Effect of Return on Asset, Price Earning Ratio and Capital Structure

on Firm Value at Company Hotel, Restaurant and Tourism

Sub-sector ServicesListed on IDX

Stephanie, Yusuf Ronny Edward, Galumbang Hutagalung and Wilsa Road Betterment Sitepu

Universitas Prima Indonesia, Jalan Sekip Simpang Sikambing, Medan, Indonesia

Keywords: Return on Asset (ROA), Price Earning Ratio(PER), Capital Structure, Firm Value.

Abstract: This study aims to examine and analyze the effect of Return on Assets (ROA), Price Earning Ratio (PER)

and Capital Structure on Firm Value in hotel, restaurant and tourism sub-sector service companies listed on

the IDX for the 2016-2018 period. The research method used in this research is quantitative research

methods. The type of research used in this research is quantitative associative research. The nature of the

research used in this study is a causal relationship. The population in this study were 25 companies

consisting of 3 years. The selection of research samples using purposive sampling technique, namely

sampling with certain criteria so that the number of samples taken was 39 samples. The data analysis

method used in this research is multiple linear regression analysis, the coefficient of determination, the F

test and the t test. The results showed that Return On Asset (ROA), Price Earning Ratio (PER) and Capital

Structure simultaneously had a significant positive effect on Firm Value with a determination coefficient of

78.4%. Return on Asset (ROA) has a negative and insignificant effect on Firm Value, Price Earning Ratio

(PER) has a positive and insignificant effect on Firm Value and Capital Structure has a significant positive

effect on Firm Value.

1 INTRODUCTION

The hotel, restaurant and tourism sub-sector service

companies are currently growing rapidly because

people now spend a lot of time traveling and these

sectors also greatly affect foreign exchange in the

country. Therefore, the competition that arises is

very fierce. This competition encourages companies

to have strong funding and large market access in

order to survive in fighting for market share and

dominating it. The strong funds can be obtained

from selling shares to investors and attracting

potential investors.

With the ease of accessing and buying shares,

investors and potential investors must be more

observant in assessing which companies are able to

provide them with benefits in the future. Investor's

investigation activities in the capital market require a

lot of information about the company that would be

the place to invest (Triani&Tarmidi, 2019).

Investors are interested in investing in companies

that have high firm value.Firm value is very

important because if a firm value is high its

stakeholders will a high prosperity (Zuhroh, 2019).

The way that investors and potential investors

can judge which firm value is better is by calculating

the asset turnover ratio or Return on Asset.Another

way to measure is the Price to Book Value (PBV)

ratio (Sudjiman&Sudjiman, 2019).

After assessing the firm value, an investor or

potential investor must be able to find out whether at

the time of buying the shares it was classified as

undervalued or overvalued. Financial ratio is an

option that can be used to measure stocks classified

as undervalued or overvalued. One of the financial

ratios available is the Price Earning Ratio.

A company that has funding that uses more debt

will increase the risk for the company which can

affect the returns that will be obtained from

investors and potential investors so it is also

necessary to know how capable the company is in

managing the existing capital structure.

As for previous research conducted (Husna &

Satria, 2019) the research found that the Return On

Asset has an effect on firm value but contradicts

research conducted by (Agustiani, 2016) and

Stephanie, ., Edward, Y., Hutagalung, G. and Betterment Sitepu, W.

Effect of Return on Asset, Price Earning Ratio and Capital Structure on Firm Value at Company Hotel, Restaurant and Tourism Sub-sector ServicesListed on IDX.

DOI: 10.5220/0010303800003051

In Proceedings of the International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies (CESIT 2020), pages 87-96

ISBN: 978-989-758-501-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All r ights reserved

87

(Salempang, 2016) which shows Return On Assets

do not have a significant effect on firm value.

Research on other variables has also been carried

out by (Prasetyorini, 2013) and (Lebelaha, 2016)

where the results of the research show that Price

Earning Ratio (PER) has a significant effect on firm

value, but on the other hand, another research

conducted by (Devianasari, 2015) Price Earning

Ratio (PER) does not have a significant effect on

firm value.

Research on capital structure variables has also

been carried out by (Chasanah, 2017) and

(Purwanto, 2017) where the results of this study

show the capital structure where the Debt to Equity

Ratio (DER) indicator has a significant effect on

firm value and it is contrary to the results of research

which conducted by (Rahmantio, 2018) and

(Mandalika, 2016) which shows that the Debt to

Equity Ratio (DER) does not have a significant

effect on firm value.

From the results above, which shows the

differences in the results of research by previous

researchers, the researchers are interested in

reexamining the effect of Return On Assets (ROA),

Price Earning Ratio (PER) and Capital Structure on

Firm Value in the hotel, restaurant and tourism sub-

sectorservice companies listed on the IDX for 2016-

2018 period.

1.1 Literature Review and Hypotheses

1.1.1 Firm Value

Price to Book Value (PBV) is a ratio that describes

the comparison between stock market prices and

book value of equity as shown in the statement of

financial position (Murhadi,2015:66). Firm value is

defined as the company's selling price, that is

reflected in the stock market prices traded in the

capital market(Widyastuti, 2019).

Based on the above understanding, it can be

concluded that company value is the investor's

assessment of a company with the benchmark is the

company's stock price.

