COVID-19 Pandemic and Differentiation of Entrepreneurial Activity

in Russian Regions in the Context of Sustainable Development

Irina Korchagina

a

Institute of Economics and Management, Kemerovo State University, Krasnaya Street, 6, Kemerovo, Russia

Keywords: Small and Medium-Sized Businesses, Russian Economy, Regions of Russia, COVID-19 Pandemic, Taxation

of Small and Medium-Sized Enterprises, Sustainable Development.

Abstract: The purpose of the study is to assess regional differences in the response of small and medium-sized

enterprises in Russia to the 2020 crisis caused by the COVID-19 pandemic. Research methods: statistical

methods of analysis of variation series, correlation analysis, cluster analysis. There is no relationship between

the level of socio-economic development of the region and the decline in the number of small and medium-

sized enterprises, the number of personnel, and tax collections. In most regions, the number of enterprises

decreased by 4.2–4.3%. This indicator is the least volatile; the distribution is close to normal. Staff numbers

and tax collections vary more. There is no correlation between the number of small and medium-sized

enterprises, the number of employees, and receipts from special tax regimes due to the legalization of

employment, government support measures, and tightening of tax administration. Most regions of Russia

form two clusters. The first differs from the second in a higher level of losses in the number of small and

medium-sized enterprises, tax revenues from them and a lower level of employment losses. Maintaining the

same level of tax revenues could negatively affect employment in the segment of small and medium-sized

enterprises.

1 INTRODUCTION

The problem of transition to sustainable development

of the whole world, individual countries and

territories is multifaceted and extremely complex.

But, of course, one of its important parts is the

formation of a strong small and medium-sized

business sector at all levels. This is provided for by

the Sustainable Development Goals and targets set

out in the documents of the United Nations.

Thus, goal 8 includes task 8.2 “Promote

development-oriented policies that support

productive activities, decent job creation,

entrepreneurship, creativity and innovation, and

encourage the formalization and growth of micro-,

small- and medium-sized enterprises, including

through access to financial services”. Goal 9 sets

target 9.3 “Increase the access of small-scale

industrial and other enterprises, in particular in

developing countries, to financial services, and their

integration into value chains and markets” (United

Nations, 2015).

a

https://orcid.org/0000-0002-3297-3259

Consequently, the UN global agenda encompasses

support for entrepreneurship, including innovative

entrepreneurship that creates new technologies; the

integration of small and medium-sized enterprises

into global value chains; providing such enterprises

with access to infrastructure and resources. This is

because the contribution of small and medium-sized

enterprises to sustainable development is very large

(Condon, 2004).

It covers, in particular, the introduction of

environmental innovations by technology

entrepreneurs (Bucea-Manea-Tonis, 2015), the social

responsibility of small and medium-sized enterprises

to harmonize the interests of business, workers, the

local community, reduce environmental damage

(Prashar, 2019), create workers jobs and

unemployment reduction, especially in developing

countries and regions (Diabate et al., 2019).

Strengthening social responsibility and green

technologies in small and medium-sized enterprises

is essential for sustainable development (Jansson et

al., 2017; Wielgórka, 2016).

138

Korchagina, I.

COVID-19 Pandemic and Differentiation of Entrepreneurial Activity in Russian Regions in the Context of Sustainable Development.

DOI: 10.5220/0010665100003223

In Proceedings of the 1st International Scientific Forum on Sustainable Development of Socio-economic Systems (WFSDS 2021), pages 138-144

ISBN: 978-989-758-597-5

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Due to their flexibility, quick response to changes,

high business activity, small and medium-sized

enterprises increase the economic stability of

countries and territories. They make a significant

contribution to the creation of the gross national

product, employment, investment, and can develop

and introduce new technologies. An economy with a

low level of entrepreneurship development, an

insufficient share of small and medium-sized

enterprises in macroeconomic indicators is unstable

and unbalanced.

At the same time, small and medium-sized

enterprises were hardest hit in 2020 due to the

COVID-19 pandemic and restrictions on business

activities. This makes it difficult to achieve the goals

of sustainable development of small and medium-

sized businesses. In this regard, the “A UN

framework for the immediate socio-economic

response to COVID-19” adopted in April 2020 sets

the task “Protecting jobs, supporting small and

medium-sized enterprises, and informal sector

workers through economic response and recovery

programs”(United Nations, 2020).

