The Effect of Ease of Use, Usefulness, Trust, Self-efficacy, and

Security on Adoption Technology

Dyah Sugandini, Mohamad Irhas Effendi, Yuni Istanto

Universitas Pembangunan Nasional Veteran Yogyakarta

Keywords: PEOU, PU, self-efficacy, trust, security, and adoption

Abstract: This study aims to determine the effect of perceived ease of use, usefulness, trust, self-efficacy, and security

towards the decision to use e-payment, namely GO-PAY. This study uses 200 respondents. Data collection

techniques using purposive sampling. The data analysis tool used is structural equation modeling (SEM).

The results of this study indicate that the hypotheses proposed are not all supported. Perceived ease does not

influence trust. Other hypotheses proposed are supported. That is, the adoption model GOPAY in this study

is influenced by perceptions of usefulness, self-efficacy, trust, and security.

1 INTRODUCTION

Digital transformation 4.0 has changed many aspects

of human life. Advances in technology have an

impact on lifestyle changes in the digital age

consumers. Transformation makes it easy for

consumers to adapt to the world of technology with

various conveniences in the media. The use of

technology requires consumers to pay more attention

to security from various aspects of information,

personal data, and financial transactions. Millward

(2014) shows that 51% of the total population in

Indonesia has used the internet through smartphones,

and noted that almost 75% of internet users in

Indonesia are aged 15-34 years. The rapid

development of the internet also makes it easy to do

various kinds of financial transactions, such as

making payments and transfers. E-payment system

(EPS) offers a variety of benefits by speeding up the

transaction process and selling products at lower

prices. GO-PAY is one of the vendors providing e-

payment. GO-PAY is an electronic money or digital

wallet or virtual wallet in the form of a GO-JEK

balance and can be used to pay for various GO-JEK

services and other transactions. EPS can be

classified into cash-based and account-based

systems. Electronic cash and prepaid cards are cash-

based systems, whereas credit cards, debit cards, and

electronic checks are account-based payment

systems. EPS has been used throughout the

world,with some countries having fully developed

systems and others continuing to improve (Kim et

al., 2010; Barkhordari et al., 2016).

Adoption EPS by customers can be influenced

by security and trust (Hanafizadeh et al., 2014;

Junadi, 2015), but there is still a lack of in-depth

studies to investigate the perceived trust and safety

of EPS customers (Barkhordari et al., 2016).

Existing studies (Sanayei and Noroozi, 2009;

Alikhani and Davarzani, 2014) do not have a broad

analysis of the various factors that influence the

adoption of EPS, and the focus is only on trust and

security limited to a group of customers. Maroofi et

al. (2012) also add that there is little research on the

direct relationship between perceived consumer

security and trust in EPS. This study analyzes EPS

adoption by adding variables PEOU, PU, and self-

efficacy. This research develops several factors that

influence adoption using the TAM 3 model

(Venkatesh and Bala, 2008), which extends TAM in

the e-commerce context.

2 LITERATURE REVIEW

2.1 e-Payment and e-Commerce

E-commerce refers to purchases and sales

transactions made through the Internet. E-commerce

includes communication to send information,

Products, services, or payments by electronic means,

technology applications towards transaction

Sugandini, D., Effendi, M. and Istanto, Y.

The Effect of Ease of Use, Usefulness, Trust, Self-efficacy, and Security on Adoption Technology.

DOI: 10.5220/0009964400890093

In Proceedings of the International Conference of Business, Economy, Entrepreneurship and Management (ICBEEM 2019), pages 89-93

ISBN: 978-989-758-471-8

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

89

automation, and services to improve the speed and

quality of shipping that can cut costs (Yang, 2017).

In an e-commerce environment, payments are made

in electronic form, so it is called an e-payment

system (EPS). Mukherjee & Roy (2017) points out

some of the main benefits of the system e-

commerce, namely: e-commerce is a modern

business system, it can be used anytime and

anywhere in the global market immediately,

requiring dedicated human resources, purchasing or

selling systems as electronic, only requires an

internet connection, PC and knowledge, information

can be shared with partners in just a few moments.

2.2 Perceived Ease of Use (PEOU) and

Trust

Gefen, Karahanna, and Straub (2003) broaden the

Technology Acceptance Model model (TAM) by

adding trust factors in the e-commerce context.

TAM states that PEOU can influence the level of

customer adoption in using information technology.

