The Efficient Fintech of Indonesian Zakat Institution based on

Muzakki's Psychology

Farikha Amilahaq

1

, Provita Wijayanti

1

, Noor Emilina Mohd Nasir

2

and Suraya Ahmad

2

1

Universitas Islam Sultan Agung, Kaligawe Raya Street, Semarang City, Indonesia

2

Universiti Technology of Mara, Dungun, Malaysia

Keywords: Muzakki’s Psychology, Mass and Non-mass Indonesian Zakat Institution, Financial Technology Services,

Digital Payment.

Abstract: This study aims to analyze the efficiency of the Indonesian Zakat Institution (IZI) based on the psychology

of Muzakki (Muslims who pay zakat). The method is done by comparing the psychological conditions

between the Muzakki of IZI Mass (their workplace is bounded by a certain IZI), with Muzakki who pay

independently (their workplace is not tied to a particular IZI). The respondents of the study consists of 78

IZI non-Mass Muzakki and 70 IZI-Mass Muzakki. The regressions analysis is done using SmartPLS. The

result shows that IZI Mass is unable to optimize the benefits of digital zakat payment service. Because the

psychology of Muzakki has not reached the right level to pay zakat (the awareness and the understanding

about the obligation to pay zakat), but they have must did it. Meanwhile independent respondents belonging

to IZI Non-Mass have a higher level of compliance. That is why IZI especially IZI Mass need to improve

their socialization and education towards Muzakki and young Muslims (prospective Muzakki), and also

informing the statements of IZI’s zakat management toward the community, especially toward Muzakki,

then offer convenience services for paying the zakat.

1 INTRODUCTION

1.1 Background

Zakat has been concerned by the Indonesian

government since 1999 by arose the Law on the

Management of Zakat. The regulation is updated by

the Act No. 23 of 2011 about the Management of

Zakat, and still used till now. The government's

concern to the zakat management has increased

because the majority of Indonesian people are

Muslims.

Zakat is one of the pillars of Islam that must be

done by Muslims when they have reached the

requirement of zakat obligation, and muzakki can be

regarded as kafir (infidel) if they deny such

obligation (Kurnia & Hidayat, 2008, p. 4). Indeed,

zakat is not just a gift from rich Muslim society to

the poor ones. However, zakat is an obligation that

must be given to the rightful person. The rightful

person is called as mustahiq, it consists of the eight

(8) types of mustahiq called as 8 asnaf i.e.; the poor

and needy people, slaves, fisabilillah (people who

struggle or dedicate their lives in the way of Allah),

muallaf (Muslims newbie), gharimin (people who

have debt), ibn sabil (travelers who run out of

supplies), and amil (zakat board).

Infact, the national collection fund of Zakat,

infaq, and Sodaqoh (charity) in Indonesia is only Rp

3.17 trillion in 2015. Meanwhile, the potential of

zakat in the same year is almost 100 times from the

collection, it is Rp 286 trillion (BAZNAS, 2017, p.

6). This phenomenon gap raises a question of how to

increase the zakat collection.

In order to increase the collection, some

researchers try to analyze the condition of muzakki.

So the compliance behaviour to pay zakat will

increase. (Sukri, Wahab, & Hamed, 2016) has

examined the behavior of obedience to paying Zakat

of gold in Universiti Utara Malaysia (UUM)

environment, where the results of his research

indicate that one of the factors that can influence the

related behavior is the individual's own attitude

toward the behavior. However, (Azman & Bidin,

2015) who have researched in UUM found that the

attitude does not have a significant effect on

compliance to pay zakat (savings).

Amilahaq, F., Wijayanti, P., Nasir, N. and Ahmad, S.

The Efficient Fintech of Indonesian Zakat Institution based on Muzakki’s Psychology.

DOI: 10.5220/0009859600002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 11-18

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

11

In the other hand, (Azman & Bidin, 2015) agreed

with (Sukri et al., 2016) that religiosity has no

significant effect on the adherence of paying zakat.

However, long time ago before the research of

(Mukhlis & Beik, 2013) believe that religiosity

affects the behavior of muzakki adherence especially

the people of Bogor Regency where they conduct

research. It is also supported by (F. binti N. A.

Mastura & Zainol, 2015) with his research on

compliance to pay zakat savings of employees of

private and public companies in Malaysia.

