Financial Ratio to Predict the Growth Income: Study on

Infrastructure Companies Listed on IDX

Ghina Kencana Mulia and Vina Kholisa Dinuka

Managerial Accounting Department, Politeknik Negeri Batam, Batam City, Riau Province, Indonesia

Keywords: Current Ratio, Debt to Equity Ratio, Total Assets Turnover, Net Profit Margin, Profit Growth.

Abstract: This study aims to determine the effect of liquidity, solvency, activity, and profitability on profit growth in

infrastructure sector companies in Indonesia. Liquidity is measured by Current Ratio (CR), solvency is

measured by Debt-to-Equity Ratio (DER), activity is measured by Total Assets Turnover (TATO), and

profitability is measured by Net Profit Margin (NPM). This study uses secondary data with data collection

techniques using financial statements of infrastructure sector companies listed on the Indonesia Stock

Exchange from 2014-2018. The purposive sampling method, obtained several 25 companies that fulfill the

criteria with a total population of 80 companies, so that the total sample of observation for five years was 125

samples. Testing is assisted by the EViews 9 program using panel data regression analysis. The result shows

that Total Assets Turnover has a significant positive effect on profit growth. While there is no significant

positive impact between current ratio into income growth. This study also found that the Debt-to-Equity Ratio

and Net Profit Margin have no significant adverse effect on profit growth in infrastructure sector companies.

1 INTRODUCTION

The increasingly growing competition in the business

world encourages business actors to carry out

company management to be more professional. One

thing that can be done is to increase the value of a

company’s success by making profit growth a

benchmark. The exposure to profit growth from the

results of the resource performance process for a

period can be reflected in the financial statements

(Manurung & Silalahi).

Financial reports are addressed to two objects,

namely internal parties, and external parties.

Management and the ranks of managers are included

in the targeted internal parties, while investors,

creditors, the government, and employees are

included in external parties. From the investor's point

of view, the financial statements can be further

processed through a comparison process and trend

analysis with other companies in the same field. The

financial statements can be used as consideration for

determining investment policies for their investments

for favorable prospects.

Nugroho, Nurdiansyah, and Erviana (2017) in

their research mention that profit growth is a potential

factor assessed by investors in determining the

success of managing a company. Predicting future

earnings can be done through financial ratio analysis.

The ratios used are Current Ratio, Debt to Equity

Ratio, Total Assets Turnover, Net Profit Margin.

Current Ratio works by appealing current assets

and current liabilities, so that the higher the current

assets, the higher the level of liquidity, meaning that

the company can pay off its short-term debt before

maturity (Mardiyanto, 2009).

Debt to Equity Ratio is part of the solvency ratio

which refers to the calculation of how much debt is

used to fund the company's capital (Salju, Dahri &

Rosmayanti, 2018). DER shows the percentage of the

company's health, if the ratio value obtained is high,

it is likely that the company runs at the expense of

creditors.

Total Assets Turnover is a ratio that calculates the

company's cability to effectively empower all

resources owned by the company. For company

owners and creditors, this ratio is useful to show the

amount of income that has increased due to the

efficient and productive use of fixed assets (Chariri &

Ghozali, 2003).

Net Profit Margin is a profitability ratio that

measures the final result and knows the company's

capability to yield a higher net profit than sales. Net

Profit Margin is a ratio that can represent the

Mulia, G. and Dinuka, V.

Financial Ratio to Predict the Growth Income: Study on Infrastructure Companies Listed on IDX.

DOI: 10.5220/0010860300003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 19-25

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

19

company's wealth obtained from the net profit after

tax on sales.

Profit as a measure of profit earned based on the

difference in income and costs with a certain period

profit is used as a basis for investment guidelines,

dividend policies, and tax bases (Hanafi & Halim,

2005). The profit referred to in this study is profit

after tax, where the profit is the result of the residual

income obtained after deducting all expenses.

Although this study has been tested by previous

researchers, there are mixed and inconsistent results.

