issued by SKK Migas. Quantitative data are

ULP Tax data issued by the Directorate General of

Taxes (DGT) in the form of Payable Tax Notification

Letter (SPPT) and Underpayment Tax Assessment

Letters (SKPKB) received by KKKS XYZ as well as

data on land and properties assets owned by KKKS

XYZ. The data sources used in this study are primary

data and secondary data. Primary data in this study

were obtained from the results of interviews

conducted with KKKS XYZ. Secondary data in this

study is the working system document of KKKS

XYZ, ULP Tax data issued by the DGT in the form

of Payable Tax Notification Letter and

Underpayment Tax Assessment Letters, as well as the

Notification of Tax Objects along with the Appendix

of Tax Object Notification reported by KKKS XYZ.

Implementation of Agile Methodologies in Developing Upstream Land and Properties Tax Reporting System to Mitigate Tax Sanction Risk:

Case Study: KKKS XYZ

641

2 THEORICAL FRAMEWORK

According to Director General of Taxes Regulation

No. PER-45/PJ/2013, subject ULP tax is a person or

entity that actually has the rights to the land, and/or

benefits from the land, and/or has, controls and/or

obtains benefits from buildings, over objects of ULP

Tax and is a contractor of production sharing contract

who has received a contract from oil and gas

supervisory body. The object of ULP tax includes

land objects, subsurface objects, and building objects

with the following details:

1 Land objects include the area used for oil and

gas mining activities covering the work area,

namely certain areas within the Indonesian

mining jurisdiction for the implementation of oil

and gas exploration and exploitation, or similar

areas and areas outside the work area or similar

territory which are used as one entity for oil and

gas mining activities. Land objects include

onshore and offshore areas used for oil and gas

exploration and exploitation activities. Both the

onshore and offshore are divided into

productive areas, developing areas,

unproductive areas, and emplacement areas.

2 Objects of the subsurface of land are parts of are

that are beneath the surface of the land. The

object of the subsurface tax covers the

subsurface of exploration and subsurface of

exploitation which is under the surface of the

land which has the potential or has produced oil

and gas.

3 The object of the building is a technical

construction that is planted or permanently

attached to land in the onshore or offshore areas.

Supporting buildings for oil and gas mining

activities can be divided into public buildings

and special buildings.

ULP Tax is a kind of centralize tax. In this case,

the agency authorized to collect data to obtain,

collect, supplement and administer tax objects and tax

subjects, whether those who have not been registered

in tax administration, who are already registered in

tax administration or to produce geographic

information related to tax objects and tax subjects are

Directorate General of Taxes (DGT).

Calculation of tax payable on ULP Tax is based

on the sum of the Tax Object Value of the land and

buildings and Tax Object Value of the subsurface.

After obtaining the value of the tax payable, the Head

of the Tax Office determines the value of the ULP

Tax and issues a Tax Return. Payable Tax

Notification Letter consists of notification for

onshore, offshore, and the subsurface. After Payable

Tax Notification Letter issued, taxpayers pay by way

of transfer or paid for themselves by the taxpayer.

Payment by book-entry is carried out by taxpayers

who sign a cooperation contract with the government

before the enactment of Government Regulation No.

79 of 2010. The payment procedure by way of

transfer is the DGT submits a request for payment of

ULP Tax to the Director General of Budget (DJA) no

later than the second week of June based on the

Payable Tax Notification Letter and Notice of Tax

Assessment ULP Tax. Administrative fines in the

ULP Tax are not included in the payment request

because they are sanctions to the taxpayer and must

be paid by themselves. The DJA then applies for

transfer to the Director General of the Treasury from

the Oil and Gas account to the Perception Bank

account and repays no later than 6 months for the

Payable Tax Notification Letter and 1 month for the

ULP Tax’s Notice of Tax Assessment. Payment by

self-imposed taxpayers applies to taxpayers who sign

a cooperation contract with the government after the

enactment of Government Regulation No. 79 of 2010.

The procedure is that payments are made by

taxpayers through the designated Perception Bank

using a Tax Payment Letter.

According to DGT Regulation No. PER-

45/PJ/2013, taxpayers can receive a fine if the

taxpayer does not submit Notification of Tax Objects

and Appendix of Tax Object Notification and after

being reprimanded in writing in the Letter of

Reprimand or based on the results of the investigation

it is known that the amount of tax payable is greater

than the tax calculated based on Notification of Tax

Objects and Appendix of Tax Object Notification.

The amount of tax payable in Notice of Tax

Assessment is equal to the principal tax plus an

administrative fine of 25% of the tax principal.

Payment of fines is carried out by taxpayers

themselves, both for taxpayers who make payments

for ULP Tax through transfers and taxpayers who

make payments for ULP Tax by taxpayers

themselves. Penalty penalties imposed on taxpayers

are the taxpayer's own responsibility and cannot be

calculated in the calculation of profit sharing and

income tax.

Accounting Information System.

According to Boockholdt (1999), accounting

information systems are part of management

information systems. Management information

systems are a set of procedures that can be used for

decision making and organizational control when

executed (Lucas, 1982). As a system used for

decision making, the level or purpose of decision

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

642

making and the problems to be resolved must be

clearly defined because this will affect the system

used.

There are three objectives or levels in decision

making, namely strategic planning, management

control, and operational control (Bodnar & Hopwood,

1995). While in decision making, there are several

forms of problems faced that determine the form of

decisions taken, namely structured problems,

unstructured problems, and semi-structured problems

(Boockholdt, 1999).

According to Romney & Steinbart (2018), there

are various reasons for an organization to make a

system change, that change in user and organizational

needs, technological changes, business process

improvements, creating competitive advantages,

increasing productivity, integrating systems, and old

systems that have expired and need to be replaced.

In analyzing and evaluating the problems

contained in the system, there is a framework that can

be used to group system problems. Wetherbe &

Vitalari (1994) as referred to by Whitten & Bentley

(2007) developed a framework that can group system

problems called PIECES Framework. PIECES

Framework includes Performance, Information (and

Data), Economics, Control (and Security),

Efficiency, and Service.