The renewal research had been done that

proofing the behaviour of paying zakat could adapt

the planned behaviour theory belongs to (Ajzen,

2006). However, the research also found the

intervension of normative factors that affecting the

models (Amilahaq & Ghoniyah, 2019). The

intervension is such an appeal from the workplace

that the Muslims employee should pay zakat. Then

the office facilites them through deduct automatic

salary. The program is a collaboration with some

Indonesian Zakat Institution (IZI) such as BAZNAS

(National Amil Zakat), LazisMU, and LazisNU.

Then the collaborated IZI can be called as IZI mass,

means the zakat institution who had fixed market.

1.2 Objective

The previous research that found another interesting

phenomenon on zakat management implementation,

need to be proven by analyze the significant

difference. Therefore, this study can be called as

advanced research about zakat of the author.

2 LITERATURE REVIEW

2.1 Zakat Definition

Zakat is the right of others (mustahiq), it is attached

in muzakki’s treasure. Therefore zakat must be

issued by muzakki then it should be distributed to

the right. The definition is confirmed by (Kurnia &

Hidayat, 2008, p. 7), that zakat is not a gift or even a

contribution/tabarru', but the rights of others.

Scientifically, zakat is one of the main

characteristics of the Islamic economic system (MA

Mannan in (Kurnia & Hidayat, 2008, pp. 8–9)). It is

based on the essence of zakat which is one form of

implementation of the justice principle. The six

principles of zakat in Islamic Economics are; the

principles of religious beliefs, the principles of

justice and equity (social goals), the principles of

productivity (unstoppable turnover), the principle of

reason (social responsibility), the principle of

freedom, and the principle of ethics and

reasonableness.

That six principles are implicitly in line with

(Yunus, 2016) opinion that the management of zakat

based on the essence of nature can convert mustahiq

into muzakki, as exemplified in the story of the

Caliph Omar's leadership in which all his people

have become sufficiently capable that the amil at the

time got confused to distribute zakat .

Distributing zakat can also make the halal

treasure of muzakki to be holy, blessing, growing,

either meaningful to Allah. Because it can be

utilized by mustahiq, not to settle only on a muzakki.

This is as stated in QS At Taubah verse 103 and QS

Ar-Ruum verse 39.

2.2 Theory of Planned Behaviour

Theory of planned behaviour first introduced by

Ajzen in 1985. This theory is the development of the

Theory of reaction action. These theories basically

born from knowledge field of the psychologist, as is

Icek Ajzen is known well as the social psychologist.

Based on planned behaviour theory, the

important factor is the tendency to do the behaviour.

The factors affect the intention are; the attitude

toward behaviour, subjective norms, and perceived

behavioural control. The perceived behavioral

control also could be hypothesed as moderating

factor. Therefore, this research is still invloving the

complete model (Ajzen, 2006; Amilahaq &

Ghoniyah, 2019; Bidin, Deraman, & Othman, 2017;

F. Mastura, 2011; Othman & Fisol, 2017; Sukri et

al., 2016).

The zakat compliance behaviour express the

Muzakki’s behavior to pay zakat on income through

IZI. While the attitude of Muzakki express their

personal opinion of the action (the behaviour). It is

based on some indicators i.e. 1) responsibilities, 2)

usefulness of zakat for the Muslim community, 3)

the priority level of paying zakat, 4) feelings of guilt

if not paying zakat, 5) zakat utilization in general, 6)

individual contribution to Muslim society , and 7)

the importance level of Zakat (Ajzen, 2006; F. binti

N. A. Mastura & Zainol, 2015).

The subjective norms is a normative factor that

express the perception about the behaviour from the

people around him, such as family, friends, or

figures/clerics related (Amilahaq & Ghoniyah, 2019;

Fishbein & Ajzen, 2010). While the perceived

behavioural control in this study is focused on the

capability of Muslims in using financial technology

services for zakat payment.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

12

2.3 Financial Technology Services

Perceived behavioral control refers to individual

perceptions of his ability to implement a behavior

(Ajzen, 2006). Based on this explanation, it can be

said that the perceived behavioral control in this

study is how much individual’s confidence can

affect to applying the behaviour. This factors

becoming the main study of the research because of

the constructs (indicators) reflect the use of high

technology in zakat transaction. The factor also

become the reason why zakat payment through

deduct automatic salary is exist. It is the financial

technology services served by the workplace along

with the IZI Mass. It is believed could increase the

ability to implement the behaviour. By the facility

served, Muzakki could pay their zakat easier.

