The Impact of the COVID-19 Pandemic on the State of Food Security

in Russia

Natalya Filimonova

a

and Mariya Ozerova

b

Krasnoyarsk State Agrarian University, st. Mira 90, Krasnoyarsk, Russia

Keywords: Agri-food System, Agriculture, COVID-19 Pandemic, Food Security.

Abstract: An assessing impact of the COVID-2019 pandemic on the agri-food system of Russia in the short, medium

and long term has been carried out. The indicators of physical and economic availability of food are analyzed

in comparison with the threshold values of the Russian Food Security Doctrine. Regions with a high and

catastrophic level of economic availability of food have been identified. Trends in consumer prices for food

products have been identified and the causes of food inflation have been determined. The mechanism of the

"grain damper" is revealed and its positive and negative impact on food security is determined. It is noted that

high risks in the agri-food system will remain in 2022.

1 INTRODUCTION

The new COVID-19 coronavirus infection has caused

large-scale shocks in all fields and sectors of the

economy. The agrifood sector is no exception, where

serious risks have formed and persist in the field of

food security and nutrition.

Quarantine measures taken in many countries of

the world since March 2020, designed to contain the

spread of the disease, create conditions for serious

disruptions in the functioning of food systems and a

sharp increase in food shortages and hunger.

According to Food and Agriculture Organization

(FAO) forecasts, "as a result of the pandemic, the

number of people facing food insecurity will increase

by 83-132 million people… An indirect socio-

economic consequence of the pandemic may be a

significant deterioration in the food security situation

in at least 25 countries around the world."(Analytic

Note FAO, 2020). Such catastrophic consequences

are typical for poor countries in Africa, Asia, Latin

America, dependent on food exports, with a weak

development level of their own agricultural

production, high differentiation of the population by

income level. In developed countries, the impact of

the pandemic is manifested by changes in the

macroeconomic environment, energy and credit

markets, high dynamics of prices for raw materials

a

https://orcid.org/0000-0002-0948-0499

b

https://orcid.org/0000-0002-7017-7972

and factors of production, and rising inflation.

Russian realities have their own peculiarities, where

the impact of the global coronavirus infection is

superimposed on unfavorable weather conditions in

2021 and changes in the market of agricultural raw

materials and food.

2 RESEARCH METHODOLOGY

The dialectical method was used as the

methodological basis of the study, which helps to

consider the events caused by the COVID-19

pandemic in development and in an inextricable

connection between the causes of these events and

their consequences, based on factual and statistical

materials. Generalization of data on the state of food

markets and the agricultural sector on the basis of

analysis and synthesis techniques helped to identify

common patterns and develop, on the basis of this,

recommendations for ensuring food security. The

information base of the study was the data of the

Federal State Statistics Service, analytical materials

from the Ministry of Agriculture in the Russian

Federation, information data of the Food and

Agriculture Organization (FAO) of the United

Nations.

362

Filimonova, N. and Ozerova, M.

The Impact of the COVID-19 Pandemic on the State of Food Security in Russia.

DOI: 10.5220/0011120700003439

In Proceedings of the 2nd International Scientific and Practical Conference "COVID-19: Implementation of the Sustainable Development Goals" (RTCOV 2021), pages 362-367

ISBN: 978-989-758-617-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

3 THE RESULTS OF THE STUDY

AND THEIR DISCUSSION

Developments since the beginning of 2020 in the

research literature, it was reflected as the influence of

a natural (or biological) factor on the economic

system, with the statement of the fact that the crisis

that formed has a non-economic nature (Russian

economy (economic overwiew), 2021). At the first

stages of the pandemic, most studies were devoted to

the problems of excessive demand in food and

consumer markets, as well as the ability of systems to

ensure food security without a shortage (Boyacι-

Gündüz, 2021; Lusk, 2021). Subsequently, the

introduction of isolation regimes gave rise to a surge

of research devoted to the search for new forms of

providing the population with food, the development

of e-commerce (Market report, 2021). The

introduction of cross-border restrictions has brought

to the first place on the availability of agricultural

labor resources (ILO Sectoral brief, 2021, especially

seasonal workers at the expense of migrant workers,

as well as access issues of agricultural producers to

markets (Thilmany, 2021). By the beginning of 2021,

comprehensive studies have appeared outlining the

full range of problems related to the development of

agriculture and ensuring food security (Analytic Note

FAO, 2021; World Bank Report, 2021; Beckman,

Coutryman, 2021).

