Detection of Income Shifting Strategy and Determining Factors

Sabar Warsini, Titi Suhartati, Herbirowo Nugroho

Accounting Departement, Politeknik Negeri Jakarta, Depok, Indonesia

Keywords: Income Shifting, Leverage, Audit Quality

Abstract: The Indonesian government reduces the corporate income tax rate to 22%, effective in 2020 and 2021, and

will decrease again to 20%, effective starting in 2022. This research aims to investigate the strategies

implemented by public companies in dealing with the corporate income tax rate reduction and the determining

factors. By using a sample of 343 Indonesian public companies, this study finds that the mean value of

discretionary book tax differences in 2019 is positive and is significantly different from zero. These results

prove that Indonesian public companies are implementing an income shifting strategy one year before the

lower tax rates are imposed. Furthermore, this study also investigated determinant factors that influence on

income shifting. Income shifting strategy is influenced by the company characteristic and the corporate

governance mechanism. Using the multiple regression method this research found that interest expense can

produce tax saving so the use of the higher debt in the structure of the company financing can limit income

shifting. In terms of the role of the external auditor, this study has not been able to prove the role of the

external auditor as an effective monitoring mechanism against opportunistic management to do income

shifting

1 INTRODUCTION

Income taxes is a significant expense for a company.

From 2010 to 2019 the Indonesian government

imposed a corporate income tax rate of 25%, which

means companies are required to give a quarter of

their profits to the government. Compared to other

Asian countries, the corporate income tax rate applied

by the Indonesian government is still relatively higher

than other Asian countries, such as: Singapore

imposes a corporate income tax rate of 17%, Brunei

Darussalam 18%, Thailand, Cambodia and Vietnam

at 20%, Laos 24%, and Malaysia 24%. Only the

Philippines still applies a higher tax of 30% (The

Global Competitiveness Report, 2018).

Nadine (2018) stated that the high corporate

income tax rate is one of the factors that encourage

taxpayer to do tax avoidance. High tax rates are also

an inhibiting factor for a country's economic growth.

Wasylenko (2019) state that the World Bank

periodically releases reports on the economic

performance of developing countries and finds that

countries with lower marginal tax rates have higher

economic growth rates.

The Indonesian government try to develop

economic growth and to increase investment in

various ways. One of an effective way is through the

provision of tax incentives. The economic slowdown

occurring 2019, globally and worse by the pandemic

covid-19 affect all countries in the world. As

happened in other countries, the covid-19 pandemic

has had a tremendous impact on the business sectors

in Indonesia. The Covid19 pandemic has threatened

economic stability due to the decline in productivity

of various affected sectors. Therefore, through

Government Regulation Number 30 of 2020 (PP

30/2020), the government provides incentives in the

form of lowering corporate income tax rates for

domestic corporate taxpayers in the form of public

companies.

The government provides incentives tax to

Indonesian public companies in form of the reduction

corporate income tax rates to 22 % into effect in 2020

and 2021, and will decline to 20 % in 2022. The

policy to reduce corporate income tax rates is a

positive signal for public companies as taxpayers.

How does company management respond to the

policy to reduce tax rates? Research in various

countries has found evidence that taxpayers respond

to lower tax rates by implementing income shifting

strategies in an effort to reduce the amount of tax

burden that must be paid. These studies are: Tao Zeng

(2018) in China, Won-Wook Choi and Hyun-Ah Lee

Warsini, S., Suhartati, T. and Nugroho, H.

Detection of Income Shifting Strategy and Determining Factors.

DOI: 10.5220/0010511300003153

In Proceedings of the 9th Annual Southeast Asian Inter national Seminar (ASAIS 2020), pages 49-53

ISBN: 978-989-758-518-0

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

49

(2013) in Korea, Grubert and Altshuler (2016) in

France, Brandstetter (2017) in Germany. The income

shifting strategy that is carried out is to adjust

commercial profit and fiscal profit. The income

shifting strategy can be done by delaying revenue

recognition and accelerating the recognition of

expenses in the fiscal year one year before lower tax

rates are imposed. Referring to the results of previous

research, this research predicts that “Indonesian

public companies are suspected of implementing an

income shifting strategy in the one year period prior

to the enactment of a lower tax rate”

If it is proven management of public companies

do income shifting strategy so the next question is

which factors influences income shifting strategy?

