Capital Market Reaction to the Announcement of 2019 Presidential

Candidates and Vice Presidential Candidates

Hendro Widjanarko, Muhammad Taufiq, and Triani Pujiastuti

Universitas Pembangunan Nasional Veteran Yogyakarta

Keyword: Event Study, Political Events, Market Reaction, Trading Volume Activity, Abnormal Return

Abstract: This research is an event study that aims to find out how the capital market reacts to the announcement of

presidential candidates and vice-candidates president in 2019. Market reaction is measured using the variable

abnormal return and the variable trading volume activity. The research sample was selected using the

purposive sampling method and obtained a sample of 41 mining companies on the Indonesia Stock Exchange.

Hypothesis testing is done by using paired sample t-test analysis test. In view of the consequences of factual

tests demonstrate that there is no huge contrast between the normal anomalous return when the declaration of

presidential up-and-comers and bad habit presidential competitors in 2019. There is a significant difference

between the average trading volume activity before and after the announcement of presidential candidates and

vice-presidential candidates president in 2019. This is because of the declaration of the presidential and bad

habit presidential up-and-comers in 2019, giving a negative sign in the capital market. Political occasions will

uncertainly affect the economy.

1 INTRODUCTION

A capital market is a spot for different gatherings,

particularly organizations that sell offers and

securities, with the point of the deal will be utilized as

extra reserves or to fortify the organization's capital

(Fahmi, 2015).

The capital market as an economic instrument is

inseparable from various environmental influences,

both the economic environment and the non-

economic environment. Changes in the

macroeconomic condition that happens, for example,

changes in loan costs on reserve funds and stores,

outside trade rates, expansion, just as different

monetary guidelines and deregulation given by the

administration additionally impact the vacillations in

stock costs and exchanging volume on the capital

market. In spite of the fact that not legitimately

identified with the impact of the non-financial

condition, likewise can not be isolated from exercises

in the capital market.

Political events are one part of the non-economic

environment. Political events can contain information

that can influence investors' decision making and

ultimately, the market reacts to that information to

form a new price balance so that it can be said that

political events can indirectly influence activities in

the capital market.

The declaration of the presidential and bad habit

presidential applicants in 2019 is one of the political

occasions. Where on September 20, 2018, it was

declared that in the 2019 presidential political

decision, there were just two competitors, to be

specific Joko Widodo with Ma'ruf Amin and

Prabowo Subianto with Sandiaga Salahuddin Uno.

Politics is closely related to power that will affect

changes in public policies that have been in force. At

the end of President Susilo Bambang Yudhoyono's

administration on January 11, 2014, the government

and the Ministry of Energy and Mineral Resources

(ESDM) imposed Government Regulation (PP) No. 1

of 2014 and ESDM Ministerial Regulation (Permen)

No. 1 of 2014 concerning Increasing Mineral Value

Added Through Mineral Processing and Refining

Activities in the Country. The enactment of these two

regulations as a form of implementation of Law

(Law) Number 4 of 2009 concerning Mineral and

Coal Mining (Minerva) which regulates the

prohibition of mining entrepreneurs from exporting

six types of raw mining materials, namely nickel,

bauxite, tin, gold, silver, and chromium before going

through the processing and refining process.

Meanwhile, during the administration of

President Joko Widodo (Jokowi), the Government

and ESDM on 11 January 2017 again allowed the

export of concentrates, low-grade raw minerals for

Widjanarko, H., Taufiq, M. and Pujiastuti, T.

Capital Market Reaction to the Announcement of 2019 Presidential Candidates and Vice Presidential Candidates.

DOI: 10.5220/0009965903370341

In Proceedings of the International Conference of Business, Economy, Entrepreneurship and Management (ICBEEM 2019), pages 337-341

ISBN: 978-989-758-471-8

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

337

washed bauxite with A12O3 levels of more than or

equal to 42% and nickel grading less than 1.7%.

Exports are permitted as a result of the issuance of

Government Regulation Number 1 of 2017 and

Minister of Energy and Mineral Resources Number 5

of 2017 and Number 6 of 2017.

As for one sector that is expected to experience a

positive trend in the political year leading up to the

2019 presidential election, namely the coal mining

sector. In light of the administration approach plot in

the 2019 Draft State Revenue and Expenditure

Budget (RAPBN), the Government of Indonesia is

focusing on expansion in coal creation from 413

million tons in 2018 to 530 million tons in 2019 or

expansion of 28.3% in the political year. Also, non-

oil and gas natural resource (SDA) revenues in the

2019 Draft State Budget remain dominated by

revenues from mineral and coal mining, which

reached Rp 23,946.9 billion and an increase of 24.5%

compared to its target in the 2018 outlook.