Price to Book Value (PBV) describes how much

the market appreciates the book value of a

company's shares. The higher this ratio means the

market is confident in the prospect

(SugionodanUntung, 2016:70).

PBV =

Stock Market Price

Share Book Value

(1)

Book Value per Share is calculated by:

BVS =

Total Equity

Number of Shares

(2)

1.1.2 Return on Asset (ROA)

Return on Asset (ROA) is a ratio that shows how

much net income the company earns when measured

from asset value (Harahap, 2015:305). High value of

Return on Assets (ROA) will increase the efficiency

of the company, and the chance for the company to

increase its value (Chabachib et al., 2020).

Based on the above understanding, it can be

concluded that Return on Assets (ROA) is a ratio to

measure how much profit a company can generate in

using existing assets.

Return on Asset (ROA) is used to measure the

company's ability to generate return on assets owned

by the company (Darmadji and Fakhruddin, 2015:

158). The measurement of Return on Asset (ROA)

can be formulated as follows:

ROA =

Net Income After Tax

Total Assets

x100%

(3)

1.1.3 Price Earning Ratio (PER)

Price Earning Ratio (PER) is a ratio to determine

whether the market is relatively attractive or

unattractive. In addition, Price Earning Ratio (PER)

is also used to identify companies with super growth

(Gumanti, 2011:236).

Based on the above understanding, it can be

concluded that Price Earning Ratio (PER) is a ratio

to measure how much earnings can be obtained from

a stock price. In other words, Price Earning Ratio

(PER) is the ratio between stock price and earning

per share of an investment.

Price Earning Ratio (PER) describes the

comparison between market prices and earnings per

share. Price Earning Ratio (PER) that is too high,

indicates that the company's stock market price is

too expensive (Murhadi, 2015:65).

Price Earning Ratio (PER) is obtained by:

PER =

Price per share

EPS

(4)

1.1.4 Capital Structure

The capital structure choice of a firm is the most

significant decision taken by the management of the

firm to maximize profits and at the same time

minimize costs of capital leads to the maximization

of stockholders wealth (Rahman et al., 2019). The

company's capital structure is a mixture or

proportion of long-term debt and equity, in order to

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

88

finance its investment (operating assets)

(Raharjaputra, 2011:212).

Based on the above understanding, it can be

concluded that the capital structure is a balance or

comparison between foreign capital and own capital.

Foreign capital is defined as long-term debt or short-

term debt. Meanwhile, capital itself is divided into

retained earnings.

The capital structure and solvency ratio

illustrates the company's ability to pay off long-term

obligations if the company is liquidated

(SjahrialdanPurba, 2013:37).

The debt to equity ratio is debt divided by equity

(Luo &Lusmeida, 2018) so the capital structure and

solvency ratios are:

DER =

Total Debt or liabilities

Equity

x100%

(5)

1.1.5 The Effect of Return on Asset on Firm

Value

Return on Asset, which is one of the ratios of

profitability, if it has a high value, will give a

positive signal to investors because the company

will be able to record an increase in profit so that it

will increase the company's stock price, which if the

stock price in the market increases, the company

value will also increase (Husna & Satria, 2019).

1.1.6 The Effect of Price Earning Ratio

(PER) on Firm Value

This ratio is obtained from the market price of

common stock divided by the company's profit

(Earning per Share), so the higher this ratio will

indicate that the company's performance is also

getting better. On the other hand, if the PER is too

high, it can also indicate that the stock price being

offered is very high or irrational (Sugiono&Untung,

2016:70).

1.1.7 The Effect of Capital Structure on

Firm Value

Funding decisions by management will affect the

company's valuation, which is reflected in the stock

price. Therefore, one of the duties of a financial

manager is to determine a funding policy that

maximizes the share price which is a reflection of

firm value (Harmono, 2014:137).

1.1.8 Hyphotesis

Based on the limitations and problem formulations,

the following research hypothesis is made:

1. Return on Asset (ROA), Price Earning Ratio

(PER) and capital structure simultaneously

influence firm value in the hotel, restaurant

and tourism sub-sector service companies

listed on the IDX for the 2016-2018 period.

2. Return on Asset (ROA) has an effect on firm

value in the hotel, restaurant and tourism sub-

sector service companies listed on the IDX for

the 2016-2018 period.

3. Price Earning Ratio (PER) affects the value of

the company in the hotel, restaurant and

tourism sub-sector service companies listed on

the IDX for the 2016-2018 period.

4. Capital structure affects the value of the

company in the hotel, restaurant and tourism

sub-sector service companies listed on the

IDX for the 2016-2018 period.

2 METHOD

2.1 Research Sites

This study uses secondary data which can be

downloaded via the website www.idx.co.id for 3

years from 2016-2018.

2.2 Population

The population in this study is the hotel, restaurant

and tourism sub-sector service companies listed on

the IDX for the 2016-2018 period where the number

of companies listed on the IDX are 25 companies.

2.3 Data Determination Techniques

The technique of determining data or sampling in

this study using purposive sampling technique where

the sampling is based on the criteria of the

researchers themselves.

These criteria are:

1. Hotel, restaurant and tourism sub-sector

service companies listed on the IDX for the

2016-2018 period.

2. Hotel, restaurant and tourism sub-sector

service companies that publish complete

financial reports for the 2016-2018 period.

3. Hotel, restaurant and tourism sub-sector

service companies that did not experience

losses during the 2016-2018 period.

