Perceives Ease of Use, Level of Trust and Knowledge of the Use of

Financial Technology

Rinny Meidiyustiani, Imelda

Universitas Budi Luhur

Keywords: perceives ease of use, level of trust, knowledge, financial technology.

Abstract: Financial Technology is a technology-based financial service that facilitates payment transactions anywhere

and anytime. This study aims to analyze the utilization of ease of use of technology, the level of trust and

knowledge of the use of Financial Technology (Fintech) in the era of society 5.0. Data analysis techniques

in this study were analyzed quantitatively using the SEM - Partial Least Square (PLS) method. Test result

showed that The R-Square value of the Fintech usage variable is 0.3920 or 39.2%. This means that 60.8% is

influenced by other factors outside of this study

1 INTRODUCTION

Financial Technology is a technology-based

financial service that facilitates payment transactions

anywhere and anytime. This study aims to analyze

the utilization of ease of use of technology, the level

of trust and knowledge of the use of Financial

Technology (Fintech).

The technological development is also felt by the

financial industry, especially banking, which once

customer data can only be seen in the form of

conventional documents, but now customer data can

also be seen in electronic or online documents, the

emergence of mobile banking, internet banking, and

other technology-related innovations. This

development has led to a lot of changes in the

banking world, resulting in many changes taking

place, including those that have been growing

rapidly lately, namely Financial Technology

(Fintech).

FinTech is not only known among entrepreneurs

but also has been known by the public in general.

The use of FinTech certainly needs to be addressed

immediately through good legal instruments. One

Fintech phenomenon that is growing very rapidly is

the existence of online transportation such as Go-Jek

through its Go-Pay, Grab with Grab Pay, and so on.

The Fintech concept has been around since the

mid-2000s when the internet began to be used as a

media that was easier to access financial data at

banks. At present, the development of Fintech had

reached all circles and can facilitate its users in

getting the concept of Fintech been around since the

mid-2000s, when the internet began to be used as a

media that was easier to access financial data at

banks. At present, the development of Fintech has

reached all circles and can make it easier for users to

get financial products. Financial products.

The fundamental problem that occurs in

implementing this technology is public distrust of

this technology. This problem occurs people's

doubts to conduct transactions with strangers

(Jennex, Amoroso, & Adelakun, 2004). This will

cause people to prefer traditional transactions rather

than online. In the business world, fintech services

as a means of electronic payment transactions much

support business processes because they are

transactional. This facility can facilitate payment

transactions in the business world because it can

reduce errors and can overcome fraud. Fintech can

speed up the transaction process, which can affect

everything. For example, in modern supermarkets,

with fintech, the transaction process will be fast. The

form of payment transactions using fintech which is

popular among MSME entrepreneurs is payment

using card payments such as "e-money" from Bank

Mandiri, "Flazz" from Bank Central Asia,

"TapCash" from Bank Negara Indonesia.

Technology is a technology-based financial service

that facilitates payment transactions anywhere and

anytime. This study aims to analyze the utilization of

ease of use of technology, the level of trust, and

Meidiyustiani, R. and Imelda, .

Perceives Ease of Use, Level of Trust and Knowledge of the Use of Financial Technology.

DOI: 10.5220/0008930901470152

In Proceedings of the 1st International Conference on IT, Communication and Technology for Better Life (ICT4BL 2019), pages 147-152

ISBN: 978-989-758-429-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

147

knowledge of the use of Financial Technology

(Fintech).

The technological development is also felt by the

financial industry, especially banking, which once

customer data can only be seen in the form of

current documents, but now customer data can also

be seen in electronic or online documents, the

emergence of mobile banking, internet banking, and

other technology-related innovations. This

development has led to a lot of changes in the

banking world, resulting in many changes taking

place, including those that have been growing

rapidly lately, namely Financial Technology

(Fintech).

FinTech is not only known among entrepreneurs

but also has been known by the public in general.