This is the reason why this research needs to be raised

and reviewed. This research is development research

from study entitled "Financial Ratio to Prediction the

Growth Income" (Nugroho, Nurdiansyah & Erviana,

2017). The sample used in this test is the

infrastructure, utilities, and transportation sectors.

The infrastructure sector was chosen as a sample

because this sector receives a lot of investment, and

the government has the policy to prioritize

development. As long as infrastructure is still a

government priority, investment in this sector will

continue to grow and increase (Mubarak, Hafidz,

2019). This information becomes an overview of the

infrastructure sector in the future, the selected sample

is the infrastructure, utilities and transportation

sectors listed on the IDX for the period 2015 to 2019.

Based on the background that has been described,

the researcher is interested in raising the title

"Financial Ratio Analysis to Predicting the

Growth Income".

2 THEORETICAL STUDY

2.1 Agency Theory

Jensen & Meckling (1976) explained that through this

theory it is stated that there is a separation of rights

and obligations between managers and shareholders.

Managers or management are called agents as parties

who are authorized by shareholders and have the

responsibility to manage all forms of activities in the

company and are expected to be able to maximize the

owner's profits.

Shareholders are called principals, which are

parties who provide facilities and funds to run the

company. To minimize conflicts between the

principal and the agent, an agreement was made in the

form of an employment contract. It is hoped that the

agent will be able to maximize the owner's profit. The

principal can provide a guarantee or award to

management as a form of satisfaction with the results

of the company's performance for commensurate

reciprocity.

2.2 Signaling Theory

Suteja (2012) explains how management should

give signals or codes to financial statement users

(principals) regarding the successes and failures of

management (agents). The transfer of information

from internal parties to external parties regarding the

company's financial status often provides a better

understanding of the company's prospects, there is an

opportunity for asymmetric information to be

provided between management and outsiders.

Good news that reaches the public will have an

impact on changes in security prices. Asymmetric

information reduction can be used as the solution for

increasing the company’s value. If management can

provide a clear signal and impress the public, it will

reduce the anxiety of external parties such as

investors and creditors regarding the uncertainty of

the company's prospects. The signal can be used as an

indication of prosperity to the owners or shareholders.

2.3 Literature Review

Salju, Dahri, & Romayanti (2018) conducted a study

with a sample of Distributor Prima Palopo using four

financial ratios namely DER, WCTA, TATO, and

NPM. After the testing process was carried out, the

results showed that partially the DER and NPM

variables had a positive influence, in contrast the

WCTA and TATO variables did not positively

impact.

Ifada & Puspitasari (2016) test whether financial

ratios can predict future earnings by using the

variables CR, DAR, TATO, GPM and NPM. The

results showed that the variables TATO, GPM, and

NPM had a significant and positive impact on income

growth.

Kurniawati (2016) found empirical evidence that

the variables of Fixed Assets Turnover (PAT) and

ROA have a positive influence that is in line with

changes in future earnings. The result of regression

coefficient, the Time Interest Earned (TIE) variable

has a negative effect. Manurung and Silalahi (2016)

conducted a similar study with a sample of

manufacturing companies from 2010 to 2013. The

results found in this study were that the TATO &

NPM variables had a significant positive impact on

forecasting the income rise.

Utami (2017) examines financial ratios that can be

used as benchmarks to predict profit growth with a

sample of LQ45 index companies in 2013-2016.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

20

From the results of the t-test used, the results show

that TATO and ROA have a partial effect on profit

increases, while DAR, CR and PER have no

significant effect on predicting earnings changes.

Suprapti, Qonita, & Hidayat (2019) examine the

analysis of financial performance in predicting

revenue growth. The examiner uses CR, TATO, and

ROA as the dependent variable in manufacturing

companies for the 2016-2017 period. Based on the

results obtained, only the CR and ROA variables have

a positive influence in predicting an increase in profit,

while the TATO variable has no effect in predicting

an increase in profit.

Baraja & Yosya (2018) examined consumption

sector companies listed on the IDX for the period

2014 to 2017 with the aim of research to determine

the effect of liquidity ratios, profitability, activity, and

solvency in changes in income. The finding proof that

only profitability ratios have an impact on profit

changes, this ratio is represented by NPM.

