The Influence of Company Size, Financial Leverage, and Public

Accounting Firm Size on Audit Report Lag: Empirical Study of the

Mining Company

Meiryani, Hendry Citra Wijaya, Jajat Sudrajat and Dedeh Maryani

Bina Nusantara University, Jakarta, Indonesia

Keywords: Company Size, Financial Leverage, Public Accounting Firm Size, Audit Report Lag.

Abstract: The purpose of this research is to ascertain clearly about the effect of company size, financial leverage and

public accounting firm size to audit report lag. This research used secondary data from mining companies that

listed on Indonesia Stock Exchange year 2016-2018. Sample were collected by purposive sampling method.

Based on the criteria predefined, a total of 33 samples used in this research were further analyzed by using

Multiple Linear Regression Analysis. The research concluded that company size has a significant and negative

effect on audit report lag, financial leverage has a significant and positive on audit report lag, while the public

accounting firm size has no significant but has negative effect to audit report lag. This research also verify

that company size, financial leverage and public accounting firm size simultaneously have a significant effect

on audit report lag.

1 INTRODUCTION

Financial reports are very important about a company

that is useful for parties who use these financial

statements as a basis for consideration in making

economic decisions (Suwanda, 2015). Financial

reports are used by many users with different

purposes including shareholders, management,

investors, creditors, laborers, auditors and customers.

According to Suwanda (2015) as important

information, financial statements must meet several

characteristics so that financial reports can be used,

namely relevant, understandable, reliable, and

comparable. Relevant, which means that financial

statements must be relevant or related to the intention

of the user having 4 elements, namely having

feedback value, having predictive value, being timely

and complete.

In 2016, the Indonesian Financial Services

Authority issued the Financial Services Authority

Regulation No. 29 / POJK.04 / 2016 concerning the

Annual Report of Issuers or Public Companies states

that companies listed on the Indonesia Stock

Exchange are required to submit an audited annual

Financial Report. According to Eksandy (2017) audit

is a systematic process to obtain and seek evidence in

an objective way relating to statements about

economic actions and events to determine the

suitability of these statements with predetermined

criteria and submit the results to interested parties.

The audit must be carried out by someone who is

competent and independent called an auditor

Timeliness which is an element of relevance is

important for users of financial statements, because if

the financial statements are not on time, users of

financial statements cannot make decisions well,

therefore financial reports that are not timely can be

said that the financial statements are irrelevant

(Afriyeni and Marlius, 2019). Therefore, in the

Financial Services Authority Regulation No. 29 /

POJK.04 / 2016 concerning the Annual Report of

Issuers or Public Companies also states that Public

Companies are required to submit an audited Annual

Financial Report to the Financial Services Authority

no later than the end of the fourth month after the

financial year ends. If there are parties who violate

these provisions, Bapepam and LK can impose

administrative sanctions on each party who violates

them and each party who causes the violation.

Because the submission of the Annual Financial

Report must be accompanied by an audit report with

a fair opinion, auditors need accuracy and

thoroughness in the audit process of the company’s

Financial Statements, if there is a decrease in the

206

Meiryani, ., Citra Wijaya, H., Sudrajat, J. and Maryani, D.

The Influence of Company Size, Financial Leverage, and Public Accounting Firm Size on Audit Report Lag: Empirical Study of the Mining Company.

DOI: 10.5220/0011243500003376

In Proceedings of the 2nd International Conference on Recent Innovations (ICRI 2021), pages 206-214

ISBN: 978-989-758-602-6

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Company’s performance then this can be a factor for

audit delays (Writers and Latrini, 2016). According to

Widhiasari and Budiartha (2016) audit report lag is

the time span for completion of the audit from the

closing date of the company’s books to the date stated

in the audit report. The audit report lag will affect the

timeliness of the submission of financial reports to its

users, so that a long audit report lag.

Table 1: List of Listed Companies That Have Not

Submitted the 2018 Audited Financial Statements and Have

Not Paid Fines.

No Code Company name

1 AISA PT Tiga Pilar Sejahtera Food Tbk.

2 APEX PT Apexindo Pratama Duta Tbk.

3 BORN PT Borneo Lumbung Energi &

Metal Tbk.