Effect of Return on Asset, Price Earning Ratio and Capital Structure on Firm Value at Company Hotel, Restaurant and Tourism Sub-sector

ServicesListed on IDX

89

4. Hotel, restaurant and tourism sub-sector

service companies whose equity was not

deficit during the 2016-2018 period.

Based on these criteria, the researchers took a

sample of 13 companies which were studied for 3

years so that the total sample studied was 39

samples.

2.4 Sample

The research sample can be seen in Table 1.

Table 1: Sample of hotel, restaurant and tourism sub-

sector service companies listed on the IDX for the 2016-

2018 period.

No

Stock

Code

Company

Name

IPO

Date

Type of

Business

1 BAYU BayuBuanaTbk

30-Oct-

1989

Tourism

2 FAST

Fast Food

Indonesia Tb

k

11-May-

1993

Restaurant

3 INPP

Indonesia

Paradise

Property Tb

k

01-Dec-

2004

Hotel

4 JIHD

Jakarta

International

Hotel &

Development

Tb

k

29-Feb-

1984

Hotel

5 JSPT

Jakarta

Setiabudi

International

Tb

k

12-Jan-

1998

Hotel

6 KPIG

MNC Land

Tbk

30-Mar-

2000

Hotel &

Tourism

7 MAMI

Mas Murni

Indonesia Tb

k

09-Feb-

1994

Restaurant&

Hotel

8 MAPB

MAP Boga

AdiperkasaTbk

21-Jun-

2017

Restaurant

9 PDES

DestinasiTirta

Nusantara Tb

k

08-Jul-

2008

Tourism

10 PGLI

Pembangunan

Graha Lestari

Indah Tb

k

05-Apr-

2000

Restaurant

11 PJAA

Pembangunan

Jaya AncolTbk

02-Jul-

2004

Restaurant

& Tourism

12 PTSP

Pioneerindo

Gourmet

International

Tb

k

30-May-

1994

Restaurant

13 SHID

Hotel Sahid

Jaya

International

Tb

k

08-Mei-

1990

Hotel

Source: www.idx.co.id (2019)

The data listed in table 1 is sample data taken after

complying with the sampling criteria where the

company name and company code listed on the IDX

and the type of business of the company are

recorded.

2.5 Data Analysis Technique

In this study, the data analysis method used was

statistical methods. This test is conducted using

SPSS statistical data processing software. The

classic assumption test is done first before testing

the hypothesis.

The data analysis model used in this research is

multiple linear regression analysis, which functions

to determine the effect of the independent and

dependent variables, the formula for multiple linear

regression analysis is as follows:

Y = a + b

1

X

1

+ b

2

X

2

+ b

3

X

3

+ e (1)

Note :

Y = Firm Value

a = Constant

b

1

b

2

b

3

= Regression Coefficient

X

1

= Return on Asset

X

2

= Price Earning Ratio

X

3

= Capital Structure

e = Standard Error (5%)

2.6 Research Procedure

2.6.1 Normality Test

In this test, it can be seen whether the confounding

variables in the regression model are normally

distributed or not.

To detect data normality can be done by:

1. Testing using theKolmogorov-Smirnov test

statistic.

2. Testing using histogram graph analysis.

3. Testing using graph analysis of normal

probability plots (Ghozali, 2016).

2.6.2 Multicollinearity Test

To get the presence or absence of multicollinearity

in the regression model, it can also be seen from the

tolerance value and the opposite of Variance

Inflation Factor (VIF). A high VIF value indicates a

low tolerance value. The determination value used

generally indicates the absence of multicollinearity,

is the Tolerance value ≥ 0.10 or equal to the VIF

value ≤ 10 (Ghozali, 2016).

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

90

2.6.3 Autocorrelation Test

Detect autocorrelation with a run test. There is no

relationship between the residuals '' threshold ''. Run

the tests used to see if the residual data is random or

systematic.

H0: residual (res_1) random (acak)

HA: residual (res_1) not random (Ghozali,

2016).

2.6.4 Heteroscedasticity Test

The heteroscedasticity test aims to test whether in

the regression model there is an inequality of

variance from the residuals of one observation to

another. A good regression model does not occur

heteroscedasticity.

In this study, to detect heteroscedasticity can be

done by:

1. Scatterplot chart method

2. Glejser test(Ghozali, 2016).

2.6.5 Coefficient of Determination

The ability of a model to explain variations in the

dependent variable can be measured by the

coefficient of determination (R2). The coefficient of

determination is between zero and one. If the ability

of the independent variables in explaining the

variation in the dependent variable is very limited, it

will be shown from the small R2 value. If the value

is close to one, it means that the independent

variables are able to provide almost all the

information needed to predict the variation in the

dependent variable (Ghozali, 2016).

2.6.6 Simultaneous Hypothesis Testing

Simultaneous hypothesis testing (F test) aims to test

whether all independent or independent variables

included in the model have a joint influence on the

dependent or dependent variable. This test is done

by comparing Fcount with Ftable with the following

conditions:

1. H

0

is accepted if F-count ≤ F-table on α = 5%

2. H

a

is accepted if F-count > F-table on α = 5%

(Ghozali, 2016).

