Health Assessment of Regional Owned Enterprises as

Efforts to Increase Local Revenue in East Java Province,

Indonesia

Eni Wuryani, Dewi Prastiwi, and Mariana

Faculty of Economics, Universitas Negeri Surabaya, Indonesia

Abstract. Companies all over the world have a goal to make a profit, as well as

a Regionally Owned Enterprise (BUMD) has a goal to make a profit. The profit

obtained by BUMD as an effort to increase Regional Original Revenue (PAD).

Regionally Owned Enterprises (BUMD) play the role of companies and service

providers to the community. BUMD in running a business has two focuses,

namely seeking profit as a form of responsibility as a business entity and

providing services to the community as the responsibility of the Regional

Government. 2002. The assessment in this research is focused on assessing

financial performance. This research uses a descriptive approach. Data was

obtained from the Regional Government Secretariat of the East Java Province

Economic Bureau. BUMDs that have a good level of health, will have an impact

on profitability. The greater the profits obtained by BUMD, it will increase the

local original income.

Keywords: Health Assessment · Profit · PAD · BUMD

1 Introduction

Regionally Owned Enterprises (BUMD) play the role of companies and service

providers to the community. BUMD in running a BUMD business has two focuses,

namely seeking profit as a form of responsibility as a business entity, and providing

services to the community as the responsibility of the Regional Government to the

community. BUMD as a service provider to the community, it must strive to improve

performance. Regionally Owned Enterprises (BUMD) is a provincial business entity

established under Law no. 23/2014 concerning Regional Government. According to

Law No. 23 of 2014, BUMDs can be wholly owned or partially owned by the Provincial

Government through direct participation and can take the form of Limited Liability

Companies or Regional Companies. The Provincial Government's ownership is 51%

and the rest is owned by general shareholders, so the BUMD is a company company.

The condition of the Regional Government is the sole owner of the BUMD, so the form

of the BUMD is the Regional Public Company or often referred to as the Regional

Company (PD).

Regionally owned enterprises (BUMD) are companies established and owned by

local governments. The authority of local governments to form and manage BUMDs is

affirmed in Government Regulation No. 25 of 2000 concerning governmental authority

and provincial authority as an autonomous region. The implementation of the regional

Wuryani, E., Prastiwi, D. and Mariana, .

Health Assessment of Regional Owned Enterprises as Efforts to Increase Local Revenue in East Java Province, Indonesia.

DOI: 10.5220/0009847500002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 179-189

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

179

autonomy system as mandated by Law Number 32 of 2004 requires fiscal

independence. Therefore, each region is expected to be able to maximize all the

potential that exists to increase Local Revenue (PAD). In addition to taxes and levies,

one source of PAD is derived from the management of separated regional assets.

Separated state assets are components of state assets whose management is handed over

to State-Owned Enterprises or Regional-Owned Enterprises. The results of the

management of separated regional assets are part of the PAD, which among other things

are sourced from the profit of the regional company, the profit portion of the bank's

financial institutions, the share of profits on equity participation in other business

entities.

2 Literature Review

2.1 Performance Assessment

There are several performance measurements according to several experts, including:

a. Objective Measures of Organizational Performance

Accounting measurement. Accounting measurements are the most common and most

likely to measure organizational performance. The validity of its use has been widely

proven and is related to economic return. Another important thing, accounting

measurements are more reliable because they reflect past performance, where the

source can be audited. But this approach has both positive and negative sides. The

negative side of the Enron case and the positive side of the internet company. Therefore

the predictability and validity of accounting measurements as signals of economic

return may be less related to their validity and more to do with the stationary nature of

the environment in which the measurements are made. The implication is that the more

turbulent the environment, the more unclear the performance rules.

b. Financial Market Measures

In financial strategy, economics, and literature, financial market measures are more

dominant for shareholder returns and the preferred instrument for measuring

organizational performance. The main strength of this measurement is that this

measurement sees the future, in theory presenting the value of future cash flow.