The use of FinTech certainly needs to be addressed

immediately through good legal instruments. One

Fintech phenomenon that is growing very rapidly is

the existence of online transportation such as Go-Jek

through its Go Pay, Grab with Grab Pay, and so on.

The Fintech concept has been around since the

mid-2000s when the internet began to be used as a

media that was easier to access financial data at

banks. At present, the development of Fintech had

reached all circles and can facilitate its users in

getting the concept of Fintech been around since the

mid-2000s, when the internet began to be used as a

media that was easier to access financial data at

banks. At present, the development of Fintech has

reached all circles and can make it easier for users to

get financial products. Financial products.

The fundamental problem that occurs in

implementing this technology is public distrust of

this technology. This problem occurs people's

doubts to conduct transactions with strangers

(Jennex, Amoroso, & Adelakun, 2004). This will

cause people to prefer traditional transactions rather

than online. In the business world, fintech services

as a means of electronic payment transactions

greatly support business processes because they are

transactional. This facility can facilitate payment

transactions in the business world, because it can

reduce errors and can overcome fraud. Fintech can

speed up the transaction process, which can affect

everything. For example, in modern supermarkets,

with fintech, the transaction process will be fast. The

form of payment transactions using fintech which is

popular among MSME entrepreneurs is payment

using card payments such as "e-money" from Bank

Mandiri, "Flazz" from Bank Central Asia,

"TapCash" from Bank Negara Indonesia.

2017 Internet User Statistics sourced from

https://apjii.or.id/content/utama shows that internet

users in Indonesia in 2017 reached 143.26 million

(54.68%) of the total population of Indonesia, which

reached 262 million users. It can be concluded that

internet assistance is one of the factors supporting

the development of FinTech's business and digital

payments in Indonesia. The development of FinTech

is strongly influenced by a factor of trust if the

public does not believe FinTech cannot develop.

