Analysis of Bankruptcy Prediction of Regional

Development Banks (BPD) using the Altman Z-Score

Method

Rahayu, and Muhammad Ridwan

Accounting Department, Jambi University, Jambi, Indonesia

Abstract: The purpose of this study is to predict the level of bankruptcy of BPD

using the Altman Z score method. The data used is the BPD Audited Financial

Statements in Sumatera region since 2014-2018. The sample of this research is

BPD Aceh, North Sumatra, South Sumatra Babel, Bengkulu, West Sumatra,

Lampung, Jambi, Kepulauan Riau. The analysis techniques in this research is the

Altman Z-score modification method using 4 ratio, that working capital to total

assets ratio (X1), retained earnings to total assets ratio (X2), earnings before

interest and taxes to total assets ratio (X3), book value of equity to total debt ratio

(X4). The formula of Altman Z-score method to calculate the level of health for

the company, that Z-score = 6.56 X1 + 3.26 X2 + 6.72 X3 + 1.05 X4. Z-Score

indicator to determine the bankruptcy of companies grouped into the healthy

category (Z-score> 2.60), gray area (Z-scores between 1.1 and 2.60) and bankrupt

(Z-score <1.1). The calculation results show that there are no BPDs in the healthy

category, all of them are in the bankrupt and gray area categories.

Keywords: Altman Z-score modification ꞏ Bankruptcy ꞏ Healthy ꞏ Bankrupt and

gray area

1 Introduction

Collecting funds from the public and channeling them back to the community is the

main function of bank financial institutions. In carrying out this function, bank collects

funds in the form of customers’ deposits in the form of savings, current accounts and

deposits. The funds will be channeled back to the community in the form of credit. The

banking activities are carried out based on government regulations, including Bank

Indonesia Regulations, Financial Services Authority Regulations (POJK), and other

related regulations.

The monetary crisis occurred in Indonesia in 2008, which began with the weakening

of the Rupiah since mid-2017. The sudden withdrawal of large amounts of funds by

foreign investors was driven by the pessimism of regional economic prospects and

immediately weakened the rupiah currency drastically. (Bulletin of Monetary,

Economics and Banking, September 1998). In that year, the value of the Rupiah

weakened compared to the value of the dollar, to reach the lowest value of IDR 12,400

on November 25

th

, 2008. (Reuters data quoted by detikFinance, Wednesday

(08/21/2013)). The weakening of the value of the rupiah impacts on the Indonesian

Rahayu, . and Ridwan, M.

Analysis of Bankruptcy Prediction of Regional Development Banks (BPD) using the Altman Z-Score Method.

DOI: 10.5220/0009855100002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 289-300

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

289

government is having difficulty to meet the state budget target, difficulties in paying

foreign debt soaring.

The weakening of the value of the rupiah has become a big shot in the banking

world. Since the enactment of banking regulation in 1988, banks in Indonesia have

begun to emerge. Banks may be established on condition that quite easily, with funds

only IDR 1 billion. The establishment of this bank is not accompanied by good banking

managerial. Banks run with the concept of seeking profit for a moment without

considering the principle of prudence, and the healthiness level of the bank. In addition,

bank supervision conducted by Bank Indonesia was very weak, so that when the

monetary crisis occurred in 1997 and 1998, these banks were unable to survive.

Banks that obtain loans in foreign currencies must repay loans that are due with a

weakening Rupiah. The public distrust towards the banking world began to fall, and it

impacts the withdrawing public funds. The decline in the Indonesian economy also

caused people to be unable to finance credit obligations, resulting in a lot of bad credits.

These factors are one of them, which makes many banks in Indonesia unable to survive.

In 1997, Bank Indonesia liquidated 16 banks deemed unable to carry out their

operational activities anymore. The monetary crisis has proven that Indonesian banking

is not healthy. The healthy level of banks is very important for banks to be able to

survive.

The World Bank recommends restoring confidence in the rupiah with four main

policies: restructuring the private debt burden, reforming and strengthening the banking

system, improving "governance", and maintaining fiscal and monetary stability during

the transition period (World Bank, 1998, p.2.2).

One of these policies has been noted

as strengthening of the banking system. The Indonesian government began to reform

them by establishing the Financial Services Authority (OJK) to improve banking

supervision through issuing relevant regulations to assess the healthiness of banks so

that banks could improving to meet the principles of

prudential banking.

