Investment Gallery: Improving Students’ Interests

through Activities and Knowledge

Albert Ignatius Saragih

and Dwi Kartikasari

Department of Business Administration, Politeknik Negeri Batam, Jl A Yani, Batam, Indonesia

Keywords: Investment Gallery, Activities, Knowledge, Interests, Capital Market, Stock Exchange, Students

Abstract: The literacy level regarding the capital market is generally low in Indonesia; thus investment galleries are set

up to increase public awareness, interests, and participation since the early stage of student investors. This

study aims to prove whether activities done by the investment gallery and the knowledge about the capital

market impact students’ interests in learning and investing in the Indonesian Stock Exchange. Socialization,

training, and competition operate as proxies for activities. Knowledge about the capital market, the investment

gallery, and education serve as proxies for knowledge. While desire, awareness, and taking time to study

investing function as proxies for students’ interests summing up to nine indicators of three variables. The

research uses a quantitative approach by implementing multiple linear regression analysis using IBM SPSS

Statistics 22. The sample totaled 213 students of Politeknik Negeri Batam who attended any activity attributed

to the investment gallery selected using a proportionate sampling technique. The authors verified that the test

was valid and reliable. They also confirmed that the relationship between variables met the classical

assumption tests, including multicollinearity, heteroscedasticity, and normality. The results of this study

indicate that both the activities variable and the knowledge factor have a significant positive effect on

investment interest, either partially or simultaneously. Therefore, investment galleries are proven to improve

student investors’ interests in participating in the capital market through their activities and knowledge sharing.

1 INTRODUCTION

The level of literacy regarding the capital market is

generally low in Indonesia. There is less than thirty

percent of Indonesia’s population who understand

financial products and services. Furthermore, those

who understand the capital market are less than five

percent, and those who invest in it are even more

shockingly low at just around 0.4 percent. When the

last number compared to that of neighboring

countries, it is 12.8 percent in Malaysia, 30 percent in

Singapore, and 13.7 percent in China (Thamrin,

2019). Thus, investment galleries are set up to

increase public awareness, interests, and participation

since the early stage of student investors at campuses

across Indonesia.

People work not only to make money but also to

be rich. Some said that the rich get richer because of

her mindset. The rich always have the principle that

money works for her so that she does not need to work

to make money anymore. Take one of the most

expensive stocks in Indonesia, namely BCA Bank

(BBCA), whose shares are owned by the wealthiest

persons in Indonesia. They have been rich for a long

time that was why they could afford to buy the stocks.

Still, they kept on being the wealthiest by maintaining

their investment in the capital market where their

secured and profitable stocks and mutual funds return

their investment.

According to Kamus Besar Bahasa Indonesia

(Indonesian Dictionary), stocks indicate our shares in

a company. Indonesia, as a developing country and

the fourth most populous country in the world, has a

myriad of potential investments like those offered by

the capital market. The latter is no longer a strange

thing to hear, but the distrust and unawareness make

it secluded. Mr. Joko Widodo, as the President of the

Republic of Indonesia, always promoted investment

and stock exchange in previous years through

newspapers and media so that people feel more secure

in investing.

Investment galleries around the country are

obliged to promote the capital market in their settings.

The investment gallery (IG) of Politeknik Negeri

Batam (Polibatam – Batam State Polytechnic) is no

exception. The IG constantly promotes and

250

Ignatius Saragih, A. and Kartikasari, D.

Investment Gallery: Improving Students’ Interests through Activities and Knowledge.

DOI: 10.5220/0010862200003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 250-255

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

introduces the basic to stocks 101 to Polibatam

students via its activities to ignite interest in investing

in the capital market. Students’ participation in the IG

programs is voluntary. Various financial products and

services are offered by the capital market for

investors to choose and make profits, either short or

long-term investment, depending on the style of the

investor.

Although students are not interested in investing

in the capital market, the IG still serve its purposes to

improve the financial literacy of students by

introducing them to the stock market trading

simulations and games that are proven to improve

their overall grades substantially (Harter & Harter,

2010; Smith & Gibbs, 2019). The IG holds many

education programs to make sure the student

investors are ready to invest in the capital market

reasonably once they want to get in. Studies have

shown that student investors are at risk of being

unreasonable as well as irrational to some extent

(Ray, 2009; Sairafi et al., 2008). That is why the IG

comes into play.

