Personalised Recommendation Systems and the Impact of COVID-19:

Perspectives, Opportunities and Challenges

Rabaa Abdulrahman and Herna L. Viktor

School of Electrical Engineering and Computer Science, University of Ottawa, Ottawa, Ontario, Canada

Keywords:

Recommendation Systems, COVID-19, Machine Learning, Cold Starts, Grey Sheep.

Abstract:

Personalised Recommendation Systems that utilize machine learning algorithms have had much success in

recent years, leading to accurate predictions in many e-business domains. However, this environment expe-

rienced abrupt changes with the onset of the COVID-19 pandemic centred on an exponential increase in the

volume of customers and swift alterations in customer behaviours and profiles. This position paper discusses

the impact of the COVID-19 pandemic on the Recommendation Systems landscape and focuses on new and

atypical users. We detail how online machine learning algorithms that are able to detect and subsequently

adapt to changes in consumer behaviours and profiles can be used to provide accurate and timely predictions

regarding this evolving consumer sector.

1 INTRODUCTION

Recommendation Systems have been widely utilized

in e-commerce settings to guide users through their

shopping experiences. A principal advantage of these

systems is their ability to narrow down purchase op-

tions and market items to customers. Specifically,

personalised recommendation systems based on col-

laborative filtering recommend items that have been

rated by other users with preferences similar to those

of the targeted users. Intuitively, the more informa-

tion that is collected about users, the more accurate

the recommendations put forth by such systems will

be.

Creating accurate and timely recommendations

for new or atypical users is an active area of research.

In the literature, new users are referred to as cold

starts, while atypical users are categorised as grey

sheep. Recently, machine learning (ML) algorithms

have had much success in improving the accuracy of

recommendations for these user categories that are

’difficult to pinpoint’. For instance, (Abdulrahman

et al., 2019) combines cluster analysis, deep learn-

ing and active learning, or the so-called user-in-the-

loop system, to yield accurate recommendations for

cold-start users. In another recent study, (Abdulrah-

man and Viktor, 2020) employs one-class learning in

order to address the grey sheep challenge.

Although personalized recommendations have

been discussed in the literature since the 1990s, they

have only been widely adopted by e-businesses re-

cently. According to (Chen et al., 2014), a per-

sonalized Recommendation System should include

data collection, data warehousing, data mining, and

data applications. Data mining techniques

1

can make

predictions without accessing users’ profile infor-

mation and items; hence, they have been used to

improve recommendation performances (Yoon-Joo,

2013) (Lucas et al., 2012). Many successful busi-

nesses have implemented personalized approaches.

For instance, Amazon created a personalized recom-

mendation list for each user and was followed by

other businesses, such as Hotels.com, which helps the

user come to a decision based on a pared down sug-

gestion list (Oestreicher-Singer, 2013). Furthermore,

studies have shown that using these approaches in-

creases profits (Li and Karahanna, 2015). However,

the e-business landscape changed abruptly with the

onset of the COVID-19 pandemic. This position pa-

per presents some thoughts on the current state of the

field and suggests some perspectives with regards to

the future.

This paper is organised as follows. Section 2 fo-

cuses on the above-mentioned challenges that person-

alised Recommendation Systems are currently fac-

ing. In Section 3, we discuss the current impact of

1

We use the terms data mining technique and ML algo-

rithm interchangeably. However, we wish to note that data

mining focuses more heavily on the discovery of patterns,

often by using ML algorithms.

Abdulrahman, R. and Viktor, H.

Personalised Recommendation Systems and the Impact of COVID-19: Perspectives, Opportunities and Challenges.

DOI: 10.5220/0010145702950301

In Proceedings of the 12th International Joint Conference on Knowledge Discovery, Knowledge Engineering and Knowledge Management (IC3K 2020) - Volume 1: KDIR, pages 295-301

ISBN: 978-989-758-474-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

295

COVID-19 and highlight future research directions.

