The Effect of Indonesian Economic Openness on Poverty Levels in

Indonesia

Purwiyanta, and Ambar Puji Harjanto

Universitas Pembangunan Negeri Veteran Yogyakarta

Keywords: Globalization, Trade openness, Financial openness, Poverty, Error Correction Model

Abstract: Globalization is often positioned as a cause of poverty problems in a country. This study seeks to provide

empirical evidence for this view, especially for the Indonesian economy. Globalization is represented

through the openness of trade in goods and services (external balance) and openness in the financial sector,

including foreign direct investment and investment portfolios. It is suspected that trade openness and

financial openness affect poverty levels in Indonesia. The model used to test the hypothesis is the error

correction model (ECM), with time-series data from 1998 to 2017. The conclusion of this study is that it is

true that trade openness affects poverty in Indonesia, but financial openness does not affect poverty in

Indonesia.

1 INTRODUCTION

Most economists agree that trade liberalization and

financial liberalization, or what is often referred to

as openness in trade and financial openness, is one

way to improve a country's economy. The openness

policy on financial trade is expected to increase

trade. World trade data from 1980 to 2002 have

more than tripled. While in 2000, foreign direct

investment worldwide reached 1.4 trillion dollars

(Deliarnov, 2012).

The level of trade openness is measured using an

index of the level of openness (ratio of exports and

imports to GDP). According to Nowbutsing (2014),

the level of openness can be classified into three

categories namely less than 50% included in the

category of low level of openness, more than 50%

and less than 100% included in the category of

medium level of openness and more than 100%

included in the category of high level of openness.

In the Asian region, Singapore has the highest level

of openness, and Myanmar the lowest. Indonesia

itself is ranked ninth on average, with a medium

level of openness category.

Financial openness is marked by the magnitude

of transactions in the financial market (financial

market) starting from around the mid-1980s. The

movement of capital flows is increasingly large in

industrialized countries, especially countries in

Europe and America that have spread to various

regions of the world, especially countries in Asia-

Pacific. Chinn and Ito (2008) revealed that since

1970, based on the characteristics of the group of

less developed countries, the financial disclosure

index calculated from the ratio of capital accounts to

foreign funding showed that the Asia-Pacific region

had the greatest degree of openness when compared

to other geographical regions. This indicates that the

financial sector in the Asia-Pacific region is more

open and has very low financial market constraints.

An economy with an increasingly free financial

sector will contribute positively to macroeconomic

conditions. Kalemli-Ozcan & Sørensen (2003)

revealed that the increasingly integrated cross-

country capital flows would keep macroeconomic

variable fluctuations. This is because open financial

flows will help the country in gaining a variety of

access to capital, making variations in a country's

production patterns increase, and in turn, will

maintain fluctuations in macroeconomic variables.

Financial openness can be seen from the amount

of foreign investment in the economy, both in the

form of or direct investment foreign direct

investment (FDI), as well as portfolio (portfolio

investment). In the case of developing countries, FDI

has a vital role in the development and economic

growth of the country, as well as portfolio

investment. This condition runs along with greater

trade openness, which also triggers the growth of

Purwiyanta, . and Harjanto, A.

The Effect of Indonesian Economic Openness on Poverty Levels in Indonesia.

DOI: 10.5220/0009966803530358

In Proceedings of the International Conference of Business, Economy, Entrepreneurship and Management (ICBEEM 2019), pages 353-358

ISBN: 978-989-758-471-8

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

353

direct investment and portfolio investment and has a

positive impact on the economic growth of

developing countries.

One of the problems faced by Indonesia as a

developing country is a large number of people who

are still living in poverty, both absolute and relative.

In 1970 the number of people living on the poverty

line (poverty line) numbered 70 million people,

decreased to 42.30 million people in 1980, 38.74

million people in 2000, and decreased to 31.02 in

2010 and 2017 there were 26, 587 million people.

The discussion about economic openness,

namely foreign factors in the Indonesian economy,

has created a polemic in the public sphere.

Specifically for foreign capital, there are pros and

cons, sometimes the debate is less constructive for

economic development. Based on the above

background, this study was conducted to analyze:

a. What is the effect of Indonesia's exports and

imports on poverty levels in Indonesia?

b. How does foreign direct investment in

Indonesia affect poverty levels in Indonesia?

c. How does the investment of Porto polio

abroad in Indonesia affect poverty levels in

Indonesia?