Bank assessment can be done in several ways, including by using Bank Indonesia

Regulation and Regulation of the Financial Services Authority, the assessment by the

CAMEL (Capital, Asset Quality, Management, Earnings, Liquidity and Sensitivity to

Market Risk) and Risk-based Banking Rate (Risk Profile, Good Corporate Governance,

Earnings, and Capital). The assessment of

the health status of bank has also been raised

by several experts based on the results of their research were noted as predicting the

level of bankruptcy of the company, including the Altman Z-Score Model,

Springate

Analysis Model (S-Score), and the Zmijewski Analysis Model (X-Score). The Altman

model is the first bankruptcy prediction model developed in 1969 by using discriminant

analysis statistical techniques. The Springate model was developed in 1978 using

discriminant analysis with several steps to identify 4 financial ratios from 19 existing

financial ratios. The Zmijewski method was developed in 1983 by expanding studies

to increase the validity of financial ratios as a means of detecting corporate failures.

This study uses the Altman Z-Score method to predict bankruptcy of banks, because

this method is the first method developed related to bankruptcy predictions. This

method

also experienced developments, including in 1984 the Altman Z-Score formula

for manufacturing companies that did not go-public and the formula for companies

other than manufacturing companies that go-public or non-public. This formula can

also be used for banking companies.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

290

Based on Indonesian Banking Statistics data-Vol. 17 No. 9 August 2019, the

number of Commercial Banks and Bank Perkreditan Rakyat has decreased, with the

following details:

Category of Bank

2015 2016 2017 2018 August

2019

Commercial Bank 118 116 115 115 111

Bank Perkreditan Rakyat 1636 1633 1619 1579 1579

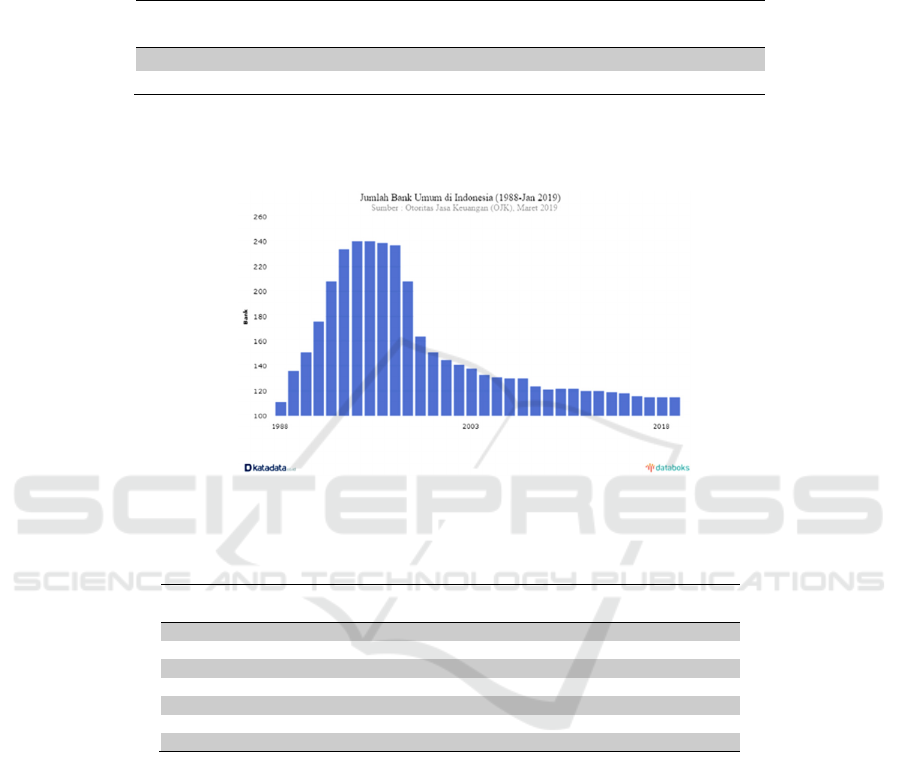

The movement of the number of commercial banks in Indonesia from 1988 to

January 2019 has decreased, based on OJK’s database for March 2019, seen in the

figure below:

Fig. 1.

The number of commercial banks in August 2019 was 111 banks, with the following

details:

Group of Bank Amount

Asset >IDR 50 Trillion

(August 2019)

%

Company Bank 4 4 100.00

Foreign Exchange BUSN 41 16 39.02

Non-Foreign Exchange BUSN 20 0 -

BPD 27 3 11.11

Mixed Bank 11 2 18.18

Foreign Bank 8 3 37.50

Amount 111 28

The highest number of commercial banks in the BUSN

(National Private

Commercial Bank) group is 41 banks, and the least is Foreign Banks. From this group

of banks, the development of banks viewed from the value of

assets shows that the

percentage of banks that have assets above IDR 50 trillion is Bank Persero, and the

low

level is Non-Foreign Exchange BUSN. The banks which are owned by the government

in this case are the Persero Bank and the Bank Pembangunan Daerah (BPD). Based on

the table, it is seen that the level of development

of

BPD assets falls into the 3 lowest

groups. With this condition, many parties often worry about the continuity of BPD

business activities if their funds are no longer fully supported by the APBD. The

number of BPD is 27 BPD, spread throughout Indonesia, with the following amounts:

Analysis of Bankruptcy Prediction of Regional Development Banks (BPD) using the Altman Z-Score Method

291

No Area Amount

1 Sumatera 8

2 Java & Southeast

N

usa

9

3 Kalimantan 4

4 Sulawesi Islan

d

5

5 Papua 1

Amount 27

This study will analyze bankruptcy predictions using the Altman Z-Score method

for BPD in the Sumatra Region, totaling 8 BPDs.