Measurement of intangible assets is more effective than accounting data, clear

relevance for those interested in resource-based and knowledge-based companies.

Therefore the connection between financial market measures such as stock price or

excess stock return on the company's actual performance depends on how much the

company's operating results flow to shareholders and financial market efficiency

information. The main limitation of the use of financial market data in management

research is evaluating the organization as a whole. For all but a few companies that

have issued stock tracking (Robinson, 2000), it is not possible to divide market steps

between activities (Jacobson, 1987). Therefore, although market value may be

generally recognized as the most appropriate measure of overall organizational

performance, it is less useful for research to focus on performance where dimensions

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

180

are defined in terms of a product or strategic business unit (SBU). Efforts to separate

the performance of business units are also problematic. Some researchers have pointed

out that the logic of having one business unit traded as a block implies that measuring

financial performance and risk at the business unit level will be flawed due to failure to

account for the synergies and cannibalization associated with unit interactions.

Therefore, even if one measures the level of a business unit's performance, it is unlikely

that this will explain the unit's performance in the context of the overall corporate

strategy.

c. Mixed Accounting / Financial Market Measures

The advantage of mixed accounting / financial market measures is that they are better

able to balance risk (largely ignored by accounting measures) against operational

performance problems that are sometimes lost in market size. The Tobin Q example is

probably the earliest and most popular hybrid measure for company performance.

Tobin's Q is the ratio of the firm's market value of assets to replacement costs and is a

theory-based measure of economic return (Tobin, 1969). One difficulty with applying

Tobin q is that the value of replacing company assets is almost always measured

through proxies that are closely related to the book value of assets. This limitation has

led to the development of a number of alternative mixed actions. The Altman Score

(Altman, 1968) was one of the first empirical steps and was specifically developed to

predict financial disaster events. The Z-score predicts a company's chances of

bankruptcy, is an extreme financial result, product market, and shareholder, using a

combination of accounting and stock market steps including the ratio of working capital

to total assets, retained earnings to total assets, market value of equity to books value

of liabilities, and sales of total assets (Altman, 1968).

d. Survival

Survival is a common dependent variable in management research, especially in

organizational and entrepreneurial sociology where increased attention is given to the

ecological explanation of company performance (Hannan & Freeman, 1977). Many

companies fail, making survival related to researchers and managers (Dunne, Roberts,

& Samuelson, 1988). Survival and financial performance results are closely related,

with an examination of financial market performance findings that delisting companies

underperform the median stock market returns of companies on the NYSE and AMEX

by 48% from 10 years to 1 year previously delisted (Baker & Kennedy, 2002 ).

2.2 Measurement of BUMD Performance

The formulation of the health level of Regionally Owned Enterprises (BUMD) is

prepared using the Balance Scorecard method and adjustments to the soundness rating

of the State Owned Enterprises (SOEs) as listed in the decree of the Minister of SOEs

Number: KEP-100 / MBU / 2002. In the evaluation of BUMD health level, the

classification of BUMD health level is as in the following table 1:

Health Assessment of Regional Owned Enterprises as Efforts to Increase Local Revenue in East Java Province, Indonesia

