The Volatility and Correlation between the Exchange Rate of British

Pound and Euro: Based on the Comparison before and after Brexit

Yuke Mei

a

School of finance, Dongbei university of finance and economics, Dalian, 116012, China

Keywords: Exchange Rate, Brexit, GARCH Model, VAR Model.

Abstract: After becoming the first country in history to leave the EU, the UK went through a transition period of 11

months, which ended on December 31, 2020. At this point, the process of the UK's exit from the EU comes

to an end, and it is also the starting point of the future relationship between the UK and the EU. This paper

focuses on the changes generated in the sterling exchange rate and the euro exchange rate before and after the

UK's formal exit from the EU, so as to detect the changes in the volatility and correlation between the sterling

exchange rate market and the euro exchange rate market. By selecting exchange rate data from the RESSET

database, this paper uses the GARCH family model as well as the VAR model to compare the degree of

volatility and correlation between the British and European exchange rate markets before and after Brexit,

and analyze the changes in the return on the pound exchange rate and the return on the euro exchange rate

before and after Brexit, as well as the correlation between the exchange rate fluctuations of the two exchange

rate markets. Through theoretical and empirical analysis, the main findings and conclusions of this paper are

that after the formal exit from the EU, the volatility of both the pound exchange rate and the euro exchange

rate are strengthening, and the effectiveness of the exchange rate market is reduced. After the empirical study,

the price volatility spillover effect of the sterling exchange rate market is obvious and it takes longer to recover

from the shock of the UK's exit from the EU; while the euro market is subject to shorter shocks relative to the

sterling market, and the correlation between the sterling exchange rate and the euro exchange rate also

decreases with the UK's formal exit from the EU.

1 INTRODUCTION

There are many scholars who have conducted studies

on exchange rate markets and Brexit. In the process

of research on international exchange rate markets,

Kim (Kim 2006) conducted an empirical analysis by

selecting daily return data between the euro and

major foreign currencies (Kim, et al, 2006), and the

experimental results showed that the correlation

between the euro and the US dollar increased and t

1

he

correlation with the yen and the Australian dollar

volatility decreased. Later some scholars continued to

expand the research object, Bunda (Bunda 2009)

studied 11 years of exchange rate market index data

of 18 emerging markets and analyzed by GARCH

family model (Bunda, et al, 2009), and the results

showed that emerging markets are similar to

developed countries, there is a linkage between

exchange rate returns. After the financial crisis in

a

https://orcid.org/0000-0002-3357-8090

2008 and the European debt crisis in 2010, the study

of the impact of major contingencies on the volatility

between markets has gradually been included in the

vision of scholars. Among the more common studies

on yields, Kollias (Kollias 2011) uses yield pricing

models, among others, to observe whether major

events cause significant positive or negative

fluctuations in market prices (Kollias et al, 2011), and

Essaddam (Essaddam 2014) uses a GARCH model to

portray the impact of major shocks on yield volatility

(Essaddam, et al, 2014). In terms of targeting

exchange rate movements, Christiansen

(Christiansen 2010) provides an in-depth analysis of

the volatility and time-variability between the euro

and other currencies, and the study finds time-varying

characteristics between the euro exchange rate and

the exchange rates of other national currencies

(Christiansen 2012). In studying the interaction

between the sterling exchange rate and the euro

exchange rate, Favero et al. (2012) developed a non-

204

Mei, Y.

The Volatility and Correlation between the Exchange Rate of British Pound and Euro: Based on the Comparison before and after Brexit.

DOI: 10.5220/0011171000003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 204-210

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

linear GVAR model and the results of the study

showed that the market spread between the euro and

sterling exchange rates are interdependent variables

(Favero 2012). By comparing the volatility between

the exchange rate of the British pound and the

exchange rates of the UK's major trading partners

before and after Brexit, Qiong Zhao (2019) shows

that the UK's exit from the EU leads to weaker

linkages between the UK market and the European

exchange rate market (Zhao, et al, 2019). Wang Lu

(2020) investigates the entire process of abnormal

exchange rate fluctuations during the referendum

period using a time series outlier diagnostic algorithm

and finds that all major exchange rates are

significantly affected (Wang, et al, 2019).

However, most of the current literature focuses on

a comprehensive analysis of the exchange rates of

several major world currencies, lacking a separate

study between the euro and the pound, two types of

European currencies, so there is still some room for

research in the analysis of the impact of the UK's exit

from the EU. This paper, on the basis of the earlier

scholars' research, analyzes the impact of the UK's

exit from the EU on the European monetary system,

separately analyzes the changes in volatility and

correlation between the exchange rates of the British

pound and the euro, and explores the impact of the

volatility caused by the UK's exit from the EU on the

exchange rates of the British pound and the euro from

the price spillover effect and the volatility spillover

effect.

