Evaluation on FinTech Capability of Municipal Commercial Banks in

China

Mu Zhang

a

and Gang Feng

b

School of Big Data Application and Economics, Guizhou University of Finance and Economics, Guiyang, China

Keywords: FinTech, Municipal Commercial Bank, Fermatean Fuzzy Sets, TOPSIS.

Abstract: This paper refers to the FinTech development index and related research published by the People's Bank of

China, this paper selects 28 listed municipal commercial banks as the research object, based on the 2020

annual report of 28 listed municipal commercial banks, establishes the FinTech capability evaluation index

system, uses Fermat fuzzy set for 3 evaluations, uses Fermat fuzzy weighted geometric operator method to

obtain comprehensive evaluation, uses AHP method to weight, and then uses TOPSIS method to obtain score.

The study found that the commercial banks in the listed cities in East China are generally in the leading

position in terms of FinTech capability, and the banks in the leading position in terms of various first-level

indicators of FinTech capability are also mostly in East China. Summing up the characteristics of the banks

and regions that rank first in FinTech capability, the following inspirations are drawn: Strengthen the FinTech

resources investment, service capability, risk control capability, basic capability, research and application

capability of municipal commercial banks. The most important of these is research capability. The

government should formulate relevant policies and pay attention to the coordinated development of banking

FinTech among regions.

1 INTRODUCTION

The core of FinTech is that licensed financial

institutions can perfect and innovate financial

products, business models and business processes

with modern scientific and technological

achievements on the premise of complying with the

law, so as to improve the quality and efficiency of

financial development. In August 2019, the People's

Bank of China issued the FinTech Development Plan

(2019-2021). It is pointed out that in order to deepen

the structural reform on the financial supply side,

strengthen the economic capacity of financial service

entities and prevent and resolve major financial risks,

we must adhere to the innovation-driven

development and speed up the deployment of

FinTech strategies and the safe application.

The continuous deepening of the development of

FinTech in commercial banks has brought

unprecedented opportunities as well as huge potential

risks. Commercial banks play an important role in the

economy. Once risks occur, they will bring huge

a

https://orcid.org/0000-0002-3895-7030

b

https://orcid.org/0000-0002-6781-9315

impact to the regional or national economy.

Therefore, the development of FinTech of

commercial banks needs to be paid great attention.

Among the listed commercial banks, the six state-

owned banks and the ten national joint-stock banks

are relatively large in size and complete in FinTech.

The rural commercial banks are relatively weak in

FinTech due to their different clients. The municipal

commercial banks are not only relatively moderate in

size but also relatively moderate in FinTech.

Municipal commercial banks also play a very

important role in their respective regions.

Therefore, this paper takes China's listed

municipal commercial banks as the research object,

based on the indicators of institutional FinTech

development in the Financial Industry Standard of the

People's Republic of China issued by the People's

Bank of China on October 22nd, 2020,

comprehensively considering comprehensiveness,

operability and timeliness, and constructs the

FinTech capability evaluation system of China's

listed municipal commercial banks. After three

Zhang, M. and Feng, G.

Evaluation on FinTech Capability of Municipal Commercial Banks in China.

DOI: 10.5220/0011154600003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 5-11

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

5

evaluations of the indicators by Fermat fuzzy set,

Using Fermat's fuzzy weighted geometric operator

method, the three evaluations are aggregated into one

comprehensive evaluation. After weighting by AHP,

the scores of each index and the scores of each bank

are calculated by TOPSIS method. Select 30

indicators to construct the evaluation system of

FinTech capability of commercial banks in listed

cities in China, and make a micro-evaluation of

FinTech capability of commercial banks in listed

cities in China.

2 RELEVANT RESEARCHES

With the research of Burrell and Morgan (Burrell,

Morgan, 1979) as the combing frame, the research on

FinTech can be divided into four categories according

to the nature of society and science, namely, order

change and objective subjectivity: functional form-

objective order, radical structural form-objective

change, interpretive form-subjective order, radical

humanistic form-subjective change. Haddad et al.

