Harmoney: Semantics for FinTech

Stijn Verstichel

1 a

, Thomas Blommaert

2

, Stijn Coppens

2

, Thomas Van Maele

2

, Wouter Haerick

1,2

,

and Femke Ongenae

1 b

1

IDLab, Department of Information Technology at Ghent University - imec, iGent Tower - Tech Lane Science Park 126,

B-9052 Ghent, Belgium

2

Harmoney, Tech Lane Science Park 122, B-9052 Ghent, Belgium

Keywords:

FinTech, Information Integration and Interoperability, Financial Education.

Abstract:

As a result of legislation imposed by the European Parliament, in order to protect inhabitants from being

exposed to a too high financial risk when investing in a variety of financial markets and products, Financial

Service Providers (FSPs) are obliged to test the knowledge and experience of potential investors. This is

oftemtimes done by means of questionnaires. However, these questionnaires differ in style and structure from

one FSP to the other. The goal of this research is to manage in a more cost-effective manner (aligned with the

needs and competencies of the individual financial investor in terms of products and services) the management

of the private equity and to facilitate the fine-tuned personalised financial advisory services needed. This is

achieved by means of a knowledge-based approach, integrating the available information of the investor (e.g.

personal profile in terms of financial knowledge and experience) and for an extendable amount of financial

service providers with their financial products and demonstrated by a number of exemplary use case scenarios.

1 INTRODUCTION

The best decisions on financial investments are those

supported by a personalised, holistic understanding of

the investor. Information such as financial knowledge,

experience and risk willingness are key topics in this

profile. Typical ways to collect this information are by

means of questionnaires – be it online or on paper – to

be filled out by potential investors. Questions found

in such questionnaires are a.o. (i) “Do you have an in-

vestment goal or are you looking for a specific prod-

uct?”, (ii) “How old are you? What is your marital

status?”, (iii) “Are bonds a no-risk investment?”, (iv)

“Have you invested previously on the stock market?”,

or (v) “What is your current professional status?”.

myHarmoney (myHarmoney, 2020), a fast grow-

ing Belgian FinTech startup, offers unique digital

tools to support information collection and aggrega-

tion and to ease the burden on all stakeholders in-

volved. All financial professionals who need to com-

ply with the MiFID II (European Parliament, 2014a)

and MiFIR (European Parliament, 2014b) regulation

can benefit from the myHarmoney platform.

a

https://orcid.org/0000-0001-8007-2984

b

https://orcid.org/0000-0003-2529-5477

One of the possible approaches to reach this per-

sonalised holistic understanding and support of the

financial investor to be, is through the creation of a

personalised profile, i.e. a one-stop-shop for all in-

formation related to that investor. Financial service

providers have to comply with all rules and legislation

and as such are obliged to have their clients fill out

specific questionnaires, defining their level of finan-

cial knowledge and experience. This in turn ensures

that appropriate products and services can be offered.

However, this can be a repetitive and boring task

if a client wants to invest with multiple financial ser-

vice providers. The goal of our research has been to

validate semantic technologies to extract information

from these information sources and how to meaning-

fully pre-populate such questionnaires. Additionally,

we have investigated how gaps in financial knowledge

can be discovered and appropriate informative mate-

rial can be suggested to the client. In such a way, the

financial literacy of the stakeholders can be improved.

The remainder of this paper is structured as fol-

lows. Section 2 presents related work for the semantic

model that is detailed in Section 3. The database and

architecture of the platform is described in Section 4,

including the evaluation of a few semantic process-

ing mechanisms that are adopted to successfully ac-

Verstichel, S., Blommaert, T., Coppens, S., Van Maele, T., Haerick, W. and Ongenae, F.

Harmoney: Semantics for FinTech.

DOI: 10.5220/0010061301410148

In Proceedings of the 12th International Joint Conference on Knowledge Discovery, Knowledge Engineering and Knowledge Management (IC3K 2020) - Volume 2: KEOD, pages 141-148

ISBN: 978-989-758-474-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

141

complish the tasks. Section 5 discusses the details of

how data quality is maintained. Summarised, this pa-

per aims to give the reader a hint of how the starting

point of facilitating a more holistic approach to finan-

cial service provisioning can be achieved through the

adoption of semantic technologies and how it might

be integrated with existing systems, both front-end as

well as back-end.

2 RELATED WORK

A number of potential data integration mechanisms

exist. Firstly, one could integrate individual appli-

cations by means of re-implementing them in one

domain-wide application. Secondly, Application Pro-

gramming Interfaces (API) could be exposed as well

offering application developers the possibility to use

one another’s applications and business information.

Lastly, the integration could also be done at data

level. This means that the individual applications

continue to be developed independently, but a com-

monly agreed domain model is established to ex-

change information between the collaborating stake-

holders. For wider specifications of system integra-

tion, as is the case in the financial domain, the pre-

ferred solution for the integration of data is one that

avoids any major alteration to existing system design.

