The Effect of Intellectual Capital (IC) on Financial Performance of

Islamic Banking by Leverage as a Moderating Variable

Aulia

1

1

Politeknik Negeri Bandung, Bandung, Jl. Gegerkalong Hilir, West Bandung, 40012

Keywords:

Intellectual Capital, VAIC, Leverage, Financial Performance.

Abstract:

The purpose of this study was to examine the effect of Intellectual Capital (IC) on Financial Performance

which is proxied by Operational Costs to Operating Income (OCOI) and moderated by Leverage on Islamic

Banking in Indonesia for annual periods from 2001 to 2018. The results of this study showed that IC can

influence OCOI, but Leverage could not moderate the IC relationship to OCOI so that it had a negative and

not significant value. The results of this study could be considered by Islamic banks in Indonesia to improve

IC quality and financial performance.

1 INTRODUCTION

In the current era of globalization, it is encouraging

business people to continue to innovate in technol-

ogy development to facilitate all community activities

and activities both in terms of personal and business

matters. In the world of good business, trading com-

panies, manufacturers and financial institutions such

as Islamic banking are urgently needed technologies

that can facilitate all activities in order to run effi-

ciently and effectively so that they can maintain their

existence. increasingly fierce competition makes Is-

lamic banking change its business strategy based on

the knowledge possessed by human resources or its

workforce, so as to improve the quality of knowledge

workers and intangible assets or intangible assets they

have (Hurwitz et al., 2002). One of the advantages of

intangible assets for companies and Islamic banking

is having a long and renewable economic life (Prase-

tio and Rahardja, 2015). One of the intangible assets

owned by the company is Intellectual Capital. Intel-

lectual Capital (IC) or commonly referred to as in-

tellectual capital began to be introduced by the first

economist, Galbraith in 1969.

Services-based companies such as Islamic bank-

ing rely more on intellectual capital in the knowledge

and creativity of employees than on physical capital

in the form of land, machinery and monetary capital

to obtain maximum value from the company (Barathi,

2010). In the banking business is a service sector

business that requires a large amount of human cap-

ital and customer capital in maintaining its existence

(Mavridis, 2004).

Banking financial institutions are one of the most

intensive sectors of IC when viewed from an in-

tellectual aspect that is more thoroughly homoge-

neous among employees in the banking sector than

other economic sectors (Firer and Mitchell Williams,

2003).

Since the monetary crisis that hit Indonesia in

1998 and in 2009, the impact was almost felt evenly

in world countries but Islamic banks experienced a

positive influence than conventional banks (Lestari

et al., 2018). One of the successes achieved by Is-

lamic banks is that they can reduce Operational Costs

and Operational Income (OCOI) with minimal so that

it can be said that banks can show efficiency, so that

the profitability to be obtained is also higher. High

banking efficiency shows that banks are able to run

their business effectively (Sunardi, 2019).

The following is a graph of the development of

Islamic banking OCOI in Indonesia from 2016-2019,

namely:

Development Period 2015-2019.png

Figure 1: OCOI Development Period 2015-2019 (OCOI

Development Period 2015-2019).

258

Aulia, .

The Effect of Intellectual Capital (IC) on Financial Performance of Islamic Banking by Leverage as a Moderating Variable.

DOI: 10.5220/0009882302580262

In Proceedings of the 2nd International Conference on Applied Science, Engineering and Social Sciences (ICASESS 2019), pages 258-262

ISBN: 978-989-758-452-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Based on the above data, there is a decrease in the

percentage of OCOI from 2015-2017 but there was a

significant increase in 2018 and then declined again

in 2019. This shows that banks can carry out their ac-

tivities effectively and efficiently despite the increase

in the OCOI percentage in 2018. It is necessary to do

further research to find out how the influence of In-

tellectual Capital on Operational Costs and Operating

Income or are there other variables that can improve

the quality of OCOI in Islamic banking in Indone-

sia. But the high or low percentage of debt in a com-

pany or commonly referred to as the leverage variable

can also affect the financial performance of compa-

nies and banks if it is balanced with a high intellec-

tual capital (Barathi, 2010; Soewarno, 2011). But too

much leverage can also be dangerous for the develop-

ment of the Company’s Financial Performance in the

future.