(Haddad, et al, 2019) discussed the technological

determinants of FinTech enterprises in their initial

stage and the framework and strategies of FinTech

platform, which belongs to functional research. The

main research issue is to discuss what FinTech is;

Yang (Yang, 2018) proposed to add a science and

technology dimension as a supplement to the

traditional supervision, and to conduct supervision

from two dimensions, and the science and technology

supervision dimension should focus on data

supervision, which belongs to a radical structural

research, mainly discussing how to develop a new

FinTech system and provide a set of solutions to

practical problems; Li et al. (Li, et al, 2020) studied

FinTech from the perspective of innovation, and

examined the function and influence mechanism of

FinTech on enterprise innovation of China's new

third board listed companies, which belongs to the

hermeneutic research, mainly discussing the function

mechanism and logic of FinTech; Wang and Huang

(Wang, Huang, 2018) based on tools such as

sentiment analysis and news analysis, build a

FinTech evaluation system, obtain data from public

platforms such as social media and news reports for

processing, measure the sentiment of the market and

its investors, and predict relevant trends. It belongs to

radical humanistic research, which is mainly

conducted from the aspect of human behaviour.

The number of high-level academic journals

searched on the title of bank and FinTech on CNKI is

only 103. Among them, there are 22 articles whose

titles contain impact, mainly studying the impact of

FinTech on banks (Qiu, et al, 2018, Sun, 2018); The

title of 14 articles includes transformation, which

mainly studies the transformation of banks under the

background of FinTech (Xie, et al, 2018, Wang &

Wang, 2017). Other articles are mostly focused on

these two aspects, and for the evaluation of the bank's

FinTech capability, only one article, such as Lin

Sheng, was retrieved. Lin et al. (Lin, et al, 2020) took

29 globally systemically important banks as the

research object, constructed the FinTech evaluation

system from 7 aspects, evaluated the FinTech

capability with the analytic hierarchy process, carried

out comparative analysis, and put forward

corresponding suggestions for the development of

banking FinTech based on the results of comparative

analysis. It can be seen that at present, the research on

the evaluation of banks' FinTech capability is still

very scarce, while the research on the evaluation of

China's listed local commercial banks' FinTech

capability still has certain deficiencies. Therefore, the

research in this paper has certain theoretical and

innovative significance.

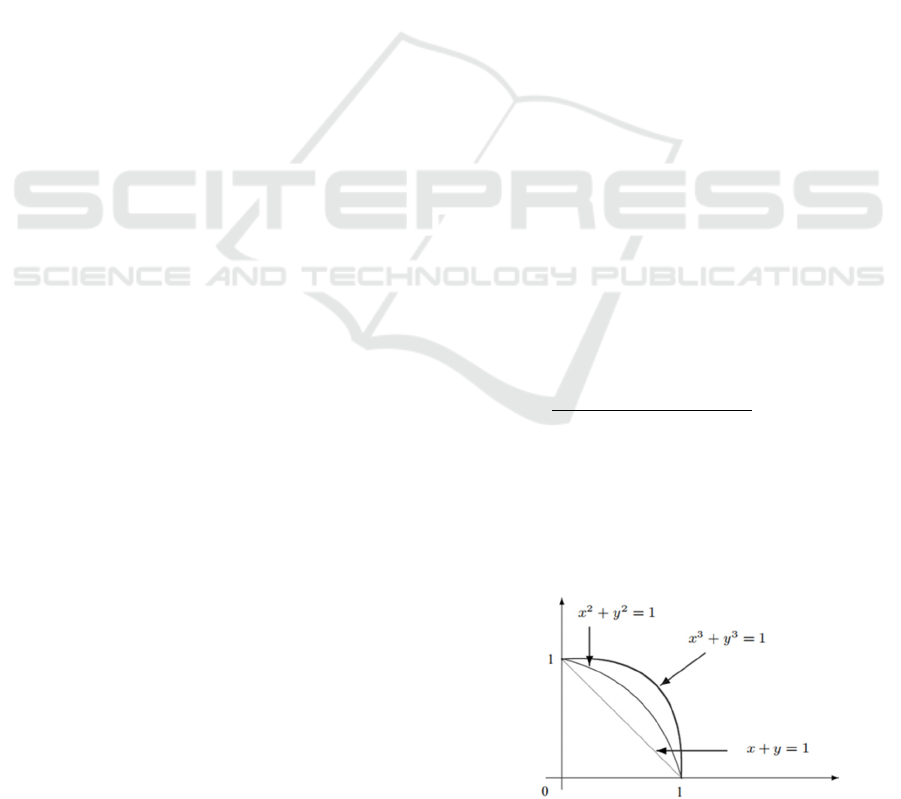

3 FERMATEAN FUZZY SETS

Definition: Let X be a universe of discourse. A

Fermatean fuzzy set F in X is an object having the

form F={<x, αF(x),βF(x)>:x∈X}, where αF(x):X→

[0,1] and βF(x):X→[0,1],including the condition 0≦

(αF(x))3+(βF(x))3≦ 1, for all x∈X. The numbers

αF(x) and βF(x) denote, respectively, the degree of

membership and the degree of non-membership of

the element x in the set F. For any FFS F and x∈X,

πF(x)=

1α

x

β

x

is identified as

the degree of indeterminacy of x to F (Senapati &

Yager 2020).