Further to this, there is a requirement to enable sys-

tems to provide data to other stakeholders that can be

extended at any time without major redesign. This in-

teraction can be achieved through the implementation

of a common vocabulary that forms the foundation for

communication between applications.

One such initiative is the Financial Industry Busi-

ness Ontology (FIBO) (Bennett, 2013). It defines

the entities and interactions/relations of interest to fi-

nancial business applications. FIBO is hosted and

sponsored by the Enterprise Data Management Coun-

cil (EDM) and is a trademark of EDM Council, Inc.

It is also standardised by the Object Management

Group (OMG). As elaborated by EDM, FIBO is de-

veloped as an ontology in the Web Ontology Lan-

guage (OWL). The use of logic ensures that each

FIBO concept is framed in a way that is unambiguous

and that is readable both by humans and machines.

Apart from developing wider semantic

technology-based platforms and solutions, On-

totext (Ontotext, 2020) has previously made the

case for the widespread adoption of these techolo-

gies in the FinTech domain. Moreover, as part of

the ‘Six Markers of Success’ in their McKinsey

report ‘Cutting through the fintech noise: Markers

of success, imperatives for banks’ (Dietz et al.,

2016), the authors proclaim Innovative uses of

data. One such initiative is, e.g. presented through

the FintechBrowser (Abi-Lahoud et al., 2017) –

a demonstrator of an integrated set of dashboards

and a graph explorative-browsing tool. Rather than

claiming a contribution to the general development

of semantic platforms, not only specifically for the

FinTech industry, but even for wider information

integration purposes, this research focuses precisely

on a specific, highly pertinent issue, as demonstrated

by the MiFID II (European Parliament, 2014a) and

MiFIR (European Parliament, 2014b) regulation, and

wants to underline the appropriateness of semantic

technologies for information integration and analysis.

3 SEMANTIC MODEL

This section presents the actual, in a scalable man-

ner engineered, ontology that is suitable to interpret

investment-related information. The architecture, the

ontology and, in case appropriate, the mapping lan-

guage will be detailed. As scoped in Section 1 the

ultimate goal is to generate and pre-populate ques-

tionnaires to define the knowledge and expertise of

potential investors.

3.1 Ontology Model

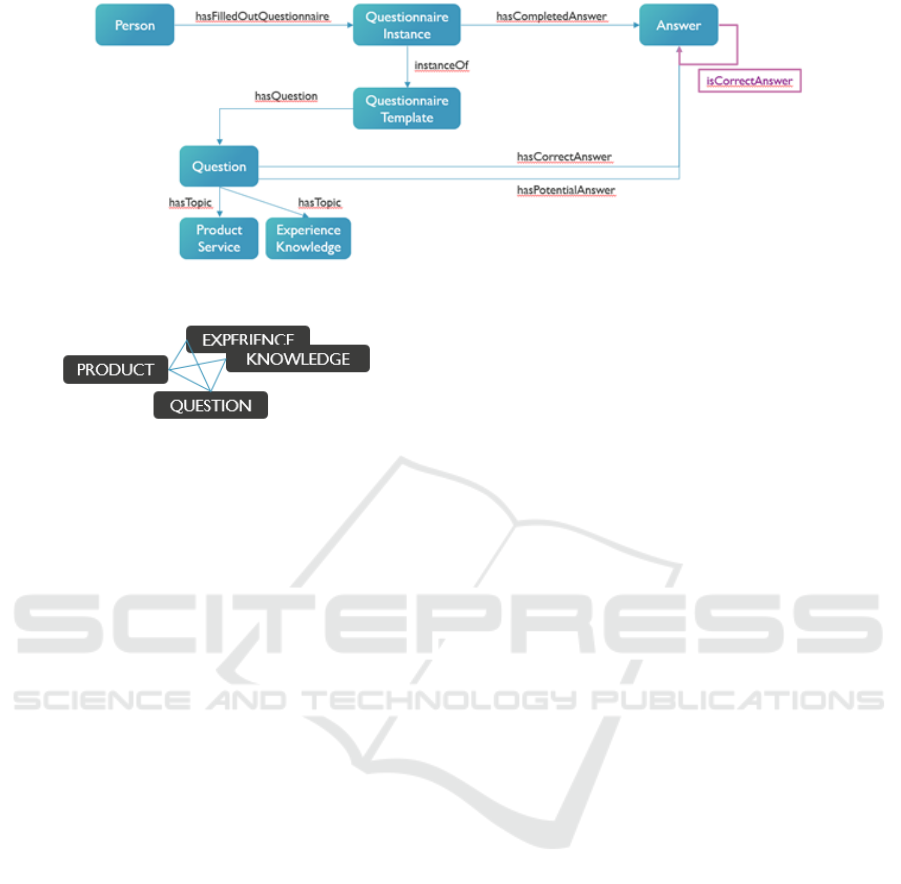

Initially, two separate sub-ontologies were designed,

namely one representing the questionnaires (both the

actual questionnaire with the questions as well as the

filled-out instance by an investor) and the other on-

tology containing all information concerning the in-

vestment services and products, its characteristics and

rules and regulations. The domain knowledge for

the first ontology model was manually extracted from

PDF documents, while the input for the second ontol-

ogy model is located in a relational database.

