Metal and Mineral Mining Firm’s Equity Valuation

in Indonesia Stock Exchange

Marfani Hasan, Riko Hendrawan

Magister Management, Telkom University, Jalan Gegerkalong Hilir No.47, Bandung, Indonesia

Keywords: Valuation, Discounted Cash Flow, Relative Valuation, Intrinsic Value, Metal, and Mineral

Abstract: The purpose of this research is to estimate the intrinsic values of the shares on the metal and mineral mining

companies listed in IDX 2018 using Discounted Cash Flow - Free Cash Flow to Firm method and verifies the

results with the relative valuation - PER and PBV methods. The sample of this research is the dominant

industry players ANTM, INCO, and TINS. The valuation baseline was the analysis of the financial statements

of those companies in the period 2013-2017 which was considered as the reference for the projection years

2018-2022. This research involved three scenarios namely pessimistic, moderate and optimistic, and the

reference market price was on January 2, 2018. The analysis concluded that using DCF-FCFF the stock’s

price of ANTM was undervalued in all scenarios, while INCO and TINS were overvalued in all scenarios.

The PER and PBV analysis found that all evaluated stocks within the industry range that mean the valuation

result is correct. Hence, the conclusion of this research is to buy ANTM stocks and to sell INCO and TINS

stocks.

1 INTRODUCTION

Investing in the capital market, especially stocks, has

a high risk considering the characteristics of these

financial instruments are high-risk and high-returns

(Damodaran, 2006). Fundamental analysis is

considered as one of the easiest ways to evaluate a

company before investing. The main objective of the

fundamental analysis is to examine the actual value

of the company today by predicting future profits and

risks to calculate the intrinsic value of a company's

stock (Baresa et al., 2013).

Nickel price is predicted to experience a stronger

trend in 2018. The main contributor to the positive

trend is the increasing demand for battery raw

materials. China's battery imports grew 26.88% year-

on-year in the first quarter of 2018 (Haffiyan, 2018).

Meanwhile, strengthening of the tin price is flat due

to slowing sales of electronic goods, especially

smartphones (Haffiyan, 2018). The projections for

world smart telephone shipments from 2015 to 2022

are expected to be gentler (Atwal et al., 2018).

However, Indonesia's tin and nickel export trend are

still growing positively in the year from 2016 to mid-

2018 (Pusat Data dan Informasi Kementrian

Perdagangan, 2018).

Nickel and tin price trend could influence the

stock price fluctuations and the level of risk and

return in this industry. However, the researchers

would not explore that hypothesis further. That

symptom had brought the researchers to discover the

stock trend in Metal and Mineral Sub-Sector in

Indonesia.

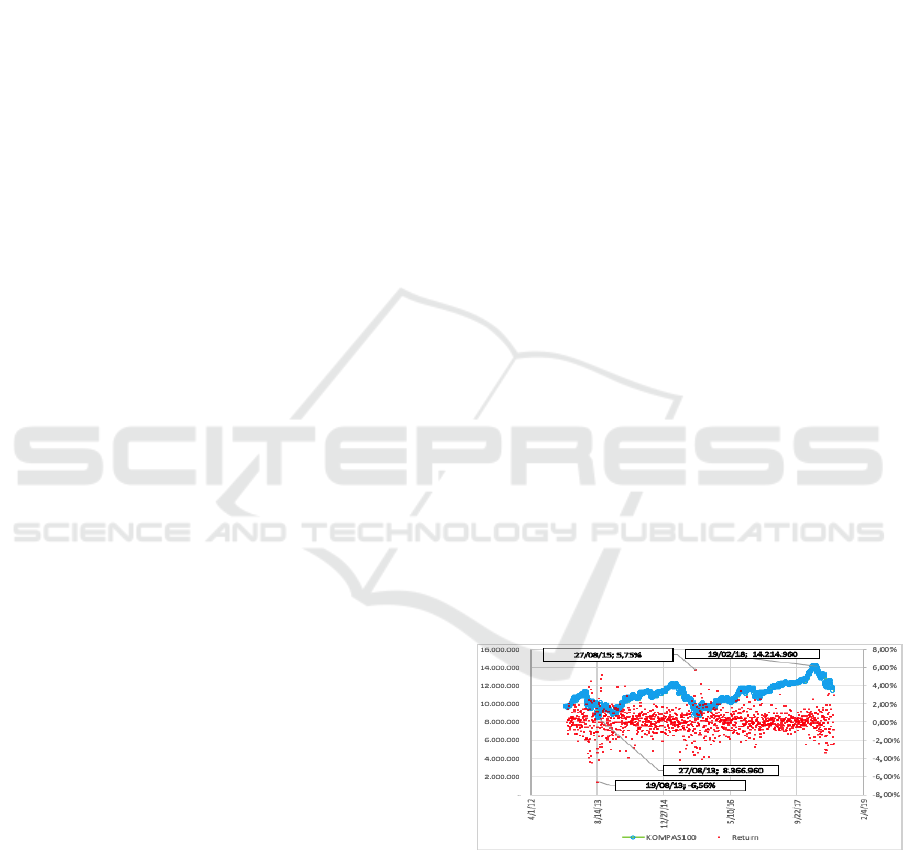

Figure 1: KOMPAS100 index trend and the risk/return

January 2013 - June 2018

The stock price fluctuations and the level of risk

and return in this sub-sector are shown in the initial

analysis of the stock prices of the three sampled

companies, ANTM, INCO, and TINS. The three

companies were selected based on three purposive

sampling criteria, namely, listed on the Indonesia

Stock Exchange (BEI) mining sector - metal and

662

Hasan, M. and Hendrawan, R.

Metal and Mineral Mining Firm’s Equity Valuation in Indonesia Stock Exchange.

DOI: 10.5220/0008435106620673

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 662-673

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

mineral mining sub-sector, listed on the

KOMPASS100 index on the Indonesia Stock

Exchange (IDX), and never suspended and actively

transacted in The IDX is at least up to June-2018

Shares up to June 2018.

Based on Figure 1, we can see that in the period

January 2013 to June 2018, overall the KOMPAS100

Index showed a positive growth trend. The highest

KOMPAS100 index value occurred on February 19,

2018, at the value of 14,214,960, and the lowest value

occurred on August 27, 2013, at the value of

8,366,960.

