Application of Data Sharing Model of Investment Facilitation based

on Multi-level Blockchain

Mengxue Zuo

a

Law School, Xi’an Jiaotong University, 28 Xianning West Road, Xi’an, Shaanxi Province, China

Keywords: Multi-Level Blockchain, Data Sharing, Investment Facilitation, Distributed Storage, Federated Learning.

Abstract: Big data technology has been used in almost every aspect of traditional industries in recent years. Investment

facilitation involves multinational corporations, host countries, investors' home countries, investment

promotion agencies and other subjects, with their data information. How to improve the efficiency of data

storage and ensure the privacy and security of data has become a key technical issue for the wide application

of investment facilitation. The data sharing model of investment facilitation based on multi-level

blockchaincan can meet the requirements of transparency, sustainable development and high efficiency of

investment facilitation, and better help investment facilitation to realize data sharing characteristics. By

encrypting investment facilitation data and its index information, and uploading the encrypted data to the

distributed storage outside the chain and the storage on the chain respectively, and adopting multi-level

blockchain technology, the data storage efficiency is significantly improved, the security of investment

facilitation data is ensured, and the scalability of blockchain is improved. In addition, the model uses the

differential privacy technology in the parameter transmission of the federal learning module, which enhances

data privacy protection. The application of investment facilitation to scientific research, monitoring and

evaluation systems, as well as the promulgation and enforcement of host country laws, can be effectively

realized by this technical means.

1 INTRODUCTION

In recent years, with the rapid development of

information technology and the wide application of

cloud computing, new network technology and

Internet of Things equipment, international

investment is gradually transforming to digitalization

and informatization. At the same time electronic

investment data are experiencing explosive growth

and diversified development of data types.

Nowadays, data is no longer a simple data storage

medium and computing protocol, but a factor of

production, with the value of resources, and causing

legal disputes. International investment is also in the

digital revolution, rushing to embrace the blue ocean

of the digital economy. However, international

investment is a complicated issue involving many

subjects including multinational corporations, host

countries, investors' home countries, investment

promotion agencies and so on. The biggest problem

is that it is difficult to guarantee the consistency,

a

https://orcid.org/0000-0001-7888-9178

authenticity and integrity of data, and it is difficult to

resist malicious attacks. In this respect, blockchain

technology has solved the problems existing in

traditional cloud servers.

Blockchain technology is characterized by

decentralization, decent-trust and anonymity, which

is more in line with the security and privacy

protection requirements in the field of data sharing in

international investment. The emergence of smart

contracts has turned the blockchain into distributed

account book with computing power, through which

users can calculate according to a fixed computing

mode. For federated learning, participants can write

intelligent contracts to complete parameters

aggregation, allocation and other operations, so as to

avoid the single point of failure of the third-party

server in the global modeling stage. The multi-level

blockchain architecture consists of the public chain

and the alliance chain. The public chain is maintained

by the special departments of the host country, which

is responsible for the interaction between the host

Zuo, M.

Application of Data Sharing Model of Investment Facilitation based on Multi-level Blockchain.

DOI: 10.5220/0011163900003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 117-123

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

117

country and the system. At the same time, these

departments also form different alliance chains

according to different data types, and combine with

attribute database encryption to ensure data privacy.

(Malamas, Kotzanikolaou, Dasaklis, 2020)

Investment facilitation is a new issue in

international investment. It is to create a transparent

and efficient investment policy environment for

investors by improving policy transparency and

predictability, simplifying investment rules and

procedures. Investment facilitation is not the right to

amend or enact the investment laws and it has nothing

to do with investment protection, investment

promotion and investment liberalization. (Hamdani

2018) The transparency mentioned in investment

facilitation suggestions put forward by various

countries mainly includes the following aspects.

When formulating investment-related policies, the

government should provide comprehensive, clear and

timely notice. The government should ensure

effective access to information, including providing

"one-stop" consultation points or special consultation

points, and appropriate online services. The

government should also promote simplification of the

language of laws and regulations and publish the

results of periodic review of the investment

mechanism in a timely manner. From the perspective

of the host country, a core aspect of investment

facilitation is to improve the openness and

transparency of investment supervision and

management of the host government. Digital

application is the simplest and most direct way to

achieve transparency.

