The Influence of Good Corporate Governance and

Reporting Lag on the Company's Financial Performance

Fenny Marietza, Nila Aprila, and Melati Agusrina

Faculty of Economics and Business Universitas Bengkulu, Indonesia

Abstract. This study aims to examine the Influence of good corporate

governance and reporting lag on the company's financial performance. The

independent variables in this study is the mechanism of good corporate

governance and reporting lag and the dependent variables is the company's

financial performance as measured by the accounting ratios of return on assets

(ROA), return on equity (ROE), earnings per share (EPS). The tested on each

variables using a quantitative research design and secondary data are derived

from companies listed on the Indonesia Stock Exchange. Data collection methods

using purposive sampling in the observation period of 2012-2016, obtained 79

observations. Data were analyzed using multiple linear regression analysis. The

criteria of the company used are companies that are late in reporting financial

reports to the Indonesia Stock Exchange and data that support the implementation

of research. The limitation of the study is that the sample of companies is limited

to 79 companies and the results of heteroscedasticity test showed that the

regression model was exposed to heteroscedasticity.

Keywords: Good corporate governance ꞏ Reporting lag ꞏ ROA ꞏ ROE ꞏ EPS

1 Introduction

Asean economic community that currently exists has demanded the company to

improve its performance and continues to innovate in the management of its business

within the framework of business competition. Indicators are often used in measuring

the financial performance of the company is Corporate Governance. The National

Policy Committee on Governance (KNKG, 2006) defines corporate governance is a

structure and process used in the company that aims to add value to the company on an

ongoing basis within long for shareholders, but will still pay attention to the interests

of other stakeholders are based on regulations and norms in force.

At the time of the economic crisis in Indonesia in 1997 caused a lot of companies

that are experiencing financial hardship or liquidation as a result of not implementing

good corporate governance concept properly. To anticipate monetary crisis happen

again then the Ministry of State began to require companies to apply the concept of

good corporate governance, especially in State-Owned Enterprises corporate

environment. Through The Decision Letter Of The Minister Of State-Owned

Enterprises No. KEP-117/M-MBU/2002 of 1 August 2002 concerning the application

of the practice of good corporate governance in State-owned enterprises

(www.kompas.com). As for the implementation or existence of implementation of good

242

Marietza, F., Aprila, N. and Agusrina, M.

The Influence of Good Corporate Governance and Reporting Lag on the Company’s Financial Performance.

DOI: 10.5220/0009854600002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 242-250

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

corporate governance is the existence of: Board of Commissioners are independent,

managerial ownership, institutional ownership, foreign ownership (foreign ownership),

the independence of the audit committee, and the quality of the audit.

In addition to good corporate governance, timeliness in financial reporting can also

affect the company's financial performance. Timeliness of financial reporting is an

important indicator for adequate financial statement information, the delay in the

submission of the report referred to the company's Financial Reporting lag. As for the

definition of the Reporting lag is the time interval between the date of the final financial

reporting (as of March 31) up to the date of submission of financial reporting by issuers

to Exchange party (Al-Ajmi, 2008; Khasharmeh & Aljifri, 2010; McGee, 2009;

Rachmawati, 2008). The length of time the submission of financial reports can affect

the value of the company and its financial performance in the stock market, the length

of time the submission of financial statements is an important thing because it can affect

judgment and decisions taken by the stakeholders in the market as investors and

creditors.

Furthermore the existence of good corporate governance implementation

undertaken by some companies and the existence of the delay time of penampaian

financial reporting issuers and previous peneltian results have not been consistent

(mixed), then it is important to do research in depth regarding the implementation of

good corporate governance and reporting lag against the financial performance of the

company. In General, this research aims to test the influence of the implementation of

good corporate governance (Board of Commissioners of independent, managerial

ownership, institutional ownership, foreign ownership, the independence of the audit

committee, and the audit quality) lag on performance reporting and corporate finance

by using measurements of the ratio of the ROA, ROE and EPS. Research results have

contributed to the development of agency theory and the theory of signalling,

contribution to academic/research foundation for further contribution to investors dang

creditors in decision making business is good and correct.