However, because customer behavior online cannot

be easily predicted and the risk of adopting payment

transactions via the Internet is also high, trust is a

factor that must be considered in adoption e-

commerce (Chinomona, 2013; Beldad & Hegner,

2018). The risk and uncertainty of using a mobile

application are because the application can

jeopardize user privacy (Giota & Kleftaras, 2014;

Keith, Lewis & Wyatt, 2014). The risks and

uncertainties associated with the decision to use

mobile applications in transactions online require

trust. Beldad & Hegner (2018); Sugandini et al.,

(2018a) show that the risks and uncertainties

associated with the decision to use a mobile

application require trust, given its relevance in

situations where the positive results of an action

cannot be ascertained precisely and when certain

technologies can be exploited to damage its users.

H1: Perceived Ease of Use influences trust H2:

Trust influences adoption technology

2.3 Perceived Usefulness and the Trust

Technology Acceptance Model (TAM) has been

widely used to explain the perceived usefulness that

affects consumers' online shopping behavior (Davis,

1989). Sugandini et al., (2018b); Diop et al., (2019)

show that perceived usefulness in using certain

technologies will improve performance. Trust is

another factor that is believed to influence consumer

online shopping behavior (Jin et al.,2015). Trust is a

multidimensional concept because trust is based on a

rational assessment of individual abilities and

integrity. In the online environment, trust is mainly

built from the site through person-to-person

communication, which is mediated by technology.

Trust is important because online shoppers and

retailers cannot physically see each other during

interactions. Lack of trust is one of the main reasons

why customers don't buy online (Beldad & Hegner,

2017).

H3: Perceived Usefulness Influences Trust

2.4 Self-efficacy and Security

Ozer and Bandura defined self-efficacy as one's

belief in their ability to mobilize the motivation,

cognitive resources, and actions needed to control

events. Self-efficacy affects one's motivation and

actions, self-regulation, initiation, and perseverance

in adapting to face obstacles (Vance et al., 2012).

Shahri and Mohanna (2016) state that self-efficacy

affects the security of user information. Self-efficacy

Users can benefit the effectiveness of information

security programs. Hameed & Arachchilage (2018)

states that self- efficacy is one of the main predictors

of information system security.

H4: Self-Efficacy influences security

2.5 Security and Trust

Access to security guidelines in e-payment systems

is among the important factors that influence

customer trust (Barkhordari, 2016). Customers who

understand security measures, security policies,

electronic payment systems will increase customer

confidence (Lim, 2008). Ease of security access,

resolve security issues through the guidelines

available on the EPS website. Ease of access and

visibility regarding security on the EPS website can

increase online transactions (Sanayei and Noroozi,

2009). Maroofi et al. (2012) conclude that online

regulations are subject to several security threats and

propose that consumer confidence in transactions

online is influenced by the security of the website.

Maroofi et al., (2012); Sugandini et al., (2018a;

2018b) show a positive and significant relationship

between the concept of online security and trust.

Barkhordari, (2016) states that e-payment service

providers must consider trust and security as

important characteristics of the use of EPS.

H5: Security influences Trust

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

90

3 RESEARCH METHOD

The study was conducted in the form of a survey,

using an explanatory research approach, namely,

research that explains the causal relationship

between variables through hypothesis testing

(Creswell and Clark, 2017), as well as with survey

samples, i.e., samples taken from a population and

using a questionnaire as a tool principal data

collection and individual analysis units. Respondents

in this study include all GO-PAY users in the

Special Region of Yogyakarta who are over 17 years

old. The number of samples in this study was 200

people. The direct effect (Path coefficient) is

observed from standardized regression weights by

testing the comparative significance of CR (Critical

Ratio). Testing of models developed with various

criteria Goodness of Fit (Hair, Anderson, Tatham, &

Black, 1998).

4 RESULTS

4.1 Hypothesis Testing Results

The measurement model test results in this study are

relatively good, so they can proceed to the structural

model analysis stage without modification. The

results of the structural equation model analysis

showed that the resulting goodness of fit index value

showed fit results. Value of 0.015; GFI 0.913;

RMSEA 0.100; TLI 0.973; CFI 0.994 and CMIN /

DF of 3,087. The results of testing the structural

model presented in table 1 show that not all

hypotheses are supported.