2 LITERATURE REVIEW

2.1 Economic Openness

The relevance of an economy to the global economy

implies that the economy is integrated into the world

market, both the goods market and the world capital

market. Calderon (2005) states that integration in the

global economy contributes to the potential benefits

of economic growth and prosperity. Economic

openness also means increasingly depleting

economic activity barriers between the domestic

market and foreign markets, both the goods market

(trade openness) and financial markets (investment

openness).

a. Trade Openness

Adam Smith explains the importance of trade

openness, where trade without restrictions can create

efficient use of resources and produce a country's

production surplus (exports). The value of trade

openness that is increasingly high is often

interpreted as a hint of a more open economy.

Measurements of trade openness can also be done

with the openness index of import(import

openness)and transparency index of export(export

openness). The import openness index is none other

than the ratio of imports to GDP, while the export

openness index measures the ratio of exports to

GDP.

b. Investment Openness

Asongu (2012), in his research entitled

"Globalization and Africa: Implications for Human

Development," measures the level of financial

openness based on the ratio of foreign investment to

gross domestic product. Simorangkir (2006), in his

study entitled "The Openness and Its Impact to the

Indonesian Economy: ASVAR Approach," measures

financial openness calculated from total foreign

direct investment and portfolio investment inflows

divided by GDP.

2.2 Poverty in Indonesia

Economically, poverty can be defined as a lack of

resources that can be used to meet the necessities of

life and improve the welfare of a group of people.

Resources in the economic context do not only

involve the financial aspects but include all types of

wealth that can improve the welfare of the

community in a broad sense.

Suharto (2006) says that there are three

categories of poverty which is the center of attention

of social work, namely:

a. The poorest group(destitute)or often defined as

poor. This group has income below the poverty line

(generally has no source of income at all) and does

not have access to various social services.

b. The poor(poor), a group who have incomes

below the poverty line, but relative to have access to

basic social services.

c. Vulnerable groups. This group can be

categorized as free from poverty because it has a

relatively better life than the destitute or poor group.

But this group that is often "near poor" (still poor) is

still vulnerable to various social changes around it.

They often move from "vulnerable" to "poor" and

even "status destitute" if there is an economic crisis

and do not get social assistance.

The Central Statistics Agency (BPS) uses the

poor limit of the amount of rupiah spent per month

per capita to meet the minimum food and non-food

needs. For the minimum food requirements, a

standard of 2,100 calories per day is used, while

non-food minimum expenditure expenditures

include spending on housing, clothing, and various

goods and services. Furthermore, to measure

poverty, applied basic needs approach is used, and

the HeadCount Index is. Measurement of poverty

with the basic needs approaches sees poverty as the

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

354

inability to meet basic needs, whereas the approach

Head Count Index is a measure used to measure the

magnitude of absolute poverty.

The World Bank measures poverty using

different measures. The poor are those whose

income is measured by their purchasing power of

less than the US $ 1.90 per day (purchasing power

parity, 2011). Of course, this measure causes

poverty in Indonesia to differ from those calculated

by BPS.

The number of poor people is the number of

people below the threshold called the poverty line,

which is the rupiah value of minimum food and non-

food needs. Therefore, the poverty line consists of

two components, namely the food poverty line(food

line)and the non-food poverty line(non-food line).

2.3 Previous Research

Feriansyah's, Noer Azam Achsani, and Tony

Irawan (2018) have examined the effect of

Financial Liberalization on Macroeconomic

Volatility in the Asia-Pacific region. The dynamic

panel model was used in 19 countries in the Asia-

Pacific region during the period 1976-2015. The

results of the study prove that the benefits of

financial liberalization in the Asia-Pacific Region

are due to the low volatility of macroeconomic

variable growth only in the group of developed

countries, and not for the group of developing

countries. This result proves that the existence of

financial liberalization has not had a full beneficial

effect in the Asia-Pacific Region.

Financial openness in the Asia-Pacific region to

global financial markets has not had a positive effect

on the group of developing countries. That is, an

increase in financial openness in a group of

developing countries will further increase

macroeconomic volatility in that group. As for

developed countries, the results of their interactions

with financial openness show significant negative

results for all estimation results.

Nowbutsing (2014), analyzes the effect of

economic openness on economic growth in member

countries Indian Ocean RIM(IOR). The research

method used was the root unit panel and panel

cointegration for 15 countries (Australia,

Bangladesh, India, Indonesia, Kenya, Madagascar,

Malaysia, Mauritius, Mozambique, Seychelles,

Singapore, South Africa, Sri Lanka, Tanzania, and

Thailand) during the 1997 period until 2011. The

dependent variable of economic growth is

represented by the GDP of each country. While the

independent variable is the degree of trade openness

measured by the ratio of exports plus imports to

GDP, the level of openness of imports (imports as a

percentage of GDP), the level of openness of exports

(exports as a percentage of GDP), government

spending, gross capital formation, inflation, and

labor. The analysis shows that the three levels of

trade openness, the level of import openness, and the

level of export openness have a positive effect. The

level of import openness has the most influence on

economic growth. This is possible because most of

the IOR member countries are large importers in the

field of technology as well as raw materials and

supporting materials for industry.

