Comparison of Financial Literacy for Micro, Small and Medium

Enterprises Entrepreneurs at Bojong Soang upon using Financial

Planning Application "SAKA (peSAK Abdi)"

Maya Malinda

1a

, Asni Harianti

1b

, Yolla Margaretha

1c

, Henky Lisan Suwarno

1d

,

Kaleb Immanuel Yahya

1e

and Miki Tjandra

2f

1

Department of Management, Maranatha Christian University, Jl Suria Sumantri No 65, Bandung, Indonesia

2

Department of Visual Communication Design, Maranatha Christian University,

Jl Suria Sumantri No 65, Bandung, Indonesia

henky.ls@eco.maranatha.edu, kalebimmanuel021@gmail.com, miki.tjandra@art.maranatha.edu

Keywords: Financial Literacy, Financial Planning, MSME Entrepreneurs, SAKA (PeSAK Abdi), Bojong Soang.

Abstract:

Financial literacy – the cognition and skills in managing financial resources is one of the elements that

determine the success of a business. It deals with the understanding on how to manage money, especially

when the money for doing the business is assisted by financial services such as banks, insurance, pawnshops,

and pension funds. In Micro Small Medium Enterprise (MSME), financial literacy plays a significant role.

Thus, the Indonesian government pays serious attention to improve the financial literacy of entrepreneurs

involved in MSMEs, to ensure that the enterprise can survive. MSMEs are supported by the government as

their existence is in accordance with one of the government’s sustainable development goals, that is to

alleviate poverty. Accordingly, this research is done to gain insight on MSME entrepreneurs’ financial

intelligence by measuring their level of financial literacy and to find out problems that the entrepreneurs have

in understanding finance. The respondent of the research is MSME entrepreneurs in Bojong Soang. The data

is gained through Financial Fitness Quiz (FFQ) to measure the entrepreneurs’ financial behaviour and literacy.

The data is taken twice, before and after they are trained to use the Financial Planning Application "SAKA

(peSAK Abdi)". The before and after data are compared using the paired sample t test. The result shows a

significantly different result before and after the training. Hence, the use of “SAKA (peSAK Abdi)" application

shows a breakthrough in increasing the level of financial literacy of the MSME Entrepreneurs in Bojong

Soang.

1 INTRODUCTION

Financial literacy involves the knowledge and

understanding of financial issues to guide people in

managing their funds. Inadequate financial literacy

can lead to bad financial decisions that result in

adverse effects not only on an individual but also his

or her family financial health. Financial literacy also

has a significant impact on welfare. (Lusardi &

Mitchell, 2014). Therefore, financial management

a

https://orcid.org/0000-0003-4265-4929

b

https://orcid.org/0000-0001-8305-9443

c

https://orcid.org/0000-0002-7960-0804

d

https://orcid.org/0000-0001-9499-789X

e

https://orcid.org/0000-0002-9904-3515

f

https://orcid.org/0000-0002-8132-1919

education is essential to help people budget and

manage their income, save and invest efficiently, as

well as avoid being victims of fraud. Not only for

people’s personal and domestic affairs, financial

education is also necessary for entrepreneurs to

ensure their own financial well-being and the smooth

functioning of financial markets and economies

(Atkinson, 2017)

Based on the 2015 S&P Global FINLIT survey,

only 1-in-3 adults worldwide were financially literate.

82

Malinda, M., Harianti, A., Margaretha, Y., Suwarno, H., Yahya, K. and Tjandra, M.

Comparison of Financial Literacy for Micro, Small and Medium Enterprises Entrepreneurs at Bojong Soang upon using Financial Planning Application "SAKA (peSAK Abdi)".

DOI: 10.5220/0010743300003112

In Proceedings of the 1st International Conference on Emerging Issues in Humanity Studies and Social Sciences (ICE-HUMS 2021), pages 82-89

ISBN: 978-989-758-604-0

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Not only is financial illiteracy widespread, but there

are also large variations between countries and

groups. The information is acquired from the Gallup

World Poll survey that added questions on financial

literacy in their survey. More than 150,000 randomly

selected adults from more than 140 countries were

interviewed during the 2014 calendar year. They were

asked questions that measure the four basic concepts

for making financial decisions: basic arithmetic,

compound interest, inflation, and risk diversification.

The result of the survey showed that Indonesian

respondents were 32% financially literate. This was

lower compared to the percentage of Malaysians

(36%) and Singaporeans (59%) (S7P Global, 2015).

The first National Survey on Financial Literacy

(SNLK) or Indonesian Financial Literacy Index (FLI)

which was conducted by Indonesian Financial

Services Authority (OJK) in 2013 revealed that only

21 out of every 100 Indonesian residents were

financial literate. This was indicated by the financial

literacy index that stood at 21.84 percent (OJK,

2017). Similar survey was conducted in Japan, in

which the result shows that the range of people that

were financially literate was almost twice of the range

in Indonesia. Surveys done in 26 OECD countries

showed that financial levels were especially low for

certain groups, such as the less educated, the

minority, and people at the lower end of the income

distribution (OECD, 2020). All the surveys showed

an indication that financial literacy was correlated

with income and education levels. The lower the

education or income level was, the lower the level of

financial literacy would be.

