Analysis of the Effect of Liquidity, Leverage, Profitability, and

Company Growth on Dividend Policy in Manufacturing

Companies Sector Food and Beverage Listed on the IDX

Paskah Ria Sitorus, Nagian Toni, Syaifuddin and Teng Sauh Hwee

Universitas Prima Indonesia, Jalan Sekip Simpang Sikambing, Medan, Indonesia

Keywords: Liquidity, Leverage, Profitability, Company Growth, Dividend Policy.

Abstract: Capital Market Issuers in Indonesia are divided into several sectors. One of them is the food and beverage

sector. So far the author has not found a research focusing on food and beverage sector manufacturing

companies. The method that researcher used in this study is associative quantitative research. About the

collection techniques of the data are carried out by collecting financial statement documents from

www.idx.co.id in the period 2015 - 2017. To analysis the data, the researcher use method like multiple

linear regression, coefficient of determination, t test, F test. The sample in this study were 18 companies

with data consisting of 3 years. The sample selection is done by purposive method. The results showed that

the ratio of liquidity, leverage, profitability and company growth have significant effect toward dividend

policy in Manufacturing Companies Sector Food and Beverage Listed on the IDX in 2015 - 2017 amounting

to 45.3%. The independent variable which have a dominant influence is the leverage variable.

1 INTRODUCTION

According to Gunawan, “Dividend policy is one

important aspect of the objective of maximizing the

value of the company. Management has two

treatment alternatives to net income after taxes or

Earnings After Tax (EAT), which divide it to

shareholders in the form of dividends, or reinvested

back into the company as retained earnings. Usually,

most EAT divided in the form of dividends and

partly reinvested. Therefore, management must

create a policy about the amount of EAT distributed

as dividends. The company's value can be seen on

the company's ability to pay dividends. The amount

of the dividend divided can affect stock prices. If

dividends were paid higher then stock prices tend to

be high so that the company's value too high.

However, if dividends paid to small shareholders the

company's stock price was too low. Thus, a large

dividend will increase the company's value (Harjito

and Martono, 2010: 115).

According to Finingsih (2018), “This study aims

to perform empirical tests on the influence of

liquidity, leverage, profitability, and company

growth to Dividend Policy. The dividend policy

basically to determine how much of the share of

profits to be shared with shareholders or to be

retained as part of profits which are subsequently

reused for the operations of the company. Based on

previous studies there are several factors that

managers need to consider in making dividend

policy decisions”.

Firms need to consider various factors in

dividend payout, which are the need of funding, the

need to retain some of the firm’s net income to

finance prospective investment, firm’s liquidity

condition, the behavior of stakeholders and other

factors related to dividend payout (Brigham and

Gapenski, 1996). According to Jiang et al. (2017)

and Banerjee et al. (2007), there is one factor that

influences dividend policy, which is stock liquidity.

According to Bahar (2018), “In the current era of

globalization, the growth of a country's economic

conditions is increasing and tighter. Competition that

occurs in the capital market is an opportunity and

also a challenge for every entrepreneur to develop in

his business. The total amount of profits to be

generated by a company is one of the determining

factors that will be taken into consideration in

paying dividends by a company. The dividends that

the company will give to its investors are different,

this is determined based on the dividend policy of

384

Sitorus, P., Toni, N. and Hwee, T.

Analysis of the Effect of Liquidity, Leverage, Profitability, and Company Growth on Dividend Policy in Manufacturing Companies Sector Food and Beverage Listed on the IDX.

DOI: 10.5220/0010312200003051

In Proceedings of the International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies (CESIT 2020), pages 384-391

ISBN: 978-989-758-501-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

each company. Investors generally want the

distribution of dividends that are relatively stable or

tend to increase, where the stability of dividend

distribution can foster investor confidence in a

company because it can minimize the uncertainty of

investors to invest their funds”.

There are two types of dividends that can be

obtained by investors, namely cash dividends and

non-cash dividends. Cash dividends are dividends

that companies will give to investors in cash.

Whereas non-cash dividends are dividends given to

investors in the form of shares with a certain size

distribution, for example assets dividends and stock

dividends. However, in reality investors tend to

prefer the provision of dividends in the form of cash

dividends, because this can reduce the risk of

uncertainty that must be faced by investors for

investments made in a company”.

According to Darmawan (2020), “The

development of the business world today, coupled

with the uncertainty of the global economic

situation, causes increasingly fierce competition

between companies. This competition makes each

company increasingly competing to improve its

performance to increase the welfare of shareholders

and attract the interest of potential investors to buy

company shares. A company with excellent

prospects can be characterized by the amount of

interest from investors to invest their shares in a

company”.