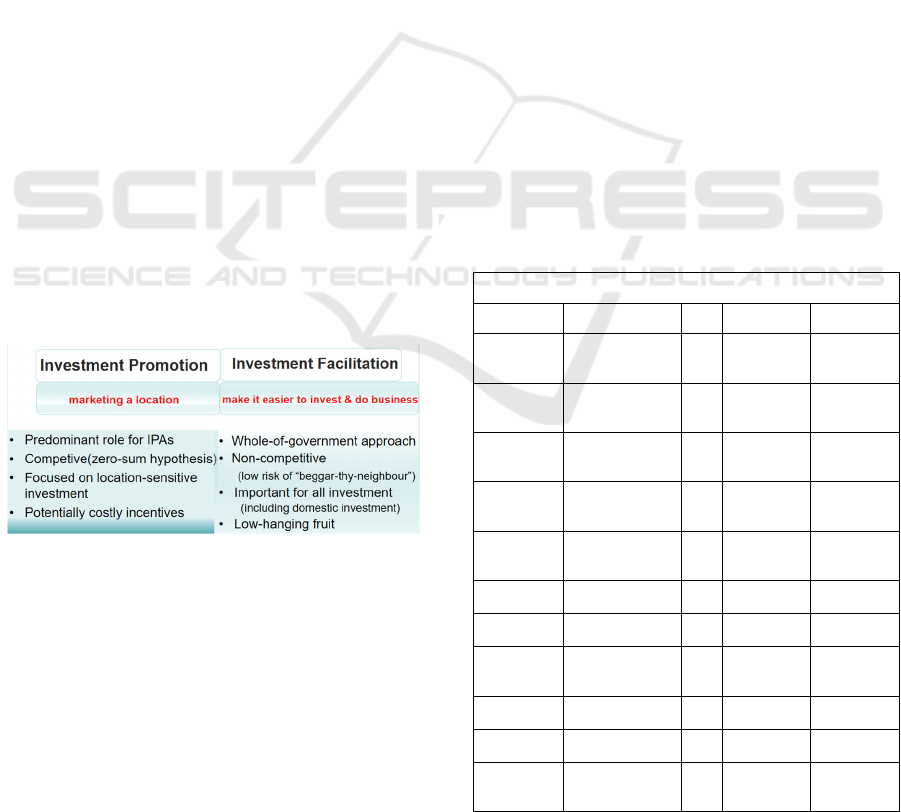

Figure 1: Scope of Investment Promotion and Facilitation.

Therefore, the most important issue is how to

implement investment facilitation under the existing

mechanisms. The research goal of this paper is to use

blockchain technology to realize the application of

investment facilitation at a wide range of levels.

Finally, it will solve the problem of mistrust among

the subjects, increase the transparency and

effectiveness of investment facilitation, and ensure

that the privacy, openness and transparency of

investment data do not conflict.

2 CHALLENGES OF

ESTABLISHMENT DATA

SHARING MODEL ON

INVESTMENT FACILITATION

2.1 Challenges in Institution

The current level of investment facilitation is low and

the depth of cooperation is shallow. Although there

are several cooperative organizations at the regional

level, the multilateral level still stays on the sidelines.

Investment facilitation belongs to an emerging

transnational legal system. Among it, global

governance has a stronger color than traditional legal

governance, but the fact is that "transnational

legislation" and "international legislation"

complement each other and move forward. The “

international legislation” based on the express or

implied mutual consent of various countries has

formed international law in the traditional sense

(international hard law), but the development of

globalization has put forward incremental

requirements for transnational legal norms, that is

international soft law formulated by various non-state

actors, which requires the introduction of the law-

making mechanism of “transnational legislation”.

Table 1: Concrete Measures of Investment Facilitation.