Therefore, proper financial management

education can help people to get away from poverty.

Furthermore, financial management education can

help individuals and families to improve their levels

of education, which will also take part in improving

the people’s welfare. With that in mind, the

researchers are interested to find out how trainings in

financial management can improve financial literacy.

The research is focused on entrepreneurs in MSMEs,

as the researchers have had scientific and practical

experiences related to financial literacy and MSMEs

in Indonesia.

The researchers are aware that there are many

MSME entrepreneurs who find it difficult to manage

their personal and business finances. They generally

find it difficult to separate business capital from

personal needs, so that in the end they think they are

lacking in capital, and they face problems in cash

flow management. In addition, there is a lack of

information about financial services that the

entrepreneurs can use to develop their business.

The above conditions lead the researchers to

identify three major problems: (1) there is a lack of

information on financial management services that

can be obtained from related financial institutions

(banks, insurance, pawnshops, pensions and others);

(2) there is a lack of coaching about financial

planning for MSME entrepreneurs; (3) there is no

financial planning application that is simple and easy

to use for the entrepreneurs. All the problems call for

a solution. Thus, the researchers are to do a field

research aiming at improving financial literacy,

especially for MSME entrepreneurs, which in this

study are those having MSMEs in Bojong Soang.

The field research is expected to fulfil the

following objectives: a) mapping the problems that

MSME Entrepreneurs in Bojong Soang have in

understanding finance; b) measuring the

entrepreneurs’ level of financial literacy before and

after financial training and practice in using a

financial application; c) creating a simple application

to help these MSME entrepreneurs improve their

financial literacy. In addition, the researchers is going

to use a financial planning application called "SAKA

(peSAK Abdi)" to assist the entrepreneurs in

managing their personal and business finances.

2 MSME ENTREPRENEURS AND

FINANCIAL LITERACY

Indonesian Ministry of Finance in their Law No. 20

of 2008 defines Micro, Small and Medium

Enterprises (MSMEs) as productive businesses

owned by individuals and/or individual business

entities that meet the criteria regulated in the Law.

(Kemenkeu, 2012). MSMEs play an important role in

Indonesian economic system for being the biggest

drivers of the informal sector, as the enterprises

absorb the largest number of workers (Aribawa,

2016).

Being owned by individuals, the financial

management principles in MSMEs is similar to that

of the personal finance. According to Braunstein and

Welch (in Aribawa, 2016), the level of financial

literacy of individuals / families would have an

impact on their ability to manage long-term savings

that could be used for some purposes, for example to

own assets such as lands or houses, to pursue higher

education, and to save for their retirement period. On

the other hand, ineffective financial management

could lead to financial crises. These findings can be

adapted for the financial management of MSMEs.

MSME entrepreneurs who have good financial

literacy will have a business development orientation,

Comparison of Financial Literacy for Micro, Small and Medium Enterprises Entrepreneurs at Bojong Soang upon using Financial Planning

Application "SAKA (peSAK Abdi)"

83

be able to achieve their company goals and to survive

economic difficulties.

Some research in business literacy (Beck,

DemirgucKunt & Maksimovic, 2005; Hutchinson &

Xavier, 2006; Malo & Norus, 2009; Coad &

Tamvada, 2012, in Aribawa 2016), found that the lack

of knowledge and access to financial resources was

linked to a company's inability to achieve goals and

constraints in taking strategic actions (Wiklund &

Shepherd, 2003, in Aribawa, 2016). Other literatures

also explained that financial literacy and inclusion

was important in increasing the company growth

(Cooper, Gimeno-Gascon, & Woo, 1994; Storey,

1994; Forbes Insights, 2011, in Aribawa, 2016).

Financial literacy could be defined as financial

knowledge whose aim was to attain prosperity

(Lusardi & Mitchell 2007). Financial literacy has

been a part of mental intelligence related to the ability

to find solutions towards financial problems. The

study of Byrne in 2007 (in Cahyono, 2012) noticed

that low level of financial knowledge would lead to

the making of wrong financial plans and cause bias in

the achievement of welfare when one had pass the

productive age. Financial difficulties occurred not

only because of a lack of income, but also because of

errors in financial management, such as the absence

of financial planning and misuse of credit. Thus,

having financial literacy is crucial to get a prosperous

and high-quality life.

Previous studies have shown that there are at least

two instruments that can be used to measure financial

literacy. The first is the measurement created by

SEADI (Support for Economic Analysis

Development in Indonesia) in a collaborative project

conducted by Definite, Indonesian Financial Services

Authority (OJK) and USAID in 2013. The result of

the project was called the Indonesian Basic Financial

Literacy Index. A sample question from the

questionnaire was "If the bank where you opened an

account in the name of the company is bankrupt, will

the government guarantee the amount of funds stored

in that account?" (Aribawa, 2016, p. 2). The second

measurement is the one used in Chen and Volpe's

(1998) research. In their instrument, financial literacy

was measured using four indicators, namely basic

knowledge of financial management, credit

management, savings and investment management,

and risk management (Fitriana, 2016). In addition, a

current study by Saksonova and Papiashvili (2021)

revealed that financial literacy scores and financial

inclusion of MSME entrepreneurs in Latvia and

Estonia evidenced a constantly positive association.