4 ELTY PT Bakrieland Development Tbk.

5 GOLL PT Golden Plantation Tbk.

6 SUGI PT Sugih Energy Tbk.

7 TMPI PT Sigmagold Inti Perkasa Tbk.

8 CKRA PT Cakra Mineral Tbk.

9 GREN PT Evergreen Invesco Tbk.

10 NIPS PT Nipress Tbk

There are many factors that can cause audit report

lag which has been carried out in several previous

studies, several factors including company size,

financial leverage and size of KAP. Company size is

a measure of the size of a company as measured by

the total assets owned by the company. Large

company sizes will tend to be faster in the audit

completion process compared to smaller companies,

because larger companies certainly have better

internal control, the better the internal control of a

company, the better the company’s operational

system will be. Larger companies are also more

closely monitored by users of financial reports such

as investors, regulators and the government, this can

usually minimize audit report lag (Rahayu, 2017).

This is in line with research conducted by Dura

(2017) which states that company size has a

significant effect on audit report lag.

H1: Company size has a significant effect on the

audit report lag.

Financial leverage is a ratio that describes the

company’s ability to fulfil all of its obligations.

According to Sundjaja (2001), he found that there was

an effect of financial leverage on the audit report lag,

because the greater the ratio of debt to total equity,

the longer the range of audit report lag will be. This

can indicate that the company is experiencing

financial difficulties which is bad news for users of

financial statements, especially investors. This makes

the Company late in submitting financial reports to

the public, because auditors will raise concerns in

auditing companies that have a high level of financial

leverage. This also makes auditors tend to work

prudently and consequently the time span for

completing the audit is getting longer and timeliness

is difficult to achieve.

H2: Financial Leverage has a significant effect on

the audit report lag.

According to Jesslyn and Ardianti (2018) The

size of the Public Accounting Firm is a measure used

to determine whether a public accountant is large or

small, the size or size of the Public Accounting Firm

can be seen from its KAP affiliation, if the KAP is

affiliated with the Big Four, then the KAP can be said

to be large. Based on research conducted by Panjaitan

(2017), because the Big Four has more resources and

has a higher staff, it is therefore possible for KAP to

provide higher quality staff, so of course the KAP size

affects the audit report lag.

H3: KAP size has a significant effect on the audit

report lag.

The difference between the object of this study

from previous studies lies in the study sample and the

study period. This research was conducted on mining

companies listed on the Indonesia Stock Exchange.

Mining companies are a promising sector, mining

companies are one of the sectors that increase

Indonesia’s economic growth. Even though it has a

big influence on the country’s economic growth, this

business sector absorbs capital, debt and risks that are

so high. Then there are 3 out of 10 companies that

were late in submitting financial reports to the public

in 2018, 4 out of 10 companies in 2017, and 5 out of

17 companies in 2016. This has attracted the author’s

interest to examine the influence of Company Size,

Financial Leverage, and KAP size on audit report lag

in the mining company sector.

The Influence of Company Size, Financial Leverage, and Public Accounting Firm Size on Audit Report Lag: Empirical Study of the Mining

Company

207

2 THEORETICAL FRAMEWORK

• Widiastuti and Kartika (2018) conducted a

research on manufacturing companies listed

on the IDX in 2013-2016 with a sample size of

45 companies. This study uses multiple linear

regression. The results of this study indicate

that company size and solvency have a

significant negative effect on audit report lag.

Meanwhile, KAP size has a significant

positive effect on audit report lag.

• Hassan (2016) conducted research on

companies listed on the Palestine Stock

Exchange (PSE) in 2011 with a population of

46 companies. This research uses multiple

linear regression method. This study shows

that company size and KAP size have a

significant positive effect on audit report lag.

• Hsu (2016) conducted research on 2410

companies listed on the Shenzhen Stock

Exchange (SSE) in 2013. This study uses

multiple linear regression methods. The

results showed that financial leverage and size

of KAP had a significant positive effect on

audit report lag.

• Dura (2017) had conducted a research on

manufacturing companies listed on the IDX in

the 2013-2015 period with a sample of 105

companies. This research uses multiple linear

regression method. The results of the study

state that solvency and firm size have a

significant negative effect on audit report lag.

• Artaningrum et al. (2017) conducted a

research on banking companies listed on the

IDX in the 2013- 2015 period with a sample of

28 companies. This research uses multiple

linear regression method. The results of the

study state that company size has a significant

negative effect and solvency has a significant

positive effect on audit report lag.