What factors affecting tax avoidance depends on the

underlying theory. Referring to the theory of capital

structure (Ross, Westerfield, and Jaffe, 2015) said

that companies using debt in the capital structure have

lower the tax charges than others. Previous studies

found evidence that leverage have negative effects on

tax avoidance (Lin, Tong, and Tucker, 2014).

Another previous research by Kovermann (2018) also

proved that tax evasion behaviour are lower in

company with the higher level of leverage. Referring

to the capital structure theory and the results of

previous research, then this research is suggesting

that the company with higher debt was lower income

shifting.

Tax avoidance studies have also found

widespread evidence of their underlying motives, and

the implications of tax avoidance (Hanlon and

Heitzman, 2010). The conventional view holds that

management conducts tax avoidance for efficiency

purposes. This has an impact on improving the

prosperity of the owner, but the agency theory

perspective developed by Desai and Dharmapala

(2007) states that management could avoid taxes to

make personal gain. Therefore, the development of

tax avoidance research further considers corporate

governance mechanisms, and it is evident that tax

avoidance and its implications are influenced by

corporate governance mechanisms.

Based on the perspective of agency theory, Nemis

and Cetenak (2012) state that audited financial

statements are a monitoring mechanism to provide

financial information to users. The quality of the

information contained in these statements is strongly

influenced by the quality of the audit that can be

determined by two factors namely: (1) the auditors’

capabilities in running the audit process, and (2). their

independence from their clients. Richardson, Taylor,

and Lanis (2015) state that the quality of auditors has

a crucial role in reducing agency problems that arise

due to conflicts between management and owners.

Previous research that examined the influence of

the audit quality on tax avoidance, we found it is not

conclusive. The test results by Heltzer, Mindak, and

Shelton (2012) found no significant evidence of

auditor influence on tax avoidance. But another

research has proven that tax avoidance is lower in

companies that are audited by qualified auditors

(Kanagaretnam, Höglund and Sundvik, 2019).

Referring to the corporate governance mechanism

theory and the results of previous research, then this

research is suggesting that the quality of auditing

lower income shifting.

This study aims to find empirical evidence

whether Indonesian public companies implement

income shifting strategies to respond to tax rate

reduction policies, and also find empirical evidence

whether income shifting strategies are influenced by

the level of leverage and the quality of the audit. The

results of this study are expected to contribute to the

development of tax avoidance research. Our research

should be useful to regulators attempting to reduce

corporate malfeasance, to investors in being more

careful when using earnings report information and

paying attention to corporate and institutional

characteristics when investing.

2 METHODOLOGY

From 664 Indonesian public companies listed on the

Indonesian Stock Exchange (IDX) up to 2019, we

determine the following selection criteria: 1) Non

financials industry because this industry is strictly-

regulated industry; 2) Non real estate and

constructions industry because this industry has their

own accounting rules, for example revenue

recognition; 3) Non mining industry because they

have different tax arrangements to other industries

(lex-specialist); 4) Availability of financial data and

other data required to measure all the variables used

in this research. The final sample of 343 firms

represents 51.89% of all observations.

There are two models used to answer the research

questions. The value of income shifting is calculated

using the book-tax differences approach, referring to

Tang and Firth (2012), the formula used is as follows:

BTDi = αi + α1TAXi + α2FIASi + α3SALESi

+ α4OINi + εi (1)

Operational Variables of Model (1)

ASAIS 2020 - Annual Southeast Asian International Seminar

50

BTDi = book-tax differences is the difference

between commercial profit and fiscal profit, TAX is

the tax expenses, FIAS is the fixed asset value,

SALES is the sales value, OIN is other income, The

independent variable of model (1) is the component

that causes the difference between commercial profit

and fiscal profit. Income shifting value is the value of

discretionary book-tax differences (DBTD) which is

calculated using the residual value or error of the

equation. Testing the significance of the value of

income shifting using the mean different analysis

The second model to test the effect of leverage

and audit quality on income shifting uses the

following model:

INSFi = α0 + α1LEVi + α2AUDITi + α3SIZEi

+ εi (2)

Operational variable of Model (2):

INSF is the value of income shifting, LEV is debt to

assets ratio, AUDIT is the quality of external auditors

measured using industry specialization, is a dummy

variable = 1 if the auditor controls the industrial

market share ≥ 30%, and is worth 0 if the other is.