One of the most desirable companies by

investors is companies in the manufacturing industry

sector. The Ministry of Industry (Kemenperin) noted

that investment in the manufacturing industry sector

continues to grow significantly. One factor that

causes high investor interest in manufacturing

companies is due to the company's excellent

performance. The performance of manufacturing

companies continues to show positive performance

throughout February 2019, with the Purchasing

Managers Index (PMI) data of Indonesian

manufacturing companies at the level of 50.1. This

figure is up from the previous month's level, which

was 49.9. Furthermore, it indicates that the

manufacturing industry sector is increasing. This

year, the Ministry of Industry (Kemenperin) projects

manufacturing industry growth of 5.4%. Subsectors

that are expected to grow high include the food and

beverage industry, the machinery industry, the

textile and apparel industry, the leather industry, the

footwear industry, the metal goods industry,

computers, and electronics goods.

Manufacturing companies are companies

engaged in processing raw goods into finished goods

to add value to the goods. Of course, there are many

manufacturing companies in Indonesia, one of which

is listed on the Indonesia Stock Exchange.

Nevertheless, investors are not just arbitrary in

choosing. Investors will consider many factors

before making an investment decision. One of the

considerations of investors to invest is to consider

the value of the company.

According to Sondakh (2019), “Firms that go

public have a goal to increase value of firm because

it is a factor that is considered by investors to name

their capital. Firm value is an indicator of financial

performance because if a high corporate value can

indicate prosperity for shareholders. In choosing a

good firm, investors certainly do not just choose

companies to invest their capital, because investors

see the value of the firm as reflected in the price of

their shares. The market price of the firm's shares

formed between buyers and sellers when a

transaction is called is called the firm's market value,

the stock market price is considered a reflection of

the value of the firm's assets. The value of a firm

formed through indicators of stock market value is

strongly influenced by investment opportunities. The

existence of investment opportunities will provide a

positive signal about firm's growth in the future, so

that it will increase stock prices and by increasing of

stock prices then value of firm will increase”.

Every firm that goes public certainly wants to

show investors that their firm is one of the best

alternatives to invest. There are many factors that

can affect firm value. In this study four factors were

used, namely dividend policy, liquidity, profitability

and firm size. This study aims to analyze the effect

of dividend, liquidity, profitability and firm size

policies on firm value. Based on the background

described above, the formulation of the problem in

this study is to analyze the effect of dividend policy,

liquidity, profitability and firm size on firm value.

This study uses financial services companies listed

on the Indonesia Stock Exchange over period 2015

to 2018 as sample where 12 firms meet the

requirements.

According to Fajaria (2018), “Each company

must take into account the advantages obtained, as

well as with investors who want to profit from the

capital that they grow in the company. A company

can be said to be included in the company an

attractive one from the company's ability not only

generate a profit, but also able to maintain and

increase profits. This advantage is known as

corporate profits. Management of the company

believes and is confident that consistent profits to

attract and retain investors to invest in the company,

Analysis of the Effect of Liquidity, Leverage, Profitability, and Company Growth on Dividend Policy in Manufacturing Companies Sector

Food and Beverage Listed on the IDX

385

which in turn will increase Firm Value. Investors are

more interested in a company that can generate

profits continuously rather than companies without

earnings”.

The company's goal is the prosperity of our

shareholders and enhance shareholder value as

reflected in the company's stock price. Investors are

more interested in investing in companies that have

favorable job prospects and promises, one of which

financial performance.

According to Tahu (2017), “Research on the

value of the company interesting to study because it

is based on the results of previous research they

found the results of research that the controversy

between the dependent variable (X) of the

independent variable (Y) and a moderating variable

(Z). In contrast to previous studies, this study is not

only to determine the effect of financial performance

(liquidity, leverage, and profitability), the value of

the company's dividend policy, and dividend policy

in this study is used as a moderating variable

between the financial performance of the company's

value”.

According to Darmawati (2018), “The dividend

policy of a company has an important impact for

many parties involved in the community. For

shareholders or investors the dividend policy tends

to attract more attention, because the dividend

obtained is one reflection of the certainty of the

value obtained on paid capital. Meanwhile, for

dividend management is cash outflow which reduces

the company's cash. Therefore, there is often a

difference between the interests of shareholders and

management companies. In this regard, it is

necessary to test to know the factors influencing

dividend policy”.

According to Sulhan (2018), “Investors who

invest in shares of a company have the primary

purpose of generating revenue or return on

investment in the form of dividend income (dividend

yield) and capital gains. Shareholders tend to prefer

dividends than capital gains, for dividends promised

something more definite. Following the theory (a

bird in the hand theory) states that investors prefer

dividends rose from the fall. The main reason

preferred dividends rose is a certainty”.

Meanwhile, expect a rise in stock prices is

something uncertain. Companies need to make

policy on the profits distributed to shareholders or

called Dividend Payout Ratio. Companies that tend

to generate profit, the company will distribute a

dividend.