Table 1. Path coefficients

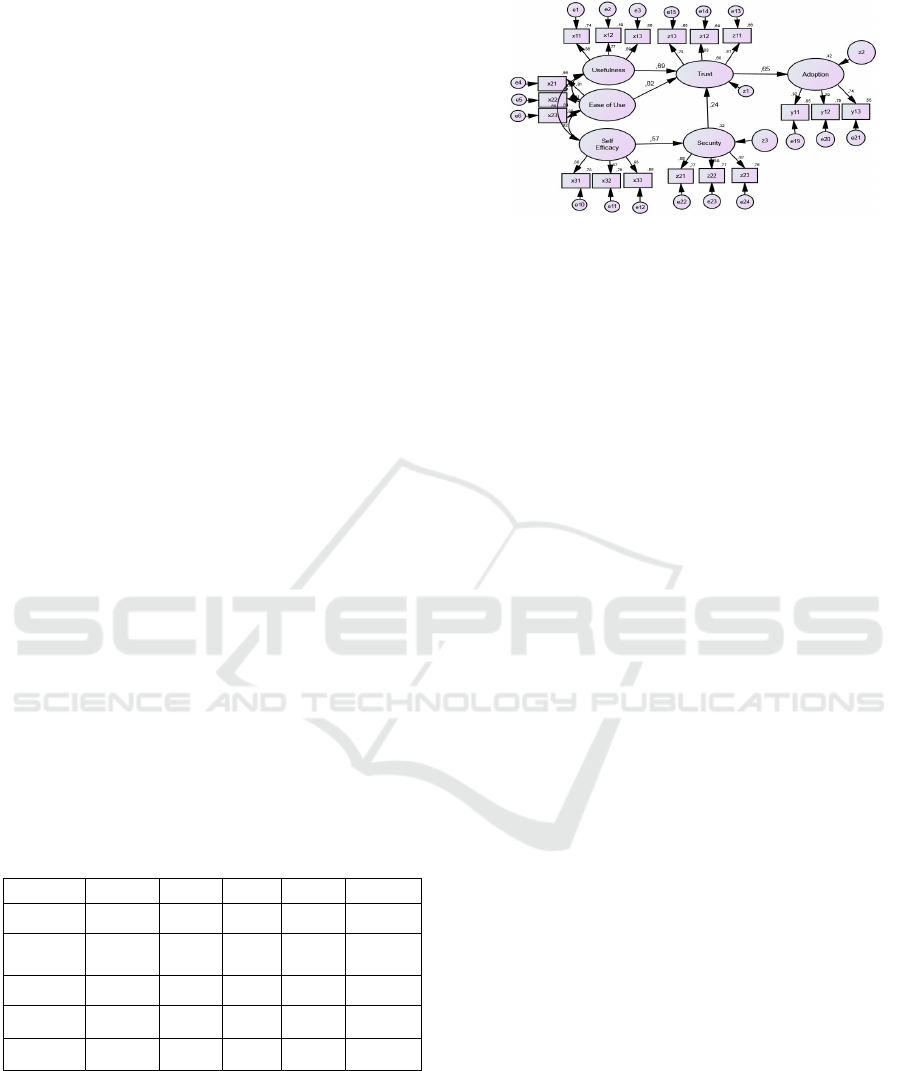

The complete model about GO-PAY adoption

can be seen in Figure 1.

Figure 1. Model of technology adoption GO-PAY

4.2 Discussion

This study could explain the model adoption of GO-

PAY technology that is influenced by usefulness,

ease of use, self-efficacy, security, and trust. Nearly

all of the hypotheses proposed in the research were

supported; only the first hypothesis in this study was

unsupported. This study does not support the

hypothesis that ease of use influences trust. This is

because going pay users already feel the ease of use,

but the convenience obtained is not able to increase

trust in using GO-PAY. This mistrust is caused by

GO-PAY users being the initial perpetrators in terms

of e-payment. So there are still doubts regarding the

use of GO-PAY. So the results of this research

cannot support the opinion of Chinomona, (2013);

Giota & Kleftaras, (2014); Keith et al., (2014), and

Beldad & Hegner, (2018).

The second hypothesis states that trust influences

the adoption of supported GO-PAY technology. This

shows that actually even though GO-PAY users

have a level of trust that is not too high, but because

of the need for high use of GO-PAY so this trust can

increase adoption of GO-PAY, even though it is still

limited payment transactions that exist in the

GOJEK application. The results of this study support

Keith et al., (2014); Sugandini et al., (2018a, 2018b),

and Beldad & Hegner (2018). The third hypothesis

which explains that there is an influence of PU on

supported trusts. Customers who already feel the

benefits of using GO-PAY will trust more.