Fermatean fuzzy sets is an improvement on the

traditional fuzzy set (Atanassov 1986, Yager 2013),

which expands the scope of fuzzy set on the original

basis. As shown in Figure 1, its advantages are more

intuitive.

Figure 1: Fermatean fuzzy sets.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

6

4 RELEVANT RESEARCHES

In this paper, Fermatean fuzzy TOPSIS method is

mainly applied, and preference aggregation is

combined with Pythagorean fuzzy weighted

geometric operator (Yang, et al, 2019). Hesitant

fuzzy language is an effective form of information

expression, which can well reflect people's

qualitative and hesitant decision-making information

(Wu, et al, 2021).

The specific calculation process is as follows:

Firstly, three evaluations are carried out by using

Fermatean fuzzy sets.

12

11111 1212 11

* 2 21 21 22 22 2 2

11 2 2

(,) (,) (,)

()) ( , ) ( , ) ( , )

(,)( , ) (, )

n

nn

jimn n n

mmm m m mnmn

CC C

Suv uv uv

RCS Suv uv uv

Su v u v u v

==

(

(1)

Where u is satisfaction degree, v is

disappointment degree, m is evaluation object, n is

evaluation index.

After three evaluations, the three evaluation

values are combined into one preference by using

Fermatean fuzzy weighted set operator. The

Fermatean fuzzy weighted geometry (FFWG)

operator is defined according to the Pythagorean

fuzzy weighted geometry (PFWG) operator (Yager &

Abbasov 2013, Yager 2014, Peng & Yang 2015) and

the Fermatean fuzzy sets, the formula is as follows:

3

3

12

11

(, , , )( ,1 (1 ))

ii

nn

ww

ni i

ii

FFWG u v

αα α

==

=−−

∏∏

(2)

Among them, the proportion of three evaluations

w

i

is 0.4, 0.3 and 0.3 respectively.

Then calculate the score.

33

(())

j

iijij

score C S u v=−

(3)

Confirm the optimal scheme S+ and the worst

scheme S-.

{}

j

11 22

j

max ( ( )), p

(,)(,) (,)

min ( ( ) n

)e

iji

nn

iji

osscore C S C

Suvuvuv

score C

itive

gativeSC

+++++++

==

,

(4)

{}

j

11 22

j

min ( ( )), positive

(,)(,) (,)

max ( ( )) negative

iji

nn

iji

score C S C

Suvuvuv

score C S C

−−−−−−−

==

,

(5)

Calculating the distance from each evaluation to

S+ and S- and summing up.

33233233332

1

11

(,) ( ())( ())( ()())

22

n

i j ij j ij j ij ij j j

j

DS S w u u v v u v u v

+++++

=

=−+−++−−

(6)

33233233332

1

11

(,) ( ())( ())( ()())

22

n

i j ij j ij j ij ij j j

j

DS S w u u v v u v u v

−−−−−

=

=−+−++−−

(7)

w

j

is the weight of each index, calculated by using

analytic hierarchy process (AHP).

Finally get a score.

()

()()

,

()

,,

i

i

ii

DS S

RC S

D

SS DSS

−

−+

=

+

(8)

5 INDEX SYSTEM

Based on the institutional FinTech development

indicators in the "Financial Industry Standard of the

People's Republic of China" issued by the People's

Bank of China on October 22, 2020, combined with

the relevant research of Lin Sheng and others, and

considering comprehensively the comprehensive-

ness, representativeness, scientificalness, operability

and timeliness, this paper constructs the FinTech

level evaluation system of China's listed commercial

banks. As shown in Table 1, a total of 6 first-level

indicators and 30 second-level indexes are used as the

evaluation basis for the FinTech level of China's

listed commercial banks.

Table 1: Index system of FinTech capability.