Eunyoung (2012) studied the impact of trade

openness and foreign direct investment on income

inequality in developing countries. They are using

panel data from 1975 to 2005 from 59 developing

countries. The results of his research suggest that

trade openness and direct investment flows have a

significant effect on expanding income inequality in

developing countries.

That Daumal, Marie (2008) also conducted a

similar study conducted by Eunyoung, for the case

of India and Brazil. Based on the data time series

from 1980-2004 for the Indian case and 1985-2004

for the Brazilian case. The conclusion of his analysis

says that economic openness significantly decreases

inequality of income in the State of Brazil, but in the

case of the State of India quite the opposite,

economic openness increases inequality in India.

Murbarani, Nova (2014) has conducted a study

of the effect of economic openness on inequality

between provinces in Indonesia using panel data

from 26 provinces in Indonesia in 1994-2012. The

results of his research provide the conclusion that

economic openness has a significant influence on

income inequality in Indonesia. His research also

proves that the Kuznets Hypothesis, the relationship

between growth and inequality, which is described

as an inverted U curve, applies in Indonesia.

Tito Brian Adiputra (2017) conducted a study to

determine the effect of economic openness

consisting of trade openness and financial openness

on the index of human development through

economic growth in Indonesia. By using time series

data(time series)from 2000 until 2015. The research

shows that that only financial openness that has a

significant influence improves the human

development index through economic growth in

Indonesia, while no effect of trade openness.

Delis, Arman, et al. (2015) conducted a study

of the effect of Foreign Direct Investment (FDI)

on Unemployment and Poverty in Indonesia, the

period 1993 to 2013. His research concludes that

The Effect of Indonesian Economic Openness on Poverty Levels in Indonesia

355

FDI has a negative and significant effect on the

number of poor people, and FDI has a negative

effect but not significant to the number of

unemployed.

3 RESEARCH METHODS

Data used are secondary time series data, from 1998

to 2017, namely data on Indonesia's poverty rate,

Export and Import Ratio to GDP, FDI to GDP Ratio,

portfolio investment to GDP ratio. The data is

sourced from the World Bank. The relationship

between the variables of Indonesia's economic

openness to poverty in Indonesia is formulated as

follows:

Y = f (X

1

, X

2

, X

3

,) ……………… (1)

Where: Y = Poverty rate in Indonesia (%)

X

1

= Export and Import Ratio to Indonesian GDP

(%)

X

2

=Ratio Foreign Direct Investment to Indonesian

GDP (%)

X

3

=ratio Portfolio investment to GDP of Indonesia

(%)

The model will be used to examine and analyze

the relationship between the dependent and

independent variable error correction model(error

correction Model - ECM). While the error correction

model (ECM) is the right model if the data time

series used is not stationary (Widarjono. 2013). The

error correction model (ECM) is formulated as

follows:

Y = β

0

+ β

1

DX

1t

+ β

2

DX

2t

+ β

3

DX

3

+ β

4

DX

4

+ β

5

ECT + e

……………….

(2)

Where; β

0

= intercept

β

1,

β

2,

β

3,

= regression coefficient

D = first level difference (fist

difference)

ECT = error of imbalance

The econometric statistical steps required

concerning data time series in this study are the unit

root test (unit root test) to see the stationarity of

data. After the unit root test is then performed

cointegration test to determine the possibility of a

long-term balance or stability between the dependent

variable (growth of Indonesian foreign exchange

reserves) with the independent variables in the

model (X1

,

X2

,

X3

,

).

a. (Unit root test unit root tests were)

Performed with the test Augmented Dickey-

Fuller (ADF). If the absolute value of the ADF

statistic is greater than the critical value, the

observed data indicates stationary. Otherwise,

the data is not stationary if the absolute value

of the ADF statistical value is smaller than the

critical value.

b. Cointegration Test Cointegration

The test is done by Johansen's cointegration

test, where Johansen suggests a maximum

estimator likelihood for Q and R and a

statistical test to determine the cointegration

variable r. The presence or absence of

cointegration is based on the test likelihood

ratio (LR). If the calculated LR value is

smaller (<) than the critical value of LR, then

there is no cointegration, and vice versa, if the

calculated LR value is greater (>) than the

critical value of LR, then it is co-integrated.

