The Effect of Unconditional Conservatism on Market

Reactions

Rini Indriani

1

, Lenza Rahayu Putri

1

, Adista Anbarani Putri Zaman

2

, and

Herawansyah

3

1

Fakulty of Economics and Bussines, University of Bengkulu, Bengkulu, Indonesia

2

Fakulty of Economics and Bussines, President University, Indonesia

3

Fakulty of Economics and Bussines, Dehasen University, Indonesia

Abstract. This This study aims to investigate the effect of unconditional

conservatism on market reactions. The study was conducted on non-financial

companies in the Indonesia stock exchange in the period 2011-2016, and used

stepwise regression for data analysis. The results showed that unconditional

conservatism had a positive effect on market reactions. Investigations in different

periods, namely the period 2011-2015 and 2011-2016 show that the influence of

unconditional conservatism is increasingly positive on market.

Keywords: Unconditional conservatism · Market reactions · Non-financial

companies

1 Introduction

Indonesia cannot avoid the manipulation of financial statements due to weak integrity, as

the case of PT Tambang Timah allegedly providing fictitious financial reports related to

the press release of the first semester of 2015 financial statements states that efficiency

and strategy have led to positive performance being contradictory to the company's

financial condition less healthy (Soda, 2016). Environmental uncertainty in economic and

business activities requires caution in recognizing assets and profits, where the integrity

of financial statements can be measured by applying the conservatism index.

Watts (2003) states that conservative accounting practices prevent companies from

exaggerating earnings and help users of financial statements in presenting non-

overstated earnings and assets so that conservative accounting results in higher quality

earnings. Based on their role, experts distinguish the concept of conservatism into two

categories, namely: conditional conservatism and unconditional conservatism (Beaver

& Ryan, 2005; Ruch & Taylor, 2015; and Zhong & Li, 2016).

The two concepts of conservatism have different but interrelated roles, where

unconditional conservatism can reduce conditional conservatism (Qiang, 2007). Using

a conditional conservatism index, research by Abedini, Hosein, & Mozaffari (2014)

and Indriani & Amalia (2019) proves that conservatism has a negative effect on market

reactions when interacted with cash changes.

Different from measurement of conservatism in the Abedini, Hosein, & Mozaffari

(2014) and Indriani & Amalia (2019) studies, this study investigates unconditional

conservatism. Research conducted by Indriani & Amalia (2019) uses one research

90

Indriani, R., Putri, L., Zaman, A. and Herawansyah, .

The Effect of Unconditional Conservatism on Market Reactions.

DOI: 10.5220/0009588600002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 90-96

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

period, and this study examines it in two periods, namely the 2011-2015 period and the

period by extending the observation year 2011-2015.

2 Literature Review

Basu (1997) defines conservatism as the practice of reducing earnings (and minimizing

net assets) in response to bad news (bad news), but does not increase profits (raising

net assets) in response to good news (good news). The opinion of Basu (1997) is also

supported by Penman & Zhang (2002) stating that conservatism which is more

descriptive is to choose accounting principles that lead to minimization of reported

cumulative earnings, namely recognizing slower income, recognizing faster costs,

valuing assets with more value low.

Ruch & Taylor (2015) stated that accounting researchers have identified two broad

forms of conservatism that produce the aforementioned understatement of accounting

value: (1) conditional conservatism, and (2) unconditional conservatism. The primary

difference between the two forms of conservatism is that the application of conditional

conservatism depends on economic news events, while the application of unconditional

conservatism does not. It is important to distinguish between conditional and

unconditional conservatism, because two forms of conservatism have different effects

on the financial statements; and research suggests that the application of one type of

conservatism affects the application of the other type.

Research by Abedini, Hosein, & Mozaffari (2014) and Indriani & Amalia (2019)

who investigate conditional conservatism, proves that conservatism has a negative

effect on market reactions when interacted with cash changes. Whereas Beaver & Ryan

(2005) found that unconditional conservatism and other factors preempt conditional

conservatism and so on the asymmetric response of earnings to positive and negative

share returns, both current and lagged. Following the research Indriani & Amalia (2019)

this research framework is presented in Figure 1.

Source: Indriani & Amalia (2019)

Fig. 1. Research Framework.

Observed Variable

Conservatism (CON)

Dummy Conservatism (DCON)

Market Reaction is

observed through

Abnormal Return

Other Variable

Change in cash Balance (ΔC)

Change in net income (ΔE)

Non Cash Asset (NCA)

Change in Interest Expense (ΔI)

Dividend (D)

Net Cash Flow Financing (NFF)

Beginning Net Income (LAGE)

Cash and Short-term Investments

(

LAGC

)

The Effect of Unconditional Conservatism on Market Reactions

91

3 Research Methodology

This research is included in a positive paradigm that uses a quantitative approach and

is an empirical research (empirical research), intending to test the proposed hypothesis.