The IG, in cooperation with students in a study

group of capital market (Kelompok Studi Pasar

Modal - KSPM), organizes many webinars to

socialize and educate the public especially fellow

students about the advantages of the capital market.

This study did not target KSPM members only but

also students who took Finance course and used the

IG services to complete their course. This kind of

event gave students knowledge and stimulated

students to open investments account and start

becoming investor (Badriatin et al., 2021). However,

this study was not backed up empirically in a

quantitative approach; thus the finding of this study is

not applicable and not be generalized to other

contexts. Therefore, the study about an investment

gallery in our paper attempts to fill this gap.

Activities conducted by an investment gallery are

confirmed to provoke the students’ interest in

investing in the capital market (Purboyo et al., 2019).

Nonetheless, this paper only speaks about sharia

investments. Hence, our paper seeks to extend

previous research by expanding the scope of

investments to not only sharia but also conventional

stocks.

The knowledge that students have about the

capital market and the investment gallery is validated

to drive the students’ interests (Supriyanto et al.,

2019). But the latter study talks about students on its

campus only. Thus, our research makes an effort to

broaden the applicability and transferability of

previous research across different settings.

2 RESEARCH METHODS

2.1 Research Design

This paper uses a quantitative method with an

explanatory approach. The authors seek for a causal

relationship between activities and knowledge

variables to students’ interests in the investment

gallery of Politeknik Negeri Batam. A questionnaire

is distributed to samples, and data collected are

analyzed by implementing multiple linear regression

analysis using IBM SPSS Statistics 22.

2.2 Population and Samples

In this study, the population is the students of faculty

of Management and Business at Batam State

Polytechnic who attended any activity attributed to

the investment gallery by 2019, totaling 978 students.

The authors picked samples using a proportionate

sampling technique, where samples are taken from

each study program proportionately according to

population distribution. Sample number is

determined according to Isaac dan Michael formula

using a table for known population (N) up to 1000 and

confidence level of 10 percent leading to 213 samples

(Sugiyono, 2017).

2.3 Hypotheses and Framework

Activities conducted by an investment gallery

provoke the students’ interest in investing in the

capital market (Purboyo et al., 2019). Theoretically,

the AIDA model states that awareness and or

attention leads to interests (Hadiyati, 2016). The aim

of marketing is always to raise awareness and or

attract attention, then increase the consumer’s interest

and desire to act (purchase). When students

understand more deeply about the capital market

through activities held by the investment gallery, they

feel more interested in investing. Thus, the following

hypothesis is set:

H1: Activities done by the investment gallery affect

students’ interests in investing in the capital market.

The knowledge that students have drives the

students’ interests (Supriyanto et al., 2019). In

modern marketing theory, the AIDA model claims

that awareness leads to interests (Hadiyati, 2016).

When students know more broadly about the capital

market, they are more interested in investing. Thus,

the following hypothesis is set:

H2: Knowledge owned by students affects students’

interests in investing in the capital market.

Investment Gallery: Improving Students’ Interests through Activities and Knowledge

251

Simultaneously, both variables influence

students’ interests in investing (Hadiyati, 2016;

Purboyo et al., 2019; Supriyanto et al., 2019) as set

by the following hypothesis:

H3: Activities and knowledge affect students’

interests in investing in the capital market.