Positive cause-effect relationships were observed

between the level of general education of the

population, personal literacy, financial literacy of the

MSME entrepreneurs and their access to finance.

The current situation in Indonesia shows that

business competition occurs in all business sectors,

including MSMEs. Different from large companies,

which have adequate resources, MSMEs usually have

limited human resource. Thus, in large companies the

administrative and financial managements are

generally done well, and there might be many models

of transaction processing in the companies’ financial

reports. On the other hand, MSMEs with their limited

resources and capabilities, might find problems to

make correct financial reports. There is also a

tendency that MSMEs do not keep records of their

transactions, which often makes them clueless

whether what they have done so far is beneficial

(profitable) or not. Hence, it is important to build the

awareness of MSME entrepreneurs about the

importance of financial recording and planning. By

doing so, hopefully they can change their lifestyles

from spending to investing (Cahyono, 2012).

Futhermore, having staff members who have

business, or business and financial recording skills in

MSMEs is crucial to ensure the smooth running of

their businesses (Cahyono, 2012).

Actually, the recording of financial transactions

does not need sophisticated equipment, but it must be

done every day. There are several things that should

be included in MSMEs financial record: (1) financial

posts, consisting of items such as assets, equity,

expenses, and income, as well as other items that can

be adjusted in accordance with the need of the

MSME; (2) daily cash flow, a record every day’s

income and expenses; (3) reports or financial

information from the results of recording (1) and (2),

and (4) calculation of budget. To help MSME

entrepreneurs in keeping financial records, the

researchers propose the implementation of "SAKA

(peSAK Abdi)" application, as shown in picture 1-6 in

the next section of this paper.

3 DATA SAMPLES,

MEASUREMENT AND

RESEARCH METHODS

3.1 Data Samples

The research took data from 51 MSME entrepreneurs

at Bojong Soang. The entrepreneurs were given

online trainings on financial literacy and asked to

implement "SAKA (peSAK Abdi)" application. The

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

84

data were collected twice, before and after the

training and use of the application. The first data were

collected in 2019 before the COVID-19 pandemic by

distributing questionnaires to the research

participants. The second data retrieval were done in

2020, during the COVID-19 pandemic, using online

questionnaires. Thus, the whole process of data

collections and analysis took about one year.

3.2 Measurement of Literacy

There are several methods that can be applied to get

data on people’s level of Financial Literacy. Previous

studies have made use of questionnaires to collect

data. A study by Ma’ruf and Desiyana (2015) was

carried out to collect data on the level of knowledge

about financial literacy. The data collection was done

by distributing questionnaires to MSME

Entrepreneurs in Yogyakarta, Indonesia. Other

researchers, such as O'Neill and Xiao (2003),

Mendari (2015), Malinda et al. (2020) used the

Financial Fitness Quiz (FFQ) to measure financial

behaviour and literacy (Agarwalla, Barua, Jacob, &

Varma, 2015) measure financial literacy, financial

knowledge, financial behaviour, and financial

attitude of the young people in India. The result show

that the respondents exhibit inferior financial

knowledge, inferior financial attitude, but superior

financial behaviour compared to their counterparts

such as Sri Lanka and Pakistan (Agarwalla et al.,

2015), Mendes-Da-Silva and Vieira also used

questionnaires to measure the attitude, behaviour and

financial management of higher education students.

(Potrich, Vieira, & Mendes-Da-Silva, 2016)

Some other research employed trainings or

educational coaching to measure the different results

in financial literacy before and after training sessions.

A recent research employing financial planning

training for 32 MSMEs in Bandung revealed

significant result in the FFQ measurement. The

average score before the training was 3.45, a medium

score for financial literacy. After the training, the

score levelled up to 4.84, which was a high score for

financial literacy. The increase was due to the

implementation of financial management practices

(Malinda, Harianti, Tjandra, & Meryana, 2020).

Another research by Malinda, Tjandra, Harianti, and

Olius (2020) to students from Management

Department, Maranatha Christian University

applying Wilcoxon test and FFQ measurement found

significantly different scores before and after

financial planning class. However, it has not been

proven that the financial planning education was

effective to increase Financial Literacy, especially in

the Financial Management and Saving, and

Investment criteria.

The instrument for measuring Financial Literacy

applied in this study is the Financial Fitness Quiz

(FFQ) founded by Rutgers University. The quiz

consists of 20 practical financial statements covering

five dimensions, namely: Financial Management (a

dimension describing how financial management is

carried out), Saving and Investing (a dimension that

describes financial behaviour in saving and

investing), Insurance and Estate Planning (a

dimension describing financial behaviour in

insurance and long-term planning), Credit (a

dimension of financial behaviour in debt

management), and Shopping (a dimension that shows

financial behaviour in spending money). Financial

behaviour was measured by counting the total score

obtained from the five dimensions. Similar to O'Neill

and Xiao (2003) study, the respondents were asked to

choose the response that was closest to their current

financial management practices.