As for the financial technology services served

by non Mass IZI are. the zakat payment by mobile

banking services; zakat payment via virtual money

collaborated with some digital platform such as Go-

Pay, Tokopedia, Bukalapak, and Paytren. Also IZI

could open zakat payment via popular website such

as kitabisa.com, even open their platform such as

sharinghappines.com which is held by IZI named

Rumah Zakat.

2.4 Zakat Understanding

Knowledge is one of religiosity dimension proposed

by (Stark & Glock, 1974, pp. 14–16). Religious

people are expected to increase their knowledge so

that the application of religious actions will be done

properly according to religious provisions. Zakat

which is part of the worship behavior toward Allah

SWT (pillars of Islam), as well as a behavior of

muamalah, is also inseparable from the various

provisions that have been regulated such as nishab

and haul. So it is important for muzakki for having

the comprehension in order to apply the behavior of

paying zakat wisely.

Based on those explanations, it can be said that

in this study, the knowledge meant is knowledge of

muzakki about zakat and various things that

encompass it, such as zakat compulsory law, zakat

obligatory terms or conditions such as nishab and

haul, and the virtue of zakat.

2.5 Trust on Indonesian Zakat Institute

(IZI)

Mayer, Davis, & Schoorman (1995) define trust as a

person's willingness, including taking risks, on the

actions of others based on the hope that the other

person will take important actions for the person

who believes them, without having any supervision

and controlling.

The trust in this research means trust of muzakki

toward IZI. Muzakki will authorize the distribution

of Zakat funds on IZI. Such trust is arised because of

the IZI’s ability to carry out its responsibilities as a

zakat manager. This responsibility is in accordance

with the expectations of muzakki and in accordance

with the provisions of the Shari'a. This capability

also can proven by a wide range of distribution and

management of ZIS fund distribution, in order to

achieve optimal utilization of ZIS fund. It also can

be seen by the IZI’s capability in accounting for ZIS

fund management reporting toward muzakki,

government, and Allah SWT.

The aspect used by the writer to measure the

trust of muzakki toward amil zakat institution in this

research are due to the seven core values that

underlie the building of a trust (Wibowo, 2006), they

are; openness, competence, honesty, integrity,

accountability, sharing, and rewards.

2.6 Intention

Tendency of person to apply a behavior is a

definition by (Ajzen, 2006). Meanwhile, the

intention to pay zakat is the first way to do worship

as a form of obedience to Allah SWT (Kurnia &

Hidayat, 2008, p. 37). The intention of this study

consists of the tendency of a person to pay zakat

through IZI, as has been exemplified by rosulullah’s

friend at the time that is paying through amil zakat.

The number of zakat can be calculated by using

nishab (and haul). It shows the application of zakat

paying behavior needs to be preceded by preparation

such as calculating whether a person is obliged to

pay zakat and how much zakah to be paid. While the

implementation of zakat paying behavior through

IZI also needs to start from finding amil zakat of

muzakki that they can contact and trust. Thus it can

be said that the tendency in the intention is not only

inward but also the real preparation of a person. In

this study, the measurement of intention is reflected

by the indicators stated by (Ajzen, 2006).

2.6.1 Intention Effect on Behavior

Intentions could indicates a person's tendency to

reject or accept, interested or disinterested, with

particular behavior (Fishbein & Ajzen, 2010), and

intention can also be said as a sign of one's readiness

to apply a behavior (Ajzen, 2006). They both believe

The Efficient Fintech of Indonesian Zakat Institution based on Muzakki’s Psychology

13

that intention is a very influential factor to predict

certain behaviors.

2.7 Difference Behaviour of Muzakki

Previous research has analyzed the efficiency of the

Indonesian Zakat Institution (IZI) by dividing it into

two groups, namely IZI which is related to certain

organizations (mass / IZI Massa) and IZI that do not

have a relationship or connection with certain

organizations (independent IZI). Therefore this

study aims to analyze the efficiency of the IZI’s

connection based on the view of the psychology of

Muzakki (Muslims who pay zakat). The method is

done by comparing the psychological conditions

between the Muzakki from the organization that is

bounded by a certain IZI and Muzakki paying

independently (the organization is not tied to a

particular IZI). The relationship owned by the

organization with IZI is the policy of an

organization/company/institution to implement a

zakat payment through salary reduction where the

certain IZIs become amil zakat (the IZI Mass).