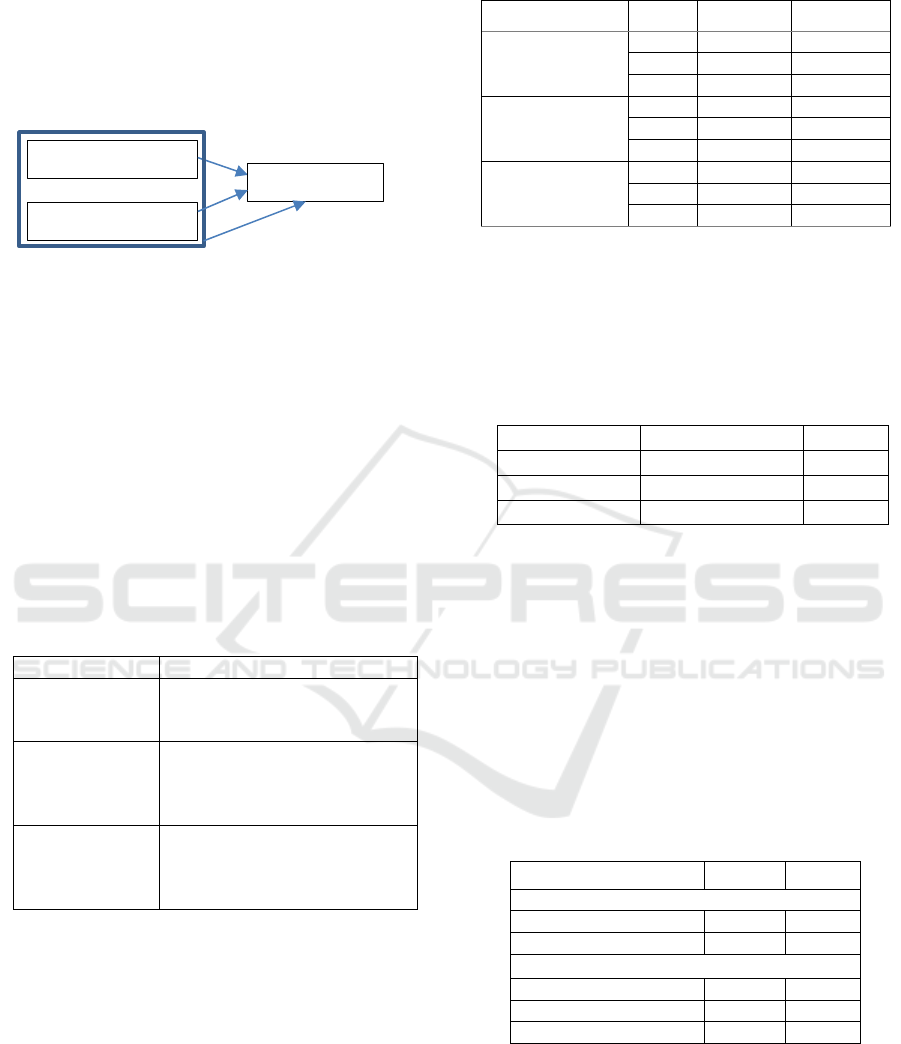

Figure 1: Research Framework

Figure 1 depicts the framework of this research

where the three hypotheses are related to one another.

2.4 Research Instrument

The authors use a questionnaire to collect data by

giving a written statement or set of questions to

respondents to be answered (Sugiyono, 2014). In this

paper, the authors use several closed statements

where the respondents answer whether they strongly

agree (4 scores), agree (3 scores), disagree (2 scores),

or strongly disagree (1 score), also known as the

Likert scale.

Table 1: Operationalization

Variable Dimension

Activity

(Purboyo et al.,

2019

)

X1.1 Socialization

X1.2 Training

X1.3 Com

p

etition

Knowledge

(Supriyanto et

al., 2019)

Knowledge about:

X2.1 The capital market

X2.2 The investment gallery

X2.3 Education progra

m

Interests

(Purboyo et al.,

2019; Supriyanto

et al., 2019)

X3.1 Desire

X3.2 Awareness

X3.3 Taking time to study

investing

3 RESULTS AND DISCUSSIONS

3.1 Validity and Reliability

The authors verified that the test was valid and

reliable, as shown in table 2 and table 3 below.

Table 2: Validity Test Results

Variable Item Pearson r Remarks

Activity (X1) X1.1 0.796 Vali

d

X1.2 0.729 Vali

d

X1.3 0.784 Vali

d

Knowledge (X2) X2.1 0.801 Vali

d

X2.2 0.780 Vali

d

X2.3 0.771 Vali

d

Interests (Y) Y.1 0.786 Vali

d

Y.2 0.805 Vali

d

Y.3 0.787 Vali

d

The value of Pearson r of all items or indicators is

greater than the r table of 0.1345; thus we can claim

that all statements are valid to be used as a measuring

instrument. While the reliability test results are

demonstrated in table 3 below.

Table 3: Reliability Test Results

Variable Alpha Cronbach Remarks

Activity (X1) 0.656 Reliable

Knowledge (X2) 0.684 Reliable

Interests (Y) 0.704 Reliable

Table 3 shows that all variables have Alpha

Cronbach values greater than 0.600 so that all

variables are declared reliable.