181

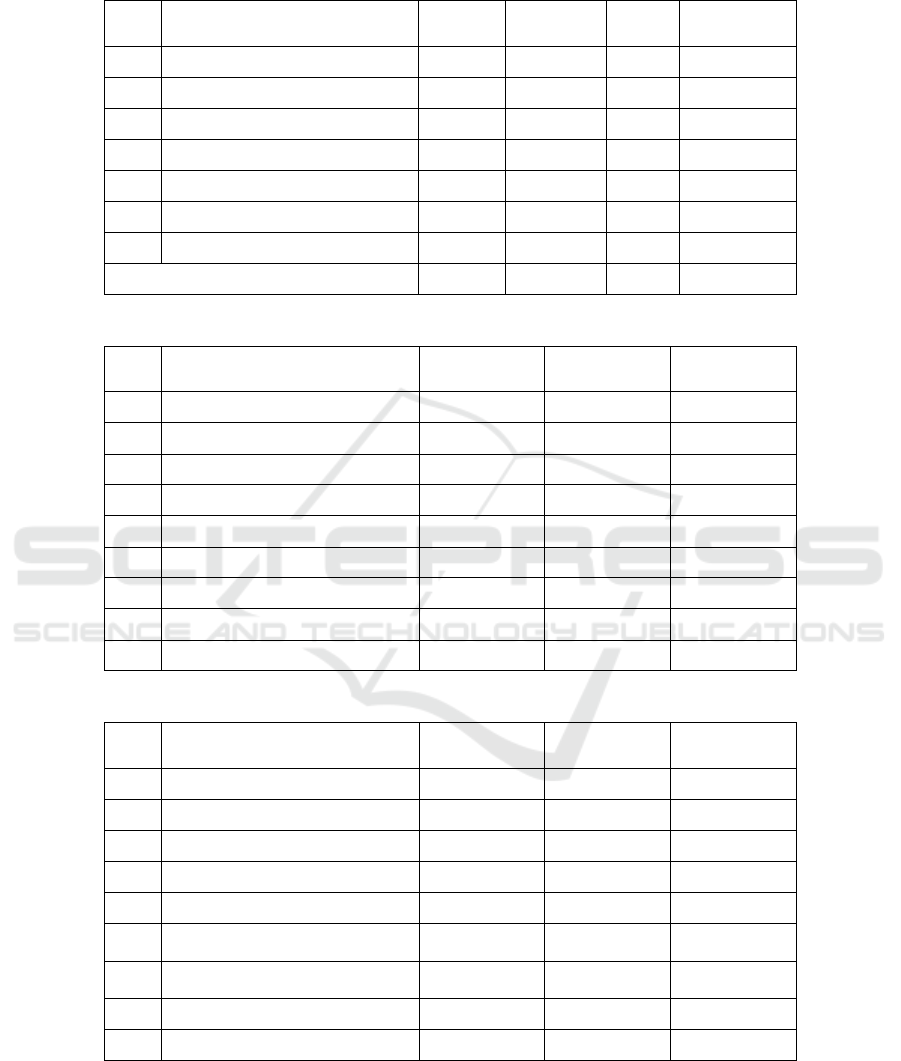

Table 1. BUMD Health Rating Assessment.

HEALTHY LESS HEALTHY NOT HEALTHY

AAA if the total (TS) is

g

reater than 95

BBB if 50<TS less or

equal to 65

CCC if 20<TS less or

equal to 30

AA if 80<TS less or

equal to 95

BB if 40<TS less or equal

to50

CC if 10<TS less or equal

to 20

A if 65<TS less or equal

to 80

B if 30<TS less or equal

to 0

C if TS<10

The level of soundness of the BUMD is determined based on an evaluation of the

company's performance for the fiscal year concerned including an assessment of:

1. Financial aspects are taken based on indicators in a financial perspective

2. Operational aspects are taken based on indicators in the customer perspective,

business processes, and learning and growth

3. Administrative aspects

The SOE Health Assessment according to this decision is only applied to SOEs if

the results of the accountant's examination of the company's annual financial

calculations are stated with a "Fair without Exception" qualification or a "Fair with

Exceptions" qualification from a public accountant or the Financial and Development

Supervisory Agency. The SOE Health Level Assessment is determined annually in the

ratification of the annual report by the General Meeting of Shareholders or the SOE

Minister for Public Companies (PERUM). The guideline in the SOE Ministerial Decree

Number: KEP-100 / MBU / 2002 is also used as a guideline for BUMD.

In a financial perspective, the indicators assessed and their respective weights are

as in the following table 2:

Table 2. Indicators on Health Level.

