Effect of Working Capital Management on Profitability of

Manufacturing Companies Listed on the IDX

Septriyani and Seto Sulaksono Adi Wibowo

Managerial Accounting Study Program, Politeknik Negeri Batam, Indonesia

Keywords: Working Capital Management, Profitability, Gross Operating Income.

Abstract: This study aims to determine the effect of WCM on the profitability of Indonesia’s listed manufacturing firms

for 2015-2019. This study has one dependent variable, namely profitability which is measured by GOI and

has an independent variable, namely WCM, which is measured by ICP, RCP, APP, and CCC. This study also

has two control variables, firm size and leverage. The sampling technique used the purposive sampling

method. Data is obtained from the annual reports of 86 companies. The data analysis technique is panel data

regression analysis with the E-views 9 software. The results of the study found that ICP, RCP, APP, and CCC

have a significant effect on profitability.

1 INTRODUCTION

Along with the times and technological

developments, every year, manufacturing companies

also experience effects and improvements. One of the

things that make economic growth also increases is

caused by the role of the manufacturing company

itself (Syafitri & Adi Wibowo, 2016). Along with the

increase in company growth, competition between

companies is also getting tighter.

Every company certainly needs funds, to be able to

finance all the company's needs, both for operational

activities or for long-term investment. This fund is

known as working capital. If you run out of working

capital, the company will certainly not be able to run

well. Setyanto & Permatasari (2014), in their

research, states that Working Capital Management

(WCM) includes Inventory, Accounts Receivables,

Accounts Payables, and Cash Conversion Cycle.

WCM needs to be appropiately managed, because

WCM is a financial component required to carry out

company activities or operations based on plans and

policies that have been set by it. Mistakes in

managing WCM can slow down the company's

performance and even cause the company to stop

operating and make its business fail.

CCC is defined as the cash flow starting from cash

disbursement to cashback (receivables paid) and can

be calculated by adding the RCP and ICP then

deducting the APP (Mamduh, 2008). Inventory

Conversion Period (ICP) is the time for a company to

process the inventory until the products can be sold.

This ICP needs to be considered because to determine

how long it takes the company to spend stock in its

production process.

Receivables Conversion Period (RCP) is the time for

the company to collect its receivables into cash.

Receivables occur when the sale is made, but the

company has not yet received it as cash. Thus, the use

of accounts receivable is expected to increase profits

and sales.

Accounts Payable Period (APP) is the time for the

company to purchase the inventories, labor, and

payments (Brigham & Houston, 2006). If debt

payments are delayed, the additional capital owned

can be used for other purposes. The level of debt,

which is an element of liability for the company, is

also an important thing that must be considered in

financing and managing working capital. Apart from

managing working capital properly, there are other

important things that companies must do, namely

maintaining and increasing profitability.

Profitability is the primary goal of every business, a

service, trading, or manufacturing company. Every

company must maintain its profitability properly so

that investors are interested in investing because

investors will usually see and analyze the company’s

profitability first before deciding to invest. In

Indonesia, the contribution of the manufacturing

sector plays a significant role in its economic growth.

Researchers hope that analyzing the effect of WCM

126

Septriyani, . and Sulaksono Adi Wibowo, S.

Effect of Working Capital Management on Profitability of Manufacturing Companies Listed on the IDX.

DOI: 10.5220/0010861700003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 126-131

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

will provide an overview and suggestions for the

company to managing working capital.

2 THEORETICAL STUDY

2.1 Pecking Order Theory

Mayers & Majluf (1984) explained that in this theory,

companies tend to use minimal risk funding sources.

This theory also suggests that in managing to fund,

companies will tend to choose internal financing first.

The use of external funds determined if internal

financing is insufficient.

2.2 Agency Theory

Jensen & Meckling (1976) explained that agency

theory is an agreement in which a principal gives

orders to the agent and is entrusted with making the

right decision for the principal. If both of them have

the same goals in increasing the firm valuation, then

it is believed that the agent has acted in the principal’s

interests.

2.3 Cash Conversion Cycle Theory

Richards & Laughlin (1980) explain how firms can

ensure short CCC to reduce the implications of poor

working capital management. Thus, it measures the

time between purchasing a company's inventory and

receiving cash from its accounts receivable.