This requires an assessment of the situation of

small and medium-sized businesses in different

countries and regions of the world. The impact of the

COVID-19 pandemic on small and medium-sized

enterprises in developed and developing countries has

begun to be discussed in a number of papers. Most

researchers agree that it is small and medium-sized

enterprises that are most affected by the pandemic and

the resulting restrictive measures. In the United

States, after two months of active social distancing

from February to April, there was the largest drop in

the number of individual business owners by 22%,

from 15.0 to 11.7 million people. By comparison, the

decline was 5% during the Great Depression (Fairlie,

2020).

In June 2020, about 50% of SMEs in the United

States planned to close if the lockdown were extended

for another three months (Liguori and Pittz, 2020). A

study from a survey of 5,800 US entrepreneurs found

that more than 40% of small businesses were closed

permanently or temporarily, the number of full-time

employees decreased by 32% in February-March

(Bartik et al., 2020).

Pakistani entrepreneurs gave similar responses to

the survey, with over 70% reporting that they were

unable to survive even two months of lockdown

(Shafi et al., 2020). In Egypt, the economic imbalance

in favor of big business has increased, as small and

medium-sized enterprises have been significantly

more affected by restrictive measures (Zaazou and

Abdou, 2021). In Armenia, it was in small and

medium-sized enterprises that the highest risk of job

and wage cuts was observed in 2020 (Beglaryan and

Shakhmuradyan, 2020).

The impact of the COVID-19 pandemic on small

and medium-sized enterprises in Russia has not yet

been studied in detail, although in general its negative

impact is quite obvious. Thus, business activity in the

small and medium-sized business sector fell by 40%,

and the deficit of state support is estimated by Russian

researchers as twofold (Razumovskaia et al., 2020).

Therefore, further research is needed on how

small and medium-sized businesses in Russia reacted

to the 2020 crisis. In addition, a regional analysis of

this problem is important, since different territories of

Russia differ significantly both in the level of

development of small and medium-sized businesses,

and in their response to the pandemic and restrictive

measures.

Therefore, the purpose of the article is to analyze

the regional differentiation of the reaction of small

and medium-sized businesses in Russia to the crisis

caused by the COVID-19 pandemic and restrictive

measures.

2 RESEARCH METHODOLOGY

A quantitative research methodology was used to

answer the research questions posed. We proceeded

from the fact that the level of development of small

and medium-sized businesses in the country and in

the region is characterized by three main indicators

that are currently available for research: the number

of small and medium-sized enterprises, the average

number of their employees, and tax revenues from

small and medium-sized enterprises.

The first two indicators are obtained from the data

of the Register of Small and Medium Enterprises of

the Federal Tax Service of Russia (FTS) (Federal Tax

Service of Russia, 2021a). The third indicator was

obtained from data on tax receipts related to special

tax regimes, according to the “Report on Form No. 1-

НМ” published by the Federal Tax Service of Russia

(2021b). It is these taxes that are paid by small and

medium-sized enterprises in Russia. For the first and

second of the considered indicators, the rates of

increase (decrease) were calculated as of January 10,

2021 in relation to January 10, 2020 (the register is

updated on the 10th day of each month). The third

indicator was used to calculate the rate of growth

(decline) in 2020 in relation to 2019. The use of

relative indicators allows us to compare the regions

of Russia without taking into account their size.

COVID-19 Pandemic and Differentiation of Entrepreneurial Activity in Russian Regions in the Context of Sustainable Development

139

The data obtained were processed by standard

statistical methods for studying variation, including

descriptive statistics, analysis of variance,

distribution kurtosis, analysis of means, assessment

of the nature of distribution and asymmetry. The

Sturgess formula is used to construct one-

dimensional groupings. Multidimensional grouping

of Russian regions was carried out by cluster analysis

using the k-means method in the SPSS Statistics 19.0

software environment. The correlation coefficient

was also used to assess the relationship between

various indicators.