3.2 Respondent Profile

The sample in this study is dominated by female and

managerial accounting study program. This

distribution seems reflective of the actual proportion

of students in business and management that are

primarily women and majoring in accounting, as

detailed in table 4 below.

Table 4: Respondent Profile

Cate

g

or

y

Numbe

r

Percent

Stud

y

p

ro

g

ra

m

Managerial accounting 116 54

Business administration 97 46

Gende

r

Male 35 16

Female 178 84

Total 213 100

3.3 Classical Assumptions

The author confirmed that the relationship between

variables met the classical assumption tests, including

multicollinearity and normality as exposed in table 5,

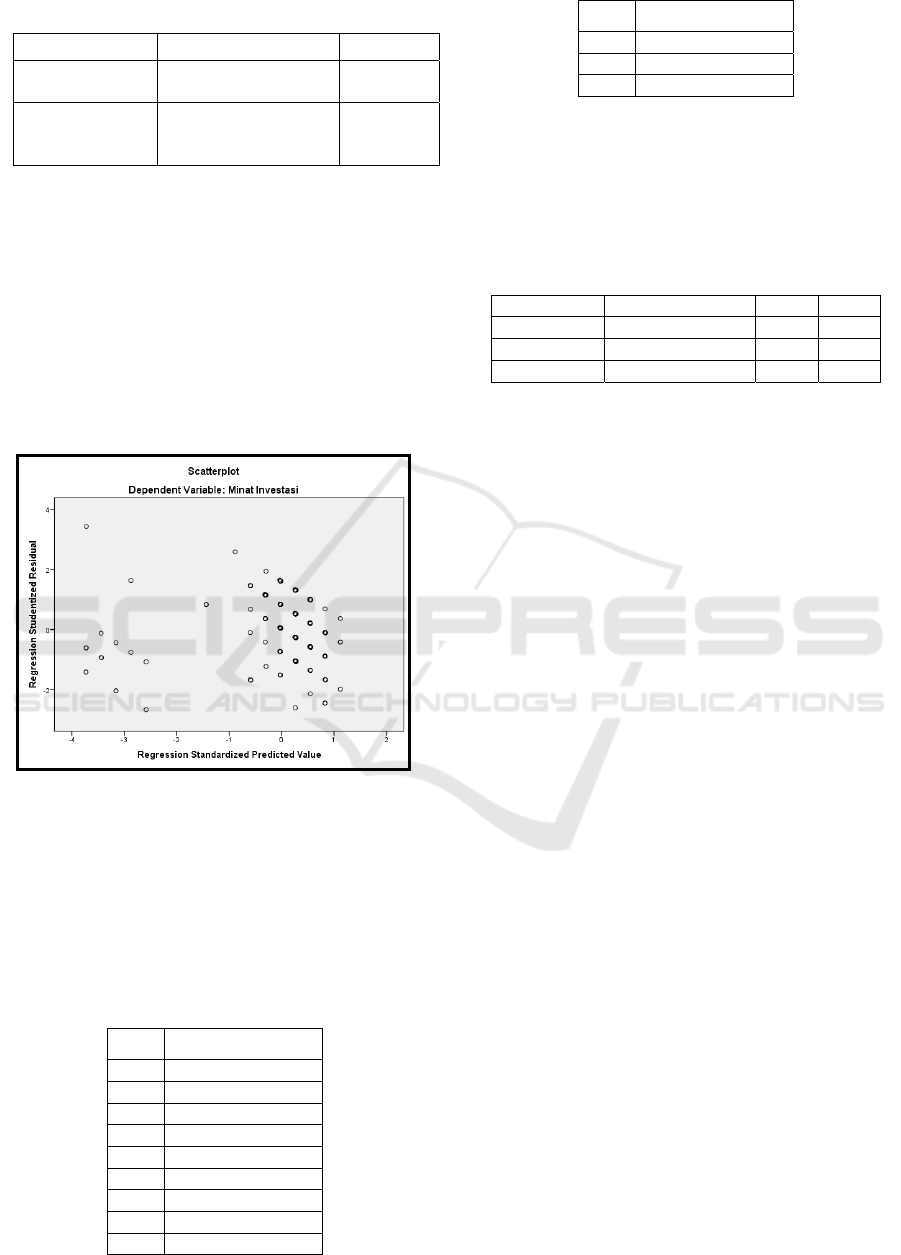

as well as heteroscedasticity as in Figure 1 below.