The observation unit (population) in this study is non-financial companies listed on the

Indonesia Stock Exchange in the period 2011-2015 and 2011-2016. The data collection

method in this study was done by purposive sampling as presented in Table 1 related

to the research sample

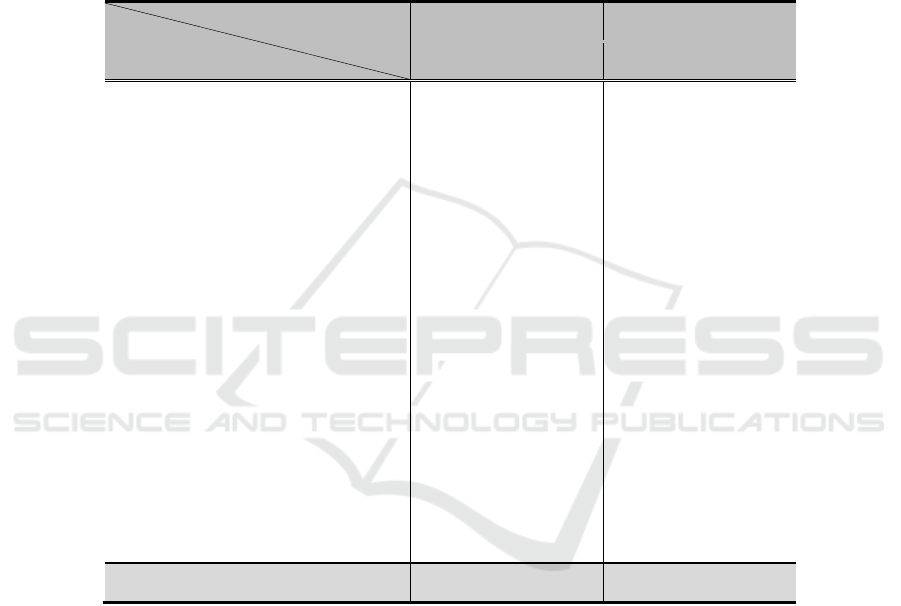

Table 1. Number of Research Samples Based on Criteria.

Period

Criteria

Year 2011-2015 Year 2011-2016

N (%) N (%)

The number of non financial companies

attending stock exchange

447 100 426 100

The number of Company data is

incomplete

(28) (6,3) (16) (3,7)

The number of Companies listing on the

IDX after 2010

(104) (23,2) (106) (24,9)

The number of Companies that report

financial statements with currencies

other than rupiah

(66)

(14,8) (62) (15,6)

The number of Companies that move

sectors

(1) (0,2) (1) (0,2)

The number of Companies that do not

have LK in 2016 (Mergers, Losses

and others)

(7)

(1.6)

The number of Companies that meet the

criteria

241 53,9 241 56,6

Year of Observation 5 6

Number or sampel 1205 1446

Source: Secondary data processed.

Abedini, Hosein, & Mozaffari (2014) and Indriani & Amalia (2019) research

investigating conditional conservatism. This research investigates the effect of

unconditional conservatism (balance sheets) for users of financial statements

(investors). Conservatism in this study was measured using the C Score index by

Penman & Zhang (2002) to determine the level of accounting conservatism on the

balance sheet, which is the sum of research and development costs by depreciation costs

divided by net operating assets. The multiple regression equation model that will be

examined in hypothesis testing is as follows according to the research of Abedini,

Hosein, & Mozaffari (2014) and Indriani & Amalia (2019):

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

92

ABRET

i

=

β

0

+ β

1

Δ

C

i

+ β

2

CON

i

+ β

3

DCON

i

+ β

4

Δ

C

i

*

CON

i

+ β

5

Δ

C

i

*

DCON

i

+

β

6

LSPT

i

+ β

7

NCA

t

+ β

8

Δ

I

i

+ β

9

Δ

D

t

+ β

10

NF

i

+ β

11

LAGE

i

+

β

12

LAGC

i

+ β

13

LAGL

i

+ β

14

Δ

C

i

*

LAGE

i

+β

15

Δ

C

i

*

LAGC

t

+

β

16

Δ

C

i

*

LAGL

i

+ ε

i

Explanation:

ABRET

i

:

Abnormal return (market adjusted model)

Δ

C

i

:

Changes in the company's cash balance in year t compared to t-1

CON

i

: Unconditional conservatism uses the C-Score index

𝐂

𝐢𝐭

=

𝐑𝐧𝐃

𝐢𝐭

+𝐃𝐄𝐏𝐑

𝐢𝐭

𝐍𝐎𝐀

𝐢

DCON

i

:

Dummy variable, the level of conservatism, is 1 if conservatism is

negative and 0 if the opposite is true (C-Score)

Δ

C

i

*

CON

i

: Changes in cash balances are multiplied by conservatism

Δ

C

i

*

DCON

i

:

Changes in cash balances are multiplied by conservatism dummy

LSPT

i

:

Changes in net income before unexpected items in year t compared

to t-1 as a control variable.