Russian scientists did not stand aside, in particular

the Institute of Economic Policy named after E.T.

Gaidar, and presented an analytical review "The

Russian economy in 2020 Trends and prospects”

(Russian economy (economic overwiew, 2021),

which highlighted both the problems facing the

country in the era of the pandemic, and ways to solve

them. Regional researchers did not stand aside. Their

articles are devoted to the readiness of regional

agriculture to respond to the challenges of the time

(Parshukov, 2021).

A comparison of problem areas in Russia and the

world helped to state the fact that the level of

agricultural production development in most

parameters meets the criteria of food security and

helps to prevent shortages of basic products (table 1).

Since 2000, there has been an increase in

production for all major types of agricultural

products, with the exception of milk and dairy

products. The level of self-sufficiency in grain,

potatoes, meat and meat products exceeds the

standard, is close to the standard for vegetables,

below the standard for fruits and berries, milk and

dairy products. The category "fruits and berries" has

been included in the food security doctrine since

2020. It is assumed that the filling of the Russian

market will be facilitated by the "roadmap" for the

accelerated development of fruit and berry production

until 2023, which provides for the achievement of

food security thresholds for production and

consumption. The continuing problems in the dairy

subcomplex of the agroindustrial complex, despite

the special attention from the Ministry of Agriculture,

do not help ensuring the country's food independence.

Given that during the pandemic, many countries are

aimed at self-sufficiency and may impose restrictions

on the export of products, the issue of import

substitution, especially for milk and dairy products,

continues to be relevant.

In the new Food Security Doctrine, the economic

accessibility of food is considered through the ability

of the population to meet the need for food products

in accordance with rational norms that meet modern

requirements of a healthy diet (On the approval of the

Food Security Doctrine: Decree of the President of

the Russian Federation No. 20 dated 21/01/2020).

Table 1: Agricultural production and the level of self-sufficiency in the Russian Federation.

Products Production in Russia, kg per

ca

p

ita

The level of self-sufficiency, %

2000 2010 2020 2000 2010 2020 Standar

d

Grain (without processed

p

roducts

)

447 427 912.4 104.0 94.5 169.9 >95

Potato 201 129.5 133.6 102.7 77.0 95.3 >95

Vegetables 74 77.1 105.3 88.2 78.8 88.8 >90

Fruits and berries 20.2 16.9 29.6 28.3 27.0 42.6 >60

Milk and dair

y

p

roducts 220.5 220.6 219.6 88.3 80.4 84.5 >90

Meat and meat

p

roducts 30.4 36.2 76.5 97.2 72.3 99.6 >85

E

gg

s

(p

cs.

)

233.0 285.4 306.1 88.3 80.4 84.5 -

Note: compiled according to the Federal State Statistics Service

The Impact of the COVID-19 Pandemic on the State of Food Security in Russia

363

Table 2: Economic accessibility of food.

Types of products

Rational

norm

*

Actual consumption of food products

on average per capita per year, kg

Economic accessibility of food, %

2000 2010 2020 2000 2010 2020

Meat and meat products 73 45 69 75 61.6 94.5 102.7

Milk and dairy products 325 215 245 240 66.1 75.4 73.8

Egg, pcs.

260 229 270 283 88.1 103.8 108.8

Fish and fish products 22

no data

available

no data

available

20 - - 90.9

Sugar 8 35 39 39 437.5 487.5 487.5

Vegetable oil 12 9.9 13.4 13.9 82.5 111.6 115.8

Potato 90 109 95 86 121.1 105.6 95.5

Vegetables and melons

140 79 98 107 56.4 70.0 76.4

Fruits and berries

100 32 57 61 32.0 57.0 61.0

Bread products 96 117 120 116 121.9 125.0 120.8

*In accordance with the orders from the Ministry of Health in the Russian Federation No. 614 dated 08/19/2016, No.

1276 dated 12/01/2020/.

The data given in table 2 indicate that in a difficult

2020, the diet of the average citizen of the country

was the closest to rational, but nevertheless its

imbalance remains, expressed by focusing on

carbohydrate, cheaper components to the detriment of

protein. To assess the economic availability of food,

it is also advisable to consider the share of food

purchase costs in the overall structure of household

spending: 2000 year – 47.6%

2010 – 29.6 %

2015 – 30.4%

2018 – 30.2 %

2019 – 29.7 %

2020 – 33.2 %.