3 RESEARCH METHODOLOGY

This research uses quantitative methods and uses

secondary data taken from the Indonesia Stock

Exchange website (www.idx.co.id). The sampling

method used a purposive sampling approach with the

following criteria:

• Total population (mining companies listed on

the IDX 2016-2018).

• Mining companies that were not recorded

during the 2016 to 2018 period.

• Mining companies that do not publish

complete audited financial reports from 2016

to 2018. • Data Outliers.

After the sample criteria were applied to all

banking companies listed on the Indonesia Stock

Exchange (IDX), 33 listed mining companies were

selected as samples of this study. Using a research

period of 3 (three) years, namely 2016-2018, the total

sample of this study was 99 samples.

The independent variables in this study are firm

size, financial leverage, and KAP size with the

dependent variable on audit report lag. The following

is an operationalization of the variables used in this

study:

Table 2: Variable Operational Table.

The data that the researchers had collected were

analyzed using the Multiple Linear Regression

method consisting of the T test (partial), F test

(simultaneous) and the coefficient of determination

test. The author also uses descriptive statistical

methods to describe all research variables using the

SPSS (Statistical Product and Service Solution) test

tool. But before that the authors conducted the

Classical Assumption Test first to find out whether

the model used in the regression method actually

shows a significant and representative relationship so

that the results can be accounted for and are not

biased. Classic assumption tests that will be carried

out include normality, multicollinearity,

autocorrelation, and heteroscedasticity tests. In this

study, researchers used multiple linear regression

models, with the following equation:

𝑌 = 𝛽0 + 𝛽1𝑋1 + 𝛽2𝑋2 + 𝛽3𝑋3 + 𝜀

(1)

Information:

Y = Audit Report Lag

X2 = Financial Leverage

0 = Constant

X3 = Size of KAP

𝛽1

–

𝛽3

= Variable Coefficient

𝜀 = Error

X1 = Company Size

ICRI 2021 - International Conference on Recent Innovations

208

4 RESULT AND DISCUSSION

The statistical test in this study was carried out using

IBM SPSS Statistics 25. The following is a table of

descriptive statistical test results that explains the

minimum value, maximum value, average value, and

standard deviation of the variables of this study:

Table 3: Descriptive Statistics Test Results.

Based on the results of the descriptive statistical

test above. Here is the information we can get:

• Company size shows a minimum value of

15.99, a maximum value of 22.68, an average

value of 19.84, and a standard deviation of

1.5D4492.

• Financial Leverage (DER) shows a minimum

value of 0.16, a maximum value of 5.98, an

average value of 1.1245 and a standard

deviation of 0.93985.

• Audit Report Lag shows a minimum value of

31 days, a maximum value of 122 days, an

average value of 72.81 days and a standard

deviation of 14,959.

Table 4: Descriptive Statistical Test Results for Variables

with a Dummy Scale Public Accounting Firm Size.

The size of the Public Accounting Firm is a

dummy variable, which is tested separately using a

frequency table. The size of KAP is seen from 2

categories, namely KAP Big Four and KAP Non Big

Four. Based on the table with a frequency of 99

samples, the data shows that 47 companies or 47.5%

of the companies that use the Big Four KAP services

are companies or 52.5%.

The classic assumption test was carried out by the

authors to ensure that the regression test gave

unbiased results, so that the study could be relied on.

The classical assumption tests carried out are

normality test, autocorrelation test, multicollinearity

test, and heteroscedasticity test.

4.1 Normality Test

The normality test is carried out to ensure that the data

is normally distributed, because a good regression

model must have normally distributed data.

Researchers use 3 methods in the normality test,

namely the histogram, the Normal P-P Plot, and the

Kolmogorov-Smirnov.

Figure 1: Histogram of normality test results.

From the picture above it can be concluded that

the data is normally distributed, where the data

distribution of the residual value (error) shows a

normal distribution and the histogram is a bell.

Figure 2: Normal P-P plot results.

Based on the results of the Normal P-P Plot

above, it can be concluded that the data has been

normally distributed, seen from the points that do not

spread far and follow a straight line.

Table 5: Kolmogorov-Smirnov Test Results One-Sample

Kolmogorov-Smirnov Test.