2 SEM - PARTIAL LEAST

SQUARE (PLS) METHOD

Data Analysis Techniques Data collected in this

study will be analyzed quantitatively using the SEM

- Partial Least Square (PLS) method that shows in

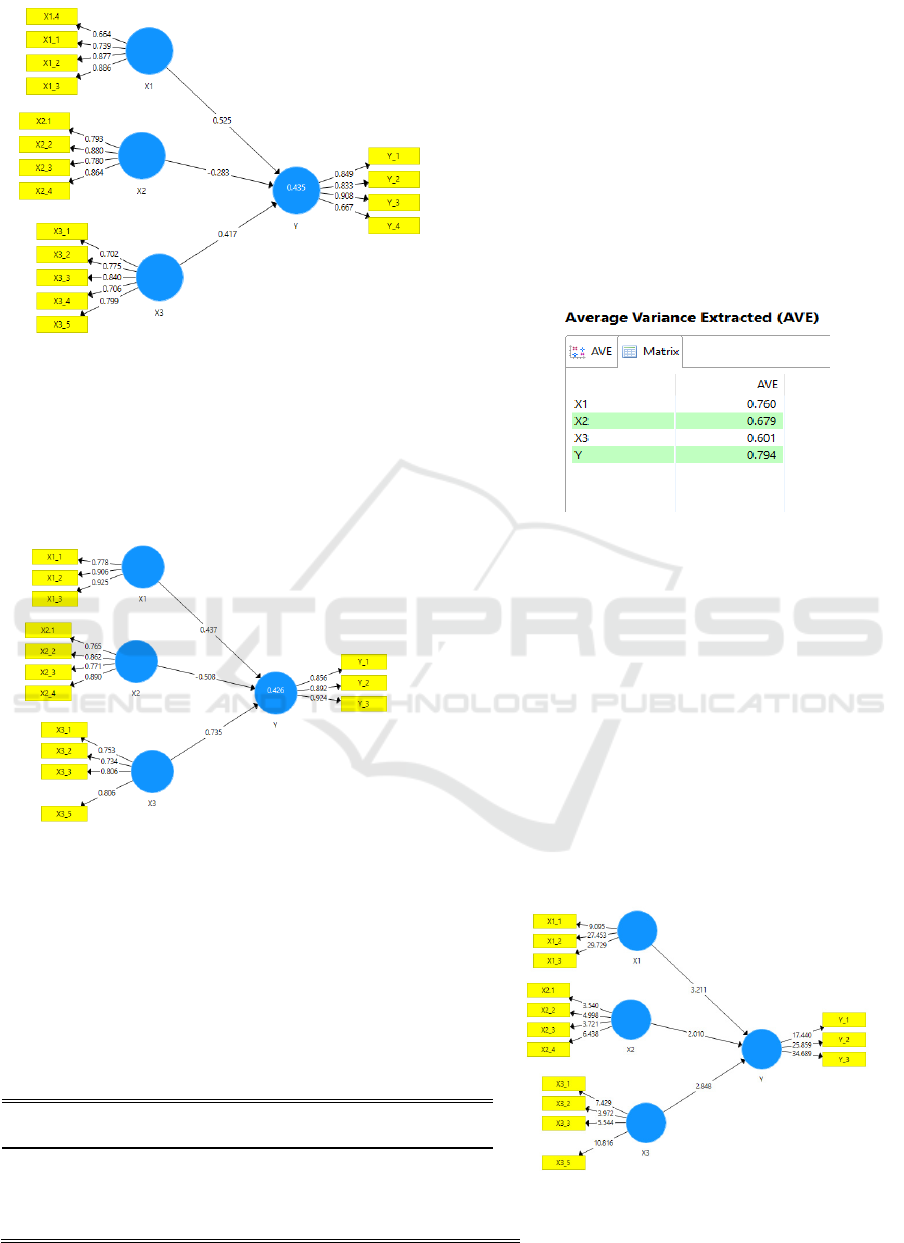

Figure 1.

Figure 1: Proposed SEM - Partial Least Square (PLS)

Method

The measurement model or Outer Model with

reflective indicators is evaluated by convergent and

discriminant validity from the indicator and

composite reliability for the indicator block (Chin in

Ghozali, 2011). The initial model of this study is as

follows in Fig.1: the ease of use (X1), confidence

level (X2) measured by 4 reflective indicators,

knowledge (X3) measured by 5 reflective indicators,

and the use of fintech measured by 4 reflective

inductors.

Knowledge is defined as everything that is

known or everything that is known about something.

Knowledge is information that has been combined

with understanding and potential to act, which then

attaches to someone's mind. Knowledge is a change

in an individual's behavior that comes from

experience. Measurement of knowledge can be done

by interview or questionnaire that asks about the

content of the material to be measured from the

ICT4BL 2019 - International Conference on IT, Communication and Technology for Better Life

148

research subject or respondent (Philip Kotler 2002).

In general, knowledge can be defined as information

stored in memory. The subset of the total

information that is relevant to the functions of

consumers in the market is called consumer

knowledge. Then Engel shares consumer knowledge

in three general fields, namely product knowledge,

purchase knowledge, and useful knowledge. Product

knowledge includes (1) Awareness of product

categories and brands in the product category; (2)

Product terminology; (3) Product attributes and

characteristics. Trust about product categories in

general regarding specific brands.

The perception usefulness (perceived usefulness)

is the extent to which a person believes that the use

of technology will improve its performance. If

someone finds useful technology believe that he

would use.However, if someone is feeling believe

that technology less useful and he will not use. (

Suyanto kurniawan, 2019). Indicators of Ease of Use

(X1) are: (1) I think the Fintech application is

effortless to use. (2) The use of the Fintech

application is effortless, so I can do it myself

without the help of others. (3) The Fintech

application is very easy to operate so I don't feel any

difficulties. (4) The operation of the Fintech

application is very light and easy so it is not so

troublesome when I use it.

