Corruption in Banking as One Form of Professional Crime

Ida Nurhayati

1

, Indianik Aminah

1

, Eri Ester Khairas

1

1

Department of Accounting , Politeknik Negeri Jakarta, Depok, Indonesia

Keywords: corruption, banking, professional crime.

Abstract: This study focuses on acts of corruption in banks which must be interpreted as crimes in the profession of

bankers. The goal is that bankers who commit corruption can be said as well as professional crimes, as well

as prevention efforts. Professional crime as a form of occupational crime, which can occur because

professionals in carrying out their profession have special rights. Because professional expertise requires

standard service standards, usually to carry out professional work requires a license to practice from the

bureaucratic authority. The method used in this study is qualitative with a normative, social and documentary

juridical approach. As a result, bankers as individual businessmen using bank / institutional facilities both as

authorities, also use bank property facilities. From the customer side as a party on the outside it often makes

them feel facilitated, but in fact the customer as a tool to realize the intention is actually very detrimental to

the bank materially and non materially. Material losses can be in the form of not making funds and profits

from the transaction to the bank, but rather becoming the personal profit of the perpetrator.

1 INTRODUCTION

The development of criminal acts of corruption was

first reported by the United Nations Congress (UN)

on The Prevention of Crime and the Treatment of

Offender. Members of the United Nations are aware

that corruption crimes have exceeded the territorial

boundaries of each country. But the pace of economic

development and trade actually helped spur the

development of criminal acts of corruption.

Corruption is a very complex crime From a political

standpoint, corruption is a factor that disturbs and

reduces the government's credibility. From an

economic standpoint, corruption is one of the factors

that cause a large amount of state financial losses.

From a cultural standpoint, corruption damages the

morals and character of the Indonesian people who

uphold noble values.

Corruption does not only occur in the public

sector, but can also occur in the private sector whose

business activities are related or related to the public

sector such as taxation, banking and public service

sectors. The banking sector is a sector / field that is

prone to corruption. Because banking is a financial

institution whose main function is to collect and

channel public funds.

The development of criminal acts of corruption in

the banking sector is developing along with the

increasing banking industry as a locomotive of

national development. The impact of the occurrence

of criminal acts of corruption in the banking sector is

not only for the victims, but will also create a negative

impression on the financial institutions / banks

themselves. This is because banks are intermediary

institutions whose operational mechanisms are based

on fiduary relations, confident relations and

prudential relations. (Setiadi and Yulia, 2010)

The existence of trust factors from other parties

and customers is the main thing for the smooth

operation of the bank. This is also banking ethics in

relation to other parties. For this reason, bankers have

a role in having morals, morals and expertise in

banking / finance.

2 LITERATURE REVIEW

The essence of a bank is how to transform

commodities that are "intangible" in the form of trust,

is the true value of a bank. How banks attract and use

money from the community, and manage money from

the community will form its own image or picture in

the minds of the people. This commodity of trust

gives rise to banks a sense of responsibility both

morally and financially.

96

Nurhayati, I., Aminah, I. and Khairas, E.

Corruption in Banking as One Form of Professional Crime.

DOI: 10.5220/0009895600002905

In Proceedings of the 8th Annual Southeast Asian International Seminar (ASAIS 2019), pages 96-101

ISBN: 978-989-758-468-8

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2.1 Corruption and Dimension of

Banking Crime

In juridical sense, the definition of corruption can be

identified from the formulations of acts that can be

punished for corruption based on Law No. 31. 1999

Junto Law No. 20. Year 2001 concerning Eradication

of Corruption Crimes.