Concrete Measures of Investment Facilitation

UNCTRAD2017 G20 APEC2009 OECD2015

Accessibility

and

trans

p

arenc

y

Line1 √ √

Stability,

security and

p

rotection

√ √

Predictability

and

consistenc

y

Line 3 √ √

Efficiency

and

effectiveness

Line 2 √

Constructive

stakeholder

relationshi

p

s

Line 4 √ √

Use of new

technology

√

Monitoring

and review

Line 6 √ √

Enhance

international

coo

p

eration

Line 7 & Line 10 √ √

Capacity-

b

uildin

g

Line 9 √

Designate a

lead a

g

enc

y

Line 5 √

Support and

technical

assistance

Line 8

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

118

The issue of investment facilitation is at the initial

stage of consultation and joint construction by

various governance entities around the world. Among

them, transnational legislation has initially developed

a set of regional standardized rules that can be used

as reference by various countries, while inter-state

legislation is trapped by conflicts of interest

distribution and differences in preferences. First, at

the regional level, only a preliminary investment

facilitation rule framework was reached in the G20

and BRICS summits. Second, at the multilateral

level, the WTO investment facilitation proposals

promoted by developing members have not been truly

adopted. Finally, at the bilateral level, there is a lack

of clauses containing specific commitments to

investment facilitation. Among the existing more

than 3,300 international investment agreements, only

some clauses contain investment facilitation

commitments, and most of them focus on the entry

and residence of investors and the enhancement of

transparency of laws and regulations. According to

UNCTAD's statistics, only India, Indonesia, ASEAN,

Japan, China, Australia, Malaysia and other countries

have relevant clauses in investment agreements, and

the relevant content is often too simple. However, in

a state where inter-state legislation is stagnant, there

are still many domestic measures that are gradually

benchmarked against the international system. This

abnormal development is enough to attract attention.

In this situation, the data sharing platform can bring

together different stakeholders such as data subjects,

data controllers, and data users, and include different

types of data, avoiding repeated collection of data and

wasting resources. In addition, the data sharing can

ensure the uniformity of the degree of investment

facilitation and reduce the huge difference between

developed and developing countries.

2.2 Challenges in Recognition

Principles

2.2.1 Transparency Principle

The principle of transparency is the most important

and targeted principle in investment facilitation. The

APEC investment facilitation agenda requires that

every APEC economy should ensure the transparency

of relevant laws, regulations and administrative

procedures affecting the flow of goods, services, and

capital, so as to create and maintain an open and

predictable trade and investment environment. The “

G20 Global Investment Policy Guiding Principles”

also regard transparency as a principle and goal. In

the WTO legal system and the international

investment dispute settlement mechanism, the

principle of transparency is an extremely important

principle. It is applicable to almost all fields of

international investment and overcomes the

information failure in international investment.

The investment facilitation proposals put forward

by various countries in recent years also mentioned

transparency requirements, mainly including: (1) The

government should provide comprehensive, clear and

timely notifications when formulating investment-

related policies, (2) Ensure effective access to

information, Including the provision of "one-stop"

consultation points or special consultation points and

appropriate online services, (3) promoting the

simplification of the language of laws

and regulations,

(4) promptly publishing the results of periodic review

of the investment mechanism. From the perspective

of the host country, a core aspect of investment

facilitation is to improve the openness and

transparency of investment supervision and

management of the host government. The application

of digitizing is the simplest and most direct way to

achieve transparency.

2.2.2 Sustainable Development Principle

The investment facilitation plays a vital role in

promoting sustainable development. According to

UNCTAD’s calculations, developing countries are

facing an annual sustainable development goal-an

investment gap of US$2.5 trillion (Hamdani 2018).

Investment facilitation will effectively reduce the

investment gap and help developing countries

achieve sustainable development goals. Data sharing

can help developed countries and developing

countries to share interests and risks, bind interests

and risks together, rather than separate them, and

achieve sustainable goals in the investment field.

2.2.3 Efficiency Principle

The principle of high efficiency is the ultimate goal

pursued by investment facilitation, different from

investment liberalization, investment promotion and

investment protection. The ultimate goal of

investment facilitation is to improve the efficiency of

the investment process, thereby effectively reducing

investors' time and costs. The supporting measures

related to the principle of high efficiency in the

international standards proposed by APEC and

UNCTAD include: (1) reducing the time for

registration, approval, registration, taxation and other

procedures, (2) avoiding multiple discussions, (3)

reducing foreign investment needs to fill in Forms,

and encourage them to be electronic, (4) The central

Application of Data Sharing Model of Investment Facilitation based on Multi-level Blockchain

119

and local levels perform their duties and coordinate.