NCA

i

:

Changes in the company's non-cash assets in year t compared to t-

1 as a control variable

Δ

I

i

:

The change in the company's interest expense in year t compared

to year t-1 as a control variable

Δ

D

i

:

Change in company dividends in year t compared to t-1

NF

i

: Net cash flow funding activities as a control variable

LAGE

i

:

Net income before unexpected items is divided by the company's

market value at the beginning of the period as a control variable

LAGC

i

:

Total cash and short-term investments divided by market value at

the beginning of the period as a control variable

LAGL

i

:

Company leverage, total debt divided by total assets as a control

variable.

Δ

C

i

*

LAGE

i

:

Changes in cash balance times net income before the unexpected

items are divided by the market value of the company at the

beginning of the period

Δ

C

i

*

LAGC

i

:

Changes in cash balance times total cash and short-term

investments divided by market value at the beginning of the period

Δ

C

i

*

LAGL

i

:

Changes in cash balance times the company's leverage, total debt

divided by total assets

β

0

:

Constanta

Β

1

, β

2

,… β

16

:

Coefficient Regression

ε

i

: Error

The Effect of Unconditional Conservatism on Market Reactions

93

Based on the research framework and research mathematical equations, in addition

to conservatism and in line with the Abedini, Hosein, & Mozaffari (2014) and Indriani

& Amalia (2019) studies involving variables of changes in cash, net operating income,

non-cash assets, interest, dividends, net cash flow financing activities, cash plus short

investment, and leverage. In addition to leverage, control variables are scaled to market

value.

Hypothesis testing uses the t test, which is by looking at the value of ρ-value and

the direction coefficient β4 (KCON) and β5 (KDCON). This study uses a level of

confidence (level of significant) 95% with ρ-value (α) = 5%, with β4 and β5 negative

values. If the variable has a p-value <0.05 then it has a significant effect.

4 Result and Discussion

Table 2 presents descriptive data statistics in this study, which consists of minimum,

maximum, average, and standard deviation of variables in the research equation.

Table 2. Descriptive Statistics.

Year 2011-2015 Year 2011-2016

n Min Max Mean

St

Dev

n Min Max Mean St Dev

ABRET

i

1205 -0.0943 0.9158 0.0106 0.0809 1446 -0,0943 0,9234 0,0127 0,0999

ΔC

i

1205 -1.1362 2.9363 0.0161 0.2032 1446 -3,5793 3,0048 0,0150 0,2320

CON

i

1205 -0.5948 1.5278 0.0279 0.0964 1446 -6,8012 2,9245 0,0318 0,2979

ΔE

i

1205 -12,2068 11,6921 0.0280 0.6021 1446 -12,2068 11,6921 0,0359 0,6543

NCA

i

1205 -28,9557 11,2707 0.1995 1.2484 1446 -28,9557 11,2707 0,1599 1,3486

ΔI

i

1205 -0,7549 4,8812 -0.0016 0.1720 1446 -0,7549 4,8812 -0,0008 0,1586

ΔD

i

1205 -1,3579 3.4746 -0.0003 0.1215 1446 -1,3579 9,0123 0,0089 0,2804

CFF

i

1205 -16.2520 7.9510 0.0519 0.6774 1446 -20,8766 8,9887 0,0358 0,8870

LAGE

i

1205 -1.9171 7.5761 0.4215 0.6265 1446 -12,0081 12,8976 0,43067 0,8716

LAGC

i

1205 0.00001 6.4680 0.2215 0.4825 1446 -1,2478 6,5608 0,2207 0,4854

LAGL

i

1205 0.0003 16.6616 0.5566 0.8504 1446 0,0001 17,5554 0,5658 0,9263

Categorical Variable

Category Dummy (n) (%) (n) (%)

DCON

i

Apply

conservatism

1 1164 97%

1391

96,2%

DCON

i

do not

apply

0 41 3%

55

3,8%

Total 1205 100% 1446 100%

Source: Secondary data processed.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

94

Stepwise Regression Testing. Investor's reaction regarding the application of

unconditional conservatism is the focus of this research. The results of the stepwise

multiple linear regression analysis for the C-Score model are presented in Table 3.

Table 3. The results of the Stepwise Multiple Linear Regression Analysis for the C-Score Model.

Year 2011-2015 Year 2011-2016

Coef.

β

Sig

Coef.