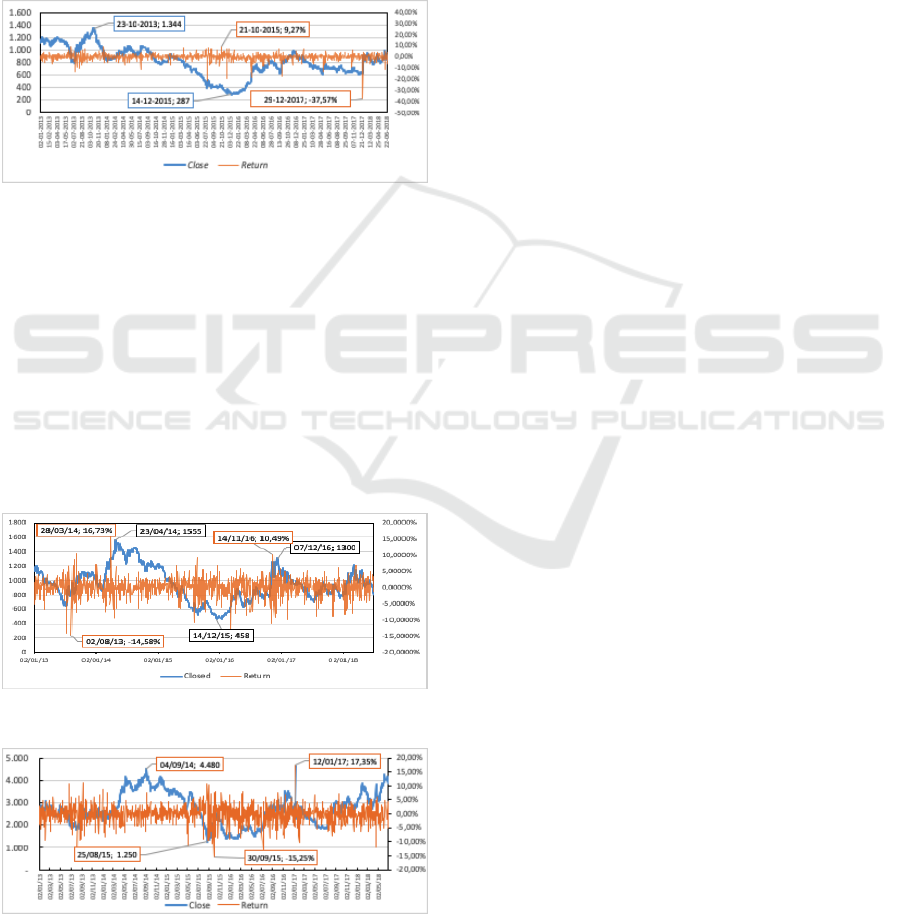

Figure 2: ANTM stock prices trend and the risk/return

January 2013 - June 2018 (processed)

Further, in the same graph on the second axis, we

can see other critical information, namely the risk and

returns figure. From the chart, there were several high

yield points, which occurred on August 27, 2015, at

5.7%, and the lowest yields that occurred on August

19, 2013, amounted to -6.5%. This phenomenon

shows that a positive trend in stock price performance

is not enough for us to decide an investment, risk and

returns factors also need to be becoming another

critical considerations of an investment.

Figure 3: INCO stock prices trend and the risk/return

January 2013 - June 2018 (processed)

Figure 4: TINS stock prices trend and the risk/return

January 2013 - June 2018 (processed)

In Figure 2, we can see that in the period of

January 2013 to June 2018, the trend of the ANTM's

shares tended to stagnate and decline until December

2017, but raised by around 50-100 points in the period

January to June 2018. The lowest value was IDR 287

on December 14, 2015, and the highest value was

IDR 1,344 occurred on October 23, 2013. Likewise,

the rate of return, the highest occurred at the value of

9.27% on October 21, 2015, and the lowest occurred

at the value of -37.57% on December 29, 2017.

In Figure 3, we can see that in the period January

2013 to June 2018, the INCO share’s value also

tended to be stagnant, but raised quite well in the last

two years. The lowest value was IDR 1,250 on

August 25, 2015, and the highest value was IDR

4,480 occurred on September 4, 2014. The second

peak value occurred again at the value of IDR 4,250

on June 6, 2018. The rate of return, the highest

occurred at the value of 17.35% on January 12, 2017,

and the lowest occurred at the value of -15.25% on

September 30, 2015.

In Figure 4, we can also see that in the period

January 2013 to June 2018, the trend of TINS shares

also tended to be stagnant, but experienced significant

fluctuations in the last two years. The lowest value

was IDR 458 on December 14, 2015, and the highest

value of IDR 1,555 occurred on April 23, 2015. The

second peak value occurred again at the price of IDR

1,300 on December 7, 2016. The highest return

occurred at 16, 73% on 28 March 2014, and the

lowest occurred at -14.58% on 2 August 2013.

Based on the phenomenon mentioned earlier, the

goal of this research is to analyze the intrinsic value

of the stock prices of companies in the Metal and

Mineral Mining Sub Sector listed in the

KOMPAS100 Index on the Indonesia Stock

Exchange in 2018, then to provide the

recommendations to the investor whether these shares

are worth buying, selling or holding after comparing

the value of shares in the market with the intrinsic

value obtained from this research.

2 LITERATURE REVIEW

2.1 Valuation Theory

In general, there are four approaches for valuing an

asset (Damodaran, 2006).

a. Asset-Based Valuation

We estimate the current asset value owned by a

company that is worthy of appreciation with this

method (Damodaran, 2006). Furthermore, we can

reveal two techniques in this method, namely using

valuation when an asset needs to be liquidated now

(liquidation value), or when we have to replicate or

Metal and Mineral Mining Firm’s Equity Valuation in Indonesia Stock Exchange

663

replace the asset (replicate/replacement value)

(Damodaran, 2006).

b. Discounted Cash Flow Valuation

In discounted cash flow (DCF) valuation, the

value of an asset is the present value of the expected

cash flows on assets, discounted at a rate that reflects

the risk of these cash flows (Damodaran, 2006).

c. The Relative Valuation

Valuation of assets using relative valuation is the

purpose of valuing an asset based on the similarity of

the asset valued in the market (Damodaran, 2006).

There are two primary consequences in relative

valuation. First, when we will do a valuation using

this method, the price of an asset must be

standardized first. General practice is by converting it

to multiples of frequently used variables, such as

earnings, book value, or revenue. Second, looking for

similar assets to compare (Damodaran, 2006).

d. Contingent Claim Valuation

In a contingent claim valuation (CCV), the option

price model is used to assess an asset. A contingent

claim or option is an asset that is paid only in certain

contingency conditions, for example in the

mechanism of a call option in the condition of the

underlying asset more penetrating the agreed value,

or put option mechanism if less than the agreed value

(Damodaran, 2006).

With these valuation methods, we can estimate an

intrinsic price, then, compared to the market price. If

the intrinsic price is higher than the market price, that

is mean the current market price is in an undervalued

position, so it is worth buying. If the intrinsic price

obtained is lower than the market price, then the stock

price is in an overvalued position, so the stock should

be sold. Moreover, if the intrinsic price is the same as

the market price, then the stock price is in the position

of fair-valued, so it is recommended to hold the stock

(Damodaran, 2006).

Relative valuation is used to validate the DCF

valuation results. The valuation results using this

method must be compared between one company and

another. One of the most popular approach in relative

valuation is price earnings ratio (PER) (Aljifri and

Ahmad, 2018). Before deciding to invest, it is

necessary to know whether the PER value of a

company is above or below the industry average. If it

is smaller, then the PER value of the company is in an

undervalued, so it is worth buying. Conversely, if it is

higher than the industry average, then the stock is in

an overvalued position, so it is worth selling. If the

PER is equal to the value of the industry, then the

stock is in a position fair-valued, and the shares

should be held (Damodaran, 2006).

Another popular multiple is the Price Book Value

approach (Aljifri and Ahmad, 2018). With the PBV,

the reference is the book value of the company's

shares, as reported in the audited financial statements.

Based on this theory, the best PBV is one, meaning

that the market price is equal to the book valuation

price. If it is smaller than one, the company's stock is

in an undervalued position, so it is worth buying.

Conversely, if it is higher than one, then the stock is

in overvalued position, so it should be sold

(Damodaran, 2006). However, since PBV is one

approach of relative valuation, we also need to

compare with the industry average as a baseline when

making an investment decision using PBV.