Application and realization of E-government, "one-

stop" services and a single window match the

demands of investment facilitation above, then

smooth deployment of follow-up work and the

improvement of safety factors.

3 TENTATIVE PLAN OF

APPLICATION OF DATA

SHARING MODEL OF

INVESTMENT FACILITATION

BASED ON MULTI-LEVEL

BLOCKCHAIN

3.1 Application Data Sharing in the

Monitoring and Evaluation System

for Investment Facilitation

In terms of performance evaluation, the Doing

Business of World Bank, the Investment Climate

Statement of US State Department and the Global

Enabling Trade Report of World Economic Forum

are all important annual report for monitoring and

evaluating the business environment and investment

environment. Among them, the most influential one

is the Doing Business, whose data has been cited by

many institutions and multinational companies.

Based on the above report, this paper designs the

performance evaluation index system of investment

facilitation based on the specific objectives and action

plans put forward by UNCTAD's Global Action

Manual on Investment Facilitation and APEC's

Action Plan on Investment Facilitation (Text of

Global Action Memu in 2001 and Text of IFAP in

2009). The ultimate goal of this performance

evaluation indicator system is to further evolve the

international standards proposed by UNCTAD and

APEC into quantifiable data, and to formulate data

that can not only reflect the performance of

environmental investment facilitation, but also reflect

the best practices of investment facilitation. Based on

the secondary and tertiary indicators demonstrated to

the world, the investment facilitation level of

countries and regions participating in international

cooperation on investment facilitation is finally

calculated. Among them, through the data sharing

platform, the evaluation reports of multiple

organizations are integrated, and the big data

software system is used to make a specific evaluation

system that meets the needs of the country or industry

according to the set standards, and the monitoring

evaluation system is implemented through big data to

track dynamic information.

3.2 Application Data Sharing in

Scientific Research for Investment

Facilitation

The League of European Research Universities

(LERU) released the Scientific Data Roadmap in

2013, which clarified the benefits and challenges of

scientific data sharing and reuse, the cost of scientific

data development, and the management of scientific

data. Skills and knowledge, as well as corresponding

training and development opportunities (LERU

2015), in order to guide LERU member universities

in the form of guidelines to carry out scientific data

management related practices. In January 2014, the

Ministry of Education, Sports and Culture of the

United Kingdom and the Ministry of Statistics

reached a data sharing agreement to promote the use

of departmental management data to conduct

research on population size, structure and migration

dynamics (POPULATION, MIGRATION, 2013).

Research on investment facilitation is currently in its

infancy so that the research level and focus of

research institutions and researchers in various

countries are different. The most representative one is

the study of the Center for Sustainable Investment at

Columbia University. The Perspective established by

this institution is an excellent platform to achieve data

sharing data on investment facilitation research.

Experts in this field around the world publish their

work report through this platform, not just mature

academic papers. Therefore, the achievements of

investment facilitation research cannot be separated

from the sharing of scientific research data in such a

short period of time. (Sauvant, 2008-2022)

3.3 Application Data Sharing in Host

Country for Investment Facilitation

Data can flow between countries in accordance with

clear, practical, and fair access and reuse rules in data

space, and access to a wider range of international

data sharing conditions while ensuring compliance

with the public interest and the legitimate interests of

data providers. These are conducive to promoting

data sharing between enterprises and governments

and promoting the structure normativeness of the

laws in host country in turn.

India set up the country’ s core institution for

investment promotion and facilitation at the federal

level——Invest India. That’s the one reason not to be

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

120

ignored to a historical high recorded for India FDI

inflows after the ongoing pandemic. For a large and

politically diverse state such as India, the potential

incompatibility of investment facilitation measures

(such as national focal points and single-window

clearance mechanisms) with its federal state structure

has been a legitimate concern, particularly given how

FDI projects inevitably require clearances from

multiple levels of subnational political entities. Yet,

Invest India virtually coordinates between federal and

provincial state agencies, both horizontally and

vertically. It therefore helps to diminish procedural

inefficiencies caused by the “ center vs. state ”

demarcation. By doing so, it attempts to fast-track all

types of licenses, approvals and clearances for

investors, without encroaching upon the

constitutionally guaranteed functional autonomy of

regional and local authorities. This not only shows the

effectiveness, but also shows that the federal state

implements investment facilitation at the domestic

law level, let alone a unified centralized state.