The null hypothesis (H

0

) indicates that the

parameters in the model are equal to zero, or:

H

0

: b

1

, b

2

, b

3

=0 (1)

Return on Asset (ROA), Price Earning Ratio

(PER) and Capital Structure have no simultaneous

effect on Firm Value at Hotel, Restaurant and

Tourism Sub Sector Service Companies listed on the

IDX for the 2016-2018 period.

The alternative hypothesis (Ha) does not all

parameters simultaneously equal zero, or:

Ha : b

1

, b

2

, b

3

≠ 0 (2)

Return on Asset (ROA), Price Earning Ratio

(PER) and Capital Structure have a simultaneous

effect on Firm Value in Hotel, Restaurant and

Tourism Sub Sector Service Companies listed on the

IDX for the 2016-2018 period.

2.6.7 Partial Hypothesis Testing

Partial hypothesis testing (t test) shows how far the

influence of one explanatory / independent variable

individually in explaining the variance of the

dependent variable. This test is done by comparing

tcount with ttable with the following conditions:

1. H

0

is accepted if t-count ≤ t-table on α = 5%

2. Ha is accepted if t-count > t-table on α =

5%(Ghozali, 2016).

The null hypothesis (H

0

) to be tested is whether a

parameter (bi) is equal to zero, or:

H

0

: b

1

= 0

(1)

Return on Asset (ROA) has no partial effect on

Firm Value in Hotel, Restaurant and Tourism Sub

Sector Service Companies listed on the IDX for the

2016-2018 period.

H

a

: b

1

≠ 0 (2)

Return on Asset (ROA) has a partial effect on

Firm Value in Hotel, Restaurant and Tourism Sub

Sector Service Companies listed on the IDX for the

2016-2018 period.

H

0

: b

2

= 0 (1)

Price Earning Ratio (PER) does not have a

partial effect on Firm Value in Hotel, Restaurant and

Tourism Sub Sector Service Companies listed on the

IDX for the 2016-2018 period.

H

a

: b

2

≠ 0 (2)

Price Earning Ratio (PER) has a partial effect on

Firm Value in Hotel, Restaurant and Tourism Sub

Sector Service Companies listed on the IDX for the

2016-2018 period.

Effect of Return on Asset, Price Earning Ratio and Capital Structure on Firm Value at Company Hotel, Restaurant and Tourism Sub-sector

ServicesListed on IDX

91

H

0

: b

3

= 0 (3)

Capital Structure does not have a partial effect on

Firm Value in Hotel, Restaurant and Tourism Sub

Sector Service Companies listed on the IDX for the

2016-2018 period.

H

a

: b

3

≠ 0 (4)

Capital Structure has a partial effect on Firm

Value in Hotel, Restaurant and Tourism Sub Sector

Service Companies listed on the IDX for the 2016-

2018 period.

3 RESULTS AND DISCUSSIONS

3.1 Results of Data Analysis

This study uses a multiple linear regression equation

research model. The following is a multiple linear

regression table:

Table 2: Multiple linear regression equation.

Coefficients

a

Model Unstandardizedcoefficients

B Std.error

(Constant) -.525 .765

ROA -.022 .156

1

PER .001 .001

DER 4.229 .379

a. Dependent Variable: PBV

Source: The data were processed using SPSS

(2019).

From Table 2 it can also be seen that the values

are as follows:

a = -0,525

β

1

=-0,022

β

2

=0,001

β

3

=4,229

So the multiple linear regression equation for the

three variables is (Return on Assets (ROA), Price

Earning Ratio (PER) and capital structure) are:

Firm value = -0,525 - 0,022 ROA + 0,001

PER + 4,229 capital structure

(1)

From the regression equation above, the constant

value (a) of the firm value is -0.525. This constant

value (a) indicates that if the independent variables,

namely Return on Assets (ROA), Price Earning

Ratio (PER), and capital structure are considered

constant or fixed, then the firm value is -0.525.

From the regression equation, the Return on

Assets (ROA) variable produces β1 = -0.022, which

means that every 1% increase in the Return on

Assets (ROA) variable, the company value will

decrease by 0.022 assuming the other variables are

fixed and the effect of Return on Assets (ROA) to

firm value is significant.

From the regression equation, the variable Price

Earning Ratio (PER) produces β2 = 0.001, which

means that each increase in the Price Earning Ratio

(PER) variable by 1%, the company value will

increase by 0.001 assuming the other variables are

fixed and the effect of Price Earning Ratio (PER).

To firm value is significant.

From the regression equation, the capital

structure variable produces β3 = 4.229, which means

that each increase in the capital structure variable by

1%, the firm value will increase by 4.229, assuming

the other variables are fixed and the effect of capital

structure on firm value is significant.

3.2 Classical Assumption Test Results

3.2.1 Normality Test Result

1. Kolmogorov-Smirnov Test Statistics (K-S)

The following is a test of data normality results

using the Kolmogorov-Smirnov (K-S) non-

parametric test:

Table 3: Kolmogorov Smirnov (K-S) test.

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N 39

Mean .0000000

Normal Parameters

a,b

Std. Deviation 2.35295705

Absolute .192

Most Extreme Differences

Positive

.192

Most Extreme Differences

Negative

-.105

Kolmo

g

orov-Smirnov Z 1.197

Asymp. Sig. (2-tailed) .114

a. Test distribution is Normal.

b. Calculate from data.

Source: The data were processed using SPSS (2019).