1.1 Liquidity

Liquidity is the company's ability to settle short-term

obligations. Companies with current Liquidity will

pay off short-term obligations promptly. The high

level of Liquidity indicates that the company is in

good condition to attract investors to invest, there by

increasing demand for company shares and, of

course, will increase the price of a company's shares.

The high ratio of company liquidity will be good

news. This is in line with the signaling theory

approach which states that a high liquidity ratio is

likely to have an effect on rising stock prices. Then

the investor will decide to buy shares when the

company's liquidity ratio is healthy and stable.

Liquidity has a positive and significant effect on

value company (Darmawan, 2020).

Liquidity is also an indicator to measure the

company's ability to pay all short-term financial

obligations at maturity using liquid assets available.

According to Hanafi and Halim "Liquidity is the

ability of the company to meet short-term liabilities

by looking at a company's current assets relative to

debt (debt, in this case, is the obligation of the

company)." Moreover, it can be said that the

company can meet short-term obligations on time

indicates that the company is in a liquid state. The

financial ratio used to measure liquidity, namely:

current ratio and quick ratio (Sulhan, 2018).

Liquidity is a picture of a company's ability to

meet its short-term obligations. Liquidity is

important to analyze because failure to pay

obligations can lead to bankruptcy. The company's

management always tries to maintain a healthy and

liquidity condition of the company that is fulfilled in

a timely manner. Companies with high liquidity can

be interpreted that the company has sufficient funds

to meet its short-term obligations.

Liquidity is also an indicator to measure the

company's ability to pay all short-term financial

obligations at maturity using liquid assets available.

According to Hanafi and Halim "Liquidity is the

ability of the company to meet short-term liabilities

by looking at a company's current assets relative to

debt (debt, in this case, is the obligation of the

company)." Moreover, it can be said that the

company can meet short-term obligations on time

indicates that the company is in a liquid state. The

financial ratio used to measure liquidity, namely:

current ratio and quick ratio (Sulhan, 2018).

The liquidity ratio according to Kasmir (2017:

129) serves to show or measure capability the

company in fulfilling its obligations that are due,

both obligations to parties outside the company

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

386

(business entity liquidity) and within the company

(company liquidity) (Darmawati, 2018).

1.2 Leverage

States that the DER is a ratio used to assess the debt

for equity. This ratio is sought by comparing the

total debt to total equity. DER ratio illustrates the

extent to which the owners of capital to cover debts

to outside parties. The smaller this ratio, the better.

This ratio is also called leverage ratio. For best

security outside parties if the total capital ratio is

greater than or at least the same amount of debt. But

for shareholders or management, this ratio should be

big. (Fajaria, 2018).

Leverage has a negative impact on the amount of

dividends payout. High leverage will lead to a

decrease in the amount of dividends paid because the

company prioritizes debt repayment. Zais (2017)

states that Debt to Equity Ratio has a significant

negative influence on dividend policy. Sari &

Sudjarni (2015) states that leverage has a significant

negative influence on dividend policy.

According to Syamsuddin (2013: 89), leverage is

the company's ability to use fixed cost assets or

funds to increase the level of income (return) for

company owners.

The solvency ratio or leverage ratio according to

Kasmir (2014: 151) is the ratio used to measure the

extent to which the company's assets are financed

with debt. This means how big the debt burden is

borne by the company compared to its assets. The

greater the degree of corporate leverage, the greater

the amount of debt used, and the greater the business

risk faced, especially if economic conditions

worsened.

According to Sjahrial and Purba (2014: 37), the

liquidity ratio describes the company's ability to pay

short-term liabilities (or current debt) at maturity

using current assets.

According to Gumanti (2013: 112), stating the

liquidity ratio or smoothness ratio shows the level of

smoothness of a company in fulfilling its short-term

obligations.

1.3 Profitability

According to Bahar (2019), profitability ratio is a

ratio that can be used as a benchmark of efficiency

against the use of assets in a company or also an

ability to earn profits in a company within a certain

time period, in order to see the company's

performance in operating efficiently [3]. If the

earnings per share (profit per share) of a company

increases, the higher the level dividends distributed.

Rising levels of dividend payments, will signal to

investors that the company's profitability is getting

better

.

Ningrum & Asandimitra (2017) said that

profitability could affect the company's stock price

so that it can be used as a signal for investors to

assess the merits of the company. Profitability has a

positive and significant effect on firm value based

Profitability ratios measure the level of profit

that can be obtained. According to Hanafi

"Profitability ratio is the ratio that measures the

ability of the company making a profit (profitability)

at the level of sales, assets, and certain share capital.