The population of the country spends a third of its

budget on food, while food is considered

economically affordable if the share of food costs

does not exceed 20% of the total final consumption if

less than one third of income is spent on food, then

the level of accessibility can be considered average,

over one third, but less than 50% is high; over 50% is

critical. For comparison, the figure in Germany is to

8.25%, France – 10.1%, Italy – 12.2%, the UK - 6.3%,

the United States - 5.7%, Canada – 7.3%, and Japan -

12.3% (according to the OECD in 2017).

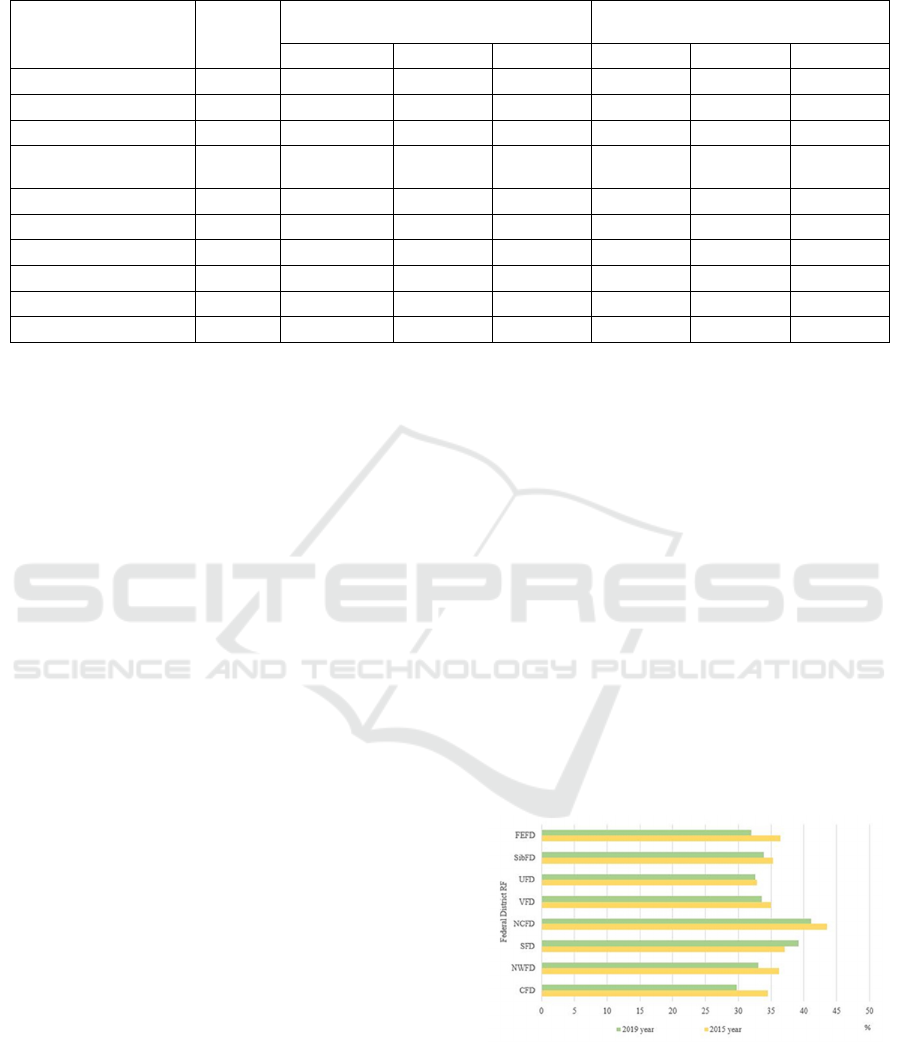

The share analysis of food purchase expenses in

the total structure of household expenditures in the

context of the federal districts in the Russian

Federation is shown in Figure 1 and shows that in

addition to the Central Federal District, in all other

districts the share of food costs exceeds 30%. And it

should also be noted the regions where this indicator

is high or has a critical level:

the Central Federal District – the Bryansk region

- 40.2%, the Smolensk region - 46.0%, the

Ryazan region - 42.3%;

the Southern Federal District - Sevastopol –

48.8%, the autonomous Republic of Crimea -

44.2 %;

the North Caucasus Federal District – the

Republic of Dagestan - 50.0%, the Republic of

Ingushetia - 64.6%, the Karachay-Cherkess

Republic - 43.1%, the Republic of North

Ossetia-Alania - 40.7%;

the Volga Federal District - the Republic of

Mordovia - 43.6 %;

the Siberian Federal District – the the

Novosibirsk Region - 41.6%;

the Far Eastern Federal District – the Chukotka

Autonomous Region - 41.3%.

