Elements of Consideration and Strategy in Making Decisions on

Islamic Commercial Bank Public Shares Issuance

Ida Syafrida

1

,

Indianik Aminah

2

, Taufik Awaludin

3

1,2

Accounting Department, Politeknik Negeri Jakarta, Kampus UI Depok, Indonesia

3

Department of Management, Economic Faculty, Pamulang University, Pamulang, South Tangerang

Keywords: element & strategy, Islamic commercial bank, public shares issuence

Abstract This study aim to formulate the dominant element and sub-elements of strenght, weakness, opportunity,

threat (SWOT) and the strategies in increasing funding sources through of public shares issuance in Islamic

Commercial Banks (ICB). The research problem related to ICB low market share, 5.94% of national

banks in Sept 2018. This is due to the lack of capital and industrial scale. For this reason, the ICB needs to

increase external funding sources through the issuance of public shares. From the 13 BUS in Indonesia at

Sept 2018, only 3 BUS issuing public shares. In an optimal capital structure, BUS can develop faster and

will encourage the growth of the Indonesian Islamic financial industry. This study uses qualitative and

quantitative methods by Analytical Network Process (ANP) using primary data sourced from in-depth

interviews to explore the knowledge and experience of the ICB emiten expert practitioners. The dominant

element of SWOT is strength and followed by opportunity. The dominant sub-elements are owner support

(strength), decreasing financial performance (weakness), broad investor base (opportunity), complex

emission formality (threat). Public share issuance strategies related to the timing of emissions, value and

price of emissions, underwriters, dividend payment policies, and use of the proceeds of emission funds.

1 INTRODUCTION

The Islamic financial services industry in Indonesia

experienced significant growth. Indonesia is

predicted to become one of the countries that

become a global player in the Islamic financial

industry in the world. Indonesia ranks 10th after

Qatar and Jordan in the development of the world's

halal industry which includes Islamic Finance

(Reuters, 2014)

. In terms of investment, Indonesia in

the top three after Malaysia and the United Arab

Emirates

(United Nation Conference on Trade and

Development, 2015). Indonesia's 6th position in the

world Islamic finance industry after the United Arab

Emirates and Kuwait, up one rank compared to 2015

(

World Bank Group, 2016). Indonesia is also listed

as the country's largest sukuk issuer in the world

2016.

Since December 2017 there are 13 Sharia

Commercial Bank (ICB), 21 Sharia Business Unit

(SBU), and 167 Sharia Rural Bank in Indonesia.

Data on ICB and SBU during the period 2013-2017,

total assets increased by an average of 17.02% per

year, financing disbursed per year on average rose

11.03%, and third party funds experienced an

average increase of 16.47% per year. Likewise, the

role of Islamic banking intermediation is empirically

better, with the average Financing to Deposit Ratio

for the 2013-2017 of 91.86% compared to

conventional banking Loan to Deposit Ratio

(90.39%). The role of intermediation is very

important because Islamic banking acts as a

commercial banking and investment banking that

can drive the real economy sector and productivity.

On the other hand, the Financial Services Authority

(FSA) in the 2015-2019 Islamic Banking Road Map

explained that there were several strategic issues

faced and had an impact on the development of

Islamic banking including inadequate capital and

small scale industries and individual banks. For this

reason, policies need to be directed towards

strengthening capital and business scale, because the

market share of sharia banking to national banks in

December 2017 only reach 5.74%. So, that the

contribution of Islamic banks to the national

economy is still not optimal. Until the end of

December 2017, from the 13 ICBs there were only

Syafrida, I., Aminah, I. and Awaludin, T.

Elements of Consideration and Strategy in Making Decisions on Islamic Commercial Bank Public Shares Issuance.

DOI: 10.5220/0009873000002905

In Proceedings of the 8th Annual Southeast Asian International Seminar (ASAIS 2019), pages 61-66

ISBN: 978-989-758-468-8

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

61

1 ICB that had been included in the Business Group

Commercial Bank (BUKU) scale 3 (core capital 5

up to 30 trillion Rp). The others of 12 ICBs are in

the BUKU scale 2 and 1 (core capital below 5

trillion Rp). Thus additional funding is needed for

the development of Islamic Banks.