After the total score was obtained, the respondents

were presented with the score interpretations. The

interpretations are divided into five categories based

on the range of points they got. When they had 0-20

points, the interpretation was “You need a lot of help,

but don't despair. You can still take action to improve

your finances”. When the total was 21-40 points, the

interpretation was “You are facing financial troubles.

Now is the right time to take action to reverse the

trend”. When the total was 41-60 points, the

interpretation was “You are doing a fair job managing

your finances and have taken several steps in the right

direction”. The total of 61-80 points lead to the

interpretation that “You are doing a good job and are

above average in managing your finances”. The last

division was 81-100 points, in which the

interpretation was “You are in very good financial

shape. Keep going and continue the good work!”

3.3 Research Method

Paired Sample t-test was used for the statistical

measurement. The paired sample t-test, sometimes

called the dependent sample t-test, is a statistical

procedure used to determine whether the mean

difference between two sets of observations is zero.

In a paired sample t-test, each subject or entity is

measured twice, resulting in pairs of observations.

(statisticssolutions.com, 2021). The use of paired

sample t-test is important as this study compares the

respondents’ financial fitness scores BEFORE and

Comparison of Financial Literacy for Micro, Small and Medium Enterprises Entrepreneurs at Bojong Soang upon using Financial Planning

Application "SAKA (peSAK Abdi)"

85

AFTER the implementation of "SAKA (peSAK

Abdi)".

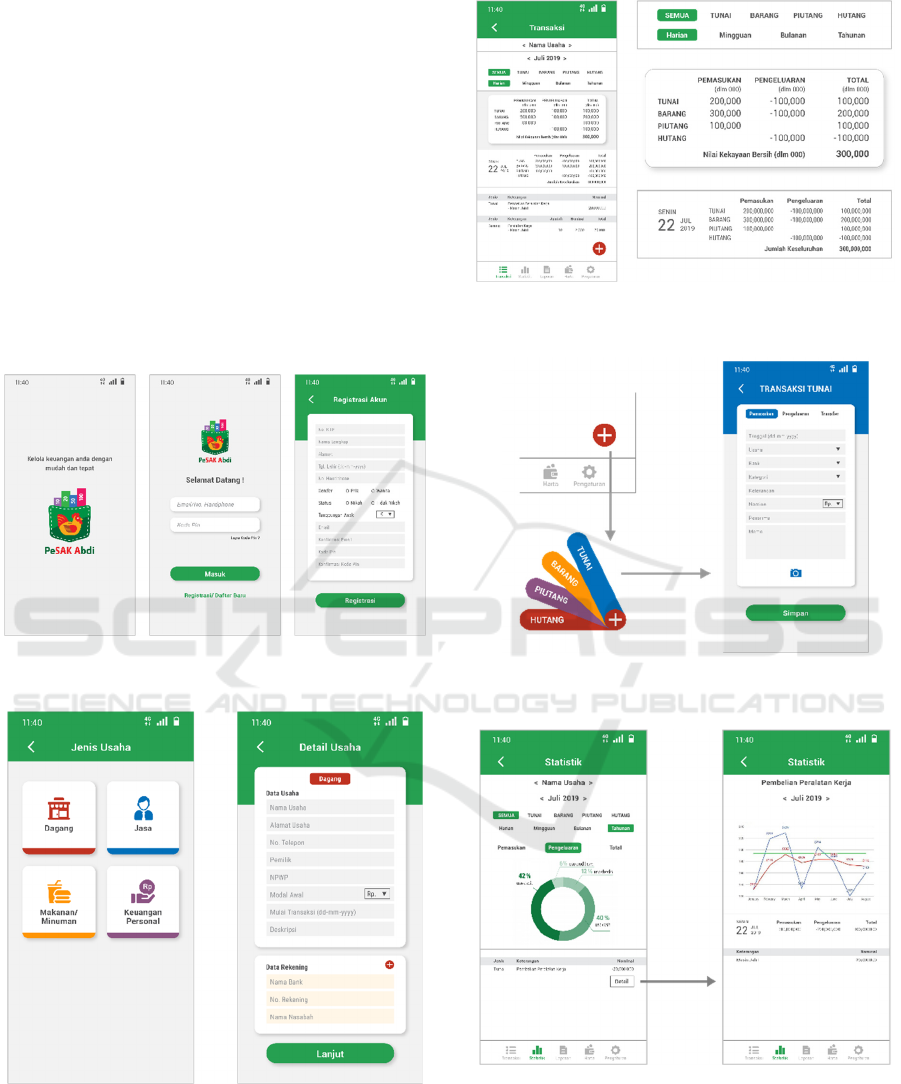

3.4 Application of "SAKA (peSAK

Abdi)"

A financial planning application called "SAKA

(peSAK Abdi)" was developed by the researchers with

the purpose to help MSME entrepreneurs to manage

their money in a simple and easy way. The figures

below (figure 1-6) show the user interfaces of the

application: the home screen, information on the

types and detailed of the business, the landing page,

the navigation page, and the statistic and financial

reports pages.

Figure 1: Splash screen page and home screen/ application

sign-up of "SAKA (peSAK Abdi)".

Figure 2: Type and detail of business page.

Figure 3: Landing page of application "SAKA (peSAK

Abdi)".