According to Whitten & Bentley (2007), system

design methods ensure that a consistent and

repeatable approach has been applied to all

information system projects; the risk of errors and

shortcuts has been minimized; Project documentation

has been fully and consistently documented; analysts,

designers, and system builders can be immediately

assigned to the project; and the results of previous

work can be easily obtained and analyzed by a new

system design team. The system design method is

basically developed from the system design life cycle

(SDLC).

Satzinger et al. (2012) develop system design in

six processes, namely:

1. Identify problems and needs.

2. Plan and monitor the project - what will be

done, how it will be done, and who will do it.

3. Discover and understand the details of the

problem or need.

4. Design system components to solve problems

or meet needs.

5. Build, test, and integrate system components.

6. Complete the system test and launch the

resulting solution.

There are several tools that can be used to review,

analyze, and design systems. These tools include

interviews, flowcharts, several forms of system

documentation, and project management tools

(Boockholdt, 1999).

1. Interview. Interviews are needed in system

design to evaluate existing systems and identify

new system requirements.

2. Flowcharts. Flowcharts describe business

processes and document flows within an

organization (Romney & Steinbart, 2018).

Agile Methodologies and Iterative Development.

One of the weaknesses of the existing system design

process is the failure to maintain the time and budget

of the system design. Most system development is

used to solve complex organizational problems that

require a lot of planning in executing projects

(Satzinger et al., 2012). In addition, the application of

the SDLC method with a waterfall approach that is

generally used assumes that the requirements that

have been made at the outset in system design do not

change until the end of the system design process or

also called plan-driven approaches (Cobb, 2015).

In fact, many requirements in a system design

project change because users often don't understand

what is desired in the system (Romney & Steinbart,

2018). Users will find out and find other requirements

that are different when the system design process is

running. In addition, very rapid technological

changes drive the product cycle to be shorter so that

the system design method that requires a long time is

no longer appropriate. Based on this, the system

designer (system developer) requires an agile

method, which is a method in which the system

developer is open to changes in system design.

Agile methodologies or agile development is a

system development process that focuses on

flexibility in dealing with changes in system design

(Satzinger et al., 2012). The basic philosophy of agile

development is that either the system developer or

user alike does not fully understand the problems and

complexity of a new system so that project planning

and execution must be able to deal with changes that

occur in system design. The design of the system

must be agile and flexible.

According to Satzinger et al. (2012), an agile

system design is carried out iteratively and

incrementally. Iterative development is a system

design in which the system is arranged part by part

through a series of iterations. Six core processes in

system development are carried out simultaneously

and are repeated continuously to add value to the

entire system designed. Thus, in a system project

there are several subproject systems to support the

system.

Implementation of Agile Methodologies in Developing Upstream Land and Properties Tax Reporting System to Mitigate Tax Sanction Risk:

Case Study: KKKS XYZ

643

At each iteration, a work plan is prepared that

includes the creation of a Work Breakdown Structure

(WBS), which lists hierarchies of activities and tasks

that must be completed. In addition, an estimate of the

effort that must be made and the parties/dependencies

needed and the schedule for completing the tasks that

have been recorded (Satzinger et al., 2012).

Recent Studies.

As far as the author's knowledge, there is not much

research that discusses Land and Properties Tax,

especially concerning the issue of reporting on ULP

Tax in Indonesia in terms of system and tax subject.

The ULP Tax research, which the authors obtained,

for example Rosdiana et al. (2015) which discusses

the impact of changes in regulation on ULP Tax after

the enactment of Government Regulation No. 79 of

2010. According to Rosdiana et al. (2015), changes in

the payment mechanism of ULP Tax from assuming

and discharge principle to cost recovery method led

to a decline in interest in investing in the upstream oil

and gas sector in Indonesia.

Another research is Adhi's (2006) research which

discusses the design of the ULP Tax object database

system Non-Oil and Gas Mining Sector with a case

study on Sukabumi Tax Office. Then there is the

study of Hermawan (2005) which discusses the effect

of the mechanism of the imposition of the ULP Tax

on offshore waters and production based on the

location of the tax object on regional revenues.

3 RESEARCH METHOD

In terms of decision making, the tax reporting system

is used to solve operational problems. In terms of tax

calculation and reporting there are criteria and

mechanisms stipulated in tax regulations. In addition,

tax issues are a structured problem with clear

solutions. Thus, the information system needed in tax

reporting is a system that can receive and process

accurate historical data to produce correct and

complete tax reports to the tax authorities.

System design through the six processes proposed

by Satzinger et al. (2012). All these processes are

carried out iteratively. In designing the system in this

study, the system is divided into two iterations which

include a sub-system of inventory of assets of the land

and buildings and sub-systems for preparing and

evaluating reporting. The division of system design

into two iterations is due to the analysis carried out,

there are two components/sub-systems needed to

design the ULP Tax reporting system.

The design and documentation of the system in

this study uses system tools such as interviews and

flowcharts. The interview was conducted to identify

problems and the factors that cause the problem and

obtain the activities expected in the ULP Tax

reporting system. Flowcharts are used to document

the types of input/output data and business processes

carried out in the related parts or functions for

reporting on ULP Tax in the KKKS XYZ. Flowcharts

are chosen because this tool is widely used in

documenting systems and writing work procedures in

KKKS XYZ.

4 ANALYSIS

Current System Analysis.

KKKS XYZ has a system for ULP Tax reporting, The

Taxation Guidelines as a manual document and a

work instruction document to create and report ULP

Tax. The guidelines contain a general description of

the obligations of the KKKS XYZ on Land and

Building Taxes. The KKKS XYZ Tax Guidelines

state that the company is obliged to submit ULP Tax

object data to the DGT and the payment will be

calculated by the Ministry of Finance from oil and gas

revenues. Submission of ULP Tax object data is the

responsibility of the Financial function assisted by

other functions such as the Legal, Surface Facility,

and ICT functions to help smooth the submission of

data on ULP Tax Oil and Gas objects. Fulfillment of

tax obligations must meet the basic principles that

include compliance, transparency, optimization,

evaluation and tax management.

