The Effect of Tax Administration, Tax Knowledge and Tax Sanctions

on Taxpayer Compliance

Annisyah Aprillia

1

and Dwi Kartika Sari

2

1

Business Management Major, Batam State Polytechnic, Indonesia

2

Business Administration Study Program, Batam State Polytechnic, Indonesia

Keywords: Tax Administration, Tax Knowledge, Sanctions Taxation, Individual Taxpayer Compliance.

Abstract: This study aims to identify and analyze whether the effect of tax administration, tax knowledge and sanctions

taxation to compliance of individual taxpayers. The method of this thesis is the research instrument test,

classic assumption test, multiple linier regression test and hypothesis testing. Independent variables in this

study are tax administration, knowledge of taxation and tax sanctions, while the dependent variable is the

individual taxpayer compliance. The number of population in this study is not known how many individual

taxpayers are registered using a sample from Paul Leedy obtained 139 people as a sample. The type of data

used is primary data. The results of this study prove that simultaneously tax administration, knowledge of

taxation and tax sanctions have an effect on individual taxpayer compliance. Partially, the variables of tax

administration and tax sanctions have an effect on individual taxpayer compliance. Meanwhile, tax knowledge

has no effect on individual taxpayer compliance.

1 INTRODUCTION

Duty income is perhaps the most elevated supporter

of state incomes which will then, at that point be

utilized for all state interests, for example,

government financing and framework advancement.

Expense income keeps on encountering an

unprecedented increment, this is clear from the 2018

income information gathered as much as 1,618.1 T

and in 2019 it expanded by 10.4%.

Hence, the Directorate General of Taxes (DGT)

keeps on searching for approaches to advance

potential assessment incomes for the state depository,

numerous things are being done and one of them is

the duty change program. there are 5 reasons why

assessment change should be done, in particular: (1)

the low degree of citizen consistence; (2) The expense

income target builds each year; (3) the quantity of HR

isn't corresponding to the increment in the quantity of

citizens, hardships in oversight and law requirement;

(4) The advancement of the computerized economy

and mechanical advancement is exceptionally fast;

(5) Rules that expect the improvement of exchange

exchanges.

This duty organization change program and action

has been completed for quite a while, in particular in

1983 which has the accompanying attributes: (1)

hierarchical design of capacities, (2) Through the

foundation of a client delegate and grievance place

for every citizen recharging administration to oblige

obligatory protests. charges (Rahayu, 2010).

Citizens who don't consent will affect tax

avoidance, tax avoidance, sneaking and carelessness,

bringing about a lessening in public assessment

income (Budhiningtias and Bimantara, 2017). That is

the reason resident consistency is a significant part for

the remainder of the world.

Consistency is where residents satisfy their every

responsibility and exercise their right of judgment

(Rahayu, 2010). Simultaneously, as indicated by the

choice of the priest of money 544/KMK.04/2000

consistence is a demonstration of the citizen in

satisfying his duty commitments as per the

arrangements of the enactment and expense execution

guidelines in power in a country.

In research directed by Clement Olatunji Olaoye,

Abiodun Rafiat Ayeni-Agbaje, Abiola Peter Alaran-

Ajewole (2017), Natrah Saad (2014), Damajanti and

Karim (2017), Ompusunggu (2015) their examination

shows charge information influences citizen

consistence decidedly.

Different investigations directed by Khuzaimah

and Hermawan (2018), Halawa and Saragih (2017) in

Aprillia, A. and Sari, D.

The Effect of Tax Administration, Tax Knowledge and Tax Sanctions on Taxpayer Compliance.

DOI: 10.5220/0010936800003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 149-154

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

149

their investigation show that assessment authorizes

significantly influence charge consistency.

Thinking about the above premise, the specialist

will lead an examination named "The Influence of

Tax Administration, Tax Knowledge and Tax

Sanctions on Individual Taxpayer Compliance."