The limitations of Islamic banks' internal funding

sources can be overcome by using external sources

of funds by issuing securities, both debt (bonds or

sukuk) and investments (stocks). Participating

funding sources are more flexible than debt, because

they do not have maturity and there are no routine

financial obligations to investors. If by the end of

2017 the Indonesia Stock Exchange (IDX) recorded

42 conventional banks that were listed as issuers,

only 1 Islamic banks that had made public offerings

and listed their shares on the IDX, namely Panin

Syariah Bank (BPS). In 2018, Bank Tabungan

Pensiun Syariah (BTPNS) and Bank Rakyat

Indonesia Syariah (BRIS) have also gone public. It

is expected that other ICB can follow the 3 ICB in

issuing public shares. According to the corporate

IDX, the issuance of public shares bring benefit new

funding sources; provide competitive advantages for

business development; merge or acquire other

companies by financing through share issuance; and

improve the going concern ability, image and value

of the company. Sulong, Embi, Arifin (2017) shows

that there is no significant difference between the

initial performance of sharia and non-sharia IPOs,

even after controlling for the characteristics of the

IPO.

Based on the description, the problems of Islamic

banks to be examined are related to capital and

industrial scale and individual banks that are still

minimal. This causes Islamic banks to be less able to

develop optimally and compete with conventional

banks. It is expected that with the addition of capital,

Islamic banks can carry out their intermediary roles

more optimally and can contribute more to the

national economy. To increase the funding source, it

is necessary to know the advantages, opportunities,

costs, risks and the factors that are considered by

the ICB in issuing stock securities based on the

knowledge or experience of the emiten and regulator

experts related to the problem.

2 THEORY

Bank capital structure can be sourced from long-

term debt (bonds or sukuk) and equity capital

investment. Equity are securities that give the holder

the right to become a shareholder of the company

that issued the securities. Whereas shares can be

defined as a sign of ownership or ownership of a

person or entity in a company or limited company.

Public offer (go public) according to Undang-

Undang Pasar Modal No. 8 Tahun 1995 is a

securities offering activity carried out by an issuer to

sell securities to the public based on the procedures

stipulated in the Capital Market Law and its

Implementing Regulations. In terms of capital

structure, a public offering is an attempt by the

company to obtain fresh funds from the wider

community or the investor community by issuing

new shares or in other words issuing shares in a

portfolio.

External sources of funds coming from bond or

sukuk and stock investors can increase the capital of

Islamic banks which will impact on increased

financing and assets. According to Manopo (2013)

who examined banks that went public on the IDX

for the period 2008-2010, sales growth, sales

stability, and company size affected the capital

structure. Decision making related to financial

decisions will affect the progress and survival of

banking in the future. Puspita and Kusumaningtias

(2010) conclude that the capital structure of banks

listed on the IDX is important in running their

operational business. Asset structure, profitability,

and dividend policy affect bank capital structure. In

Susyanti (2008), bank profitability has a significant

negative effect, while the growth of bank assets and

liquidity has a significant positive effect on the

financial capital structure of the "X" Bank. Banks

need to consider these factors in determining their

capital structure.

Poulsena and Stegemollerb (2005) study the

movement of assets from private to public

ownership through two alternatives, namely the

acquisition of a private company by a public (sell

out) company or by an initial public offering of

shares (IPO). The results show that companies will

move to public ownership through an IPO when they

have greater growth opportunities. Selling-out seems

to be preferred when managers liquidate more from

the company and when they face financial

constraints. Sulong, et al (2017) is consistent with

previous studies which showed that there were no

significant differences between the initial Shariah

and non-Sharia IPO performance, even after

controlling for the IPO Characteristics. However,

when the level of openness is considered, the

difference in initial returns applies.

ASAIS 2019 - Annual Southeast Asian International Seminar

62

3 METHOD

The research population is a Sharia Commercial

Bank in Indonesia which at the end of 2017

numbered 13 ICB and sharia financial regulators.