Unstandardized Residual

As

y

m

p

. Si

g

.

(

2-tailed

)

,200

c,d

Based on the results of the Kolmogorov-Smirnov

test above, explain the results of the normality test by

making the following decisions:

• Asymp Value. Sig. (2-tailed) ¡0.05, which

means that the data is not normally distributed.

• Value of Asymp. Sig. (2-tailed) 0.05, which

means that the data is normally distributed.

The Influence of Company Size, Financial Leverage, and Public Accounting Firm Size on Audit Report Lag: Empirical Study of the Mining

Company

209

The result of the Kolmogorov-Smirnov test is

0.200 which is greater than 0.05, it can be concluded

that the data is normally distributed. So it can be

concluded that the data has met all the measurement

requirements and has been normally distributed.

4.2 Autocorrelation Test

To test for the presence or absence of autocorrelation,

the examiner uses the Run Test test. Run tests are part

of non-parametric statistics, but run tests can be used

to test whether there is a high correlation between

residuals (autocorrelation). If there is no correlation

between residuals, it can be said that the residuals are

random (no autocorrelation occurs). How to

determine the autocorrelation test is as follows:

• If the probability value is significant ¡than

0.05, then autocorrelation occurs.

• If the probability value is significant 0.05, then

there is no autocorrelation.

Table 6: Autocorrelation Test Results Runs Test.

Unstandardized Residual

As

y

m

p

. Si

g

.

(

2-tailed

)

,266

The results of the Run Test from table 6 show a

significant probability value of 0.266. Then the

probability value is greater than 0.05 (0.226

> 0.05),

so it can be concluded that the data does not occur

autocorrelation.

4.3 Multicollinearity Test

The multicollinearity test aims to determine whether

or not there are deviations from the multicollinearity

assumption, namely the linear relationship between

the independent variables in the regression model. a

good regression model is that there is no strong

relationship between the independent variables. To

test the presence or absence of multicollinearity

between independent variables, it can be seen in the

coefficient table and observing the tolerance value

and Variance Inflation Factor (VIF) with the

following criteria:

• If the VIF value

> 10 and the tolerance value

<0.1, then there is a correlation between the

independent variables.

• If the VIF value

<10 and the tolerance value >

0.1, then the data is free from

multicollinearity.

Table 7: Multicollinearity Test Results.

Model Collinearit

y

Statistics

Tolerance VIF

1

(

Constant

)

Company Size ,714 1,401

Financial Leverage ,931 1,074

KAP Size ,712 1,405

a. Dependent Variable: Audit Report Lag

Table 7 shows that the independent variable has a

Variance Inflation Factor (VIF) value of: Company

Size 1.401; Financial Leverage 1,074; KAP size

1,405. And the tolerance value is: Company Size

0.714; Financial Leverage 0.931; and KAP size of

0.712. From these results, we can conclude that the

VIF value of the independent variable is less than 10

and the tolerance value of the independent variable is

greater than 0.1, so there is no correlation between

independent variables, which means that the research

regression model is free from multicollinearity.

4.4 Heteroscedasticity Test

The heteroscedasticity test aims to test whether in the

regression model there is an inequality of variants

from the residuals of one observation to another

which is called heteroscedasticity. To test the

heteroscedasticity, the writer used 2 methods,

namely:

4.4.1 Glejser Test

Table 8: Glejser Test Results.

Model t Sig.

1

(

Constant

)

-,966 ,337

Company Size 1,713 ,090

Financial Leverage ,227 ,821

In the Glejser test, regression is carried out between

the independent variables and their residual absolute

values. If the independent variable is statistically

significant in influencing the dependent, then there is

an indication that heteroscedasticity occurs. If the

significant value of each independent variable is

>

ICRI 2021 - International Conference on Recent Innovations

210

than 0.05, heteroscedasticity does not occur, on the

contrary, if the significant value of each independent

variable is

<0.05, heteroscedasticity occurs.