The document reporting work instructions for the

ULP Tax KKKS XYZ contains the mechanism for

making and reporting ULP Tax conducted by

reviewing the asset data master using the DGT Oil

and Gas Notification of Tax Objects reporting format.

The assets in question are land and buildings that are

objects of the ULP Tax. The indicator of the success

of the procedure for the preparation and reporting of

the ULP Tax Notification of Tax Objects of the

KKKS XYZ is the timeliness of payment and the

suitability of the value of the Payable Tax

Notification Letter of ULP Tax with the obligation

that should be payable.

There are several weaknesses in the current ULP Tax

reporting system in the KKKS XYZ by analyzing the

documentation of the ULP Tax reporting system

using the PIECES Framework. The weakness of the

system supports the causes of the ULP Tax reporting

problem which led to tax sanctions received by the

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

644

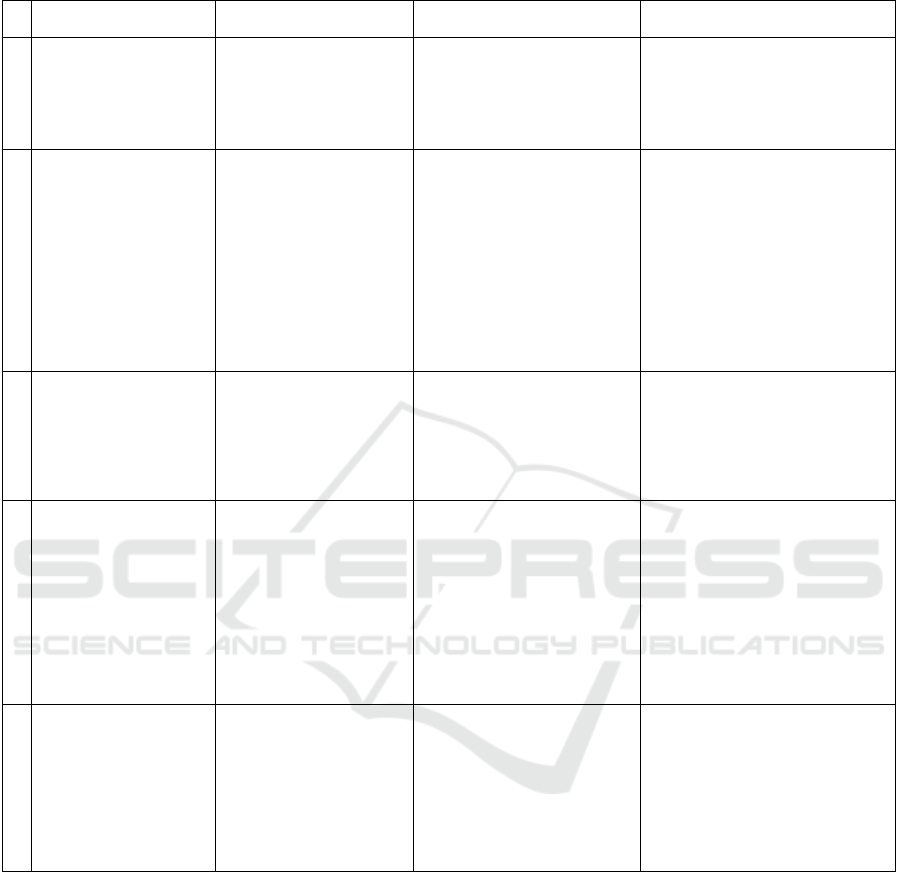

Table 3: Current System Analysis.

No

PIECES Framework

Classifications

System Weakness Analysis

Relevant Causes

Suggestion

1

Efficiency: the effort to

complete the task is very

large

Service: a confusing

system to use

The system does not provide

complete and detailed

instructions or provide

references to tax regulations

to prepare reports on ULP

Tax.

Human Factor: Lack of

knowledge in compiling the ULP

Tax report.

The system must provide complete

and detailed instructions or at least

provide reference to tax regulations

that explain the procedures for

reporting ULP Tax that must be

carried out by the user.

2

Information (and Data):

very much processed data,

there is data that is not

obtained, data is not stored

properly, data is not

accurate

Service: the system is

confusing to use, the

system is not compatible

with other systems

The system does not provide

information about the input

data needed, the source of

acquisition of input data, and

the processing of input data

to the user. The input data

includes data on land and

building assets and oil and

gas lifting data.

Material Factors: The compilation

of reports on the ULP Tax

collects vast amounts of data on

land and buildings assets.

Method Factor: The preparation

of the ULP Tax report requires

intensive coordination between

the functions of the users/owners

of the land and building assets.

The system must provide clear

information about the input data

provided and how to obtain and ensure

the data is correct and complete. This

is very crucial considering that the tax

sanctions received by the KKKS XYZ

are due to incorrect data on land and

building assets in the ULP Tax report.

The use of Flowcharts can help

describe the types of documents and

processes for input data needed

between users.

3

Control (and Security): too

little control

The system does not provide

information on the timing of

the preparation and reporting

of ULP Tax.

Human Factor: Lack of

knowledge in compiling the ULP

Tax report.

The system needs to provide

information on the timeline for

preparation and reporting of the ULP

Tax so that the report can be submitted

to the Directorate General of Taxes

(DGT) at the time specified in the tax

regulations.

4

Information (and Data): no

information needed

Control (and Security): too

little control

The system does not provide

an evaluation of the ULP Tax

report prepared by the user.

Evaluation is needed

specially to analyse the

reasonableness of reported

ULP Tax reports, for example

by comparing the results of

the UN ULP Tax report in the

previous year.

Human Factor: Lack of

knowledge in compiling the ULP

Tax report.

Tool Factors: The working paper

for asset inventory is different/out

of sync with the Notification of

Tax Objects along with the

Appendix of Tax Object

Notification ULP Tax working

paper.