2 Literature Review

Agency theory (agency theory) is a theory that explains the relationship between the

principal parties is as the owner of the company and the agent is as the party that

manages the company, both bound in a contract. The owner or principal is the party

that does the monitoring and evaluation of the information that the agent was a party as

running opersaional management activities and to take strategic decisions at the

company (Jensen and Meckling, 1976) . Agency theory is the basis for the

understanding of corporate governance. That is because the Agency theory indicates

that there is an asymmetry of information between the managers as agent and the owner

(shareholder) as principal (Jensen and Meckling, 1976), so the Agency theory became

the basis of thought that performance corporate finance better can be achieved due to

good corporate governance.

Based on signal theory, companies that have good performance or good companies

use financial information in the financial statements in order to send a signal to the

stock market (Spence, 1973). The signal in the form of information about the company's

financial circumstances during a certain period to the stakeholders. The information is

The Influence of Good Corporate Governance and Reporting Lag on the Company’s Financial Performance

243

provided by way of disclosure of accounting information such as financial reports

(financial reporting). The information contained in the financial reports contain a signal

in the form of good news or bad news that will affect investment decisions. Good news

is a good news for investors as a good signal to determine the decision of investing.

While bad news information is information that identifies the bad news to investors as

a signal that less good in determining decisions investing (Goddess, 2013).

The company's financial performance is a whole State companies within a certain

period which is an accomplishment or results influenced by the operational activities

of the company in utilizing resources owned, Helfert (1996) in Nuswandari (2009).

Performance is also an important thing that must be achieved by each company because

performance is a reflection of the company's ability in allocating resources.

Measurement of the company's performance in the various studies are measured on the

performance of the operations and performance of the company dikarenaka, suau

market companies tend to rely on capital from externally to finance operational

activities then the company must eyakinkan the owners of capital that they invested in

these companies has been used appropriately.

Corporate governance or corporate governance is the answer of the theory of

Agency (agency theory) which stated that the importance of the company's shareholders

to hand over authority in the management of the company to the more expert the

delivery of the management authority, known as separation between the ownership of

the company with the party that controls the company, or often known with the issue

of Agency. Good corporate governance is a process and structure used to direct and

manage the business and Affairs of the Corporation, with the ultimate goal of realizing

shareholder value in the long run, keeping notice interests of other stakeholders

(Malaysian Finance Committee on Corporate Governance in February, 1999 Haat et al,

2008). The mechanism of corporate governance is a system that regulates and controls

the company so that it can create added value to all parties with an interest in it. If the

concept of corporate governance can be applied to the maximum in a company, then

the company's financial performance will be getting better and can minimize the delay

in submission of the financial statements of the company.

The proportion of Board of Commissioners are independent, in the decision of the

Board of Directors of PT Jakarta Stock Exchange Number Kep-305/BEJ/07-2004

required the company to record an independent Commissioners have at least 30% of

the total membership of the Board of Commissioners. The presence of the independent

Commissioner is expected to enhance good corporate governance to its full potential.

Managerial ownership is the condition of the existence of stock ownership by

company managers. This study refers to a keaganan theory assumes that the managerial

ownership serves as the corporate governance mechanisms that can reduce the action

managers perform acts of fraud or manipulate earnings. One of the mechanisms of

corporate governance is managerial ownership, ownership of the company can reduce

conflict of interest caused by the agency problem between owners and managers.

Amyulianthy (2012) suggested that the managerial ownership effect significantly to

financial performance.

Institutional ownership shareholder is company owned by institutions such as:

financial institution, the institution of the legal institutions shaped abroad, the

Government and other institutions. The structure of ownership of public companies in

Indonesia are generally concentrated on institutional ownership. Septiana dkk (2016)

stated that the institutional party has a great influence in the governance of the company

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

244

management because of the institutional party is a party that acts as a supervisor and

has the right to monitor operational activities the company.

