A Trading Strategy in the Forex Market based on Linear and

Non-linear Machine Learning Algorithms

Nabil Mabrouk

a

, Marouane Chihab

b

and Younes Chihab

c

Computer Sciences Laboratory, Ibn Toufail University, Kenitra, Morocco

Keywords: forex, trading, machine learning, SVM, random forest, logistic regression, technical indicators

Abstract: In this article, we have compared two Forex trading strategies based on different machine learning algorithms.

We used an algorithm that generates technical indicators and technical rules. The technical indicators contain

information that may explain the movement of the stock price. The generated data was fed to a machine-

learning algorithm to learn and recognize price patterns. The first approach uses a linear classifier algorithm

to classify data into two classes by a line or a hyperplane (BUY or SELL Signal); the second approach, unlike

the first one, uses a non-linear classifier algorithm to predict the next day's stock movement. We have

evaluated the model's performance by different metrics generally used for machine learning algorithms,

another method used to profitability by comparing the strategy returns and the market returns.

1 INTRODUCTION

The foreign exchange market (FOREX or FX) is a

global market for trading currency. The forex is

known as the largest financial market in the world

(TANAMARTTAYARAT, 2018); investors can

make money by exchanging currency against another.

Still, the strong fluctuations of the prices make this

market a risky area for them. In the last few decades,

reducing the rate of risks and increasing the

profitability of investment in the forex using different

analyses such as the fundamental and the technical

analysis was a common researcher stream.

Many researchers proposed different strategies to

forecast the prices movement by applying technical

analysis; this type of analysis uses technical

Indicators that are mathematically calculated based

on historical data; although many practitioners use

technical indicators for trading, and they have not

received the same kind of attention in the literature

(Schwager, 1989; Lo, 2010). Technical indicators are

generally used to create a link between the past and

the future based on historical data (price and volume

patterns); those patterns are used to identify trends

believed to persist in the future (J. Neely, E. Rapach,

Tu, & Zhou, 2014). The traders use technical

a

https://orcid.org/0000-0001-8399-5581

b

https://orcid.org/0000-0001-5335-4329

c

https://orcid.org/0000-0003-0031-7609

indicators separately or combine some of them to get

the best result, such as the Relative Strength Index

(RSI); RSI is a commonly used oscillator in technical

analysis because of its ease of use and interpretation

(Moroșan, 2011).

Traditional programming could not solve

complicated real-life classification problems. Still,

Machine learning (ML) has shown impressive results

in solving such kinds of issues in many different areas

such as medicine (Di, 2007). The application of

machine-learning algorithms to predict trading on the

financial markets have become an area of interest of

a large group of traders; it shows a significant rate of

successful predicted trading, by transforming the

risky fluctuation into a source of information to

identify price patterns based on historical data; those

patterns are used to improve the profitability of the

strategy in the future.

Intelligent machine learning systems played an

important role and showed impressive performance in

modeling and forecasting data, such as Bitcoin high-

frequency price time series (Lahmiri & Bekiros,

2020). Numerous researchers have applied machine

learning to build trading strategies, among the

machine learning algorithms, such as Random Forest

(RF), support vector machine (SVM), Logistic

regression (LR), Neural Network (NN).

Mabrouk, N., Chihab, M. and Chihab, Y.

Trading Strategy in the Forex Market based on Linear and Non-linear Machine Learning Algorithms.

DOI: 10.5220/0010728800003101

In Proceedings of the 2nd International Conference on Big Data, Modelling and Machine Learning (BML 2021), pages 81-85

ISBN: 978-989-758-559-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

81

In this article, we will compare two approaches

that use machine learning to predict the price

movement of a pair of currencies. The first approach

is a strategy built with a linear classifier algorithm,

and it tries to separate the classes by a line or

hyperplane like logistic regression. The second

approach is a different strategy built using a non-

linear classifier algorithm that does not use the

linearity of the data, like the decision tree, KNN.

2 ALGORITHMIC TRADING

Traders have developed numerous trading strategies

to avoid emotional investment and make profits from

the market. However, sticking to one trading strategy

will not necessarily lead always to good results, not

all successful trading strategies will stay helpful and

profitable in the future, the financial markets are

changing continuously with time due to various

factors that impact the state of the financial markets,

technical and fundamental analysis differentiate

and adapt their strategies for different situations.