The sample of the study consisted of 5 practitioners

from BUS who had made a public offering of shares:

BDPS, BTPNS, and BRIS.

In this study, the main data used is primary data.

Primary data is sourced from indepth interviews to

explore the knowledge and experience of experts of

ICB from Treassury Division and Corporate

Planning Division. The selection of respondents in

this study was carried out by purposive sampling

and convenience sampling. Sampling is included in

the non-probability sample technique. The selected

respondents are experts who have knowledge and

experience and can answer research questions so that

they get theoretical insights (Saunders, Lewis,

Thornhill, 2009). Resource persons from the sample

of study. Additional data in the form of secondary

data obtained from the literature of journals,

working papers, books, and publication reports that

are closely related to research problems.

The initial stage is carried out in-depth interviews

with resource persons with open questions related to

the characteristics of funding sources from public

shares with SWOT (Strength, Weakness,

Opportunity, Threat) approach.

4 RESULT AND DISCUSSION

Based on the results of interviews obtained

information on several elements and sub-elements of

SWOT approach. The classification of these

elements and sub-elements are:

4.1 Strength Elements

In the strenght elements, there are 4 sub-elements

that are considered: a) owner support, b)

management skills, c) size and company reputation,

d) business prospects. This is in line with the results

of the study (Wieland, 2001; Sirgy, 2002; Booth,

2007; Garcia, Durendez, Marino, 2011; Chen, Lin,

Chang, Lin, 2013)