Figure 4: Navigation page, application content and data

entry.

Figure 5: Statistic report page.

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

86

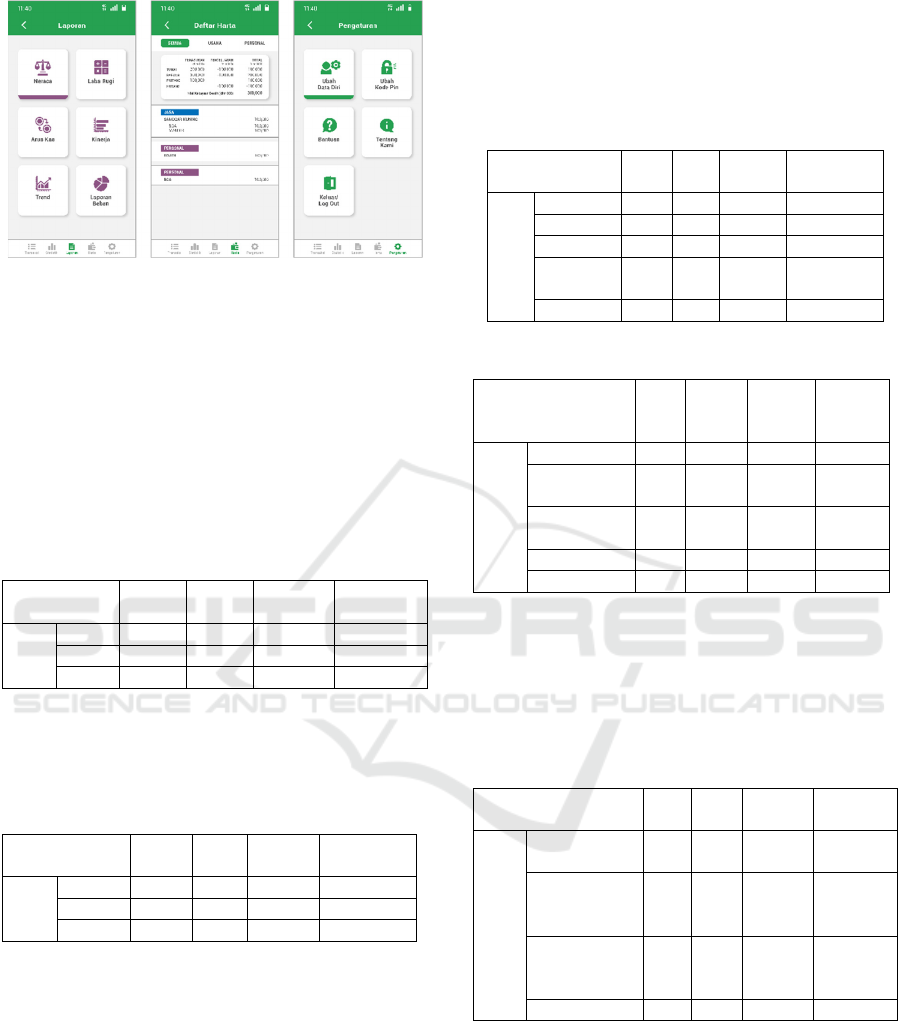

Figure 6: Financial report page, asset list and settings of

application "SAKA (peSAK Abdi)".

4 RESULTS AND DISCUSSION

Information about the demography of the MSME

entrepreneurs in Bojong Soang is presented in Tables

1 to 5. The information is provided to give a prelude

before further explanation on the data findings and

discussion.

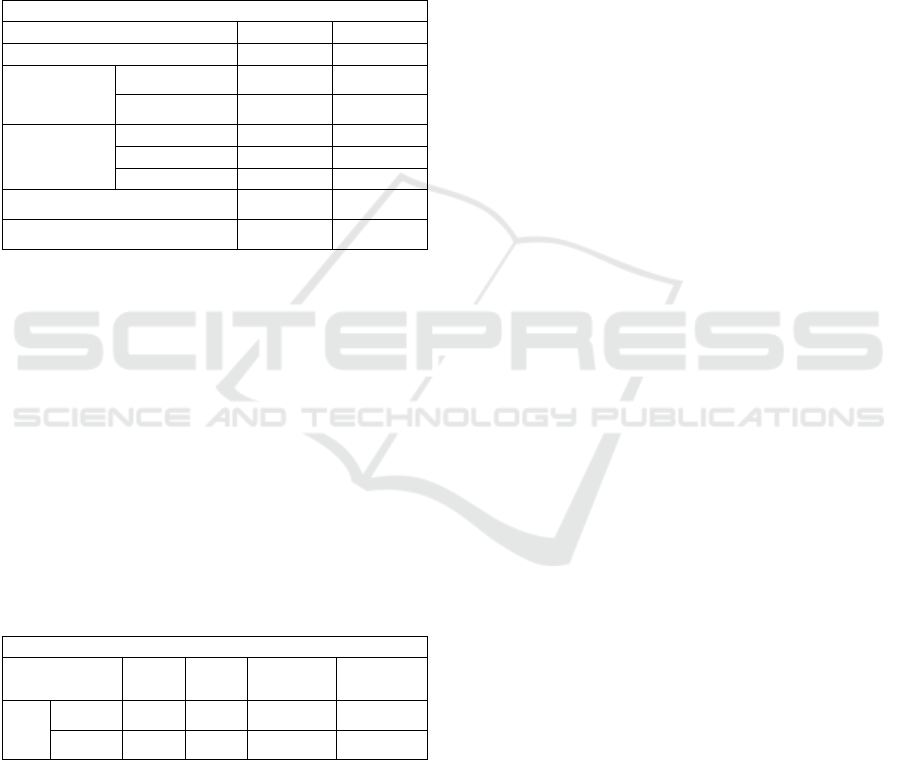

Table 1: Business type.