Section 4 concludes the paper.

2 TOWARDS PERSONALISED

RECOMMENDATION

SYSTEMS

Consumers face information overload every time they

access the Internet to make a purchase. In today’s

fast-paced world, they have neither the time nor the

patience to explore all these suggestions. Therefore,

the main idea behind Recommendation Systems is to

address the above-mentioned problem and aid users

in narrowing down their list of choices through an un-

derstanding of their preferences and personalising the

experience, as depicted in Figure 1.

Generally speaking, Recommendation Systems

use content-based filtering (CBF), collaborative filter-

ing (CF) or hybrid approaches (Abdulrahman et al.,

2019). These systems rely on two basic inputs: the set

of users in the system, U (also known as customers),

and the set of items to be rated by the users, I (also

known as the products) (Kumar and Thakur, 2018).

The systems employ matrices based on past purchase

patterns. With CBF, the system focuses on item ma-

trices, whereby it is assumed that if a user liked an

item in the past, he or she is more inclined to pre-

fer a similar item in the future. Therefore, these sys-

tems study the attributes of the items. On the other

hand, CF systems focus on user-rating matrices, rec-

ommending items that have been rated by other users

with preferences similar to those of the targeted user.

Thus, these systems rely on historic data consisting of

user ratings and similarities across the user network.

As hybrid systems employ both the CBF and CF ap-

proaches, they concurrently consider items based on

users’ preferences and on the similarity between the

items’ contents. In recent years, research has trended

toward hybrid systems. Another growing trend is the

use of ML algorithms to identify patterns in users’

interests and behaviours, including supervised, unsu-

pervised and one-class learning algorithms.

In essence, the recommendation process con-

sists of three main phases, namely, information col-

lection, learning and recommending (Kumar and

Thakur, 2018). During information collection, as the

name suggests, the aim is to learn more about the

users. As many authors have noted, the accuracy of

the recommendation is highly related to the quality of

information about the users in the system. This infor-

mation enters the system in the form of users’ feed-

back. There are three types of feedback that could

exist in the system: explicit feedback, where the user

provides a rating through the system interface; im-

plicit feedback, where the system monitors user be-

haviour, history, and purchases; and hybrid feedback,

which is a combination of explicit and implicit feed-

back. During the learning phase, an algorithm is ap-

plied to learn the users’ preferences. Finally, the sys-

tem turns out predictions in the form of prediction

scores, where a particular prediction score measures

how likely it is that user U

i

will be interested in item

I

o

, or recommendations, each of which list the top N

items that might be of interest to a specific user.

As noted above, recommendation systems have

been highly successful in tracking existing customers

with typical profiles. However, when clients are first-

time users of e-business systems, as is the case with

the surge in online shopping during the COVID-19

pandemic, their preferences are unknown. Further-

more, an increasing number of users have unique and

exotic tastes, which makes it harder for the system to

match their interests with the current customer base.

These two categories of users may also overlap, lead-

ing to inaccurate or nonsensical recommendations.

2.1 Cold-start Users

Recall that a cold-start user refers to a new user with

unknown preferences. In recommendation systems,

users’ preferences, historic data regarding what they

like and dislike and their item ratings and reviews are

used to match them with other users. In cold-start

situations, such information does not exist, which

makes it difficult for the system to calculate similar-

ity scores. Indeed, the tremendous increase in the use

of e-commerce websites during the current COVID-

19 pandemic has highlighted the importance of, and

difficulty in, providing accurate recommendations to

many first-time users (Argaman, 2020).