Andriyani (2015) has conducted tests on mining

companies which concluded that the four variables

studied influences on profit growth. The variables are

CR, DAR, TATO, and ROA. Partially, the variable

that has an influence on the increase in profit is ROA.

Prakarsa (2019) examines the predictions of

mining sector companies in the next five years. The

study was conducted using annual financial reports

from 2013 to 2015 using several financial ratios, such

as QR, DAR, DER, TATO, and Inventory Turnover.

The researcher obtained the results that partially QR,

DER and inventory turnover variables had a

significant effect on increasing profits.

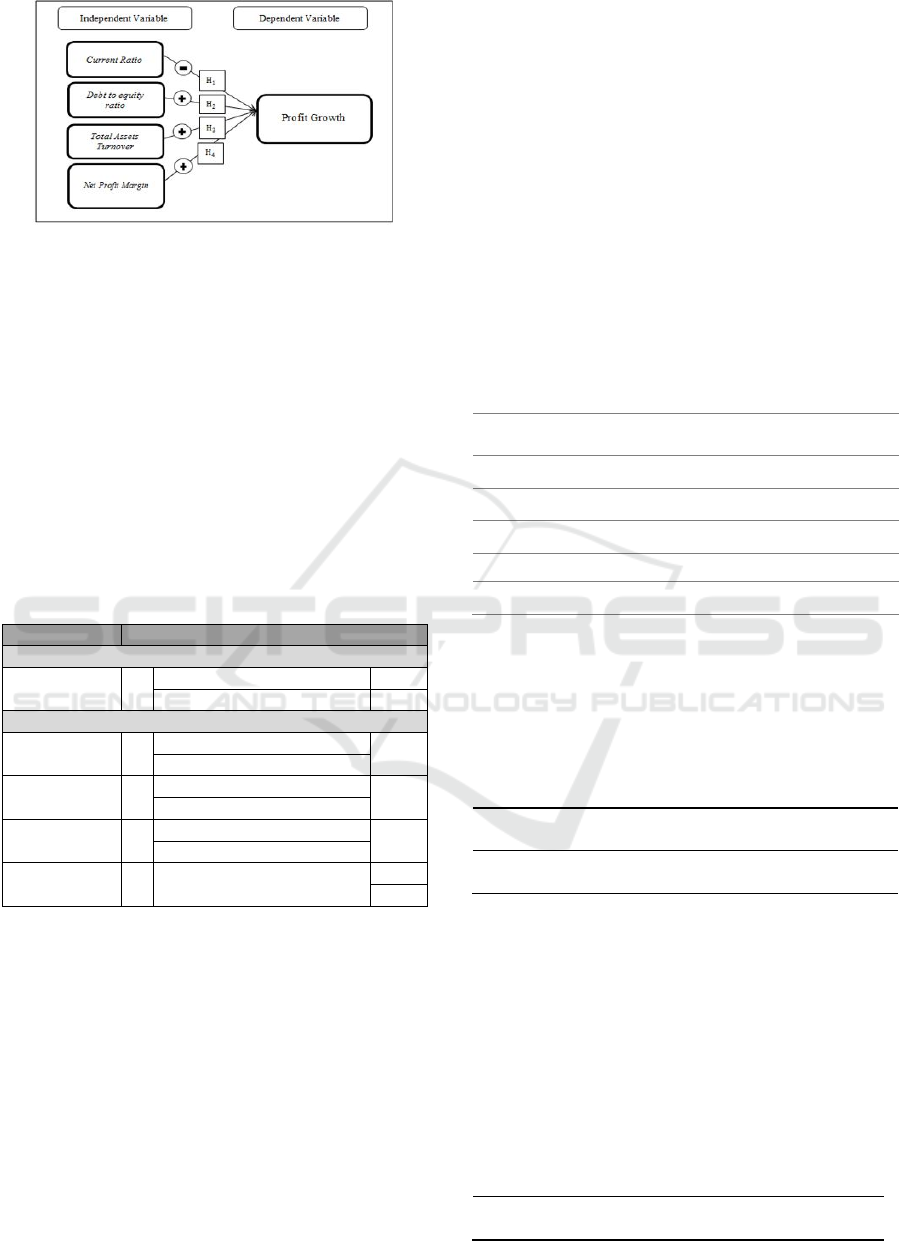

2.4 Hypothesis Development

2.4.1 Effect of Current Ratio on Profit

Growth

CR can describe whether current assets can pay off a

company's short-term debt. In other words CR can be

used as a value to measure the margin of safety in a

company (Kasmir, 2016). Research by Utami (2017)

states that the CR variable does not have a significant

impact on income growth. It proves that the

company's capability to complete short-term

obligations does not warrant the availability of capital

to help the operational activities of the firm. Based on

this statement, the hypotheses proposed from this

study are:

H1: Current Ratio has a negative effect on growth

2.4.2 Effect of Debt to Equity Ratio on

Profit Growth

DER is a ratio that can indicate a measure of the firm's

capital ability to pay off its debts. The measuring tool

for assessing this ratio is by comparing total debt to

capital (Kasmir, 2016). The research of Snow, Dahri

& Rosmayanti (2018) proof that DER has a positive

impact on profit growth. Nugroho, Nurdiansyah, and

Erviana (2017) also strengthen empirical evidence

that DER has a positive effect on profit growth. Based

on this statement, the hypotheses proposed from this

study are:

H2: Debt to Equity Ratio has a positive influence

on profit growth

2.4.3 Effect of Total Assets Turnover on

Profit Growth

TATO is a measuring tool to show the amount of

income that increases due to fixed assets. The higher

the value of the comparison of sales to assets, it means

the better the sales strategy or method used (Kasmir,

2016). In Utami's research (2017) it was found that

TATO has a positive effect on profit growth by

describing the level of efficiency in using all assets to