2 LITERATURE REVIEW

2.1 Intellectual Capital

Intellectual Capital (IC) is an intangible asset that has

the potential to give more value to companies and so-

ciety such as copyright, intellectual property rights

and franchising (Mavridis, 2004). Whereas accord-

ing to (Rehman et al., 2011) intellectual capital is one

of the strategic assets that has an important role in

economic-based knowledge (Faradina, 2016). In this

study, the independent variable is intellectual capital

which consists of three components, namely Capital

Employed (CE), Human Capital (HC), and Structural

Capital (SC). The combination of the three added val-

ues is symbolized by the name Value Added Intellec-

tual Capital (VAIC) developed (Pulic, 1998). Intel-

lectual Capital is measured by value added or Value

Added (VA). VA is calculated by finding the differ-

ence between output and input. Where outpun con-

sists of total net sales and other income - other. While

input consists of expenses and other costs (other than

employee salaries) (Pulic, 1998).

Capital Employed (CE) shows the contribution

that is made for each capital invested in the company.

The CE value is obtained from available funds (equity

and net income) (Goh, 2005).

Value Added Capital Employed (VACA) can be

calculated with the following formula:

VACA =

ValueAdded

CapitalEmployee

Human Capital (HC) reflects the collective ability

to produce the best solutions based on the knowledge

held by people in the company to add value to the

company (Gupta, 2015). Value Added Human Capi-

tal (VAHU) shows the contribution made by each ru-

piah invested in human capital (HC) to the organiza-

tion’s value added, where vahu value is obtained from

the employee’s burden. VAHU is calculated using the

following formula:

VAHU =

ValueAdded

HumanCapital

Structural capital (SC) is a facility and infras-

tructure that supports employees to create optimum

performance, including organizational capabilities to

reach markets, hardware, software, databases, orga-

nizational structures, patents, trademarks, and all or-

ganizational capabilities to support employee produc-

tivity (Bontis, 2004). Structural capital value (STVA)

can be calculated by finding the difference between

VA and HC and divided by VA value, where structural

capital value is obtained from the difference between

VA and HC values. The formula for calculating STVA

can be seen below:

VAHU =

StructuralCapital

ValueAdded

After calculating the overall components of the

IC, the last step is to calculate the value added intel-

lectual capital (VAIC). VAIC can be calculated using

the following formula:

VAIC = VACA + VAHU + STVA

H

1

= VAIC has a significant effect on OCOI

2.2 Leverage

Leverage is the portion of company assets financed

by debt. With the existence of leverage, also the in-

terest costs that must be paid by the company. On the

one hand, leverage can increase the ability of compa-

nies to invest in the creation of information systems

that can enhance the competitiveness and excellence

of companies, but the repayment of loans and interest

payments can also limit funding for human resources

(Nawaz and Haniffa, 2017).

H

2

: Leverage affects significantly between VAIC and

OCOI

2.3 Firm Size

Firm size as an indicator that shows how much the

company has wealth that is used to run a business.

Firm size is used as a control variable because it has

a direct effect on company performance. Firm size is

used to control the impact of measures in the creation

of prosperity through economies of scale, monopoly

The Effect of Intellectual Capital (IC) on Financial Performance of Islamic Banking by Leverage as a Moderating Variable

259

power, and bargaining power. The size of the com-

pany (firm) can be measured using market capitaliza-

tion, total assets, number of employees, and company

cycles, such as growing and mature (Audreylia and

Ekadjaja, 2014).