Activities (X1)

H1

Interests (Y)

H2

Knowledge (X2)

H3

ICAESS 2021 - The International Conference on Applied Economics and Social Science

252

Table 5: Classical Assumptions Test Results

Test Indicator Remarks

Multicollinearity Tolerance 0.488, VIF

2.050

Not

detecte

d

Normality Kolmogorov-Smirnov

Asymp. Sig. (2-

tailed) 0.232

Not

detected

Based on the table above, it can be seen that since

tolerance values > 0.1 and VIF <10, then no

symptoms of multicollinearity problems are detected

in the regression model in this study. Likewise, the

data is claimed as normally distributed because the

significance value of the data is 0.232, which is

greater than 0.05. Meanwhile, figure 1 below reveals

that there are no specific patterns in the scatterplot

graph, so it can be said that no symptoms of

heteroscedasticity problems in the regression model

in this study.

Figure 2: Heteroscedasticity Test (scatterplot) Results

3.4 Descriptive Statistics

Table 6 below shows that the activity variable (X1)

captures the most awareness to students at 3.41, with

socialization activity (X1.1) being the highest value

at 3.46.

Table 6: Descriptive Statistics

Item Mean (out of 4.00)

X1.1 3.46

X1.2 3.41

X1.3 3.36

X1 3.41

X2.1 3.31

X2.2 3.27

X2.3 3.28

X2 3.28

Y.1 3.32

Item Mean (out of 4.00)

Y.2 3.34

Y.3 3.30

Y 3.32

3.5 Hypotheses Testing

Table 7 below shows that partially activity variable

(X1) or knowledge variable (X2) affect students’

interests in a statistically significantly manner.

Table 7: Partial Regression Results

Model Unstandardized B t Sig

Constant 1.960 3.835 0.000

Activit

y

* 0.394 6.053 0.000

Knowled

g

e* 0.404 5.931 0.000

* Statistically significant

The t threshold value of 1.971 is found in the

table for df (degree of freedom) equals (213-2) =

(211) with a significance level of α = 5%. Table 7

indicates that activity (X1) amounted to 6.053> t

tabel

1.97 and sig value of 0.00 <0.05; hence H1 is

confirmed, and it can be stated that the activity (X1)

has a partially positive effect on the investment

interest variable. While the value of t

knowledge

(X2) is 5.931 > t

tabel

1.97 and sig value of 0.00 < 0.05

hence H2 is confirmed and it can be stated that the

knowledge (X2) has a partially positive effect on the

investment interest variable.

Based on the simultaneous F test, SPSS results in

the value F at 126.259 with a sig value of 0.000 while

the F threshold with 5% significance

was 3.04.

Because the value of F 126,259 > 3.04 and sig value

of 0.00 < 0.05 hence H3 is confirmed and it can be

stated that both variables of the activity (X1) and the

knowledge (X2) have a simultaneously significant

positive effect on the investment interest variable.

3.6 Discussions

This research affirms previous studies (Hadiyati,

2016; Purboyo et al., 2019; Supriyanto et al., 2019),

proving that awareness that stimulated by variables

of activity and knowledge significantly influences

students’ interests. However, this study extends the

context from a previously sharia environment to a

more generalized setting. Furthermore, this study

enriches literature in a way that it finds the

simultaneous significant positive effect of these two

factors (H3) on students’ interests especially given

the fact that the two reference studies did not test this

hypothesis and only tested separate effects.

Investment Gallery: Improving Students’ Interests through Activities and Knowledge

253

Provided the consistency of this finding with

previous researches, this study implies that it is

imperative for managers of investment galleries

across Indonesia to pay great attention to plan

successful activities to stimulate students’ interests

and further sales in the capital market’s products and

services. It is evident that students appreciate

updated and relevant socialization about the products

and services. The student investors tend to accept

services from the capital market once they are

introduced by their fellow in the investment gallery;

hence the capital market and Indonesia Stock

Exchange should collaborate strongly with the

investment gallery in each campus. All institutions

should work hand in hand to build a good reputation

and respectable opinions of the capital market’s

products and services among potential investors.

Future studies might find disparities of outcome

where they might be caused by differences in the

respondents’ culture that result in distinct behavior.

Activities vary in different campuses and regions.

For example, socialization, training, and competition

exist in Politeknik Negeri Batam, but might not in

other campuses. Hence this study calls for researches

in diverse settings in the future.