To address this problem, some researchers use

CBF systems, in which information about the items is

used to find the best match (Lu, 2015). Other systems

simply present these users with a predefined recom-

mendation list. Although these solutions may be suc-

cessful with some users, they often result in redun-

dant lists being presented, which causes these users

to lose interest. Another solution is to use conver-

sational learning models, where the new user is pre-

sented with a list of questions to build a preference

profile (Lamche et al., 2014). Doing so might also

drive them away due to the time it takes to build the

profile or privacy concerns. Recently, (Abdulrahman

et al., 2019) proposed the Popular User Personalized

Prediction (PUPP-DA) framework, which combines

active learning, ML, and deep learning algorithms to

KDIR 2020 - 12th International Conference on Knowledge Discovery and Information Retrieval

296

Figure 1: Personalised Recommendation System.

accurately recommend items to new users.

2.2 Grey-sheep Users

As mentioned above, grey-sheep users are difficult to

identify or characterize. These users are often willing,

to some degree, to share their feedback. However,

their preferences typically do not match the majority

of preferences in the system. In contrast to cold starts,

the system might have the information it needs to cal-

culate similarity scores and produce recommendation

lists. However, such lists may not be accurate due

to their unique tastes and characteristics. Typically,

grey-sheep users are treated as outliers and removed

from the system (Srivastava et al., 2020). Other re-

searchers move them to a separate system where their

preferences can be better matched with those of oth-

ers (Zheng et al., 2017). However, doing so is not a

realistic option in large and online systems, as identi-

fying and moving users/items to a secondary system

is time consuming. (Abdulrahman and Viktor, 2020)

presents the Grey-Sheep One-Class Recommendation

(GSOR) framework, which is designed to create accu-

rate prediction models while considering both regular

and grey-sheep users. The GSOR framework utilizes

one-class classification, whereby the learning process

is accomplished with information from the majority

class, while predictions are made for the minority

class, i.e. the grey-sheep users.

3 COVID-19 AND

PERSONALISED

RECOMMENDATION

SYSTEMS

Recently, with the onset of the COVID-19 pandemic,

many businesses have turned to e-commerce solutions

in an attempt to not only survive but also thrive in

the post-pandemic world (Goldstein, 2020). When

COVID-19 appeared in late 2019, governments were

forced to develop plans for facing the virus when it ar-

rived in their countries. In many countries, lockdown

procedures were implemented immediately, leaving

citizens with little choice but online shopping.

As the World Bank Group (Ungerer et al., 2020)

notes, e-commerce is emerging as a major pillar in

the COVID-19 crisis. Before the pandemic, for many

users, e-commerce was used to import unique items

unavailable in local markets or to provide the luxury

of shopping from the warmth and comfort of home

during cold winters. However, for many, the pan-

demic transformed e-commerce into a tool for sur-

vival. In many countries, even if a complete lock-

down was not enforced, physical distance measures

were encouraged. Thus, as infection rates climbed,

people started to turn to online ordering to avoid con-

tact with other people. In addition, the movements

of the vulnerable and elderly were restricted, lead-

ing a large portion of these individuals to turn to e-

commerce for the first time. Furthermore, in many

countries, most non-essential businesses closed until

further notice. In order for these businesses to sur-

Personalised Recommendation Systems and the Impact of COVID-19: Perspectives, Opportunities and Challenges

297

vive, they needed to reach out to customers through

web-based or social media stores, for instance, the In-

stagram and Facebook markets.

In terms of general e-commerce, online shopping

has shifted from being a convenience in terms of time

and location to being a necessity. In fact, as the United

States started lifting its partial lockdown and opening

up the economy again, a survey of consumers’ inten-

tions regarding the return to old shopping practices

was conducted (Post, 2020). The results showed that

24% of those surveyed did not intend to shop in a mall

during the next six months, while another 16% stated

that they did not intend to do so for the next three

months. We believe that the same observations hold

true in Canada.

The current shift in consumers’ habits stresses the

importance of meeting customers’ demands. Further-

more, it confirms the significance of catering the right

products to the right customers, including cold starts

and grey sheep, to avoid losing them to other busi-

nesses and to also streamline supply chains. On-

line competition is at its peak, and a significant per-

centage of businesses must address this challenge.