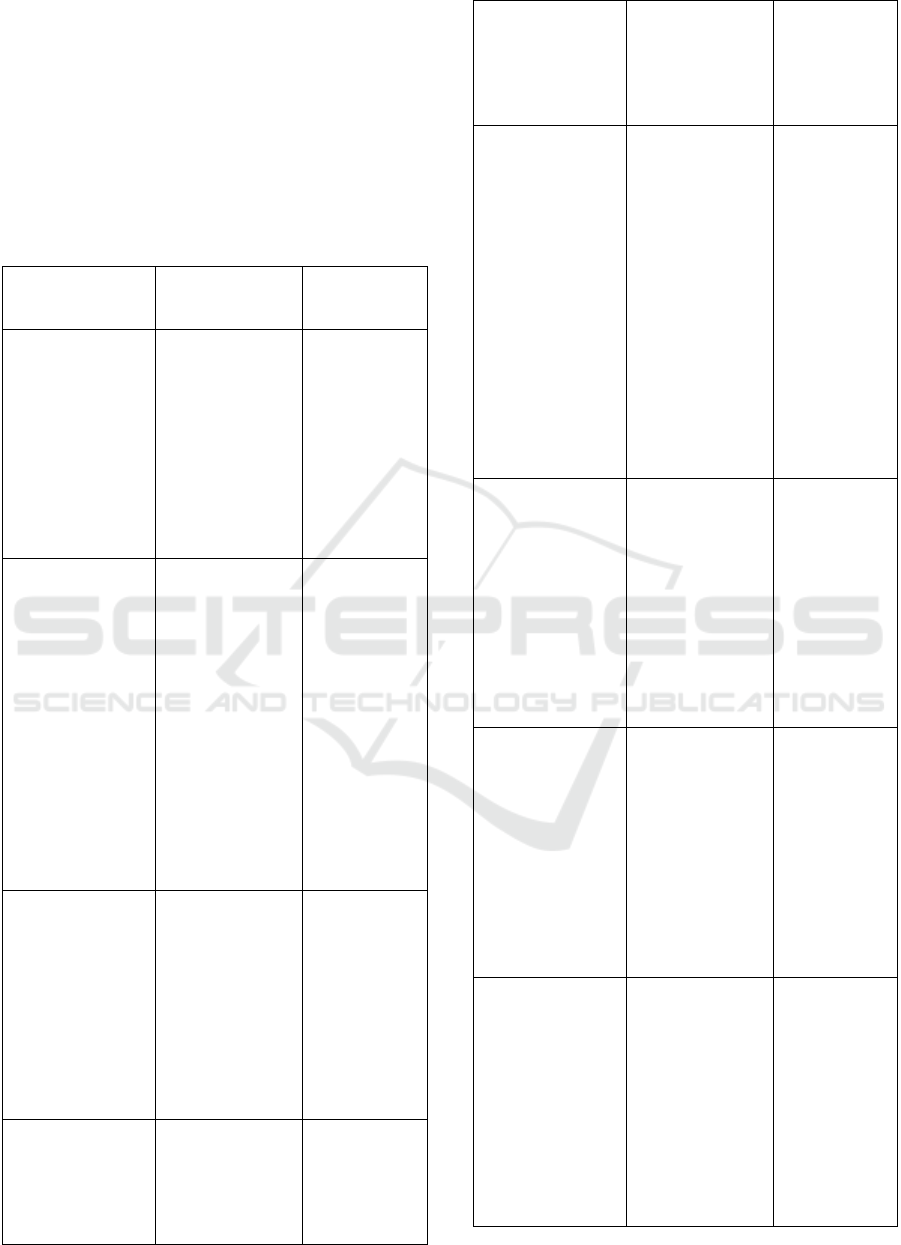

Table 1: The Definition Of Corruption Between The Anti-

Corruption Law and The Criminal Code

Law No.31 1999

Junto Law No.20

2001

Kitab Undang-

undang Hukum

Pidana

Article

Anyone is

prohibited from

enriching

themselves, or

other people, or

corporations,

which can harm

the country's

finances and the

country's

economy

Article 2

Paragraph (1)

Any person who

intends to seek

personal gain or

another person or

a corporation, by

misusing the

authority,

opportunity or

means they have,

based on their

position or

position that can

harm the

country's finances

or country's

economy.