Trust is one important thing to make someone

move from a system that manual to a more advanced

system. Trust usually will not be easily obtained by

someone but requires time first. (Chandra, 2016)

Indicators of confidence level (X2) are: (1)

Fintech can improve performance. (2) Fintech is

able to increase the level of productivity. (3) Fintech

can improve performance effectiveness. (4) Fintech

is able to benefit me.

Product knowledge is defined as information

obtained from a product including categories

products, brands, product attributes, product

features, product prices, and product trust

(Candraditya, 2013).

Indicators of Knowledge (X3) are: (1) I already

know fintech. (2) I have stored information about

fintech. (3) I know the use of fintech is more

efficient. (4) I understand how to use fintech. (5) I

am actively looking for information on using

fintech.

Indicators of Use of Fintech are: (1) I am

interested in using Fintech because the features

offered are complete and interesting. (2) The Fintech

application greatly facilitates the transactions that I

do so I always try to use them. (3) I always try to use

Fintech because there are always attractive offers.

(4) I always use Fintech because I need it.

(Anggraini and Widyastuti, 2017)

Estimation of SEM Parameters - Partial Least

Square (PLS): The path analysis model of all latent

variables in PLS consists of three sets of

relationships: (1) Inner model that specifies the

relationship between latent variables (structural

models). (2) Outer model that specifies the

relationship between latent variables with indicators

or manifest variables (measurement model). (3)

Weight relation, to set scores or calculate latent

variable data.

Steps of structural model fit analysis with SEM-

Partial Least Square (PLS): In this study, data

analysis on SEM-PLS will use the help of SmartPLS

software. (a) Obtain a concept and theory based

model for designing structural models (relationships

between latent variables) and measurement models,

namely the relationship between indicators and

latent variables. (b) Make a path diagram (path

diagram) that explains the pattern of the relationship

between latent variables and indicators. (c) Convert

path charts into equations. (d) Evaluating goodness

of fit is by evaluating the measurement model (outer

model) by looking at validity and reliability. If the

measurement model is valid and reliable then the

next stage can be carried out, namely the evaluation

of structural models. If not, then it must re-construct

the path diagram. (e) Model interpretation.

3 ANALYSIS AND DISCUSSION

Data Analysis Techniques Data collected in this

study will be analyzed quantitatively using the SEM

- Partial Least Square (PLS) method that shows in

Figure.1.

3.1 SEM-PLS Test Result

Cross Loading Croos Loading is a construct of

correlation with measurement items greater than the

size of other constructs, so it shows that latent

constructs predict the size of their blocks better than

other block sizes (Fornell and Larcker, in Ghozali,

2011). Test results from Cross Loading can be

shown in Fig.2.

Perceives Ease of Use, Level of Trust and Knowledge of the Use of Financial Technology

149

Figure 2. Convergent Validity

Individual reflective size is said to be high if it

correlates more than 0.70 with the construct you

want to measure. However, for the initial stage of

the study, the scale of measurement of loading

values of 0.50 to 0.60 was considered sufficient

(Chin, in Ghozali, 2011).

Figure 3. Modified Structural Model

Based on the measurement model above, all

indicators are analysis of research variables with a

loading factor greater than 0.50 so that it is declared

significant or meets convergent validity

requirements.

Table I: Variable of Composite Realibility and Cronbach's

Alpha

Variable

Composite

Reliability

Cronbach's Alpha

X1 0.904 0.841

X2 0.894 0.858

X3 0.858 0.798

Y 0.920 0.870

3.2 Average Variance Extracted (AVE)

and Latent Correlation

Another method for assessing discriminat validity is

comparing the square root of average variance

extracted (AVE) value of each construct with a

correlation between constructs and other constructs

in the model. If indigo square root AVE of each

construct is greater than the correlation value

between constructs and other constructs in the

model, it is said to have good discriminat value

validity (Forwell and Lacker, in Ghozali, 2011). The

test results of AVE can be shown in Fig.4:

Figure. 4. AVE test

Figure 4 shows the AVE value where all the

values of the variables are greater than 0.50 so that it

can be said that each indicator that has been

measured has been able to reflect on each variable

validly.