Several studies have shown the importance of e-

commerce, along with personalised Recommendation

Systems, during the pandemic across all sectors. For

instance, this shift is also relevant to the health care

sector, where healthcare providers have moved to e-

commerce to provide tailor-made care and treatments

(Ungerer et al., 2020).

In January 2020, the U.S. Census Bureau of the

Department of Commerce reflected on the growth

of e-commerce and noted that, in the United States

alone, sales were expected to top $4.2 trillion USD

in 2020 and that 2.1 billion customers would have

shopped online by the end of the year (Winkler,

2020). These numbers and expectations were based

on data previously collected for 2020. However, on

April 30, 2020, Amazon released their first-quarter fi-

nancial results, which described their total earnings as

“exceptionally” strong, as Amazon had made an esti-

mated $33 USD million an hour in sales for the first

three months of the year (Kaplan, 2020). In North

America alone, sales increased by 29%, i.e. by about

$46.1 billion, compared to the same period in 2019.

3.1 Addressing Cold Starts and Grey

Sheep

The implications of this trend for the Recommenda-

tion System research community are manifold. In-

deed, as the number of users increased exponentially,

many new users were added to systems. Another as-

pect of note is that, even for existing users, there has

been a shift in their preferences. Since the pandemic

started, many users have switched preferences from

“what to buy” to “what is needed,” which has resulted

in previously popular and frequently rated items be-

ing ignored. Furthermore, considering the current sit-

uation we live in, many businesses have decided to

maintain work-from-home practices until the end of

2020. Consequently, many consumers have changed

their clothing preferences from formal dress, for in-

stance, to comfortable lounge wear.

Another challenge centres on cold-start users, as

many of these individuals have turned to e-commerce

for the very first time. This influx poses a challenge

for Recommendation Systems, since there substantial

gaps exist in what is known about these users. It may

well be that a substantial portion of these new users

are indeed grey sheep who typically would not use

e-businesses during normal times.

Considering these challenges, let us now illustrate

the current situation with some examples from the

Canadian perspective. As discussed earlier, the shift

in preferences causes data sparsity, which is a princi-

pal challenge for Recommendation Systems. Accord-

ing to Statista (2019), the lowest two categories by

household type who shopped online in Canada prior

to the pandemic were singles who cohabitated with

other adults (e.g. parents or roommates) and single

parents (Statista, 2019). These groups represented

12% and 3%, respectively, of all users. Within these

groups, there are users that have never shopped on-

line before or are currently using e-commerce now

for different types of demands. In Canada, Millen-

nials and Baby-Boomers produced the highest per-

centage of online consumer sales during 2019 (Post,

2020). Today, preferences have turned towards order-

ing what is necessary for homeschooling or entertain-

ing children. A 2019 report by Canada Post indicated

that 62% of Canadians shopped for clothing apparel,

whereas 41% shopped for computers and electronics

using e-commerce. After the pandemic hit, a report

by Cision (2020) showed that all e-commerce sales

increased, except for clothing (which had the lowest

increase of 21%). Meanwhile, the sales of electronics

increased by 160% (Absolunet, 2020).

In 2019, it was reported that Pre-Boomers, i.e.

those aged 73 and older, as well as Gen Z, i.e. cus-

tomers in the 18–23 age group, constitute the lowest

percentages, 5% in each category, of online shoppers

in Canada, as depicted in Figure 2. These customers

represent two very different generations and are thus

often difficult to target. For a business to thrive on-

line, it must understand its customers’ behaviours and

characteristics in order to expand its customer base.