Article 3

Everyone who

promises to give

gifts to officials

referred to in this

Law will be

subject to

imprisonment of

1 to 5 years

and/or a fine of

Rp 50,000,000 to

Rp 250,000,000.

Any person who

gives a gift or

makes a promise

to an official

with intent to

move him to

commit or omit

something in his

service contrary

to his duty.

Article 5 Law

No.31 Year

1999 and

Article 209

KUHP

Any person

committing a

criminal acts as

referred to in

Article 210 of the

Criminal Code

Any person who

gives a gift or

makes a promise

to a judge with

intent to exercise

influence on the

Article 6 Law

No.31 Year

1999 and

Article 210

KUHP

shall be liable to a

prison sentence of

3 to 15 years and

a fine of

Rp150.000.000 to

Rp750.000.000.

decision on a

case.

Any person

committing the

criminal acts as

referred to in

Article 387 or

Article 388 of the

Criminal Code

shall be liable to a

prison term of 2

to 7 years and a

fine of

Rp100.000.000 to

Rp350.000.000.

Any master

builder or an

architect who is

performing the

job or the

delivery of the

materials

commits a

fraudulent act,

and also any

person who

charged with the

supervision of

the work with

deliberate intent

allows the

fraudulent act.

Article 7 Law

No.31 1999

and Article

387 or 388

KUHP

Any person

committing the

criminal acts as

referred to in

Article 415 of the

Criminal Code

shall be liable to a

prison term of 3

to 15 years and a

fine of

Rp150.000.000 to

Rp750.000.000.

Any official or

any other person

continuously or

temporarily in

charge of a

public service

who deliberately

embezzles

money or

securities.

Article 8 Law

31 Year 1999

and Article

415 KUHP

Any person

committing the

criminal acts as

referred to in

Article 416 of the

Criminal Code

shall be liable to a

prison term of 1

to 5 years and a

fine of

Rp50.000.000 to

Rp250.000.000.

Any official or

any other person

continuously or

temporarily in

charge of a

public who

deliberate intent

falsely draws up

or falsifies books

or registers.

Article 9 Law

No.31 Year

1999 and

Article 416

KUHP

Any person

committing the

criminal acts as

referred to in

Article 417 of the

Criminal Code

shall be liable to a

prison term of 2

to 7 years and a

fine of

Rp100.000.000 to

Rp350.000.000.

Any officials of

any other person

continuously or

temporarily in

charge of a

public service

who with

deliberate intent

embezzles,

destroys,

damages on

evidence.