Based on the table of the results of the

Kolmogorov-Smirnov (K-S) test, it shows that the

Kolmogorov-Smirnov (K-S) value is 1.197 and the

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

92

significant value is 0.114. It can be concluded that

all variables meet the normal data distribution

because the significant value is greater than 0.05.

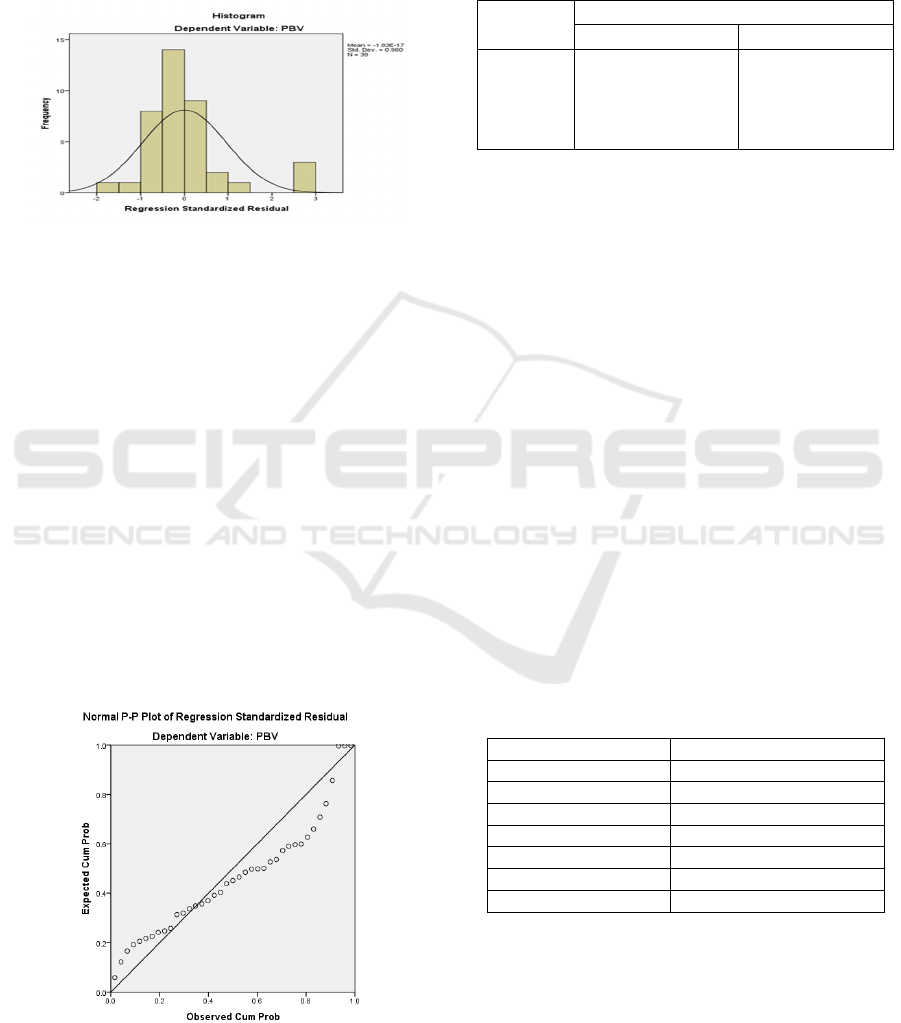

2. Histogram Graph Analysis

The following is a test of the results of data

normality using graph analysis and normal

probability plots as shown in Figures 1 and 2.

Figure1: Histogram graph.

Based on Figure 1 from the Histogram Graph, it

shows that the observation data has been normally

distributed. This can be seen from the curve on the

histogram graph is not skewed to the left or right.

And also the data can be seen that the data bars are

inside the curve, so it can be concluded that the data

in this regression model is normally distributed.

3. Normal Probability Plot Graph Analysis

If the data spreads far from the diagonal line or does

not follow the direction of the diagonal line or the

histogram graph does not show a normal distribution

pattern, then the regression model does not meet the

normality assumption. However, from the above test

it can be seen in the normal probability plot graph in

Figure 2 that the data spreads close to the diagonal

line and follows the direction of the diagonal line, so

it can be said that the data meets the assumption of

normality.

Figure 2: Normalprobability plot graph analysis.

3.2.2 Multicollinearity Test Results

The results of the multicollinearity test can be seen

in Table 4.

Table 4: Multicollinearity test results.

Coefficients

a

Model Collinearity Statistic

Tolerence VIF

(

Constant

)

ROA .728 1.374

1

PER

.818 1.223

DER .878 1.139

a. Dependent Variable: PBV

Source: The data were processed using SPSS (2019).

The results of the tolerance value calculation

show that the three independent variables, namely

Return on Asset (ROA), Price Earning Ratio (PER)

and capital structure have a tolerance value greater

than 0.10 with a Return on Asset (ROA) value of

0.728, Price Earning Ratio (PER). ) amounting to

0.818 and the capital structure of 0.878.

Meanwhile, the VIF value calculation results

also show that the three independent variables,

namely Return on Asset (ROA), Price Earning Ratio

(PER) and capital structure have a value less than 10

with a Return on Asset (ROA) value of 1.374 Price

Earning Ratio (PER) of 1,223 and the capital

structure of 1,139.

From the results of the above calculations it can

be concluded that the data does not occur

multicollinearity.