Customers can feel that the benefits of using GO-

PAY are relatively numerous; among other things,

customers have no trouble paying if they don't carry

cash, GO-PAY can handle payments with just one

click so that the results of this study support Diop et

al., (2019) and Jin et al., (2015).

The fourth hypothesis which states that efficacy

has an influence on security supported. This can

indicate that the ability to control attitudes and

behavior towards the desired course of action can

increase perceptions about the safety of using GO-

H

ypothesis

E

stimate S.E. C.R P

n

formation

H1 0.445 0.055 8.106 ***

S

upporte

d

H2 0.022 0.094 0.231 0.817 Not

S

upporte

d

H3 0.752 0.094 7.982 ***

S

upporte

d

H4 0.285 0.075 3.789 ***

S

upporte

d

H5 0.645 0.085 7.607 ***

S

upporte

d

The Effect of Ease of Use, Usefulness, Trust, Self-efficacy, and Security on Adoption Technology

91

PAY. Users who feel confident that they can use the

GO- PAY application properly feel comfortable and

safe using GO-PAY. This study supports Vance et

al. (2012), Shahri & Mohanna (2016), and Hameed

& Arachchilage (2018). The fifth hypothesis states

that security influences supported trust. Customers

who understand the security system in electronic

payments can increase trust in e-payment. GO-PAY

customers mostly already understand the good use of

GO-PAY. Proficiency in handling risk and ease of

accessing security systems from GO-PAY can

increase customer confidence in using GO-PAY. So

that by increasingly perceiving that GO-PAY is safe

to use, then trust in GO-PAY also increases. The

results of this study support Maroofi et al. (2012):

Barkhordari (2016), who states that e-payment must

consider trust and security as important factors in the

adoption of GO-PAY.

5 LIMITATIONS AND

SUGGESTIONS

This study only analyzes the use of GO-PAY for

payment transactions, although there are many other

forms of payment that can be used in online

transactions. Further research is expected to further

analyze the adoption of GO-PAY by taking a

complete set so that it can revise the findings of this

research, which are not significant. Taking more

complex e-payment settings can increase the

generalization of the research findings. Some

research variables can also be used in analyzing GO-

PAY adoption as a form of e-payment. These

variables are the Technical & Transaction Procedure

(Barkhordari et al., 2016), compatibility, and

network externalities (Maxim Lundh & Alexander

Svensson, 2018).

REFERENCES

Alikhani, A., & Davarzani, M. H., 2014. “An investigation

on factors influencing electronic banking adoption in

private banks versus public banks”. Management

Science Letters, 4 (1): 37-42.

Barkhordaria, M., Nourollaha, Z., Mashayekhib, H.,

Mashayekhic, Y., Ahangar, M.S., 2016. “Factors

influencing adoption of e-payment systems: an

empirical study on Iranian

customers", Information Systems and e- Business

Management. March, pp 1-26. DOI: 10.1007 / s10257-

016-0311-1

Beldad, Ardion D., & Hegner, Sabrina. M., 2017.

"Expanding the technology acceptance model with the

inclusion of trust, social influence, and health

valuation to determine the predictors of German users'

willingness to continue using a fitness app: a structural

equation modeling approach". International Journal of

Human – Computer Interaction. Vol. 34, Issue 9. Nov,

pp. 882-893. https://doi.org/10.1080/10447318.

2017.1403220.

Chinomona, R.. 2013. “The influence of perceived ease of

use and perceived usefulness on trust and intention to

use mobile social software”, African Journal for

Physical, Health Education, Recreation and Dance

(AJPHERD), Volume 19 (2), June. pp. 258-273.

Creswell, J. W., & Clark, Vicki L. Plano., 2017.

“Designing and Conducting Mixed Methods

Research”. SAGE Publications Inc. Publication City /

Country Thousand Oaks, United States ISBN-10

1483344371. 9781483344379

Davis, F. D., 1989. “Perceived usefulness, perceived ease

of use, and user acceptance”, MIS Quarterly. Vol.13

(3), pp. 319–39.

Diop, E.B, Zhao S., & Duy, T.V., 2019. “An

extension of the technology acceptance model for

understanding travelers' adoption of variable

message signs”, PLoS ONE, 14 (4):

e0216007https://doi.org/10.1371/journal.pone.

0216007

Fatonah, S., Yulandari, A., & Wibowo, F.W., 2018. “A

Review of E-Payment Systems in E- Commerce”,

Journal of Physics Conference Series. December,

DOI: 10.1088 / 1742-6596 / 1140/1/012033

Hameed, M.A., & Arachchilage, N. A. G., 2018.