Article 10

Law No.31

Year 1999

and Article

417 KUHP

Corruption in Banking as One Form of Professional Crime

97

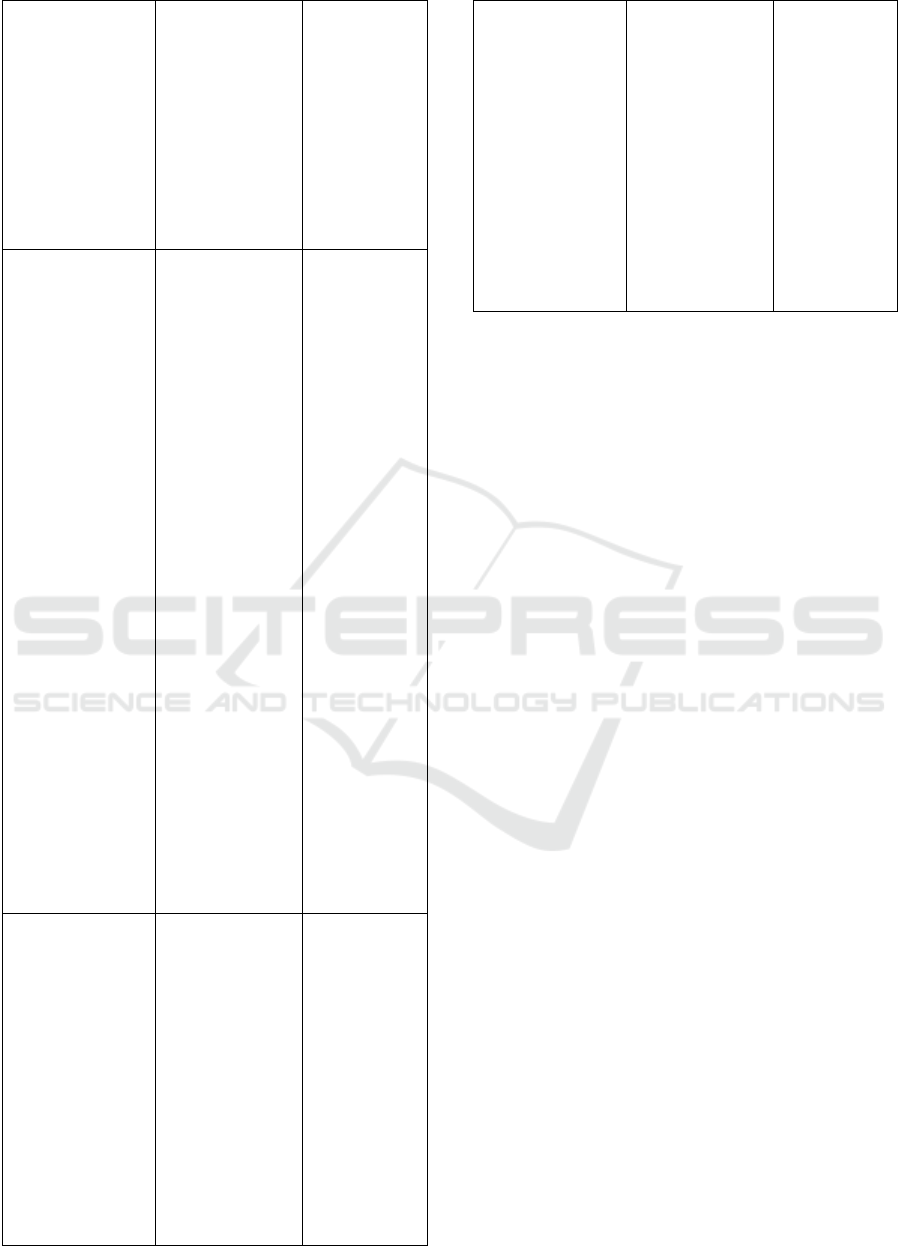

Any person

committing the

criminal acts as

referred to in

Article 418 of the

Criminal Code

shall be liable to a

prison term of 1

to 5 years and/or

a fine of

Rp50.000.000 to

Rp250.000.000.

Any official who

accepts a gift or

promise related

to his authority

in office.

Article 11

Law No.31

Year 1999

and Article

418 KUHP

Any person

committing the

criminal acts as

referred to in

Article 419,

Article 420,

Article 423,

Article 425 or

Article 435 of the

Criminal Code

shall be liable to

life

imprisonment, or

a prison term of 4

to 20 years and a

fine of

Rp200.000.000 to

Rp1.000.000.000

Any official who

accepts a gift or

promise in order

to move him

contrary to his

duty, any judge

who accepts a

gift or promise in

order to exercise

influence on the

decision of a

case, any official

who intent to

unlawfully

benefit himself

or another by

misuse of power,

any official who

in the exercise of

his service

demands or

accepts or

withholds

payment, any

official who with

deliberate intent

takes part

directly or

indirectly in

tenders,

deliveries or

leases.

Article 12

Law No.31

Year 1999

and Articles

419, 420,

423, 425 and

435 KUHP

Any person

rendering gifts or

promises to civil

servants in view

of the powers and

authority attached

to their respective

ranks or

positions, or

deemed by the

person rendering

such gifts or

promises to be

attached to the

aforementioned

rank or position.