3.2.3 Autocorrelation Test Results

The results of the run test can be seen in table 5.

Table 5: Run test.

Unstandardized Residual

Test Value

a

-.29885

Cases < Test Value 19

Cases >= Test Value 20

Total Cases 39

Number of Runs 14

Z -1.944

Asymp. Sig. (2-tailed) .052

a. Median

Source: The data were processed using SPSS (2019).

The results of the above calculation can be seen

that the value of the run test is -1.944 with a

probability of 0.052 which is significantly greater

than 0.05, which means that there is no correlation

Effect of Return on Asset, Price Earning Ratio and Capital Structure on Firm Value at Company Hotel, Restaurant and Tourism Sub-sector

ServicesListed on IDX

93

between residuals or it can be said that the data is

random or there is no autocorrelation between

residual values.

3.2.4 Heteroscedasticity Test Results

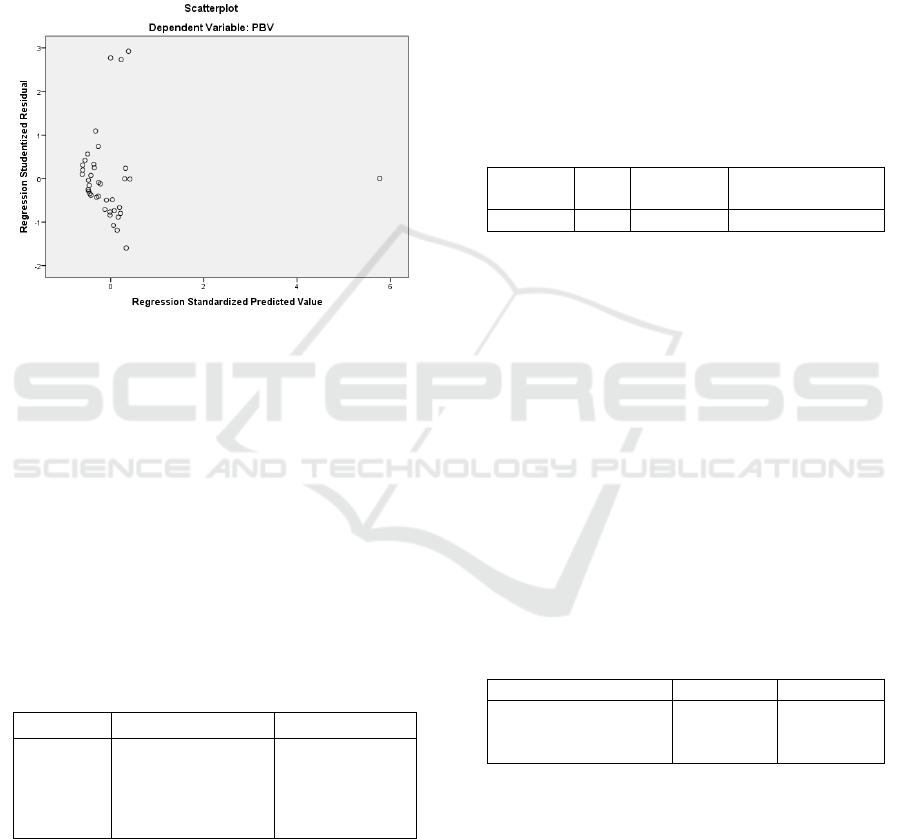

1. Test Scatterplot Graph

Thefollowing are the results of the heteroscedasticity

test by looking at the Scatterplot Graph:

Figure 3: Scatterplot graph.

Based on the image from the scatterplot graph

above, it can be seen that the dots are spread

randomly and are spread either above or below the

number 0 on the Y axis. It can be concluded that

there is no heteroscedasticity in the regression model

so this regression model is feasible to use.

2. Glejser Test

In addition to using a scatterplot graph to test for

heteroscedasticity, the Glejser test can also be used.

The results of the Glejser test can be seen in Table 6.

Table 6: Glejser test.

Coefficients

a

Model t Sig.

(

Constant

)

2.610 .013

ROA .095 .925

1

PER

.157 .876

DER .033 .974

a. Dependent Variable: ABS_RES1

Source: The data were processed using SPSS (2019).

Based on the results of the Glejser test, it shows

that all independent variables, namely Return on

Assets (ROA), Price Earning Ratio (PER) and

capital structure have a significant value above 0.05

with a Return on Assets (ROA) value of 0.925; Price

Earning Ratio (PER) of 0.876 and capital structure

of 0.974.

From the results of the Glejser test above, it can

be said that the regression model does not have

heteroscedasticity.

3.3 Results of the Hypothesis

Determination Coefficient

To test the hypothesis, the researcher used multiple

linear regression analysis. Based on the results of

data processing with SPSS version 21, the results are

as shown in Table 7.

Table 7: The coefficient of determination (Adjusted R

Square).

Model Summary

b

Model R R Square Adjusted R

Square

1 .895 .801 .784

Source: The data were processed using SPSS

The coefficient of determination test results

shows that the value of the Adjusted R Square

coefficient of determination is 0.784. This shows

that the variable Return on Assets (ROA), Price

Earning Ratio (PER) and capital structure can affect

firm value by 78.4%. Meanwhile, 21.6% of the firm

value variable is influenced by other factors outside

the variables studied.