Recently, Artificial intelligence (AI) Toke

advantage of the continuous changes of the financial

market to create a new type of trading based on Data

mining and machine learning. This type of trading

requires a complex analysis; the first step is feeding a

computer with a massive amount of past data sets,

then giving it enough time to execute complex

calculations; the computer learns price patterns by

itself and predicts them in the future. In the pre-

market-efficiency era (i.e., pre- 1960s), several

practitioners and researchers believed that predictable

patterns in stock returns might lead to "abnormal"

profits for trading techniques (Conrad & Kaul, 1998).

In (Chihab, Bousbaa, H., & Bencharef, 2019),

researchers have proposed a theoretical Multi-Agent

System for stock market Speculation. They used four

agents, the Metaheuristic Algorithm agent, technical

indicators, Text Mining agent, and Fundamental

Factor agent. The final decision is made based on the

combination of the four agent’s results.

2.1 Support Vector Machine (SVM)

In 1992 Vapnik and coworkers had introduced The

Support Vector Machine (SVM) as a computer

algorithm that learns by example to assign labels to

objects (M. Guyon, N. Vapnik, & E. Boser, 1992).

The SVM is a machine learning algorithm applied in

many different fields of business such as biology,

biomedical, recognizing handwritten digits,

fraudulent credit cards (Chihab, Bousbaa, Chihab,

Bencharef, & Ziti, 2019; S. Noble, 2006). To solve a

time-series forecasting problem, Cao (Juan Cao &

Eng Hock Tay, 2001) proposed a solution based on

two-stage neural network architecture constructed by

combining Support Vector Machines (SVMs) with a

self-organizing feature map (SOM). The backtest

showed an impressive result, not only in the

prediction performance but also in speed compared

with a single SVM model. In (Kim, 2003), Kyoung-

Jae proposed a promising alternative to predict the

stock market, by comparing the proposed method

with back-propagation neural networks and case-

based reasoning.

2.2 Logistic Regression

Logistic regression Is a commonly used machine

learning algorithm to model the chance of an event.

In (Sperandei, 2014) Sperandei, defined Logistic

regression as an algorithm that works very similar to

linear-regression, but with a binomial response

variable, which tries to model the logarithm of the

chance. (Kung-Yee & L. Zeger, 1988) proposed an

approach to solving multivariate time binary series

data; in this approach, the logistic regression eases the

computational burden of the maximum likelihood

method.

2.3 Random Forest

The Random Forest (RF) was Introduced in

(Breiman, 2001) as a combination of predictor trees.

It uses many trees to generate a predictive model. In

each node, a random selection of features is used to

identify the important predictors automatically.

Random forest (RF) is a non-linear machine

learning algorithm that can resolves classification

problems in many different fields of business; RF was

used to understand the financial markets and forecast

changes in prices. In (Booth, Gerding, & McGroarty,

2014), a trading strategy was built and developed

based on a Random Forest algorithm. The proposed

trading system forecasts the price return. The results

showed that random forests produce superior results

in terms of both profitability and prediction accuracy

compared with other ensemble techniques. Also, in

(Chihab, Bousbaa, Chihab, Bencharef, & Ziti, 2019),

another approach was proposed to forecast the future

price in the next week; the study showed impressive

results to improve the prediction accuracy by using

Random forest.

BML 2021 - INTERNATIONAL CONFERENCE ON BIG DATA, MODELLING AND MACHINE LEARNING (BML’21)

82

3 METHODOLOGY AND

RESULTS

3.1 Data

In this research, the used datasets are of the two most-

traded currencies in the world: the United States

Dollar and the Euro; the EUR/USD currency pair

represents the quotation of these two currencies EUR

and USD; the EUR is called the base currency, and

the USD is called the quote currency, when trading a

currency pair, the quote currency is used to buy the

base currency. The dataset covers the period from

January 01, 2014, until January 30, 2021. 80% of this

dataset was used for the training phase, the other 20%

of the dataset was used for the test phase; the data

segregation was done non-randomly to conserve the

temporal order. A time-series dataset is sequential

data obtained through repeated measurements over

time, hourly, daily, or weekly.

This work proposes two approaches for day

trading; the used dataset is an OLHCV data

indexed on the timestamp one day; each row is an

observation of five variables: Open, High, Low,

close, and Volume (OLHCV).

3.2 Feature Generation

3.2.1 Technical Indicators

Based on the existing OLHCV features, an algorithm

generates new features known as "technical

indicators"; this process adds additional information

based on mathematical calculations.

Technical analysts use technical indicators to analyze

and understand the price movement; they give an idea

of where the price might go next in a given market.