2 Literature Review

2.1 Definition of Bank

Based on Banking Law Number 10 in the year of 2008, Banking is defined as

everything related to banks, including institutions, business activities, as well as ways

and processes in carrying out their business activities; whereas the term "Bank" is a

business entity that collects funds from the public in the form of deposits and distributes

them to the community in the form of credit and or other forms in order to improve the

lives of many people.

2.2 Definition of Bank Healthiness

Based on the Financial Services Authority Regulation, the healthiness of a bank is the

result of an assessment of the condition of a bank conducted on risk and bank

performance. According to Kasmir (2008: 41) "The healthiness of a bank can be

interpreted as the ability of a bank to be interpreted as the ability of a bank to carry out

banking operations normally and be able to fulfill all its obligations properly in ways

that are in accordance with applicable banking regulations."

Understanding bank healthiness according to Veithzal Rivai (2007: 118) "The

healthiness of a bank is a bank that can carry out its functions properly, which can

maintain public trust, can carry out the intermediary function of the government in

implementing various policies, especially monetary policy".

Healthiness can be interpreted as the ability of a bank to carry out banking

operations normally and as well as to fulfill all its obligations properly in accordance

with applicable regulations. (Susilo et al, 2000: 22-23).

2.3 Rating of Bank Healthiness based on Bank Indonesia Regulations

and Financial Services Authority Regulations

An assessment of the healthiness of a bank can be done in several ways. Several

regulations have been issued by Bank Indonesia and the Financial Services Authority

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

292

(OJK) related to the assessment. The following are a number of regulations relating to

assessing the healthiness level of banks, including:

1. Based on the Financial Services Authority Regulation Number 4 / POJK.03 / 2016

concerning Rating of Healthiness of Commercial Banks

Article 6

Banks are required to conduct individual bank healthiness assessments using a

risk-based Bank Rating approach as referred to in Article 2 paragraph (3), with

the scope of the assessment of factors: (a) risk profile; (b) Good Corporate

Governance (GCG); (c) earnings (earnings); and (d) capital (capital).

2. Based on Bank Indonesia Regulation Number 13/1 / PBI / 2011 dated January 5,

2011 concerning Rating of Healthiness of Commercial Banks; Article 6 Banks are

required to conduct an assessment of the Bank on an individual basis using risk

approach (Risk-based Bank Rating) as referred to in Article 2 paragraph (3), the

scope of an assessment of the factors as follows: (a) The risk profile (risk profile);

(b) Good Corporate Governance (GCG); (c) Profitability (earnings); and (d)

Capital (capital).

3. Based on Bank Indonesia Regulation Number 6/10/PBI/2004 concerning Rating

System for Commercial Banks, in article 3, it is stated that the assessment of bank

healthiness includes an assessment of the following factors: (a) capital (capital);

(b) asset quality; (c) management (management); (d) earnings (earnings); (e)

liquidity (liquidity); and (f) sensitivity to market risk (sensitivity to market risk).

This healthiness rating is usually abbreviated as CAMEL.

2.4 Bank Risk Assessment using the Bankruptcy Risk Altman Z-Score

Method

Some researchers have conducted research to assess the risk of

companies including

banking. One of them is the Altman

Z-Score.

Altman has conducted research and has

introduced 3 (three) formula models that can be used to see the level of

bankruptcy of

a company. The formula is:

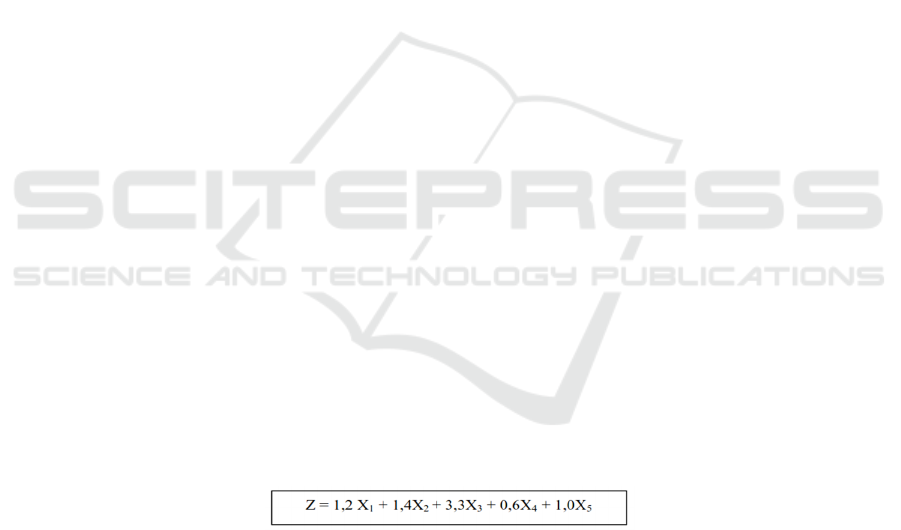

1. The first Z-Score formula was produced by Altman in 1968.This formula is

produced from research on various manufacturing companies in the United States

that sell their shares on the stock exchange. Therefore, the formula is more suitable

to predict the business continuity of manufacturing companies that go public. The

first formula is as follows:

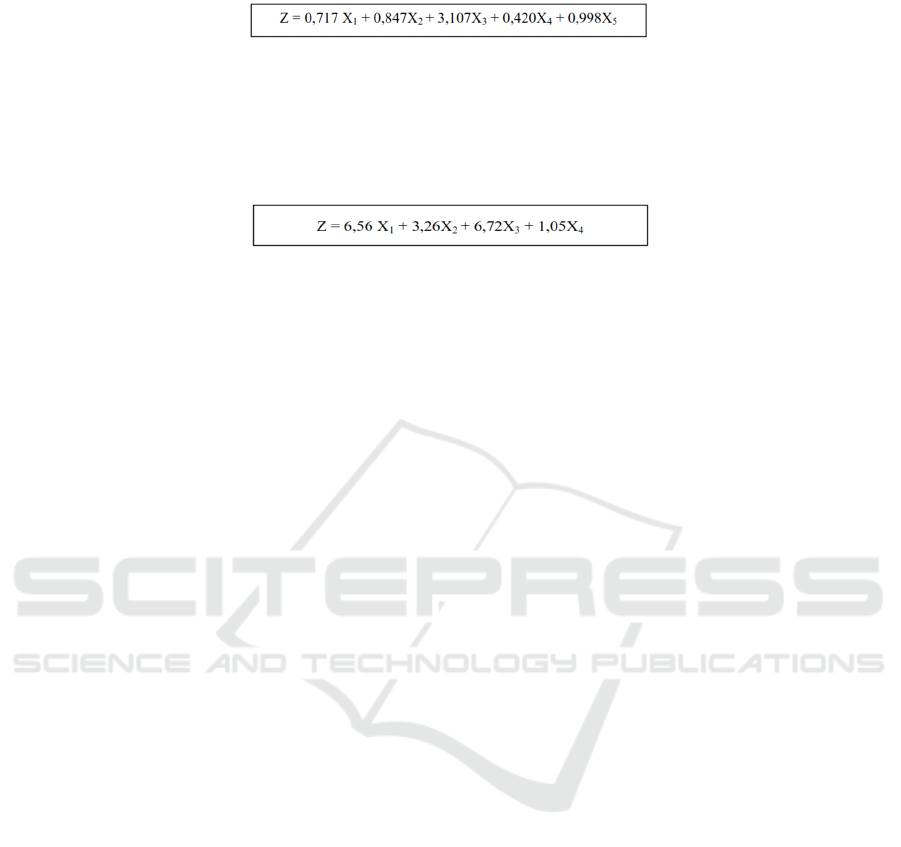

2. In 1983, Altman conducted research in various countries. This research uses a

variety of manufacturing companies that do not go public. Therefore, the formula

of the results of the study is more appropriate for manufacturing companies that do

not sell their shares on the stock exchange. The results of these studies produce the

second Z-Score formula for manufacturing companies that do not go public, as

follows:

Analysis of Bankruptcy Prediction of Regional Development Banks (BPD) using the Altman Z-Score Method

293

3. Altman (2000) conducted more research on the potential bankruptcy of companies

other than manufacturing companies, both those that

went public

or not. The last

Z-Score formula is a very flexible formula because it can be used for various types

of business fields of the company, both those that

go public

or not, and is suitable

for use in developing countries like Indonesia. This model is also suitable for use

by service companies such as banking companies. The formula is:

The formula for obtaining X1, X2, X3, and X4, is as follows:

1. Working capital to total asset ratio (X

1

). The value of working capital is obtained

from the difference between the current assets and the bank's current debt.

2. Retained earnings to total asset ratio (X

2

).