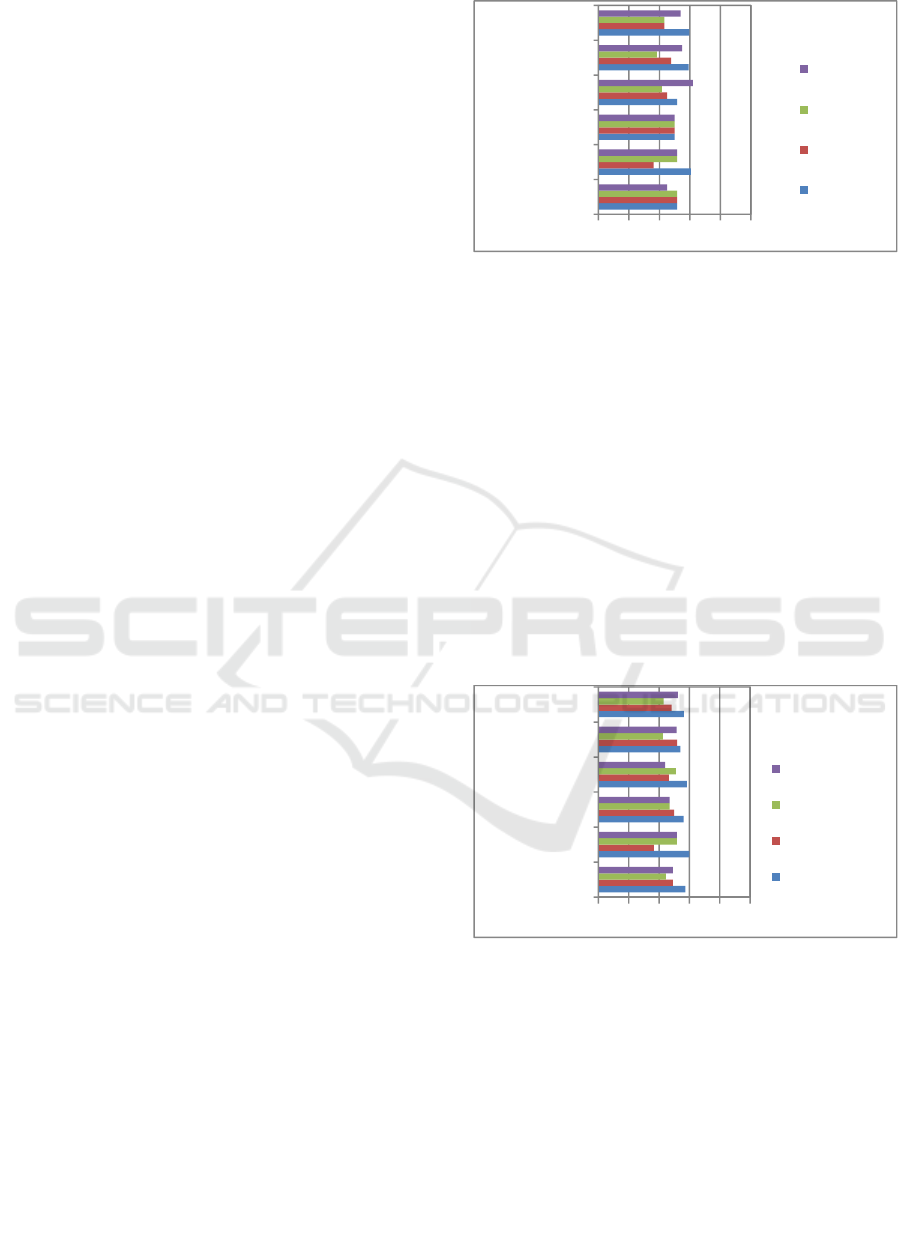

Figure 1. Sub-Elements of Strength

Based on Figure 1 ANP analysis results, overall the

practitioners agreed at 0.179 that the dominant sub-

element of ICB strength in stock issuance was the

owner support followed by business prospects.

4.2 Weakness Elements

The sub-elements of weakness are: a) decreasing

financial performance, b) lack of human resources

knowledge about stock emissions, c) less

management experience in emissions, d) adjustment

of emission preparation processes. This is in

accordance with the results of the study (Brau,

Francis, Kohers, 2003; Lee & Lee, 2008; Chaddad &

Reuer, 2009).

Figure 2. Sub-Elements of Weakness

Figure 2 explains that all practitioners agreed (w =

0.516) that the biggest weakness of ICB related to

stock issuance was the decreasing financial

performance followed by an adjustment of emission

preparation processes.

4.3 Opportunity Elements

Opportunity consist of 4 sub-elements: a) broad

investor base, b) a competent underwriters, c) strong

regulatory support, d) a good investment climate.

0 0.1 0.2 0.3 0.4 0.5

Practitioner 1

Practitioner 2

Practitioner 3

Practitioner 4

Practitioner 5

Total

Strength

W= 0.179

Sub

Elemen 4

Sub

Elemen 3

Sub

Elemen 2

Sub

Elemen 1

0 0.1 0.2 0.3 0.4 0.5

Practitioner 1

Practitioner 2

Practitioner 3

Practitioner 4

Practitioner 5

Total

Weakness

W= 0.516

Sub Elemen 4

Sub Elemen 3

Sub Elemen 2

Sub Elemen 1

Elements of Consideration and Strategy in Making Decisions on Islamic Commercial Bank Public Shares Issuance

63

The statement regarding sub-elements of

opportunity are supported by Bildik & Yilmaz

(2006) and Benninga, Helmantel, Sarig (2005).