SIZE is the size of the company as a control variable

measured by the value of the natural logarithm (Ln)

of the company's total assets. The independent

variable of model (2) is the variable that affects tax

avoidance. The analysis used a significance t-test.

The financial reports data sourced from IDX website

www.idx.co.id and annual report data sourced from

the Indonesian public company website.

3 RESULTS AND DISCUSSIONS

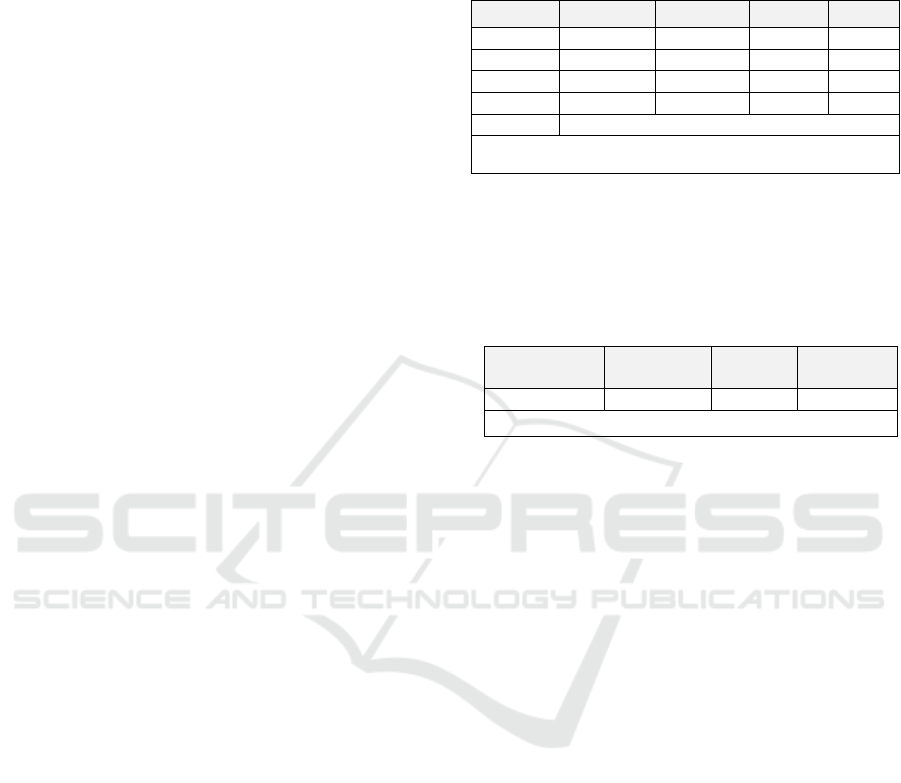

Table 1 presents the descriptive statistics, which

provide an overview of the sample profiles and

research variables. The mean value of the INSF

variable is 0.2725, which means that on average, the

sample companies did income shifting in 2019. In this

study, income shifting was calculated using

discretionary book-tax differences (DBTD). A

positive DBTD value indicates that the company has

reported a higher commercial profit than fiscal profit.

High commercial profits will get a good assessment

for investors, and lower fiscal profits will have an

impact on lower tax paid. The mean value of variable

LEV is 0.4635 indicates that on average the use of

debt on Indonesian publics funding structure is

significantly high at 46.35%. AUDIT is measured by

an industry specialization audit, with an average

value of 0.3835, indicating that 38.35% of the

observed firms are audited by industry-specific

auditors.