increase sales. Based on this statement, the

hypotheses proposed from this study are:

H3: Total Assets Turnover has a positive effect on

profit growth

2.4.4 Effect of Net Profit Margin on Profit

Growth

Companies with healthy financial conditions should

have a positive NPM value. This is because a positive

NPM value indicates the company has not suffered a

loss. NPM can show the high or low level of

profit/profit obtained by the company (Kasmir,

2016).

Baraja and Yosya (2018) state that the greater the

NPM value, the better because the company is

considered capable of achieving high enough income

and will have a positive effect on increasing profits.

Therefore, the fourth hypothesis is obtained as

follows:

H4: Net Profit Margin has a positive effect on

profit growth.

The research model can be seen in Figure 1:

Financial Ratio to Predict the Growth Income: Study on Infrastructure Companies Listed on IDX

21

Figure 1: Research Model.

3 RESEARCH METHOD

This study uses a quantitative approach which is a

type of structured, systematic, and planned research

that aims to prove how the influence between the

dependent variable and the independent variable is.

The independent variables used are financial ratios

represented by CR, DER, TATO, and NPM. While

the dependent variable used is profit growth.

Operational variables and their indicators can be seen

in table 1:

Table 1: Operational variables and indicator.

Variable Indicator

De

p

endent Variable

Profit

Growth

=

Sales-Cost of Sales

Total Assets

Independent Variable

CR =

Current Assets

Current Liabilities

DER =

Total Liabilities

E

q

uit

y

TATO

=

Sales

Total Sales

NPM

=

(Net Profit / Net Sales) x

100%

The population of this research is Indonesian

companies from the infrastructure, utility, and

transportation sector listed in the Indonesia Stock

Exchange which provides the annual reports. The

total population of 80 companies for five periods

from 2015 to 2019 was obtained from the

www.idx.co.id page.

This study is analyzed using the panel data

regression equation using E-Views 9 software. Data

analysis in this study uses descriptive statistical

analysis. The estimation model was determined using

the Chow test and Hausman test. The classical

assumption test used is the heteroscedasticity test and

multicollinearity test, and the hypothesis test is the

coefficient of determination, t test, and f test.