First-level

index

Second-level index

Resource input

FinTech focus

FinTech development function

Percentage of investment in

FinTech

Percentage of FinTech personnel

FinTech-related training attention

Service

capability

Number of mobile banking users

Bank staff

Total turnover

Total profit

Ratio of mobile banking users to

total users

Ratio of mobile banking users to

bank employees

Average employee profit

Average turnover of employees

Banking attention

Number of bank branches

Bachelor degree rate of banking

staff

Graduate and above proportion of

bank staff

Risk control

capability

Tier 1 capital rate

Non-performing loan rate

Capital adequacy ratio

Risk exposure ratio

Basic capability Asset size

Evaluation on FinTech Capability of Municipal Commercial Banks in China

7

First-level

index

Second-level index

Net profit

Net profit growth rate

ROA

ROE

Research

capability

Number of patents

IPC patents

Application

capability

FinTech related awards

Information technology

development

FinTech focus refers to the frequency of FinTech

in the annual report. The FinTech development

function refers to whether relevant departments are

established. FinTech-related training attention refers

to the frequency of training in the annual report.

Banking attention refers to the frequency of service

in the annual report. FinTech related awards refer to

the number of FinTech related awards received in the

annual report. Information technology development

refers to the frequency of information technology in

the annual report.

The data in this paper are mainly from the 2020

annual report published by various banks,

supplemented by internet search, in which patent-

related data are from the State Intellectual Property

Office and refer to the patent applications after

January 1, 2020. The missing values are evaluated by

approximate values.

6 RESULTS AND ANALYSIS

Establishing a matrix according to the formula (1) to

obtain three evaluation matrixes, synthesizing the

three evaluation matrixes into one evaluation matrix

according to the formula (2), calculating the scores of

each index of each bank by using the formula (3),

determining the optimal scheme and the worst

scheme by using the formula (4) and the formula (5)

according to the score situation, calculating the

distance from each evaluation value to the optimal

scheme and the worst scheme by using the formula (6)

and the formula (7) and summing up, and finally

calculating the scores of each bank by using the

formula (8) and ranking, the results are shown in

Table 2.

Table 2: Score and ranking of FinTech capability.

Bank Score Ranking

Shanghai 0.509358 1

Chongqing 0.491643 2

Zhongyuan 0.489337 3

Hangzhou 0.442895 4

Beijing 0.416211 5

Ningbo 0.415359 6

Nanjing 0.410792 7

Huishang 0.408684 8

Jiangsu 0.407023 9

Jiangxi 0.403569 10

Luzhou 0.401217 11

Changsha 0.394509 12

Chengdu 0.388694 13

Guiyang 0.381703 14

Qingdao 0.381655 15

Gansu 0.378831 16

Xian 0.378459 17

Xiamen 0.372064 18

Suzhou 0.372017 19

Tianjin 0.364058 20

Zhengzhou 0.363532 21

Weihai 0.361962 22

Guizhou 0.360259 23

Haerbin 0.356358 24

Jiujiang 0.35547 25

Jinshang 0.349468 26

Jinzhou 0.348694 27

Shengjing 0.345607 28

Among the 28 listed municipal commercial

banks, the bank of Shanghai scored the highest,

0.5094; The bank with the lowest score was Jiangyin

Bank, with 0.3456, and the extremely poor score was

0.1638. On the whole, the scores are clearly

distinguishable.

The average score of 28 listed municipal

commercial banks is 0.3946, with a median of

0.3817. The banks closest to the median are Bank of

Guiyang and Bank of Qingdao, with the

corresponding ranking of 14 and 25 among the 28

banks respectively. The average score is 0.0129

points higher than the median, and the difference is

small, which indicates that the overall distribution of

scores is relatively uniform.

The variance of the scores of 28 listed municipal

commercial banks is 0.0018 and the standard

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

8

deviation is 0.0427, which indicates that the

dispersion of the scores is more appropriate.

Figure 2: Ranking chart of FinTech capability.

According to the score range of 0.1638, the scores

of 28 listed local commercial banks are divided into

10 grades. The number of banks falling within these

10 grades is: 7, 4, 6, 5, 2, 1, 0, 0, 2 and 1 respectively.

As shown in Figure 2, the scores of the vast majority

of banks are concentrated in another 1-4 grades,

which shows that the vast majority of banks have

relatively low FinTech capability.

Generally speaking, listed municipal commercial

banks have low FinTech capability; By region, the

listed city firms in East China rank ahead in FinTech.

Among the top 10 banks with FinTech capability of

listed municipal commercial banks, there are 7 in East

China and 1 each in Southwest, North and Central

China. The highest ranked bank in the northeast is

Harbin Bank, which ranks 24th. The highest ranked

bank in the Northwest is Bank of Gansu, which ranks

16th.