2.4 Bank Age

Older companies have better performance than

younger ones, because their experience in the mar-

ket helps them gain competitive advantage through

better implementation of staff recruitment, production

and marketing strategies (Irawan and Achmad, 2014).

The age of the company is proxied by the period of

time since the company was established until the re-

search was carried out so that the age of the bank is

used as a control variable because it has an effect on

the duration of the establishment of the company or

bank.

2.5 Financial Performance

The success of the company in achieving company

goals can be seen by measuring its performance. Per-

formance measurement is needed as information for

internal and external parties to make decisions. In-

tellectual capital affects the company’s financial per-

formance. Companies that have human capital with

the ability, competence and high commitment will in-

crease productivity and efficiency which in general

will increase company profits. Structural capital is re-

flected in the ability of the system, structure, strategy

and corporate culture in finding market demand and

achieving company goals (Puspitosari, 2016).

Bank efficiency measurements can be used by us-

ing a comparison between Operational Costs and Op-

erating Income (OCOI). This performance is a mea-

sure of efficiency commonly used to assess the perfor-

mance of banking efficiency. The greater the OCOI

of a bank shows the greater the amount of operat-

ing costs, so it tends to decrease the profitability of

the bank and conversely the smaller the OCOI a bank

shows the more efficient, so that profitability will be

higher. Banks with high efficiency show banks are

more effective in carrying out their business (Sunardi,

2019).

3 RESULTS AND DISCUSSION

The purpose of this study was to see the effect of Intel-

lectual Capital as an independent variable on financial

performance which is proxied by Operational Costs

and Operating Income (OCOI) as the dependent vari-

able with leverage as a moderating variable and total

assets and bank age as a control variable in Islamic

banks in Indonesia.

Good management of intellectual capital will

make customers or partners loyal to banks so that they

can have a good influence on financial performance.

The data used in this study is secondary data obtained

from annual reports from 2001 to 2018 published by

the Financial Services Authority (FSA). The popu-

lation in this study are all Islamic banks in Indone-

sia which consist of Sharia Commercial Banks (SCB)

and Sharia Business Units (SBU). The sample used in

this study consisted of 3 Islamic banks, namely Bank

Mega Syariah, Bank Muamalat Indonesia and Bank

Syariah Mandiri. The sample selection in this study

uses Purposive Sampling. Purposive Sampling is the

selection of samples based on several criteria, as fol-

lows: a. Banks registered consecutively during the

observation period, namely 2001-2018; b. Banks that

issue annual financial reports regularly. This study ap-

plied data analysis techniques using simple linear re-

gression, multiple linear regression and linear regres-

sion with moderating variables (Moderate Regression

Analysis) and control variables. The tool used in this

study is to use Statistical Product and Service Solu-

tion (SPSS) version 22.0.