4 RESULT AND ANALYSIS

This research using listed infrastructure companies

during 2014-2018 with total 25 companies. This

amount is reduced by the criteria of the research

sample. The total sample for 2014-2018 that meets

the criteria is 25 companies or 125 data samples.

4.1 Descriptive Statistical Analysis

Below is a descriptive statistical analysis table:

Table 2: Descriptive statistical table.

Variable Mean Max Min Std.De

v

Y

-0.287 16.202 -16.040 2.878

CR

2.206 49.774 0.134 5.921

DER

4.599 370.574 -3.171 33.069

TATO

0.665 7.043 0.064 1.013

NPM

-0.023 0.772 -3.859 0.569

4.2 Model Selection

4.2.1 Chow Test

Table 3: Chow Test.

Effect Test

Statist

ic

d.f. Prob

Cross-section F

1.904

2

(24,96) 0.0149

Cross-Section Chi-

S

q

uare

48.67

05

24 0.0021

Based on table 3, the value of Prob. Cross-section

F is smaller than 5% alpha (0.0149 > 0,05), which

means the best estimation model is FEM.

4.2.2 Hausman Test

This test aims to determine the suitable model

between FEM or REM.

Table 4: Hausman Test.

Test Summary

Chi-Sq.

Statistic

Chi-

S

q

. d.f.

Prob.

Cross-section

rando

m

12.186036 4 0.016

ICAESS 2021 - The International Conference on Applied Economics and Social Science

22

Based on table 4, the cross-section value is

smaller than alpha 5% (0.016 < 0.05), which means

that the best estimation model is the FEM, because

the results of the Chow test and the Hausman test both

shows that the correct model is FEM, so it is no need

to do the next test, that is the Lagrange multiplier test.