2.4 Literature Review

Based on previous research, Jin-Yap (2017)

examined the effect of WCM on profitability in

companies in Vietnam. Independent variables use

WCM, which is proxied by ICP, RCP, APP, and

CCC. FS, sales growth, and debt were used as control

variables. Meanwhile, profitability is proxied through

GOI (Gross Operating Income). The results show that

ICP, ARP, APP, and CCC have a significant effect on

profitability.

Ng, Ye, Ong, & Teh (2017) examined the effect of

WCM. Independent variables use WCM, which is

proxied by ICP, RCP, APP, and CCC. GOI is used as

the dependent variable. The results show that ICP,

ARP, APP, and CCC have a significant effect on

profitability.

Le (2018) examines the effect of WCM on firm value,

profitability, and risk. It uses NWC and CCC as

independent variables. ROI is used as the dependent

variable. As a result, there is a negative relationship

between NWC and firm value, profitability, and risk.

The results of this study suggest that in managing

working capital, managers must make objective

considerations for profitability and risk control.

Kwatiah & Asiamah (2020) examined the effect of

WCM on manufacturing companies in Ghana. WCM

is proxied through ICP, RCP, APP, and CCC as

independent variables. The control variables are

Current Ratio, Current Assets, Firm Size, and

Leverage. Meanwhile, the dependent variables are

ROA and ROE. The results show that ICP, ARP,

APP, CCC, Current Ratio, Current Assets, and Firm

Size have a positive effect on ROA and ROE.

Meanwhile, leverage has a negative impact on ROA

and ROE.

2.5 Hypothesis Development

2.5.1 Effect of Inventory Conversion Period

on Profitability

ICP is the period used to process raw material until

the product is finished and can be sold. The longer the

ICP, the costs will be increase the company's

operational costs. If the company's operating costs are

high, it will reduce profitability. Therefore, to reduce

costs arising from excess inventory, a low ICP level

is needed (Brigham & Houston, 2006).

H1: Inventory Conversion Period has a significant

effect on profitability

2.5.2 Effect of Receivable Collection Period

on Profitability

RCP is the time a company takes to convert

receivables into cash. Receivables arise because of a

sale, but the company has not yet received it as cash.

So that the use of receivables is expected to increase

profits, but there are other risks arise in the form of

unpaid receivables. RCP is calculated by dividing the

number of receivables by the number of sales and

then multiplying by 365 days (Deloof, 2003).

H2: Receivable Collection Period has a significant

effect on profitability

2.5.3 Effect of Accounts Payable Period on

Profitability

APP calculates the number of days it will take to pay

its suppliers. It is calculated by dividing the accounts

payable by the cost of sales, and then multiplying by

Effect of Working Capital Management on Profitability of Manufacturing Companies Listed on the IDX

127

365 days (Deloof, 2003). The results of previous

research (Chowdhury, Alam, Sultana, & Hamid,

2018) explain that APP has a significant effect on

profitability.

H3: Accounts Payable Period has a significant

effect on profitability

2.5.4 Effect of Cash Conversion Cycle on

Profitability

CCC is a calculation to determine the period when the

company makes payments and receives cash.

Increased profit can be obtained if the company

shortens the conversion cycle.