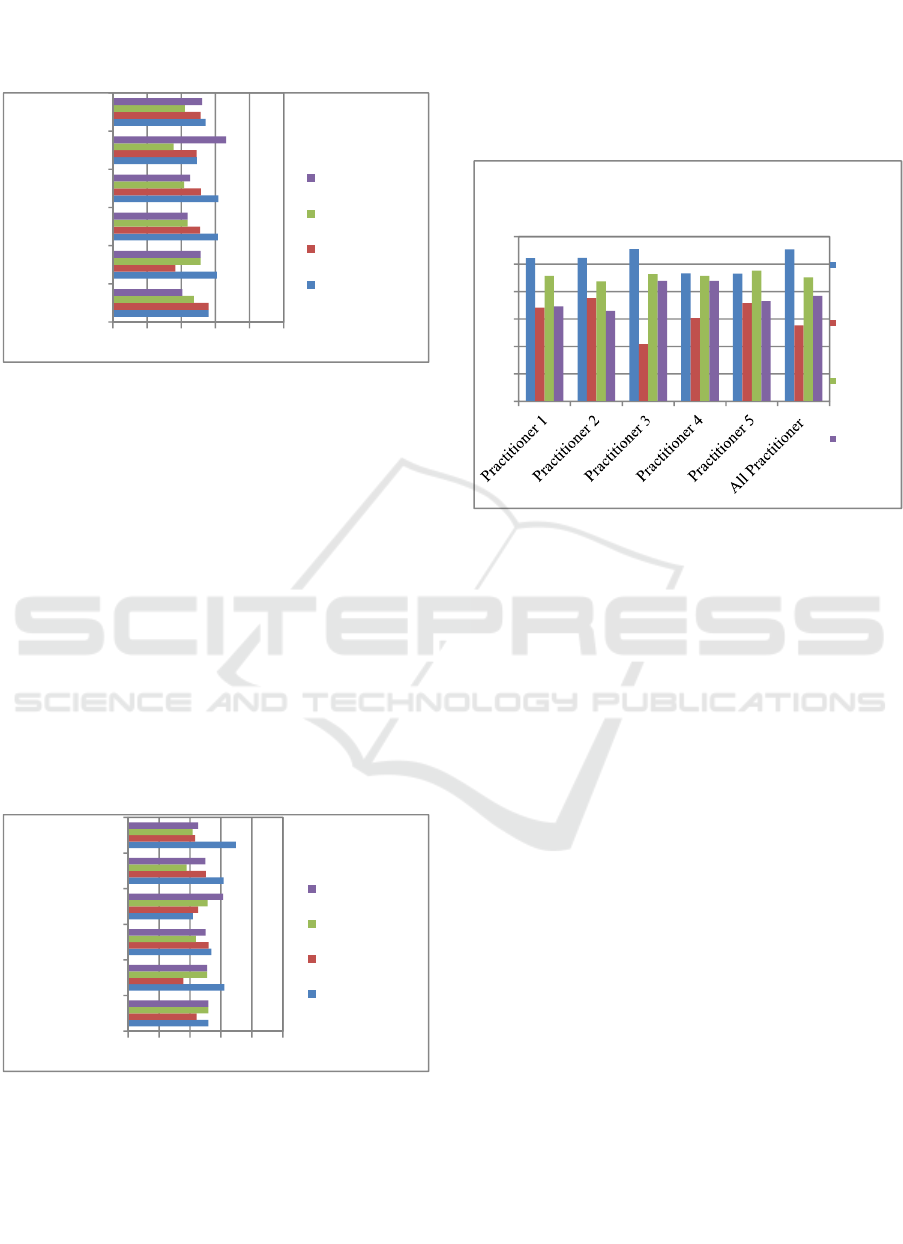

Figure 3. Sub-Elements of Opportunity

The dominant sub-element of opportunity owned by

ICB as consideration for issuing shares according to

the agreement of the practitioner (W = 0.395) is a

broad investor base and then a good investment

climate.

4.4 Threat Elements

The sub-elements that are influenced to threat: a)

complex emission formality, b) competition to get

investors, c) turbulence in capital markets, d) less

stable economic conditions. The research results

that support this statement is Mori (2000), Certo,

Covin, Dalton (2001), Guo, Lev, Zhou (2005,

Harjoto & Garen (2005), Asker, Farre-Mensa,

Ljungqvist (2014).

Figure 4. Sub-Elements of Threat

In accordance with ANP results, the practitioners

chose complex emission formality followed by less

stable economic conditions as the dominant sub-

element of the threat with an agreement level of

0.159.

Strengts, Weaknesses, Opportunities, and Threats

need to be considered by the ICB before deciding to

issue shares as a source of funding. This is related to

the consequences that will be faced by the ICB after

the issuance of shares. ANP results from all SWOT

elements and sub-elements are described as follows:

Figure 5. SWOT Elements

Based on Figure 4, the practitioners have an

agreement of 0.752 to choose the strength and

followed by the opportunity as dominant elements

which becomes the consideration of ICB in issuing

shares as an alternative source of funding. After that,

the new ICB will consider the threats faced and its

weaknesses.