Therefore, in this study only hipothesing one, it

is whether any difference behaviour (Muzakki's

Psychology to Pay Zakat), between the Muzakki

who pay zakat through Mass IZI, with the

Muzakki who pay zakat volunteerly, it is by the

non Mass IZI.

3 METHODOLOGY

Questionnaires consist of 11 points of respondent

identity / Muzakki, 47 open questions with a Likert

scale of 1-7, and 7 closed questions. Nevertheless,

there is a possibility of more in-depth interviews

with practitioners in the Zakat institutional sector in

Indonesia to strengthen the results of this research.

The data obtained from the questionnaire was

processed by using Partial Least Square (PLS)

program. Partial Least Square analysis is a powerful

analytical method because it does not have to

assume data with certain measurements. It can be

applied to any data scale, and does not require many

assumptions fulfillment (Ghozali & Latan, 2015).

The respondents of the study consists of 78

Muzakki who pay zakat independently (IZI non-

Mass), and 70 Muzakki who pay zakat through their

workplace (Mass IZI). As for the analysis is done by

three regression usig SmartPLS. Two regressions are

for comparing the difference between two kind of

respondent, and the third regression is using dummy

variable in testing the significant difference.

4 RESULT AND ANALYSIS

First analysis is done by arrange the descriptive

statistic. This study devide the demographics

elements based on the type of respondent.

Table 1: Descriptive Statistic of IZI non-Mass Muzakki

and IZI Mass Muzakki.

Description Criteria

IZI Non-

Mass

Muzakki

IZI

Mass

Muzakki

Sex

Male 32 34

Female 46 36

Age

19-35 years old 47 33

36-50 years old 17 22

51-58 years old 10 9

No Answer 4 6

The last

education

level

High school 10 6

Diploma 3 20 14

Bachelor 39 31

Master 5 6

Doctoral 3 1

Others 1 7

Marital

Status

Single 29 17

Married 47 52

others

(widower/

Widow)

2

No Answer - 1

Experience

of paying

Zakat in

ZMO

< 1 year 34 15

1-5 years 26 17

> 5 years 12 35

No answer 6 3

Jobs

Entrepreneurs 14 -

Civil Servant 14 43

Private

employees

40 25

Others 10 2

Income

Range

< Rp 4,480,000 40 37

Rp 4,480,000 -

Rp 6,055,200

12 26

> Rp 6,055,200 22 5

No answer 4 2

Total Respondent (N) 78 70

Source: Author’s Document (2019).

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

14

IZI non Mass Muzakki is 78 respondents with

various background and profession. As for the 70 of

IZI Mass Muzakki is dominated by worker,

especially civil servant worker. It is because public

institution has collaborated with National Amil

Zakat Institute such as BAZNAS, to manage the

zakat of the employee. So do with some private

institutions who have collaborated with some IZI,

such as Sultan Agung High School with Lazis Sultan

Agung in Semarang City, and some Islamic High

School that collaborate with LazisNU, LazisMu, or

National Amil Zakat Institute (Baznas). Those

collaboration in kind of zakat management of their

employee, such as the financial technology services

to take the zakat automatically when the salary is

distributed.

The variables analyzed is using more

comprehensif model than the previous study

(Amilahaq & Ghoniyah, 2019). This study is not

only involve variables from Planned Behaviour

Theory, but also adding trust and religios factors in

affecting behaviour. Moreover, the perceived

behaviour control is put as moderating variable. The

previous study believed that higher capability of the

person in perceived behavioral control, will

moderate the other factors toward behaviour. Thus is

inline with the existence of technology. When the

person is able to use the technology to pay zakat,

then it will be easier for them to do so. Therefore,

perceived behavioral control in this study is focused

on the use of financial technology services in zakat.

Three regression model has been analyzed and

showed some differences relationship towards

behaviour. It can be said that for difference

background of respondent, they showed different

relation. As for the analysis result could be

summarized on Table 2 as below.

Based on the Table above. We can see the

different relationship between two kind of

respondents. Subjective norms as an external factor

of a person, directly affects towards behaviour. It

happens to the two group. However, the impact is far

higher happen in IZI Mass Muzakki. It strengthen

the fact that the behaviour of paying zakat by

respondent of IZI Mass is caused by the external

pressure, such as the strong persuation of the

workplace.