4 RESULTS

Test results stasionaritasagainst variables analyzed

produced simpilan that all the variables stationary at

first difference. Cointegration test results provide an

indication of the long-term cointegration of the data.

Therefore the error correction model reflected in

equation (2) can be estimated. The estimation results

of the equation are presented in Table 1.

From the estimation results, it is known that the

coefficient value of ECT, shows a statistical

significance, then the model specifications used are

valid. The classical assumption test results also show

that this model is free from heteroscedasticity and

autocorrelation problems. From the estimation

results, it is known that only the variable degree of

openness in the field of trade (X1), which has a

significant influence on poverty in Indonesia. The

degree of financial openness, both variable X2 (FDI)

and X3 (portfolio investment), both have no

significant effect on poverty in Indonesia.

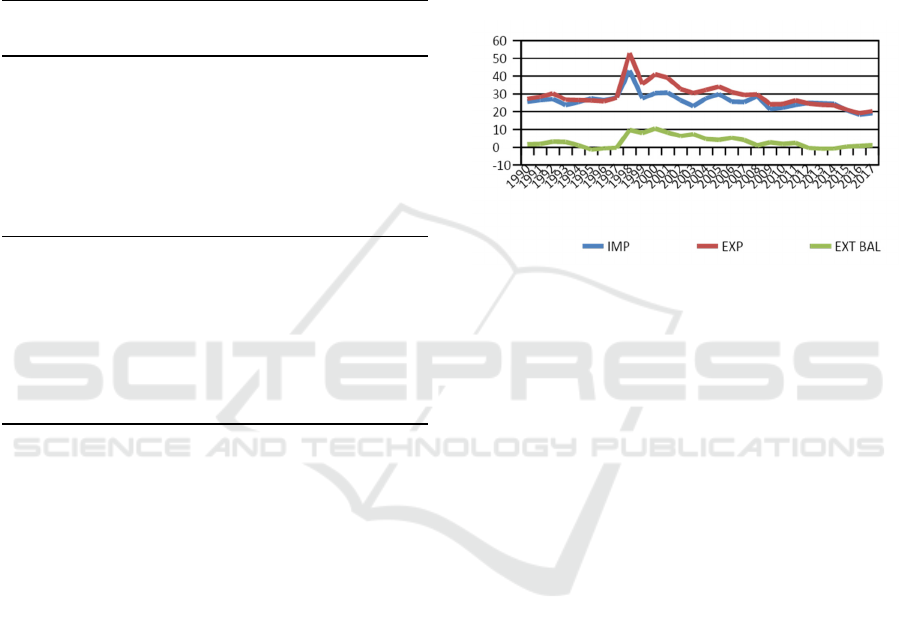

The openness of the Indonesian economy in the

field of trade (X1), measured by the ratio of exports

and imports to GDP. This variable is nothing but the

external balance of goods and services (External

balance on goods and services). Based on data from

1990-2017, fluctuations in Indonesia's exports and

imports tend to be in line, and inline (Figure 1). The

positive relationship of external balance with

poverty in Indonesia can be interpreted that if the

ratio of the surplus of goods and services balance to

GDP is higher, then poverty in Indonesia will

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

356

increase. This tendency must, of course, be

addressed wisely, bearing in mind that Indonesia has

entered into bilateral agreements to open up its

economy widely, such as the MEA, APEC, and

WTO agreements, which aim to expand market

access.

Table 1:Result of Estimated Error Correction Model-ECM

Dependent Variable: D (Y)

Method: Least Squares

Variable Coefficient Std. Error t-Statistic Prob.

C

0.906986 -

2.287462

0.0382 -2.074696

D (X1) 1.613625 0.616793 2.616155 0.0203

D (X2) -0.425048 0.891387 -0.476839 0.6408

D (X3) -0.947886 1.031233 -0.919178 0.3736

ECT -0.756322

0.136744 -5.530957 (-1) 0.0001

R-squared 0.727404 Mean dependent var -3.210526

Adjusted R-squared 0.649519 SD dependent var 6.332622

SE of regression 3.749003 Akaike info criterion 5.701791

Sum squared resid 196.7704 Schwarz criterion 5.950328

Log-likelihood -49.16702 Hannan-Quinn criterion. 5.743854

F-statistic 9.339498 Durbin-Watson stat 0.991198

Prob (F-statistic) 0.000681

Source: Data processed, 2019

Technically so that the impact of openness on

trade in goods and services does not increase

poverty, what needs to be maintained is the ratio of

external equilibrium to GDP maintained at zero

range (or low) or not in the range that is not too

extreme. This can be achieved by:

a. Spurring economic growth beyond export and

import growth

b. Keeping the external balance surplus at a low

range.

c. Maintaining a balance in goods and services

transactions,

Policies that encourage the growth of goods

exports can be used to create a trade balance surplus

and eliminate the service account deficit that has

been occurring so far. Government policies can be

fully directed towards increasing productivity and

reducing inefficiency and increasing

competitiveness. In the long run, government policy

is more directed at fulfilling domestic services by

building a domestic service industry that is robust,

developed and developing, and capable of

contributing to the achievement of a trade surplus in

services.