3 RESEARCH RESULTS

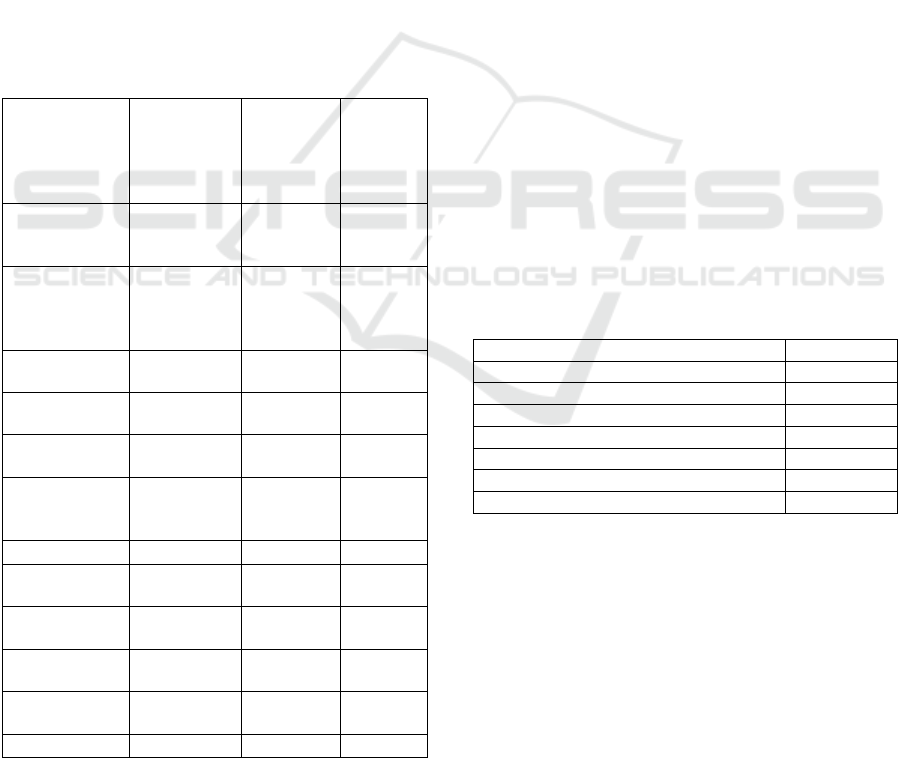

Descriptive statistics on indicators characterizing the

reaction of small and medium-sized enterprises in

Russia to the 2020 crisis are presented in Table 1.

Table 1: Descriptive statistics of the growth rates of

entrepreneurial activity indicators in the regions of Russia.

Number of

small and

medium-

sized

enterprises

Average

number of

employees

Tax

revenues

Simple

arithmetic

mean

–

4.06

2.11

–

2.28

Weighted

average for

Russia as a

whole

–

3.93

1.10

–

24.01

Maximum

value 4.96 163.70 27.69

Minimum

value

–

9.09

–

6.71

–

83.95

Swipe

variation 14.05 170.41 111.64

The

coefficient of

variation 57.75 852.98 560.78

Median value

–

4.26

0.00

–

0.54

Modal

meaning

–

0.00

–

Variance

(

corrected

)

22.26 332.79 170.84

Distribution

kurtosis 2.47 74.15 20.89

Standard

deviation 2.35 18.01 12.79

Asymmetry

–

2.34 8.83

–

4.22

The variation in the growth rates of all indicators

of entrepreneurial activity across the regions of

Russia in 2020 was very large, but its main part falls

on a small number of regions with abnormal

“emissions” indicators. The most stable and least

volatile indicator is the growth rate of the number of

small and medium-sized enterprises. Here are the

smallest values of skewness (–2.34) and deviations

from the normal distribution. The left-sided

asymmetry means that in most regions the decline in

the number of small and medium-sized enterprises

was above average (since in this case negative values

are considered).

This is also confirmed by the ratio of the

arithmetic mean and median value. A decrease in the

number of small and medium-sized enterprises by

4.2-4.3%, rather than 3.9-4.0%, can be considered

more typical for the regions of Russia. The nature of

distribution and the formation of asymmetry was

significantly influenced by the fact that in five regions

(Republic of Buryatia, Republic of Dagestan,

Chukotka autonomous district, Rostov Region,

Leningrad Region) the number of small and medium-

sized enterprises increased, despite the crisis, and in

three more (Nenets autonomous district, Moscow

region, Leningrad region) changed slightly.