Freq.

%

Valid

Percent

Cumulative

Percent

Valid

Service 43 84.3 84.3 84.3

Product 8 15.7 15.7 100.0

Total 51 100.0 100.0

Table 1 provides information on the respondent’s

types of business. Most of them provided service, and

only 15% of them sold products.

Table 2: Gender of MSMEs.

Freq. %

Valid

Percent

Cumulative

Percent

Valid

Male 3 5.9 5.9 5.9

Female 48 94.1 94.1 100.0

Total 51 100.0 100.0

The data distribution of the respondents’ gender is

shown in Table 2. More than 90% of the respondents

were females. They were usually mothers and wives

who also support their families. This implies that

female MSME entrepreneurs have potentials for

development and growth.

Table 3 shows the data distribution of the number

of family members who were financially dependent

upon each MSME entrepreneur. The highest

frequency was found in entrepreneurs with three to

four dependent family members. This implies that the

more an entrepreneur has dependent family members,

the more proficient he or she is in financial

management. The fact also shows the importance of

equipping MSME entrepreneurs with financial

planning skills.

Table 3: Dependent family members.

Freq. %

Valid

Percent

Cumulative

Percent

Valid

1-2 14 27.5 27.5 27.5

3-4 27 52.9 52.9 80.4

>= 5 7 13.7 13.7 94.1

No

de

p

endent

3 5.9 5.9 100.0

Total 51 100.0 100.0

Table 4: Expenditure.

IDR

(Indonesian Rupiah)

Freq. %

Valid

Percent

Cumula

tive

Percent

Valid

< 1.000.000 4 7.8 7.8 7.8

1.000.000 -

< 2.000.000

1 21.6 21.6 29.4

2.000.000 -

< 3.000.000

22 43.1 43.1 72.5

>3.000.000 14 27.5 27.5 100.0

Total 51 100.0 100.0

The highest frequency shown in Table 4 was

MSME entrepreneurs whose expenditure was

between 2.000.000-3.000.000 IDR. In other words,

the minimum expenditure per day for this group was

around 70.000-100.000 IDR.

Table 5: Assets.

IDR

(Indonesian Rupiah)

Freq. %

Valid

Percent

Cumulative

Percent

Valid

<50.000.000

(

Micro

)

41 80.4 80.4 80.4

50.000.000-

500.000.000

(small)

8 15.7 15.7 96.1

500.000.000-

1.000.000.000

(Medium)

2 3.9 3.9 100.0

Total 51 100.0 100.0

Data distribution of assets is shown in Table 5.

More than 80% of the MSMEs in Bojong Soang were

categorized as Micro Entrepreneurs. Whereas less

than 4% could be categorized as medium

entrepreneurs. The data imply that there were a

significant number of micro entrepreneurs who need

support to be able to gain skills in financial planning.