Openness in financial markets, both foreign

direct investment (FDI) and portfolio investment,

does not have a significant effect on Indonesian

poverty. Further investigation shows that there is no

causality between FDI and poverty in Indonesia.

FDI does not cause poverty in Indonesia. Likewise,

with portfolio investment, there is no causal

relationship between portfolio investment and

poverty. Portfolio investment does not cause poverty

in Indonesia.

Figure 1: Indonesia's Exports, Imports, and External

Equilibrium (% of GDP), 1990 -2017

Thefacts found in this model are that trade

openness (goods and services) to the foreign

economy influences poverty levels in Indonesia.

This tendency more or less provides reinforcement

to the conclusions of the study conducted by

providing support for the results of this study

Eunyoung (2012), Dat Daumal, Marie (2008), and

Murbarani, Nova (2014). Economic openness in the

field of trade is a necessity, but it must still be

sought so that the social impact, especially on

poverty levels, must still be reduced.

5 CONCLUSIONS

The hypothesis that openness in the Indonesian

economy, especially openness in trade, can increase

poverty levels in Indonesia is indeed proven.

However, economic openness in the financial sector

does not contribute to increasing/decreasing poverty

in Indonesia. To reduce the impact of trade openness

on poverty in Indonesia, it is necessary to pay

attention to Indonesia's economic growth rate, which

must be greater than the growth of Indonesia's goods

and services balance.

The Effect of Indonesian Economic Openness on Poverty Levels in Indonesia

357

REFERENCES

Agus Widarjono, 2013: Introduction to Econometrics and

their Applications, Fourth Edition, UPP STIM YKPN

Publisher, Yogyakarta.

Adiputra, Tito Brian, 2017: "The Effect of Economic

Openness on the Indonesian Human Development

Index, Year 2000-2015", Thesis, Hasanudin

University, Makassar.

Arman Delis, Candra Mustika, Ethics of Umiyati, 2015:

"The Effect of FDI on Poverty and Unemployment in

Indonesia", Journal of Economic Paradikma, Vol.10,

No. 0

Asongu, SA, 2012: "Globalization and

Africa: Implications for Human Development", AGDI,

Working Paper.

Chinn, Menzie D, and Hiro Ito, 2008: " A New Measure of

Financial Openne". Journal of Comparative Policy

Analysis, Volume 10, Issue 3,

Calderon, Cesar, 2004: "Trade Openness and Real

Exchange Rate Volatility: Panel Evidence Data",

Central Bank of Chile, Working Papers 294.

Daumal, Marie, 2008: Impact of Trade Openness on

Regional Inequality and Political Unity: the Cases of

India and Brazil. Paper Dauphine Paris University,

Paris

Deliarnov. 2012: "Development of Economic Thought".

Rev.ed .. Jakarta: Rajawali Press.

Feriansyah, Noer Azam Achsani, and Tony Irawan, 2018:

"The Effects of Financial Liberalization on

Macroeconomic Volatility in the Asia-Pacific

Region", JEPI Vol. 18 No. 2

Ha, Eunyoung, 2012: Globalization, Government

Ideology, and Income Inequality in Developing

Countries. The Journal of Politics, Vol. 74, No. 2

Kalemli-Ozcan, S., & Sørensen, B. 2003: Financial

Integration and Economic Welfare.

http://econweb.umd.edu/∼kalemli / assets / books /

SorensenKalemli-Ozcan Feb9 06.pdf.

Murbarani, Nova. 2014: "The Effect of Economic

Openness on Interprovincial Inequality in Indonesia".

Thesis. Gadjah Mada University, Yogyakarta.

Nowbutsing, Baboo M. 2014: "The Impact of Openness on

Economic Growth: Case of Indian Ocean Rim

Countries" Journal of Economic and Development

Studies. Vol.2, No.2, pp. 407-427.

Salim and Budi Sutrisno. 2008: "Investment Law in

Indonesia" Jakarta: PT Raja Grafindo Persada,

Jakarta

Suharto, Edi. 2006: "Public Policy Analysis: A Practical

Guide to Assessing Problems and Social Policy",

Alfabeta, Bandung

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

358