With good profitability, conditions will encourage

investors to invest in the company in order to receive

dividends on the company's profits. So a decent

profit share of the shareholders is profit after the

company meets all its fixed obligations, namely

interest expenses and taxes. Therefore, dividends are

taken from the net profits derived by an enterprise

succeed, then the benefit will affect the amount

distributed by the company.

According to Gunawan (2018), the value of the

company will also be influenced by the profitability.

Profitability is considered important in the retention

of the company's survival in the long term, because

the profitability indicate whether the company has

good prospects in the future. Thus, each company

will always strive to improve its profitability,

because the higher the level of profitability of the

company, the company's survival will be more

secure. Profitability means the extent to which

companies make a profit from sales and investment

companies.

1.4 Company Growth

According to Sulhan (2018), the rate of growth of

assets is where the faster the growth rate of the asset

is greater cash needs for the foreseeable future to

finance its growth, and the company is usually more

than happy to hold the "earning" it rather than be

paid as a dividend to shareholders keeping in mind

the limitations costs. Thus it can be said that the

rapid rate of growth in the greater assets of the fund

is needed, the greater the opportunity for profit, the

greater part of the company's retained earnings,

which means the lower the "Dividend Payout Ratio"

her. If the company has achieved a growth rate such

that the company has been "well established" where

the funds' needs can be met with funds from the

capital markets or other sources of external funding,

Analysis of the Effect of Liquidity, Leverage, Profitability, and Company Growth on Dividend Policy in Manufacturing Companies Sector

Food and Beverage Listed on the IDX

387

then the situation is different. In such cases, the

company may set "Dividend Payout Ratio" is high.

Growth assets can be used as a benchmark for

asset growth that is used as a measure in assessing

operational activities in a company. The higher the

growth of a company, the greater the need for funds

needed to finance the development of the company.

If the need to finance the growth of a company in the

future is getting higher, then the company tends to

hold income rather than pay it as dividends to

investors.

The Assets Growth shows the growth of assets

used for operating activities of the company, the

more rapid rate of growth of assets, the higher the

funds needed to finance the growth of the company

so that the more significant part of retained earnings

in the company which means fewer dividends paid.

According to Gunawan (2018) Companies that

have total assets of the shows that the company has

reached a stage of maturity where at this stage the

company cash flow has been positive and is

considered to have good prospects within a

relatively long time, but it also reflects that the

company is relatively more stable and better able to

generate profits than companies with total assets

were small (Indriani 2005 in Daniati and Suhairi,

2006). Usually large companies have assets greater

value.

Chang & Rhee (1990) in Maladjian & Khoury

(2014) state that high Growth of the company led to

an increase in the need for funds to finance

expansion, enabling the company to retain its profits

rather than paying it as dividends. Zaman (2013)

states that the company growth has a significant

influence on dividend policy, Lestari (2017) states

that the growth of the company as measured by

Assets Growth has no influence on dividend policy.

(Finingsih, 2018).

According to the research Rahmanita shows that

assets growth does not affect the dividend payout

ratio. In contrast to the results of research Lopolusi,

research shows that the growth assets showed a

significant negative effect on dividend payout ratio.

Jossie research results Jossie The results showed that

the growth assets showed a significant positive

effect on dividend payout ratio.

1.5 Dividend Policy

According Sudana (2015: 192), dividend policy

relating to the determination of the dividend payout

ratio, ie the percentage of the amount of net profit

after tax which is distributed as dividends to

shareholders. Parliament proxy can be calculated by

comparing the dividend per share to earnings per

share for the company.

Dividend policy is a part that cannot separate

with corporate funding decision and one crucial

factor that must be considered by management in

managing the company. According to Gitman

(2012), dividend policy as a policy to determine how

much profit to paid in the form of dividends to

shareholders and how much should be reinvested

(retained earnings).

According to Horne (2013), stated that there are

several factors that affect dividend policy, are as

follows: The rules of Law (Legal Rules), Needs

Funding Company (Funding Needs of the Firm),

Liquidity (Liquidity), ability to Borrowing (Ability

to borrow), Limitation on Debt Contracts

(Restrictions in Debt Contract).

According to Harmono (2015: 12), dividend

policy is the percentage of profit paid to

shareholders in the form of cash dividends,

maintaining dividend stability from time to time,

distributing stock dividends, and buying back shares.

According to Gumanti (2013: 7), dividend policy

is a practice carried out by management in making

dividend payment decisions, which include the

amount of rupiah, the pattern of cash distribution to

shareholders.

Ross et al. (2016:600) define dividend as a

payment made out of a firm’s earnings to its owners,

in the form of either cash or stock. Sudana

(2015:192) argues that dividend policy is related to

the amount of dividend payout ratio (DPR), which is

the amount of cash paid put to shareholders divided

by net income.