2 LITERATURE REVIEW

2.1 Tax

As indicated by Mardiasmo (2013:1) Taxes are

responsibilities made by people to the state and seen

from the law, are coercive and don't get

correspondence that is felt to be direct and can be

applied to meet all state needs. Furthermore, in light

of the overall arrangements and tax collection

systems in the KUP Law Number 28 of 2007 Article

1 Paragraph 1 assessment implies it is compulsory to

partake locally, the two people or elements to the state

and it is upheld as indicated by the law of backhanded

pay, and is utilized to address the issues of the local

area. individuals' flourishing.

2.2 Tax Administration

As indicated by Olaoye, Ayeni-Agbaje, and Alaran-

Ajewole (2017:133) charge organization is a strategy

or system made with the goal that citizens complete

their commitments to the public authority. The duty

organization is straightforwardly taken care of by the

directorate general of tax collection to be evaluated,

gathered and observed its encouraging as per the set

up charge laws and guidelines. There are 5 (five)

pointers of assessment organization, in particular: (1)

Law; (2) Public Administration; (3) Sociology; (4)

Psychology; (5) Economics.

2.3 Tax Knowledge

Information is extremely significant for citizens to

satisfy their commitments, particularly information

about charges. A citizen can be supposed to be loyal

in the event that he can know what his commitments

are. On the off chance that the citizen doesn't know

about the rudiments of tax collection, it will be hard

for him to enlist himself, round out a warning letter

(SPT), not realize how much duty he should pay and

store the assessment (Rahayu, 2010).

As per Rosyida (2018) there are 3 (three) pointers

of authoritative responsibility, to be specific as

follows: (1) Understanding the duty work; (2)

Taxpayer's information on charge guidelines; (3)

Knowing the expense rate and methods for making

good on charges.

2.4 Tax Sanctions

As demonstrated by the entire lawful course of action

and rules, charge sanctions are utilized as an

assurance to be consented to/agreed. Then again in

various terms as an obstruction with the point that

residents don't manhandle the standards of tolls

(Mardiasmo, 2013).

As per the arrangements of Article 7, Article 28 of

the 2007 KUP, if the Taxpayer doesn't present the Tax

Return (SPT) inside the predefined time limit, and as

far as possible agrees with the arrangements of

Article 3, passage 3, and Article 3, section 4 of the

Law on charge sanctions, executed, the General

Regulation of Taxation Number 28 of 2007 which

peruses as follows:

1. For period notification letters, the latest deadline

is the 20th (twentieth) day after the end of the

tax period.

2. For individual annual tax returns, the deadline is

3 (three) months after the end of the tax year.

3. For corporate tax annual notification, the

deadline is 4 (four) months after the end of the

tax year.

The indicators of tax sanctions are (1)

administrative sanctions and (2) criminal sanctions.

2.5 Tax Compliance

As per the Big Indonesian Online Dictionary, Edition

V, 2016 devoted resembles complying (orders, etc);

restrained. While dutifulness has the significance of

loyal nature, submission. Consequently, consistence

is faithful and dependent upon the guidelines that

have been set. As indicated by Marcori (2018), it is a

necessity for citizens to comprehend, recognize,

regard and sit tight for the pertinent duty guidelines

and desire to satisfy their assessment commitments.

Resident consistency can be deciphered as a

condition wherein residents do a great deal of

expenditure on their privileges and responsibilities.

The markers of expense consistence are (1) Service

Quality; (2) Education level; (3) Timeliness in

making good on charges.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

150

3 METHOD

3.1 Population and Sample

The populace in this examination were singular

citizens enlisted at KPP Pratama Batam Utara with an

example of 139 individuals.

3.2 Method

The exploration methodology utilized is quantitative

examination strategies. The aftereffects of this test

come from the responses to the poll that have been

appropriated to the example which will then, at that

point be handled and broke down.

This investigation utilizes 3 (three) free factors

specifically charge organization, charge information

and expense sanctions and the reliant variable is

singular citizen consistence. This assessment utilizes

different direct assessments with the accompanying

conditions:

Y= α + β1X1 + β2X2 + β3X3 + β4 + e

Description :

Y : Taxpayers Compliance

α : Constant

β1 : Tax Knowledge Coefifficient

β2 : Tax Administration Coeeficient

β3 : Sanctions Taxation Coefficient

X1 : Tax Administration Variable

X2 : Tax Knowledge Variable

X3 : Sanctions Taxation Variable

e : Error

4 RESULT AND DISCUSSION

4.1 Validity Test

The legitimacy test was endeavored to gauge whether

the survey was legitimate. (Ghozali, 2016). it was

reasoned that all things had rcount > rtable, in

particular at a critical degree of 5% (α = 0.05) and

(N=139-2) so the reference number was 137. Thusly,

rtable = 1.165 was acquired. The end is that the

inquiry things in this examination are substantial.