2.2 Firm Value

The value of an investment is essentially the present

value of cash flows obtained from the company

resources management (Mohammad, 2016). The

value of an investment in a company is closely related

to the value of the company's shares (Baresa et al.,

2013). Two main controls that determine the value of

share, the first is the perception of investors, and the

second is demand and fulfilment (demand and

supply) (Damodaran, 2006). The stock price in the

market (market price) does not necessarily reflect the

real price of the company (Paramitha et al., 2014).

The business conditions of the company will

significantly influence the value of a company

(Paramitha et al., 2014).

Meanwhile, the macro conditions, such as the

political, economic, social conditions of the country

strongly influences the company operation and the

industrial conditions. Therefore, in addition to

evaluating the company, it is essential to conduct an

assessment of macroeconomic and industrial

conditions in the country where the company is

engaged in business activities (Paramitha et al.,

2014).

The main objective of corporate financial

management is to maximize company value.

Financial policies, corporate strategies, and company

values are mutually supportive (Damodaran, 2006).

The positive growth of company value is an

achievement desired by its owners because the

increase in the value of the company is synonymous

with the welfare of its owners as well (Zemba and

Hendrawan, 2018).

2.3 Discounted Cash Flow

The Discounted Cash Flow (DCF) is a valuation

method of an assets by assuming its present value’s

cash flows (cash flows) that can be generated by the

asset, discounted at a specific ratio which represents

the risk of cash flows (Damodaran, 2006). We can

calculate the cash flow generated by an asset with

following basic formula where E(CF) is the

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

664

estimation of the cash flow, n this year of estimation,

and r is the discounted rate (Damodaran, 2006).

(1)

The Discounted Cash Flow (DCF) method is

divided into three models, i.e. Dividend Discounted

Model (DDM), Free Cash Flow to Equity (FCFE),

and Free Cash Flow to Firm (FCFF) (Damodaran,

2006).

2.3.1 Dividend Discounted Model

Dividend Discounted Model (DDM) is the longest

Discounted Cash Flow model practiced (Damodaran,

2006). Many researchers are shifting from the DDM

model because the results obtained from this model is

overly conservative (Damodaran, 2006). The

underlying principle of the DDM model is when

investors buy shares in a public company, in general,

they expect two benefits; first, the profit from

dividends during the holding period, and the second

is the profit from the increase in the share price itself

at the end of the holding period. Because the expected

stock price is determined by future dividends, the

value of a stock can be reflected as the present value

of dividends forever (Damodaran, 2006).

The following is an example of a formula that can

be used to calculate the intrinsic value of shares using

the DDM model in n years, assuming the revenue is

in stable growth and the company pays dividends

regularly.

(2)

2.3.2 Free Cash Flow to Equity

Free Cash Flow to Equity (FCFE) is the cash flow

available after repayment of obligations to non-equity

investors (interest obligations, debt repayment, and

preferred dividend) has been fulfilled (Damodaran,

2006). Furthermore, there are several stages that must

be done to estimate the cash flow that can be

generated by a company to shareholders (Damodaran,

2006).

The first stage, each investment expenditure

issued must be reduced first with net income (net

income) from a company so that it can represent the

cash outflows. It is then added with depreciation.

In the second stage, if there is an increase in

working capital, it will reduce the cash flow available

to shareholders. In the last stage, if the company gets

new debt and debt that has been paid in the company's

cash flow, then the principal debt payment represents

cash out money, while the issuance of new debt will

represent the money that enters.

Following is the formula for calculating FCFE

values, where NWC is the net working capital.

FCFE = Net Income

– Capex

+ Depreciation

– NWC

+ Cash

(3)

2.3.3 Free Cash Flow to Firm

The Free Flow to Firm Cash (FCFF) is the amount of

cash flow available to all investors in a company,

including common stockholders, bondholders, or

preferred-stockholders (Damodaran, 2006). The

general calculation formula for getting a Free Cash

Flow to Firm (FCFF) is as follows:

FCFF = (EBIT x (1-Tax)

+ Depreciation

– Capex

– NWC

(4)

The value of the company is obtained by

discounting the Free Cash Flow to Firm (FCFF) with

the Weighted Average Cost of Capital (WACC)

factor in this method (Damodaran, 2006). We can use

the following formula to calculate the value of the

company, where t is the year of calculation

(Damodaran, 2006):

(5)

After getting the present value of the cash flow

obtained from a particular scenario (FCFF) and

discounted terminal value. Then, the two present

values are summed to get the firm value or equity

value (Damodaran, 2006). The formula that can be

used to calculate company value using FCFF whose

growth has stabilized in a given year, and continues

to grow stably at the perpetual growth level of g is as

follows (Damodaran, 2006). TV is the terminal value

that will be discussed in the next section.

(6)

Metal and Mineral Mining Firm’s Equity Valuation in Indonesia Stock Exchange

665

(7)

2.4 Cost of Capital

The cost of capital definition is the rate of return that

becomes an return expectation when an investor put

an investment in a capital market (Damodaran, 2006).

In general, the expected rate of return is represented

by the Weighted Average Cost of Capital (WACC) in

the company value formula. The Weighted Average

Cost of Capital (WACC) provides an illustration to

investors that the capital cost of a company is a

weighted average of the various costs contained in the

company's capital structure (Damodaran, 2006).

WACC is a very important parameter when

estimating the value of a company using the DCF

model. Minor changes in WACC will result in major

change in company value. The WACC is calculated

by weighting the source of capital according to the

company's financial structure and then multiplying it

with the portion of their costs. The WACC calculation

formula is as follows:

WACC = (Equity ratio x Equity rate) + ((Debt

ratio x Debt rate) x (1 – tax)

(8)

In the WACC calculation there are two main

factors explained as follows:

a. Cost of equity

Definition of cost of equity (R

e

) is the rate

of return expected by the shareholder (equity)

on his investment in a company (Damodaran,

2006). The formula to calculate the cost of

equity (R

e

) is as follows (Damodaran, 2006):

(9)

If the company distributes dividends

regularly, alternative formula that can be used

to calculate R

e

is as follows (Damodaran,

2006):

R

e

=

(10)

b. Cost of debt

Cost of debt (Rd) is the interest rate that

must be paid by the company for its debt or

external capital (Damodaran, 2006).

2.5 Terminal Value

The technical problem that often arises is how to

determine the proxy that can represent the value of

the company after an explicit projection period. For

example, the company conducts financial report

projections for five years. Terminal value provides an

estimate of the amount of the estimated value of the

company after the fifth year period. Terminal value is

a proxy to simplify the calculation of company value

after an explicit period (Damodaran, 2006).

One common method used to calculate proxy

terminal values is the Gordon Growth method. The

Gordon Growth method uses the potential for growth

in calculating the proxy terminal value. This method

is derived to two, namely: (1) Growing Free Cash

Flow Perpetuity; and (2) Shortcut Growing Cash

Flow Perpetuity (Damodaran, 2006).

a. Growing Free Cash Flow Perpetuity

This method assumes that free cash flow

will grow continuously over a very long period

of time, or forever, after passing an explicit

projection period, when the growth rate is

constant. The formula for Growing Free Cash

Flow Perpetuity is as follows (Damodaran,

2006):

(11)

b. Shortcut Growing Free Cash Flow Perpetuity

This method is the same as the method of

Growing Free Cash Flow Perpetuity whose

terminal value is calculated from the expected

free cash flow for the first year after the explicit

projection period. The difference is that this

method simplifies how to get FCF

t + 1

by

assuming FCFt + 1 = FCF

t + 1

x (1 + g), so that

the formula is as below (Damodaran, 2006):

(12)

2.6 Relative Valuation

The easiest analogy for understanding relative

valuation is if we are going to buy a 100m

2

type

house, then we will compare the price of the similar

type of house around it with the price of the house we

will buy. With the relative valuation method, we

value an asset based on the similarity of similar assets

valued in the market (Damodaran, 2006).