Indicator

Weight

Infrastructure

Non

Infrastructure

Return on Equity (ROE) 15 20

Return on Invesment (ROI) 10 15

Cash Ratio 3 5

Current Ratio 4 5

Collecting Period 4 5

Inventory Turnover 4 5

Total Assets Turnover 4 5

The Ratio of Own Capital to Total Assets 6 10

Other IIndicator 0 0

Total Bobot Keuangan 50 70

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

182

Table 2 illustrates that in financial perspective weighting BUMDs are classified as

infrastructure BUMDs and non-infrastructure BUMDs. BUMD infrastructure is a

BUMD whose activities provide goods and services for the benefit of the wider

community, whose business fields include:

a) Electricity generation, transmission or distribution

b) Procurement and support of supporting facilities for the transport of goods or

whether sea, air or train

c) Toll roads and bridges, docks, seaports or rivers or lakes, airports and airports;

and

d) Dams and irrigation

Meanwhile, non-infrastructure BUMDs are BUMDs whose business sectors are

outside the business fields in the above BUMD infrastructure. Examples are banking,

insurance, guarantee services, and non-finance outside of infrastructure. BUMD Health

Level Assessment is only carried out for results for company financial audits relating

to the qualification of "Fair without Exceptions" or qualifications "Fair with

Exceptions" from public accountants.

In the table above, driving profitability can be measured by the percentage of ROE

growth (Return on Equity) or the ratio of profit to growth in net income (return on

investment) or the ratio of profit to investment. Profit consists of two components,

namely income and expenses. This is what underlies the purpose of the financial

performance below related to increased sales growth and increased margin growth.

3 Methodology

The object of research used in this study is the Regional Owned Enterprises (BUMD)

in East Java with 8 BUMDs. This type of research is descriptive research. This study

uses secondary data sources from the 2018 BUMD annual financial statements. Data

collection methods are: (1) documentation, namely financial reports for 2017-2018,

BUMD secondary data collection through the East Java provincial economic Bureau.

(2) interview the East Java Provincial Government's Bureau of Economics to explore

data, among others, regarding the investment decision making mechanism in East Java

Provincial Government.

3.1 Data Analysis Techniques

Based on BUMD financial report data, the data analysis stages are as follows:

a. Measuring the ratio of earnings to equity

b. Percentage of growth in return on investment (ROI)

c. Measuring Current Ratio

d. Measuring Collecting Period

e. Measuring inventory turnover

f. Measuring total asset turn over (TATO)

g. Measuring the ratio of total own capital to total assets (TMS to TA)

Health Assessment of Regional Owned Enterprises as Efforts to Increase Local Revenue in East Java Province, Indonesia

183

h. Based on the results of the stages point a to point g, the next step is to provide a

weighting based on the Decree of the State Owned Enterprise Number: KEP -

100 / MBU / 2002 about the Rating of the Health Level of the Owned Enterprise

i. The final step is to provide an assessment of the health level of BUMD.

4 Result and Discussion

4.1 Result

Table 3. BUMD Performance Assessment Results East Java.

NO BUMD RESULTS

1 PT. A

Healthy with AA criteria.

2 PT. B .

Healthy with AAA criteria.

3 PT. C

Healthy with A criteria.

4 PT. D

Healthy with AA criteria.

5 PT. E

Healthy with A criteria.

6 PT. F

Healthy with AA criteria.

7 PT. G

Less Healthy with BB criteria.

8 PT. H

Less Healthy with B criteria.