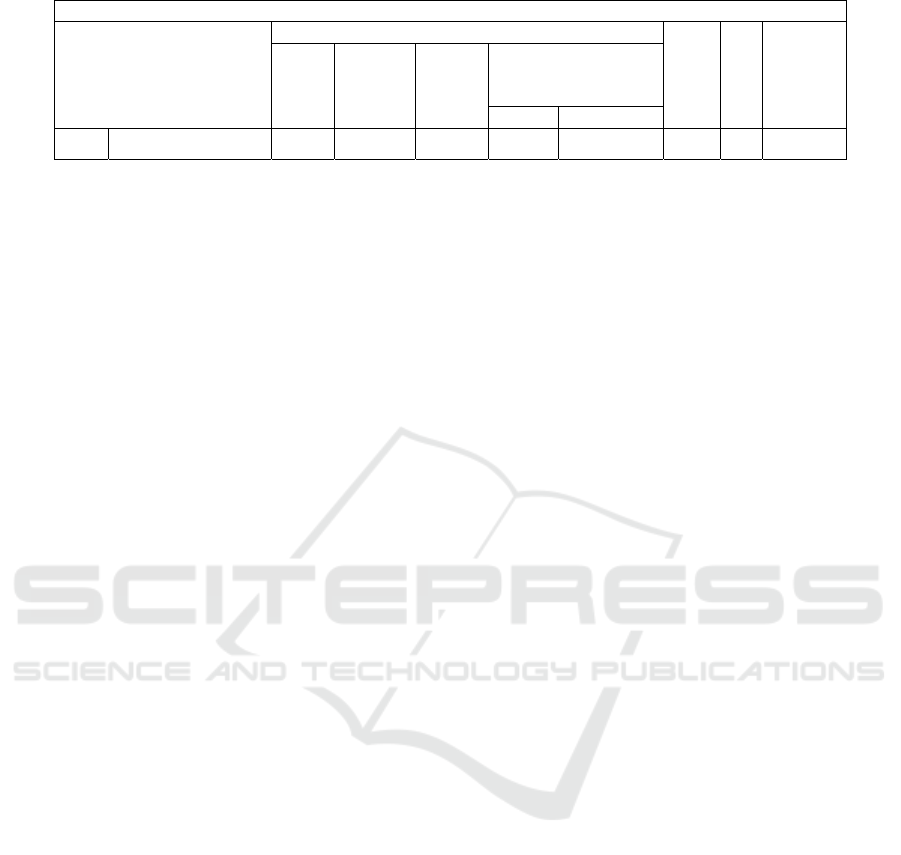

The results of the Paired Sample t-test are shown

in tables 6 to 8. The normality of data distribution was

Comparison of Financial Literacy for Micro, Small and Medium Enterprises Entrepreneurs at Bojong Soang upon using Financial Planning

Application "SAKA (peSAK Abdi)"

87

checked by applying Kolmogorov Smirnov Test.

When the data distribution showed normal result, the

Paired Sample t-test was done. The outcome of the

Paired Sample t-test would be two hypotheses:

H0: There was no difference BEFORE and AFTER

"SAKA (peSAK Abdi)” training.

H1: There were differences BEFORE and AFTER

"SAKA (peSAK Abdi)” training.

Table 6 below presents the result of presents the

results of the Paired Sample t-test:

Table 6: Normality test results.

One-Sam

p

le Kolmo

g

orov-Smirnov Test

BEFORE AFTER

N 51 51

Normal

Parameters

a,b

Mean 9.4235 15.6745

Std. Deviation 3.18085 3.04866

Most

Extreme

Differences

Absolute .090 .122

Positive .090 .117

Ne

g

ative -.066 -.122

Kolmogorov-Smirnov Z .642 .870

Asymp. Sig. (2-tailed) .805 .435

a. Test distribution is Normal.

b

. Calculated from data

Based on the result of the normality test, it was

found that the data was normally distributed, because

the sig value of the before and after was 0.805 and

0.435 respectively. When the value was greater than

0.05 or 5%, the data was normally distributed.

Concerning the hypotheses tested, the result was as

follows:

H

0

: Residual data were normally distributed

H₁: Residual data were not normally distributed

Criteria: Asymp sig> 0.05: H

0

is accepted; Asymp sig

≤ 0.05: H

0

is rejected (reference.wolfram.com, 2021).

Table 7: Statistical descriptive test results.

Paired Samples Statistics

Mean N

Std.

Deviation

Std. Error

Mean

Pair 1

BEFORE 9.4235 51 3.18085 .44541

AFTER 15.6745 51 3.04866 .42690

Table 7 shows the results of descriptive tests such

as mean and std. deviation, for each of the BEFORE

and AFTER variables. The BEFORE result standard

deviation was more than the AFTER. This means that

the data BEFORE was more spread out than the

AFTER.

Based on the results of the Paired Sample t-test in

table 8, it is found that the Asymp.Sig obtained was

0,000 and the value was below the 5% significance

level. Therefore, it can be concluded that Ho is

rejected as there is a difference of data between

BEFORE and AFTER the training and

implementation of "SAKA (peSAK Abdi)” for

financial planning.

5 CONCLUSIONS

After finding out the result and discussion, the

researchers draw several conclusions. First of all, the

mapping the financial literacy problems of MSME

entrepreneurs in Bojong Soang shows three major

problems. First, the entrepreneurs did not have

financial notes. Second, they found it difficult to

manage personal and business finances and to

separate business capital and personal spending.

Third, they did not have any application to help them.

Secondly, the levels of financial literacy among

MSME Entrepreneurs BEFORE and AFTER they

underwent a training and implementing “SAKA

(peSAK Abdi)” application differ significantly.

Before the training their average score was only 9,42,

and after training the average increase to 15,67. It

means the training has high impact in increasing the

entrepreneurs’ score in the Financial Fitness Quiz.

This is in line with the result of a previous study done

by that after the training of financial planning there

was significant improvement in the level of financial

literacy of the respondents (Malinda, Harianti, et al.,

2020).

Third, the implementation of a simple financial

management application "SAKA (peSAK Abdi)"

proves to improve MSME entrepreneurs’ financial

literacy. This is shown from the different result

BEFORE and AFTER the training using the

application.

Finally, it is expected that when MSME

entrepreneurs are financially literate, they can employ

careful financial planning that will help them build

their enterprises. The new finding from this research

is that implementing a simple financial management

application turns out to bring great result in

improving MSME entrepreneurs’ financial literacy.

ICE-HUMS 2021 - International Conference on Emerging Issues in Humanity Studies and Social Sciences

88

Table 8: Hypothesis test results.

Paired Samples Test

Paired Differences

t df

Sig.