In the research process, this paper decided to

adopt an empirical research method. By using the

data of the British pound exchange rate and the euro

exchange rate before and after the formal exit of the

UK from the European Union, this paper builds a

VAR model and a GARCH model to analyze the log

returns of the exchange rate and investigate the price

spillover effect and the volatility spillover effect on

the British pound exchange rate and the euro

exchange rate, respectively.

2 CHARACTERISTICS OF

EXCHANGE RATE MARKET

VOLATILITY

2.1 Pound Sterling Exchange Rate

Market

The pound exchange rate fell continuously after the

UK began preparations for a formal exit from the EU.

Over the following three long years of Brexit

negotiations, the pound exchange rate moved

differently with each Brexit proposal. By January

2020, the UK was in the critical phase of its imminent

formal exit from the EU and caught up in a sudden

new crown epidemic. The dual pressures have had a

significant impact on the sterling exchange rate

market and indeed European currency markets.

However, in late 2020, new economic stimulus

policies were introduced in the Eurozone and the UK,

combined with the successful development and

application of several new crown vaccines, which

mitigated the impact of the new crown epidemic and

allowed the UK to avoid a disorderly exit from the

EU to the greatest extent possible. In turn, at the end

of 2020, after the UK and Europe in reaching a trade

agreement, the pound against the dollar trend has

entered the upward channel. And given that the pound

is severely undervalued against the dollar, with Brexit

officially in place, the pound will have far more

upside against the dollar than the euro against the

dollar in 2021.

2.2 Euro Exchange Rate Market

A look at the changes in the euro's movement over the

last six years reveals a strong correlation between

changes in the euro exchange rate and EU policy.

Between mid and late 2014, the European Central

Bank lowered its benchmark interest rate twice in line

with the Fed's movements and the euro depreciated

by 10% relative to the dollar. The European Central

Bank announced another impending quantitative

easing in January 2015, and the euro continued to

dive against the dollar between the policy

announcement and its implementation, with the shock

in the euro exchange rate exacerbated by the events

of the 2016 Brexit referendum in the period

thereafter.

Given the large impact of the epidemic on the

eurozone economy, the ECB continued to implement

a more accommodative monetary policy, with interest

rates and asset returns remaining largely low. The

euro exchange rate saw an appreciative move in April

2020 as we entered 2020, i.e. after the formal signing

of the Brexit agreement between the UK and the EU.

3 CORRELATION ANALYSIS OF

THE BRITISH POUND AND

THE EURO

3.1 Price Spillover Effects

Price spillovers i.e. due to the existence of liquidity

and transmission of funds and information and

consumer information in the market itself, yields are

affected not only by their own prior period yields but

also by the current and prior period yields of other

The Volatility and Correlation between the Exchange Rate of British Pound and Euro: Based on the Comparison before and after Brexit

205

assets. For example, the spread between the yield on

10-year gilts and the yields on other countries' bonds

or US Treasury bills over the same period, 3-month

European sterling deposits, i.e. sterling deposits

placed with non-UK banks, and UK equities all have

varying degrees of influence on the sterling exchange

rate. Where the yield on the Euro exchange rate can

also have a crossover effect on the Pound exchange

rate. As the UK was also a member of the EU, there

is a clear correlation between the fluctuations in

exchange rate yields between the sterling exchange

rate market and the euro exchange rate market.

3.2 Volatility Spillover Effects

Volatility spillover effects mainly measure the

transmission of volatile information among exchange

rate markets, and the causes of volatility in an

exchange rate market may include not only its own

volatility but also the volatility of other markets. For

the euro and the pound, before Brexit, the pound as

one of the European currencies, due to monetary

policy, economic and trade relations, capital flows

and other factors show a strong synergy with the euro.

And the end of the referendum, the euro exchange

rate of the pound exchange rate trend occurred in a

clear sign of divergence. The reason for this is that

the ongoing Brexit negotiations at the time had a

significant impact on the pound exchange rate market

and the euro exchange rate market.

4 EMPIRICAL ANALYSIS

4.1 Data Selection

In this paper, the pound to dollar exchange rate and

the euro to dollar exchange rate are selected as

variables for two different time periods and the

exchange rates are indirectly marked up. The first

time period before the formal exit from the EU, i.e. 1

January 2014 to 31 January 2020, and the second time

period after the formal exit from the EU, i.e. 31

January 2020 to 31 March 2021, respectively. The

daily returns on the sterling exchange rate and the

daily returns on the euro exchange rate for the

corresponding periods are then continued to be

selected and processed, following which the

corresponding four variables are obtained as shown

in Table 1. All data were obtained from the RESSET

database.