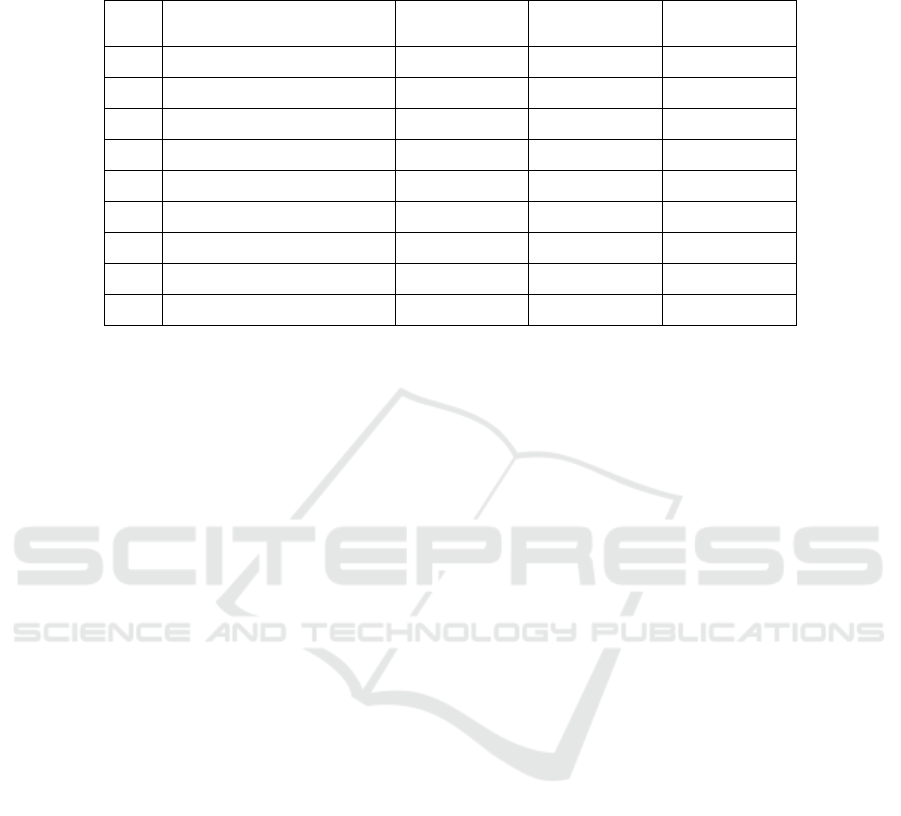

Table 4. PT. A Health Illustration of 2018.

NO DESCRIPTION WEIGHT RESULTS SCORE

1 R O E 20 80,83 20

2 R O I 15 34,83 15

3 Cash Ratio 5 234,07 5

4 Current Ratio 5 829,65 5

5 Collection Period (CP) 5 107 4

6 Inventory Turnover (PP) 5 98 4

7 Total Asset Turnover (TATO) 5 86,67 3,5

8 TMS to TA 10 26,35 7,25

AMOUNT 70 63,75

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

184

Table 5. PT. B. Health Illustration of 2018.

No Ratio Weight Value Score Information

1 Non Performing Loan (NPL) 10 3,75 8 Sehat

2 Loan to Deposit Ratio (LDR) 10 66,57 10 Sangat sehat

3 Return on Total Assets 10 2,96 10 Sangat sehat

4 Return on Equity 10 17,75 10 Sangat sehat

5 Net Interest Margin 10 6,37 10 Sangat sehat

6 BOPO 10 69,45 10 Sangat sehat

7 Capital Adequacy Ratio (CAR) 10 24,21 10 Sangat sehat

Amount 70 68 Sangat sehat

Table 6. PT. C Health Illustration of 2018.

NO DESCRIPTION WEIGHT RESULTS SCORE

1 R O E 20 5,89 8,5

2 R O I 15 9 7,5

3 Cash Ratio 5 1297,79 5

4 Current Ratio 5 1359,35 5

5 Collection Period (CP) 5 31 5

6 Inventory Turnover (PP) 5 20 5

7 Total Asset Turnover (TATO) 5 77,29 3,5

8 TMS to TA 10 70,96 7,5

AMOUNT 70 47

Table 7. PT. D PT. A Health Illustration of 2018.