For IZI non mass Muzakki, arguments from

around also could increase the trust toward IZI. As

for the IZI mass Muzakki, although they do the

payment due to the external factor, it can not

increase their trust towards IZI. Thus because the

persuassion to two cluster is in different way. The

one could be soft persuasion due to other’s

experience and understanding about paying zakat

through IZI, while the another could be strong

persuassion to do the payment through their

workplace, without any comprehensif explaination.

Table 2: The Results of The Three Regression Analyzes.

No. Relationship

IZI Non Mass -

Muzakki

IZI Mass -

Muzakki

All Muzakki

1 Attitude -> Intention Not significant Not significant Not significant

2 Attitude -> Trust significant Not significance Significant

3 Int*PBC -> Behaviour Not significant Not significant Not significant

4 Intention -> Behaviour Not significant Not significant Not significant

5 PBC -> Behaviour Not significant Not significant Not significant

6 PBC -> Intention Significant Significant

7 PBC -> Trust Significant Significant Significant

8 Religiosity -> Behaviour Not significant Significant Not significant

9 Religiosity -> Intention Not significant Not significant Not significant

10 SN -> Behaviour Significant Significant Significant

11 SN -> Intention Significant Significant Significant

12 SN -> Trust Significant Not significant Significant

13 Trust -> Behaviour Significant Not significant Significant

14 Trust -> Intention Significant Significant Significant

15 Dummy -> Behaviour - - Not significant

16 PBC -> Trust -> Behaviour Significant Not significant Significant

17 Attitude -> Trust -> Intention Significant Not significant Significant

18 PBC -> Trust -> Intention Significant Significant Significant

19 SN -> Trust -> Intention Not significant Not significant Significant

Source: SmartPLS 3 (2019).

The Efficient Fintech of Indonesian Zakat Institution based on Muzakki’s Psychology

15

Perceived behavioral control significantly

affecting the behaviour for the IZI non-mass cluster,

through trust. It strengthen the allegation that

Muslims will choose to pay zakat through IZI

because of the easiness to access the institution.

Perceived behavioral control in this study is focused

on the capability to use the financial technology

served by many IZI, such as paying zakat via online,

bank transfer, through some marketplace aplication

such as bukalapak and tokpedia, and through

website of charity. In fact, the financial technology

served is not only ease the transaction but also be

able to publish the some charity program such as

donation for the poor, orphaned, serously ill

Muslims, mosque construction, etcetera.

As for the zakat payment through salary

reductions is digital zakat payment served by some

workplace. The existence is notes on dummy

variable in this study. The result of third regression

shows the not significant relationship of dummy

variable.

Thus, this study still could not provide the

significant prove that there is difference of

phenomenon between Muzakki who pay

independently, with the Muzakki who get strong

persuasion from their workplace. However, the

existence of difference relation of other factors can

be seen by comparing the first and second

regression. Atleast, it can explain how the

psychological of two type of Muzakki are different,

as has been explained on paragraphs above.