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

666

There are several approaches that can be used to

do a valuation of a company using the relative

valuation method.

a. Price Earnings Ratio Approach

Price/Earnings (P/E) multiple analysis is

considered as the king of relative valuation. It is

computed as the ratio between the share price and

earnings per share (EPS) or alternatively as market

capitalization over total earnings. The multiple can be

built in different ways, depending on the

methodology used to select earnings (Massari et al.,

2018):

(13)

b. Price to Book Value Approach

Another approach that can determine the value of

a stock in relative valuation method is to compare the

stock market price to the book value per share

(Damodaran, 2006). In ideal conditions, the market

value of a stock must describe the value of the book

(Damodaran, 2006).

The formula that can be used to determine price

book value (PBV) is as follows (Damodaran, 2006):

(14)

2.7 Building Research Assumptions

Uncertainty is an unpredictable part and reward of the

valuation process, two things that are crucial are the

times when we make a valuation of a company, and

how long our valuations last until new information is

found that affects the valuation validity. Information

can be in the form of the specific information related

to the company, and it can also be more general

related to the sector in which the company operates,

or more general market information, such as interest

rates and general economic conditions (Damodaran,

2006).

Furthermore, the valuations can be wrong with

several reasons that can be categorized into three

groups as follows (Damodaran, 2006):

a. Estimation uncertainty. Although the source of

information used is indisputable, at the time of

valuation, a valuator must convert raw

information into inputs, and process it in a

research model. An error in data processing or

assessment that occurs at this stage can cause

estimation errors.

b. Firm-specific uncertainty. Estimates built when

valuing a company can be completely wrong. A

company can in fact produce better or worse

performance than our prediction, causing

earnings and cash flows to be far different from

our estimates (Abdullah et al., 2017).

c. Macroeconomic uncertainty. When both of

these things are in accordance with the

estimation of a valuator, macroeconomic

conditions can change unexpectedly. Interest

rates can go up or down in certain situations,

and general economic conditions can get better

or worse. Changes in these macroeconomic

conditions will affect the value of a company

2.8 Framework of Thinking

Stock price valuation analysis in this research was

carried out by utilizing the Discounted Cash Flow

(DCF) method Free Flow to Firm (FCFF) approach,

then comparing the results with the relative valuation

(RV) method to validate the estimates using the FCFF

method. The validation using RV can minimize bias

and assumptions error when doing valuations. RV is

carried out with the Price Earnings Ratio (PER) and

Price Book Value (PBV) approach by utilizing data

that is already available in quarterly reports on the

Indonesia Stock Exchange.

The basis of estimation utilizes company data

samples taken in the last five years, namely from

2013 to 2017. The stock valuations using the

Discounted Cash Flow (DCF) method require

assumptions and projection determinations the

condition of the company to produce free cash flow

in the future and then calculate the present value

(Neaxie and Hendrawan, 2017). Determination of

assumptions and projections needs to be adjusted to

specific scenarios because of uncertainty on the

company condition in the future. The research uses

three scenarios, namely optimistic conditions,

moderate conditions, and pessimistic conditions

(Neaxie and Hendrawan, 2017).

The scenarios can be determined based on

information on environmental data and facts (Neaxie

and Hendrawan, 2017). An optimistic condition is a

condition that is considered as the highest growth

condition of the company and seen from the

difference in industrial growth and the target of

company management (above the industry growth

average). Moderate conditions are conditions where

the most likely to occur is seen from the fundamental

states of the company (the most likely conditions)

whereas the pessimistic condition is the condition

where the condition of the company is the worst

(Neaxie and Hendrawan, 2017).

The optimistic condition will be calculated from

the average growth of the industry plus the spread

Metal and Mineral Mining Firm’s Equity Valuation in Indonesia Stock Exchange

667

between the average growth of the industry and the

average growth of the company coupled with half of

the spread of growth. While moderate conditions will

be calculated from the average growth of the industry

coupled with the average growth of the company.

Pessimistic conditions will be calculated only based

on the average growth industry (Zemba and

Hendrawan, 2018).

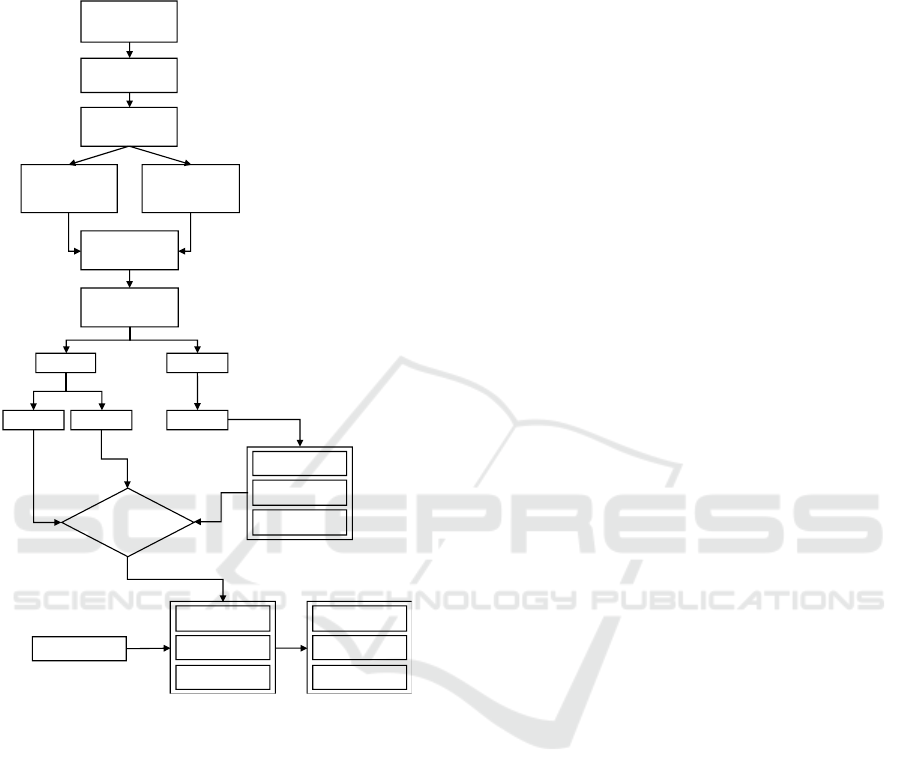

Figure 5: Research framework of thinking

The final process of valuation with Discounted

Cash Flow (DCF) method is to obtain equity value or

intrinsic value of the company which then gets the

intrinsic value per share in each defined scenario.

Then, the equity value obtained from the fundamental

estimation is compared to the market price, so it can

be concluded whether the stock price is fair-valued,

undervalued, or overvalued (Damodaran, 2006).

After knowing the position of the stock price, we

can advise whether the shares can be bought, held, or

sold so that investors can maximize their investment

to get the maximum profit.

The framework of thinking developed in this

research follows the flow diagram in Figure 5.