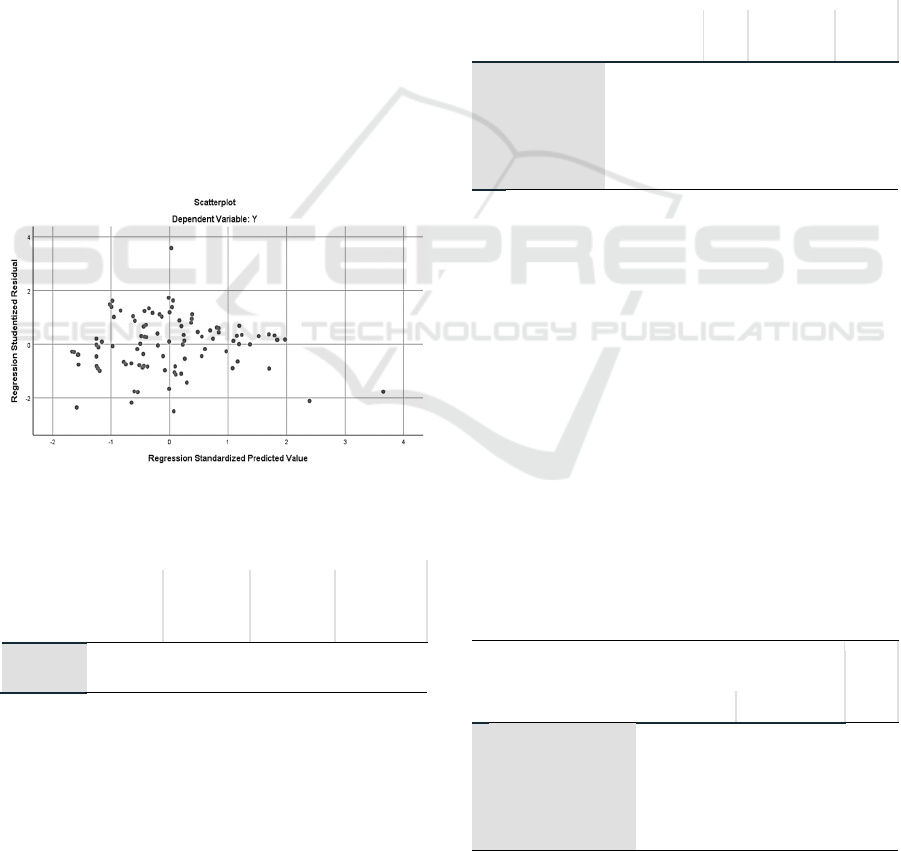

4.4.2 Scatterplot Diagram

The scatterplot diagram uses the predictive value of

the dependent variable with its residuals, with the

premise that if there is a certain pattern, such as the

existing points forming a certain regular pattern

(wavy, widening then narrowing), it indicates

heteroscedasticity. Conversely, if there is no clear

pattern, and the dots spread above and below the 0

and Y-axis, then there is no heteroscedasticity.

After passing the classical assumption test. The

author continues the statistical hypothesis test. In this

study the authors used a multiple linear analysis

model to analyze the data and test the hypotheses that

were made.

The first is the coefficient of determination test

which aims to determine the overall ability of the

independent variables contained in the regression

model in explaining the variance in the value of the

dependent variable.

Figure 3: Scatterplot results.

Table 9: Determination Coefficient Test Results Summary.

Model R R Square Adjusted

R Square

Std. Error

of the

Estimate

1 ,403

a

,163 ,136 13,903

This study uses an adjusted R2 value because

there are more than two independent variables. This

is done to avoid bias in the R2 value due to the large

number of independent variables in the regression

equation. Based on Table 9, adjusted R2 shows a

value of 0.136, which means that 13.6% of the audit

report lag can be explained by variables of company

size, financial leverage, and KAP size, while the

remaining 86.4% is influenced by other factors

outside of the study. The second is the F test or also

known as the simultaneous test which is used to

determine whether the independent variables jointly

or simultaneously affect the dependent variable. The

level of significance is 0.05. So based on the

comparison of significant values, there are 2 criteria

for accepting or rejecting Ho, namely:

• If the significant value >𝛼= 0.05 then Ho is

accepted and Ha is rejected.

• If the significant value <𝛼 = 0.05 then Ho is

rejected and Ha is accepted.

Table 10: F-Statistical Test Results ANOVA.

Model

Sum of

Squares

df

Mean

S

q

uare

F

1 Re

g

ression 3566,361 3 1188,787 6,150

Residual 18362,993 95 193,295

Total 21929,354 98

Table 10 shows the calculated F value of 6.150

with a significance of 0.001. The significance valuis

less than 0.05, which means that Company Size,

Financial Leverage, and KAP Size simultaneously

affect the Audit Report Lag.