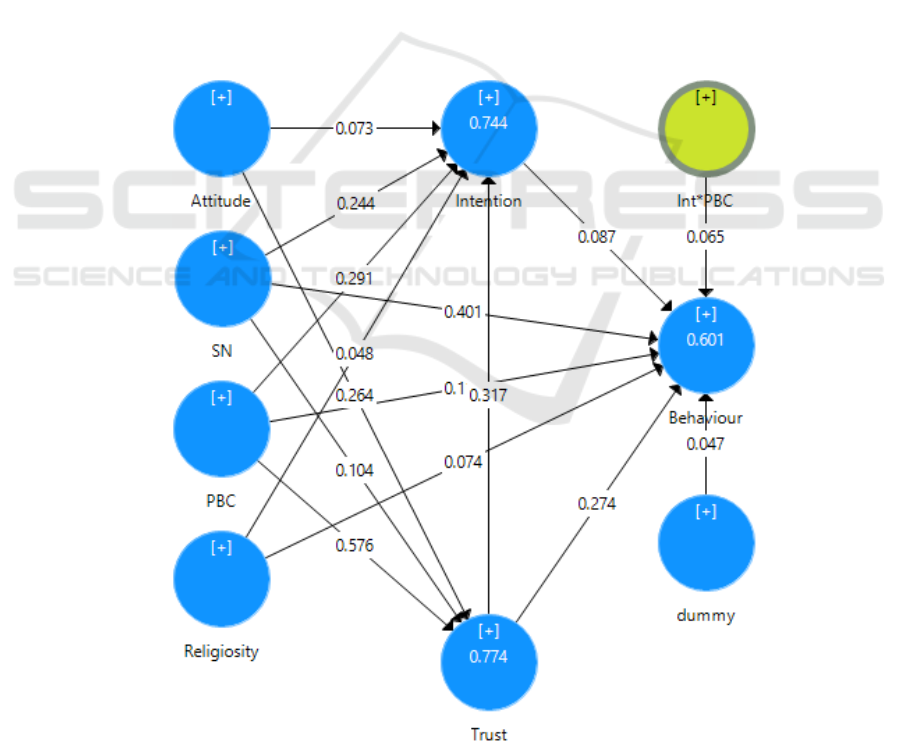

The result of regression also can be served on

Figure 1.

5 CONCLUSION

The existence of financial technology services ease

the access of transaction and the access to get

information about IZI. Muzakki will be easier to pay

zakat through online platforms, and will be easier to

update

the information about zakat management

Figure 1: Result of Third Regression; Model with Dummy Variable. Source: Output of SmartPLS, 2019. Notes: The

number displayed on the model reflect the regression coefficient. As for the complete result of three regression can be

shown on the table below.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

16

Table 3: Result of Three regression Model.

No. Relationship

IZI Non Mass - Muzakki IZI Mass – Muzakki All Muzakki

Coefficient P Values Coefficient P Values Coefficient P Values

1 Attitude -> Intention 0,224 0,161 0,023 0,863 0,073 0,481

2 Attitude -> Trust 0,395 0,004 0,089 0,471 0,264 0,008

3 Int*PBC -> Behaviour 0,111 0,144 0,000 0,996 0,065 0,152

4 Intention -> Behaviour 0,169 0,287 0,029 0,870 0,087 0,504

5 PBC -> Behaviour 0,215 0,169 0,039 0,860 0,115 0,366

6 PBC -> Intention 0,029 0,862 0,419 0,001 0,291 0,003

7 PBC -> Trust 0,429 0,001 0,733 0,000 0,576 0,000

8 Religiosity -> Behaviour -0,062 0,664 0,279 0,089 0,074 0,489

9 Religiosity -> Intention 0,076 0,477 0,016 0,826 0,048 0,456

10 SN -> Behaviour 0,295 0,014 0,557 0,000 0,401 0,000

11 SN -> Intention 0,303 0,001 0,179 0,019 0,244 0,000

12 SN -> Trust 0,106 0,076 0,142 0,122 0,104 0,055

13 Trust -> Behaviour 0,353 0,034 -0,026 0,890 0,274 0,030

14 Trust -> Intention 0,304 0,050 0,338 0,003 0,317 0,000

15 dummy -> Behaviour 0,047 0,423

16 PBC -> Trust -> Behaviour

0,151

0,038

-0,019

0,894

0,158 0,025

17 Attitude -> Trust -> Intention 0,120 0,088 0,030 0,474 0,084 0,034

18 PBC -> Trust -> Intention 0,130 0,085 0,248 0,006 0,183 0,002

19 SN -> Trust -> Intention 0,032 0,223 0,048 0,159 0,033 0,097

Source: Output of SmartPLS 3, 2019.

reports of IZI. This factor is covered on perceived

behavioral control variable, as reflection of the

capability of Muslims to implement the behaviour

through online platforms.

In other way, strong persuasion of external

environment could also encourage the Muslims to do

so, such as the strong persuasion from the workplace

to pay zakat simply and automatically, it is through

salary reductions, along with payroll system

execution. However, the Muzakki who pay zakat

automatically through their workplace (IZI Mass

Muzakki) is not ready psychologically.

The study showed that there really is exist the

difference psychology between the Muzakki who

pay zakat volunteerly, with the Muzaki who pay

zakat normatively. Therefore it strengthen the

important of socialization and education toward

society about the understanding of zakat. Therefore,

their worhship will be worth. So that is why IZI

especially IZI Mass need to improve their

socialization and education (syi'ar) towards Muzakki

and young Muslims (prospective Muzakki), and also

informing the statements of IZI’s zakat management

toward the community, especially toward Muzakki,

in order to achieve their willingness and obedience

to pay zakat (Muzakki’s psychology), only then

offer convenience services for paying zakat.