Table 2 shows the distribution of Russian regions

into 7 groups (based on the Sturgess formula and the

number of research objects) according to the rate of

increase (decrease) in the number of small and

medium-sized enterprises.

Table 2: Distribution of Russian regions by the rate of

increase (decrease) in the number of small and medium-

sized enterprises in 2020.

Grou

p

Re

g

ions

First

(

from 4.96% to 2.96%

)

2 re

g

ions

Second (from 2.96% to 0.96%) 1 region

Third (from 0.96% to

–

1.04%) 5 regions

Fourth (from

–

1.04% to

–

3.04%) 13 regions

Fifth

(

from

–

3.04% to

–

5.04%

)

37 re

g

ions

Sixth

(

from

–

5.04% to

–

7.04%

)

22 re

g

ions

Seventh

(

more than

–

7.04%

)

5 re

g

ions

From the data in Table 2, it can be seen that more

than 40% of regions fall into the fifth group, where

the rate of increase (decrease) in the number of small

and medium-sized enterprises ranges from 3.04% to

5.04%. Another 22 regions or more than 25% of them

were in the sixth group, where the growth rates varied

from –5.04 to –7.04%. Thus, in more than 75% of

regions, more than 3% of small and medium-sized

enterprises were lost in a year. At the same time, it

was possible to reduce or even increase

entrepreneurial activity in 7 regions.

The indicator of the growth (decrease) rates of the

average number of employees employed in small and

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

140

medium-sized businesses is even more variable. In

many regions, paradoxically, it had positive

dynamics. The median and modal value is equal to

zero, in 46 regions out of 85 (about 55%) the number

of employed in small and medium-sized enterprises,

at least, has not decreased. Anomalous values in the

Chechen Republic (163.7%) and the Republic of

Ingushetia (16.3%) give significant variation to a

number.

Therefore, there is a high level of right-sided

asymmetry; in most regions, the growth rate of the

average number of employees was below the average

level. Nevertheless, only in 15 regions out of 85

(about 18%) the decrease in the number of personnel

of small and medium-sized enterprises was more than

2%. The worst dynamics was demonstrated by the

Republic of Khakassia, Astrakhan Region, Jewish

autonomous district, Arkhangelsk Region, where the

decline exceeded 5%. However, this is an

uncharacteristic indicator for most regions.

Tax revenues from special tax regimes have

declined in most regions of Russia. Three special tax

regimes were considered – a simplified taxation

system, a single tax on imputed income, and a single

agricultural tax. Almost all small and medium-sized

enterprises use them. Unlike corporate property tax or

personal income tax, revenues from these tax regimes

are related to the scale and efficiency of the

entrepreneur's activities.

The increase in fees, however, was noted in 41

regions (or 48% of their total number), and in 24 – by

3% or more. The highest growth rates took place in

the Chechen Republic (about 27.7%), the Magadan

region (about 12.6%), the Republic of Adygea (about

7.7%), and the Ulyanovsk region (about 7.3%). At the

same time, in 9 regions the decline was more than

10%, in particular, in the Sakhalin region – by 84%,

in the Nenets Autonomous District – 56%,

Kamchatka Territory – over 22%, the Komi Republic

– about 19%, Tyumen region – more than 16%.

The variation in the rate of increase (decrease) in

tax revenues is characterized by the Poisson

distribution, which means the presence of rare events

(a decrease in tax revenues from small and medium

enterprises in some regions to almost zero or one and

a half to two times). As a consequence, the variation

in tax levies for maximum and minimum emissions is

very high. In general, for the national economy of

Russia, the decrease in revenues from special tax

regimes was about 24%, on average for the regions –

2.3%, while the median is close to zero.

Consequently, in a significant part of Russian regions,

tax revenues from small and medium-sized

enterprises increased, despite the crisis.

4 THE DISCUSSION OF THE

RESULTS

The study confirms the hypothesis of deep regional

disparities in the level of entrepreneurial activity in

the context of the COVID-19 pandemic and

restrictive measures. The spread of three key

indicators – the number of small and medium-sized

enterprises, the number of employees, tax collections

– is very large. This is evidenced by the main

indicators assessing the variation series (variance,

standard deviation, coefficient of variation). This

conclusion confirms the manifestation of the

asymmetry of regional development characteristic of

Russia.