3. Earnings before Interest and taxes to total asset ratio (X

3

),

4. Book value of equity to total debt ratio (X

4

)

The results of calculations using the Z-Score formula will produce a different score

between one company and another company. The score must be compared with the

following assessment standards to assess the viability of the company:

1. If Z value> 2.60

= Safe Zone (HEALTHY)

2. If the value is 1.10 <Z <2.60

= Gray Zone (RISKY)

3. If Z value <1.10

= Dangerous Zone (BANKRUPT)

2.5 Prior Research

Several previous studies have been conducted to look at the level of bank health by

assessing bankruptcy predictions using the Altman Z-Score method, including:

1. Analysis of Camel and Altman's Z-Score Models in Predicting Bankruptcy in

Commercial Banks in Indonesia (Studies in Commercial Banks Listed on the

Indonesia Stock Exchange in 2007-2011); (2014, Kusdiana)

2. Analysis of the Altman Z-Score Model for Predicting Financial Distress in Banks

Listed on the Indonesia Stock Exchange in 2010 - 2013; (2015, Ariesco).

3. Analysis of Altman Method Prediction Accuracy Against Liquidation in Banking

Institutions (Case of Bank Liquidation in Indonesia); (2001; Adnan & Taufik).

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

294

3 Research Methodology

3.1 Population and Research Samples

The population in this study is all Regional Development Banks (BPD) in the Sumatra

Region, which are 8 (eight) BPDs, namely: (1) Aceh BPD; (2) BPD North Sumatra; (3)

South Sumatra BPD and Bangka Belitung; (4) BPD Bengkulu; (5) West Sumatra BPD;

(6) BPD Lampung; (7) Jambi BPD; and (8) BPD Riau Kepri.

The sampling method used is saturated samples, i.e. the entire population will be

sampled. The year of observation was 2014-2018, so the number of observations were

40 (forty).

3.2 Data Sources and Data Collection Techniques

The data used in this study are secondary data in the form of audited bank financial

statements for

the 2014-2018 period. Data is collected from bank annual reports

which

are published annually.

3.3 Data Analysis Tool

To analyze this research data, the steps that will be carried out are:

1. Bank financial report data for 2014-2018 was obtained from

each bank's website.

The

financial statements used are the audited financial statements.

2. Data from the financial statements will be processed using the Altman Z-Score

formula. The Altman formula used is the modified Altman Z-Score.

3. Altman conducted more research on the potential bankruptcy of companies other

than manufacturing companies, both those that

went public

or not. The last

Z-Score

formula is a very flexible formula because it can be used for various types of

business fields of the company, both those that

go public

or not, and is suitable for

use in developing countries like Indonesia. The formula is:

The score must be compared with the following assessment standards to assess the

viability of the company:

1. If Z value> 2.60

= Safe Zone (HEALTHY)

2. If the value is 1.10 <Z <2.60

= Gray Zone (RISKY)

3. If Z value <1.10

= Dangerous Zone (BANKRUPT)

Analysis of Bankruptcy Prediction of Regional Development Banks (BPD) using the Altman Z-Score Method

295

4 Results and Discussion

4.1 Z-Score Value of the Regional Development Bank of Sumatera

Region

Based on the Sumatra Regional BPD financial report data obtained from each annual

report, the Z-Score values for these banks were obtained from 2014-2018, as follows:

Name of BPD 2014 2015 2016 2017 2018 AVG

ACEH 1,197 1,361 1,551 1,368 1,476 1,391

SUMATERA URATA 2,278 2,241 2,191 1,174 1,209 1,818

SUMSEL BABEL 0,939 0,974 1,226 1,287 1,221 1,129

BENGKULU 1,418 1,345 1,344 1,491 1,409 1,401

SUMATERA BARAT 1,288 1,450 1,230 1,495 1,223 1,337

LAMPUNG 2,064 2,035 2,230 2,200 2,145 2,135

JAMBI 1,616 1,514 1,525 1,810 1,866 1,666

RIAU 1,288 1,450 1,426 1,519 1,528 1,442

AVERAGE 1,511 1,546 1,590 1,543 1,510 1,540

Name of BPD 2014 2015 2016 2017 2018

ACEH Rawan Rawan Rawan Rawan Rawan

SUMATERA URATA Bankru

p

t Bankru

p

t Rawan Rawan Rawan

SUMSEL BABEL Rawan Rawan Rawan Rawan Rawan

BENGKULU Rawan Rawan Rawan Rawan Rawan

SUMATERA BARAT Rawan Rawan Rawan Rawan Rawan

LAMPUNG Rawan Rawan Rawan Rawan Rawan

JAMBI Rawan Rawan Rawan Rawan Rawan

RIAU Rawan Rawan Rawan Rawan Rawan

The calculation results show that the Z-Score for BPD in Sumatra Region is more

grouped in the value of 1.1 - 2.6 and included in the category of gray areas, or

vulnerable conditions. In 2014 and 2015, there was 1 (one) BPD which was included

in the bankrupt category with a

Z-Score <1.1, namely Bank Sumsel Babel. There is no

BPD in the healthy category, which is a Z-Score greater than 2.6. Based on the average

Z-Score for each bank, the banks that have the highest average Z-Score from 2014-

2018 are Bank Lampung with a value of 2.135; which was followed by the North

Sumatra Bank and the Jambi Bank, while the bank with the lowest average Z-Score

was the Sumsel Babel Bank with a value of 1,129.