4.3 Classic Assumption Test

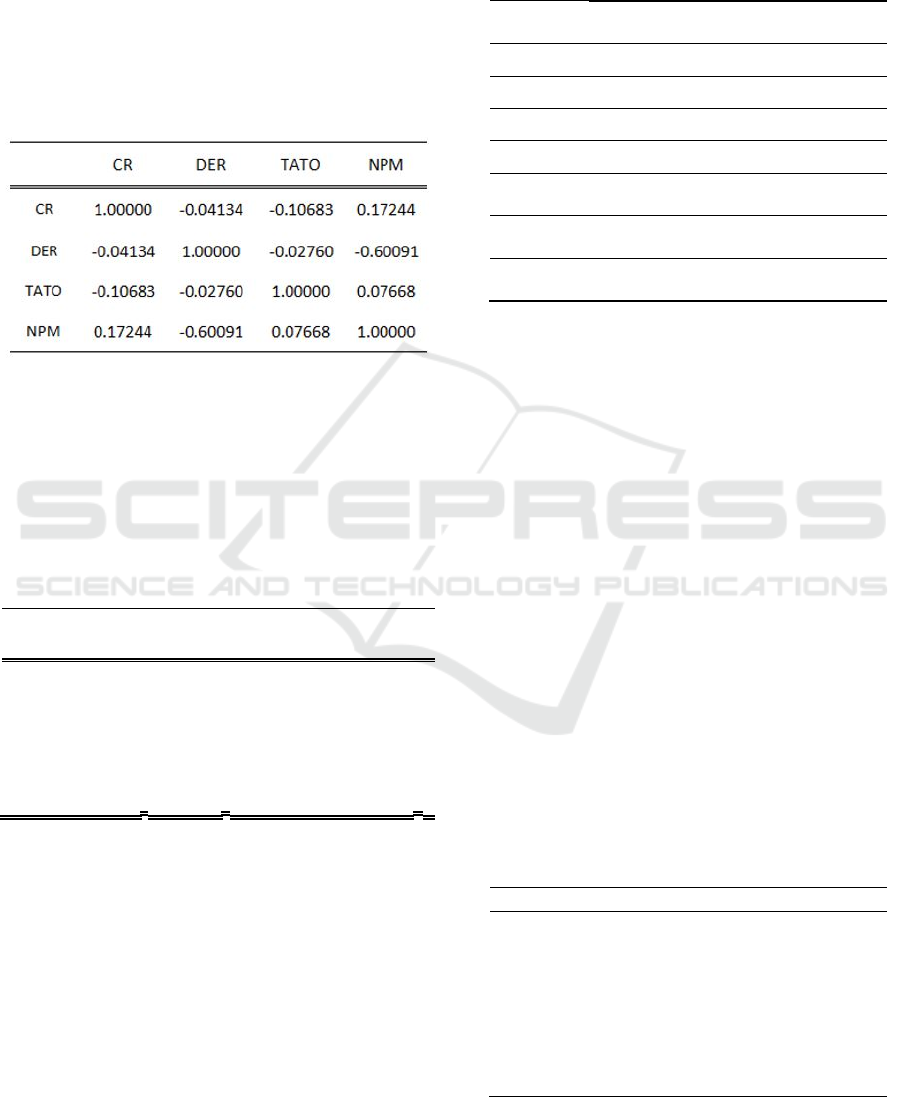

4.3.1 Multicollinearity Test

Figure 2: Multicollinearity Test.

The value of the correlation coefficient between

variables has a value less than 0.8. This indicates that

the data used in this test does not occur

multicollinearity.

4.3.2 Heteroscedasticity Test

Table 5: Heteroskedasticity Test: Glejser.

Heteroskedasticit

y

Test: Gle

j

se

r

F-statistic

0.127093

Prob. F (4,120)

0.9724

Obs*R-square

d

0.527322

Prob. Chi-Square

(

6)

0.9708

Scaled

explained SS

1.105051

Prob. Chi-Square

(

6)

0.8935

The table above shows that the value of Obs*R-

squared is 0.527322 and the p-value is 0.9708. Where

the value is > 0.05. It was concluded that the data did

not experience heteroscedasticity problems.

4.4 Hypothesis Test

Table 6 Hypothesis Test.

Variable Coefficient t-statistic Prob.

C -1.169389

-

2.822985 0.0058

CR 0.046117 0.857777 0.3932

DER -0.010601 -0.985471 0.3269

TATO 1.227272 2.713606 0.0079

NPM -0.586095 -0.742557 0.4596

Adjusted

R-Square

d

0.1342

Prob (F-

Statistic)

0.0324

Model

Result

Fixed

4.4.1 Coefficient of Determination

The Adjusted R-squared value in table 6 shows a

value of 0.1342 or the equivalent of 13.42%. This

value indicates that the amount of profit growth that

is influenced by CR, DER, TATO, and NPM is

13.42%. 886.58% of the remaining value is explained

by other variables not examined in this test.

4.4.2 F Test

The results of the F test with the dependent variable

of the Profit Growth can be seen in table 6. The

probability value (F-statistic) is 0.0324, this value is

smaller than the alpha level (5%). This means that it

can be said that CR, DER, TATO, and NPM

simultaneously affect Profit Growth.

4.5 Results Discussion

The following is a summary table of test results from

the study:

Table 7: Result Discussion.

Hypothesis Result

H1: Current Ratio has negative

effect on profit

g

rowth

Not

Supporte

d

H2: Debt to Equity Ratio has

p

ositive effect on profit

g

rowth

Not

Supporte

d

H3: Total Assets Turnover has

p

ositive effect on profit

g

rowth

Supported

H4: Net Profit Margin has

p

ositive effect on profit

g

rowth

Not

Supporte

d

Financial Ratio to Predict the Growth Income: Study on Infrastructure Companies Listed on IDX

23

4.5.1 Effect of Current Ratio on Profit

Growth

Judging from the results of statistical tests, H1 states

that the level of liquidity as measured by the CR

variable has a positive and insignificant direction on

profit growth, the test results do not support

hypothesis 1. In line with Utami's research (2017)

which explains that CR has no significant positive

impact on profit growth. It means that the company's

capability to complete short-term obligations does not

warrant the availability of capital to help the

operational activities of the firm, so that the profits to

be achieved are not as expected.