In general, the depth of the fall of small and

medium-sized businesses is below the level of

developed countries, but inside the Russian economy

there are territories with completely different

indicators. For example, the Republic of Crimea, as

noted above, has lost more than 9% of small and

medium-sized enterprises, which corresponds to the

world level, and in the Chukotka Autonomous

District their number, despite the crisis, increased by

5%.

The three studied indicators, paradoxically, do not

demonstrate statistically significant relationships.

According to standard economic concepts, in a crisis,

the number of small and medium-sized enterprises,

the number of their personnel and tax payments

should simultaneously decrease. However, in fact,

this did not happen. The number of small and

medium-sized entrepreneurs themselves has

decreased in the overwhelming majority of regions,

but this is not typical for the other two indicators.

The correlation coefficient between the rates of

growth (decline) in the number of small and medium-

sized enterprises and their employees was 0.0517.

The critical value of this coefficient at 80 degrees of

freedom and significance level α = 0.05 is 0.2172.

Consequently, the decrease in the number of

entrepreneurs had practically no effect on the average

number of employees. This can only be explained by

the legalization of shadow employment of small and

medium-sized businesses under the influence of

government support measures. This process was

especially active in the predominantly agrarian

republics of the North Caucasus Federal District.

The correlation coefficient between the rates of

growth (decrease) in the number of small and

medium-sized enterprises and revenues from special

tax regimes was –0.1594, which is also below the

critical level of significance. With a moderate drop in

the number of small and medium-sized enterprises,

COVID-19 Pandemic and Differentiation of Entrepreneurial Activity in Russian Regions in the Context of Sustainable Development

141

tax revenues from them fell to a much lesser extent if

we consider the arithmetic mean and modal value in

the regional context. In the national economy as a

whole, the decline was very deep (about 195 billion

rubbles), but almost this entire amount fell on the

Sakhalin Oblast. Here, the rates for the simplified

taxation system were reduced to a minimum. The

main reason is to improve efficiency and tighten tax

administration. The increase in the transparency of

the smallest and medium-sized businesses interested

in state support also had an impact. The correlation

coefficient between the headcount of small and

medium-sized enterprises and tax revenues from

special tax regimes was 0.2541, which is slightly

above the critical level of significance. However,

multicollinearity of indicators took place here, due to

the third factor – a general tightening of

administration and an increase in the information

openness of business.

It should be noted that the dynamics of

entrepreneurial activity in 2020 did not reveal any

obvious links with the level of socio-economic

development of the region, previously established

parameters of the entrepreneurial sector. For example,

the fourth group of regions (Table 2), where the

number of small and medium-sized enterprises has

decreased by 1-3%, includes the leading cities in

terms of economic development, the City of Moscow,

the Republic of Tatarstan and, at the same time, one

of the least developed regions – the Republic of

Kalmykia, the Republic of Altai, and the Republic of

Tyva. There are also middle regions in this group in

terms of the main socio-economic indicators.

Taking into account the significant territorial

differentiation of entrepreneurial activity, a cluster

analysis was carried out with the aim of

multidimensional classification and search for

characteristic groups of regions, profiles of their

entrepreneurial activity. The best results were

obtained by identifying 7 clusters. The distribution of

regions by clusters is shown in Table 3.

Table 3: Distribution of Russian regions by clusters.

1 cluster

–

1 re

g

ion

2 cluster

–

4 regions

3 cluster

–

39 regions

4 cluster

–

7 regions

5 cluster

–

32 re

g

ions

6 cluster

–

1 re

g

ion

7 cluster

–

1 re

g

ion

The final centres of the clusters are shown in Table

4.

Table 4: End centres of clusters.