Article 13

Any person

violating the

provision of the

law which clearly

states that

violations against

the provision of

the

aforementioned

law shall be

regarded as

corruption shall

be liable to the

provisions of this

law.

Article 14

Corruption has been considered as a very

extraordinary crime or "extraordinary ordinary

crime", so that this crime is often regarded as "beyond

the law" because it involves the perpetrators of high-

level economic crime (high level economic) and the

bureaucracy of the high level (high level beurocratic),

both economic and government bureaucrats (Seno

Adji, 2007).

2.2 Dimensions of Banking Crime

There are several dimensions of banking crime

namely, it can be a person's crime against a bank, a

bank crime against another bank, or a bank crime

against an individual. The dimension of banking

crime space is not limited to a particular place, but

can cross a country's territorial boundaries. Likewise,

the time dimension can occur instantaneously, but it

can also last for some time.

Qualifications of banking crimes that often occur,

including:

1) Fraud, or fraud in the field of credit (credit

fraud).

2) Embezzlement of public funds (embezzlement

of public funds).

3) Misappropriation, or misuse of public funds

(misapropriation of public funds).

4) Violations of financial regulations, or

(violation of currency regulation) (Djumhana,

1996).

The pattern of banking crimes is often

complicated, because the culprit is the average person

who is an expert in his field, also often very neat, and

veiled (disguise of purpose or intent / disguising the

purpose of crime).

Gottschalk's research (2011) provides statistical

evidence that top-level executives are involved in

financial crime. Like Tillman's research (2009), his

analysis shows that a network of collusion and

financial statement fraud involves a large number of

ASAIS 2019 - Annual Southeast Asian International Seminar

98

board members, auditors, and bankers who help and

conspire with senior managers in their efforts to

deceive investors.

Banking crimes are categorized as criminal

banking and are always carried out in an organized

manner. In this sense, banking activities are merely

camouflage because all activities are systemic

violations of the law for purposes of making a profit

(a systematic act against the law for profit). Usually

the most popular of criminal banking is money

laundering and window dressing or in banking laws

themselves have been determined for example doing

banking activities without permission, dealing with

bank secrets, the obligation to provide information to

Bank Indonesia and provide incorrect information

(Setiadi and Yulia , 2010).

2.3 Banking Crimes as Professional

Crimes

Generally professional crimes are very careful in

choosing their victims. They believe that some people

are more worthy of being victims than others.

Professional robbers, for example, make a conscious

effort to choose victims who are also capable of

suffering losses, namely large organizations

especially banks.

Sutherland, in Clinard-Quinney (1972) observed

that professional thieves are characterized by (1) skill

— there are complex techniques for committing

crime; (2) professional crime status has a high

prestige position in the crime world; (3) professional

crime-consensus sharing shared values, beliefs and

attitudes, with enthusiasm among members; (4)

differential associations with other professional

criminals the association rules out law-abiding

persons and other criminals; and (5) organization

activities in terms of general knowledge carried out

through information and assistance in the informal

system.

3 METHOD

This research uses a qualitative descriptive method

using a formal, normative, and document study

approach. The availability of legislation as an official

document as a legal basis. The norms as a reference

in banking regulations at each bank. Formal juridical

analysis with reference to the laws and regulations

that apply to banks, both written and customary

practices in banking activities as a form of convention

that still applies to the banking business.

4 RESULTS AND DISCUSSION

4.1 Several Factors That Cause

Corruption in Banking

1) The Nonshareble aspect; in his book Cressey

(1953) most managers in running their lives,

especially in the face of financial difficulties in

their families, it will be decided by taking a

shortcut, that is, using the money of the company

where they work.

2) Environmental / community aspects;

Environmental or community aspects also

influence a person's behavior to commit acts of

corruption. In general, people will respect

someone because of the wealth they have,

without being balanced with a critical attitude

from where the wealth comes or is obtained.