If seen the value of Z-Score for each year, then the

highest Z-Score value in 2014

is the Bank of North Sumatra and the lowest Bank of South Sumatra Babel. The highest

Z-Score in 2015 was the North Sumatra Bank and the lowest was the South Sumatra

Babel Bank. For the highest Z-Score value from 2016 to 2018 is the Lampung Bank,

and the lowest since 2016-2018 is the Sumsel Babel Bank. BPDs that achieved a Z-

Score 2 score were only the Lampung Bank and the North Sumatra Bank. The Z-Score

value which reached 2 in 2014 and 2018 was only Bank Lampung, and the value was

quite stable.

Bank Sumsel Babel entered the category of bankruptcy based on the Z-Score

assessment

in 2014 with a value of 0.939. In 2015, the

Z-Score

increased to 0.974, but

it still entered the bankrupt category. In 2016, the Bank Sumsel Babel began to rise and

is able to reach a value of Z-Score of 1.226 and included in the gray category or

categories of vulnerable bankruptcy.

In 2017, the

Z-Score

increased again to 1,287,

and again declined in 2018 to 1,221. However, this value is still included in the

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

296

vulnerable category. With the increase in the value of the Z-Score each year, it shows

that Altman's bankruptcy prediction did not

occur at the South Sumatra Bank of Babel.

The bank actually experienced an increase in Z-Score and began to enter the vulnerable

category for the next 5 years.

Z-Score value each year for each bank has increased and decreased varies. From

this value

, there is no BPD that has an increase in the Z-Score every year and a

decreasing Z-Score every year. All banks show increases and decreases in different

years. For the value of

Z-Score each year, shows that the average value of the Z-Score

for all BPD in the Sumatra Region each year is at 1.5. The lowest value is 1,510 in 2018

and the highest value is 1,590 in 2016.

The Z-Score rating can be seen in the table below:

Name of BPD The average of Z-Score Rangking

LAMPUNG 2,135 1

JAMBI 1,666 2

RIAU 1,442 3

BENGKULU 1,401 4

ACEH 1,391 5

SUMATERA BARAT 1,337 6

SUMATERA UTARA 1,188 7

SUMSEL BABEL 1,129 8

AVERAGE 1,461

Based on the table above, the average value of Z-Score since 2014-2018, the highest

is Bank Lampung, Bank Jambi and Bank Riau. While the

lowest Z-Score is Bank

Sumsel Babel.

4.2 Comparison of Z-Score Value with Bank Capital

Commercial Banks based on Business Activities, hereinafter referred to as BUKU

(Commercial Banks Business Groups), are groupings of Banks based on Business

Activities that are adjusted to their Core Capital. Based on its Core Capital, Banks are

grouped into 4 (four) BOOKS, namely:

1. BUKU 1 is a Bank with a Core Capital of less than Rp1,000,000,000,000.00 (one

trillion Rupiahs);

2. BUKU 2 is a Bank with Core Capital of no less than Rp1,000,000,000,000.00 (one

trillion Rupiahs) up to less than Rp5,000,000,000,000.00 (five trillion Rupiahs);

3. BUKU 3 is a Bank with a Core Capital of at least Rp5,000,000,000,000.00 (five

trillion Rupiahs) to less than Rp30,000,000,000,000.00 (thirty trillion Rupiahs);

and

4. BUKU 4 is a Bank with a Core Capital of at least IDR 30,000,000,000,000.00

(thirty trillion Rupiahs).

5. BUKU Grouping for Syariah Business Units is based on the Core Capital of

Conventional Commercial Banks that are the parent.