Therefore, the performance of mining companies

in Indonesia is strongly influenced by policies issued

and determined by the Government of Indonesia.

Regarding the above wonder, specialists are keen

on leading occasion study to explore on market

responses to occasions that are not straightforwardly

identified with the economy, in particular, the

declaration of presidential up-and-comers and bad

habit presidential applicants in 2019. The market

response in this investigation is estimated by

anomalous return and exchanging volume action.

2 RESEARCH METHODS

This type of research is an event study. Occasion

studies can be utilized to test the data substance of an

occasion or declaration and can likewise be utilized

to test the market proficiency of a half solid structure

(Hartono, 2010).

The populace in this investigation, in particular,

46 mining organizations recorded on the Indonesia

Stock Exchange. The inspecting method in this

examination, to be specifically utilizing the purposive

testing procedure. Of the several criteria determined,

41 mining companies meet the criteria and will then

be the object of research.

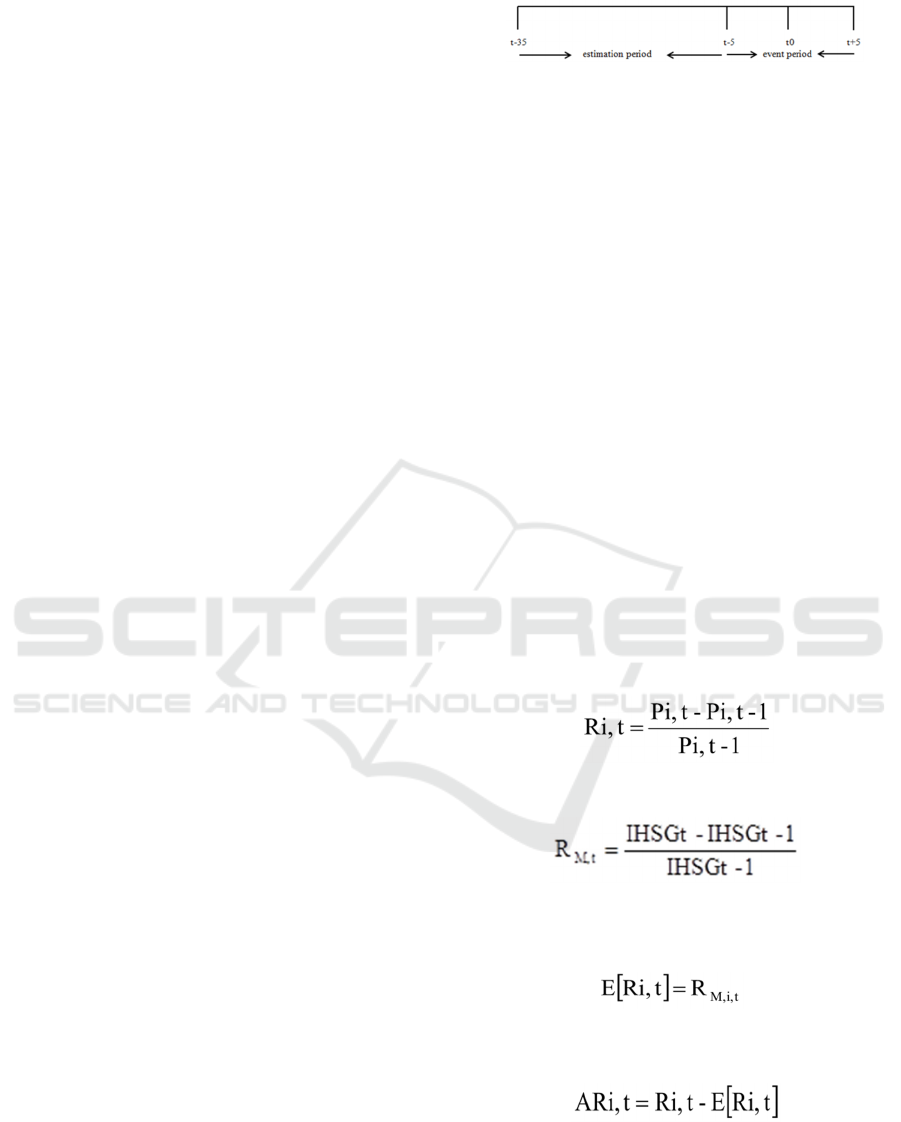

The perception time frame (occasion period)

utilized is 11 days, for example, 5 days before the

declaration of the presidential and bad habit

presidential applicants in 2019 (t-5), 1 day during the

declaration of the 2019 presidential and bad habit

presidential up-and-comers (occasion day), and 5

days after the declaration of the presidential and bad

habit presidential competitors in 2019 (t + 5).