NO DESCRIPTION WEIGHT RESULTS SCORE

1 R O E 20 14,78 18

2 R O I 15 74,12 15

3 Cash Ratio 5 52,08 5

4 Current Ratio 5 97,63 2

5 Collection Period (CP) 5 40 5

6

Inventory Turnover (PP)

5 3 0,6

7

Total Asset Turnover (TATO)

5 128,83 5

8 TMS to TA 10 26,26 7,25

AMOUNT 70 57,85

Health Assessment of Regional Owned Enterprises as Efforts to Increase Local Revenue in East Java Province, Indonesia

185

Table 8. PT. A Health Illustration of 2018.

NO DESCRIPTION WEIGHT RESULTS SCORE

1 R O E 20 8,46 12

2 R O I 15 34,92 15

3 Cash Ratio 5 12,37 2

4 Current Ratio 5 128,13 5

5 Collection Period (CP) 5 93 4

6 Inventory Turnover (PP) 5 40 5

7 Total Asset Turnover (TATO) 5 47,32 2,5

8 TMS to TA 10 34,42 10

AMOUNT 70 55,5

4.2 Discussion

Assessment of the soundness of PT.A based on the Decree of the State Owned

Enterprise Number: KEP - 100 / MBU / 2002 about the Health Level Assessment of

the State Owned Enterprise. Assessment aspects based on Article 3 Number: KEP -

100 / MBU / 2002 assessment there are 3 aspects, namely Financial Aspects,

Operational Aspects and Administrative Aspects. In this analysis only analyzes the

Financial Aspect based on the financial statements of PT. SEER. The results of the

assessment are based on financial aspects of PT. SIER reached a score of 63.5, the

achievement of performance from the financial aspect has a value of 91. PT. SIER is

categorized as Healthy with AA criteria.

The level of soundness of PT. B is based on the Soundness Rating of BUMD

Financial Services Banking from Bank Indonesia Regulation Number 13/1 / PBl / 2011

concerning the Rating of Soundness of Commercial Banks and Decisions of State-

Owned Enterprises Number: KEP - 100 / MBU / 2002 concerning Level of Assessment

Health of State Owned Enterprises. The evaluation aspects based on Article 3 Number:

KEP - 100 / MBU / 2002 assessment there are 3 aspects, namely Financial Aspects,

Operational Aspects and Administrative Aspects. In this analysis only analyze the

Financial Aspects based on the financial statements of BANK JATIM. The results of

the assessment based on the financial aspects of Bank Jatim reached a score of 68

performance achievements from the financial aspect has a value of 97. Bank Jatim is

categorized as Healthy with AAA criteria.

PT.C's soundness rating is based on the Decree of the State Owned

Enterprise Number: KEP - 100 / MBU / 2002 about the Health Level Assessment

of the State Owned Enterprise. Assessment aspects based on Article 3 Number: KEP -

100 / MBU / 2002 assessment there are 3 aspects, namely Financial Aspects,

Operational Aspects and Administrative Aspects. In this analysis only analyzes the

Financial Aspect based on the financial statements of PT. C. The results of the

assessment based on financial aspects of PT. C reached a score of 47, the achievement

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

186

of performance from the financial aspect has a value of 67. PT. C is categorized as

Healthy with criteria A.

PT.D's soundness assessment is based on the Decree of the State Owned

Enterprise Number: KEP - 100 / MBU / 2002 about the Health Level Assessment of

the State Owned Enterprise. Assessment aspects based on Article 3 Number: KEP -

100 / MBU / 2002 assessment there are 3 aspects, namely Financial Aspects,

Operational Aspects and Administrative Aspects. In this analysis only analyzes the

Financial Aspect based on the financial statements of PT. D. Assessment results based

on financial aspects of PT. D reached a score of 57.85 Achievement of performance

from the financial aspect has a value of 83. PT. D is categorized as Healthy with AA

criteria.