Table1. Descriptive statistics

Variable Maximum Minimum Mean Stdev

INSF 0.9346 -0.1452 0.2725 0.1995

LEV 0.8263 0.1699 0.4635 0.1919

AUDIT 1 0 0.3835 0.2472

SIZE 1.0743 18.3002 8.8123 4.1715

N 343

INSF = income shifting, LEV = leverage, AUDIT = audit

quality, SIZE = firm size

One sample compare mean t-test used to verify

whether Indonesian public companies do income

shifting before the lower corporate income tax rate is

implemented. Testing result is presented in table 2

Table 2. one sample t-test of income shifting

One-sample

t-test

variable mean Sig.(2-

tailed)

2019 INSF 0.2725 0.02446

N = 343

The result of different test shown that mean of

income shifting in 2019 is significantly different from

zero with a significance level below 5 %. This result

is consistent with the conjecture that companies

shifted taxable income in the year preceding the

corporate income tax rate decrease. The results of this

study are in line with previous research in other

countries such as: in Korea by Won-Wook Choi and

Hyun-Ah Lee (2013), in China (Tao Zeng, 2018), in

French (Grubert and Altshuler, 2016), and in

Germany by Brandstetter (2017). The income shifting

strategy can be done by setting up accounts that have

different treatment between generally accepted

accounting standards (GAAP) and tax regulations.

These accounts include: fixed asset accounts related

to depreciation expense, tax expense paid, differences

in recognition of sales or income, and recognition of

other income.

Further testing conducted to determine factors

that affect income shifting. Factors affect considered

in this study is the level of leverage and quality of the

audit. The testing used the multiple regression model

and the testing result is presented in the following

table 3.

The results show that the coefficient of LEV is -

0.1039 significant based on the p-value lower than 10

%. This is consistent with this research prediction that

the bigger the use of debts in the capital structure of

company will the lower income shifting by the

company. The results of this research are in line on

Detection of Income Shifting Strategy and Determining Factors

51

the capital structure theory presented by Ross,

Westerfield, and Jaffe (2015). The greater use of debt

in financing benefits of tax saving, because the higher

interest expense as a deduction taxable income.

Hence the use of higher debt can restrict the

management to perform the act of tax avoidance.

These results support the results of previous studies

conducted Lin, Tong, and Tucker (2014).

Table 3. Regression result

Independent

Variable

prediction INSF as dependent

variable

coefficient p-value

Constant 0.4228 0.000

LEV - -0.1039 0.062*

AUDIT - -0.0033 0.733

SIZE +

/

- -0.0148 0.068*

N = 343 Ad

j

R

2

= 0.1484

INSF = income shifting, LEV = leverage, AUDIT =

audit

q

ualit

y

, SIZE = firm size

Financial reporting is not independent from the

role of auditors. External auditor’s services not only

limited in the financial audit services but also

includes. tax services. To understand the role of

external auditors in aggressive tax behaviour, this

research examines the effect of audit quality on the

income shifting. Audit quality is difficult to assess, so

much of the previous research has used auditor size

and/or reputation as a proxy for audit quality.

However, with the emergence of financial reporting

scandals from companies audited by KAP Arthur

Anderson, such as Enron and Dynegi Corporation, the

use of auditor reputation as a measure of quality may

not reflect actual audit quality (Heltzer, Mindak, and

Shelton (2012).

By using industry-specialized auditors the results

of this study have not been able to prove the effect of

audit quality on income shifting. The p-value of

coefficient AUDIT is 0.733 is higher than level of α

= 10%. The results of this research failed to support

the agency theory which states quality audit is able to

act as an effective monitoring mechanism against

opportunist action by managers (Richardson, Taylor,

and Lanis, 2015). This finding is also not in line with

the results of previous studies which found that audit

quality reduces tax avoidance (Kanagaretnam, Lee,

and Lim, 2016; Höglund and Sundvik, 2019).

We include SIZE as a company characteristic

control variables. SIZE is measured by the natural

logarithm of the total assets of firm i. And the results

show that the size of the company significantly

negatively influence income shifting. The result of

this research supports the political hypothesis theory

states that large companies liable to be public interest

so they kept reputation.