Gen Z, for instance, is considered to exert the main

KDIR 2020 - 12th International Conference on Knowledge Discovery and Information Retrieval

298

Figure 2: Online Shopping by Age in Canada in 2019 (Statista, 2019).

influence over buying decisions for families (Gold-

stein, 2020). According to Forbes (2020), technol-

ogy is crucial for enhancing the Gen Z shopping ex-

perience and providing them with instant and qual-

ity services (Goldstein, 2020). In Canada, it is ex-

pected that by 2026, 21% of the population will fall

into the 73 years old and older category. Older cus-

tomers often fall in the grey-sheep category and, as

discussed in (Insider, 2020), they have a preference

for products that provide them with improved quality

of life. As noted by Retail Insider (2020), this group

of customers prefers to view products physically be-

fore buying them (Insider, 2020). For instance, as the

pandemic lockdown started in Canada in mid-March

2020, many grocery stores dedicated special hours to

senior shoppers. However, a recent study by Statis-

tics Canada indicated that a large portion of such cus-

tomers turned to online shopping, with 45% of people

aged 75 and older indicating that they did so (Post,

2020). The question here is how to target these cus-

tomers and, as many have turned to e-commerce for

the first time, how to keep them in the customer base

when life returns to normal. Next, we explain how on-

line ML algorithms can be used to address this chal-

lenge.

3.2 Adaptive Machine Learning

ML algorithms have been used successfully in in-

creasing the accuracy of personalised Recommenda-

tion Systems. The earliest works focused on using the

k-nearest neighbours technique (Kumar and Thakur,

2018), where a recommendation is provided by cal-

culating the distance between a user U

i

and all others

in the database in terms of user characteristics that

are described by a number of features F = { f

1

, ..

f

l

}. Next, the k nearest neighbours {U

1

, .. U

k

} of

user U

i

are determined using some distance measure,

such as Euclidian distance, and their preferred items

are suggested to user U

i

. This approach is based on

the assumption that consumers are easily grouped into

neighbourhoods, and the accuracy of the approach is

highly dependent on the available features and the

distance measure. Other recent methods employ ad-

vanced algorithms, such as ensembles, cluster analy-

sis and deep learning algorithms, to improve the qual-

ity of predictions (Abdulrahman et al., 2019).