The system must be able to assist the

user in analysing the fairness of the

ULP Tax report prepared, for example

by producing information that shows

the comparison of the results of the

current ULP Tax report or the data

from the ULP Tax report with data on

land and building assets.

5

Service: a confusing

system to use

System documentation that

shows the current and source

of data acquisition is not

available.

Human Factor: Lack of

knowledge in compiling the ULP

Tax report.

Method Factor: The preparation

of the ULP Tax report requires

intensive coordination between

the functions of the users/owners

of the land and building assets.

There needs to be good system

documentation so that users can

understand the data flow and

processes that occur in the system.

System documentation can use system

tools, such as Flowcharts.

KKKS XYZ from the DGT. Based on the weaknesses

found, the following are suggested suggestions for

improvement of the ULP Tax ULP Tax reporting

system in the KKKS XYZ which can be seen in Table

3.

Based on an analysis of the existing system

weaknesses, the causes of the problem, and the

suggested improvements above, then a new system of

ULP Tax reporting is carried out. In terms of the

causes of system change as stated by Romney &

Steinbart (2018), the design of the new system is

included in system changes caused by an increase in

old business and system processes that have expired

and need to be replaced.

Iteration 1: Land and Properties Assets Inventory

Sub System.

In this phase identification of problems as well as

expectations of the user on the existing system are

compiled in the System Vision Document, which is a

document that helps explain the scope of the system

(Satzinger et al., 2012). Vision System Documents

can be seen in Table 4. Next is the division of system

components and the iteration phase. The ULP Tax

Implementation of Agile Methodologies in Developing Upstream Land and Properties Tax Reporting System to Mitigate Tax Sanction Risk:

Case Study: KKKS XYZ

645

reporting system will be completed in two iterations,

namely:

1. Iteration 1: Land and Building Asset Inventory

Sub System

This sub-system aims to fulfill the two

capabilities expected of the system, namely

collecting and storing data on land and

building assets owned and used and storing

supporting files such as photographs of land

and building assets, land certificates,

location/production facilities, building permit

documents, and so on.

2. Iteration 2: Reporting Compilation and

Evaluation Sub-System

This sub-system aims to gather information on

the submission of ULP Tax reports and collect

files of copies of the ULP Tax report that have

been submitted to the DGT by each person in

charge of the Regency/City area where the

KKKS XYZ operates.

Furthermore, the Work Breakdown Structure of

iteration 1 is compiled as shown in Table 5. Based on

the compiled WBS, further identification of data on

land and building assets needed for ULP Tax

reporting and identification of the parties involved

and their role in the asset inventory land and buildings

for reporting on ULP Tax in KKKS XYZ.

Identification of land and building asset data refers to

PER-45/PJ/2013 concerning Procedures for

Imposing Land Tax and Mining Sector Buildings for

Petroleum, Natural Gas, and Geothermal Mining.

Table 4: Vision System Document.

Vision System Document

ULP Tax Reporting System of KKKS XYZ

Description

ULP Tax Reporting is an obligation for KKKS XYZ by

providing data on land and building assets and oil and gas

lifting in the form of ULP Tax the Notification of Tax Objects

and Appendix of Tax Object Notification. In the past few

years, KKKS XYZ received tax sanctions because of ULP

Tax Report that was incorrect and detrimental to the company

because the fines could not be recovered by the government.

It is thus important to design a reliable and accurate ULP Tax

reporting system to carry out the obligations of the KKKS

XYZ in the field of taxation and ensure that the data reported

is correct and complete.

System Capabilities

The new ULP Tax reporting system should be able to:

Collect and store data on land and building assets

owned and used by KKKS XYZ.

Collect and store supporting files for data on land and

building assets owned and used by KKKS XYZ such as

photographs of land and building assets, land certificates,

location/production facilities, building permit documents, and

so on.

Collect information on the submission of the ULP Tax

Report by each person in charge of the Regency/City area

where the KKKS XYZ operates.

Collect copies of the ULP Tax Report submitted to the

Directorate General of Taxes (DGT).

Comparing ULP Tax Reports in several reporting

periods, namely data on reported land assets and buildings.

System Benefits

The ULP Tax Reporting System is expected to provide the

following benefits:

Ensure data on land and building assets owned and

used by KKKS XYZ is complete, accurate and up to date.

Ensure the fairness of data on land and building assets

reported annually.

Ensure that the ULP Tax Report has been submitted

correctly and on time to the Directorate General of Taxes

(DGT).

Simplify the user in collecting data for verification

needs and preparing supporting evidence if a tax audit is

carried out by the Directorate General of Taxes (DGT).

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

646

Table 5: Work Breakdown Structure of Iteration 1.

Work Breakdown Structure

Iteration 1: Sub System of Land and Building Inventory

Planning

Arrange the WBS and determine the plan and completion

schedule - 1 day

Analysis

Identify data on land and building assets needed for

reporting on ULP Tax - 1 day

Identify the parties involved (actors) along with their role in

the inventory of land and building assets for reporting ULP

Tax in KKKS XYZ - ½ day

Design

Designing a working system for inventorying land and

building assets for reporting on ULP Tax by using a

Flowchart - 2 days

Settlement

Submit the results of the iteration 1 work to the Tax Function

- ½ day

Discussion with Tax Functions - ½ day

In this process, the attributes needed for each data

of the land and building assets are determined and the

data sources/supporting files that are needed.

Attributes can be divided into two, namely general

The next process is to identify the parties involved

(actors) from the internal company and its role in

collecting data and supporting files needed in the

reporting of ULP Tax. Based on the discussion with

the Tax Function of the KKKS XYZ, there are several

parties involved in collecting data and supporting

files needed because it is the party that

stores/processes/produce the supporting data and files.

The results of identification can be seen in Table 6.

Table 6: Related Parties Data Sources/Supporting Files for

the Inventory of Land and Building Assets.