Figure 1. The Windows Event

Sort of information utilized in this examination is

auxiliary information from the Indonesia Stock

Exchange (www.idx.co.id), which comprises: (1).

The daily closing stock price of each mining company

that is the sample of the study during the study period.

(2). Composite stock price index (CSPI) during

transaction days on the Indonesia Stock Exchange

(IDX) included in the study period. (3). The daily

trading volume of shares of each mining company

that was the sample of the study during the study

period. (4). Number of shares outstanding from each

mining company that was the sample of the study

during the study period.

Research Variables: (1). Abnormal return is the

difference between the actual return that occurs, and

the expected return (Hartono, 2010). (2). Trading

volume activity is a comparison of the number of

shares of a company traded in a certain period with

the total number of shares outstanding from that

company in the same period (Mansur et al., 2014).

2.1 Calculation of Abnormal Return

a. Calculates the actual return using the

formulation as follows (Hartono, 2010):

(1)

b. Calculates market return using the following

formulation (Hartono, 2010):

(2)

c. Calculates the Expected Return (Expected

Return) by using the following formulation

(Hartono, 2010):

(3)

d. Calculating Abnormal Returns using the

following formulations (Hartono, 2010):

(4)

e. Calculating Average Abnormal Returns

using the following formulations (Hartono,

2010 ):

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

338

(5)

2.2 Calculation of Trading Volume

Activity

a. Calculate Trading Volume Activity by using

the following formulation:

(6)

b. Calculate Average Trading Volume Activity

(7)

2.3 Hypothesis

Hypothesis testing using different paired sample t-test

using a confidence level of 95 % or α = 5%, with the

following conditions (Ghozali, 2012):

a. Ho is accepted if sig-t (probability)> 0.05

b. Ha is accepted if sig-t (probability itas) <0.05

3 RESULTS

3.1 Hypothesis Testing I

The first hypothesis in this study is that there is a

difference between the average abnormal return

before and after the announcement of presidential

candidates and vice-presidential candidates in 2019.

Theory testing uses matched example t-test

measurable tests to decide if there is a noteworthy

distinction between the normal irregular return when

the declaration of the presidential and bad habit

presidential up-and-comers in 2019. The results of

testing the average abnormal return using the paired

sample t-test are obtained as follows:

Table 1 Paired Samples Test average Abnormal Return

In light of the test results above demonstrates that

the centrality estimation of the normal variable

anomalous return when the declaration of the

imminent declaration president and bad habit

presidential applicants in 2019 added up to 0.202.

This shows the significance value is greater than the

level of significance that has been set, namely 0.05

(0.202> 0.05). In this way, it tends to be reasoned that

the elective theory (Ha) is rejected, and the invalid

speculation (Ho) is acknowledged, or there is no huge

distinction between the normal unusual return when

the declaration of the presidential and bad habit

presidential competitors in 2019. The in addition to

signing (+) in front t worth demonstrates that the

normal estimation of unusual return before the

declaration of the presidential and bad habit

presidential applicants in 2019 is more noteworthy

than the normal estimation of anomalous return after

the occasion.

3.2 Hypothesis Testing II

The second theory in this investigation is that there is

a contrast between the normal exchanging volume

movement when the declaration of the presidential

and bad habit presidential up-and-comers in 2019.

Theory testing utilizes a combined example t-test

measurable test to see if there is a critical contrast

between the normal exchanging volume action when

the declaration of the presidential and bad habit

presidential up-and-comers in 2019. The aftereffects

of testing the normal exchanging volume action

utilizing the combined example t-test are acquired as

pursues:

Table 2: Test Results Paired Samples Test Average Trading

Volume Activity

In view of test outcomes combined example t-test

above demonstrates that the estimation of variable

noteworthiness normal exchanging volume

movement when the declaration of the presidential

and bad habit presidential applicants in 2019 adding

up to 0.003. This demonstrates the criticalness worth

is littler than the degree of centrality that has been set,

which is 0.05 (0.003 <0.05). Accordingly, it tends to

be inferred that the elective speculation (Ha) is

acknowledged, and the invalid theory (Ho) is

Capital Market Reaction to the Announcement of 2019 Presidential Candidates and Vice Presidential Candidates

339

rejected, or there is a noteworthy contrast between the

normal exchanging volume movement when the

declaration of the presidential competitors and bad

habit presidential up-and-comers in 2019. The in

addition to signing (+) in front t worth demonstrates

that the normal benefit of exchanging volume action

before the declaration of the presidential and bad

habit presidential up-and-comers in 2019 is more

noteworthy than the normal benefit of exchanging

volume movement after the occasion.