Based on bank capital, BPDs in the Sumatra region are in the following capital

groups:

Analysis of Bankruptcy Prediction of Regional Development Banks (BPD) using the Altman Z-Score Method

297

The Capital of

The Bank

2014 2015 2016 2017 2018

ACEH 1,810,489,653,203 1,952,844,970,594 2,073,577,807,208 2,169,482,198,756 2,217,946,337,147

SUMATERA

URATA

1,995,720,290,879 1,992,416,897,528 2,719,148,719,086 2,994,537,223,528 3,173,605,799,781

SUMSEL BABEL 1,801,584,523,019 2,073,759,380,591 2,829,832,670,059 2,977,056,034,301 3,270,043,930,878

BENGKULU 457,729,210,000 530,998,414,000 618,557,359,000 713,181,819,000 769,333,081,210

SUMATERA

BARAT

1,789,199,254,658 2,139,599,910,099 2,474,316,465,533 2,683,687,060,316 2,900,346,936,365

LAMPUNG 545,753,917,455 663,296,230,888 727,207,507,390 809,353,897,606 821,843,994,664

JAMBI 913,960,515,028 985,124,808,438 1,104,992,007,462 1,284,133,787,372 1,460,751,529,921

RIAU 2,387,137,839,421 2,393,670,063,449 2,674,459,553,784 2,866,704,041,783 2,942,807,090,336

BPD

2014 2015 2016 2017 2018

Group

of

Capital

Z-Score

Group

of

Capital

Z-Score

Group

of

Capital

Z-Score

Group

of

Capital

Z-Score

Group

of

Capital

Z-Score

Aceh BUKU II 1,197 BUKU II 1,361 BUKU II 1,551 BUKU II 1,368 BUKU II 1,476

Sumatera Utara BUKU II 1,227 BUKU II 1,191 BUKU II 1,141 BUKU II 1,174 BUKU II 1,209

Sumsel Babel BUKU II 0,939 BUKU II 0,974 BUKU II 1,226 BUKU II 1,287 BUKU II 1,221

Bengkulu BUKU I 1,418 BUKU I 1,345 BUKU I 1,344 BUKU I 1,491 BUKU I 1,409

Sumatera Barat BUKU II 1,288 BUKU II 1,450 BUKU II 1,230 BUKU II 1,495 BUKU II 1,223

Lampung BUKU I 2,064 BUKU I 2,035 BUKU I 2,230 BUKU I 2,200 BUKU I 2,145

Jambi BUKU I 1,616 BUKU I 1,514 BUKU II 1,525 BUKU II 1,810 BUKU II 1,866

Riau BUKU II 1,288 BUKU II 1,450 BUKU II 1,426 BUKU II 1,519 BUKU II 1,528

Based on the above table, it appears that BPD in the Sumatra Region is in the BUKU

I and II groups. The highest Z-Score was obtained by Lampung BPD, and based on the

BUKU group, Bank Lampung was still in the BUKU I's position. Other banks that are

also in BUKU I are Bengkulu Bank and Jambi Bank, and in that position each bank is

included in the Risky category according to the Altman Z-Score method .The lowest Z-

Score is obtained by the South Sumatra Bank of Babel, and for capital positions, the

bank is included in the category of BUKU II. With this result, it can be concluded that

high bank capital does not directly affect the Altman Z-Score category.

4.3 Comparison between Z-Score and Bank Assets

Assets are assets owned by companies to be used to carry out operational activities.

According to IAI, the definition of assets is the resources controlled

by the company as

a result of events that occurred in the past and bring economic benefits in the future for

the company. With

assets owned, the bank can use it to improve business continuity to

avoid

bankruptcy. Here is a comparison of the Z-Score value with the assets owned by

the bank:

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

298

BPD Type 2014 2015 2016 2017 2018

Aceh

Total Asset 16,375,138,309,571 18,590,014,442,084 18,759,190,948,558 22,612,006,926,978 23,095,158,779,296

Z-Score 1,197 1,361 1,551 1,368 1,476

Sumatera

Utara

Total Asset 23,389,209,268,233 24,130,113,107,232 26,170,043,788,235

28,931,823,934,130 28,121,107,028,840

Z-Score 1,227 1,191 1,141 1,174 1,209

Sumsel

Babel

Total Asset 16,072,595,700,887 16,515,086,293,124 18,911,353,525,089 22,145,410,143,202 25,672,239,733,320

Z-Score 0,939 0,974 1,226 1,287 1,221

Bengkulu

Total Asset 3,920,719,978,000 4,607,038,828,000 5,136,647,584,000 5,865,005,396,000 5,893,387,816,082

Z-Score 1,418 1,345 1,344 1,491 1,409

Sumatera

Barat

Total Asset 18,017,897,548,922 19,448,300,127,447 20,616,860,447,266 21,371,463,635,573 23,190,691,424,930

Z-Score 1,288 1,450 1,230 1,495 1,223

Lampung

Total Asset 4,987,459,199,385

5,835,227,784,316 5,367,473,702,955 5,979,450,593,305 7,348,167,382,969

Z-Score 2,064 2,035 2,230 2,200 2,145

Jambi

Total Asset 5,779,858,202,959 6,580,730,164,473 7,591,715,071,059 9,526,848,629,322 10,895,786,868,743

Z-Score 1,616 1,514 1,525 1,810 1,866

Riau

Total Asset 18,017,897,548,922 19,448,300,127,447 21,220,939,642,979 25,492,549,495,353 27,414,272,407,258

Z-Score 1,288 1,450 1,426 1,519 1,528

Based on the above table, it appears that the decreasing asset bank the assets the

Bank of Sumatra Utara in 2017 to 2018, while the value of the Z-Score even increase.