4 HOW TO APPLICATION OF

DATA SHARING MODEL OF

INVESTMENT FACILITATION

BASED ON MULTI-LEVEL

BLOCKCHAIN

4.1 Industrial Data Sharing Platform

The industry data sharing platform is to set up a data

sharing intermediary platform in a specific industry

or field. For example, China's unified environmental

assessment declaration and approval system has

achieved national data sharing for fixed asset

investment in China. It is conducive to the

implementation of interconnection and centralized

exchange at the national level, sharing EIA approval

data with relevant local departments through the

investment platform as needed, relying on the

investment platform to reduce the burden of project

units, the integrated management department of the

investment platform supports data sharing,

coordination and cooperation between departments

With the help of the data sharing platform, the ability

of the company is significantly improved. On this

basis, cross-border cooperation for scientific data

sharing is realized.

There are already many practices for co-

construction and sharing of scientific data according

to different industries. Such as the Center for

Scientific and Industrial Research (CSIR) of India

and the sharing of medical information in Kenya.

Kenya Medical Research Institute (KEMRI) connects

with each other and shares resources by compiling

data and catalogs for research and use by Kenyan

medical institutions. The earth system science data

sharing platform in China is undertaken by the

Institute of Geographic Sciences and Natural

Resources Research of the Chinese Academy of

Sciences, the Institute of Resources and Environment

of the Chinese Academy of Sciences, more than 40

well-known universities in the field of domestic

geosciences, the World Data Center, International

Mountain Center, and the University of Maryland and

other international organizations and institutions

participate in the construction and operation of this

platform. With reference to the operating mode of

these existing industry data intermediary platforms, it

is feasible to apply data sharing to investment

facilitation to a large extent.

In the application of investment facilitation,

investment can be regarded as a generalized area,

which can be specifically divided into energy

industry investment, technology investment,

infrastructure construction investment, and tertiary

industry investment. The characteristics of different

industries should be highlighted in the application of

investment facilitation. For instance, in the energy

industry, the focus of investment facilitation should

be on the transparency and process of obtaining

licenses and the social obligations undertaken by

enterprises. In technology investment, the focus of

investment facilitation should be on the security of

the technology protection platform and the

transparency of the scope of technology application.

In infrastructure construction investment, the focus of

investment facilitation should be on the degree of

openness of relevant information in the host country,

reducing corruption and promoting good

communication between the home country and the

host country.

4.2 Distributed Storage of Data in

Investment Facilitation

In addition to considering the types of investment in

different industries and fields, it is also necessary to

determine an appropriate way of organizing data, that

is, to implement the subject of investment facilitation

data sharing. One is the collaborative construction

and sharing model of international organizations. As

the name suggests, the cooperative joint construction

and sharing mode of international organizations

refers to a sharing mode in which international

Application of Data Sharing Model of Investment Facilitation based on Multi-level Blockchain

121

organizations jointly formulate related sharing

strategies on a certain research direction or research

subject under a certain agreement or treaty. The

sharing strategy which includes the scope, method

and related policies of sharing can promote the

exchange and share of data in the same field. The

cooperation methods of international organizations

include international intergovernmental cooperation

and international non-governmental cooperation.

Either way, they must follow the purpose of sharing

and be bound by a common agreement to promote the

global sharing of data and improve technology of

member states. The Organization for Economic

Cooperation and Development (OECD) is an

intergovernmental international economic

organization composed of 30 market-economy

internationals. It aims to jointly respond to the

economic, social and government governance

challenges brought about by globalization and grasp

the opportunities brought by globalization.

In addition, there is a policy-driven co-

construction and sharing model. This model refers to

the promotion of the co-construction and sharing of

scientific data under the compulsory drive of national

laws, regulations and policies. The United States is

the earliest experimenter of this model. The US

Freedom of Information Act and the Copyright Act

are the legal foundations of this model. US issued the

"Global Change Research Data Management Policy"

centered on the "full and open" scientific data sharing

policy in 1991. Through this policy, the sharing of

scientific data was promoted, thereby providing

strong guarantees for scientific research in the United

States, which ensures the realization of its strategic

goals of national development and scientific and

technological development in the 21st century (Yang,

Chen, 2014).