Likewise, the culture of tribute or bribery of

customers who want to get credit quickly even if

it does not meet the criteria, then he will bribe

bank employees for the smooth administration.

The need for an active public role in fighting

corruption, because it is not only the duty of the

state. The normative active role of society can

also help eradicate corruption.

3) Other factors that also influence are regulations

that are less socialized to the public, so that

ordinary people do not know. Dissemination or

dissemination to the public can be used as a

detective effect, namely the lack of corruption

because the prospective karuptor is afraid of the

penalties contained in the legislation, and of

course he will be embarrassed when the public

knows that his actions are corruption. Added to

the application of sanctions that are too light and

indiscriminate. Causing the weak eradication of

corruption because it does not cause a deterrent

effect to the perpetrators.

4.2 Efforts to Prevent Corruption in

Banking through Law Enforcement

Law enforcement in banking and banking crime can

be done in various ways, both in the fields of civil

law, administrative law and criminal law. Related to

law enforcement in the field of criminal law,

eradication or efforts to tackle corruption in the

banking sector can be pursued by means of penal

(criminal law) and non-penal means. Means of

punishment can be done through the application of

criminal law and criminal administrative law as a

means of shock therapy. Whereas non-penal facilities

Corruption in Banking as One Form of Professional Crime

99

can be carried out by means of supervision (built in

control), improvement of the supervision system and

strengthening regulations through the application of

the precautionary principle, establishing a financial

safety net (financial safety net), stabilizing the

banking system that directs the bank to good practices

corporate governance and the fulfillment of the

principle of prudence, professionalism of the

apparatus continues to be improved so that it has high

integrity capabilities, has sufficient competence, and

has a good financial reputation or non-juridical

measures in the form of public opinion actions and

socialization of the community.

Lewerissa (2013) states specifically, law

enforcement and prevention of banking crimes can be

pursued through:

1. It is necessary to increase the ability of

investigators in the field of accounting and

finance.

2. An effective bank supervision system and this

can be done if employee recruitment

emphasizes more on mental ideology.

3. Expansion of the authority of investigators in

the context of carrying out their duties, not just

concerning bank secrets.

4. Renewal of laws in the economic field in casu

banking law.

Majority observations indicate that some

businesses are in the process of becoming

professions, some professions that take on some

business characteristics, and other jobs that are

appropriate and have even been firmly included in

business and professional roles.

These two conflicting roles are likely to create a

conflict of interest, which in turn can lead to a

deviation and violation of the rules. If a profession on

one side then doubles with a job that does not support

the profession, even if it crosses business alone, then

usually there will be a violation, because there are

multiple roles that conflict with each other. This

creates a conflict of interest.

Delegation of work roles is a common

phenomenon in modern society, partly because of the

frequency and speed with which changes in the

definition of work roles occur and new job roles

emerge. In particular, it seems clear that the role of

business and professional work.

5 CONCLUSION

The bankers in carrying out their profession have

operational guidelines, both in the form of formal

provisions, and ethics which are conduct norms. In

carrying out there are two roles that he lived. It

depends on how bankers can position themselves

when acting as bankers and not as bankers. When

they cannot play the two roles properly, there will be

a role conflict that can lead to violations. However, if

they can portray correctly, when as a banker and

when as a non-banker, then this banker is not the

violator. For this reason, it is necessary to understand

by bankers, so that in carrying out these dual roles,

they can truly be carried out in accordance with their

conditions, both as bankers and as employees. And

this is followed by making a good control mechanism

continuously and consistently.

ACKNOWLEDGEMENTS

I would like to thank the implementation of this

research to the Director of the Jakarta State

Polytechnic, the Deputy Director of Academic

Affairs, the Deputy Director of Administration and

Finance, the Chair of the Accounting Department and

all the leaders of the Jakarta State Polytechnic

.

REFERENCES

Badan Pengawasan dan Pembangunan, 1999. Strategi

Pemberantasan Korupsi Nasional.