The existence of foreign ownership in the company considered concern towards the

improvement of good corporate governance. Investors who come from abroad usually

have a more critical because of their incomprehension factor driven will condition the

company culture and environment that exists in Indonesia, so that foreign investors will

sue the company for had a good performance. DWI and Putu (2016) found that the

greater the ownership of foreign stocks (foreign ownership) in a company then the

better corporate governance (good corporate governance) that will have an impact on

the financial performance of the company

Apadore and Marjan (2013) suggests that the audit commitee is responsible in

overseeing the company's financial statements, provide oversight on external audit and

supervision in the internal control system. The existence of the audit committee to be

very important because it is one of the most important factors in the implementation of

good corporate governance in which the concept of accountability, independence,

responsibility, transparency, as well as the attitude of the fair into a runway and the

principle on the company. In the research of Sarafina and Muhammad (2017) mention

that the independence of the audit committee of a positive effect on performance of

financial companies using ratio ROA (Return On Assets).

The financial report is the source of the information used for external parties and

shareholders of the company for investment decision making. In this case the auditor

has a role as the party that gave the assurance in terms of the reasonableness of the

company's financial statements, the financial statements are in accordance with the

prevailing accounting standards or not. According to Lugianto (2008) in Sartika (2012)

the quality audit done HOOD whose reputation will ensure more in terms of

accountability and the financial performance of companies that diauditnya, thus the

level of risk the company will be pressed to the level lower. Research conducted Agyei

and Mensah (2018) suggests that the size of the HOOD effect significantly to the

company's financial performance.

Delays in financial reporting (reporting lag) the company will make the

shareholders and potential shareholders to defer their stock transactions, so that the

delay in the submission of the financial report will be influential on performance of a

company. Bijalwan and Madan (2013) in Agyei and Mensah (2018) observed that the

policy of corporate governance, the timeliness of financial reporting and disclosure to

the company's performance. Research Agyei and Mensah (2018) suggests that the

results of the regression analysis indicates that the reporting lag has a significant

negative relationship statistically with ROA and ROE, the implications are when the

company's good financial performance companies have a tendency to reveal an earlier

financial reports to the public.

3 Research Method

This research gave priority to research on empirical facts and data by using a secondary

data source. The population in this research is all the non-finance listed on the Indonesia

stock exchange (idx) of the period 2012-2016. In this study, researchers used a

purposive sampling method in obtaining samples of research.This research is grouped

The Influence of Good Corporate Governance and Reporting Lag on the Company’s Financial Performance