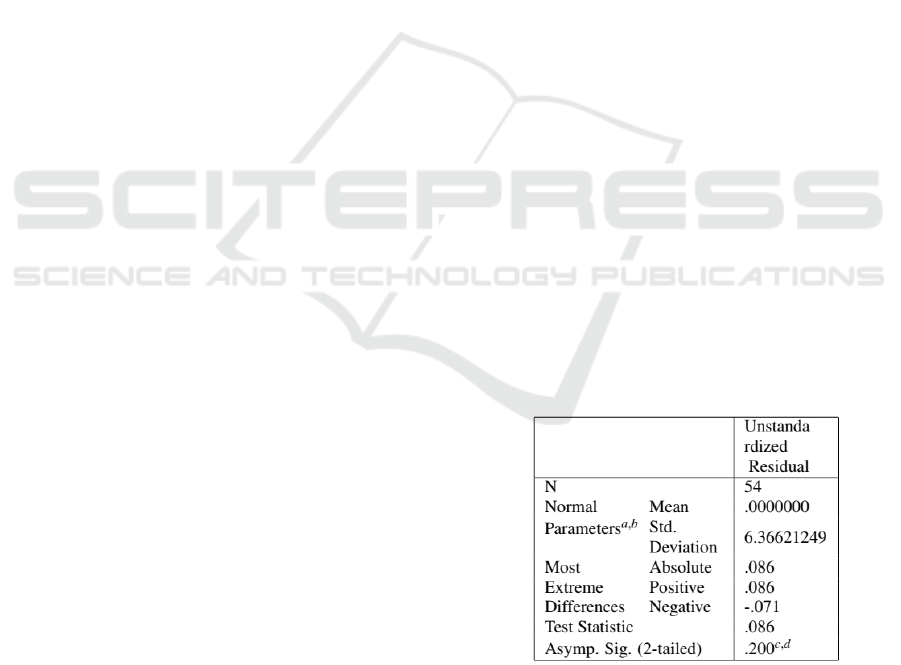

Before conducting multiple regression analysis to

test the effect of VAIC on Operational Costs and Op-

erating Incomes (OCOI), a classic assumption test

was carried out to ensure that the data obtained

passes the normality test. The classic assumption test

showed that the data was normally distributed with

the value of Asymp. Sig (2-tailed) 0.200 greater than

α (0.05). The results of the normality test were shown

in Figure 2:

Figure 2: Normality Assumption Test of Regression Model

One-Sample Kolmogorov-Smirnov Test.

Source: data processed.

After passing the classic assumption test then the

research hypothesis testing was carried out as follows:

From the results of multiple linear regression analysis

the multiple linear regression equation was obtained

ICASESS 2019 - International Conference on Applied Science, Engineering and Social Science

260

according to the research conducted (Nawaz and Han-

iffa, 2017) as follows:

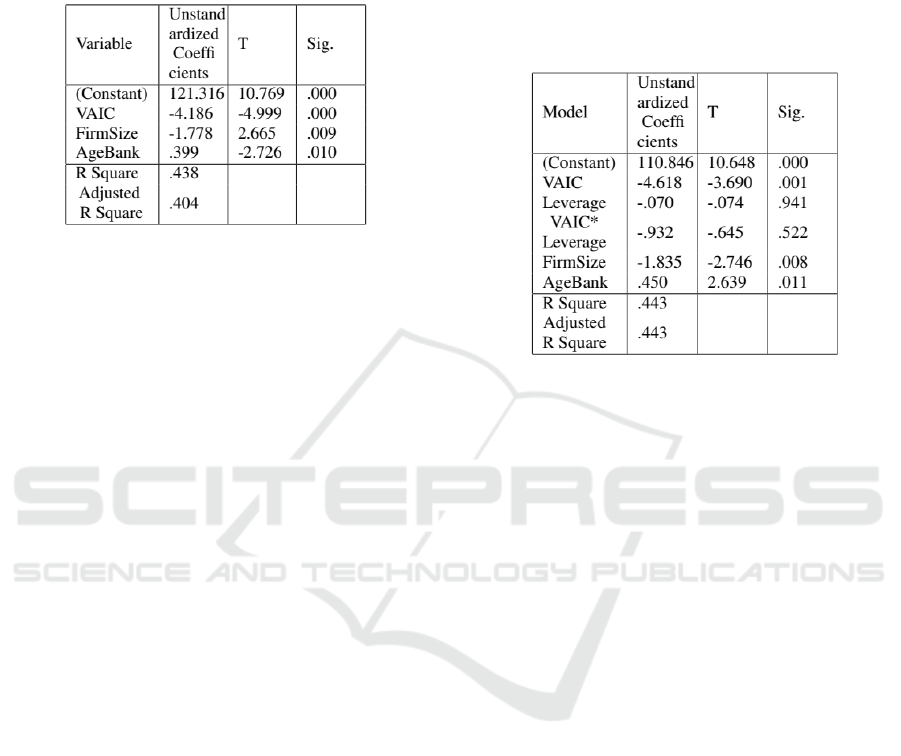

Y = α + β1X 1 + β2X2 + β3X3 + e. (1)