No

Data Sources

Related Parties

Role

1

Certificate, agreement,

document permit

Legal

Saving data

2

Location Map/Picture

Surface

Facilities

Saving data,

creating data

3

Working Area Map

ICT

Saving data

4

Inventory list

Accounting

Saving data,

creating data

5

Production sharing

contract agreement

Legal

Saving data

6

Building permits

Surface

Facilities

Saving data

7

Technical Completion

Report of Asset

Accounting

Saving data,

creating data

8

Well Completion

Report

Accounting

Saving data,

creating data

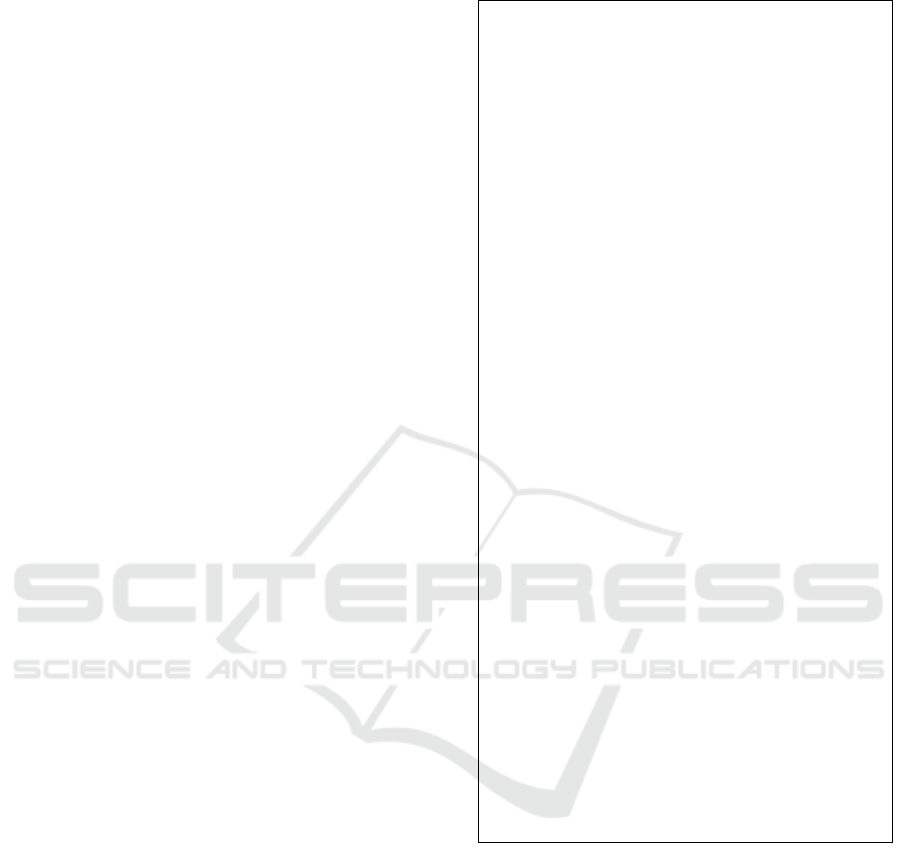

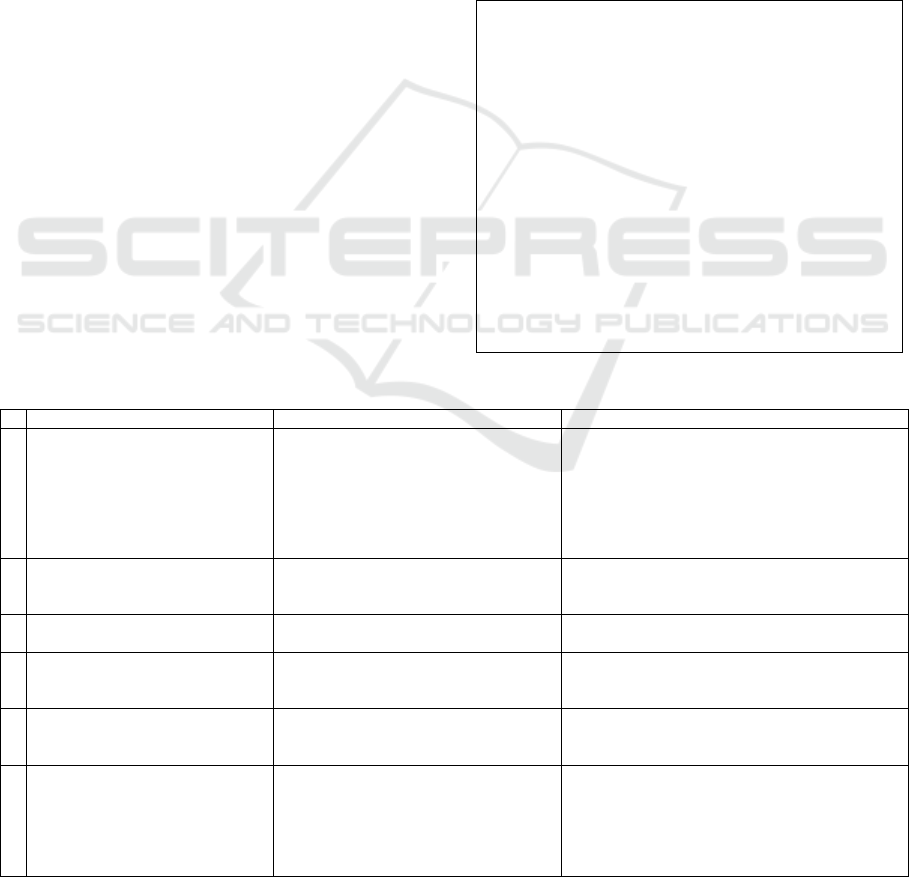

After identifying data on land assets and buildings

needed for reporting on ULP Tax and the parties

involved along with their roles on the inventory of

land and building assets for reporting on ULP Tax, a

system of inventory of land and building assets is

reported for ULP Tax with the help of Flowcharts.

The inventory system of land and building assets

covers the entire process starting from collecting data

and supporting evidence for the ULP Tax Report to

filling in the ULP Tax Notification of Tax Objects

and Appendix of Tax Object Notification so that the

ULP Tax Report is accurate and complete. The

flowchart can be seen in Figure 1.