The third is the T test or also known as the partial

test which aims to determine the effect of each

independent variable on the dependent variable. The

steps taken in the T test are the same as the F test.The

level of significance is 0.05, so based on the

comparison of significant values there are 2 criteria

for accepting or rejecting Ho, namely:

• If the significant value > 𝛼 = 0.05 then Ho is

accepted and Ha is rejected.

• If the significant value

<𝛼= 0.05 then Ho is

rejected and Ha is accepted.

Table 11: T-Statistical Test Results Coefficients.

Model Unstandardized Coefficient

s

t

B Std. Erro

r

1 (Constant) 113,512 20,232 5,610

Com

p

an

y

Size -2,222 1,076 -2,065

Financial Levera

g

e 4,535 1,549 2,928

The Influence of Company Size, Financial Leverage, and Public Accounting Firm Size on Audit Report Lag: Empirical Study of the Mining

Company

211

Before discussing the T test, there is a regression

equation that can be seen from table 11, by looking at

the value in column B, the first row (Constant) is a

constant (a) and the next row shows the independent

variable. Then the regression model equation used is

as follows:

𝑌 = 113,512 + (−2,222)𝑋1 + 4,535𝑋2

+ (−3,256)𝑋3

(2)

Information:

Y = Audit Report Lag

X1 = Company Size

X2 = Financial Leverage

X3 = KAP size

Based on the regression model equation above, it

can be explained as follows:

• A constant value of 113.512 states that if there

is no company size, financial leverage, and

KAP size, the audit report lag will be 113.512

days.

• The coefficient of variable X1 is -2,222, which

means that company size has a negative effect

on the audit report lag, if the company size

increases by 1 unit, the audit report lag will

decrease by 2.222 days.

• The coefficient of variable X2 is 4.535, which

means that financial leverage has a positive

effect on the audit report lag, if financial

leverage increases by 1 unit, the audit report

lag will increase by 4.535 days.

• The coefficient of variable X3 is -3,256, which

means that the size of KAP has a negative

effect on the audit report lag. If the size of the

KAP increases by 1 unit, then the audit report

lag will decrease by 3.256 days.

Based on the results of the t test and the Beta value

presented, the significant value is 0.042 and the Beta

value is -2.222, where the significance value is less

than 0.05 and the Beta value shows negative results.

This shows that company size has a significant

negative effect on audit report lag. So it can be

concluded that the first hypothesis is accepted.

Companies that are larger in size tend to have a higher

public demand for that company information. This is

a sign that the company has won the trust of the

public, so that large companies will certainly

maintain this trust by providing information quickly

and accurately. In addition, a larger company

certainly has better internal control, the better the

internal control of a company, the better the

company’s operational system. The results of this

study are in line with research conducted by previous

studies (Artaningrum et al., 2017; Dura, 2017;

Hassam, 2016; Widiastuti and Kartika, 2018) which

states that company size has a significant negative

effect on audit report lag. However, the results of this

study are not in line with research conducted by

Arifuddin and Usman (2017) which states that

company size has a positive effect on audit report lag.

Financial leverage has a significance value of

0.04 and a Beta value of 4.535, which means that the

significant value is less than 0.05 and the Beta value

shows a positive value. This shows that financial

leverage has a significant positive effect on audit

report lag, so it can be concluded that the second

hypothesis is accepted. High financial leverage

indicates that the company is in financial trouble,

which reflects high financial risk. Companies will try

to reduce the level of financial leverage of their

companies, not wanting to give bad news to users of

financial reports, especially investors. In addition,

auditors will also be more careful in carrying out

audits, so that the fieldwork time in the audit will be

longer, this causes the signal or information conveyed

by the company to users of the information to be late.

The results of this study are in line with research

conducted by previous studies which states that

financial leverage has a significant positive effect on

audit report lag. On the other hand, in contrast to the

results of this study, research conducted by other

studies states that financial leverage has a significant

negative effect on audit report lag.