Y = 121.316 − 4.186VAIC − 1.788Firmsize +

0.399AgeBank + e. (2)

Figure 3: T-test of Multiple Linear Regression Models

Coefficients

a

.

a Dependent Variable: BOPO

Based on Figure 4 showed that the determination co-

efficient value is 0.438. This showed that the OCOI

variable could explain VAIC, firm size, and age bank

variables of 0.438 or 43.8%. From the results of the

regression analysis, it was found that VAIC had a neg-

ative effect that was significant on OCOI, indicated by

a significance value of 0.000 and a t value of -4.999.

This result was in line with the research of (Soheili

and Pakdel, 2012; Andriana, 2014) but was contrary

to the study. The high Intellectual Capital (IC) cannot

guarantee that the Operational Costs Ratio (OCR) can

be calculated because the development of IC in banks

is not a priority but it is the focus of government pol-

icy direction and Indonesian banks are still oriented

to structural improvements that focus on economies

of scale, efficiency and adequacy capital. That is why

the quality of the policies taken by banking compa-

nies in Indonesia is still not optimal because human

resources have not been managed optimally ((Huta-

galung, 2012).

Whereas for moderate regression analysis (MRA)

for testing VAIC variables that were controlled by

control variables against OCOI as follows:

Y = α + β1X1 + β2X2 + β1X 1 ∗ β2X2 + β3X3 +

β4X4 + e. (3)

Y = 121.316–4.186VAIC–0.070Leverage–

1.835VAIC ∗ β2X2–1.835Firmsize +

0.450Agebank + e. (4)

Figure 4: T-test of Moderation Regression Analysis Models

Coefficients

a

.

a Dependent Variable: OCOI

Based on Figure 4 showed that the determination co-

efficient value was 0.443. This showed that the OCOI

variable could explain the VAIC, firm size, and age

bank variables of 0.443 or 44.38%. From the results

of the moderation regression analysis (MRA), it was

found that VAIC*Leverage had a negative and was

not significant effect on BOPO, indicated by a signif-

icance value of 0.522 and a t value of -0.645. This re-

sult was in line with. Leverage cannot strengthen the

relationship between IC and financial performance

(BOPO) if the leverage value held by the company

or bank is not too high or is still within reasonable

limits.

4 CONCLUSION

This study showed that Intellectual capital (IC) could

affect financial performance which was proxied to op-

erating costs and operating incomes (OCOI) if mod-

erated by leverage which means that H1 was accepted

and H2 was rejected. Leverage cannot strengthen IC

relations with OCOI, if the leverage value held by the

bank is still too high level because if the bank has high

debt, the bank will not be able to meet all operational

costs that will have a direct impact on the bank’s op-

erations. It is important for banks to improve IC qual-

ity, especially in one component of IC, namely human

capital. Quality human capital certainly can provide a

The Effect of Intellectual Capital (IC) on Financial Performance of Islamic Banking by Leverage as a Moderating Variable

261

good contribution to the company so that it can min-

imize the amount of debt and operational costs so as

to increase the income that will be received.

The limitations in this study were on data and vari-

ables, this was due to the limited data obtained by re-

searchers. Therefore, it was expected that researchers

in the future could add variables and data that would

be examined so that other variables could be identified

which was able to strengthen IC relations with opera-

tional costs and operating incomes (OCOI) in Sharia

banking in Indonesia.

REFERENCES

Andriana, D. (2014). Pengaruh intellectual capital terhadap

kinerja keuangan perusahaan. Jurnal Riset Akuntansi

dan Keuangan,, 2:251–260.

Audreylia, J. and Ekadjaja, A. (2014). Pengaruh modal in-

telektual terhadap kinerja perusahaan perbankan den-

gan ukuran perusahaan sebagai variabel kontrol. Uni-

versitas Tarumanagara Journal of Accounting, 18.