3.4 Simultaneous Hypothesis Testing

Based on the results of data processing with the

SPSS version 21 program, the results are as shown

in Table 8.

Table 8: Simultaneous hypothesis testing (F-test).

ANOVA

a

Model F Sig.

Re

g

ression 47.047 .000

b

1 Residual

Total

a. Dependent Variable: PBV

b. Predictors: (Constant), DER, PER, ROA

Source: The data were processed using

SPSS(2019).

Based on the ANOVA or F-test, it is obtained

that Fcount is 47.047 greater than Ftable 2.85 with a

significant value of 0.000 less than 0.05, so the three

independent variables are Return on Assets (ROA),

Price Earning Ratio (PER) and capital structure.

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

94

significantly influence the dependent variable,

namely firm value together or simultaneously.

3.5 Partial Hypothesis Testing

Based on the results of data processing with the

SPSS 21 program, the results are as shown in Table

9.

Table 9: Partial hypothesis testing (t-test).

Coefficients

a

Model t Sig.

(

Constant

)

-.686 .497

ROA -.141 .888

1

PER

1.363 .182

DER 11.160 .000

a. Dependent Variable: PBV

Source: The data were processed using SPSS (2019).

From the regression coefficient table above, a

conclusion can be drawn, namely:

1. The resulting t-count value is -0.141 with a

significant value of 0.888. So it can be

concluded that the variable Return on Assets

(ROA) has no effect and is not partially

significant to the variable firm value because

the t-count -0.141 is smaller than the t-table

value of 2.02269 and the significant value of

0.888 is greater than 0.05.

2. The resulting t-count value is 1.363 with a

significant value of 0.182. So it can be

concluded that the variable Price Earning

Ratio (PER) has no effect and is not partially

significant to the firm value variable because

the t-count value of 0.182 is smaller than the t-

table value of 2.02269 and the significant

value of 0.182 is greater than 0.05.

3. The resulting t-count value is 11.160 with a

significant value of 0.000. So it can be

concluded that the capital structure variable

has a partially significant effect on the firm

value variable because the t-count value of

11.160 is greater than the t-table value of

2.02269 and the significant value of 0.000 is

less than 0.05.

4 CONCLUSIONS

From the results of research conducted by

researchers, it can be concluded that:

The variable Return on Asset (ROA), Price

Earning Ratio (PER) and capital structure

simultaneously have a significant positive

effect on firm value in the hotel, restaurant and

tourism sub-sector service companies listed on

the IDX for the 2016-2018 period.

The variable Return on Asset (ROA) has a

negative and insignificant effect on firm value

in the hotel, restaurant and tourism sub-sector

service companies listed on the IDX for the

2016-2018 period.

The variable Price Earning Ratio (PER) has a

positive and insignificant effect on firm value

in the hotel, restaurant and tourism sub-sector

service companies listed on the IDX for the

2016-2018 period.

The capital structure variable has a significant

positive effect on firm value in the hotel,

restaurant and tourism sub-sector service

companies listed on the IDX for the 2016-2018

period.

REFERENCES

Agustiani, RizkiMuti., 2016. Pengaruh Good Corporate

Governance, Return On Asset, Return On Equity,

BOPO, Dan Capital Adequacy Ratio TerhadapNilai

Perusahaan Go Public Di Bursa Efek Indonesia.

FakultasEkonomiUniversitasGunadarma,JurnalEkono

miBisnis. Vol.21, No.2, 132-135.

Chabachib, M., Fitriana, T. U., Hersugondo, H.,

Pamungkas, I. D., &Udin, U, 2020. Firm value

improvement strategy, corporate social responsibility,

and institutional ownership, International Journal of

Economics and Management Systems, 5.

Chasanah, Amalia Nur& Daniel Kartika

Adhi.,2017.Profitabilitas, Struktur Modal

danLikuiditasPengaruhnyaTerhadapNilai Perusahaan

Pada Perusahaan Real Estate Yang Listed Di BEI

Tahun2012-2015,PoliteknikStiBISNIS. Semarang,

Vol.12, No.2 Desember (2017), 131-146.

Darmadji, Tjiptono& Hendy M. Fakhruddin., 2015. Pasar

Modal di Indonesia Pendekatan Tanya

Jawab,SalembaEmpat. Jakarta, 3

rd

edition.

Devianasari, Ni Luh& Ni Putu Santi Suryantini, 2015.

Pengaruh Price Earning Ratio, Debt To Equity Ratio,

Dan DividenPayout Ratio TerhadapNilai Perusahaan

Pada Perusahaan Manufaktur Yang Terdaftar Di

Bursa Efek

Indonesia,FakultasEkonomidanBisnisUniversitasUday

ana (Unud). E-JurnalManajemenUnud. Bali,Vol.4,

No.11, 3646-3673.

Ghozali, Imam., 2016. AplikasiAnalisis Multivariate

dengan Program

SPSS,BadanPenerbitUniversitasDiponegoro.

Semarang, 8

th

edition.

Effect of Return on Asset, Price Earning Ratio and Capital Structure on Firm Value at Company Hotel, Restaurant and Tourism Sub-sector

ServicesListed on IDX

95

Gumanti, Tatang Ary., 2011. Manajemen Investasi Konsep

Teori dan Aplikasi, Mitra Wacana Media. Jakarta, 1st

edition.

Harahap, SofyanSyafri., 2015.