3 PROBLEM DEFINITION

Based on the introduction and literature review in

previous sections, the problem definition in this

research are:

a. What is the intrinsic value of ANTM, INCO,

and TINS shares in the Indonesia Stock

Exchange using the Discounted Cash Flow

method with the Free Cash Flow to Firm

(FCFF) approach? Also, What is the value of

the Price Earnings Ratio (PER) and Price Book

Value (PBV) in the optimistic scenario for

2018?

b. What is the intrinsic value of ANTM, INCO,

and TINS shares in the Indonesia Stock

Exchange using the Discounted Cash Flow

method with the Free Cash Flow to Firm

(FCFF) approach? Also, What is the value of

the Price Earnings Ratio (PER) and Price Book

Value (PBV) in the moderate scenario for

2018?

c. What is the intrinsic value of ANTM, INCO,

and TINS shares on the Indonesia Stock

Exchange using the Discounted Cash Flow

method with the Free Cash Flow to Firm

(FCFF) approach? Also, What is the value of

the Price to Earnings Ratio (PER), and Price

Book Value (PBV) in the pessimistic scenario

for 2018?

d. What recommendations can this research give

to the investors after knowing the share’s

intrinsic value, PER and PBV of these

companies in those three scenarios? Is it sold,

bought or held?

4 METHODOLOGY / APPROACH

This research took a quantitative descriptive approach

and aimed to provide an up-to-date description of the

fair price of sampled company stocks. Quantitative

descriptive research is a type of research giving a

deeper picture of the present situation (Zemba and

Hendrawan, 2018). The fair price reference in this

research is the intrinsic stock price obtained from the

valuation techniques used in this research.

The research variable used in this study is the

intrinsic value of shares based on the company's

fundamental value (firm value). Then the variables

will be calculated using the Discounted Cash Flow

Market (ISE)

Exploration (data

and news)

KOMPAS100

Index Exploration

Population and

Sampling

(3 companies)

KOMPAS100

Index Analysis

2013-2017

Sample historical

data and analysis

Projection

Development

2018-2023

Estimating intrinsic

value of the stocks

DCFRV

PER PBV FCFF

FCFF stock

valuation in

the range?

Optimistic Value

Moderate Value

Pessimistic Value

Overvalued ?

Fair-valued ?

Undervalued ?

Buy

Sell

Hold

Offered Price

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

668

(DCF) method Flow to the Firm Free Cash (FCFF)

approach, and Relative Valuation approaches with

Price Earnings Ratio (PER), Price Book Value Ratio

(PBV) approaches. The measurement scale used to

measure the research variable is the ratio

measurement scale (Zemba and Hendrawan, 2018).

The sampling technique used by researchers was

purposive sampling technique. The purposive

sampling technique is a sampling selection technique

that selects a specific sample intentionally by the

researcher because only the sample represents or can

provide information to answer the research problem

statements (Sekaran, 2003).

The criteria of the purposive sampling technique

in this research are as follows:

a. Shares in the Indonesia Stock Exchange (IDX)

mining sector in the metal and mineral mining

sub-sector,

b. Shares listed on the KOMPASS100 index on

the Indonesia Stock Exchange (IDX),

c. Active shares up to June 2018 on the Indonesia

Stock Exchange (IDX) and are not suspended.

From each of these criteria, the companies that

become the population are obtained and the sample as

follows:

a. Based on the first criteria acquired nine

companies as follows:

1. Aneka Tambang Tbk.

2. Cita Mineral Investindo Tbk.

3. Cakra Mineral Tbk.

4. Central Omega Resource Tbk.

5. Vale Indonesia Tbk.

6. Merdeka Copper Gold Tbk.

7. J Resource Asia Pacific Tbk.

8. Timah Tbk.

9. Kapuas Prima Coal Tbk.

b. Based on the second criteria, three companies

were sampled, namely Aneka Tambang Tbk.,

Vale Indonesia Tbk., And Timah Tbk. The

reference used in determining the companies

that enter KOMPAS100 is the announcement of

the Indonesia Stock Exchange regarding

companies coming to the KOMPAS100 Index

Number Peng-00698 / BEI.OPP / 07-2018,

dated July 25, 2018, which is valid from August

2018 to January 2019.

c. Based on the data available on the website

www.duniainvestasi.com daily transaction data

for these three companies complete the

observation period January 1, 2013, to June 30,

2018, which means that the three companies

never experience the suspension throughout the

period of data collection

The type of data used in this research is the

secondary data types, such as company financial

statements, Indonesia Stock Exchange, World Stocks,

and Yahoo Finance. Secondary data is supporting

data obtained from other sources.

The data used in this research are secondary data

originating from the published and audited financial

statements historically in the last five years of the

sample companies, i.e., from January 2013 to

December 2017. The five-year historical data of the

KOMPAS100 index is taken from Yahoo Finance.

4.1 DCF-FCFF Share Value Approach

Estimating the share's intrinsic value stages using the

Discounted Cash Flow (DCF) - Free Cash Flow to

Firm (FCFF) approach is as follows (Damodaran,

2006):

a. Classify the historical data as the basis for

projection

In this stage data classification from

financial statements and company annual

reports is in the form of sales data (revenue),

the percentage of operating expenses (EB),

depreciation and amortization costs (DA),

EBIT, tax costs, capital expenditure, and net

working capital. The data was taken in the

range from 2013 to 2017.

Based on the historical data, we can get the

average data percentage (%) on revenue. That

leads us to its cost behavior. The cost behavior

is used as a reference for projecting over the

next five years, namely 2018-2022.

b. Conduct projections and analysis of financial

statement ratios

The basis of future financial statement

projections is taken from financial statement

data in the past. So that conducting company

valuation involves elements of forecasts,

estimates, and assumptions.

c. Calculating the free cash flow

After projecting the financial components

that form the EBIT, such as sales, costs, and

depreciation/amortization, then calculate FCFF

using formula 4.

d. Calculating the estimated cost of capital

The next is determining the discount. In this

approach, the discount rate used is WACC.

WACC is calculated based on the proportion of

the company's financing sources (equity and

debt). WACC is calculated using formula 8.

e. Figuring Value Terminals

In this research, the authors assume that

growth is constant, so the equation that can be

used is formula 7 or 11.

f. Calculating cash flows from FCFF and

Terminal Value

Metal and Mineral Mining Firm’s Equity Valuation in Indonesia Stock Exchange

669

The next step is to calculate the projection

of free cash flows until 2021, and the cash flow

of the terminal value assuming the company

has a constant growth in 2022. Cash flow

projections in this research used formulas 6.

g. Calculating the Enterprise Value

Furthermore, the enterprise value is

obtained from the sum between the number of

FCFF present values from 2018 to 2021 plus

the present value of the terminal value.

h. Calculating the company's Equity Value

The value of equity is obtained using the

value of the company or enterprise value

reduced by the amount of debt held, minus the

ownership of the minority company, and

summed by the amount of cash carried (Antwi

et al., 2012).

i. Calculating the intrinsic value of the stock

We need to divide the equity value with the

number of shares outstanding to get the

intrinsic value of the stocks. The intrinsic value

per share will be different depending on the

three scenarios of predetermined conditions

(optimistic, moderate, pessimistic) (Zemba and

Hendrawan, 2018).

j. Assessing and providing recommendations

After getting the intrinsic value, the value of

the stock needs to be compared with the stock

price in the evaluation period. The results of

this comparison will conclude that the value of

shares is in an undervalued, fair-valued, or

overvalued condition. From these conditions,

the researcher will advise investors to buy,

hold, or sell the evaluated shares.