Figure 1: Flowchart of Sub System of Land and Properties Asset Inventory.

Implementation of Agile Methodologies in Developing Upstream Land and Properties Tax Reporting System to Mitigate Tax Sanction Risk:

Case Study: KKKS XYZ

647

Iteration 2: Report Preparation and Evaluation

Sub System.

In iteration 1 it is known that the design of the ULP

Tax reporting system will be divided into two sub-

systems, namely the sub-system of inventory data on

land and building assets and sub-systems for

evaluation of compilation and reporting. Thus

iteration 2 will focus on the sub-system for evaluation

of preparation and reporting. In this step the Work

Breakdown Structure is compiled from iteration 2, as

follows.

Based on the WBS, further identification of the

data needed to evaluate the preparation and reporting

of the ULP Tax is then carried out. Evaluation is

carried out to ensure that the preparation and

reporting of ULP Tax have been carried out correctly

and on time, storing data and evidence of ULP Tax

reporting, and analyzing the risk of inspection and the

possibility of the issuance of Underpayment Tax

Assessment Letters from the submitted ULP Tax

Report.

As mentioned earlier, according to DGT

Regulation No. PER-45/PJ/2013, ULP Tax penalty

sanctions are caused by taxpayers not submitting

Notification of Tax Objects and Appendix of Tax

Object Notification and/or because based on the

results of the examination it is known that the amount

of tax payable should be greater than the amount of

tax calculated based on Notification of Tax Objects

and Appendix of Tax Object Notification. Based on

the discussion and identification with the KKKS

XYZ Tax Function, the following is a list of

necessary evaluations, data for evaluation of the

preparation and reporting of ULP Tax and supporting

sources/evidence as found in Table 7.

There are six things that need to be evaluated in

the preparation and reporting of ULP Tax, namely the

reasons for changes in land and building data in the

current year's ULP Tax Report compared to the

previous year's assets and ULP Tax Reports,

authorizing those who signed the ULP Tax Report,

readiness for the ULP Tax Report reported, the place

of submission of the ULP Tax Report, the time of

submission of the ULP Tax Report, and the value of

ULP Tax according to the assessor/examiner of the

DGT.

Table 7: Work Breakdown Structure of Iteration 2.

Work Breakdown Structure

Iteration 2: Sub System of Preparation and Reporting

Evaluation

Planning

Arrange the WBS and determine the plan and completion

schedule - 1 day

Analysis

Identify data needed for evaluation of the preparation and

reporting of ULP Tax along with supporting sources/evidence in

KKKS XYZ - 2 days

Design

Designing a working system for evaluating the preparation and

reporting of ULP Tax by using a Flowchart - 2 days

Settlement

Submit the results of the iteration 2 work to the Tax Function -

½ day

Discussion with Tax Functions - ½ day

Table 8: ULP Tax Preparation and Reporting Evaluation.