4 DISCUSSION

4.1 Analysis of Hypothesis I Testing

A decrease in the normal estimation of unusual

returns five days prior and five days after the

declaration shows that the market is reacting

contrarily (awful news) from the declaration of the

presidential and bad habit presidential up-and-comers

in 2019. Likewise, speculators have foreseen the

declaration of the presidential and bad habit

presidential up-and-comers in 2019 by not making

such a large number of exchanges around the

occasion, making the stock cost on the stock trade

decay, as confirm by the normal unusual return

esteem that demonstrates a negative number around

the declaration date (t-2, t-0, and t + 1).

The nonappearance of a noteworthy distinction is

conceivable in light of the fact that data about when

the declaration of the presidential and bad habit

presidential applicants in 2019 has been across the

board both through print media, TV media, and online

media with the goal that no financial specialist has

more (data asymmetry) to get an irregular return.

Speculators have not responded to the declaration

of the presidential and bad habit presidential up-and-

comers in 2019, in light of the fact that each of the

presidential and bad habit presidential up-and-comers

has not had the option to impact financial specialist

inclinations in settling on venture choices, so there is

no huge contrast between the strange normal return

when the declaration occasion. This shows that the

announcement of the presidential and vice-

presidential candidates in 2019 had no impact on the

investment climate in Indonesia.

This examination supports research led by

Meidawati et al. (2004) in the 2004 authoritative

political decision, Trisnawati (2011) in the 2004

presidential political race, Hutami et al. (2015) in the

2014 presidential political decision, Rahmawaty et al.

(2015) in 2014 presidential political decision

occasions, and Hasib et al. (2017) in the bureau

reshuffle volume II occasion, which found that there

was no noteworthy distinction between the normal

anomalous return when the occasion.

4.2 Analysis of Hypothesis II Testing

The presence of critical contrasts in normal

exchanging volume action when the declaration of the

presidential chosen people and bad habit presidential

applicants in 2019 gives an outline that speculators

make noteworthy buys and deals when the declaration

of presidential up-and-comers and bad habit

presidential up-and-comers in 2019. The distinction

in normal exchanging volume movement when the

declaration of the presidential and bad habit

presidential applicants in 2019 likewise demonstrates

that the declaration of presidential and bad habit

presidential up-and-comers in 2019 has enough data

content that impacts financial specialist inclinations

in settling on speculation choices.

There is a huge distinction between the normal

exchanging volume movement when the declaration

of the presidential applicants and the 2019 bad habit

presidential competitors. This is conceivable in light

of the fact that financial specialists have foreseen the

occasion by diminishing and not liable to lead stock

exchanging exchanges after the declaration of the

presidential up-and-comers and bad habit presidential

up-and-comers. 2019.

In view of exchanging volume movement, the

declaration of presidential applicants and bad habit

presidential up-and-comers in 2019 gave a negative

supposition to the venture atmosphere in the

Indonesian capital market, as demonstrated by the

decrease in normal exchanging volume action after

the occasion. This is on the grounds that the

declaration of the presidential and bad habit

presidential up-and-comers in 2019 gives an

underlying portrayal of the vulnerability of

government approaches in the following five years,

so financial specialists dodge and not purchase and

sell partakes in the occasion and pause and carry on

observe (keep a watch out) how the effect of the

declaration of the presidential and bad habit

presidential competitors in 2019 on the Indonesian

economy, which caused a critical distinction between

the normal exchanging volume action when the

occasion.

If, after an event occurs, trading volume activity

increases, the information released is positive (good

news); on the contrary, if trading volume activity

decreases, the information released is negative

(Mansur et al., 2014). So it very well may be said that

data discharged from the declaration of the

presidential and bad habit presidential competitors in

2019 is negative (terrible news) since it causes a

decline in normal exchanging volume action after the

occasion.