4.2 PER Approach

This method uses the value of earnings to estimate

intrinsic value. The Price to Earnings Ratio (PER)

method is also called the multiplier method because

investors will count the multiplier value of earnings

reflected in the stock price. Thus, the PER method

describes the ratio or comparison between stock

prices and earnings per share of the company

(Damodaran, 2006).

The higher the PER value, the smaller the profit

for each share, because market prices are considered

to be increasingly expensive. Conversely, the lower

the PER value indicates the higher the benefit gained

for each share since the price is considered cheaper

(Damodaran, 2006).

Table 1: Stock Valuation Based on PER Value

PER> Average PER of Industry

Overvalued

PER<Average PER Industry

Undervalued

PER= Average PER Industry

Fair-valued

The PER value of a share of 5 means that the

return on investment is five years, or investors will

get a return of twenty percent each year. Meanwhile,

if the PER value is 10, then the return on invested

investment is ten years, equivalent to a gain of ten

percent per year. So, the higher the PER of a stock,

the worse it is because the profit per share is relatively

smaller (Damodaran, 2006).

The stages of estimating the PER value based on

the intrinsic value of shares obtained from the DCF

estimation are as follows (Zemba and Hendrawan,

2018):

a. Calculate Earnings per Share (EPS) using a

formula

EPS = EAT / Number of Shares

(15)

b. Calculating PER using a formula

PER = Share Intrinsic Value / EPS Price

(16)

Table 2: Investment Decisions based on Stock

Assessment Results

Stock price position

investment decision

Undervalued

Buying because it is possible

prices will rise

Overvalued

Selling because it is likely

prices will fall

Correctly valued

Hold (wait and see)

The next step is to compare the PER value

obtained with the industry average. Table 1 provides

an overview of stock positions if assessed based on

the estimated PER. Investment decisions based on

PER analysis is as shown in Table 2.

4.3 PBV Approach

The steps that must be taken to determine the position

of the stock are in an undervalued, fair valued or

overvalued position on the Price Book Value method

(PBV) is quite simple. Ideally, the stock market price

compared to the book value of its assets will approach

one. Stocks that have a low price/book value ratio

should be purchased to obtain a higher level of return

at a certain level of risk (Damodaran, 2006).

PBVs that have a value below or close to one is

considered good by investors, but PBV that has a

value above one means classified as expensive

(overvalued). However, PBVs that have high value

still can rise if the company has excellent

performance and business processes. Business

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

670

prospects can be seen from how high the profits that

can be produced by the company. Investors can see

the amount of Return On Equity to know the

company's ability to generate profits based on owned

capital (Damodaran, 2006).

Further, since the native of relative valuation, we

need to also consider the average PBV of industry to

determine the position of evaluated shares in the

market. Therefore, below is the guideline for the

investors to determine the share position based on

PBV (Neaxie and Hendrawan, 2017).

a. If PBV> industrial PBV, then the stock is in an

overvalued position

b. If PBV= industrial PBV, then the stock is in a

fair-valued position

c. If PBV<industrial PBV, then the stock is

undervalued

5 ANALYSIS AND RESULT

The historical data were derived from the company's

financial reports from 2013 - 2017 and in further

taken as the reference for the free cash flow

calculation. The projection of free cash flow to the

firm is based on the cost behavior of the historical

data in 2013 - 2017 for the projections of 2018-2022.

In this research, we generated three scenarios of

projected corporate revenue growth based on industry

analysis namely the pessimistic, moderate, and

optimistic scenarios. A pessimistic scenario is a

scenario where the company's growth is the same as

industrial growth. The moderate scenario is a scenario

where the company's growth is industrial growth plus

the company's historical growth difference to

industrial growth. An optimistic scenario is a scenario

where the company's growth is industrial growth plus

the company's historical growth difference to

industrial growth, then added half of the difference

(Neaxie and Hendrawan, 2017).

The pessimistic scenario is built on the

assumption of consistent revenue growth of 2.16%

per year per the average industrial growth. The

moderate scenario was constructed with the

assumption of revenue growth of 5.15% for ANTM,

3.19% for INCO, and 3.52% for TINS. The three

companies are assumed to experience revenue growth

of 2.16% at the end of the year of analysis.

The optimistic scenario is built on the assumption

of revenue growth of 6.64% for ANTM, 3.71% for

INCO, 4.20% for TINS. The three companies are

assumed to experience revenue growth of 2.16% at

the end of the year of analysis.

5.1 DCF-FCFF Valuation Results

The stock valuation using DCF-FCFF method in this

research resulted in the share’s intrinsic value as

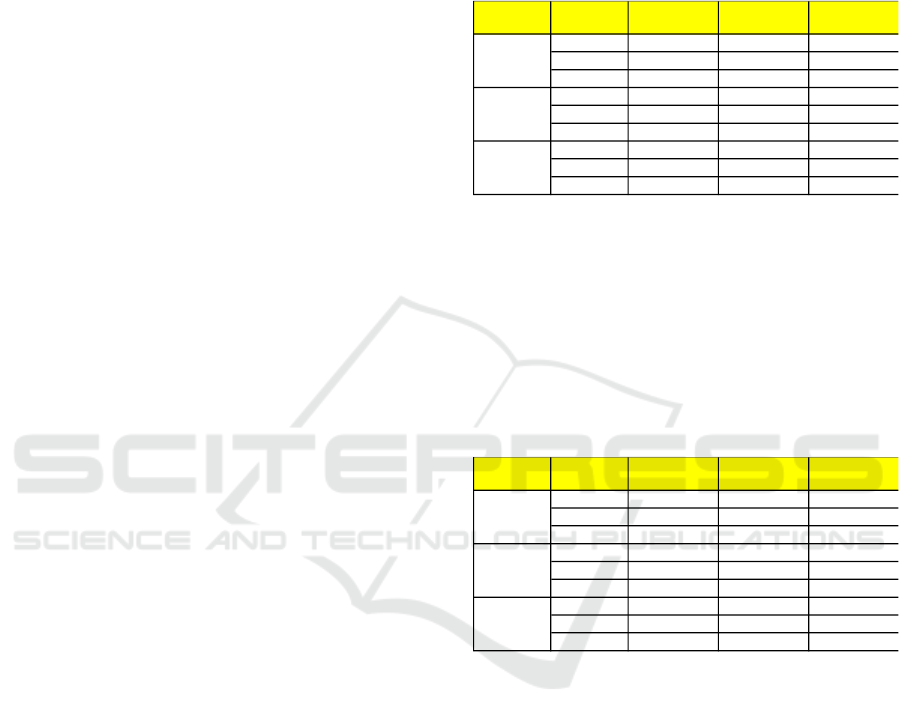

listed in Table 3.