β

Sig

CON

i

0.062 0.019

LAGE

i

0.101 0.002

LAGC

i

-0.075 0.021

A

d

j

. R

2

0.007 0.003

F 5.346 5.545

Si

g

0.005 0.019

Source: Secondary data processed.

Table 3 can be concluded that the effect of unconditional conservatism is not

consistent in the two testing periods, so this study uses the results of the standardized

coefficient in the equation. Using stepwise regression, unconditional conservatism is

not included as a variable that influences the market reaction in the period 2011-2015.

But the reverse happened in the period 2011-2016 where only unconditional

conservatism variables that entered affected the market reaction. The testing period of

2011-2016 accounting conservatism has a significant positive effect on market reaction

(abnormal return)

Discussion of the Effect of Unconditional Conservatism on Market Reactions.

Based on hypothesis testing using the C-Score model, it is obtained inconsistent results

related to the effect of unconditional conservatism on market reaction. In the 2011-2015

period, unconditional conservatism is not a variable that affects market reactions, but

in the 2011-2016 period, unconditional conservatism has a positive effect on market

reactions. This influence is different from the results of research Abedini, Hosein, &

Mozaffari (2014) and Indriani & Amalia (2019), which shows that conditional

conservatism has a negative effect.

. Unconditional conservatism, also called news-independent or ex ante

conservatism would prevent such conditional conservatism from improving contracting

efficiency and could even distort financial reporting used by investors (Zhong & Li,

2016). Earlier Beaver & Ryan (2005) concluded that unconditional conservatism and

other factors preempt conditional conservatism and so affect the asymmetric response

of earnings to positive and negative share returns, both current and lagged.

5 Conclusion

Unconditional conservatism is reacted positively by the market, where investors as

market participants assume that conservatism in the balance sheet is good news.

However, this reaction is not consistent in the observed period, where in the first period

conservatism is not a variable that influences market reaction, whereas in the second

The Effect of Unconditional Conservatism on Market Reactions

95

period unconditional conservatism becomes the only variable that affects the market

reaction of the variables included in the mathematical equation. Therefore, it is

concluded that unconditional conservatism in this study is only able to explain in the

sample period of the study and cannot be used to predict.

References

[1] Abedini;, B., Hosein;, R. M., & Mozaffari, A. (2014). Investigating Effect of Accounting

Conservatism and Earning Quality on Reaction of Investors to Cash Stocks of Companies

Accepted in Tehran Stock Exchange. International Journal of Academic Research in

Accounting, Finance and Management Sciences, 4(1), 331–339. https://doi.org/

10.6007/ijarafms/v4-i1/656

[2] Basu, S. (1997). The conservatism principle and the asymmetric timeliness of earnings.

Journal of Accounting and Economics, 24, 3–37. https://doi.org/10.1016/S0165-

4101(97)00014-1

[3] Beaver, W. H., & Ryan, S. G. (2005). Conditional and Unconditional Consevatism:

Concept and Modeling. Review of Accounting Studies, 10, 269–309.

https://doi.org/10.2753/CED1061-1932270492

[4] Indriani, R., & Amalia, R. M. (2019). Efek Negatif Konservatisme Terhadap Reaksi Pasar.

Jurnal Akuntansi Multiparadigma, 10(2). Retrieved from https://jamal.ub.ac.id/index.

php/jamal/article/view/1133

[5] Penman, S. H., & Zhang, X.-J. (2002). Accounting the Quality Stock of Conservatism ,

Earnings , Returns and. The Accounting Review, 77(2), 237–264.

[6] Qiang, X. (2007). The effects of contracting, litigation, regulation, and tax costs on

conditional and unconditional conservatism: Cross-sectional evidence at the firm level.

Accounting Review, 82(3), 759–796. https://doi.org/10.2308/accr.2007.82.3.759

[7] Ruch, G. W., & Taylor, G. (2015). Accounting conservatism: A review of the literature.

Journal of Accounting Literature, 34, 17–38. https://doi.org/10.1016/j.acclit.2015.02.001

[8] Soda, E. (2016). PT Timah Diduga Buat Laporan Keuangan Fiktif. Tambangcoid, p. 9640.

Retrieved from https://www.tambang.co.id/pt-timah-diduga-membuat-laporan-keuangan-

fiktif-9640/

[9] Watts, R. (2003). Conservatism in accounting part I: Explanations and implications.

Accounting Horizons, Vol. 17, N, 207–221. Retrieved from http://www.aaajournals.org/

doi/ abs/10.2308/acch.2003.17.3.207

[10] Zhong, Y., & Li, W. (2016). Accounting Conservatism: A Literature Review. Australian

Accounting Review, 27(2), 195–213. https://doi.org/10.1111/auar.12107

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

96