245

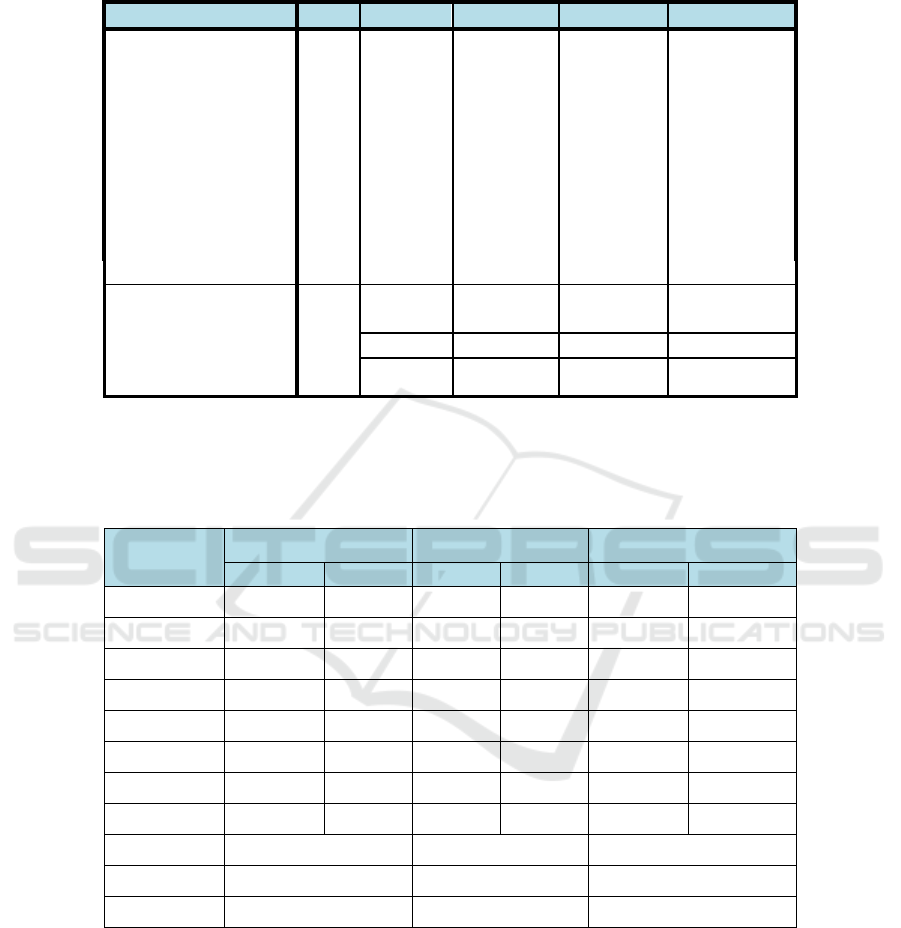

into variable independent variable and the dependent variable. Each of these variables

and the measurement are presented in table 1 below.

Table 1.

Type of

variables

Variables Measurement

Dependent

Variabel

1. Financial

Performance

ROA = Net Income x 100%

Total Assets

ROE = net income x 100%

Total equity

EPS = Pre Tax Income

Number of share in market

Independent

Variabel

1. Independent Board

of Commissioners

= The number of Independent Board of

Commissioners

Total of Board of Commissioners

2. Managerial

ownership

=number of share that owned by manager

the number of outstanding shares

3. Institutional

ownership

= The number of shares owned by an

institution

the number of outstanding shares

4. Foreigners

ownership

= The number of shares owned by foreigners

the number of outstanding shares

5. Audit committee

Independent

= Audit committee Independent

Totals of audit committee

6. Audit quality = Measured by dummy variables, 0 for KAP

Non Big 4, 1 for KAP Big 4

7. Reporting Lag = Number of days between the date of the final

financial reporting (March 31) up to the date of

submission of financial reporting by issuers to

bursa

𝒀𝛂𝛃

𝟏

𝐗𝟏 𝛃

𝟐

𝐗𝟐 𝛃

𝟑

𝐗𝟑 𝛃

𝟒

𝐗𝟒 𝛃

𝟓

𝐗𝟓 𝛃

𝟔

𝐗𝟔 𝛃

𝟕

𝐗𝟕 𝒆

Keterangan:

Y

= ROA, ROE, EPS

x1 = Independent Board of Commissioners

x2 = Managerial ownership

x3 = Institutional ownership

x4 = Foreigners ownership

x5 = Audit committee Independent

x6 = Audit quality

x7 = Reporting Lag

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

246

Table 2. Descriptive Statistic.

N

Minimu

m

Maximu

m

Mean Std. Deviation

ROA 79 ,0001 2,1900 ,107980 ,2728771

ROE 79 ,0005 2,9700 ,287938 ,6091114

EPS 79 ,0004 9388,0000 163,986007 1056,975137

Independent Board of

Commissioners

79 ,2000 1,0000 ,437903 ,1314105

Mana

g

erial ownership 79 ,0000 ,56000 ,040239 ,09777505

Institutional ownership 79 ,0000 ,9999 ,416908 ,3000508

Forei

g

ners ownership 79 ,0000 ,9850 ,200704 ,2150589

Audit committee

Independen

t

Audi

t

79 ,3333 1,0000 ,661603 ,3436383

RL 79 1,0000 258,0000 32,974684 47,1796824

Dummy Frekuensi Persentase

Audit qualit

y

79 0

N

on Bi

g

4 66 83,5

1 Big 4 13 16,5

4 Result and Discussion

Tabel 3. Multiple Regression Linier.