The outstanding performance of FinTech

capability of listed municipal commercial banks in

East China reflects the leading advantages of East

China in FinTech. East China, especially the Jiangsu,

Zhejiang and Shanghai regions, is represented by a

large number of listed local commercial banks and a

well-developed regional economy. It is the economic

centre of China. In terms of policy, since the

economic opening policy is also relatively open,

FinTech innovation is encouraged on the premise of

risk prevention; In terms of science and technology,

the regional economy is developed, there are many

universities and colleges, and there are many talents.

They are actively exploring in the research and

development and application of many emerging

technologies, and have certain advantages in starting

first. In the market, the regional market is open and

has a high acceptance of FinTech-related service

innovation, and there is a huge space for financial

market expansion. Listed municipal commercial

banks in other regions can refer to the development

experience in East China to improve their FinTech

capability.

7 CONCLUSIONS

7.1 Resources Investment

In terms of investment in FinTech resources, Bank of

Hangzhou and Bank of Beijing are significantly

ahead of other banks, with five banks in East China

in the top ten, and the municipal commercial banks in

East China are generally ahead of other regions.

Although the East China region as a whole has a

leading edge, the Bank of Beijing ranks second, far

ahead of other banks. The reason is that the Bank of

Beijing owns its own FinTech company. Although

Hangzhou Bank, which ranks first, does not have a

FinTech company, its development in FinTech talents

is far ahead of other banks.

Therefore, each bank can make reference to the

experience of the two banks and make efforts in terms

of strategy, capital and talents to increase the

investment in FinTech resources and enhance their

own FinTech Capability. In particular, we should pay

attention to the investment in strategy and talents.

FinTech companies should be established if

conditions permit, and FinTech departments should

be actively established if conditions do not permit,

and professional management should be

implemented. At the same time, we should actively

introduce FinTech personnel.

7.2 Services

In terms of FinTech service capability, Bank of

Shanghai is significantly ahead of other banks, with

six banks in East China in the top 10, and banks in

East China are generally ahead of other regions. As

for the FinTech service capability of listed municipal

commercial banks, East China has a clear leading

advantage. The main reason why Shanghai Bank,

which ranks first, came first is that it ranks first in all

its indicators and has a strong comprehensive

capability.

Banks can refer to the above banking experience

and focus on the development of mobile banking to

enhance service focus, expand service coverage while

saving costs and improve service Capability. In the

process of development, pay attention to efficiency,

can optimize the personnel structure, improve the

proportion of highly educated, enhance service at the

Evaluation on FinTech Capability of Municipal Commercial Banks in China

9

same time, reduce expenses, achieve the purpose of

improving service capability.

7.3 Risk Control and Basic Capability

In terms of FinTech risk control capability, banks in

Bank of Ningbo and Hangzhou are significantly

ahead of other banks, and they are also on a ladder,

while the gap between other banks is not big. There

are 6 banks in East China in the top 10, and they are

all in the top 3 with obvious advantages. In terms of

basic FinTech Capability, the East China region as a

whole is in the lead, with six of the top 10 banks all

located in the East China region. In terms of FinTech,

risk control and basic Capability, the listed municipal

commercial banks in East China have obvious

leading advantages.

The indicators under risk control and basic

capability are both the basic indicators of banks and

the foundation of banks. At the same time, they are

also the necessary premise for banks to carry out

FinTech. Only based on solid foundation can FinTech

be carried out smoothly. However, attention should

also be paid to the issue of efficiency. On the premise

of ensuring safe risk control and basic Capability,

FinTech should be actively developed to achieve high

efficiency in resource allocation, instead of

excessively concentrating large amounts of idle

resources in risk control.

7.4 Research and Application

In terms of FinTech research and development

capability, Zhong Yuan Bank's score is far ahead of

other banks. Among the top 8 banks, there are 4 banks

in East China, 2 banks in Southwest China and 2

banks in Central China, which shows that Southwest

China and Central China pay relatively much

attention to FinTech research and development to

make up for their own shortcomings. On the whole,

the banks in the Southwest, Central and East China

regions have certain leading advantages over other

regions in terms of FinTech research and

development capability. In terms of FinTech

application capability, the East China region ranks

high, with five of the top 10 banks located in East

China and ranking No.1 in Jiangxi having significant

scoring advantages.