Cressey, R.D, 1953. Other People’s Money: A Study In The

Social Psychology of Embezzlement. Glencoe, Illinois:

The Free Press.

Gottschalk, P, 2011. Executive Positions Involved in

White-Collar Crime. Journal of Money Laundering

Control 14. 4 : 300-312.

Hansen, Laura. 2009. Corporate Financial Crime: Social

Diagnosis and Treatment. Journal of Financial

Crime16. 1: 28-40. 2009.

Hermansyah, 2008. Hukum Perbankan Nasional Indonesia.

Jakarta: Kencana Predana Media Group.

Hongming, Cheng, and Ma Ling. 2009."White Collar

Crime And The Criminal Justice System: Goverment

Response To Bank Fraud And Corruption in China."

Journal of Financial Crime. 166-173.

Huynh, Daniel. 2010. Premption V. Punishment: A

Comparative Study of White Collar Crime Prosecution

in The United States and The United Kingdom. The

Journal of International Business and Law.

Institut Bankir Indonesia, 1994. Kode Etik Bankir. Jakarta.

J.B. Suh,et al, “The Effects Of Reducing Opportunity And

Fraud Risk Factors On The Occurrence Of

Occupational Fraud In Financial Institutions”.

International Journal Of Law, Crime And Justice 56,

(2019), 79-88. journal homepage:

www.elsevier.com/locate/ijlcj. Accessed on 18

November 2019.

ASAIS 2019 - Annual Southeast Asian International Seminar

100

K.A. Adetiloye, et al, “ Fraud Prevention and Internal

Control in The Nigerian Banking System, International

Journal of Economic and Financial Issues, 2016,(3),

1172-1179. http: www.econjournals.co Accessed on 18

November 2019.

Kasiyanto, S, 2017. Central Bank Transparancy In

Indonesia: A Law And Economic Perspective.

Indonesia Law Review. 2: 178-207. ISSN : 2088-8430;

EISSN : 2356-2129.

Klenowski, P. M, 2008. Other’s People Money: An

Empirical Examination of The Motivational

Differences Between Male and Female White Collar

Offenders. ProQuest Dissertation and Theses:10.

Lewerissa, A.Y, 2013. Korupsi Di Bidang Perbankan.

Kompilasi Pemikiran Tentang Dinamika Hukum

Dalam Masyarakat (Memperingati Dies Natalis ke -50

Universitas Pattimura Tahun 2013).

Nabhan, Latif R.A, and Hindi, M. Nitham. 2009. Bank

Fraud: Perception of Bankers in the State of Qatar.

Academy of Banking Studies Journal, Volume 8,

Number 1. Qatar University.

Quinney, R and Marshal, B. C, 1972. Criminal Behavior

System A Typology. 2nd edn. Chapel Hill, North

Carolina: Madison, Wisconsin.

Reem Abdul Latif, Nabhan and Hindi, Nitham M. (2009)

Bank Fraud: Perception Of Bankers In The State Of

Qatar.Academy of Banking Studies Journal8. 1/2: 15-

38.

SBM, Nugroho. 2011. "Mencegah Kejahatan

Perbankan."Artikel. Diakses pada 1 Mei 2011 di

http://nugroho-sbm.blogspot.com/2011/05/mencegah-

kejahatan-perbankan.html.

Seno, A. I, 2001. Money Laundering Dalam Perspektif

Hukum Pidana. Jakarta: CV Rizkita bekerja sama

dengan Kantor Pengacara dan Konsultan Hukum Prof.

Seno Adji, S.H dan Rekan.

Setiadi, E and Yulia, R, 2010. Hukum Pidana Ekonomi.

Yogyakarta: Graha Ilmu.

Tillman, R, 2009. Reputations and Corporate Malfeasance:

Collusive Networks in Financial Statement Fraud.

Crime, Law and Social Change 51. 3-4: 365-382.

Corruption in Banking as One Form of Professional Crime

101