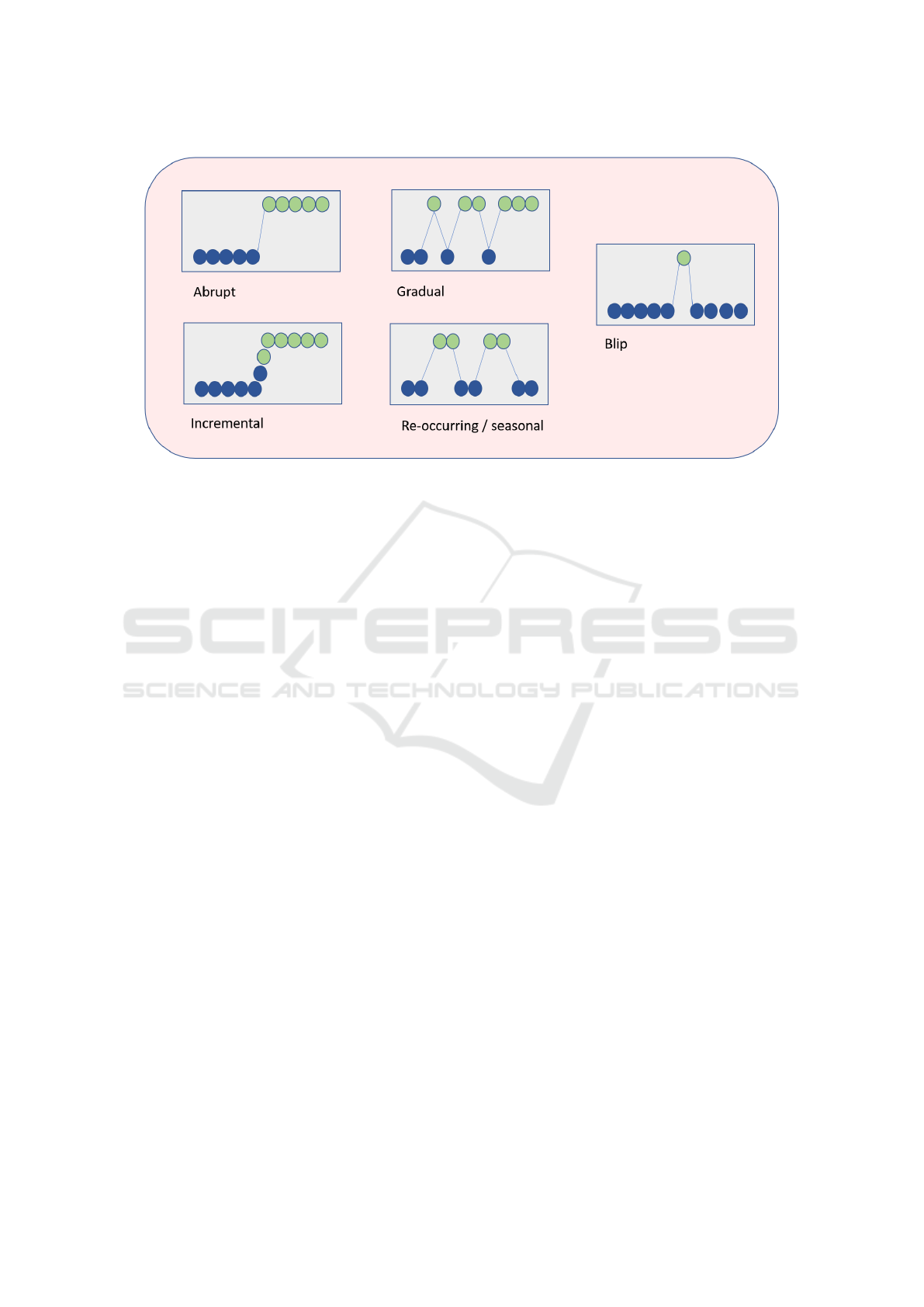

A major drawback of most the above-mentioned

algorithms is that they are unable to detect and adapt

to changes. Such changes can be gradual, incremen-

tal, re-occurring, seasonal or abrupt, as illustrated

in Figure 3. Abrupt change occurs when customer

behaviours and/or customer profiles change over a

very short time period. Gradual change occurs more

slowly and less radically. Gradual drift can be incre-

mental, with many intermediate steps between the ex-

tremes, or dispersed, whereby new trends appear in

increasingly more instances. It is also possible for

previous patterns to reoccur through time. For exam-

ple, seasonal patterns might reoccur each year but not

necessarily at exactly the same time. Formally, let us

assume that a set of features F = { f

1

, .. f

l

} is utilised

to recommend an item I

o

from the item set I = {I

1

, ..

I

p

} to user U

i

. A concept drift has occurred if there

is a change in the probability P(I

o

|F

i

), i.e. the proba-

bility that item I

o

will be preferred by user U

i

, who is

described by a feature set F

i

.

Indeed, the COVID-19 pandemic constituted a

major and abrupt change in consumer behaviours. In

addition, the presence of numerous new, and atypi-

Personalised Recommendation Systems and the Impact of COVID-19: Perspectives, Opportunities and Challenges

299

Figure 3: Drifts in consumer behaviour (adapted from (Gama et al., 2014)).

cal, users led to a further recommendation challenge.