No

Evaluation Needed

Supporting Data

Data Sources

1

Changes in earth and building data in

the ULP Tax Report have

reasons/justifications

The number of public building and special

building items per type, the total area of

public buildings and special buildings per

type, the area of the earth and buildings,

records, year of reporting

The reason/justification prepared by the Treasury

Function is based on the results of examination and

research as well as supporting evidence provided by

the Legal Function, Function of Surface Facilities,

Accounting Function, and ICT Function when filling

Appendix of Tax Object Notification, copy of the

ULP Tax Report reported to Tax Office/DGT

2

The ULP Tax Report has been signed

by the President Director/Senior

Manager

Name of signatory, position of signatory,

date of signing

Letter of Authority from the President Director for the

signing of the ULP Tax Report

3

There has been a ULP Tax Report

submitted to Tax Office/DGT

Name of Regency/City, name of Work Area

Copies of ULP Tax Reports reported to Tax

Office/DGT

4

The ULP Tax Report has been

submitted to Tax Office/DGT where

reporting should be carried out

Regency/City Name, Work Area name, Tax

Office/DGT name where to report, Proof of

Receipt Number

Proof of Receipt of Letters from Tax Office/DGT

5

The ULP Tax Report has been

submitted on time/before January 31

of the current year

Date of receipt of the ULP Tax Report by

Tax Office/DGT

Proof of Receipt of Letters from Tax Office/DGT

6

Data on earth and buildings that are

used as the basis for imposing taxes

by Tax Office/DGT inspectors are in

accordance with those reported

The amount of land and building according

to the examiner of Tax Office/DGT, the area

of the land and building in the current year

which is reported to be the function of the

Treasury, the value of the ULP Tax which

must be paid

SPPT from Tax Office/DGT

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

648

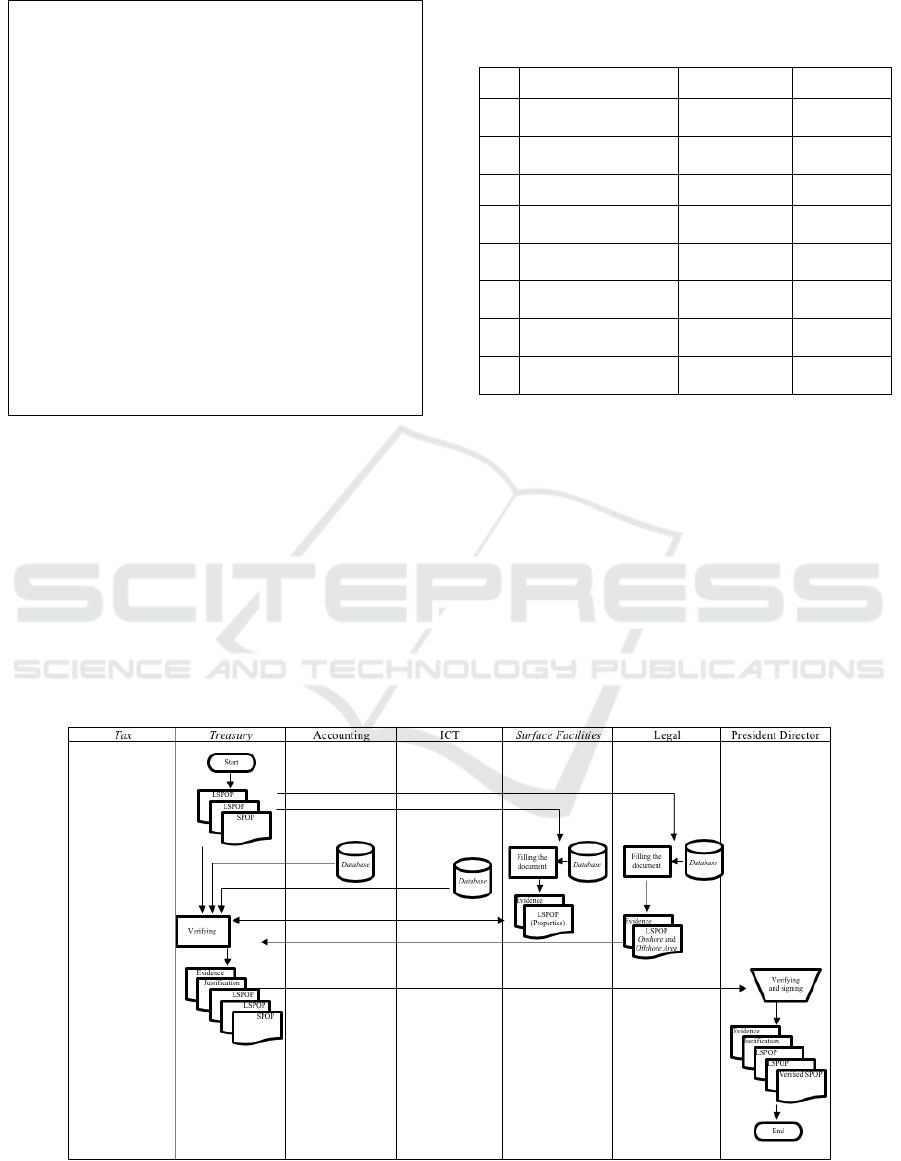

Figure 2: Flowchart of Sub System of Preparation and Reporting Evaluation.

The next process is to identify the parties involved

(actors) from the internal company and its role in

collecting data and supporting files needed in the

evaluation of the preparation and reporting of ULP

Tax. After discussing with the Tax Functions of

KKKS XYZ, the results of identification can be seen

in Table 9.

Table 9: Parties Related to Data Sources of Preparation and

Evaluation ULP Tax Report.

No

Data Source

Related Parties

Role

1

Justification

Treasury

Creating data

2

Copy of ULP Tax Report

submitted to DGT

Treasury

Saving data,

Creating data

3

Letter of authority

President

Director/Senior

Manager

Saving data,

Creating data

4

Receipt

Treasury

Saving data

5

SPPT from DGT/ Tax

Office

Treasury

Saving data

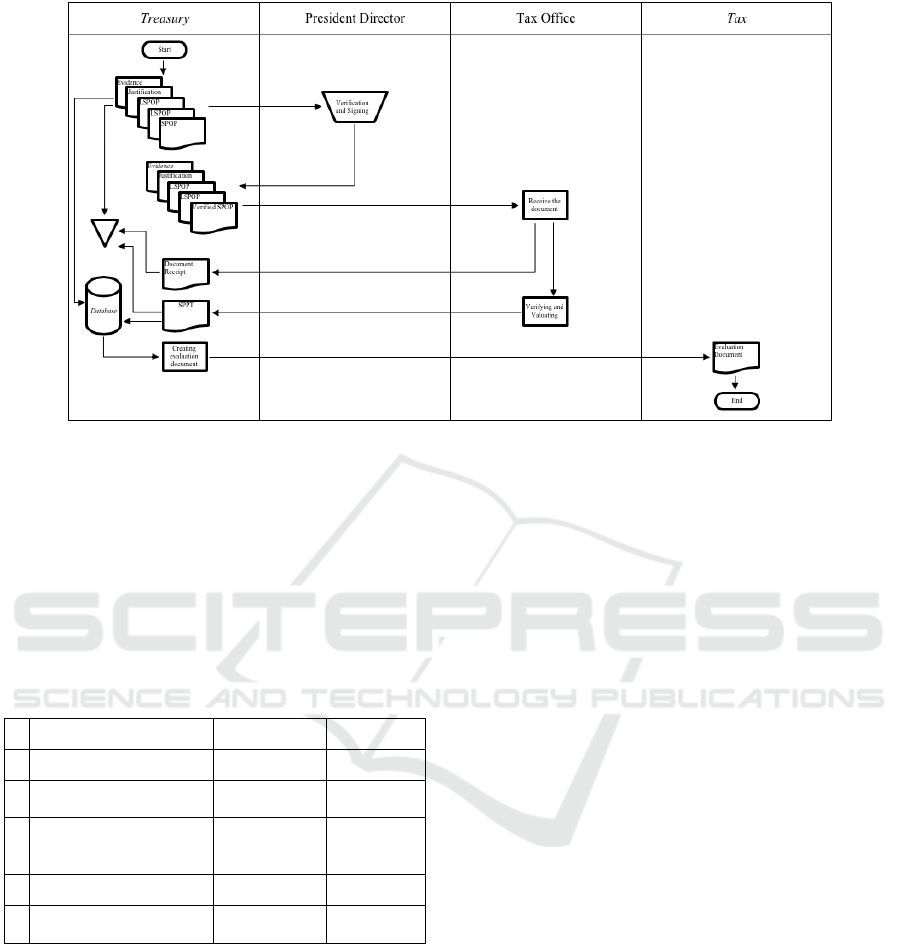

After identifying and compiling a list of necessary

evaluations, data for evaluating the preparation and

reporting of ULP Tax, and supporting

sources/evidence, a system for evaluating and

compiling ULP Tax is then developed with the help

of a Flowchart. The evaluation system includes the

entire process starting from the submission of the

ULP Tax Report to the Managing Director/Senior

Manager (as the attorney of the President Director) to

be examined and signed until the ULP Tax Report is

prepared for the evaluation of the Tax Function. The

flowchart can be seen in Figure 2.