2 METHOD

In this study, researchers used associative

quantitative methods in research on the Analysis of

Effects of Liquidity, Leverage, Profitability, and

Company Growth on Dividend Policy in

Manufacturing Companies Sector Food and

Beverage Listed On The IDX 2015 - 2017. The

location on this Research is at Medan. The data

collection technique used by researchers is the

technique of collecting data through documents from

the website www.idx.co.id. The data format is in the

form of annual financial statements of the

Manufacturing Companies Sector Food and

Beverage On The IDX for the 2015 - 2017 Period.

The sampel of this Research are 54. This study uses

the normality test, multicollinearity test,

autocorrelation test, heteroscedasticity test, multiple

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

388

linear regression, t - statistical test, F - statistical test,

determination coefficient test. (Ghozali, 2016).

Formula of Liquidity

𝑪𝒖𝒓𝒓𝒆𝒏𝒕 𝑹𝒂𝒕𝒊𝒐

𝐂𝐮𝐫𝐫𝐞𝐧𝐭 𝐀𝐬𝐬𝐞𝐭

𝐂𝐮𝐫𝐫𝐞𝐧𝐭 𝐃𝐞𝐛𝐭

(1)

Formula of Leverage

𝑫𝒆𝒃𝒕 𝒓𝒂𝒕𝒊𝒐

𝐓𝐨𝐭𝐚𝐥 𝐃𝐞𝐛𝐭

𝐓𝐨𝐭𝐚𝐥 𝐀𝐬𝐬𝐞𝐭𝐬

(2)

Formula of Profitability

𝑹𝑶𝑨

𝑵𝒆𝒕 𝑰𝒏𝒄𝒐𝒎𝒆

𝑻𝒐𝒕𝒂𝒍 𝑨𝒔𝒔𝒆𝒕

(3)

Formula of Company Growth

𝑪𝒐𝒎𝒑𝒂𝒏𝒚 𝑮𝒓𝒐𝒘𝒕𝒉

𝐓𝐀 𝐓𝐡𝐢𝐬 𝐘𝐞𝐚𝐫𝐓𝐀 𝐋𝐚𝐬𝐭 𝐘𝐞𝐚𝐫

𝐓𝐨𝐭𝐚𝐥𝐀𝐬𝐬𝐞𝐭𝐬 𝐥𝐚𝐬𝐭 𝐘𝐞𝐚𝐫

(4)

Formula of Dividend Policy

𝑫𝑷𝑹

𝑪𝒂𝒔𝒉 𝑫𝒊𝒗𝒊𝒅𝒆𝒏𝒅 𝑷𝒆𝒓 𝑺𝒉𝒂𝒓𝒆

𝑵𝒆𝒕 𝑰𝒏𝒄𝒐𝒎𝒆 𝑷𝒆𝒓 𝑺𝒉𝒂𝒓𝒆

(5)