Coming up next are the consequences of testing the

authenticity of this examination:

Table 1: Validity Test

Source : Output SPSS, 2021

4.2 Realibility Test

On the off chance that the Cronbach Alpha worth is

more noteworthy than 0.6, the exploration poll is

dependable Sugiyono (2018:268). It is realized that

the survey is solid, on the grounds that Cronbach's

Alpha worth is more prominent than 0.6.

Table 2: Realibility Test

Variable

Nilai Alpha

Cronbach

(Y) Tax Compliance 0,853

(X1) Tax Administration (X1) 0,941

(X2) Tax Knowledge (X2) 0,922

(X3) Sanctions Taxation (X3) 0,946

Source : Output SPSS, 2021

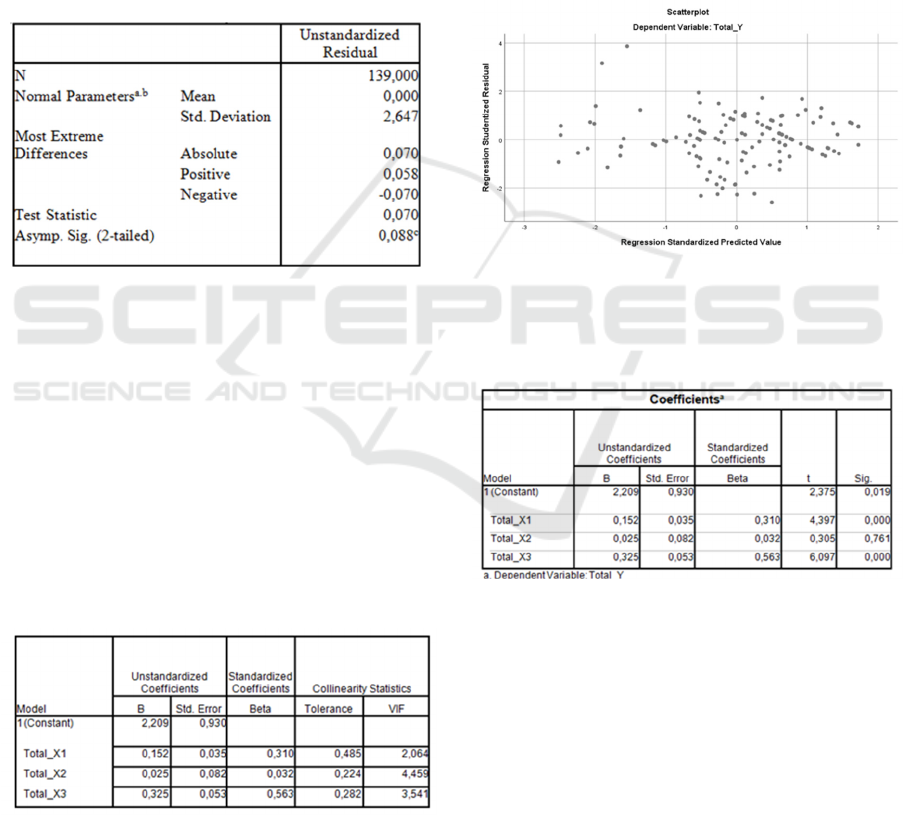

4.3 Normality Test

Routineness test for deposits utilizing Kolmogorov-

Smirnov. The importance level utilized is = 0.05. The

The Effect of Tax Administration, Tax Knowledge and Tax Sanctions on Taxpayer Compliance

151

justification settling on the decision is to take a gander

at the conceivable number P, with the going with

conditions.

In the event that the likelihood worth of P 0.05, the

suspicion of ordinariness is met.