ROA

ROE EPS

Koef Sig Koef Sig Koef Sig

(Constant)

1,033 0,000

1,000 0,000

34,490 0,000

KOMIND

0,101 0,000

0,256 0,000

6,644 0,529

MANAG

0,234 0,000 -0,103 0,000 -46,657 0,006

INST

0,029 0,000 0,087 0,000

-4,626 0,444

FOREIGN

0,102 0,000

0,287 0,000

8,841 0,266

INDAUD

-0,040 0,000 -0,117 0,000 -27,126 0,000

KAP

-0,050 0,000 -0,093 0,000 -17,756 0,000

RL

-0,005 0,000 0,001 0,000 -0,057 0,048

Adjusted R

2

1,000

1,000 0,424

F 181765,107 162035,481 6,158

Sig 0,00 0,00 0,00

Based on results, the independent Board of Commissioners have an impact on the

company's financial performance using the ROA and ROE ratios. The proportion of

independent BOC capable to improve the company's financial performance, because

the independent Board of Commissioners can provide supervision on the policy and

implementation of good corporate governance so that the financial performance of the

The Influence of Good Corporate Governance and Reporting Lag on the Company’s Financial Performance

247

company will increase. Managerial share ownership positively affects the company's

financial performance with the ROA ratio, suggesting that good financial performance

can be influenced by the amount of managerial shares in the company. While

managerial shareholding proved to be negatively affected by the company's financial

performance using the ratio of ROE and EPS, while the percentage of managerial stock

ownership is the greatest owned by the company Bumi Resources Minerals TBK

(BRMS) amounted to 0.560 or 56%.

Institutional share ownership affects the company's financial performance using

ROA and ROE ratios. Institutional ownership plays a very important role in minimizing

agency conflicts between managers and shareholders. The presence of institutional

investors is considered to be an effective monitoring mechanism in every decision taken

by the manager (Amyulianthy, 2012). Based on the results of the study using the three

accounting ratios, it can be concluded that foreign share ownership affects the

company's financial performance using ROA and ROE ratios, the greater the proportion

of the party's shareholding Will increase the company's financial performance by

looking at the profit generated from all total assets and profits generated by the entire

total company's equity.

The independence of the Audit Committee proved to be negatively impacted by the

company's financial performance using ROA, ROE, and EPS ratios, with the

independence of the Audit Committee lowering the financial performance of the

administration. Descriptive statistical results stated that a minimum value of 33.3%

indicates that the sample company has only 1 Independent audit Committee, the

minimum value is owned by 26 sample companies, meaning there are still many

companies that do not has a sufficient independent audit committee. In addition, the

audit Committee of 1 person in the sample company will also affect the outcome of the

research, because the number of audit committees in an enterprise consists of three to

five people and has a background in accounting and Other things related to internal and

external oversight of the company.

Based on the research results it can be concluded that the quality of audit (BIG4 or

Non Big4) negatively affects the company's financial performance using ROA, ROE,

and EPS ratios. It proves that the KAP can decrease the company's financial

performance. The BIG4-affiliated KAP tends to perform a faster audit than the BIG4-

partner KAP, as the BIG4-affiliated KAP can conduct its audit more efficiently and

have a level of flexibility in schedule Higher time to complete the audit on time and

affect the company's financial performance. The research results there are 13 companies

audited by KAP BIG4 and 66 companies audited by KAP Non Big4, if a company is

audited by one of the companies of audit services BIG4 and the quality of audit meets

the quality standards of audit received, then The company's performance is expected to

be better as well as financial reporting will be more transparent. However, many sample

companies are not audited by KAP BIG4 so that the independence is less than maximal

and will affect the outcome of this research.

Reporting Lag (RL) negatively affects the company's financial performance using

ROA and EPS ratios, and positively affects the company's financial performance using

the ROE ratio. Timeliness of financial reporting is a reflection of the number of days a

company needs to compile financial statements that will be reported. Timeliness of the

preparation or reporting of a company's financial statements can affect the value of the

financial statements. The timeliness of reporting a company's financial statements can

affect the value of the financial statements. Delays in information will cause negative

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

248

reactions from capital market participants. The information presented in the financial

statements contains a good news and bad news that can influence the investment

decision (Dewi, 2013).

5 Conclusion

The results found that independent Board of Commissioners, managerial shareholding,

institutional ownership, foreign ownership and reporting lag were influential in the

financial performance and independence of the Audit Committee and Audit quality

Impact on the company's financial performance with ROA, ROE and EPS ratios.