H4: Cash Conversion Cycle has a significant effect

on profitability

H5: Inventory Conversion Period, Receivable

Collection Period, Accounts Payable Period, and

Cash Conversion Cycle is having a simultan

impact on profitability

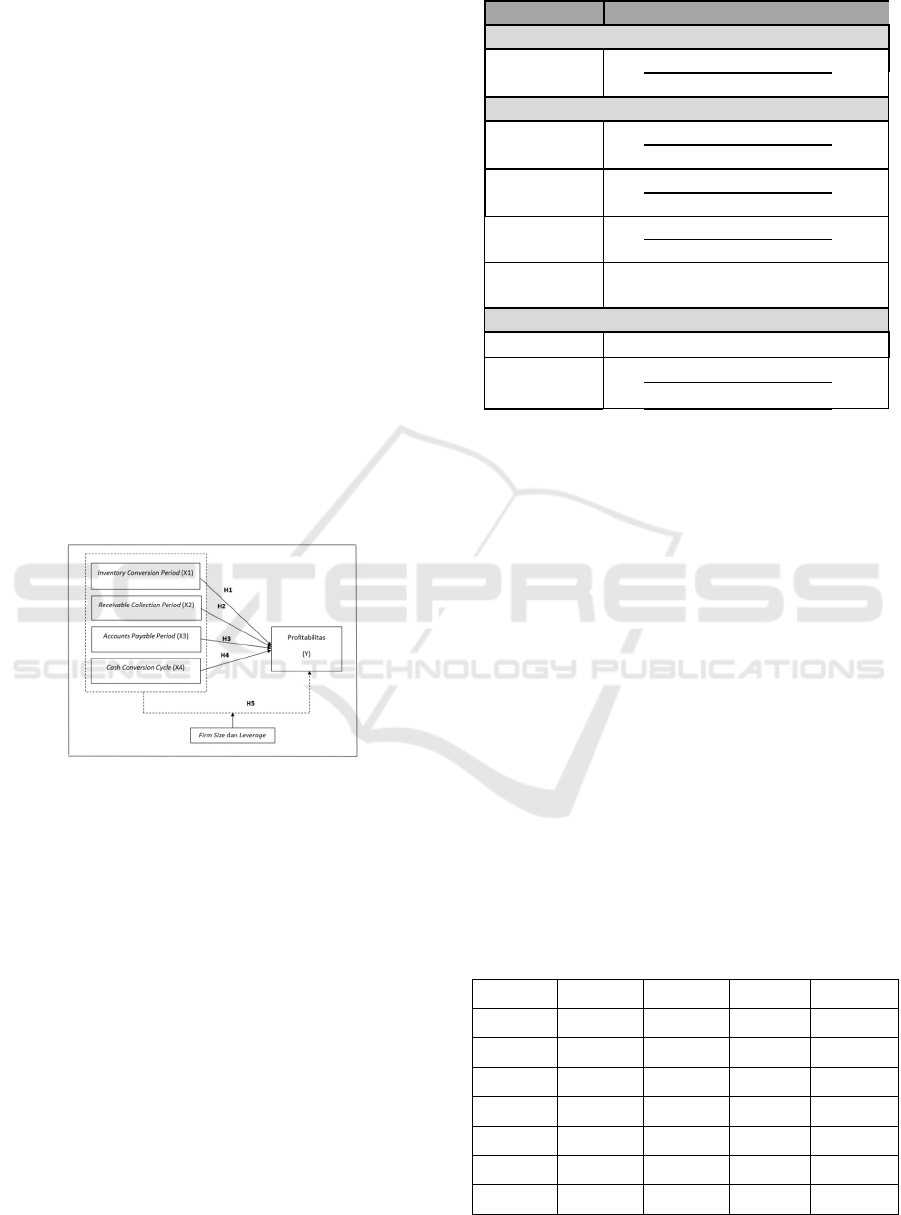

The research model can be seen in Figure 1:

Figure 1: Research Model.

3 RESEARCH METHOD

This study uses a quantitative approach which is a

type of structured, systematic, and planned research

aimed at proving how the influence between the

dependent variable and the independent variable is.

The independent variable used is the working capital

management is represented by the ICP, RCP, APP,

and CCC. The dependent variable used is profitability

which is measured by GOI. The operational variables

and indicators can be seen in table 1:

Table 1: Operational variables and indicator.

Variable Indicator

Dependent Variable

GOI =

Sales-Cost of Sales

Total Assets

Independent Variable

ICP =

Inventory

X

365

Cost of Sales

RCP =

Accounts Receivable

X

365

Sales

APP =

Accounts Payable

X

365

Cost of Sales

CCC = ICP+RCP-APP

Control Variables

FS = Ln Total Sales

LEV =

Long Term Debt

Total Assets

The object in this study is the financial statements of

manufacturing companies for 2015-2019 listed on the

IDX. The data analysis technique used panel data

regression analysis using E-Views 9 software.

Descriptive statistical analysis will be used in this

study. Determination of the estimation model using

the Chow test and Hausman test. The classical

assumption test were used in this study is the

multicollinearity and heteroscedasticity test.

4 RESULT

The population data used in this study are

manufacturing companies listed on the IDX from

2015 to 2019, with 86 companies. This amount is

reduced by the criteria of the research sample. The

total sample for 2015-2019 that meets the

requirements is 86 companies or 430 data samples.

4.1 Descriptive Statistical Analysis

Table 2: Descriptive statistical table.