Another bank that experienced a decline was Bank Lampung in 2015 to 2016. In the

same year, the

bank's Z-Score also increased. In addition to the decline, there were

BPDs that experienced an increase in total assets, namely Bank Aceh in 2014 to 2015,

this increase was also followed by an increase in the Z-Score

. The increase in assets

also occurred at the North Sumatra BPD in 2014 to 2015, but the Z-Score value actually

declined. This also happened to other BPDs as seen in the table above. With this result,

it can be concluded that the increase in

assets does not directly increase the Z-Score

value.

5 Conclusion

The conclusions of this study are:

1. Of the 8 (eight) Regional Development Banks in the Sumatra Region, none of the

BPD is included in the Healthy category, all are in the Risky and Bankrupt

categories.

2. Altman Z-Score values starting from the highest are Lampung Bank, Jambi Bank,

Riau Bank, Bengkulu Bank, Aceh Bank, West Sumatra Bank, North Sumatra

Bank, and Sumsel Babel Bank.

3. The bank that got the Z-Score in the category of Bankrupt was the Bank of South

Sumatra Babel in 2014 and 2015.Until 2018, the value of the Z-Score able to enter

the Vulnerable category. Thus, it can be concluded that the Altman Z-Score

bankruptcy prediction has not been proven for banking companies, especially

Regional Development Banks, for 5 (five) years.

4. BPD grouping based on capital value shows that BPD in Sumatra region is still in

BUKU I and BUKU II.

5. Comparison of the Z-Score value with bank capital, is not able to show the

relationship between the two hectares.

6. The increase in assets does not directly increase the Z-Score value.

Analysis of Bankruptcy Prediction of Regional Development Banks (BPD) using the Altman Z-Score Method

299

Acknowledgment. We are very grateful to the University of Jambi's Economics and

Business Faculty for funding this research through the DIPA PNBP for the Research

Group for FY 2019.

References

Adnan dan Taufik. 2001. Analisis Ketepatan Prediksi Metode Altman Terhadap Terjadinya

Likuidasi Pada Lembaga Perbankan [ Kasus Likuidasi Perbankan Di Indonesia ].

Altman, Edward I. (1968): Financial Ratios, Discriminant Analysis and the Prediction of

Corporate Bankruptcy. In: The Journal of Finance, 22(4), 589-609.

Altman, Edward I. (1983), Corporate Financial Distress: A Complete Guide to Predicting,

Avoiding, and Dealing With Bankruptcy, USA: John Willey & Sons.

Altman, Edward I. (2000), Predicting financial distress of companies: Revisiting the Z-score and

ZETA® models

Ariesco . 2015. Analisis Model Altman Z-Score Untuk Memprediksi Financial Distress Pada

Bank Yang Listing Di Bei Tahun 2010 – 2013.

Buletin Ekonomi Moneter dan Perbankan, September 1998

Data Reuters yang dikutip detikFinance, Rabu (21/8/2013

Kasmir. 2014. Bank dan Lembaga Keuangan Lainnya. Edisi Revisi 2014.Jakarta: Raja Grafindo

Persada.

Kusdiana. 2014. Analisis Model Camel Dan Altman’s Z-Score Dalam Memprediksi

Kebangkrutan Bank Umum Di Indonesia (Studi Pada Bank Umum Yang Tercatat Di Bursa

Efek Indonesia Tahun 2007-2011).

Undang-undang Perbankan No. 10 tahun 2008 tentang Perubahan Atas Undang-Undang Nomor

7 Tahun 1992 Tentang Perbankan

Peraturan Otoritas Jasa Keuangan Nomor 4/POJK.03/2016 tentang Penilaian Tingkat Kesehatan

Bank Umum

Peraturan Bank Indonesia Nomor 13/1/PBI/2011 tanggal 5 Januari 2011 tentang Penilaian

Tingkat Kesehatan Bank Umum

Peraturan Bank Indonesia Nomor 6/10/PBI/2004 tentang Sistem Penilaian Tingkat Kesehatan

Bank Umum

Statistik Perbankan Indonesia-Vol. 17 No. 9 Agustus 2019. Otoritas Jasa Keuangan

World Bank. 1998. The World Bank annual report 1998 (English). Washington DC; World Bank.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

300