4 CONCLUSIONS

This research affirms previous studies proving that

activities held by the investment gallery, including

socialization, training, and competition positively

associated with students investors’ interests.

Likewise, knowledge owned by student investors

about the capital market, the investment gallery, and

education program positively affect student

investors’ interests. Last but not least, both variables

of activity and knowledge simultaneously impact

students’ interests.

It is important to note that this study extends the

context from the previously sharia setting.

Furthermore, this study enriches literature in a way

that it finds the simultaneous significant positive

effect of these two factors of activity and knowledge

on students’ interest given the fact that past studies

only tested separate effects.

Provided the consistency of this finding with

previous researches, this study implies that it is

imperative for managers of investment galleries

across Indonesia to pay great attention to plan

successful activities to stimulate students’ interests

and further sales in the capital market’s products and

services. It is obvious that students appreciate

updated and relevant socialization about the products

and services. The student investors tend to accept

services from the capital market once they are

introduced by their fellow in the investment gallery;

hence the capital market and Indonesia Stock

Exchange should collaborate strongly with the

investment gallery in each campus. All institutions

should work hand in hand to build a good reputation

and respectable opinions of the capital market’s

products and services among potential investors.

Future studies might find disparities of outcome

where they might be caused by differences in the

respondents’ culture that result in distinct behavior.

Activities vary in different campuses and regions.

For example, socialization, training, and competition

exist in Politeknik Negeri Batam, but might not in

other campuses. Hence this study calls for researches

in diverse settings in the future.

REFERENCES

Badriatin, T., Setiawan, I. A., & Rahayu, S. T. (2021).

Webinar Event about Capital Market Intellectuals in the

Digital Age, as a Form of Socialization, Education and

Scientific Understanding of the Capital Market. Journal

of Character Education Society, 4(2), 514–521.

Hadiyati, E. (2016). Study of Marketing Mix and Aida

Model to Purchasing on Line Product in Indonesia.

British Journal of Marketing Studies, 4(7), 49–62.

http://www.eajournals.org/wp-content/uploads/Study-

of-Marketing-Mix-and-Aida-Model-to-Purchasing-

On-Line-Product-in-Indonesia.pdf

Harter, C., & Harter, J. F. R. (2010). Is Financial Literacy

Improved by Participating in a Stock Market Game?

Journal for Economic Educators, 10(1), 21–32.

Purboyo, Zulfikar, R., & Wicaksono, T. (2019). Pengaruh

Aktivitas Galeri Investasi, Modal Minimal Investasi,

Persepsi Risiko, dan Persepsi Return terhadap Minat

Investasi Saham Syariah. Jurnal Wawasan Manajemen

(Universitas Lambung Mangkurat), 7(2), 136–150.

Ray, K. K. (2009). Investment Behavior and the Indian

Stock Market Crash 2008: An Empirical Study of

Student Investors. IUP Journal of Behavioral Finance,

6(3/4), 41–66.

Sairafi, K., Selleby, K., & Stahl, T. (2008). Behavioral

Finance: The Student Investor. Jonkoping International

Business School, March.

Smith, C. M., & Gibbs, S. C. (2019). Stock market trading

simulations: Assessing the impact on student learning.

Journal of Education for Business, 95(4), 234–241.

https://doi.org/10.1080/08832323.2019.1643279

Sugiyono. (2014). Metode Penelitian Pendidikan

Pendekatan Kuantitatif, Kualitatif dan R&D. Bandung:

Alfabeta.

Sugiyono. (2017). Metode Penelian Kuantitatif, Kualitatif

dan R&D. Bandung: CV. Alfabeta.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

254

Supriyanto, R. G. E., Andayani, E., & Arsy, A. F. Al.

(2019). Pengaruh Preferensi Resiko, Literasi Ekonomi,

Pengetahuan Galeri Investasi terhadap Minat Investasi

Mahasiswa Fakultas Ekonomika dan Bisnis. Jurnal

Riset Pendidikan Ekonomi, 4(1), 1–7.

Thamrin, H. (2019). Socialization and Training on

Implementation of Investment Selection Strategies.

ICCD, 2(1), 528–532.

https://doi.org/10.33068/iccd.Vol2.Iss1.261

Investment Gallery: Improving Students’ Interests through Activities and Knowledge

255