5 DISCUSSION

Iteration 1 and iteration 2 have resulted in

improvements to the reporting system of ULP Tax in

the KKKS XYZ in terms of the process of inventory

of land and building assets to the evaluation of the

preparation and reporting of ULP Tax. This section

then collects the results of the improvement into a

proposal for Treasury Function work instructions that

standardizes the improvement of the ULP Tax

reporting system at the KKKS XYZ. Work

instructions for the preparation and reporting of the

KKKS XYZ ULP Tax are prepared according to the

standards for the preparation of KKKS XYZ work

instructions which include work tools, references,

implementing qualifications, work instructions, and

indicators and measures of success.

6 CONCLUSIONS

There are several weaknesses in the current ULP Tax

reporting system at KKKS XYZ by analyzing the

ULP Tax reporting system documentation in existing

manuals and work instructions using the PIECES

framework. The weakness of the system supports the

causes of relevant problems based on interviews

conducted with the user. Based on the identification

of the weaknesses of the system, then improvements

were made to the new system design.

The results of Iteration 1 and 2 are the results of

the ULP Tax reporting system design documented in

Implementation of Agile Methodologies in Developing Upstream Land and Properties Tax Reporting System to Mitigate Tax Sanction Risk:

Case Study: KKKS XYZ

649

the form of Flowcharts which can then be used to help

prepare the ULP Tax report in KKKS XYZ. The

results of the design are expected to mitigate the risk

of ULP tax sanctions in KKKS XYZ in the future.

This study presents a Flowchart that can be used

in the reporting of ULP Tax. We suggest for further

research to improve the system in this study by

designing a computer application for processing data

on land and properties assets and compiling reports

on ULP Tax. Based on the analysis of the factors

causing differences in data on land and properties

assets in the KKKS XYZ's ULP Tax report which are

grouped into the material, people, methods, tools, and

environment, most of the factors causing problems

has been addressed in the new system designed in this

study. However, there are several factors causing

other problems that have not been resolved by the

system that has been designed, especially factors that

originate from the environment. There needs to be an

approach or other solution to overcome the causes of

this problem. This can be a topic of concern for

further research.

REFERENCES

Adhi, Iswara. (2006). Perancangan sistem basis data obyek

Pajak Bumi dan Bangunan sektor pertambangan non

migas: Studi kasus pada Kantor Pelayanan PBB

Sukabumi. Tesis. Yogyakarta: Universitas Gadjah

Mada.

Bodnar, George H. & Hopwood, William S. (1995).

Accounting information systems (Edisi 6). New Jersey:

Prentice-Hall, Inc.

Boockholdt, J. L. (1999). Accounting information systems:

Transaction processing and controls (Edisi 5).

Singapore: McGwar-Hill Book Co.

Cobb, Charles G. (2015). The project manager’s guide to

astering agile: Principles and practices for an adaptive

approach. New Jersey: John Wiley & Sons, Inc.

Hermawan, Ayi. (2005). Pengaruh mekanisme pengenaan

PBB pertambangan migas atas areal perairan lepas

pantai (off shore) dan hasil produksi berdasarkan

lokasi objek pajak terhadap penerimaan daerah. Tesis.

Jakarta: Universitas Indonesia.

Lucas, Henry C. (1982). Information systems concept for

management. New York: McGraw-Hill.

Lyytinen, K. (1987). A taxonomic perspective of

information systems development: theoretical

constructs and recommendations. Critical issues in

information systems research (pp. 3-41). New York:

John Wiley & Sons, Inc.

Peraturan Direktorat Jenderal Pajak Nomor PER-

45/PJ/2013 tentang Tata Cara Pengenaan Pajak Bumi

dan Bangunan Sektor Pertambangan untuk Per-

tambangan Minyak Bumi, Gas Bumi, dan Panas Bumi.

Peraturan Menteri Keuangan Nomor 76/PMK.03/2013

tentang Penatausahaan Pajak Bumi dan Bangunan

Sektor Pertambangan untuk Pertambangan Minyak

Bumi, Gas Bumi, dan Panas Bumi.

Peraturan Pemerintah Nomor 79 Tahun 2010 tentang Biaya

Operasi yang Dapat Dikembalikan dan Perlakuan Pajak

Penghasilan di Bidang Usaha Hulu Minyak dan Gas

Bumi.

Pudyantoro, A. Rinto. (2012). A to Z Bisnis Hulu Migas.

Jakarta: Petromindo.

Romney, Mashall B. & Steinbart, Paul John. (2018).

Accounting information systems (Edisi 14). Essex:

Pearson Education Limited.

Rosdiana, Haula et al. (2015). Indonesia property tax policy

on oil and gas upstream business activities to promote

national energy security: quo vadis. Procedia

Environmental Sciences 28 (2015) 341 – 351.

Satzinger, John W., Jackson, Robert B., Burd, Stephen D.

(2012). System analysis and design in a changing world

(Edisi 6). Boston: Course Technology.

Sekaran, Uma & Bougie, Roger. (2013). Research methods

for business: a skill-building approach. West Sussex:

John Wiley & Sons Ltd.

Sistem Tata Kerja KKKS XYZ: Pedoman Perpajakan

Nomor A-006/A4/EP4000/2014-S4 Revisi 1.

Sistem Tata Kerja KKKS XYZ: Tata Kerja Individu

Pembuatan dan Pelaporan SPOP PBB Nomor

Undang-Undang Nomor 22 Tahun 2001 tentang Minyak

dan Gas Bumi.

Waluyo. (2011). Perpajakan Indonesia (Edisi 10). Jakarta:

Salemba Empat.

Wetherbe, James & Vitalari, Nicholas P. (1994). Systems

analysis and design: Traditional, Best Practices (Edisi

4). St. Paul: West Publishing.

Whitten, Jeffrey L. & Bentley, Lonnie D. (2007). Systems

analysis and design methods (Edisi 7). New York:

McGraw-Hill.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

650