Later on, these models were further extended with

a more detailed structure of the questionnaires, so

that automatic questionnaire generation can be sup-

ported, as well as the partitioning between individual

financial service providers. Questionnaires have been

modelled as a combination of an empty questionnaire

template on the one hand and a completed version by

an investor on the other hand. Questions in the ques-

tionnaires have two important relationships for this

research, namely the topic concerned and the product

which the question asks information about.

Questions in the questionnaires have two impor-

tant relationships for this research, namely the topic

concerned and the product which the question asks

information about.

KEOD 2020 - 12th International Conference on Knowledge Engineering and Ontology Development

142

In a similar fashion all (potential) answers are in-

stantiated into the ontology model. Apart from mod-

elling the decomposition of a questionnaire into indi-

vidual questions and answers, linked to the products

and topics, one of course needs to be aware of cor-

rect and incorrect answers. This to be able, in a later

stage, to suggest questions in an automated manner

and contextualised to the situation of a given person.

As such, the model as presented earlier can be fully

summarised as in Figure 1.

Surveying through all available questionnaire

PDF documents and using the expertise of the part-

ners in the project, the taxonomy for the ‘Profile-

Topics’ has been defined. Just over 200 questions

have been analysed, and this has resulted in multiple

topics being attributed to individual questions. The

main modelling principle to facilitate capturing the

knowledge and experience of a person allowing to

suggest other questions is presented in Figure 2. Here,

‘Experience’ and ‘Knowledge’ represent placeholders

for specific ‘Topics’ as discussed earlier in this sec-

tion.

Depending on the (set of) answers given by a

particular person/investor, an investment profile can

be affirmed or inferred for that person. An ex-

ample definition of a ‘ConservativeProfile’ could be

that a ‘Person’ has answered a question of a ‘Ques-

tionnaire’ with the name ‘INGQuestionnaireSum-

mer2017 Q1 A1’, should be realised as an individual

of the concept ‘ConservativeProfile’.

The actual ‘Profiles’ to be modelled for all

banks/financial service providers to be considered can

be extended, as can the rules and axioms that de-

fine the automatic realisation. Ontologies allow to

describe anything about anything. Thus, to enforce

some constraints, two main methods are generally ac-

cepted:

• Usage of DOMAIN and RANGE specification for

properties, e.g. ‘Entity’ ‘hasProfile’ ‘Profile’, and

• LOGIC AXIOMS, e.g. ‘Person’ ‘hasProfession-

alActivity’ some ‘ProfessionalActivity’.

To illustrate that not all information in the knowl-

edge model should be entered manually, the hierar-

chical modelling of the known products and services

in the relational database provided by Harmoney has

been imported using the OnTop (Calvanese et al.,

2017) mechanism. This mechanism is further detailed

in Subsection 4.1. So in detail, one implies that the

individual (i) is of a certain type, i.e. specified by the

‘code’ column, (ii) is a product of a certain service

provider, (iii) has a required minimal knowledge test

score threshold, and (iv) has a minimal experience test

score threshold; the latter two being a datatype rela-

tionship to values of the type ‘decimal’.

4 DATABASE AND APPLICATION

ARCHITECTURE

4.1 Importing Information from a

Relational Database

This section details the adopted technology stack and

corresponding application architecture.

Obviously, one needs to create a semantic model

first, i.e. the ontology. The approach adopted for this

research is first to create a clean-field proprietary on-

tology model, according to the OWL2 standard. In a

follow-up stage, alignment with existing models, such

as e.g. FIBO (Bennett, 2013) can be provided, due to

the inherent nature of ontology models and the OWL

modelling language.

Having defined the ontology model in terms of its

concepts, relationships and axioms, the raw data (i.e.

individuals) need to be imported. This can be done

manually, but of course much data already exist in

proprietary systems. The example illustrated here is

one where the data is stored in a relational database,

namely an instance of MySQL. Mappings can be de-

fined, e.g. using the OnTop engine, that specify how

the cells in the tables of the relational database can

be projected to become individuals of concepts in the

ontology, together with their properties and relation-

ships with other cells. As such a virtual RDF graph is

created, allowing semantic querying in the same man-

ner as if it were executed on a native RDF graph. In

this context, RML (Dimou et al., 2014) needs men-

tioning as well, as this broadens the same mechanism

for a variety of underlying persistency mechanisms.