3.3 Cronbach's Alpha and Composite

Reliability

The next stage of convergent validity is reliability

constructs by looking at the reliability composite

output or cronbach's Alpha. Criteria are said to be

reliable is the composite reliability value or

cronbach's Alpha is more than 0.70.

Figure 5. Inner Model Evaluation with PLS Bootstrapping

ICT4BL 2019 - International Conference on IT, Communication and Technology for Better Life

150

3.4 Evaluation of Inner Model and Inner

Outer Loading model

Inner model is a test by evaluating between latent

constructs that have been hypothesized in the study.

Bootstrapping that shows in Fig. 5 is a resampling

statistical procedure or technique. Resampling

means that respondents are drawn randomly with

replacement, from the original sample many times to

observation.

4. HYPOTHESIS TESTING

Sampling technique is a way to determine a sample

whose amount is in accordance with the sample size

that will be used as the actual data source, taking

into account the characteristics and distribution of

populations in order to obtain a representative

sample. (Sugiyono, 2011). The sample used

accidental method, researchers took samples that

match the research characteristics. To meet the

required criteria, the research sample needed is one

that has used financial fintech for payment types or

things related to technology. The sample used in this

study was Budi Luhur University students who had

used financial fintech and obtained random samples

of 60 students.

The significance of the estimated parameters

provides very useful information about the

relationship between the research variables. The

basis used in testing hypotheses is the value found in

the result for inner weight output. The following

table provides estimated output for testing structural

models. To find out the suitability of the proposed

model in a population, see the value of the

relationship between one variable with another

variable or path coefficient value (rho) by looking at

the size of the O (original sample) and T value

statistics as a statement of the significance level of

the relationship between one variable with other

variables (the significance level is taken at the 5%

error level or at T above 1.96).

From Figure 6 it is clear that the ease of use

(X1), confidence level (X2) and knowledge (X3),

affect the use of fintech where t count is greater than

t 1.96 (Ghozali and Latan, 2015).