In the event that the likelihood P < 0.05, the suspicion

of ordinariness isn't met.

Since the worth of Kolmogorov-Smirnov is 0.070

while the worth of Asymp.Sig. (2-tailed) got 0.088

higher than the degree of significance of 0.05 then

reasonableness is met.

Table 3: Normality Test

Source : Output SPSS, 2021

4.4 Multicollinearity Test

To see the presence or nonattendance of

multicollinearity, it is awesome to see the change

expanding factor (VIF) esteem. A VIF worth of more

than 10 shows an autonomous factor,

multicollinearity happens (Ghozali, 2016).

In this examination, there were no manifestations

of multicollinearity on the grounds that the VIF

esteem was under 10 with a resistance esteem above

0.1.

Table 4: Multicollinearity Test.

Source : Output SPSS, 2021

4.5 Heteroscedasticity Test

To recognize the presence of heteroscedasticity

appearances, it will in general be seen from the

presence or nonattendance of explicit models on the

disipate plot chart between SRESID on the Y turn,

and ZPRED on the X pivot (Ghozali, 2016). It very

well may be found in the picture underneath that there

is no unmistakable example, and the specks spread

above and beneath the number 0 on the Y pivot, so

there is no heteroscedasticity.

Figure 1: Scatterplot

Source : Output SPSS, 2021

4.6 Multiple Linier Regresion Test

Table 5: Multiple Linier Regresion Test

Source : Output SPSS, 2021

This assessment is relied upon to have the option

to choose the heading of the connection between the

self-sufficient variable and the reliant variable,

whether or not every free factor has a positive or

negative relationship. Can be found in the table

beneath that the outcomes are sure factors.

4.7 T Test

As indicated by Sugiyono (2018: 275) the inspiration

driving the T test is to check whether there is a

deficient or reformist connection between the self-

ruling variable and the reliant variable. On the off

chance that the likelihood is < 0.05, the hypothesis is

ICAESS 2021 - The International Conference on Applied Economics and Social Science

152

viewed as enormous, and alternately with the

supposition that the likelihood is > 0.05, theory is

considered immaterial. The consequences of the T

test can be found in table 5.

4.8 F Test

According to Ghozali (2016: 96) the purpose of this

simultaneous hypothesis test (Test F) is to prove that

all independent variables together significantly affect

the significance of the dependent variable or not. if

the significance value of F is 0.05 then it can be used

to predict the dependent variable. The following are

the results of the F test.

Table 6.

Source : Output SPSS, 2021

4.9 Coefficient of Determination (R2)

Describes changes in the dependent variable with

coefficients ranging from zero to one. The smaller the

coefficient value means the dependent variable has a

very limited ability to explain changes in the variable.

A value close to 1 indicates that the dependent

variable provides almost all the information needed to

predict changes in the dependent variable (Ghozali,

2016). The following is the result of the coefficient of

determination.

Table 7: Coefficient of Determination (R2)

Source : Outpus SPSS, 2021

4.10 Discussion

In light of the examination of the coordinated data,

the accompanying can be acquired:

1. Duty Administration Variable (X1) on

Individual Taxpayer Compliance (Y) gets

4.397, more noteworthy than 1.978 t table with

a meaning of 0.000 <0.05, for that the proposed

speculation is acknowledged. implies that Tax

Administration (X1) significantly affects

Individual Taxpayer Compliance (Y) at a huge

degree of = 5%.

2. Information on Taxation (X2) on Individual

Taxpayer Compliance (Y) got by 0.305 lower

than 1.978 t table with a meaning of 0.761 >

0.05, then, at that point the accommodation of

the speculation is dismissed. This shows that

Tax Knowledge (X2) doesn't to some degree

influence the Individual Taxpayer Compliance

variable (Y) at a huge degree of = 5%.

3. Duty Sanctions (X3) on Individual Taxpayer

Compliance (Y) are gotten at 6,097 and surpass

ttable 1,978 at an importance level of 0.000 <

0.05, the proposed speculation is acknowledged.

It implies that the Tax Sanction (X3) has no

huge impact on Individual Taxpayer

Compliance (Y) with a meaning of = 5%.