In terms of FinTech research and development

and application Capability of listed municipal

commercial banks, the East China region has obvious

advantages. Among the research and development

Capability, the Southwest region and the Central

China region have excellent performance, which is

mainly due to their attention to patents. The number

of patents applied for has obvious advantages. The

number of patents applied for by Zhong Yuan Bank

is as high as 13, ranking first. Therefore, banks should

strengthen their research and development Capability

and increase the number of patent applications, so as

to enhance the banking FinTech Capability. In terms

of application, it should pay more attention to

information technology, actively carry out relevant

businesses, and actively innovate and research and

develop under the premise of effective risk control,

so as to obtain awards from relevant institutions or

media, thus demonstrating the effectiveness of

FinTech application.

Finally, the most important thing is the banks'

own technical capability, and each bank should

improve its technical capability most. In addition, the

government should pay attention to the coordinated

development among regions so as to formulate

corresponding policies. The research in this paper

still has some problems such as single sample, short

time and no further analysis. In the future, the scope

and time of the research can be expanded based on

the research in this paper, so as to further increase the

accuracy of the research and conduct more in-depth

research.

ACKNOWLEDGEMENTS

This research was funded by the Regional Project of

National Natural Science Foundation of China, grant

number 71861003.

REFERENCES

Atanassov, K. T. (1986). Intuitionistic fuzzy sets. J. Fuzzy

Sets Syst. 20, 87-96.

Burrell G., Morgan, G., 1979. Sociological paradigms and

organization analysis, Routledge. London, 1

st

edition.

Haddad, C., Hornuf, L. (2019). The emergence of the

global FinTech market: economic and technological

determinants. J. Small Business Economics. 53, 81-

105.

Li, C. T., Yan, X.W., Song, M., Yang, W. (2020). FinTech

and enterprise innovation: evidence from new third

board listed companies. J. China's Industrial Economy.

1, 81-98.

Lin, S., Yan, H., Bian, P. (2020). Global systemically

important banks' FinTech capability assessment

research. J. Financial development research. 01, 20-29.

Peng, X. D., Yang, Y. (2015). Some results for Pythagorean

fuzzy sets. J. International Journal of Intelligent

Systems. 30 (11), 1133-1160.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

10

Qiu, H., Huang, Y.P., Ji, Y. (2018). The impact of FinTech

on traditional banking behaviour-based on the

perspective of internet wealth management. J. Financial

Research. 11, 17-29.

Senapati, T., Yager, R.R. (2020). Fermatean fuzzy sets. J.

Journal of Ambient Intelligence and Humanized

Computing. 11. 663-674

Sun, N. (2018). The impact of FinTech on commercial

banks under the new situation and countermeasures. J.

Macroeconomic Management. 04, 72-79.

Wang, J.Y., Huang, Y.P. (2018). The characterization of

FinTech media sentiment and its impact on the online

credit market. J. Economic Quarterly. 17 (4), 1623-

1650.

Wang, N., Wang, Z. Q. (2017). Researches on

transformation strategies of commercial banks under

the background of FinTech. J. Modern Management

Science. 07, 24-26.

Wu, P., Wu, Q., Zhou, L.G., Chen, H.Y. (2021). Decision-

making method of TOPSIS based on multi-objective

attribute weight optimization in hesitant fuzzy lang-

age. J. Operation and Management. 30 (06), 42-47.

Xie, Z.C., Zhao, X.L., Liu, Y. (2018). The development of

FinTech and the digital strategic transformation of

commercial banks. J. China Soft Science. 08, 184-192.

Yager, R.R. (2014). Pythagorean membership grades in

multicriteria decision making. J. IEEE Transactions on

Fuzzy Systems. 22 (4), 958~965.

Yager, R.R., 2013. Pythagorean fuzzy subsets. In 2013

Joint IFSA World Congress and NAFIPS Annual

Meeting (IFSA/NAFIPS). IEEE Xplore.

Yager, R.R., Abbasov, A.M. (2013). Pythagorean

membership grades, complex numbers, and decision

making. J. International Journal of Intelligent Systems.

28 (5), 436~452.

Yang, D. (2018). Regulatory technology: FinTech

regulatory challenges and dimension construction. J.

China Social Sciences. 5, 69-91+205-206.

Yang, Y., Yu, S.Q., Ren, J. (2019). Integrally consistent

Pythagorean fuzzy preference relation and its

application to group decision making. J. Fuzzy Systems

and Mathematics. 33 (06), 114-129.

Evaluation on FinTech Capability of Municipal Commercial Banks in China

11