4.1.1 Augmenting Imported Data with

Additional Knowledge through the Use of

JSON-LD

Apart from importing all data from a relational

database, it should be considered that in certain sit-

uations, either not all information is available in the

database, or manual enhancements/improvements on

the imported data need to be performed. Several well

established technologies exist to achieve this goal,

such as by using spreadsheets, text files, XML doc-

uments, editors, etc. One particular technology of in-

terest is based on the well-known serialisation format

JSON, namely JavaScript Object Notation for Linked

Data (JSON-LD). As its name suggests, it is an ex-

tension on the JSON format, and thus also backwards

compatible with it. Information from existing systems

or repositories that can produce JSON documents, can

in a straightforward manner be extended to produce

JSON-LD. Indeed, converting JSON into JSON-LD

Harmoney: Semantics for FinTech

143

Figure 1: Decomposition of Questionnaires.

Figure 2: Three-way relation between ‘Topic’, ‘Product’

and ‘Question’.

only requires the addition of a concept reference. The

example in Subsection 4.1.2 presents this approach in

more detail and arguments why in a semantically rich

environment it is of great additional benefit over the

standard benefits when using plain JSON.

One particular important use case in the context

of this research trajectory is the augmentation of ex-

isting information about topics and subtopics of the

questions in available questionnaires with manual ex-

tensions, defined by domain experts. This can be done

in parallel with the ongoing database development,

without interfering with it. Currently, the Harmoney

RDB only contains information about four high-level

topics, namely: (i) Financial Knowledge, (ii) Finan-

cial Experience, (iii) Financial Situation, and (iv) In-

vestment Goals. However as indicated earlier, more

detailed classification about the topics concerned by

certain questions in the questionnaire is needed. This

supports the use case of more intelligent and person-

alised testing of products, topics and knowledge of an

investor.

One way to support the domain expert in speci-

fying this more fine-grained modelling is through the

supply of independent information documents. Those

can be generated by a proprietary tool, or manually

by the domain expert itself. Positive experience has

been gained in the past with using JSON-LD. Its nat-

ural symbiosis with semantics allows the import of the

JSON-LD documents in a straightforward and generic

manner. This in contrast to e.g. other formats such as

CSV, which require more intervention to get it in line

with the semantics of the existing model. Therefore,

the JSON-LD serialisation format is used to demon-

strate the process of extending existing information

with more detail. It should be kept in mind, of course,

that JSON-LD is only a means to an end and not a

goal in itself.

4.1.2 High-level Information Imported by

Means of the OnTop Procedure

Indeed, this is what the OnTop processor does, us-

ing the mapping specification that is provided by the

system engineer. If we now want the include more

detailed information into the knowledge model about

the fact that this question does not only consider fi-

nancial knowledge, but also the topic ‘Liquidity’, a

separate JSON-LD document could be provided with

this information. In this way, the original mapping

can be maintained, but in parallel can be augmented

with the information that it is not only about the high

level notion of ‘Financial Knowledge’, but more de-

tail about the ‘Liquidity’ of the product. This addi-

tional document could then be formatted as follows:

{

{1} "@context":

"http://idlab.technology/harmoney/",

{2} "@type": "Question",

{3} "@id": "question_170",

{4} "hasTopic": "Liquidity",

{5} "hasQuestionText": "Money market funds

a}ways offer a capital guarantee."@EN

{5} "hasQuestionText": "Geldmarktfondsen

bieden altijd een kapitaalgarantie."@NL

}

What we can see in this sample is that first a static

reference is made towards the ontology URI 1 that is

being referenced, namely that of the developed Har-

money ontology: http://idlab.technology/harmoney/.

Next, 2 defines that the subsequent information

and relations define knowledge about an instance

of the type ‘Question’, as defined in the on-

tology referenced in 1. Rather than using the

KEOD 2020 - 12th International Conference on Knowledge Engineering and Ontology Development

144

Figure 3: Dataflow, augmenting the asserted data out of the

inherent information, using reasoning, and making it avail-

able for querying and processing through an API.

plain numeric mapping from the relational database

(id question : 170), a more textual description

is used in 3 to create a URI specifying that

this question is actually a ‘Question’ with URI:

http://idlab.technology/harmoney/question 170 in the

resulting ontology. Line 4 in its turn specifies, in

addition to the ‘id subsegment’ specification earlier,

which actual low level topic this question is about,

namely ‘Liquidity’, again as specified in 1. Finally, 5

adds the information into the model that the descrip-

tion specified is actually corresponding to the value of

the ‘hasQuestionText’ property, with language speci-

fication ‘EN’ and ‘NL’.

4.2 Analysing the Model, Its Data and

Reasoning about the Contents

Once the ontology model and its corresponding data

are aligned and available in their respective reposito-

ries, optional reasoning can be triggered, using e.g.

the HermiT reasoner (Glimm et al., 2014). This way,

one or more inferred models are generated which can

then in parallel be queried by the application through

some API. Those queries are oftentimes specified us-

ing the SPARQL query language. This is presented in

Figure 3.