KAP size has a significant value of 0.329 and a

Beta value of -3.256, where the significant value is

greater than 0.05 and the Beta value shows a negative

value. This shows that the KAP size has a negative

effect but does not significantly influence the audit

report lag, so it can be concluded that the third

hypothesis is rejected. Big Four and Non Big Four

KAPs have the same accounting standards, namely

Financial Accounting Standards (SAK) made by the

Indonesian Accounting Association (IAI) so that Big

Four and Non Big Four KAPs have the same rules and

standards in carrying out audit procedures. So the

auditors from Big Four and Non Big Four KAPs have

the same responsibility to comply with standards in

carrying out their work. Apart from the same

standards, KAP Big Four and Non Big Four are also

regulated by laws made by the government.

Therefore, Big Four and Non Big Four KAPs have the

same performance to perform audit procedures. The

results of this study are in line with research

conducted by previous studies which state that KAP

size does not have a significant effect on audit report

lag. However, the results of this study are not in line

with the research conducted by other studies which

ICRI 2021 - International Conference on Recent Innovations

212

states that KAP size has a significant negative effect

on audit report lag.

5 CONCLUSION AND

SUGGESTION

5.1 Conclusion

Based on the results of the research that has been

done, it can be concluded that:

• The results show that the variables of company

size, financial leverage, and size of KAP

simultaneously affect the audit report lag.

• Company size has a negative and significant

effect on the audit report lag.

• Financial leverage has a positive and

significant effect on the audit report lag. •

• KAP size has a negative but insignificant

effect on the audit report lag.

During making this research, researchers

certainly did not escape the limitations as a human

being. The following are some research limitations

that hinder the achievement of research objectives:

• This study uses data from mining companies

listed on the Indonesia Stock Exchange from

2016-2018 (3 years). This can cause the results

of the study do not reflect the real results, due

to the lack of data studied.

• Collecting company data is done by sampling

method. The observation unit used in this

research is mining companies listed on the

Indonesia Stock Exchange from 2016-2018

with a sample size of 33 companies, so not all

of the population of mining companies on the

Indonesia Stock Exchange are used as

research objects, so there is a risk that the

selected sample cannot describe and represent

the population.

• The value of the coefficient of determination

(adjusted R2) in this study shows that the

independent variables, namely company size,

financial leverage, and KAP size can only

explain the dependent variable, namely the

audit report lag of 13.6% while 83.4% can be

explained by factors. other than this research.

5.2 Suggestion

Suggestions that can be given from the results of this

study are as follows:

• Suggestions for Users of Audited Financial

Statements It is hoped that users of company

information such as investors and creditors

will be more careful in investing or extending

credit. Information users can consider the

results of this study, namely if the size of the

company is getting bigger, then the possibility

of audit report lag will be smaller and

information users must also be careful if the

level of financial leverage is high, because it

can slow down the audit process, causing audit

report lag.

• Advice For Companies Companies listed on

the Indonesia Stock Exchange, especially

mining companies, are expected to be able to

use this research to overcome and minimize

audit report lag so as to avoid delays in

submitting audited financial reports to the

public.

• Suggestions for Auditors Auditors are

expected to be able to use this research to be

more aware of the factors that affect the audit

report lag so that the auditor can evaluate the

actions that can be taken to overcome these

factors so that the submission of audited

financial reports to the public can be done on

time.

• Suggestions for Further Research Future

research is expected to add years of

observation so that the research can better

describe the prediction of audit report lag that

occurs in a company. Further research is also

expected to increase the research sample in

order to represent the population under study.

Further research is also expected to be able to

add other variables to test the audit report lag,

so that the research can provide evidence of a

stronger effect on the audit report lag.

REFERENCES

Afriyeni, & Marlius, D. (2019). Analysis Of Factors

Affecting The Timeliness Of Submission Of Financial

Statements In Company Listing In Indonesia Stock

Exchange.

Apriyana, N., & Rahmawati, D. (2017). The Effect Of

Profitability, Solvability, Company Size, And Kap Size

On The Audit Delay Of Property And Real Estate

Companies Registered In Indonesia Stock Exchange

For 2013-2015. Nominal Journal, 6 (2), 108-124.

Arifuddin, Hanafi, K., & Usman, A. (2017). Company Size,

Profitability, and Auditor Opinion Influence to Audit

Report Lag on Registered Manufacturing Company in

Indonesia Stock Exchange. International Journal of

The Influence of Company Size, Financial Leverage, and Public Accounting Firm Size on Audit Report Lag: Empirical Study of the Mining

Company

213

Applied Business and Economic Research, 15 (19),

353-367.