Based on in-depth interviews, there are several

strategies related to the selection in the issuance of

ICB public shares:

a) Emission time

The timing of shares issuance is adjusted to the

bank's business plan by considering macroeconomic

factors in the country of issuance, because it will

affect market conditions that will absorb the stock

offering. The right time based on research and

observations is in the first semester or first quarter,

because investment conditions are generally on the

rise.

b) Emission value and price

Determination of the value of emissions is adjusted

to the needs of bank funds by considering the ability

of issuers to channel funds raised, willingness of

dilution from the owner of the company or holding

company, and estimates of supply and demand or

0 0.1 0.2 0.3 0.4 0.5

Practitioner 1

Practitioner 2

Practitioner 3

Practitioner 4

Practitioner 5

Total

Opportunity

W= 0.395

Sub Elemen 4

Sub Elemen 3

Sub Elemen 2

Sub Elemen 1

0 0.1 0.2 0.3 0.4 0.5

Practitioner 1

Practitioner 2

Practitioner 3

Practitioner 4

Practitioner 5

Total

Threat

W= 0.159

Sub Elemen 4

Sub Elemen 3

Sub Elemen 2

Sub Elemen 1

0.00

0.06

0.12

0.18

0.24

0.30

0.36

Strength

Weakness

Opportunity

Threat

W = 0.752

ASAIS 2019 - Annual Southeast Asian International Seminar

64

potential market that can absorb. Determination of

the price (valuation) of emissions seen from the

results of the calculation of the value of the company

by considering the condition of stock price

fluctuations in the market and benchmarking of

stock prices in the financial industry. The value and

price of the emissions are decided jointly between

the company, the underwriter, and even involving

the holding company.

c) An underwriter

The selection of underwriters is based on previous

collaboration experience by the company or the

holding company. Then another consideration is the

reputation and industry knowledge of the

underwriter, the network owned by the underwriter

and the decision whether emissions are only for the

domestic market or will also be sold abroad.

Determination of the underwriter also through the

selection process (submission of proposals and

presentations), as well as negotiation of emission

costs which normally are in the range of 4%-5%.

d) Dividend payment policy

Determination of dividend payment policy learns

from experience and consultation with the holding

company, market appeal, the company's financial

condition, and the flexibility or agreement of

shareholders for the development of the company.

Dividend policies are generally paid in the range of

20% to 40% can be paid directly the following year

or postponed in the next few years to give the

company time to make a profit.

e) Use of proceeds from emissions funds

The use of the results of the emission funds is

optimized in accordance with those listed on the

prospectus, meaning that it is in accordance with the

initial planning that has been formulated by the

issuer before issuance is made. Proceeds from the

issuance can be used to increase capital, increase

financing, and develop business networks (offices)

of banks and information technology (digital

banking).

5 CONCLUSION

Before issuing shares, ICB needs to consider the

elements of strength, weakness, opportunity, and

threat that influence stock issuance decisions to

understand the positive and negative consequences

of these actions.

ICB's dominant element in considering stock

issuance is the strength followed by opportunity.

The dominant sub-element in the SWOT element:

owner support (strength), decreasing financial

performance (weakness), broad investor base

(opportunity), complex emission formality (threat).

Public share issuance strategies related to the timing

of emissions, value and price of emissions,

underwriters, dividend payment policies, and use of

the proceeds of emission funds.