References

Afify, H.A.E. 2009. Determinants of Audit Report Lag : Does Implementing corporate

governance have any impact Empirical Evidence from Egypt. Journal of Applied Accounting

Research, Vol.10 No.1 2009, pp 56-86.

Al-Ajmi, J. 2008. Audit and Reporting Delays: Evidence from an Emerging Market. Advances

in Accounting, Incorporating Advances in International Accounting, 24,217-228.

Amyulianthy, Rafriny. 2012. Pengaruh Struktur Corporate Governance Terhadap Kinerja

Perusahaan Publik Indonesia. Journal Liquidity. Vol. 1, No. 2 Juli 2012.

Arifani, Rizky. 2013. Pengaruh Good Corporate Governance Terhadap Kinerja Keuangan

Perusahaan. Jurnal Universitas Brawijaya Malang: 1-17.

Agyei, Ben Kwame dan Mensah. 2018. Impact of Corporate Governance Attributes and

Reporting Lag on Corporate Financial Performance. African Journal of Economic and

Management Studies. 29 March 2018.

Apadore, Kogilavani dan Mohd Noor Marjan. 2013. “Determinants of Audit Report Lag and

Corporate Governance in Malaysia”. International Journal of Business and Management,

Vol.8, No. 15; 2013.

Astuti, Theresia Dwi. 2005. Hubungan antara Good Corporate Governance dan Struktur

Kepemilikan Dengan Kinerja Keuangan (Studi kasus pada perusahaan yang listing di Bursa

Efek Jakarta). Makalah Simposium Nasional Akuntansi VIII.

Classens, Stijn., Simeon Djankov, dan Leora Klapper. 1999. “Resolution of Corporate Distress

in East Asia.” World Bank Policy Research Working Paper. June (1999): 1-33.

Dewi, Karina Mutiara. 2013. Analisis Faktor-Faktor yang Mempengaruhi Ketepatan Waktu dan

Audit Delay Penyampaian Laporan Keuangan (Studi Empiris pada Perusahaan Manufaktur

yang Terdaftar di BEI Periode 2007-2013). Skripsi, Universitas Dipenegoro.

Dwi, I Made dan Ni Gusti Putu. 2016. Analisis Faktor-faktor yang Mempengaruhi Ketepatan

Waktu Pelaporan Keuangan Pada Perusahaan Manufaktur yang Terdaftar di BEI. E Jurnal

Akuntansi Universitas Udayana. Vol.15.1. April 2016 : 17-26.

Ghozali, Imam. 2011. Analisis Multivarian dengan Program SPSS. Semarang Badan Penerbitan

Universitas Diponegoro.

Herman, Darwis. 2009. Corporate Governance Terhadap Kinerja Perusahaan. Jurnal Keuangan

dan Perbankan, Vol. 13, No. 3, September 2009, hal. 418-430.

Hermawan, A.A. 2009. Pengaruh Efektivitas Dewan Komisaris dan Komite Audit, Kepemilikan

oleh Keluarga dan Peran Monitoring Bank Terhadap Kandungan Informasi Laba. Disertasi,

Universitas Indonesia.

Hilmi, U dan Ali . 2008. Analisis Faktor-Faktor Yang Mempengaruhi Ketepatan Waktu

Penyampaian Laporan Keuangan (Studi Empiris Pada Perusahaan-Perusahaan yang

Terdaftar di BEJ). Simposium Nasional Akuntansi XI, Pontianak.

The Influence of Good Corporate Governance and Reporting Lag on the Company’s Financial Performance

249

Jensen, MC and Meckling. 1976. “Theory of the Firm: Managerial Behavior, Agency Costs and

Ownership Structur”. Journal of Financial Economics. Vol 3, p.305-360.

Septiana, Nurul., R.Rustam Hidayat dan Sri Sulasmiyati. 2016. Pengaruh Mekanisme Good

Corporate Governance Terhadap Profitabilitas Perusahaan (Studi pada Perusahaan Makanan

dan Minuman Tahun 2011-2014). Jurnal Administrasi Bisnis. Vol. 38, No. 2 September

2016.

www.kompas.com diakses tanggal 25 Agustus 2018 pukul 16.00 WIB.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

250