Health level assessment of PT. E based on the Decree of the State Owned Enterprise

Number: KEP - 100 / MBU / 2002 concerning the Assessment of the Health Level of

the State Owned Enterprise. Assessment aspects based on Article 3 Number: KEP -

100 / MBU / 2002 assessment there are 3 aspects, namely Financial Aspects,

Operational Aspects and Administrative Aspects. In this analysis only analyze the

Financial Aspects based on the financial statements of PT.E. The results of the

assessment are based on financial aspects of PT. Panca Wira Usaha achieved a score of

55.5 Achievement in financial performance has a value of 79.29. PT. E is categorized

as Healthy with criteria A.

Health level assessment of PT. F based on the Decree of the State Owned Enterprise

Number: KEP - 100 / MBU / 2002 concerning the Assessment of the Health Level of

the State Owned Enterprise. The evaluation aspects based on Article 3 Number: KEP -

100 / MBU / 2002 assessment there are 3 aspects, namely Financial Aspects,

Operational Aspects and Administrative Aspects. In this analysis only analyze the

Financial Aspects based on the financial statements of PT.F. The results of the

assessment based on financial aspects of PT.F reached a score of 62, the achievement

of performance from the financial aspect had a value of 89. PT.F was categorized as

Healthy with AA criteria.

The soundness rating of PT.G is based on the Decree of the State Owned

Enterprise Number: KEP - 100 / MBU / 2002 about the Health Level Assessment of

the State Owned Enterprise. Assessment aspects based on Article 3 Number: KEP -

100 / MBU / 2002 assessment there are 3 aspects, namely Financial Aspects,

Operational Aspects and Administrative Aspects. In this analysis only analyze the

Financial Aspects based on the financial statements of PT.Jatim Grha Utama. The

results of the assessment based on the financial aspects of PT. G reached a score of 33

performance achievements from the financial aspect has a value of 47.14. PT.G is

categorized as Less Healthy with BB criteria ...

Health level assessment of PT. H is based on the Decree of the State Owned

Enterprise Number: KEP - 100 / MBU / 2002 about the Health Level Assessment of

the State Owned Enterprise. Assessment aspects based on Article 3 Number: KEP -

100 / MBU / 2002 assessment there are 3 aspects, namely Financial Aspects,

Operational Aspects and Administrative Aspects. In this analysis only analyzes the

Financial Aspect based on the financial statements of PT. H. Assessment results based

on financial aspects of PT. H reaches a score of 30.5, achievement of financial

performance has a value of 43.57. PT. H is categorized as Less Sound with critics.

Health Assessment of Regional Owned Enterprises as Efforts to Increase Local Revenue in East Java Province, Indonesia

187

5 Conclusion

BUMD under the East Java provincial government of 8 BUMDs have health level with

6 criteria of healthy BUMD and 2 BUMDs have unhealthy criteria. Analysis of BUMD

health level assessment in East Java based on the Decree of the State Owned Enterprise

Number: KEP - 100 / MBU / 2002 about the Health Level Assessment of the State

Owned Enterprise. 8 BUMDs in East Java Province, both with healthy and unhealthy

levels of health, still provide dividends to the government of Daerha, East Java

Province.

References

Abor, Joshua., Godfred A. Bokpin, (2010). Investment opportunities, corporate finance, and

dividend payout policy: Evidence from emerging markets. Studies in Economics and

Finance, Vol. 27 Issue: 3, pp.180-194.

Arieftiara, D., Wuryani, E., Yanthi, M.D. (2017). Analysis of Simultaneous Effect Between

Investment Opportunity Set and Working Capital: It’s Effect On Firm’s Performance. Paper

Presented at International Conference on Management, Accounting, Business and

Entrepreneurship (ICMABE 2017). IPMI International Business School. Jakarta October

15

th

-18

th

, 2017.