Artaningrum, R. G., Budiartha, I. K., & Wirakusuma, M. G.

(2017). The Effect Of Profitability, Solvability,

Liquidity, Company Size And Management Change On

Audit Report Lag Of Banking Companies. E-Journal of

Economics and Business, Udayana University 6.3,

1079-1108.

Ashton, R., John, J., & Robert, K. (1987). An Empirical.

Dura, J. (2017). The Effect Of Profitability, Liquidity,

Solvability, And Company Size On The Audit Report

Lag Of Companies Listed In Indonesia Stock Exchange

(Case Study in Manufacturing Sector). Scientific

Journal of Asian Business and Economics, 11 (1), 64-

70.

Eksandy, A. (2017). The Effect Of Company Size,

Solvability, Profitability And Audit Committee On The

Audit Delay (In Property and Real Estate Companies

Listed on the Indonesia Stock Exchange in 2012-2015).

Competitive Journal of Accounting and Finance, 1 (2).

Fiatmoko, A. L., & Anisykurlillah, I. (2015). Factors

Affecting The Audit Delay Of Banking Companies.

Accounting Analysis Journal, 4 (1), 1-10.

Hassan, Y. M. (2016). Determinants of audit report lag:

evidence from Palestine. Journal of Accounting in

Emerging Economies, 6 (1), 13-32.

Hery. (2016). Financial Statement Analysis. Jakarta: PT.

Gramedia Widiasarana Indonesia.

Hsu, H. (2016). An Empirical Analysis on the Determinants

of Audit Report Lag. 3rd International Conference on

Social Science (ICSS 2016), 732-735.

Jesslyn, C., & Ardianti, A. Y. (2018). The Influence of

Company Complexity, Company Size, and Public

Accounting Firm Size on audit fees in manufacturing

companies. MODE, 30 (2), 198-211.

Panjaitan, I. (2017). Effect of KAP Size, Return on Assets

and Loan to Deposit Ratio on Audit Report Lag. Journal

of Management Applications, Economics and Business,

1 (2), 36-50.

Putra, P. G., & Putra, I. M. (2016). Size Of Company As

Moderates Influence Of Auditor Opinion, Profitability,

And Debt To Equity Ratio On Audit Delay. E-Journal

of Accounting at Udayana University, 14 (3), 2278-

2306.

Rahayu, L. R. (2017). Determinants Of Audit Delay In

Indonesia Companies: Empirical Evidence.

INVENTORY: Journal of Accounting, 1 (1), 1-11.

Writers, I. P., & Latrini, M. Y. (2016). Effect Of

Profitability, Solvability, And Company Size On Audit

Report Lag, In Manufacturing Companies. Udayana

University Accounting E-Journal, 17 (1), 311-337.

Senata, M. (2016). The Effect of Dividend Policy on the

Value of Companies Listed in the LQ-45 Index of the

Indonesia Stock Exchange. Journal of Micro-Civil

Economics Entrepreneurs, 6 (1), 73-84.

Sudarno & Triyaningtyas, M. (2019). Factors Influencing

Audit Report Lag Financial Statements (Empirical

Study of Service Companies Listed on the Indonesia

Stock Exchange 2012-2015). Diponegoro Journal Of

Accounting, 1-9.

Sundjaja, R. S., & Barlian, I. (2001). Financial

Management (3rd ed.). Jakarta: Prenhallindo.

Suwanda, D. (2015). Factors Affecting Quality of Local

Government Financial Statements to Get Unqualified

Opinion (WTP) of Audit Board of the Republic of

Indonesia (BPK). Research Journal of Finance and

Accounting (Paper), 6 (4).

Widhiasari, N. M., & Budiartha, I. K. (2016). The Influence

Of Company Age, Company Size, Auditor's

Reputation, And Auditor Changes On Audit Report

Lag. Udayana University Accounting E-Journal, 15 (1),

200-227.

Widiastuti, I. D., & Kartika, A. (2018). Company Size,

Profitability, Company Age, Solvability And Kap Size

Against Audit Report Lag. Dynamics of Accounting,

Finance and Banking, 7 (1), 20-34. www.idx.co.id

ICRI 2021 - International Conference on Recent Innovations

214