3 RESULT AND DISCUSSION

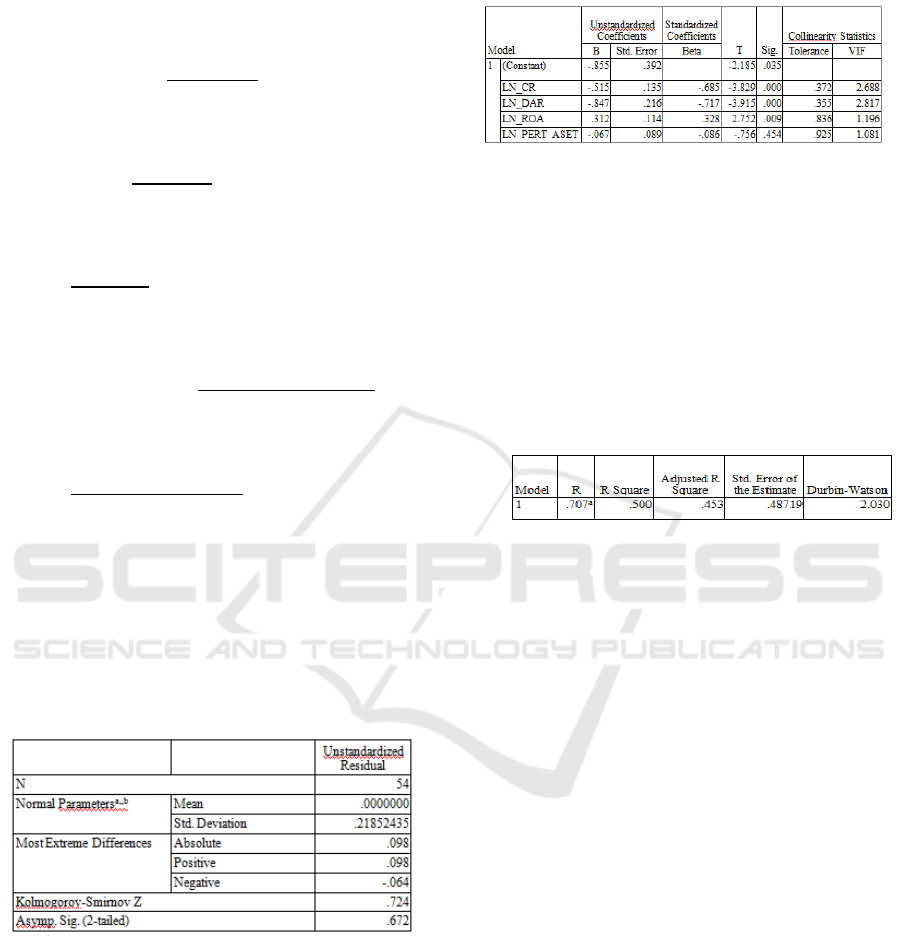

To find out the normality of a data, it can be done by

using the Kolmogorov - Smirnov test as in Table 1.

Table 1: Normality Test Results.

One-Sample Kolmogorov-Smirnov Test

a. Test distribution is Normal.

b. Calculated from data.

Because the value of Asymp. Sig. (2-tailed) 0.672>

0.05, it can be concluded that the data is normally

distributed.

To determine whether there is multicollinearity

or not, it can be seen from the tolerance and VIF

values as in Table 2.

Table 2: Multicollinearity Test Results.

Coefficients

a

a. Dependent Variable: LN_DPR

From the test results, it was found that none of

the independent variables had a Tolerance value of

less than 0.10. None of the VIF values of all the

independent variables is greater than 10. It can be

concluded that the data does not occur

multicolinearity.

To find out whether there is autocorrelation or

not, it can be seen from Table 3

Table 3: Autocorrelation Test Results.

Model Summary

b

a. Predictors: (Constant), LN_PERT_ASET, LN_CR,

LN_ROA, LN_DAR

b. Dependent Variable: LN_DPR

From the test results of the Durbin Watson test

show that the Durbin Watson value is 2.030 while in

the DW table "k" = 4 (independent variables,

excluding dependent variables) and N = 54, the

values of dL and dU by looked at the DW table are:

d

L

(lower limit) : 1,4069

d

U

(lower upper) : 1,7234

4 - d

L

: 2,5931

4 - d

U

: 2,2766

By looked at the criteria in the Durbin Watson

guideline, it shows the value of dU<dw<4 - dU or

1.7234 <2.030 <2.2766, the autocorrelation result is

not positive or negative autocorrelation.

To determine the presence or absence of

heteroscedasticity, it can be seen from the Glejser

test as shown in Table 4.

Analysis of the Effect of Liquidity, Leverage, Profitability, and Company Growth on Dividend Policy in Manufacturing Companies Sector

Food and Beverage Listed on the IDX

389

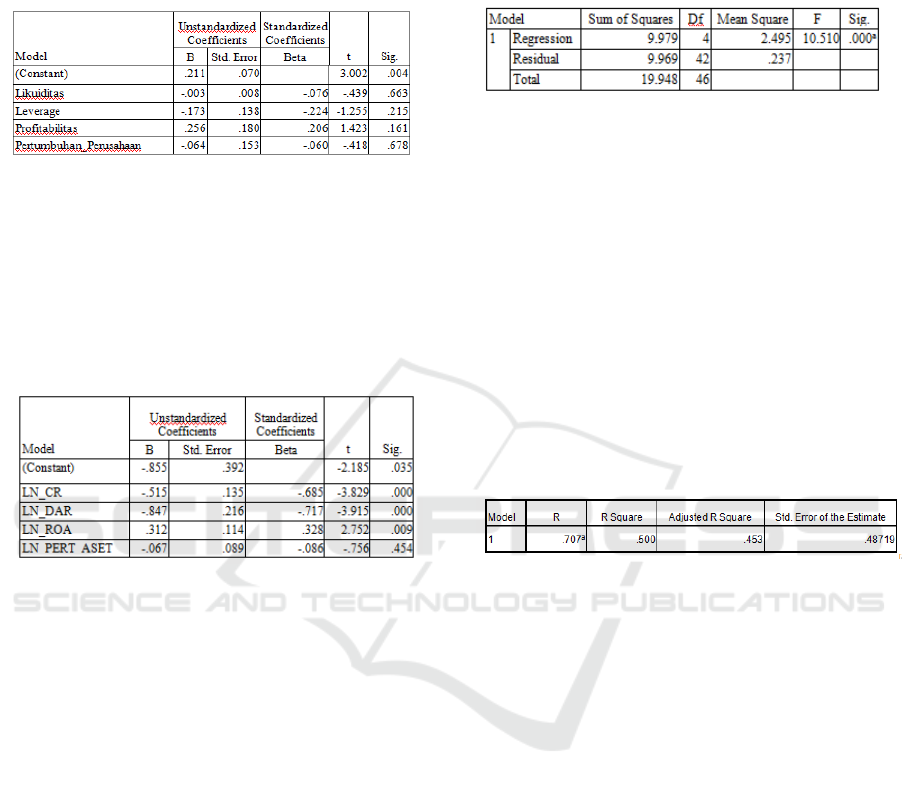

3.1 Heteroscedasticity Test Result

Table 4: Heteroscedasticity Test Results.