The memory and CPU usage of this pre-

processing reasoning stage have been evaluated in

a test datacentre environment. The results are pre-

sented in the following subsection. It has to be noted,

however, that this process is only a periodic phe-

nomenon, i.e. when the contents of the underlying

data (currently in the Harmony DB and called the A-

Box) change. Additionally, when the T-Box or R-Box

changes, this process will have to be executed as well.

The likelihood of this happening is even less than that

of a changing database content. Using this approach

we can more easily guarantee a responsive deploy-

ment. One can compare the adaptation of the T-Box

and R-Box with the change of a database schema and

corresponding triggers.

4.3 Evaluation of the Reasoning

Performance

The configuration of the machine on which the experi-

ment was executed is: 4 64-bit Intel(R) Xeon(R) CPU

E3-1220 v3 @ 3.10GHz processors, a total mem-

ory of 16262552 kB, Ubuntu 14.04.1 LTS as oper-

ating system, running the 3.13.0-33-generic kernel,

Java(TM) SE Runtime Environment (build 1.8.0 191-

b12) and HermiT version 1.3.8.

The materialisation process has been executed 35

times. During this execution process, the CPU us-

age and memory consumption was recorded using the

‘top’application.

Analysing the results, it can be derived that on av-

erage 165.15% of CPU is used (having 400% avail-

able in this setup), and 2.74% of available memory,

which corresponds to 445419.3 kB. Standard Devia-

tion are respectively: 50.53 and 1.86. The extreme

values are: (i) Minimum: 6% CPU and 0.3% Mem-

ory (45787.66 kB) and (ii) Maximum: 264.6% CPU

and 8% Memory (1301004 kB). Regarding the exe-

cution time, including some household keeping code,

and combining all phases together, an average time of

9926 ms, with a maximum of 10251 ms and a min-

imum of 9766 ms is achieved. (Standard deviation

of 134.9). The main conclusion that can be drawn

from these measurements is that, given the fact that

this materialisation process is not to be executed in

every single incoming application request, these re-

sults are acceptable and can be accommodated with a

batch-processing or pre-loading style of architecture.

A final evaluation is loading the materialised

model into the query engine. Once this is completed,

the query engine is available for querying in an opera-

tional environment. Results are on average 14424.97

ms, with extreme values of 14080 ms and 15005 ms.

(Standard deviation of 271.75). To conclude, the DL

expressivity of the model is SROIF(D).

Once the above reasoning process has been com-

pleted, the resulting model – i.e. the inferred model

– is persisted into a separate instance. This is called

materialisation. During operation, this materialised

model is read at boot-time, without additional reason-

ing being performed. This means that queries can be

executed on a semantically enhanced model, without

the need for resource intensive reasoning every time,

and results in good performance in regard to response

times of those queries while maintaining the added

value of using description logics annotated semantic

models.

Harmoney: Semantics for FinTech

145

5 ENSURING DATA QUALITY

AND USING

ONTOLOGY-BASED DATA

INTERPRETATION

This section focusses on the establishment of data-

interpretation mechanisms (semantic modelling) to

interpret the data presented in Section 4, with the

aim to generate specific investor profiles. This will

be achieved through the generation of questionnaires,

tailored towards the needs of the investor concerned.

5.1 Exploiting the Semantics to

Contextualise the Questions in the

Questionnaire

It should be clear that the strength of using ontolo-

gies and semantics is that any relations and hidden

knowledge in the model can be exploited to create

innovative applications. Focussing on questionnaire

generation, a number of potential scenarios are: (i)

Check the answers given by a person on a previous

questionnaire to find the topics and products in need

of further training, (ii) Check which questions are

frequently wrongly answered, (iii) Check which top-

ics and/or products/services are suitable/unsuitable

for a person, (iv) Find other questions on the same

topic/product/service and (v) Find information docu-

ments or training material.

One thing to keep in mind is that any of these

use cases can be supported in a variety of manners

and with a number of very different technologies, in-

deed. However, some of those technologies will re-

quire more application programming, or more sophis-

ticated query engineering with a tight coupling of do-

main knowledge inside the application, rather than

the model. Therefore, the approach suggested in this

work is to support the right balance between gen-

erally accepted domain knowledge (thus exploiting

DL-Reasoning) and proprietary application specific

knowledge (potentially supported by generic Rule En-

gines).