Figure 1: The share of food purchase expenses in the total

structure of household expenditures by federal districts of

the Russian Federation.

One of the reasons for the high economic

availability of food is the low level of the population

income. In particular, the gap with the average

RTCOV 2021 - II International Scientific and Practical Conference " COVID-19: Implementation of the Sustainable Development Goals

(RTCOV )

364

Russian value in terms of per capita income is most

pronounced in the regions of the North Caucasus

Federal District - 2.1 times in the Republic of

Ingushetia, 1.9 times in the Karachay-Cherkess

Republic, 1.4 times in the Republic of North Ossetia-

Alania.

A decrease in real incomes and a drop in the

purchasing power of the population will be associated

with a decrease in demand for food, and the trends of

2019-2020, which are associated with a decrease in

the consumption of bread, cereals and potatoes and an

increase in the consumption of meat and dairy

products, vegetables and fruits, may be suspended in

2021.

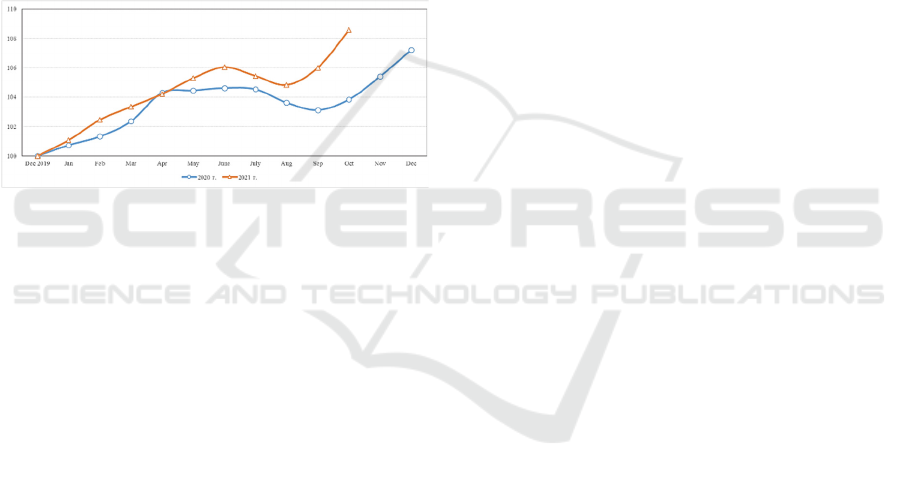

Among the main reasons for the increase in cost

of food in 2020-2021 note the increase in food prices

(figure 2).

Figure 2: Consumer price index for food products in % to

December of previous year.

The trigger for the increase in food prices in 2020

year was an increase in production costs caused by a

change in the composition of the labor force due to

restrictions on the use of migrant labor, changes in the

supply chains of raw materials, an increase in the cost

of imported components (feed, fertilizers, packaging,

etc.), the need to provide workers with personal

protective equipment, disinfection of premises and

production facilities.

In 2021, new factors were added to these factors,

namely: a decrease in production volumes due to

adverse weather conditions and a difficult epizootic

situation in animal husbandry (by 3.4% in 8 months

of 2021), as well as increased interest of Russian

producers in world markets, where there is an upward

price trend, to the detriment of Russian market.

According to the Federal Customs Service, in

2020 Russia exported 79 million tons of agricultural

products and food worth $30.7 billion, which is 20%

more than in 2019. The largest share in the value

volume by the end of 2020 was taken by exports of

grain (33.5%), fish and seafood (17.4%), fat and oil

products (16.2%), in the export structure are also

significant products of the food and processing

industries (14.7%) and other agricultural products

(14.4%). In 2021, export growth trends continued –

in 10 months, the volume of exports amounted to

$30.3 billion, approaching the annual figures of 2020.