The datasets contain the most-used technical

indicators:

i) The Weighted Moving Average (WMA)

ii) The Exponential Moving Average

(EMA)

iii) The simple moving average (SMA)

iv) The Relatively Strength Index (RSI)

v) The average directional index (ADX)

vi) The Commodity Channel Index (CCI)

vii) The Rate-of-Change (ROC)

viii) The Bollinger Band (BB)

ix) The Moving Average Convergence

Divergence (MACD)

Each technical indicator is created on different

periods, as shown in Table 1; to give the algorithm

the ability to find the best combination of parameters

and select the best subset of relevant features

(predictors)

3.2.2 Feature Selection

Generating a large number of technical indicators on

different timeframes could lead to opposite effects on

the model performance due to noisy features; as a

solution, we decided to reduce the high

dimensionality of the datasets by selecting the

variables that contribute most to the prediction. In

(Guyon, 2017) Guyon determined the objective of

features selection in three parts: improving the data

speed prediction, facilitating the interpretation of

predictors, and providing a better understanding of

them, reducing the noise to improve the prediction

performance.

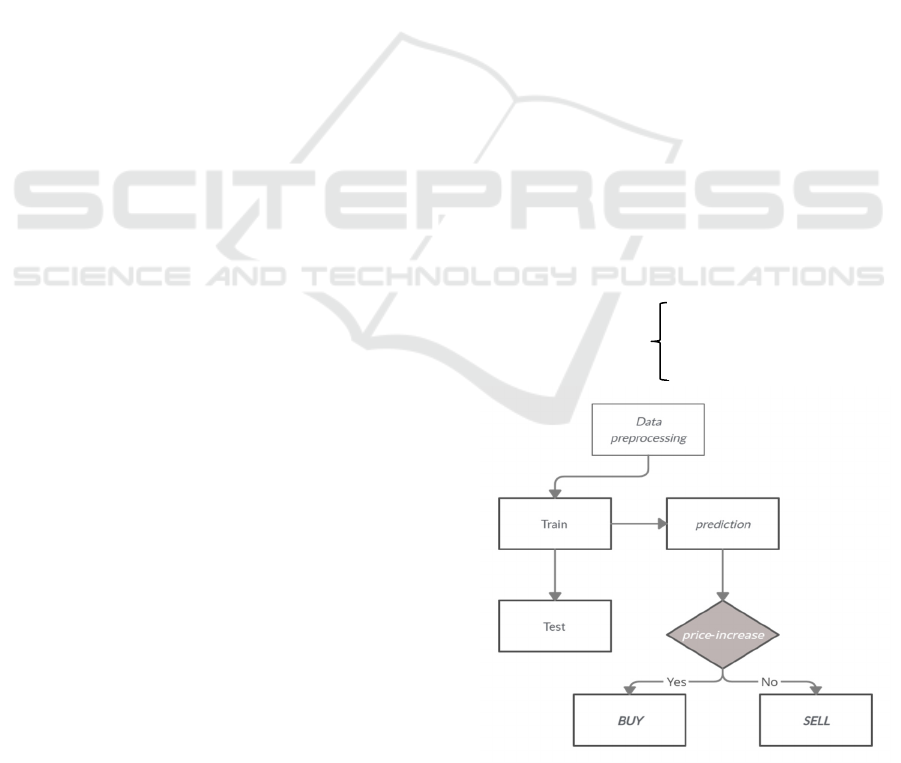

3.3 Our investment Strategy

The goal of our strategy is to buy when the price is

high and sell when the price is higher, which means

the machine learning model will predict the direction

of trade in the future. If the current day's closing price

is lower than the next day's closing price, it is a BUY

signal; otherwise, it is a SELL signal; the machine

learning algorithm will resolve a binary classification

problem. However, in the datasets, the dependent

variable will be coded “1” for a buy signal; and “0”

for a sell signal.

Y(t) = Signal (t+1)

Or Signal(t+1)

Figure 1: Investment strategy.

Buy (1), if price(t) < price(t+1)

Sell (0), otherwise

Trading Strategy in the Forex Market based on Linear and Non-linear Machine Learning Algorithms

83

Table 1: Technical indicators used and their parameters

Technical Indicators

(TI)

Intervals for TI

p

arameters

SMA Period: [5, 30]

WMA Period: [5, 100]

EMA Period: [5, 100]

RSI Period: [5, 30]

ADX Period: [5, 30]

ROC Period: [15, 30]

MACD

Fast: [10, 20]

Slow: [20, 35]

Signal: [5, 10]

CCI Period: [5, 30]

BB Period: [5, 30]

3.4 Discussion and Results

Both the linear and non-linear algorithms achieved an

accuracy between 60% and 72%; the linear approach

was more performant than the non-linear as shown in

table 2. However, in forex trading, the machine

learning metrics are not enough to evaluate the

profitability of the strategy, we used another backtest

to evaluate it based on the log-returns as shown in

figures 2, 3, 4, and 5. The backtest showed that The

SVM with a linear Kernel gave the best results by

reaching 62% of total profits during the backtest

period, the non-linear approach also showed

promising results but it was not so impressive, it did

not exceed 34% of total profits.