Baker, G. P., & Kennedy, R. E. (2002). Survivorship and the Economic Grim Reaper * George

P. Baker Robert E. Kennedy. Journal of Law, Economics and Organization.

Diana, A. T. (2016). Analisis Tingkat Kesehatan Perusahaan Dalam Menilai Kinerja Keuangan

Perusahaan BUMN. Integra, 6, 15–25.

Donaldson, L., & Davis, J.H. (1991). Agency Theory of Stewardship Theory: CEO Governance

and Shareholder Returns. Australian Journal of Management. Vol. 16., pp. 49 – 64.

Fitriani, A. (2013). Pengaruh Kinerja Lingkungan dan Biaya Lingkungan Terhadap Kinerja

Keuangan pada BUMN. Jurnal Ilmu Manajemen, 1, 137–148.

Johnson, J. L. (1998). meta-analytic reviews of board composition , leadership structure , and

financial performance. Strategic Management Journal, 19(February 1996), 269–290.

Jabbouri, I. (2017). Determinants of corporate dividend policy in emergingmarkets: Evidence

from MENA stock markets. Research In International Business and Finance. Vol. 37, pp.

283-298.

Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. American

Economic Review. Vol. 76. No. 2, pp. 323 – 329.

Orlitzky, M., Schmidt, F. L., Rynes, S. L., & Rynes, S. L. (2003). Corporate Social and Financial

Performance : A Meta-analysis. Organization Studies, 24, 403–441.

Richard, P. (2009). Measuring Organizational Performance: Towards Methodological Best

Practice. Journal of Management, (June). https://doi.org/10.1177/0149206308330560

Sukmana, W., & Firmansyah, I. (2013). ANALISIS PROBLEMATIKA KINERJA BUMD

NON-KEUANGAN DI JAWA BARAT : APLIKASI METODE ANALYTIC NETWORK

PROCESS, 48–62.

Yi-Hua Lin, Jeng-Ren Chiou & Yenn-Ru Chen. (2010). Ownership Structure and Dividend

Preference. Emerging Markets Finance and Trade. 46:1, 56-74.

Morgan at al. (1979). Introduction to Psychology. Sixth Edition. McGraw-Hill.

Kogakusha.Tokyo

Oladipupo, A. O., & Ibadini, P.O. (2013). Does Working Capital Management Matter in

Dividend Policy Decision? Empirical Evidence from Nigeria. International Journal of

Financial Research. Vol. 4, No. 140-145.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

188

Tidajoh, B. E. (2015). The effect of Contingent Fit between competitive strategy and Investment

Opportunity Set on firm performance with corporate governance as moderation factor.

Dissertation. Economics and Business Faculty. Postgraduate Program of Accounting

Science. Universitas Indonesia. Depok.

Wuryani, Eni (2012) Company Size in Response to Earnings Management and Company

Performance, Journal of Economics, Business, and Accountancy Ventura Volume 15, No. 3,

December 2012, pages 491 – 506 Accreditation No. 80/DIKTI/Kep/2012

____________, (2013) Pengaruh Earnings Management dalam memediasi Hubungan antara

Good Corporate Governance dan Kinerja Perusahaan pada Peserta CGPI Tahun 2004 -2008,

Jurnal Akuntansi dan Manajemen JAM Vol 24 Nomor 2 Agustus 2013.

_____________, (2013) Kajian Analisis Efektivitas Investasi dalam Mencapai Outcome pada

BUMD dalam Rangka Meningkatkan Kinerja Keuangan Perusahaan, Sekretariat Daerah

Propinsi Jawa Timur, Biro Administrasi Perekonomian.

______________, (2015) Analysis Working Capital on Company Profitability, Australian

Journal of Basic and Applied Sciences, 9(7) April 2015, Pages: 86-88

______________, (2015) Asset Management in Improved Performance Optimization, Australian

Journal of Basic and Applied Sciences, 9(31) September 2015, Pages: 396-398.

Health Assessment of Regional Owned Enterprises as Efforts to Increase Local Revenue in East Java Province, Indonesia

189