Variable Mean Max Min Std.Dev

GOI

24.98030 94.40000 -4.71000 17.50968

ICP 114.5353 387.8100 12.12000 71.07829

RCP 67.93681 300.3500 9.200000 4470.256

APP 47.80144 182.2100 -4.71000 28.65895

CCC 134.6705 520.3600 12.12000 91.93375

FS 14.43579 18.49000 9.200000 1.479053

LEV 15.41570 212.8600 0. 66000 18.08306

ICAESS 2021 - The International Conference on Applied Economics and Social Science

128

4.2 Classic Assumption Test

4.2.1 Multicollinearity Test

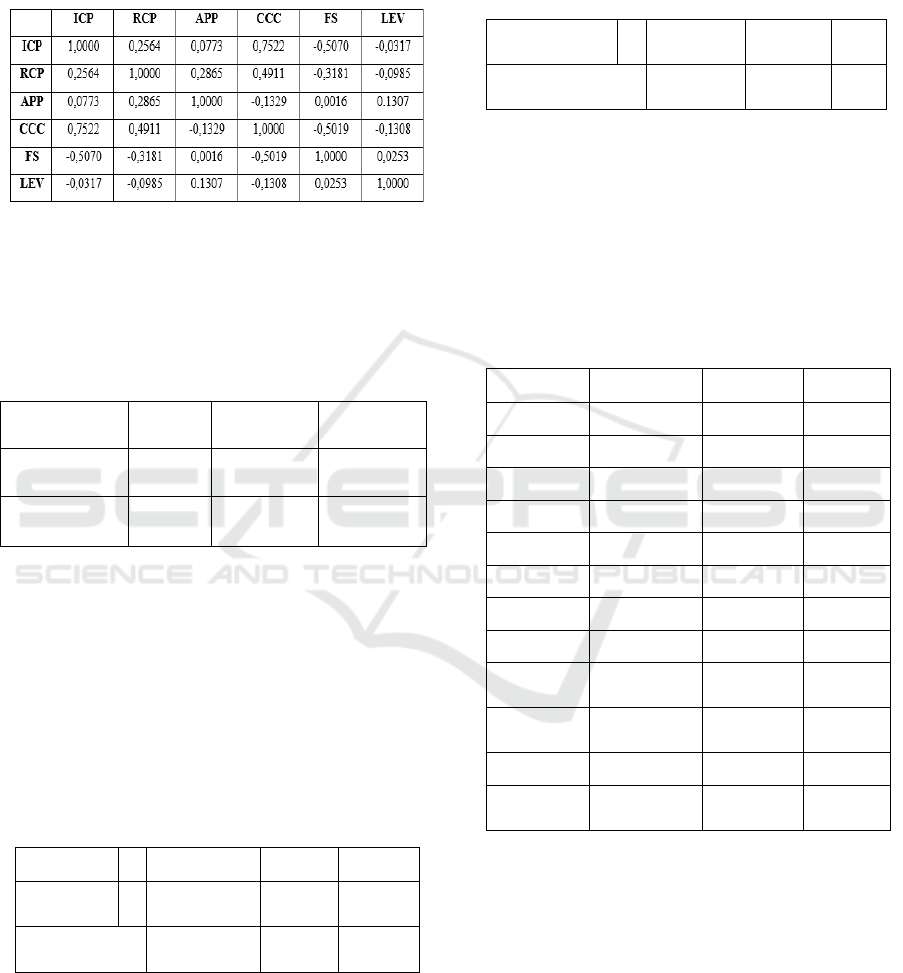

Table 3: Multicollinearity test.

The value of the correlation coefficient between

variables has a value below 0.8. This shows that the

data in this study does not have multicollinearity

problems.

4.2.2 Heteroscedasticity Test

Table 4: Heteroscedasticity test.

Heteroscedasticity test in this study using the Glejser

test. Obs *R-Squared is 10.1664, and the probability

is 0.1178, which is > of (5%). This indicates that the

data does not have heteroscedasticity problems.

4.3 Model Selection

4.3.1 Chow Test

This test aims to see whether the FEM or CEM.

Table 5: Chow Test.

Effect Test Statistic d.f. Prob

Cross-

section F

37.84328 (85,338

)

0.00000

Cross-Section

Chi-Square

1011.7788 85 0.00000

Prob. Cross-section F is greater than 5% alpha (0.000

> 0.05), which means that the best estimation model

is Fix Effect Model.

4.3.2 Hausman Test

This test aims to determine the suitable model

between FEM or REM.

Table 6: Hausman Test.

Test Summary Chi-Sq.

Statistic

Chi-Sq.

d.f.

Pro

b.

Cross-section

random

12.595621 6 0.04

99

Based on table 6, the cross-section value is smaller

than alpha 5% (0.0499 < 0.05), which means that the

best estimation model is the FEM, because the results

of the test both show that the correct model is FEM,

so it is no need to do the next test, that is the Lagrange

multiplier test.