4 CONCLUSIONS

Using sample of 343 Indonesian public companies,

this research has found evidence that the tax rate

reduction policy has been responded by public

companies as tax payers by implementing an income

shifting strategy in one year before the lower tax rate

is effectively enforced. Income shifting strategy is

influenced by the company characteristic and the

corporate governance mechanism. The results of this

research consistently find that interest expense can

produce tax saving so the use of the higher debt in the

structure of the company financing can limit income

shifting. In terms of the role of the external auditor,

this study has not been able to prove the role of the

external auditor as an effective monitoring

mechanism against opportunistic management

actions.

ACKNOWLEDGEMENTS

The researchers thank the Accounting Department

and the Jakarta State Polytechnic Research and

Community Service Unit (UP2M), which has

provided opportunities and facilitated researchers to

conduct this research. Furthermore, the researcher

also expressed his deep gratitude to the Jakarta State

Polytechnic Director, who had provided funding for

this research activity.

REFERENCES

Brandstetter, Laura, 2017. Do Corporate Tax Cuts Reduce

International Profit Shifting? Contemporary

Accounting Research, 34:455-493

Desai A. M. and Dharmapala, D., 2007. Taxation and

Corporate Governance: An Economic Approach, The

Conference on Taxation and Corporate Governance as

the Max Planck Intitute in Munich, SSRN, downloaded

on June, 2015

Grubert H, and Altshuler R., 2016. Shifting the Burden of

Taxation from the Corporate to the Personal Level and

Getting the Corporate Tax Rate Down to 15 Percent,

National Tax Journal, 69: 643-676

Hanlon, M., and Heitzman, S., 2010. A Review of Tax

Research, Journal of Accounting and Economics, 50:

127-178

Heltzer, W., Mindak, M.P. and Shelton, S.W., 2012. The

Relation Between Aggressive Financial Reporting and

ASAIS 2020 - Annual Southeast Asian International Seminar

52

Aggressive Tax Reporting : Evidence from ex-Arthur

Andersen Clients, Research in Accounting Regulation,

24 : 96-104

Höglund, Henrik and D. Sundvik, 2019. Do Auditors

Constrain Intertemporal Income Shifting in Private

Companies?, Journal of Accounting and Business

Research, 49: 245-270

Kanagaretnam, K., Lee, K., Bee, J., Lim, C. and Lobo, G.,

2016, "Relationship between auditor quality and

corporate tax aggressiveness: implications of cross-

country institutional differences", Auditing: A Journal

of Practice and Theory, 35 (4), 105-135

Kovermann J and Velte P., 2019. The impact of corporate

governance on corporate tax avoidance-A literature

review, Journal of International Accounting, Auditing

and Taxation, 36

Lin S, Tong N., and Tucker, 2014. Corporate tax aggression

and debt, Journal of Banking and Finance 40 (1) 227-

241

Nemis, M.U. and Cetenak, E.,H., 2012. Earnings

Management, Audit Quality and Legal Environment:

An International Comparison, International Journal of

Economics and Financial Issues, 2: 460-469

Richardson, G., Taylor, G., and Lanis, R., 2015, The impact

of financial distress on corporate tax avoidance

spanning the global financial crisis: evidence from

Australia, Economic Modeling, 44, 44-53

Riedel, Nadine, 2018. “Quantifying International Tax

Avoidance: A Review of the Academic Literature”,

Review of Economics, 69(2): 169–18

Ross, W. Ryan, Westerfield dan Jordan, 2015. Corporate

Finance, McGraw-Hill Ryerson

Tang, T. and Firth, M., 2011. Can Book-Tax Differences

Capture Earnings Management and Tax Management?

Empirical Evidence from China, The International

Journal of Accounting, 46: 175-204

Tao Zeng, 2018. “Earnings Management Around Tax Rate

Reduction: Evidence from China's 2007 Corporate Tax

Reform”, Asian Review of Accounting, 22

The Global Competitiveness Report, “World Economic

Forum”, 2018

Wasylenko M., 2019. Taxation and economic development:

The state of the economic literature, BOOK

CHAPTER: 309-327

Won-Wook Choi and Hyun-Ah Lee, 2013. Management of

Accrual Components In Response To Corporate

Income Tax Rate Changes: Evidence From Korea, The

Journal of Applied Business Research, 29, Number 5

www.idx.co.id

Detection of Income Shifting Strategy and Determining Factors

53