REFERENCES

Asker, J., J. Farre-Mensa, A. Ljungqvist, 2014. Corporate

investment and stock market listing: A puzzle?. The

Review of Financial Studies, 28(2), 342-390

Benninga, S., M. Helmantel, O. Sarig, 2005. The timing of

initial public offerings, J Financial Economics, 75(1),

115-132

Bildik, R., M.K. Yilmaz, 2006. The market performance

of initial public offerings in the Istanbul Stock

Exchange

Booth, R.A., 2007. Going public, selling stock, and buying

liquidity. Entrepreneurial Bus L J, 2, 649

Brau, J. C., B. Francis, N. Kohers, 2003. The choice of

IPO versus takeover: empirical evidence. Journal of

Business, 76 (4): 583-612

Certo, T.S., J. G. Covin, D. R. Dalton, 2001. Wealth and

the effects of founder management among IPO-stage

new ventures. Strategic Management Journal, 22(6–

7): 641–658

Chaddad, F.R., J.J. Reuer, 2009. Investment dynamics and

financial constraints in IPO firms. Strategic

Entrepreneurship J, 3(1), 29-45

Chen, S.S., W.C. Lin, S.C. Chang, C.Y. Lin, 2013.

Information uncertainty, earnings management, and

longrun stock performance following initial public

offerings. J Business Finance & Accounting, 40(9-

10), 1126-1154

García-Pérez-de-Lema, D., A. Duréndez, T. Mariño, 2011.

A strategic decision for growth, financing and survival

of Small and Medium Family Businesses: Going

Public in an Alternative Stock Market (MAB).

Economics and Finance Review, 1(8), 31-42

Guo, R., B. Lev, N. Zhou, 2005. The valuation of biotech

IPOs. Journal of Accounting, Auditing Finance, 20:

423–459

Harjoto, M., J. Garen, 2005. Inside ownership beyond the

IPO: the evolution of corporate ownership

concentration. Journal of Corporate Finance, 11: 661-

679

Lee, Y.J., J.D. Lee, 2008. Strategy of start-ups for IPO

timing across high technology industries. Applied

Economics Letters, 15(11), 869-877

Elements of Consideration and Strategy in Making Decisions on Islamic Commercial Bank Public Shares Issuance

65

Manopo, W.F., 2013. Faktor-Faktor yang Mempengaruhi

Struktur Modal Perbankan yang Go Publik di BEI

Tahun 2008-2010, Jurnal Riset Ekonomi, Manajemen,

Bisnis, dan Akuntansi, Vol. 1, No. 3

Mori, 2000. SMEs Attitude to Social Responsibility.

January – February

Poulsena, A., M. Stegemmolerb, 2005. Moving from

Public Ownership: Selling Out to Public Firm VS

Initial Public Offerings. University of Georgia-Texas

Tech University

Puspita, G.C., R. Kusumaningtias, 2010. Pengaruh

Struktur Aktiva, Profitabilitas, Kebijakan Deviden

terhadap Struktur Modal pada Perbankan yang

Terdaftar di BEI tahun 2005-2009, Akrual Jurnal

Akuntansi, Vol. 2, No. 1

Reuters, T., D. Standard, 2014. State of the global Islamic

economy 2014-2015 report, May, available

at:http://halalfocus.net/wpcontent/uploads/2015/01/SG

IE-Report-2014.Pdf

Saunders, M., P. Lewis, A. Thornhill, 2009. Research

Methods For Business Students, Ed-5. England(UK):

Pearson Education Limited

Sirgy, M. J., 2002. Measuring Corporate Performance by

Building on the Stakeholders Model of Business

Ethics. Journal of Business Ethics, 35: 143–162

Sulong, Z., N.A.C. Embi, M.R. Arifin, 2017. Performance

of Initial Public Offerings: Does Sharia Complience

Make A Difference?. J Accounting, Finance, and

Business (IJAB), 2 (6), 190-205

Susyanti, J, 2008. Profitabilitas, Pertumbuhan Aktiva,

Ukuran Perusahaan, Struktur Aktiva, dan Likuiditas

terhadap Struktur Modal PT Bank “X” Tbk. Jurnal

Iqtishoduna, Vol. 4, No. 3

United Nation Conference on Trade and Development,

2015. World Investment Report 2015. Jenewa(SW):

UNCTAD

Wieland, J., 2001. The Ethics of Governance, Business

Quarterly, 11(1): 73–87

World Bank Group, 2016. Global Islamic Financial 2016

ASAIS 2019 - Annual Southeast Asian International Seminar

66