The results of this study are supported by

Andriyani (2015) who explains that CR does not have

a significant impact on profit growth, because the CR

value depends on the type of business firm, the faster

the company pays off short-term debt, the greater the

CR value obtained there are no special provisions that

can state the amount of CR value that is considered

good.

4.5.2 Effect of Debt-to-Equity Ratio on

Profit Growth

Based on the results of statistical tests, it is stated that

DER has a negative and insignificant direction on

profit growth, so the test results do not support

hypothesis 2. The company's reduced ability to

increase the level of productivity as a result of less-

than-optimal asset financing and will have an impact

on the company's declining income level.

The results of a similar study by Baraja & Yosya

(2018) explain that DER does not have a significant

negative effect on profit growth, this variable is

declared to have no effect because if the capital used

comes from debt, the greater the burden that must be

borne by the company. A high equity value will

reduce the negative impact of declining profits,

because the DER measurement uses the equity value

as a divisor.

4.5.3 Effect of Total Assets Turnover Ratio

on Profit Growth

Based on the finding of this research, it is stated that

the TATO variable has a positive and significant

direction on profit growth, so it can be concluded that

hypothesis 3 is supported. The TATO value has a

significant effect because the company can use its

assets effectively. The relatively small tariffs and

other costs in the infrastructure industry can support

high sales levels.

In line with research by Utami (2017) which

reveals that TATO has a significant positive impact

on profit growth, the TATO variable assumes that the

firm's asset turnover is very effective in generating

profits, where if the company produces a faster asset

turnover rate, the profit earned will rise. This is

because the firm can take benefit from assets for sales

increasing which has an impact on increasing profits.

4.5.4 Effect of Net Profit Margin on Profit

Growth

Based on the finding of this research, it is shown that

NPM has a negative and insignificant direction on the

dependent variable, so the test results do not support

hypothesis 4. The NPM value that does not have a

negative impact on profit growth is due to the average

value of NPM in the infrastructure industry during the

research period only around the number -0.023. The

unstable and fluctuating NPM value cannot affect

profit growth because the change in profit value tends

to be stable.

The results of this study are supported by Yanti

(2017), where in theory a healthy company has a

positive NPM value which indicates that the company

does not suffer losses, but a low NPM value can occur

because the profit from sales obtained by the

company cannot cover operating expenses and high

tax rates. imposed.

5 CONCLUSION

Based on the results of the tests and discussions that

have been described, conclusions can be drawn

regarding the effect of liquidity ratios, solvency,

activity and profitability on listed infrastructure,

transportation, and utilities sector companies on IDX

from 2014 to 2018. The independent variables used in

this study are Current Ratio (CR), Debt to Equity

Ratio (DER), Total Assets Turnover (TATO), and

Net Profit Margin (NPM). The dependent variable

used in this study is profit growth. The test results

show that only the TATO variable influences profit

growth, while the CR, DER, and NPM variables have

no effect on predicting profit growth.

The results of this study support agency theory,

which requires shareholder trust in management.

Management is expected to achieve the company's

goal of achieving the highest profitability by

maintaining the company's financial health.

Management can control the good use of assets to

help the company achieve maximum profit. Control

of all assets can be seen through the TATO ratio,

ICAESS 2021 - The International Conference on Applied Economics and Social Science

24

where this ratio shows the level of efficiency of the

company in using all assets. So that good asset control

is needed in infrastructure sector companies.

The application of signal theory in this sector can

be seen from all companies listed in the infrastructure

sector which display the number of Sales and Total

assets in the annual financial statements for each

period. Information obtained that the average value of

TATO in the infrastructure sector shows a value of

0.665. This value is less than 1, where net sales from

the infrastructure sector are not able to cover total

assets. The minimum value of asset utilization in the

infrastructure industry is 0.064 or not less than 0, this

indicates that all infrastructure sector companies use

less debt than assets to generate sales. Good

management performance can be seen from the

ability to sell assets which is getting higher. The more

effective the management in managing its assets, the

better the level of efficiency in the use of assets to

support sales.