Barathi, K. (2010). The intellectual capital performance of

banking sector in pakistan. Pakistan Journal of Com-

merce and Social Sciences (PJCSS), 4:84–99.

Bontis, N. (2004). Ic what you see: Canada’s intellectual

capital performance. 10:2005.

Faradina, I. (2016). Pengaruh intellectual capital dan in-

tellectual capital disclosure terhadap kinerja keuangan

perusahaan. E-Jurnal Akuntansi, page 1623–1653.

Firer, S. and Mitchell Williams, S. (2003). Intellectual capi-

tal and traditional measures of corporate performance.

Journal of intellectual capital,, 4:348–360.

Goh, P. (2005). Intellectual capital performance of commer-

cial banks in malaysia. Journal of intellectual capital,

6:385–396.

Gupta, T. (2015). Intellectual capital & firm profitabil-

ity: An empirical study on the it sector listed in nse.

Global Journal of Multidisciplinary Studies, 4.

Hurwitz, J., Lines, S., Montgomery, B., and Schmidt, J.

(2002). The linkage between management practices,

intangibles performance and stock returns. Journal of

Intellectual Capital, 3:51–61.

Hutagalung, N. (2012). Pengembangan modal intelek-

tual di bidang perbankan;tantangan dan peluang pen-

didikan manajemen dalam bidang perbankan dalam

upaya peningkatan daya saing industri perbankan di

indonesia.

Irawan, I. and Achmad, T. (2014). Analisis pengaruh uku-

ran perusahaan terhadap kinerja intellectual capital

dengan struktur kepemilikan sebagai variabel moder-

ating. Diponegoro Journal of Accounting, 3:646–656.

Lestari, S., Paramu, H., and Sukarno, H. (2018). Pen-

garuh intellectual capital terhadap kinerja keuangan

perbankan syari’ah di indonesia. In EKUITAS (Jurnal

Ekonomi dan Keuangan), volume 20, page 346–366.

Mavridis, D. (2004). The intellectual capital performance

of the japanese banking sector. Journal of Intellectual

capital, 5:92–115.

Nawaz, T. and Haniffa, R. (2017). Determinants of financial

performance of islamic banks: an intellectual capital

perspective. Journal of Islamic Accounting and Busi-

ness Research, 8:130–142.

Prasetio, F. and Rahardja, R. (2015). Pengaruh intellec-

tual capital terhadap kinerja keuangan perusahaan.

Diponegoro Journal of Accounting, 4:748–759.

Pulic, A. (1998). Measuring the performance of intellectual

potential in knowledge economy. In 2nd McMaster

Word Congress on Measuring and Managing Intellec-

tual Capital by the Austrian Team for Intellectual Po-

tential, page 1–20.

Puspitosari, I. (2016). Pengaruh modal intelektual terhadap

kinerja keuangan pada sektor perbankan. EBBANK,

7:43–53.

Rehman, W., Ilyas, M., and Rehman, H. (2011). Intellec-

tual capital performance and its impact on financial

returns of companies: An empirical study from insur-

ance sector of pakistan. African Journal of Business

Management, 5:8041–8049.

Soewarno, N. (2011). Pengaruh intellectual capital ter-

hadap kinerja keuangan dengan ukuran, jenis industri,

dan leverage sebagai variabel moderating. In Jurnal

Ekonomi dan Bisnis Airlangga (JEBA), page 21.

Soheili, S. and Pakdel, A. (2012). Intellectual capital per-

formance (evidence from iranian banks. Australian

Journal of Basic and Applied Sciences, 6:146–152.

Sunardi, N. (2019). Determinan intelectual capital den-

gan pendekatan ib-vaictm terhadap efisiensi biaya im-

plikasinya pada profitabilitas perbankan syariah di in-

donesia. JIMF (JURNAL ILMIAH MANAJEMEN

FORKAMMA).

ICASESS 2019 - International Conference on Applied Science, Engineering and Social Science

262