5.2 ‘Knowledge’ and ‘Experience’ in

Relation to ‘Person’ and

‘Investment Group’

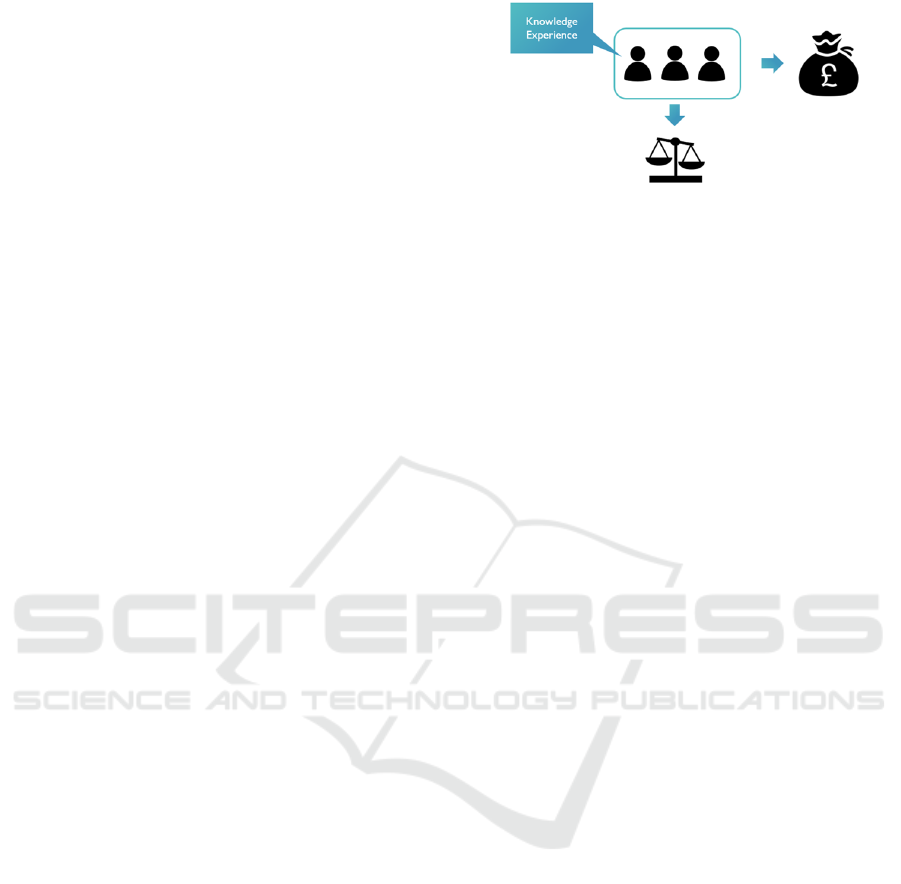

Based on the domain knowledge of the partners in-

volved in the project, part of the model, as illustrated

in Figure 4, has been defined. ‘Knowledge’ and ‘Ex-

perience’ of financial products is defined on an indi-

vidual basis.

Figure 4: Relation Person / Investment Group / Knowledge

& Experience / Balance / Investment Goal.

Person hasFinancialKnowledge

some FinancialKnowledge

Person hasFinancialExperience

some FinancialExperience

Furthermore, an ‘Investment Group’ is composed

of one or more ‘Person’ individuals. And finally,

the ‘Investment Goal’ is linked to the ‘Investment

Group’.

Group hasMember

some Person

InvestmentGroup = Group and

hasInvestmentGoal some InvestmentGoal

5.3 Value Partitioning to Classify

Persons

One of the important characteristics of ontologies in

general, and of OWL DL in particular is the base

Open World Assumption (OWA). In short, this means

that no conclusions can be drawn based on the ab-

sence of information. Basically, it is not because it is

not asserted that a ‘Person’ is knowledgeable about a

certain ‘Product’, given a certain ‘Topic’, that it can

automatically be inferred that they are NOT knowl-

edgeable. There could indeed be some place, reposi-

tory or database not currently considered that affirms

that they are not knowledgeable indeed. In order to

overcome this potential issue, a standard modelling

principle, named ‘Value Partitioning’ has been intro-

duced. Compare this to the ‘Design Patterns’ in soft-

ware programming (Gangemi, 2005).

The principle underlying value partitioning is

rather straightforward, we state in the model that a

person is either knowledgeable or not, and we affirm

that those are the only two options. A covering ax-

iom is another term referring to exactly this mecha-

nism. This basically closes the world to the data-sets

included in the run-time processing of the reasoner.

A concrete example in the scope of this project is

given below. With the covering axiom, it is modelled

KEOD 2020 - 12th International Conference on Knowledge Engineering and Ontology Development

146

that a ‘Person’ is either knowledgeable about liquid-

ity, or not, while without the covering axiom, this bi-

nary conclusion cannot be automatically drawn.