Traditional ML algorithms are not able to automati-

cally detect and handle such changes in user prefer-

ences and profiles. Rather, a decrease in the accura-

cies of their predictions will indicate that the mod-

els are incorrect, leading to the realisation that new

models need to be built; this typically happens after

some delay. On the other hand, online or incremen-

tal learners, such as adaptive trees and ensembles, are

highly suitable for learning in such changing environ-

ments (Bifet et al., 2018). These incremental learn-

ing algorithms update their models upon the arrival of

new data and may ”forget” old concepts using local

replacement, in which irrelevant subsections of the

model are discarded and replaced with subsections

trained on recent data. This process made possible

by the incorporation of drift detection into their de-

signs; thus, these algorithms are able to dynamically

and seamlessly adapt their models to changes in user

preferences. Although such explicit concept drift de-

tection is not necessary for incremental algorithms to

adapt to drifting concepts, as they often do so natu-

rally by continually updating and forgetting, it does

afford several advantages. For example, if concept

drift occurs abruptly, the model can detect and adapt

to it more quickly. Concept drift detection also pro-

vides insights into the mechanics of the generation

process in order to facilitate the modelling of future

re-occurring or seasonal changes in customer profiles

or purchase patterns.

In terms of the COVID-19 pandemic, it is too early

to say whether a second or third wave will occur. It

is also not possible to predict consumer behaviours

in the unfortunate event that these waves occur. How-

ever, the authors are of the opinion that any such event

may potentially lead to another abrupt drift or the re-

currence of the patterns observed in mid-March 2020.

The use of online learning algorithms that incorporate

drift detection algorithms appears to be a promising

research direction, helping to ensure that e-businesses

are able to adapt rapidly and efficiently to changes in

their customer bases and purchase patterns (Ungerer

et al., 2020), while facilitating interactions with cold

starts and grey sheep.

4 CONCLUSIONS

Recommendation Systems are crucially important for

the economic growth of businesses engaged in e-

commerce. With the recent abrupt shift in their lives,

many consumers currently depend on e-commerce for

essential items. The challenge is accommodating this

entire customer base, including loyal customers, new

users, and those with unique tastes, as the pandemic

continues to ebb and flow. This position paper illus-

trated how online ML, by incorporating change de-

tection in the design, can be potentially utilised to ad-

dress these challenges.

The COVID-19 pandemic has been a shocking,

yet eye-opening experience, with a wide impact on

e-commerce, technology, and Recommendation Sys-

tems. This impact has, however, not been all negative.

For instance, Shopify, a well-known Ottawa-based e-

commerce business, recently became the most valu-

able publicly traded company in Canada in May 2020,

even topping the stock value of the Royal Bank of

Canada (Simpson, 2020). Shopify’s financial results

for the first quarter of 2020 increased by 47%, an

KDIR 2020 - 12th International Conference on Knowledge Discovery and Information Retrieval

300

increase in total revenue of $470 million USD com-

pared to the same period last year. In the mer-

chant solutions component of Spotify, which houses

its Recommendation System, there was growth of

57%, as reported by (Simpson, 2020). Indeed, the

Shopify case study reconfirms the value, importance

and growth of intelligent personalised Recommenda-

tion Systems.

Incremental ML approaches will continue to of-

fer crucial insights into evolving consumer bases, and

our current research focuses on this aspect of ML. We

plan to utilize drift detection algorithms from the on-

line learning research community (Gama et al., 2014)

to build adaptive predictive models. Our future work

will also include a study of the world-wide impact

of shifting consumer habits on the Recommendation

Systems landscape, with a focus on cold starts and

grey sheep.

REFERENCES

Abdulrahman, R. and Viktor, H. (2020). Catering for

Unique Tastes: Targeting Grey-Sheep Users Recom-

mender Systems through One-Class Machine Learn-

ing. Technical Report IDEAL1-2020, University of

Ottawa.

Abdulrahman, R., Viktor, H., and Paquet, E. (2019). Ac-

tive learning and user segmentation for the cold-start

problem in recommendation systems. In Proceed-

ings of the Eleventh International Joint Conference on

Knowledge Discovery, Knowledge Engineering and

Knowledge Management, IC3K 2019. ScitePress.

Absolunet (2020). COVID-19 driving consumers online:

Canadian ecommerce sales double in 2 weeks. In CI-

SION.

Argaman, O. (2020). Why customer re-engagement

has become more valuable during COVID-19.