REFERENCES

Ajzen, I. (2006). Theory of Planned Behavior. Retrieved 4

November 2017, from people.umass.edu/ajzen/

tpb.background.html

Amilahaq, F., & Ghoniyah, N. (2019). COMPLIANCE

BEHAVIOR MODEL OF PAYING ZAKAT ON

INCOME THROUGH ZAKAT MANAGEMENT.

SHARE: Jurnal Ekonomi Dan Keuangan Islam, 8(1),

114–141. https://doi.org/10.22373/share.v8i1.3655

Azman, F. M. N., & Bidin, Z. (2015). Factors Influencing

Zakat Compliance Behavior on Saving. International

Journal of Business and Social Research, 05(01), 118–

128.

Baznas. (2017). Outlook Zakat Indonesia 2017. Jakarta.

Retrieved from https://www.puskasbaznas.com/

The Efficient Fintech of Indonesian Zakat Institution based on Muzakki’s Psychology

17

images/outlook/OUTLOOK_ZAKAT_2017_PUSKAS

BAZNAS.pdf

Bidin, Z., Deraman, M. J., & Othman, M. Z. (2017).

Individual Determinats of Zakat Compliance Intention

on Saving. In A. H. M. Noor, R. Nordin, M. S. A.

Rasool, D. Sharif, N. Rabu, & F. Johari (Eds.), 5th

South East Asia International Islamic Philantrophy

Conference 2017 (pp. 365–376). Melaka, Malaysia:

Center for Islamic Philanthropy and Social Finance

(CIPSF). Retrieved from http://www.cipsf.my/seaiipc

Fishbein, M., & Ajzen, I. (2010). Predicting and

Changing Behavior, The Reasoned Action Approach.

New York: Psychology Press, Taylor & Francis

Group.

Ghozali, I., & Latan, H. (2015). Partial Least Squares,

Konsep, Teknik, dan Aplikasi menggunakan Program

SmartPLS 3.0 (untuk Penelitian Empiris) (Second).

Semarang: Badan Penerbit Universitas Diponegoro

Semarang. Retrieved from http://onesearch.id/

Record/IOS3107.UMS:57482

Kurnia, H. H., & Hidayat, H. A. L. (2008). Panduan

Pintar Zakat. (D. N. M. A. Nuraeni, Ed.). 2008:

QultumMedia.

Mastura, F. (2011). Zakat Compliance Intention Behavior

on Saving Among Universiti Utara Malaysia’s Staff.

Universiti Utara Malaysia, Kedah, Malaysia.

Mastura, F. binti N. A., & Zainol, B. B. (2015).

Determinants of Attitude Toward Zakat on Saving.

Australian Journal of Basic and Applied Sciences,

9(31), 7–13. Retrieved from www.ajbasweb.com

Mukhlis, A., & Beik, I. S. (2013). Analysis of Factors

Affecting Compliance Level of Paying Zakat : A Case

Study in Bogor Regency. Jurnal Al-Muzara’ah, I(1),

83–106.

Othman, Y., & Fisol, W. N. M. (2017). Islamic Religiosity

, Attitude and Moral Obligation on Intention of

Income Zakat Compliance : Evidence from Public

Educators in Kedah. International Journal of

Academic Research in Business and Social Sciences,

7(2), 726–737. https://doi.org/10.6007/IJARBSS/v7-

i2/2680

Stark, R., & Glock, C. Y. (1974). American Piety: The

Nature of Religious Commitment. London: University

of California Press. Retrieved from

https://books.google.co.id/books/about/American_Piet

y.html?id=MlN6qjKQtqIC&redir_esc=y

Sukri, N. F. A. M., Wahab, N. A., & Hamed, A. B. (2016).

Compliance to Pay Zakat on Gold: A Study on UUM

Staff. Global Review of Islamic Economics and

Business, 4(2), 90–101.

Wibowo. (2006). Manajemen Perubahan. Jakarta: PT

Grafindo Persada.

Yunus, M. (2016). Analisis Pengaruh Kepercayaan,

Religiusitas, dan Kontribusi terhadap Minat Pedagang

Mengeluarkan Zakat di Baitul Mal (Studi Kasus pada

Pedagang Pasar Los Lhokseumawe). At-Tawassuth,

1

(1), 95–124.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

18