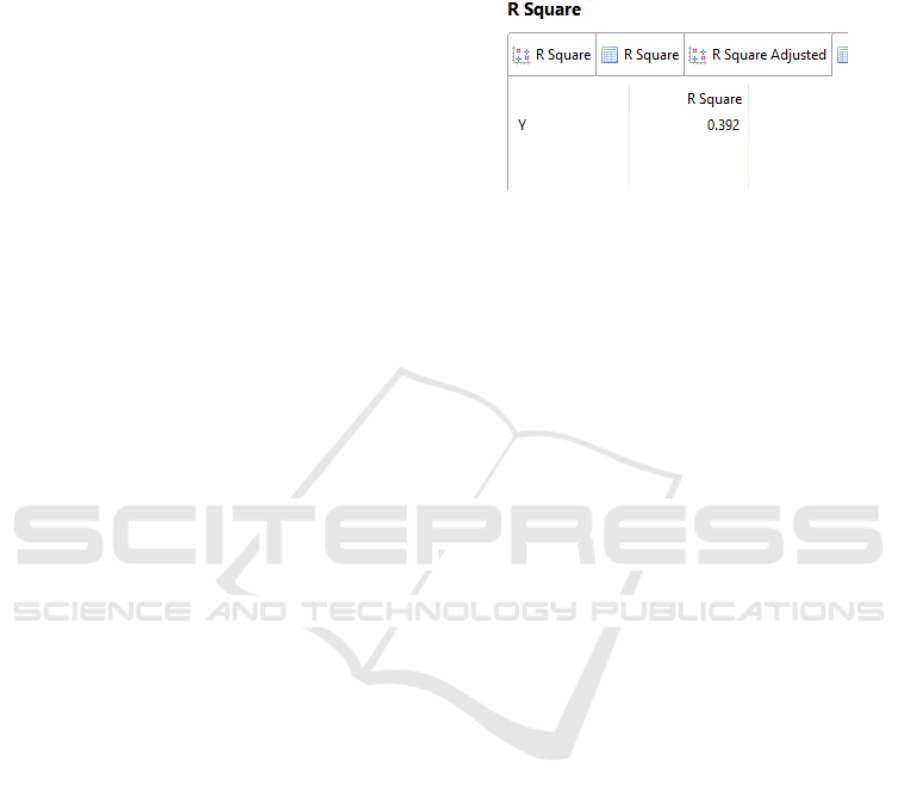

Based on the initial model of the proposed SEM-

PLS method, it can be said that the relationship

between the latent variable and the other if it shows

a number above 1.96 with an estimated parameter of

95% is declared valid. Furthermore, it is seen how

much the strength of exogenous variables and

endogenous variables are dependent on this initial

model by looking at the magnitude of the value of R

Square in each of the endogenous variables in Figure

7.

Figure. 7. R square

Figure 7 explains the contribution of variables

that affect the variables in the R-Square. The R-

Square value of the Fintech usage variable is 0.3920

or 39.2%. This means that 60.8% is influenced by

other factors outside of this study.

5. CONCLUSION

Based on the results of the analysis and discussion

that has been done, on the use of fintech, the

conclusion can be drawn as follows: exogenous

latent variables ease of use (X1), confidence level

(X2), and knowledge (X3), affect the use of fintech

(Y). The level of ease of use of applications from

Fintech products should be increased. The easier the

user uses and does not feel difficulties, the more

interested users are to use Fintech products.

Subsequent research can develop this research using

other factors that influence the use of Fintech and

choose a broader object.

REFERENCES

Moore, R., Lopes, J., 1999. Paper templates. In

TEMPLATE’06, 1st International Conference on

Template Production. SCITEPRESS.

Smith, J., 1998. The book, The publishing company.

London, 2nd edition.

Anggreani, Kartika. 2017. Pengaruh Kemudahan

(Perceives Ease Of Use) Terhadap Minat Ulang

Penggunaan Aplikasi mobile Banking Jenius. Program

Studi Management: Universitas Bakrie

Candraditya, I. H. 2013. “Analisis penggunaan uang

elektronik (Studi Kasus Pada Mahasiswa Pengguna

Produk Flazz BCA di Fakultas Ekonomika dan Bisnis

Universitas Diponegoro).” Diponegoro Journal of

Management 2(3): 1–11. http://ejournal-

s1.undip.ac.id/index.php/dbr

Perceives Ease of Use, Level of Trust and Knowledge of the Use of Financial Technology

151

Chandra, Izhal Rio. 2016. Pengaruh Kemudahan

Penggunaan, Kepercayaan, Dan Computer Self

Efficacy Terhadap Minat Penggunaan E- Spt Dalam

Pelaporan Pajak.JURNAL NOMINAL / VOLUME V

NOMOR 1 / TAHUN 2016

Kotler Philip. 2002. Manajemen Pemasaran Analisis,

Perencanaan, Implementasi dan Pengendalian.

Penerbit Erlangga: Jakarta.

Kurniawan, Taudan Adi.2019. Faktor yang Mempengaruhi

Tingkat Kepercayaan Penggunaan FinTech pada

UMKM Dengan Menggunakan Technology

Acceptance Model (TAM). Jurnal Akuntansi &

Manajemen Akmenika Vol. 16 No. 1 Tahun 2019

Sugiyono.2011. Metode Penelitian Kuantitatif,Kualitatif

dan R&D.Bandung: Alfabeta

Wibowo, Setyo Ferry dkk. 2015. Pengaruh Persepsi

Manfaat, Persepsi Kemudahan Penggunaan, Fitur

Layanan dan Kepercayaan terhadap Minat

menggunakan E-money card. Jurnal FE UNJ

ICT4BL 2019 - International Conference on IT, Communication and Technology for Better Life

152