4.4 Panel Data Regression Analysis

Table 7: Fixed Effect Model.

Variable Coefficient t-statistic Prob.

C -15,15280 -0,642977 0,5207

ICP -119,7704 -2,097767 0,0367

RCP -119,7177 -2,096778 0,0368

APP 119,6675 2,095988 0,0368

CCC 119,6884 2,096265 0,0368

FS 3,627146 2,250003 0,0251

LEV 0,011572 0,384364 0,7010

R-Squared

0.907

Adjusted

R-Squared

0.8822

Prob (F-

Statistic)

0.00000

N 75

Model

Result

Fixed

The following equation can be obtained:

GOIt = -15,1528 – 119,7704ICPt –

119,7177RCPt + 119,6675APPt + 119,6884CCCt +

3,6271FSt + 0,0115LEVt

4.5 Coefficient of Determination

The Adjusted R-squared value in table 7 shows a

value of 0.8822. The meaning of the dependent

variable in the form of GOI is influenced by

independent variables and control variables (ICP,

RCP, APP, CCC, FS, and LEV) by 88% (0.8822).

F-Statistic 1.7072 Prob F.

(3.71)

0.1177

Obs*R-

squared

10.1664 Prob. Chi-

Square(3)

0.1178

Scaled

explained SS

14.0872 Prob. Chi-

Square(3)

0.0287

Effect of Working Capital Management on Profitability of Manufacturing Companies Listed on the IDX

129

4.6 F Test

Results of the F test with the dependent variable GOI

can be shown in table 7. The probability value (F-

statistic) is 0.000003. The value is smaller than the

alpha level (5%). It means that ICP, RCP, APP, and

CCC simultaneously affect on GOI.

4.7 Data Analysis

The following is a summary table of test results from

this study:

Table 8: Summary of test result

Hypothesis Result

H1: Inventory Conversion Period

has a significant effect on

profitability

Supported

H2: Receivable Collection Period

has a significant effect on

profitability

Supported

H3: Accounts Payable Period has

a significant effect on

profitability

Supported

H4: Cash Conversion Cycle has a

significant effect on profitability

Supported

H5: Inventory Conversion Period,

Receivable Collection Period,

Accounts Payable Period, dan

Cash Conversion Cycle has

simultaneously effect on

profitability

Supported

4.7.1 Effect of Inventory Conversion Period

on Profitability

The statistical tests show that the ICP has a significant

effect on firm’s profit. The coefficient is -119.7704,

which means that the ICP negatively affects

profitability. Jin-Yap (2017) and Berg (2016)

supported these studies. This indicates that the longer

the ICP, the company's profitability will decrease,

because the longer the period required to convert

inventory to cash, the longer the company receives

money which will be used as working capital funds.

Where if the ICP is low, it will increase profitability.

A low ICP indicates that the company carries out the

process of producing and selling goods for a short

period so that there are no idle items in the warehouse.

4.7.2 Effect of Receivable Collection Period

on Profitability

The statistical tests show that RCP has a significant

affects profitability. The coefficient is -119.7177,

which means that RCP negatively effect the

profitability. Jin-Yap (2017) and Berg (2016) explain

that improving the efficiency of RCP can increase a

firm’s profit. Berg (2016) examines the effect of

WCM on companies in Norway. The independent

variable uses RCP. That shows the longer the period

for receiving accounts receivable, the company's

profitability will decrease. The longer it takes to

convert receivables into cash, it means that the more

likely the supplier company will not pay its accounts

payable.

4.7.3 Effect of Accounts Payable Period on

Profitability

The statistical tests show that APP has a significant

effect on profitability. The coefficient value is

119.6675. The results of this study are supported by

research by Ng, Ye, Ong, & Teh, (2017) and Afrifa,

Tauringana, & Tingbani (2015). Therefore, the

company is expected to know the effective WCM,

especially determining the debt deferral period. If the

debt deferral period can be appropriately managed,

then the company can maximize the profit earned.

However, the deferral period is relative, depending on

the type of industry of each company.