4.3 Refined Management by Federated

Learning

The professional and refined information data

management platform unifies the data caliber and

penetrates the investment business process. So the

basic data of investment projects get rid of the

discrete, isolated, incomplete, and unrelated state.

Based on this, the foundation of investment

management is consolidated. And the free interaction

and sharing of information and data can meet the

different needs of investment management and

decision makers for rich investment data expression,

and provide convenient support for micro-level

investment decision makers.

In addition, it is necessary to carry out targeted

management of different regions. This model limits

those participating in the joint construction and

sharing of scientific data within a certain geographic

scope, which is similar to the coordination and

sharing mode of international organizations, and the

former is relatively in scope. Smaller ones, generally

limited to a certain region or a certain country,

collectively store shared resources in a specific

location, and operate and build jointly under the joint

management and co-funding of related units.

5 CONCLUSIONS

Through the investment data sharing model based on

multi-level chains, multi-level storage on the chain

and mixed storage of IPFS under the chain are

adopted, which ensures the security of investment

facilitation data and improves the scalability of

blockchain. In the data sharing based on multilevel

blockchain, the data of the host country of investment

convenience is encrypted to prevent malicious

attackers from stealing data. For the problem of data

sharing among institutions, institutions can freely

choose whether to participate in federal learning or

not, and use local differential privacy technology to

perturb and add model parameters before sending

them. Bringing together stakeholders at all stages of

the data production and use chain can greatly

overcome information asymmetry in investment

facilitation, as well as coordination among host

countries, investors and other stakeholders, and at the

same time meet the requirements of transparency,

sustainable development and high efficiency in

investment facilitation. In the future, in terms of

specific applications, besides scientific research,

legislation of host country and monitoring and

evaluation system of investment facilitation, more

suitable fields need to be developed. In addition,

according to the characteristics of data itself, we

should attach great importance to data security, and

research in this area needs further strengthening.

ACKNOWLEDGMENTS

The author is most grateful to the Law School and the

Silk Road Institute for International and Comparative

Law of Xi’an Jiaotong University for their generous

assistance. The research was funded by the projects

of National Social Science Foundation of China

Youth Project: Multilateral Reform and Chinese

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

122

Countermeasures of International Investment

Arbitration under the Background of "One Belt and

One Road" (18CFX084)

REFERENCES

Hamdani K, “Investment facilitation at the WTO is not

investment redux,” Columbia FDI Perspectives, No.

226, May 21, 2018. Reprinted with permission from the

Columbia Center on Sustainable Investment.

LERU roadmap for research data [EB/OL]. [2015-03-09].

http: //www.leru.org /files/

publications/AP14_LERU_Roadmap_for_Research_d

ata_final.pdf.

Malamas V, Kotzanikolaou P, Dasaklis T. K, et al. A

hierarchical multi blockchain for fine grained access to

medical data [J]. IEEE Access, 2020, 8: 134393-

134412.

POPULATION AND MIGRATION, Data sharing

agreement with statistics unit: population and migration

statistics [EB/OL]., OECD Factbook 2013

https://www.oecd.org/sdd/01_Population_and_migrati

on.pdf.

Sauvant P. K, Columbia FDI Perspectives, 2008-2022

https://ccsi.columbia.edu/content/columbia-fdi-

perspectives

The full text of the UNCTAD Global Action Menu for

Investment Facilitation is available at:

https://investmentpolicy.unctad.org/uploaded-

files/document/Action%20Menu%2001-12-

2016%20EN%20light%20version.pdf. The full text of

the IFAP is available at:

https://www.apec.org/docs/default-

source/Press/Features/2009/09_cti_ieg_IFAP.pdf

Yang Y, and Chen Y, “Scientific Big Data Sharing

Research: Based on the International Scientific Data

Service Platform,” in New Century Library, 2014(03):

24-28.

Application of Data Sharing Model of Investment Facilitation based on Multi-level Blockchain

123