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

340

This study supports research conducted by

Meidawati et al. (2004) on the events of Indonesia's

legislative elections in 2004, Hutami et al. (2015) in

the 2014 presidential election event, and Putra et al.

(2018) on the announcement of Donald Trump's

victory as President of America States, which found

that there were significant differences between the

average trading volume activity before and after the

event.

5 CONCLUSION

(1). There is no huge distinction between the normal

irregular return when the declaration of the

presidential competitor and the bad habit presidential

applicant in 2019. (2). There is a huge contrast

between the normal exchanging volume movement

when the declaration of the presidential and bad habit

presidential applicants in 2019.

For future researchers, it is expected to continue

research at the 2019 general election vote counting

event or the 2019 general election winner

announcement event because the event will have an

impact on the policies of the Indonesian government

in the next 5 years so that the market can react more

with the event. Also, it is expected to develop a

research hypothesis by comparing the average

abnormal return and the average trading volume

activity before the time of the event, after with the

time of the event, and before and after the event.

REFERENCES

Fahmi, Irham. 2015. Manajemen Investasi Teori dan Soal

Jawab. Jakarta: Salemba Empat.

Hartono, Jogiyanto. 2010. Teori Portofolio dan Analisis

Investasi. Edisi 7. Yogyakarta: BPFE.

Hartono, Jogiyanto. 2010. Studi Peristiwa: Menguji Reaksi

Pasar Modal Akibat Suatu Peristiwa.Yogyakarta:

BPFE.

Hasib, Fatin Fadhilah, Dewi Nuraini Rahmi Azasi, Nisful

Laila, Achsania Hendratmi dan Puji Sucia

Sukmaningrum. 2017. The Effect of The Working

Cabinet Reshuffle Volume II on Abnormal Return and

Abnormal Trading Volume Activity of The Companies

Listed in Jakarta Islamic Index (JII). Advances in

Economics, Business and Management Research.

Volume36.

Hutami dan Moh Didik Ardiyanto. 2015. Abnormal Return

dan Trading Volume Activity Sebelum dan Setelah

Pemilihan Presiden Secara Langsung 9 Juli 2014 (Studi

Kasus Pada Saham LQ-45). Diponegoro Journal Of

Accounting. Volume 4, Nomor 2 Tahun 2015, Halaman

1.

Mansur, Fitrinidan Salman Jumaili. 2014. Reaksi Pasar

Modal terhadap Peristiwa Pemilihan Umum Tahun

2014 pada Perusahaan Terdaftar di Bursa Efek

Indonesia. Jurnal Penelitian Universitas Jambi Seri

Humaniora. Volume 16, Nomor 2, Hal.59-68

Meidawati, Nenidan Mahendra Harimawan. 2004.

Pengaruh Pemilihan Umum Legislatif Indonesia Tahun

2004 terhadap Return Sahamdan Volume

PerdaganganSaham LQ-45 di PT. Bursa Efek Jakarta

(BEJ).Jurnal SINERGI KAJIAN BISNIS DAN

MANAJEMEN. Vol. 7 No. 1, 2004 Hal. 89 – 101.

Mentayani, Ida, Rusmanto dan Ridho Ridhani. 2016.

Analisis Perbedaan Harga Saham Sebelum dan Sesudah

Pemilihan Umum Presiden 2014 (Event Study pada

Sektor Jasa Keuangan yang Listing di Bursa Efek

Indonesia). Jurnal Ekonomi dan Bisnis. Vol. 9 No.1.

Putra, I Made Deva Hasdwidan I GustiAyu Made

AsriDwijaPutri. 2018. Analisis Reaksi Pasar Sebelum

dan Sesudah Pengumuman Kemenangan Donald

Trump menjadi Presiden Amerika Serikat. E-Jurnal

Uniersitas Udayana. Vol.23.1. April (2018): 406-435.

Rahmawaty dan Riezky Ryatun Putri. 2015. The Impact of

Indonesia Presidential Election Year 2014 on

Abnormal Return and Trading Volume Activities of

Stocks in Indonesia Stock Exchange (Event study on

Advertising Printing Media Stocks Listed on IDX)”.

Proceedings of The 5th Annuual International

Conference Syiah Kuala University (AIC Unsyiah).

Trisnawati, Fenny. 2011. Pengaruh Peristiwa Politik

terhadap Perubahan Harga Saham. Pekbis Jurnal.

Vol.3, No.3.

Capital Market Reaction to the Announcement of 2019 Presidential Candidates and Vice Presidential Candidates

341