“Understanding the influence of individual, self-

efficacy for information systems security innovation

adoption: A systematic literature review”, 17th

Australian Cyber Warfare Conference (CWAR),

October 10-11th, Melbourne, Victoria, Australia.

arXiv: 1809.10890

Hair Jr., Anderson, R.E, Tatham, R.L., & Black, W.C.,

1998. “Multivariate Data Analysis”, New Jersey:

Prentice-Hall International, Inc. Hawkins DI, Best.

Hanafizadeh, P., Behboudi, M., Koshksaray, A., & Tabar,

J. S. M., 2014. “Mobile-banking adoption by Iranian

bank clients”, Telematics and Informatics. 31 (1): 62-

78.

Junadi, S., 2015. “A model of factors influencing

consumer's intention to use e-payment systems in

Indonesia". Procedia Computer Science. Vol. 59, p.

214-220.

Karamjeet Kaur., & Ashutosh Pathak., 2015. “E- Payment

System on E-Commerce in India”, Journal of

Engineering Research and Applications. Vol. 5, Issue

2, (Part -1) February, pp.79-87.

Kim, C., Tao, W., Shin, N., & Kim, K. S., 2010. “An

empirical study of customers' perceptions of security and

trust in e-payment systems”, Electronic Commerce

Research and Applications. Vol. 9 (1), pp. 84-95.

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

92

Lim, A. S., 2008. “Inter-consortia battles in mobile

payments standardization”, Electronic. Commerce.

Vol.7, pp. 202-213.

Lim, Yi-Jin., Osman, A., & Suberi, M., 2014. “Perceived

usefulness and trust towards consumer behavior: a

perspective of consumer online shopping”, Asian

Journal of Scientific Research. Vol. 4 (10), pp. 541-

546. http://www.aessweb.com/journals/5003

Maroofi, F., Hashemi, R., & Nargesi, Z., 2012. “Survey of

customers' conceptions of security and trust in e-

payment systems”, Asian Journal of Business

Management. Vol. 4 (3): 275-285

Maxim., & Alexander., 2018. “Exploring the consumer

adoption of alternative e-payment methods: A study of

the Swedish market”, Bachelor of Thesis in Business

Administration, Jonkoping University.

Mukherjee, Momin., & Roy, Sahadev., 2017. “E-

commerce and online payments in the modern era”,

Volume 7, Issue 5, May, pp 1-5. DOI: 10.23956 /

ijarcsse / SV7I5 / 0250.

Sanayei, A., & Noroozi, A., 2009. “Security of Internet

banking services and its linkage with users' trust: A

case study of Parsian banks of Iran and CIMB banks

of Malaysia”, International Conference on Information

Management and Engineering, IEEE press, pp. 3-7.

Shahri, A.B., & Mohanna, S., 2016. “The Impact of the

Security Competency on "Self-efficacy in Information

Security" for Effective Health Information Security in

Iran. In: Rocha Á., Correia A., Adeli H., Reis L.,

Mendonça Teixeira M (eds), New Advances in

Information Systems and Technologies. Advances in

Intelligent Systems and Computing, Vol 445.

Springer, Cham

Sugandini D., Sudiarto., Surjanti, J., Maroah, S., &

Muafi. (2018a). “Intention to delay: The

context of technology adoption based on android”,

International Journal of Civil Engineering and

Technology, Vol 9, Issue 3, p. 736-746.

Sugandini D., Purwoko., Pambudi, A., Resmi, S., Reniati.,

Muafi., and Kusumawati, R.A (2018b). “The Role of

Uncertainty, Perceived Easy of Use, and Perceived

Usefulness Towards the Technology Adoption”,

International Journal of Civil Engineering and

Technology, Vol 9, Issue 4, p. 660-669

Vance, A., Siponen, M., & Pahnila, S., 2012. “Motivating

IS security, compliance: insights from habit and

protection motivation theory”, Information &

Management. Vol. 49, pp. 190- 198.

Venkatesh, V., & Bala, H., 2008. “Technology acceptance

model 3 and a research agenda on interventions”.

Decision sciences. 39 (2): 273-315.

Yang, Wenjing., 2017. “Analysis on online payment

systems of e-commerce”. Bachelor's Thesis. Business

Information Technology, Oulu University of Applied

Sciences

The Effect of Ease of Use, Usefulness, Trust, Self-efficacy, and Security on Adoption Technology

93