REFERENCES

Andriyani, I. (2015). Pengaruh Rasio Keuangan Terhadap

Pertumbuhan Laba pada Perusahaan Pertambangan

yang Terdaftar di BEI. Jurnal Manajemen dan Bisnis

Sriwijaya, 343-358.

Baraja, L., & Yosya, E. A. (2018). The Impact of Liquidity,

Profitability, Activity and Solvency Ratio on Change in

Earnings. Indonesian Managemen and Accounting

Research, 1-17.

Chariri, & Ghozali, I. (2003). Teori Akuntansi. Semarang:

BP UNDIP.

Ghozali, I. (2016). Aplikasi Analisis Multivariate Program

IBM SPSS 23 (8 ed.). Semarang: UNDIP.

Hanafi, M., & Halim, A. (2005). Analisis Laporan

Keuangan, edisi kedua. Jakarta: PT. Raja Grafindo

Persada.

Ifada, L. M., & Puspitasari, T. (2016). Analisis Pengaruh

Rasio Keuangan Terhadap Perubahan Laba. Jurnal

Akuntansi & Auditing, 97-108.

Jensen, & Meckling. (1976). Theory of The Firm:

Managerial Behavior, Agency Cost and Ownership

Structure. Journal of Financial Economics, 305-360.

Kasmir. (2016). Analisis Laporan Keuangan. Jakarta: Raja

Grafindo Persada.

Manurung, C. S., & Silalahi, E. R. (2016). Analisis Rasio

Keuangan Dalam Memprediksi Perubahan Laba pada

Perusahaan Manufaktur Yang Terdaftar di BEI. Jurnal

Riset Akuntansi dan Keuangan, 35-62.

Mardiyanto, H. (2009). Inti Sari Manajemen Keuangan.

Jakarta: Grasindo.

Mubarak , Hafidz;. (2019, 07 30). Beritagar.id. Retrieved 4

28, 2020, from Beritagar.id:

https://market.bisnis.com/read/20191029/189/1164253

/indeks-sektor-properti-dan-infrastruktur-melaju-

simak-rekomendasi-mnc-sekuritas

Nugroho, E. S., Nurdiansyah, D. H., & Erviana, N. (2017).

Financial Ratio to Predicting the Growth Income.

International Review of Management and Marketing,

77-84.

Prakarsa, R. B. (2019). EFFECT OF FINANCIAL RATIO

ANALYSIS ON PROFIT GROWTH IN. e-Jurnal

Apresiasi Ekonomi, 90-94.

Salju, Dahri, & Rosmayanti. (2018). Penggunaan Rasio

Keuangan dalam Memprediksi Pertumbuhan Laba pada

Distributor Prima Palopo. Equilibrium, 70-89.

Suprapti, E., Qonita, & Hidayat, A. (2019). Analysis of

Financial Performance in Predicting Earning Growth .

Journal of Accounting and Strategic Finance, 70-81.

Suteja. (2012). Manajemen Keuangan Perusahaan, Edisi 1.

Bandung: Medio.

Utami, W. B. (2017). Analysis of Current Ratio Changes

Effect, Asset Ratio Debt, Total Asset Turnover, Return

On Asset, And Price Earning Ratio In Predictinggrowth

Income By Considering Corporate Size In The

Company Joined In Lq45 Index Year 2013 -2016.

International Journal of Economics, Business and

Accounting Research (IJEBAR, 25-37.

Yanti, N. S. (2017). Dampak Kinerja Keuangan Terhadap

Pertumbuhan Laba (Studi Kasus pada Perusahaan

Makanan dan Minuman yang Terdaftar di Bursa Efek

Indonesia Tahun 2010-2016). Jurnal Ekonomi dan

Bisnis Dharma Andalas, 220-234.

Financial Ratio to Predict the Growth Income: Study on Infrastructure Companies Listed on IDX

25