1 2 3 4 5 6 7

Number of

small and

medium

ente

r

-

p

rises 27.7 0.7

-

2.7

-

16.8 4.4

-

56.3

-

83.9

Ave-rage

number of

employees -4.0

-

1.3

-

3.9 -4.5 -4.7 -0.3 -1.5

Tax

revenues 163.7 8.6

-

0.4 -1.2

-

0.01 5.4 -0.6

The data in Tables 3 and 4 show that most of the

regions of Russia (71 out of 85 or about 85%) are

included in the third and fifth clusters. The third

cluster is characterized by a moderate decline in all

indicators of entrepreneurial activity, including the

average number of employees in small and medium-

sized enterprises. At the same time, employment

losses are somewhat lower here than in the fifth

cluster, and tax revenues are higher (the final centres

of clusters are not necessarily associated with specific

average values of indicators, but allow the clusters to

be compared with each other).

In the fifth cluster, compared to the third, the crisis

had less impact on the total number of small and

medium-sized enterprises and more on employment.

Tax revenues from small and medium-sized

businesses have been preserved to a greater extent. It

should be noted that the clusters do not differ

significantly in terms of the general level of socio-

economic development of the regions. In both groups

there are leading, lagging and average territories in

terms of the main socio-economic indicators.

The fourth cluster is specific, where the northern

regions of Russia are represented. Here, the highest

rates of decline in the number of small and medium-

sized enterprises and the maximum losses in tax

revenues are observed. Apparently, in the economy of

these regions, small and medium-sized enterprises

were already in a difficult situation, which worsened

in 2020. At the same time, in terms of the rate of

decrease in the average headcount, the fourth cluster

occupies an average position between the third and

fifth.

The second cluster unites such different regions as

the Republic of Ingushetia, the Republic of Dagestan,

the Leningrad region and the city of Moscow. Small

and medium-sized businesses here were least affected

by the crisis. In the first two regions this is explained

by the agrarian specialization of the economy, in the

other two – by a high level of economic development,

a capacious regional market and large-scale support

measures. Here the number of small and medium-

sized enterprises has increased, and tax revenues from

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

142

them have increased. A much more favourable

situation with the dynamics of the number of

personnel of small and medium-sized enterprises.

Separate clusters with pronounced regional

features are formed by the Chechen Republic (rapid

legalization of small and medium-sized businesses),

the Nenets autonomous district and the Sakhalin

Region (large-scale support for small and medium-

sized enterprises through a sharp reduction in taxes,

which made it possible to preserve and even increase

their number and headcount).

5 CONCLUSIONS

Small and medium-sized businesses are very

important for the sustainable development of regions

and countries. However, it was hit hardest by the

COVID-19 pandemic and the restrictions imposed in

connection with it. In large and heterogeneous

countries such as Russia, it is necessary to study the

response of small and medium-sized enterprises to the

pandemic from a regional perspective. The variation

in the rate of increase (decrease) in entrepreneurial

activity was high. The closest to the normal

distribution is the rate of growth (decline) in the

number of small and medium-sized enterprises, the

median value of which is close to 4.2–4.3%. In some

regions (7 observations), on the contrary, this

indicator grew.

The rate of growth (decline) in the number of

personnel was more varied and differed in greater

asymmetry, and its modal and median values were

equal to zero. In half of the regions, the number of

employed in small and medium-sized enterprises, at

least, has not decreased. Almost 50% of the regions

showed an increase in tax collections from small and

medium-sized enterprises. This is the most variable

Poisson exponent. In some regions, it decreased by

50-80%.

There are no correlations between the studied

indicators in the regional aspect. The decrease in the

number of small and medium-sized enterprises did

not lead to a similar decrease in the number of

employees (correlation coefficient 0.0517). There is

also no connection with the receipt of taxes from

special tax regimes (coefficient –0.1594). This is

explained by measures to preserve employment in

exchange for its legalization, as well as an increase in

the degree of transparency of small and medium-sized

businesses, and a tightening of tax administration.

The reaction of small and medium-sized

businesses to the crisis of 2020 practically did not

depend on the level of socio-economic development

of the region and other obvious factors. Both the

leading and lagging regions had a similar rate of

decline in the number of small and medium-sized

enterprises. Cluster analysis showed that one of the

two largest clusters differs from the other in terms of

a higher level of losses in the number of small and

medium-sized enterprises, tax revenues from them

and a lower level of employment losses. Maintaining

the same level of tax revenues could negatively affect

employment in the segment of small and medium-

sized enterprises. There are also smaller clusters with

positive growth rates of entrepreneurial activity. This

is due to either the agrarian specialization of the

economy, or active tax support, or an initially high

level of economic development.