The impact of exports on food security is

manifested in the increase in prices of products for

which Russia is integrated into the world market as an

exporter (grain, sunflower oil, sugar). Thus, in 2020,

prices for soft wheat varieties (SRW, USA) increased

by 7.8% to $227.7/ton, futures prices on the Chicago

Stock Exchange increased by 12.5% to $204/ton. In

the first half of 2021, prices for soft wheat varieties

added another 4.9% relative to the beginning of the

year, in June they exceeded the level of the same

period in 2020 by 31.4% (report of the Ministry of

Economy, 2021). The cost of Russian wheat for

delivery in October is at the level of $305 per ton, in

November - $307 per ton. The stabilization of prices

on the Russian grain market is designed to ensure the

export duty on wheat (from October 6 to 12, 2021 is

$ 57.8 / ton), as well as a tariff quota for export

outside the territory of the EAEU member states. The

grain damper mechanism, introduced on June 2,

2021, helps regulating the supply and price of grain

on the Russian market ensuring food security.

The essence of the mechanism is as follows: if the

world price of wheat is up to $200 per ton, the duty is

not charged, and at a higher one it is 70% of the

difference between the world and the base price of $

200/ton. For barley and corn, the price level, not

subject to export duty, is $185 per ton. The higher the

export price, the more funds are cut off by the duty.

The "grain damper" involves the return of funds

received through the collection of export duties to

farmers in the form of subsidies.

In addition, from February 1 to June 30, 2021, an

export duty on soybeans was in effect — 30% of the

customs value, but not less than €165 per ton (before

that, the export of soybeans was not taxed), and from

July 1, 2021 to August 31, 2022, the amount of the

duty on soybeans is 20% of the products cost, but not

less than $ 100 per ton.

Additionally, a damper was installed for the

export of sunflower oil. From September 1, 2021 to

August 31, 2022, a floating export duty of 70% is in

effect. It is charged from the difference between the

base price ($1 thousand/ton) and the indicative price

(the arithmetic mean of market prices for the month),

reduced by the amount of the correction factor ($ 50

per ton). All these measures are aimed at regulating

prices in the Russian market.

The main positive aspect of the damping

mechanism is that the introduction of duties led to a

reduction in the impact of rising world prices on

Russian prices, which reduced purchase prices for

The Impact of the COVID-19 Pandemic on the State of Food Security in Russia

365

processors, as well as for livestock breeders and

eventually contributed to the stabilization of prices in

the Russian market. But at the same time, according

to the calculations of the Institute for Research and

Expertise of Vnesheconombank (VEB), the lost

revenue of agricultural producers in 2021/2022 may

amount to $2.3 billion and will lead to a reduction in

production and its technical and technological

equipment, a decrease in exports and its

competitiveness, loss of world market share (VEB

report). According to researchers and practitioners,

the duty may be effective as an emergency measure,

but in the long term, another mechanism is needed to

smooth out the negative impact of rising prices, for

example, food aid.

In general, the pandemic has led to

comprehensive changes in the food system, which

manifested themselves differently in different time

periods (figure 3).

Figure 3: The impact of the Covid-19 pandemic on the

agrifood system in the short, medium and long term.

The continuing threats of the coronavirus

infection spread do not give reason to believe that

2022 will be a year of recovery growth. On the

contrary, with continuing trends, a further decline in

real incomes of the population will continue with a

change in the structure of food consumption, at the

same time, a reduction in growth rates and a decrease

in investment activity may occur on the part of

production.

4 CONCLUSION

1. The modern agrifood system of Russia is self-

sufficient in order to provide the country's population

with most food products. According to the Global

Food Security Index in 2020 (GFSI, 2021), Russia

ranks the 24

th

in the global food security index with

73.7 points, rising by 12 positions compared to 2019;

2. In 2020, the level of economic availability

of food decreased, caused by a drop in real incomes

of the population, an increase in prices on the food

market;

3. Due to the fall in real incomes, a decrease in

the purchasing power of the population, respectively,

and the demand for food, it is expected that the

positive dynamics in the structure of consumption

associated with a decrease in the proportion of

carbohydrate-containing components in favor of

protein, will stop;

4. The increase in prices for agricultural raw

materials and food is caused by an increase in

production costs due to the need to comply with

sanitary and epidemic measures, a reduction in the

employment of migrant workers, an increase in prices

for factors of production;