5 CONCLUSION

In light of the consequences of the investigation, the

accompanying ends can be drawn:

1. Duty Administration has incomplete impact on

Individual Taxpayer Compliance.

2. Duty information somewhat has no impact on

Individual Taxpayer Compliance.

3. Duty Sanctions somewhat influence the

Compliance of Individual Taxpayers.

4. Duty Administration, Tax Knowledge and Tax

Sanctions simultaneously affect Individual

Taxpayer Compliance.

ACKNOWLEDGEMENT

Thanks to Mrs. Dwi Kartikasari, S.T., MBA. Mr.

Rahmat Hidayat., S.AB., M.AB Mr. Fandy Bestario

Harlan, S.T., M.MT. and all academic ranks and staff

of the Department of Business Management and

Batam State Polytechnic.

REFERENCES

Budhiningtias, M., & Bimantara, F. W. (2017). The

Influence of the Quality of the SPT Information System

on the Improvement of Taxpayer Satisfaction at the

The Effect of Tax Administration, Tax Knowledge and Tax Sanctions on Taxpayer Compliance

153

Merauke Pratama Tax Service Office. Unikom

Scientific Magazine Journal, 15, 123–136.

https://jurnal.unikom.ac.id/jurnal/unjuk-kualitas-

sistem.6d

Damajanti, A., & Karim, A. (2017). Effect of Tax

Knowledge on Individual Taxpayers Compliance.

Economics & Business Solutions Journal, 1, 1–19.

Directorate General of Taxation. Tax Reform in Indonesia.

www.pajak.go.id

Directorate of State Budget Preparation. (2019). State

Budget 2019.

https://www.kemenkeu.go.id/media/11213/buku-

information-apbn-2019.pdf

Ghozali, I. (2016). Multivariate Analysis Application with

IBM SPSS 23 Program. Diponegoro University.

Halawa, Jenita; Saragih, J. L. (2017). The Influence of Tax

Awareness, Tax Sanctions, Fiscus Attitudes, on

Compulsory Compliance at KPP Pratama Lubuk

Pakam. Journal of Accounting and Financial Research,

3(2), 243–256.

https://doi.org/10.1234/akuntansi.v3i2.449

Khuzaimah, N., & Hermawan, S. (2018). The Effect of

Taxpayer Understanding Level, Taxpayer Awareness,

and Tax Sanctions on Taxpayer Compliance. JIATAX

(Journal of Islamic Accounting and Tax), 1(1), 36.

https://doi.org/10.30587/jiatax.v1i1.447

Marcori, F. (2018). The Influence of Taxpayer Awareness,

Fiscus Service and Tax Sanctions on Individual

Taxpayer Compliance Conducting Small and Medium

Enterprises. Accounting journal.

http://ejournal.unp.ac.id/students/index.php/akt/article/

view/3791

Mardiasmo. (2013). 2013 Revised Edition of Taxation.

Andi.

Minister of Finance Decree no. 544 of 2000: regarding the

criteria for taxpayers who can be given a preliminary

refund of tax overpayments, (2000).

Olatunji Olaoye, C. (2017). Tax Information,

Administration and Knowledge on Tax Payers'

Compliance of Block Molding Firms in Ekiti State.

Journal of Finance and Accounting, 5(4), 131.

https://doi.org/10.11648/j.jfa.20170504.12

Rahayu. (2010). Indonesian taxation: concepts and formal

aspects. Graha Ilmu.

Saad, N. (2014). Tax Knowledge, Tax Complexity and Tax

Compliance: Taxpayers' View. Procedia - Social and

Behavioral Sciences, 109(1), 1069–1075.

https://doi.org/10.1016/j.sbspro.2013.12.590

Sudrajat, Ajat; Ompusunggu, A. P. (2015). Utilization of

Information technology, Tax Socialization, Tax

Knowledge, and Tax Compliance. Journal of

Accounting and Taxation Research, 2(2), 193–202.

Sugiyono. (2018). Quantitative Research Methods.

Alphabet.

KUP Law Number 28 of 2007, (2007).

ICAESS 2021 - The International Conference on Applied Economics and Social Science

154