(2-tailed)

Mean

Std.

deviation

Std. Error

Mean

95% Confidence

Interval of the

Difference

Lowe

r

U

pp

e

r

Pair 1 BEFORE – AFTER -6.250 4.157 .582 -7.420 -5.081 10.7 50 .000

ACKNOWLEDGEMENTS

Special thanks to the LPPM of Maranatha Christian

University for all the support and funding for this

research. Furthermore, special thanks also go to Bank

Sampah Bersinar (BSB) that has provided a place for

training and encouraging MSME entrepreneurs from

Bojong Soang to join the training and to implement

"SAKA (peSAK Abdi)” application.

REFERENCES

Aribawa, D. (2016). Pengaruh literasi keuangan terhadap

kinerja dan keberlangsungan UMKM di Jawa

Tengah. Jurnal Siasat Bisnis, 20(1), 1-13.

Agarwalla, S. K., Barua, S. K., Jacob, J., & Varma, J. R.

(2015). Financial Literacy among Working Young in

Urban India. World Development, 67, 101-109.

doi:10.1016/j.worlddev.2014.10.004

Atkinson, A. (2017). Financial Education for MSMEs and

Potential Entrepreneurs. doi:10.1787/bb2cd70c-en

Cahyono, Nur Edi. (2012). Pentingnya Melek Finansial

Bagi Pelaku Usaha Kecil Menengah.STIE Rajawali,

Purworejo.

Fitriana, Cynthia N. (2016). Studi Literasi Keuangan

Pengelola Usaha Kecil Menengah pada wilayah

Gerbangkertasusila. STIE Perbanas, Surabaya.

Kemenkeu. (2012).

https://kemenkeu.go.id/sites/default/files/laporan_tim_

kajian_kebijakan_antisipasi_krisis_tahun_2012_melal

ui_kur.pdf

Lusardi, A., & Mitchell, O. S. (2014). The Economic

Importance of Financial Literacy: Theory and

Evidence. Journal of Economic Literature, 52(1), 5-44.

doi:10.1257/jel.52.1.5

Malinda, M., Harianti, A., Tjandra, M., & Meryana, M.

(2020). Analysis of the Effectiveness of Financial

Education for Small and Medium Enterprises to

Increase Financial Literacy (Preliminary Study: A

Small Business Enterprise in Bandung).

Malinda, M., Tjandra, M., Harianti, A., & Olius, O. V.

(2020). Analysis of the Effectiveness of Financial

Education for Students in Higher Education to Increase

Financial Literacy (Case Study: Financial Planning

Class in Maranatha Christian University).

O'Neill, B., & Xiao, J. J. (2003). Financial Fitness Quiz: A

Tool For Analyzing Financial Behavior. Consumer

Interests Annual, 49.

Potrich, A., Vieira, K., & Mendes-Da-Silva, W. (2016).

Development of a financial literacy model for

university students. Management Research Review, 39,

356-376. doi:10.1108/MMR-06-2014-0143

OECD. (2020). International Survey of Adult Financial

Literacy.

OJK. (2013). Tentang OJK, Visi Misi. Cited on January 17,

2017.http://www.ojk.go.id/id/tentang-ojk/Pages/Visi-

Misi.aspx#

OJK. (2013). Edukasi dan Perlindungan Konsumen. Cited

on January 17, 2017. http://www.ojk.go.id/id/kanal/

edukasi-dan-perlindungan-konsumen/Pages/Literasi-K

euangan.aspx

OJK .(2017). https://www.ojk.go.id/en/berita-dan-kegia

tan/siaran-pers/Documents/Pages/Press-Release-OJK-

Announces-Higher-Financial-Literacy-and-Inclusion

Indices/SIARAN%20PERS%20SURVEI%20LITERA

SI%20DKNS%20%20final-ENGLISH.pdf

Reference.wolfram.com. (2021). Cited on May 15,

2021.https://reference.wolfram.com/language/ref/Kol

mogorovSmirnovTest.html

Saksonova S., & Papiashvili T. (2021). Micro and Small

Businesses Access to Finance and Financial Literacy of

their Owners: Evidence from Latvia, Estonia and

Georgia. In: Kabashkin I., Yatskiv I., Prentkovskis O

(eds.), Reliability and Statistics in Transportation and

Communication. RelStat 2020. Lecture Notes in

Networks and Systems, vol 195. Springer, Cham.

https://doi.org/10.1007/978-3-030-68476-1_62

S7P Global. (2015). Financial literacy around the world:

Insight from The S&P Global FINLIT survey. Cited on

June 15, 2015. https://www.spglobal.com/corporate-

responsibility/global-financial-literacy-survey

Mendari, S., & Anastasia. (2015). Financial Fitness Quiz:

Barometer Perilaku Keuangan. Buletin Ekonomi Jurnal

Manajemen, Akuntansi Dan Ekonomi Pembangunan,

13(2), 243-253

Statisticssolutions.com. (2021). Cited on May 15, 2021.

https://www.statisticssolutions.com/manova-analysis-pa

ired-sample-t-test/#:~:text=The%20paired%20sample%

20t%2Dtest,resulting%20in%20pairs%20of%20observa

tions

Comparison of Financial Literacy for Micro, Small and Medium Enterprises Entrepreneurs at Bojong Soang upon using Financial Planning

Application "SAKA (peSAK Abdi)"

89