Table 2: The performance of algorithms

Figure 2: SVM (linear Kernel) returns

Figure 3: Logistic regression returns

Figure 4: SVM (non-linear Kernel) returns

Figure 5: Random Forest returns

4 CONCLUSIONS

In the forex, many factors may impact the state of the

market in different ways, making it too complex to

develop the best trading strategy. In this study, we

have proposed a trading strategy to trade the

EUR/USD pair; this solution is developed and

backtested in a specific period, it may not stay helpful

and profitable in the future. In this case, our proposed

solution must be adapted to the current situation.

We hope that solution helps the traders to avoid

the emotional investment, and act without fear.

Algorithm Accuracy

Logistic regression

71%

SVM (linear Kernel)

72%

Random Forest

62%

SVM (non-linear Kernel)

60%

BML 2021 - INTERNATIONAL CONFERENCE ON BIG DATA, MODELLING AND MACHINE LEARNING (BML’21)

84

REFERENCES

Booth, A., Gerding, E., & McGroarty, F. (2014).

Automated trading with performance-weighted random

forests and seasonality. Expert Systems with

Applications, 41(8), 3651-3661.

Breiman, L. (2001). Random forests. Machine learning, 45,

5-32.

Chihab, Y., Bousbaa, Z., Chihab, M., Bencharef, O., & Ziti,

S. (2019). Algo-Trading Strategy for Intraweek Foreign

Exchange Speculation Based on Random Forest and

Probit Regression. Applied Computational Intelligence

and Soft Computing, 2019.

Chihab, Y., Bousbaa, Z., H., J., & Bencharef, O. (2019). An

approach based on a heterogeneous multiagent system

for stock market speculation. Journal of Theoretical

and Applied Information Technology, 835-845.

Conrad, J., & Kaul, G. (1998). An Anatomy of Trading

Strategies. The Review of Financial Studies, 11(3),

489–519.

Di, M. (2007). A survey of machine learning in Wireless

Sensor networks From networking and application

perspectives. 2007 6th International Conference on

Information, Communications & Signal Processing.

Guyon, I. (2017). Feature Selection: A Data Perspective.

ACM Computing Surveys, 50(6).

J. Neely, C., E. Rapach, D., Tu, J., & Zhou, G. (2014).

Forecasting the Equity Risk Premium: The Role of

Technical Indicators. Institute for Operations Research

and the Management Sciences.

Juan Cao, L., & Eng Hock Tay, F. (2001). Improved

financial time series forecasting by combining Support

Vector Machines with self-organizing feature maps.

Intelligent Data Analysis, 5(4), 339-354.

Kim, K.-j. (2003). Financial time series forecasting using

support. Neurocomputing, 55(1-2), 307-319.

Kung-Yee, L., & L. Zeger, S. (1988). A Class of Logistic

Regression Models for Multivariate Binary Time

Series. Journal of the American Statistical Association,

447-451.

Lahmiri, S., & Bekiros, S. (2020). Intelligent forecasting

with machine learning trading systems in chaotic

intraday Bitcoin market. Elsevier.

Lo, A. W. (2010). The Evolution of Technical Analysis:

Financial Prediction from Babylonian Tablets to

Bloomberg Terminals. Bloomberg Press.

M. Guyon, I., N. Vapnik, V., & E. Boser, B. (1992). A

training algorithm for optimal margin classifiers. COLT

'92: Proceedings of the fifth annual workshop on

Computational learning theory, 144–152.

Moroșan, A. (2011). The relative strength index was

revisited. African Journal of Business Management, 2.

S. Noble, W. (2006). What is a support vector machine? Nat

Biotechnol, 24, 1565–1567.

Schwager, J. D. (1989). Market Wizards. New York

Institute of Finance.

Sperandei, S. (2014). Understanding logistic regression

analysis. Biochem Med (Zagreb), 24(1), 12-18.

TANAMARTTAYARAT, K. (2018). THE WORLD’s

LARGEST FINANCIAL MARKET: FOREX. Social

Science Research Network, 2.

Trading Strategy in the Forex Market based on Linear and Non-linear Machine Learning Algorithms

85