4.7.4 Effect of Cash Conversion Cycle on

Profitability

The statistical tests show that the CCC has a

significant effect on profitability. The coefficient

value is 119.6675, which means that the CCC has a

positive impact. The results of this study are

supported by Ng, Ye, Ong, & Teh, (2017) and Afrifa,

Tauringana, & Tingbani (2015). The findings

regarding CCC contradict with studies by Jin-Yap

(2017) and Berg (2016). According to Deloof (2003),

this difference is also due to the CCC, which is

influenced by several factors such as the ICP, RCP,

and APP. Thus, there is a difference between the size

of the CCC of each company.

5 CONCLUSION

The study has explored the relationship between

WCM and the profitability of Indonesian

manufacturing firms. It finds that ICP, RCP, APP,

ICAESS 2021 - The International Conference on Applied Economics and Social Science

130

and CCC have a significant effect on a firm’s profit.

This study suggests that ICP and RCP can increase

firms’ profitability by improving the efficiency of

collecting account receivables and managing the

inventories. This study also suggests that extending

the APP may be regarded as an attractive source of

financing. Firms can reserve working capital by

delaying the payment to suppliers for increased

profitability, but this must be managed properly

because if the company delays debt for too long, it

will generate interest.

REFERENCES

Afrifa, G. A., Tauringana, V., & Tingbani, I. (2015).

Working capital management and performance of listed

SMEs. Journal of Small Business & Entrepreneurship.

Berg, H. L. (2016). Working capital management: evidence

from Norway. International Journal of Managerial

Finance, Vol. 12 Iss 3.

Brigham, E. F., & Ehrhardt, M. C. (2017). Financial

Management: Theory and Practice 15th Edition.

Boston – United State of America: 20 Channel Center

Street.

Chowdhury, A. Y., Alam, M. Z., Sultana, S., & Hamid, M.

K. (2018). Impact of Working Capital Management on

Profitability: A Case Study on Pharmaceutical

Companies of Bangladesh. Journal of Economics,

Business and Management, Vol. 6, No. 1.

Deloof, M. (2003). Does Working Capital Management

Affect Profitability of Belgian Firms? Journal of

Business Finance & Accounting, Vol. 30(3) & (4),

0306-686X.

Ghozali, I. (2012). Aplikasi Analisis Multivariate Dengan

Program SPSS. Semarang: Badan Penerbit Universitas

Diponegoro.

Jensen, M. C., & Meckling, W. H. (1976). Theory of The

Firm: Managerial Behavior, Agency Costs and

Ownership Structure. Journal of Financial Economics,

Vol. 3 No. 4, pp. 305-360.

Jin-Yap, H. T. (2017). How Does Working Capital

Management Affect the Profitability of Vietnamese

Small and Medium Sized Enterprises? Journal of Small

Business and Enterprise Development, Vol. 24 Iss 1.

Kwatiah, K. A., & Asiamah, M. (2020). Working Capital

Management and Profitability of Listed Manufacturing

Firms in Ghana. International Journal of Productivity

and Peformance Management.

Le, B. (2018). Working capital management and firm’s

valuation, profitability and risk: Evidence from a

developing market . International Journal of

Managerial Finance.

Mamduh, M. H. (2008). Manajemen Keuangan Edisi 1.

Yogyakarta: BPFE.

Mayers, S. C., & Majluf, N. S. (1984). Corporate Financing

and Investment Decisions When Firms Have

Information That Investors Do Not Have. Journal of

Financial Economics 13, 187-221.

Ng, S. H., Ye, C., Ong, T. S., & Teh, B. H. (2017). The

Impact of Working Capital Management on Firm’s

Profitability: Evidence from Malaysian Listed

Manufacturing Firms. International Journal of

Economics and Financial Issues, Vol. 7(3), 662-670.

Richards, V. D., & Laughlin, E. J. (1980). A Cash

Conversion Cycle Approach to Liquidity Analysis.

Financial Management, Vol. 9 No. 1, pp. 32-38.

Setyanto, A. D., & Permatasari, I. (2014). Manajemen

Modal Kerja Dan Dampaknya Terhadap Nilai

Perusahaan Dengan Corporate Governance Sebagai

Variabel Pemoderasi. Akrual: Jurnal Akuntansi, 66-82.

Syafitri, R. A., & Adi Wibowo, S. S. ( 2016). Pengaruh

Komponen Modal Kerja Terhadap Profitabilitas

Perusahaan Manufaktur Yang Terdaftar Di BEI. Jurnal

Akuntansi, Ekonomi dan Manajemen Bisnis, Vol. 4, No.

1.

Effect of Working Capital Management on Profitability of Manufacturing Companies Listed on the IDX

131