REFERENCES

Bartik, A., Bertrand, M., Cullen, Z., Glaeser, E., Luca, M.,

and Stanton C. (2020). The impact of COVID-19 on

small business outcomes and expectations, Proceedings

of the National Academy of Sciences, 117(30), 17656–

17666.

Beglaryan, M. and Shakhmuradyan, G. (2020). The impact

of COVID-19 on small and medium-sized enterprises

in Armenia: Evidence from a labor force survey, Small

Business International Review, 4(2): e298.

Bucea-Manea-Tonis, R. (2015). SMEs role in achieving

sustainable development, Journal of Economic

Development Environment and People, 4(1): 41–50.

Condon, L. (2004). Sustainability and small to medium

sized enterprises – how to engage them, Australian

Journal of Environmental Education, 20(1): 57–67.

Diabate, A., Sibiri, H., Wang, L., and Yu, L. (2019).

Assessing SMEs’ sustainable growth through

entrepreneurs’ ability and entrepreneurial orientation:

An insight into SMEs in Côte d’Ivoire. Sustainability,

11(24): 7149.

Fairlie, R. (2020). The impact of COVID-19 on small

business owners: Evidence from the first 3 months after

widespread social-distancing restrictions, Journal of

Economics & Management Strategy, 29(4): 727–740.

Federal Tax Service of Russia (2021a). Unified register of

small and medium-sized businesses. Retrieved from

https://rmsp.nalog.ru/index.html

Federal Tax Service of Russia (2021b). Data on forms of

statistical tax reporting. Receipt of taxes, charges and

other mandatory payments to the consolidated budget

of the Russian Federation,

https://www.nalog.ru/rn42/related_activities/statistics_

and_analytics/forms/9777509/

Jansson, J., Nilsson, J., Modig, F., and Hed Vall, G. (2017).

Commitment to sustainability in small and medium-

sized enterprises: The influence of strategic orientations

and management values, Business Strategy and the

Environment, 26(1): 69–83.

COVID-19 Pandemic and Differentiation of Entrepreneurial Activity in Russian Regions in the Context of Sustainable Development

143

Liguori, E. and Pittz, T. (2020). Strategies for small

business: Surviving and thriving in the era of COVID-

19, Journal of the International Council for Small

Business, 1(2): 106–110.

Prashar, A. (2019). Towards sustainable development in

industrial small and Medium-sized Enterprises: An

energy sustainability approach, Journal of Cleaner

Production, 235(10): 977–996.

Razumovskaia, E., Yuzvovich, L., Kniazeva, E., Klimenko

M., and Shelyakin V. (2020). The effectiveness of

russian government policy to support SMEs in the

COVID-19 pandemic, Journal of Open Innovation:

Technology, Market, and Complexity, 6(4): 160.

Shafi, M., Liu, J., and Ren, W. (2020). Impact of COVID-

19 pandemic on micro, small, and medium-sized

enterprises operating in Pakistan, Research in

Globalization, 2: 100018.

United Nations. (2020). A UN framework for the immediate

socio-economic response to COVID-19,

https://www.un.org/sites/un2.un.org/files/un_framewor

k_report_on_covid-19.pdf.

United Nations. General Assembly (2015). Resolution

adopted by the General Assembly on 25 September

2015 “Transforming our world: the 2030 Agenda for

Sustainable Development”, 70(1),

https://www.un.org/ga/search/view_doc.asp?symbol=

A/RES/70/1&Lang=E.

Wielgórka, D. (2016). Environmental management in the

aspect of sustainable development in micro-, small-,

and medium-sized enterprises, Desalination and Water

Treatment, 57(3): 982–992.

Zaazou, Z. and Salman Abdou, D. (2021). Egyptian small

and medium sized enterprises’ battle against COVID-

19 pandemic: March – July 2020, Journal of

Humanities and Applied Social Sciences, 3(2).

WFSDS 2021 - INTERNATIONAL SCIENTIFIC FORUM ON SUSTAINABLE DEVELOPMENT OF SOCIO-ECONOMIC SYSTEMS

144