In https://www.destinationcrm.com/Articles/Web-

Exclusives/Viewpoints/Why-Customer-Re-

engagement-Has-Become-More-Valuable-During-

COVID-19-141234.aspx.

Bifet, A., Gavald

`

a, R., Holmes, G., and Pfahringer, B.

(2018). Machine Learning for Data Streams with

Practical Examples in MOA. MIT Press.

Chen, M., Chen, K., and Chen, C. (2014). The CRM-based

digital exhibition system for clothing industry. In In-

ternational Journal of Electronic Business Manage-

mentg.

Gama, J., Zliobaite, I., Bifet, A., Pechenizkiy, M., and

Bouchachia, A. (2014). A survey on concept drift

adaptation. ACM Computing Surveys, 46(4).

Goldstein, J. (2020). What does Gen Z want from retail? In

https://www.forbes.com/sites/forbesbusinessdevelop

mentcouncil/2020/02/25/what-does-gen-z-want-from-

retail/#578ce084661b. Forbes.

Insider, R. (2020). How does aging change Canada’s

consumer behavior? In Available from:

https://www.retail-insider.com/articles/2020/2/how-

does-aging-change-canadas-consumer-behavior.

Retail Insider Press.

Kaplan, M. (2020). Amid covid-19, Amazon’s Q1

2020 earnings confirm e-commerce dominance. In

https://www.practicalecommerce.com/amid-covid-

19-amazons-q1-2020-earnings-confirm-ecommerce-

dominance.

Kumar, P. and Thakur, R. (2018). Recommendation system

techniques and related issues: a survey. In Interna-

tional Journal of Information Technology.

Lamche, B., Trottman, U., and Worndl, W. (2014). Ac-

tive learning strategies for exploratory mobile recom-

mender systems. In Proceedings of the fourth Work-

shop on Context-Awareness in Retrieval and Recom-

mendation.

Li, S. and Karahanna, E. (2015). Online recommendation

systems in a B2C e-commerce context: A review and

future directions. In Journal of the Association for

Information Systems.

Lu, J. (2015). Recommender system application develop-

ments: A survey. In Decision Support System.

Lucas, J., Segrera, S., and Moreno, M. (2012). Making use

of associative classifiers in order to alleviate typical

drawbacks in recommender systems. In Expert Sys-

tems with Applications.

Oestreicher-Singer, G. (2013). The network value of prod-

ucts. In Journal of Marketing.

Post, C. (2020). The 2020 Canadian e-commerce report. In

Canada Post Press.

Simpson, M. (2020). Shopify sees 47 percent revenue

growth in q1 2020 amid impacts of covid-19. In

https://betakit.com/shopify-sees-47-percent-revenue-

growth-in-q1-2020-amid-impacts-of-covid-19.

Srivastava, A., Bala, P., and Kumar, B. (2020). New per-

spectives on grey sheep behavior in e-commerce rec-

ommendations. In Journal of Retailing and Consumer

Services.

Statista (2019). Distribution of online shop-

pers in Canada as of April 2019, by

household type. Cited 2020, Available at

https://www.statista.com/statistics/1044443/canada-

online-shoppers-by-household-type/.

Ungerer, C., Portugal, A., Molinuevo, M., and Rovo, N.

(2020). Recommendations to leverage e-commerce

during the covid-19 crisis. In World Bank Group.

Winkler, N. (2020). Quarterly e-commerce sales. In

https://www.census.gov/retail/mrts/www/data/pdf/

ec

current.pdf.

Yoon-Joo, P. (2013). The adaptive clustering method for the

long tail problem of recommender systems. In IEEE

Transactions on Knowledge and Data Engineering.

Zheng, Y., Agnani, M., and Singh, M. (2017). Identifying

grey sheep users by the distribution of user similari-

ties in collaborative filtering. In Proceedings of the

sixth Annual Conference on Research in Information

Technology.

Personalised Recommendation Systems and the Impact of COVID-19: Perspectives, Opportunities and Challenges

301