Coefficients

a

a. Dependent Variable: ABS_UT

From the research results, it can be seen that the

Sig. value of the independent variable is greater than

0.05, it can be concluded that the data does not occur

heteroscedasticity.

The results of the multiple linear regression

equation can be seen in Table 5.

Table 5: Multiple Linear Regression and t - Test Results

a. Dependent Variable: LN_DPR

LN_DPR=-0,855-0,515LN_CR-

0,847LN_DAR+0,312LN_ROA-

0,067LN

_

PERT

_

ASET

The results of the t test between the independent

variable and earnings management can be seen in

Table 5:

The result is: (i) The t value for liquidity of -3.829 is

greater than the t table value of 2,00958 and the Sig t

value of 0.000 is less than 0.05. So that liquidity has

a significant dividend policy; (ii) The t value for

leverage of -3.915 is greater than the t table value of

2,00958 and the Sig t value of 0.000 is less than

0.05. So that leverage has a significant dividend

policy; (iii) The t value for profitability of 2.752 is

greater than the t table value of 2,00958 and the Sig t

value of 0.009 is less than 0.05. So that profitability

has a significant dividend policy; (iv) The t value for

company growth of -0.756 is greater than the t table

value of 2,00958 and the Sig t value of 0.454 is less

than 0.05. So that company growth has no

significant dividend policy.

The results of the F test can be seen in Table 6:

Table 6: F - Test Results.

ANOVA

b

a. Predictors: (Constant), LN_PERT_ASET, LN_CR,

LN_ROA, LN_DAR

b. Dependent Variable: LN_DPR

From the test results obtained an F value of

10.510 with a significance level of 0.000. Based on

the F table value of 2.56 is smaller than the

calculated F value of 10.510 and the significance

value of 0.000 is smaller than 0.05. So that

simultaneously the liquidity, leverage, profitability,,

and company growth have an effect on dividend

policy.

The result of the determination coefficient test

can be seen in Table 7.

Table 7: Determination Coefficient Test Results.

Model Summary

b

a. Predictors: (Constant), BEBAN, TAX, ROA

b

. De

p

endent Variable: LABA

From Table 7 indicates that the R Square value is

0.453. This means that the ratio of liquidity,

leverage, profitability and company growth can

explain the dividend policy variable ratio of 45.3%

and the remaining 54.7% is explained by other

variables not included in this research model.

4 CONCLUSION

Based on the discussion of the research results, the

conclusions of this study are as follows:

The liquidity ratio has a effect on the dividend

policy ratio of the Manufacturing Companies Sector

Food and Beverage Listed on the IDX in 2015 -

2017. The leverage ratio has a effect on the dividend

policy ratio of the Manufacturing Companies Sector

Food and Beverage Listed on the IDX in 2015 -

2017. The profitability ratio has a effect on the

dividend policy ratio of the Manufacturing

Companies Sector Food and Beverage Listed on the

IDX in 2015 - 2017.

CESIT 2020 - International Conference on Culture Heritage, Education, Sustainable Tourism, and Innovation Technologies

390

The company growth ratio has not a effect on the

dividend policy ratio of the Manufacturing

Companies Sector Food and Beverage Listed on the

IDX in 2015 – 2017. Liquidity, Leverage,

Profitability and Company Growth simultaneously

have a effect on Dividend Policy in Manufacturing

Companies Sector Food and Beverage Listed on the

IDX in 2015 - 2017 amounting to 45.3%. The

independent variable that has a dominant influence

is the tax planning variable.

REFERENCES

Bahar, Syamsul Bahari, Rudi Abdullah & Hardin (2019).

Effect Of Current Ratio, Debt to Equity Ratio, Growth

Asset, and Earning Per Share on Dividend Per Share.

International Symposium on Humanities, Economics

and Social Sciences (BIS-HESS 2019).

Darmawan, Akhmad, Bima Cinintya P ratama, Yudhistira

Pradhipta Aryoko, Dinda Intan Vistyan. The Effect of

Profitability, Debt Policy, And Liquidityon Corporate

Values with Dividend Policy as Moderating Variables.

International Conference Of Business, Accounting and

Economics (ICBAE 2020).