5.4 Analysing and Classifying the

Person According to Their Topic

Knowledge

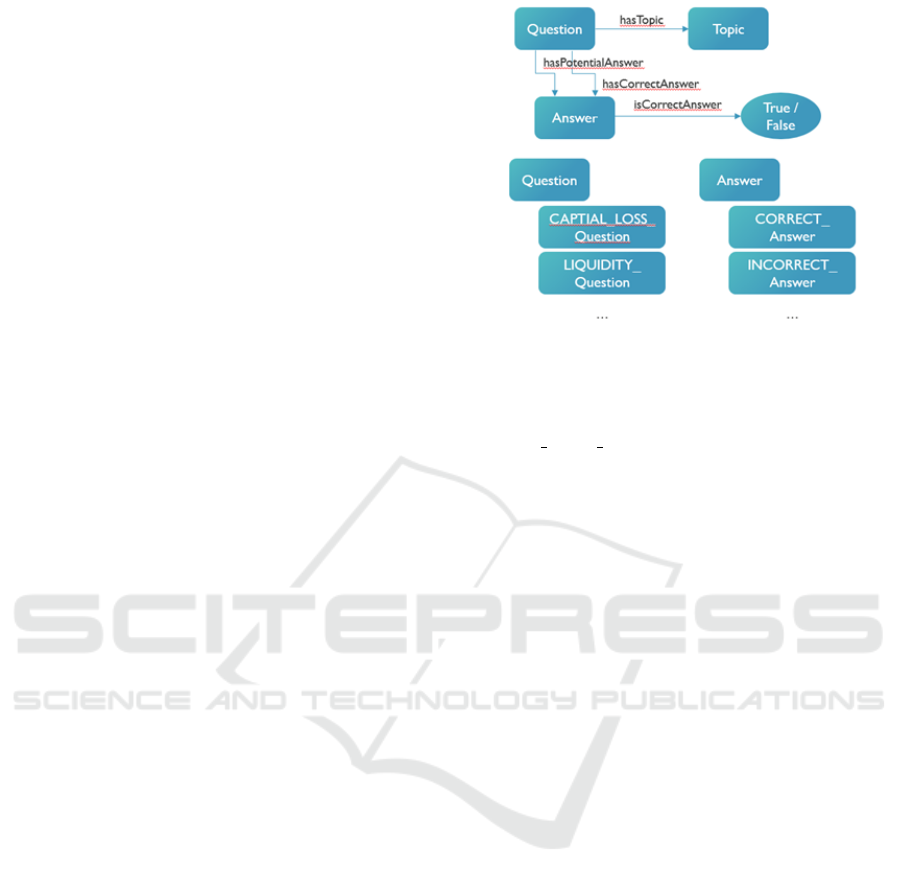

One approach to support the automatic realisation of

individuals according to the answers that were given

on the questions of a particular questionnaire, and

referring to the base modelling principle detailed in

Subsection 5.3, is to define every category into per-

sons that can be realised with a logical axiom, such

as:

CAPITAL_LOSS_KNOWLEDGEABLE_PERSON =

Person and

(hasFilledOutQuestionnaire some

(hasCompletedAnswer some

((isAnswerForQuestion some

(hasTopic some CAPITAL_LOSS))

and isCorrectAnswer value true))))

Combined with the covering axiom, this will re-

sent in a ‘Person’ either be realised capital loss knowl-

edgeable or not. However, this can quickly become

cluttered and overly complicated. Additionally, rea-

soning with datatype properties is oftentimes not the

most performant mechanism. So a more divide and

conquer-based approach might be necessary. Thus,

rather than using properties for classification, the use

of fine-grained concepts with axioms is proposed. As

such, easier querying is supported and it should be

more performant, due to the underlying mechanisms

of the tableau algorithms in the reasoner(s). As such,

a new, additional, concept structure has been devel-

oped. This is presented in Figure 5.

Therefore, the corresponding query with the new

structure can be formulated as:

Person and (hasFilledOutQuestionnaire

some (hasCompletedAnswer some

((isAnswerForQuestion some

(CORRECT_Answer

and isAnswerForQuestion

some CAPITAL_LOSS_Question)))

5.5 Automatic Questionnaire

Generation

A number of typical base question categories can be

defined to support the automatic questionnaire gener-

ation, and this for the three phases in the process.

Figure 5: Additional (supporting) concepts in the model to

facilitate distributed query answering and algorithmic prun-

ing.

• Learning: find me all ‘CAPI-

TAL LOSS Question’ individuals

• Testing: find me a ‘Question’ individual for each

‘Topic’

• ReTesting: find me a ‘Question’ individual for ev-

ery ‘INCORRECT’ Answer

More detailed/fine-grained queries can be devel-

oped as well, e.g. (i) one could make combinations

of (false) answers that lead to certain questions being

asked, (ii) indicate compulsory questions, or (iii) in-

dicate probabilities of questions or indicate a desired

frequency of questions appearing in a generated ques-

tionnaire. Of course, it should be clear that potentially

some service providers or banks will be accepting all,

some or none of the questions present in the ontol-

ogy model. Thus, a trust relationship will have to be

introduced.

The above ideas are but a number of suggestions

and can be further defined in further research later on.