AnalisisKritisAtasLaporanKeuangan,PT.RajaGrafindo

Persada. Jakarta.

Harmono., 2014. ManajemenKeuanganBerbasis Balanced

Scorecard, PT.BumiAksara. Jakarta.

Husna, Asmaul & Satria Ibnu., 2019. Effect of Return on

Asset, Debt to Asset Ratio, Current Ratio, Firm Size,

and Dividen Payout Ratio on Firm Value,

International Journal of Economics and Financial

Issues. Vol 9, Issue 9(5),50-54.

Lebelaha, Devina L. A. & Ivonne S. Saerang, 2016.

Pengaruh Price Earning Ratio, Debt To Equity dan

Dividend Payout Ratio Terhadap Nilai Perusahaan

BUMN Yang Terdaftar Di Bursa Efek Indonesia

Periode 2011-2014. Fakultas Ekonomi dan Bisnis

Universitas Sam Ratulangi. Jurnal Berkala Ilmiah

Efisiensi. Manado, Vol.16, No.02 (2016), 376-386.

Luo, J., & Lusmeida, H., 2019. The Effect of Corporate

Social Responsibility and Financial Ratio to

Company’s Value (Case Study of Companies Listed in

LQ45 of IDX for the period 2011-2015). International

Conference on Islamic Economics and Business

(ICONIES 2018). Atlantis Press.

Mandalika, Andri, 2016. Pengaruh Struktur Aktiva,

Struktur Modal, dan Pertumbuhan Penjualan

Terhadap Nilai Perusahaan Pada Perusahaan Yang

Terdaftar Di Bursa Efek Indonesia Periode 2011-

2014. Fakultas Ekonomi dan Bisnis Universitas Sam

Ratulangi. Jurnal Berkala Ilmiah Efisiensi. Manado,

Vol.16, No.01, 207-218.

Murhadi, Werner R., 2015. Analisis Laporan Keuangan

Proyeksi dan Valuasi Saham, Salemba Empat. Jakarta.

Nurainy, R., Nurcahyo, B., Kurniasih, A.S., Sugiharti, B.,

2013. Implementation of good corporate governance

and its impact on corporate performance : The

mediation role of firm size (empirical study from

Indonesia), Global Business and Management

Research: An International Journal, Vol 5, Nos 2-3.

Prasetyorini, Bhekti Fitri, 2013. Pengaruh Ukuran

Perusahaan, Leverage, Price Earning Ratio Dan

Profitabilitas Terhadap Nilai Perusahaan.. Fakultas

Ekonomi Universitas Negeri Surabaya. Jurnal Ilmu

Manajemen. Surabaya, Vol.1, No.1, 183-196.

Purwanto,P & Jillian Agustin, 2017. Financial

Performance towards Value of Firms in Basic and

Chemicals Industry. Faculty of Economic and

Business, Padjajaran University. European Research

Studies Journal. Bandung, Volume.XX, Issue.2A, 443-

460.

Raharjaputra, Hendra S., 2011. Buku Panduan Praktis

Manajemen Keuangan dan Akuntansi untuk Eksekutif

Perusahaan, Salemba Empat. Jakarta.

Rahman, M. A., Sarker, M. S. I., & Uddin, M. J., 2019.

The impact of capital structure on the profitability of

publicly traded manufacturing firms in Bangladesh.

Applied Economics and Finance, 6(2), 1-5.

Rahmantio, Imam, dkk., April 2018. Pengaruh Debt To

Equity, Return On Equity, Return On Asset dan

Ukuran Perusahaan Terhadap Nilai Perusahaan

(Studi pada Perusahaan Pertambangan yang

Terdaftar di Bursa Efek Indonesia Tahun 2012-2016).

Universitas Brawijaya. Jurnal Administrasi Bisnis.

Malang, Vol.57, No.1, 151-159.

Salempang, Lita Elisabeth, dkk, 2016. Pengaruh Return

On Asset, Debt To Equity dan Pertumbuhan Penjualan

Terhadap Nilai Perusahaan Pada Sektor Real Estate

Dan Property Yang Terdaftar Di BEI Tahun 2013-

2014. Universitas Sam Ratulangi. Jurnal Berkala

Ilmiah Efisiensi. Manado, Vol.16, No.03, 813-824.

Sudjiman, P. E., & Sudjiman, L. S, 2019. Do Leverage

Concentration Influence Firms Value, In Abstract

Proceedings International Scholars Conference. Vol.

7, No. 1, pp. 1330-1342.

Sugiono, Edy Untung., 2016. Panduan Praktis Dasar

Analisa Laporan Keuangan, PT Grasindo. Jakarta.

Triani, N., &Tarmidi, D., 2019. Firm Value: Impact of

Investment Decisions, Funding Decisions and

Dividend Policies, International Journal of Academic

Research in Accounting, Finance and Management

Sciences, 9(2), 158-163.

Widyastuti, M., 2019. Analysis of liquidity, activity,

leverage, financial performance and company value in

food and beverage companies listed on the Indonesia

Stock Exchange, SSRG International Journal of

Economics and Management Studies (SSRG-IJEMS),

6(5), 52-58.

Zuhro, I., 2019. The Effects of Liquidity, Firm Size, and

Profitability on the Firm Value with Mediating

Leverage,KnE Social Sciences, 203-230.

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

96