Darmawati, Lativah Irvan & Vaya Juliana Dillak. (2018).

The Effect of Current Ratio, Debt To Equity Ratio,

Profitability and Company Size On Dividend Policy.

E-Proceeding of Management : Vol.5, No.3.

Fahmi, Irham. 2015. Pengantar Manajemen Keuangan.

Cetakan Ketiga. Bandung : Alfabeta.

Fajaria, Ardina Zahrah, Isnalita. (2018). The Effect of

Profitability, Liquidity, Leverage and Firm Growth of

Firm Value with its Dividend Policy as a Moderating

Variable. International Journal of Managerial Studies

and Research (IJMSR).

Finingsih, Okta, Siti Nurlaela & Kartika Hendra Titisari.

(2018). The Influence of Profitability, Liquidity,

Leverage and Company Growth to Dividend Policy on

Agricultural Companies In Indonesia Stock Exchange.

Jurnal International Conference on Technology,

Education, and Social Science (The 2

nd

ICTESS) .

Ghozali, Imam., 2016. Aplikasi Analisis Multivariete

Dengan Program IBM SPSS 23 (Edisi 8). Semarang:

Badan Penerbit Universitas Diponegoro.

Gumanti, Tatang Ari. 2013. Kebijakan Dividen. Ed

1.Yogyakarta : UPP STIM YKPN.

Gunawan, I Made Adi, Endar Pituringsih and Erna

Widyastuti. (2018). The Effect Of Capital Structure,

Dividend Policy, Company Size Value. .International

Journal of Economics, Commerce and Management,

United Kingdom.

Horne, James C. Van., Wachowicz. (2013). Principles of

Financial Management. Indonesian edition. Publisher

Salemba Four. Jakarta.

Jossie, Janifairus Basten. (2013). Influence Return On

Assets, Debt to Equity Ratio, Growth Assets, and Cash

Ratio Against Dividend Payout Ratio On The

Consumption Company Listing In BEI Year 2008-

2010. Brawijaya University, Malang: Unpublished.

Lopolusi, Ita. (2013). "Analysis of Factors Affecting

Dividend Policy Manufacturing Sector Listed in

Indonesia Stock Exchange Period 2007-2011".

Scientific Journal Universitas Surabaya Vol.2, No.1.

Rahmanita, Anggraeni. (2013). Effect of profitability,

liquidity and size of the Company's Dividend Policy

on Manufacturing Companies Listed in Indonesia

Stock Exchange Period 2009-2012. Journal of

Finance and Accounting, Faculty of Economics

Pandanaran University, Semarang.

Sawitri, Amira Nadia and Chorry Sulistyowati. (2018).

Stock Liquidity and Dividend Policy. International

Confrence of Organizational Innovation.

Silaban, Dame Prawira & Ni Ketut Purnawati. (2016).

Pengaruh Profitabilitas, Struktur Kepemilikan,

Pertumbuhan Perusahaan dan Efektivitas Usaha

Terhadap Kebijakan Dividen Pada Perusahaan

Manufaktur. Jurnal Manajemen UnudI SSN : 2302-

8912 Vol.5, 1251-1281.

Sjahrial, Dermawan. 2014. Manajemen Keuangan

Lanjutan. Ed 1, Jakarta : Mitra Wacana Media.

Sondakh, Renly. (2019). The Effect Of Dividend Policy,

Liquidity, Profitability and Firm Size On Firm Value

In Financial Service Sector Industries Listed In

Indonesia Stock Exchange 2015-2018 Period.

International Licensi Accountability Volume 08,

Number 02.

Sulhan, Muhammad & Tri Yeni Herliana (2018). The

Effect of Liquidity and Profitability to Dividend

Policy With Asset Growth as Moderating Variable.

Jurnal International Conferenceon Islamic Economics

and Business (ICONIES 2018).

Sunyoto. 2015. Analisis Manajemen Keuangan Untuk

Perusahaan. Cetakan Pertama. Yogyakarta : CAPS

(Center of Academic Publishing Service).

Syamsuddin, Lukman. 2013. Manajemen Keuangan

Perusahaan: Konsep Aplikasi dalam Perencanaan,

Pengawasan dan Pengambilan Keputusan. Edisi Baru.

Cetakan ke 12. Jakarta : PT. Raja Grafindo Persada.

Tahu, Gregorius Paulus, Dominicius Djoko Budi Susilo.

(2017). Effect of Liquidity, Leverage and Profitability

to The Firm Value (Dividend Policy as a Moderating

Variable) in Manufacturing Company of Indonsia

Stock Exchange. Research Journal Finance and

Accounting (IISTE).

Analysis of the Effect of Liquidity, Leverage, Profitability, and Company Growth on Dividend Policy in Manufacturing Companies Sector

Food and Beverage Listed on the IDX

391