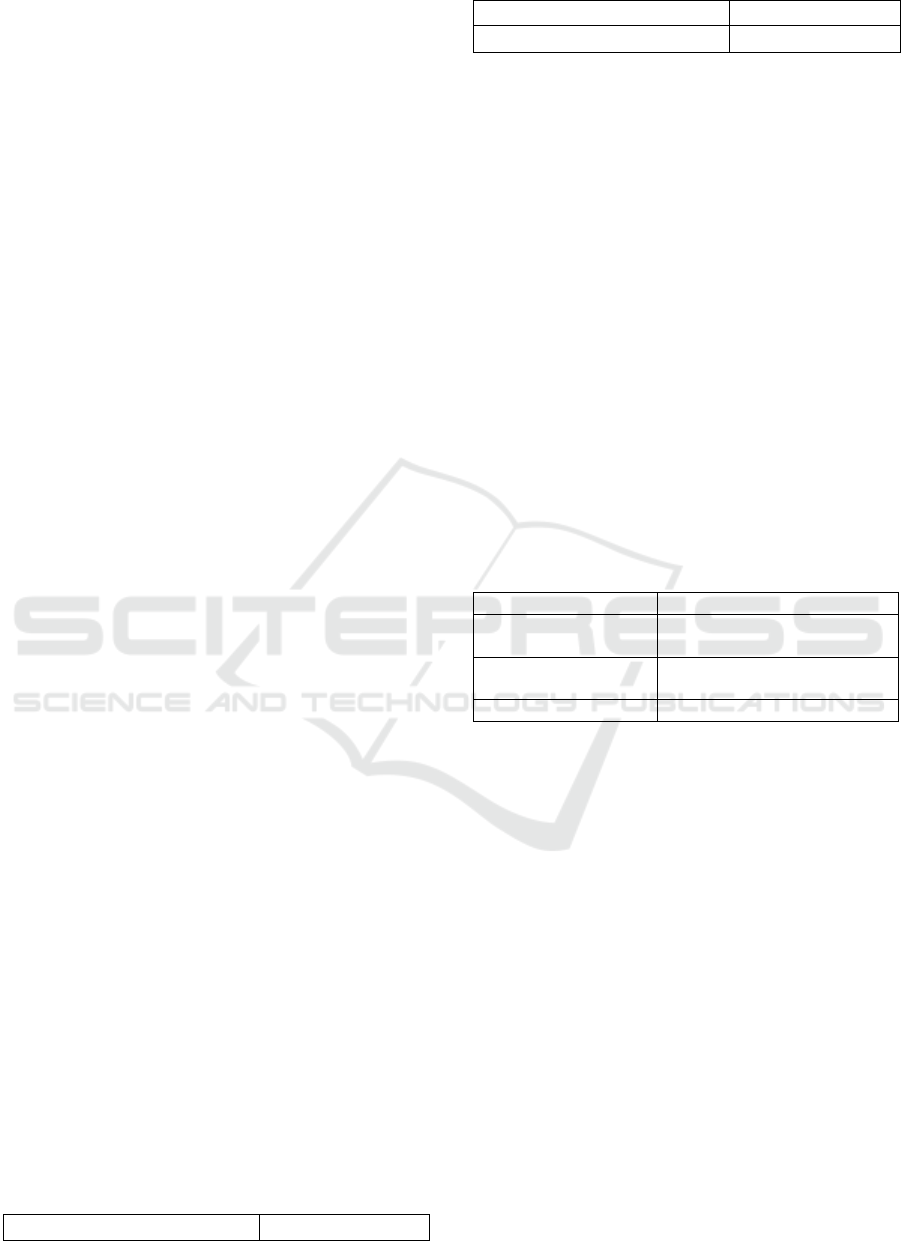

Table 3: DCF-FCFF Valuation Results

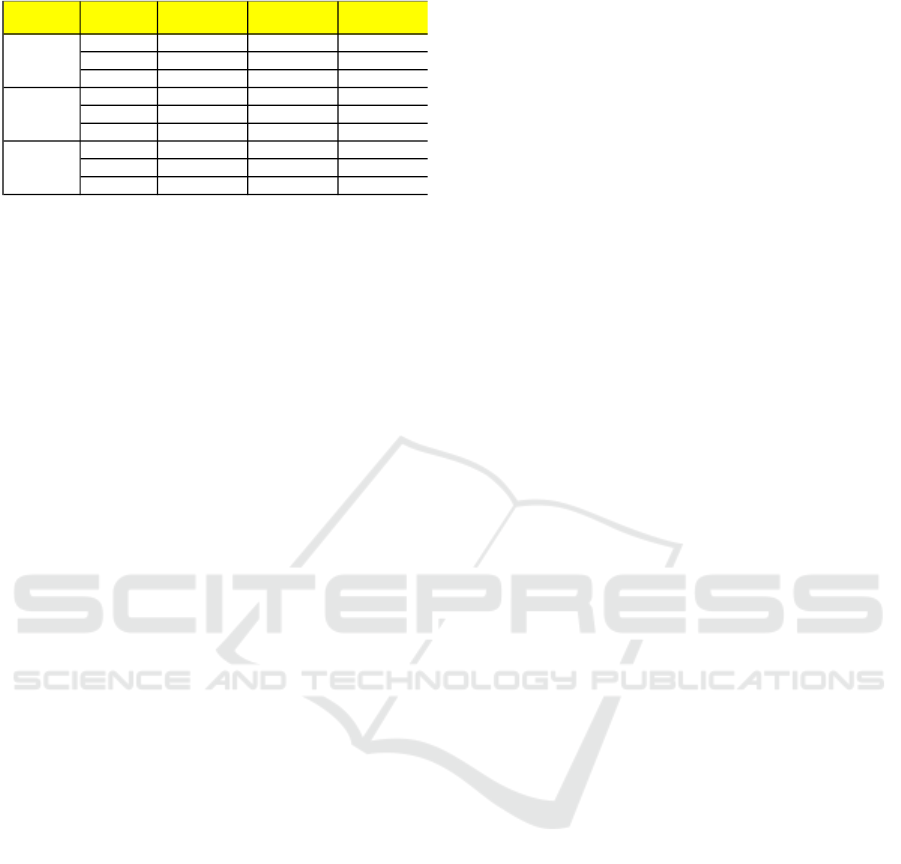

5.2 PER Valuation Results

The stock valuation using relative valuation method

with Price Earnings Ratio (PER) approach resulted in

the PER values as listed in Table 4.This research used

the average PER of the industry from Q1 Statistic

Report of Indonesia Stock Exchange.

Table 4: PER Valuation Results

5.3 PBV Valuation Results

The stock valuation using relative valuation method

with Price Book Value (PBV) approach resulted in

the PBV values as listed in Table 5.This research also

used the average PBV of the industry from Q1

Statistic Report of Indonesia Stock.

Company Scenario Intrinsic Value

Opened Price

2 Jan 2018

Analysis

Pessimistic IDR 644 IDR 635 Undervalued

Moderate IDR 735 IDR 635 Undervalued

Optimistic IDR 784 IDR 635 Undervalued

Pessimistic IDR 2,376 IDR 2,920 Overvalued

Moderate IDR 2,455 IDR 2,920 Overvalued

Optimistic IDR 2,496 IDR 2,920 Overvalued

Pessimistic IDR 568 IDR 780 Overvalued

Moderate IDR 611 IDR 780 Overvalued

Optimistic IDR 633 IDR 780 Overvalued

ANTM

INCO

TINS

Company Scenario PER Result

PER Industry

Q1-2018

Analysis

Pessimistic 115.65 25.62 Overvalued

Moderate 122.52 25.62 Overvalued

Optimistic 126.25 25.62 Overvalued

Pessimistic 49.02 25.62 Overvalued

Moderate 50.06 25.62 Overvalued

Optimistic 50.61 25.62 Overvalued

Pessimistic 11.86 25.62 Undervalued

Moderate 12.46 25.62 Undervalued

Optimistic 12.77 25.62 Undervalued

TINS

ANTM

INCO

Metal and Mineral Mining Firm’s Equity Valuation in Indonesia Stock Exchange

671

Table 5: PBV Valuation Results

6 CONCLUSIONS

The conclusions of this research are as follows:

a. Based on the analysis carried out on the

optimistic scenario, it can be concluded that the

intrinsic value of ANTM shares is IDR 784 with

a PER value of 126.25 and a PBV value of 1.02.