5. The increase in prices on the Russian

market also occurred under the influence of food

prices on the foreign market. In 2020, the World Food

Price Index (FAO) increased by 3.1% compared to

2019, and by October 2021 it reached 133.2 points,

which is 17.4% higher compared to the beginning of

the year. In Russia, prices for commodity groups,

according to which the country is integrated into the

world market as an exporter (grain, sunflower oil) and

importer (vegetables and fruits), increased more

significantly;

6. In order to curb the growth of food prices,

export duties on grain, oilseeds and sunflower oil

were introduced in 2021. Since Russian prices for

them correlate with world prices, the task of duties is

to protect Russian consumers from a sharp rise in the

price of products on the global market. At the same

time, duties reduce the profitability of agricultural

producers and demotivate export operations;

7. Due to the identification of new strains of

SARS-CoV-2 coronavirus, threats to food security in

2022 remain and will be primarily associated with a

drop in the incomes of agricultural producers.

REFERENCES

Impacts of COVID-19 on food security and nutrition:

developing effective policy responses to address the

hunger and malnutrition pandemic, Committee on

World Food Security High Level Panel of Experts on

Food Security and Nutrition, Rome, 2020.

The Russian economy in 2020. Trends and prospects. 2021.

(Issue 42), Under the scientific editorship of Dr. Kudrin

A.L., Dr. Mau V.A., Dr. Radygin A.D., Dr. Sinelnikov-

RTCOV 2021 - II International Scientific and Practical Conference " COVID-19: Implementation of the Sustainable Development Goals

(RTCOV )

366

Muryleva S.G., Doctor of Economics]; Gaidar Institute.

- Moscow: Gaidar Institute Publishing House.

Boyacι-Gündüz, C.P., Ibrahim, S.A., Wei, O.C., Galanakis,

C.M. 2021. Transformation of the food sector: security

and resilience during the Covid-19 pandemic, Foods. Т.

10. № 3.

Lusk, J, 2020. Consumer Behavior during the Pandemic,

Economic impacts of Covid-19 on food and agricultural

markets. pp. 11-13.

Food And Beverages E-Commerce Global Market Report

2021: COVID-19 Growth And Change To 2030. 2021.

ILO Sectoral brief. COVID-19 and the impact on

agriculture and food security. 2020.

Thilmany, D, Canales, E, Low, S, Boys, K., 2021. Local

Food Supply Chain Dynamics and Resilience during

COVID-19, Applied Economic Perspectives and

Policy, Volume 43, Number 1, pp. 86–104.

World Bank. 2021. Recovering Growth: Rebuilding

Dynamic Post‐COVID-19 Economies amid Fiscal

Constraints. LAC Semiannual Report; Washington,

DC: World Bank. URL: http://hdl.handle.net/

10986/36296.

World Bank. 2021. Europe and Central Asia Economic

Update, Fall 2021: Competition and Firm Recovery

Post-COVID-19. Washington, DC: World Bank Bank.

URL: https://openknowledge.worldbank.org/handle/10

986/36296 License: CC BY 3.0 IGO.

Beckman, J, Coutryman, A.M., 2021. The Importance of

Agriculture in the Economy: Impacts from COVID-19,

American Journal of Agricultural Economics, Vol. 103,

Issue 5, pp. 1595-1611.

Parshukov, D. V., 2021. Agriculture of the Krasnoyarsk

territory under the influence of the Covid-19 pandemic

factor: state, threats and security risks, Socio-economic

and Humanitarian Journal of the Krasnoyarsk State

University, 1 (19), pp. 46-64.

Results of foreign economic activity of the Russian

Federation in 2020 and the first half of 2021, Ministry

of Economic Development Russian Federation,

Department of Analytical Support of Foreign Economic

Activity. Moscow, 2021. https://www.economy.gov

.ru/material/news/mer_predstavilo_doklad_ob_itogah_

vneshneekonomicheskoy_deyatelnosti_rf_v_2020_go

du_i_i_polugodii_2021_goda.html.

Global Food Security Index 2020. https://impact.econo

mist.com/sustainability/project/food-security-index/.

Agricultural duties: Macroeconomic effect and Alternative

ways to support the population, VEB Institute for

Research and Expertise, 2021. http://www.inveb.ru/ru/

articles-menu/706-agrarnye-poshliny-makroekonomic

heskij-effekt-i-alternativnye-puti-podderzhki-

naseleniya-2.

The Impact of the COVID-19 Pandemic on the State of Food Security in Russia

367