It should also be clear by now, that due to the adop-

tion of the ontology modelling principle, additional

information, stating anything about anything, can be

added in a straightforward, and backwards compati-

ble manner as long as the ontology model in itself is

kept consistent.

5.6 Modelling the Structure of a

Questionnaire

In Subsection 5.5, it was already indicated that a

trust relationship is needed. This way banks/service

providers can indicate whether questions on a cer-

tain topic for a certain product can be sourced in

the collection of questions from a questionnaire from

another trusted source. A key selling point of this

Harmoney: Semantics for FinTech

147

Figure 6: Modelling the structure of a questionnaire.

functionality is that banks and service providers can

then automatically generate random or contextualised

questionnaires for a given investor. However, spe-

cial attention is to be given to the situation where one

bank/service provider only accepts its own questions.

In this situation, the questionnaire generator should

generate an exact copy of the questionnaire of that

particular bank/service provider. This requires the

structure of a questionnaire to be modelled as well.

Having the structure of the questionnaire in the

knowledge model allows a second functionality to be

provided, i.e. that a given bank/service provider can

accept the questionnaire structure of another service

provider/bank, but can indicate that more than that

bank’s questions can be sourced from. This ques-

tionnaire template structure model is presented in Fig-

ure 6.

6 CONCLUSIONS

In the previous sections of this paper, we have

presented our research into optimising the use of

available financial consumer information in order to

streamline personalised financial investment over the

border of individual financial service providers. We

have demonstrated that, using semantic technologies,

an extendable, intelligent knowledge base can be cre-

ated to support potential financial investors by lower-

ing the administrative burden, through re-using pre-

vious information captures and to improve the in-

vestor’s financial expertise in an intelligent manner.

Modelling questionnaires into the knowledge base

in an innovative way by separating the structure of

the questionnaire with the actual filled-out versions of

the investors to be, has opened up a way of cleverly

building new personalised questionnaires, either for

different financial service providers or to enhance the

financial literacy of the investors.

Using existing software libraries for most of the

aspects of the overall application ensures a future-

proof approach. Of course, the presented approach

has to be approved by the necessary governing bodies

in the financial sector. Although no official request

has been made to the regulator, safeguarding this ac-

ceptance, was kept in mind throughout the research

by the expertise of myHarmoney.

ACKNOWLEDGEMENTS

This research or part of this research is conducted

within the project entitled Harmoney co-funded by

VLAIO (Flanders Innovation & Entrepreneurship)

and myHarmoney.eu.

REFERENCES

Abi-Lahoud, E., Raoul, P.-E., and Muckley, C. (2017).

Linking data to understand the fintech ecosystem. In

SEMANTICS Posters&Demos.

Bennett, M. (2013). The financial industry business ontol-

ogy: Best practice for big data. In Journal of Banking

Regulation, volume 14, pages 255–268.

Calvanese, D., Cogrel, B., Komla-Ebri, S., Kontchakov, R.,

Lanti, D., Rezk, M., Rodriguez-Muro, M., and Xiao,

G. (2017). Ontop: Answering sparql queries over re-

lational databases. In Semantic Web, volume 8, pages

471–487.

Dietz, M., Khanna, S., Olanrewaju, T., and Rajgopal, K.

(2016). Cutting through the fintech noise: Markers of

success, imperatives for banks.

Dimou, A., Vander Sande, M., Colpaert, P., Verborgh, R.,

Mannens, E., and Van de Walle, R. (2014). Rml: a

generic language for integrated rdf mappings of het-

erogeneous data. In 7th Workshop on Linked Data on

the Web, Proceedings, page 5.

European Parliament, C. o. t. E. U. (2014a). Directive

2014/65/eu of the european parliament and of the

council of 15 may 2014 on markets in financial in-

struments and amending directive 2002/92/ec and di-

rective 2011/61/eu.

European Parliament, C. o. t. E. U. (2014b). Regulation

(eu) no 600/2014 of the european parliament and of

the council of 15 may 2014 on markets in financial in-

struments and amending regulation (eu) no 648/2012

text with eea relevance.

Gangemi, A. (2005). Ontology design patterns for seman-

tic web content. In Gil, Y., Motta, E., Benjamins,

V. R., and Musen, M. A., editors, Proceedings of the

4th International Semantic Web Conference (ISWC

2005), volume 3729 of Lecture Notes in Computer

Science, pages 262–276, Galway, Ireland. Springer.

doi: 10.1007/11574620 21.

Glimm, B., Horrocks, I., Motik, B., Stoilos, G., and Wang,

Z. (October 2014). Hermit: An owl 2 reasoner. In

J. Autom. Reason., volume 53, page 245–269, Berlin,

Heidelberg. Springer-Verlag.

myHarmoney (2020). https://www.myharmoney.eu/.

Ontotext (2020). https://www.ontotext.com/.

KEOD 2020 - 12th International Conference on Knowledge Engineering and Ontology Development

148