The intrinsic value of INCO shares is IDR 2,496

with a PER value of 50.61 and PBV at a value

of 1.01. The intrinsic value of TINS shares is

IDR 633 with a PER value of 12.77 and PBV at

a value of 0.78.

b. Based on the analysis carried out in the

moderate scenario it can be concluded that the

intrinsic value of ANTM shares is IDR 735 with

a PER value of 122.52 and a PBV value of 0.96.

The intrinsic value of INCO shares is IDR 2,455

with a PER value of 50.06 and PBV at a value

of 0.99. The intrinsic value of TINS shares is

IDR 611 with a PER value of 12.46 and PBV at

a value of 0.75.

c. Based on the analysis that has been done on the

pessimistic scenario it can be concluded that the

intrinsic value of ANTM shares is IDR 644 with

a PER value of 115.65 and a PBV value of 0.84.

The intrinsic value of INCO shares is IDR 2,376

with a PER value of 49.02 and PBV at a value

of 0.96. The intrinsic value of TINS shares is

IDR 568 with a PER value of 11.86 and PBV at

a value of 0.70.

d. Recommendations from the results of this study

are as follows:

1. PT Aneka Tambang Tbk.

Based on the FCFF approach, the research

recommends buying ANTM shares on all

scenarios because the valuation results are

undervalued. Based on the Price Earnings Ratio

(PER) approach, the valuation produced an

overvalued position against the industry PER

(12.62x) in all scenarios, so the researcher’s

recommendation is to sell ANTM shares. Based

on the Price Book Value (PBV) approach, the

valuation resulted in undervalued values in all

scenarios, since they are below the industry

average of 3.55. Base on the result, the author

recommends buying ANTM shares.

2. PT Vale Indonesia Tbk.

Based on the results of the analysis using the

FCFF approach, it was concluded that INCO

shares were overvalued in all scenarios, so they

were recommended for sale. If using the Price

Earnings Ratio (PER) approach, the three

scenarios produce values above the industry

average of 25.62x, so the researcher also

recommends selling INCO shares. While the

analysis of INCO stock prices using the Price

Book Value (PBV) concluded that INCO shares

were in an undervalued position on all scenarios

because they are below the industry average of

3.55, so they are worth buying.

3. PT Timah Tbk.

The result of the analysis using the FCFF

approach recommends selling in all three

scenarios since the share value was overvalued.

If using the Price Earnings Ratio (PER)

approach, the three scenarios produce PER

values in the investment range below the

Industry average of 25.62, so the researcher

recommends buying PT Timah Tbk shares.

While the analysis of the stock price of PT

Timah Tbk. using Price Book Value (PBV)

produces a value below the industry average of

3.55 in all three scenarios, which means the

shares of PT Timah Tbk. worth to buy.

7 STUDY LIMITATIONS AND

FURTHER STUDY

Refer to the stock price trend, and the discussions in

this research, metal and mineral sub-sector could

probably have the relation with the battery and

smartphone industry trend. Researchers have yet

explored that interesting correlation. Further study in

that field is expected to strengthen the fluctuation

analysis of the stocks.

Another limitation of this research is the intrinsic

value valid time is only in 2018, and the sampled

companies were only 3 of 12 industry players. The

next valuator will have a possibility to revaluate the

intrinsic value of the company in 2019 and so on, or

include all industry players to have a complete figure

of the industry.

Company Scenario PBV Valuasi

PBV Industry

Q1-2018

Analysis

Pessimistic 0.84 3.55 Undervalued

Moderate 0.96 3.55 Undervalued

Optimistic 1.02 3.55 Undervalued

Pessimistic 0.96 3.55 Undervalued

Moderate 0.99 3.55 Undervalued

Optimistic 1.01 3.55 Undervalued

Pessimistic 0.70 3.55 Undervalued

Moderate 0.75 3.55 Undervalued

Optimistic 0.78 3.55 Undervalued

ANTM

INCO

TINS

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

672

REFERENCES

Abdullah, A. I., Ali, M. M. and Haron, N. H., 2017.

Ownership Structure, Firm Value and Growth

Opportunities: Malaysian Evidence. Journal of

Computational and Theoretical Nanoscience. August

2017.

Aljifri, K., Ahmad, H.I., 2018. Preferred Valuation

Techniques in the UAE: A Comparative Study of

Financial and Non-financial Sectors. International

Journal of Economics and Financial Issues, 2019, 9(1),

51-59.

Antwi, S., Mills, E.F.E.A. and Zhao X., 2012. Capital

Structure and Firm Value: Empirical Evidence from

Ghana. International Journal of Business and Social

Science Vol. 3 No. 22.

Atwal, R. et al., 2018. Forecast : PCs, Ultramobile, and

Mobile Phones, Worldwide, 2016-2022, 1Q18 Update,

s.l.: Gartner

Baresa, S., Bogdan, S. and Ivanovic, Z., 2013. Strategy of

stock valuation by fundamental analysis. UTMS

Journal of Economics, University of Tourism and

Management, Skopje, Vol. 4, Issue 1, pp. 45-51.

Damodaran, A., 2006. Damodaran on Valuation. Second

ed. New Jersey: Wiley Finance.

Haffiyan, 2018. 3 Saham Emiten Tambang Mineral Ini

Paling Prospektif. [Online]

Available at: www.bisnis.com [Accessed 23 9 2018]

Pusat Data dan Informasi Kementrian Perdagangan. (2018).

Perkembangan Ekspor NonMigas (Komoditi) Periode :

2013-2018. Available at : www.

http://www.kemendag.go.id/id/economic-

profile/indonesia-export-import/growth-of-non-oil-

and-gas-export-commodity [15-Nopember-2018]

Massari, M., Difonzo, C., Gianfrate, G. and Zanetti, L.,

2018. Bank Valuation Using Multiples in US and

Europe: An Historical Perspective. Business Valuation

OIV Journal Fall 2018, Vol.0, Issue 0.

Mohammad, A.N.,2016. Valuation Tools for Determining

the Value of Assets: A Literature Review. International

Journal of Academic Research in Accounting, Finance

and Management Sciences Vol. 6 (4), pp. 63–72.

Neaxie, L. V. and Hendrawan, R., 2017. Stock Valuation in

Telecomunication Firms : Evidence from Indonesian

Stock Exchange. Journal of Economic & Management

Perspective (ISSN:2523-5338), Vol. 11(Issue 3).

Paramitha, A.L., Hartoyo, S. and Maulana, N.A., 2014. The

Valuation of Initial Share Price using Free Cash Flow

to Firm Method and The Real Option Method in

Indonesia Stock Exchange. JMK, Vol. 16, No. 1, March

2014, page 9–16.

Sekaran, U., 2003. Research Method for Business. Illinois,

USA: John Wiley & Sons, Inc.

Zemba, S. and Hendrawan, R., 2018. Does Rapidly

Growing Revenues Always Produces An Excellent

Company’s Values? DCF & PE Valuation Assessment

on Hospital Industry. ISCLO, Volume 6

th

Metal and Mineral Mining Firm’s Equity Valuation in Indonesia Stock Exchange

673