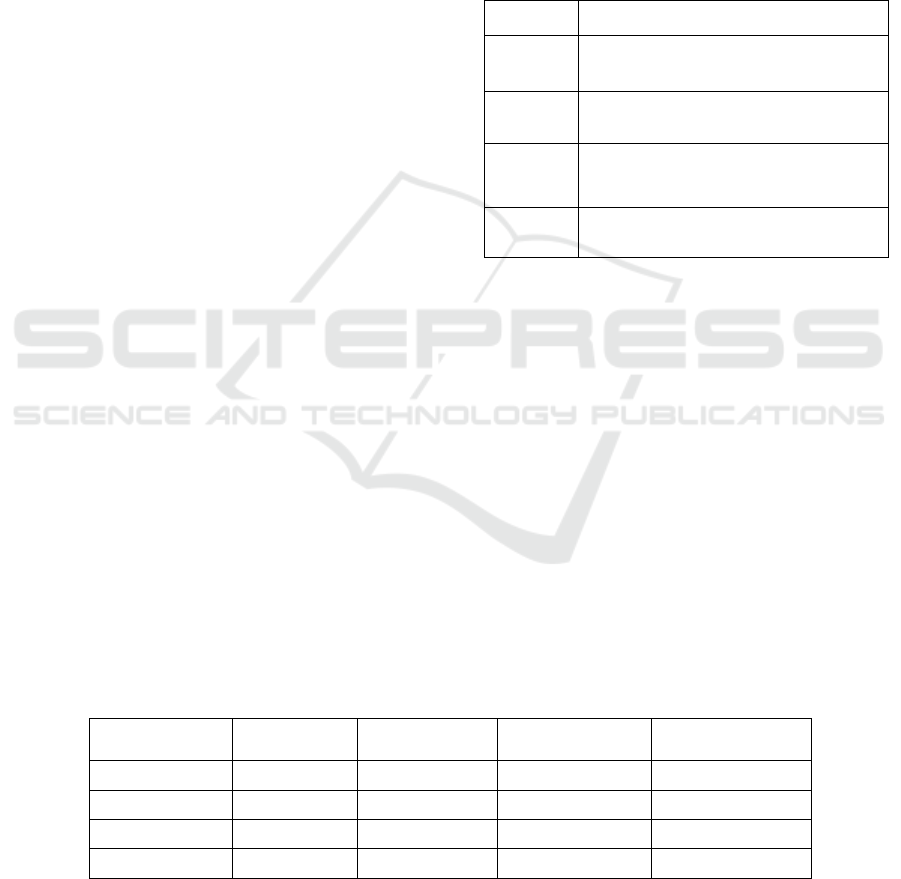

Table 1: Variables.

Variables Variable Meaning

RGBPB

GBP exchange rate yields from 1 January

2014 - 31 January 2020 (before official

Brexit)

RGBPA

GBP exchange rate yields from 31 January

2020 - 31 March 2021 (after official Brexit)

RERUB

Euro exchange rate yields from 1 January

2014 - 31 January 2020 (prior to official

Brexit)

RERUA

Euro exchange rate yields from 31 January

2020 - 31 March 2021 (after official Brexit)

4.2 Data Processing

After selecting the daily closing prices of the

exchange rates in both phases, this paper uses

logarithmic first order difference to obtain the daily

returns. 𝑅

is the daily return on day t, the 𝑃

and𝑃

are the exchange rate daily closing prices on

day t and (t-1), respectively.

𝑅

=𝑙𝑛𝑃

−𝑙𝑛𝑃

(1)

4.3 Correlation Test of Variables

4.3.1 Unit Root Test

In this paper, the ADF unit root test is selected in the

form of a test that includes a trend term and an

intercept term.

Table 2: ADF unit root test.

Variables ADF value 1% threshold

probability

(

math.

)

conclude

RERUB -41.01785 -3.434265 0.0000 smoothly

RERUA -14.35927 -3.99374 0.0000 smoothly

RGBPB -39.73734 -3.434265 0.0000 smoothly

RGBPA -13.52014 -3.99374 0.0000 smoothly

Based on the results in Table 2, it can be seen that

the results of the unit root test are smooth.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

206

4.3.2 ARCH Effect Test

Before proceeding with the GARCH model

modeling, the presence of autoregressive conditional

heteroskedasticity in the error term needs to be tested,

and in this paper, the ARCH-LM method is chosen to

test for ARCH effects.

Table 3: ARCH effect test.

Variables F-statistic P-value

RERUB 39.86798 0.0000

RERUA 7.701291 0.0059

RGBPB 49.21345 0.0000

RGBPA 12.88510 0.0004

It can be seen from Table 3 that the p-values of

the F-statistics are all less than 0.05, indicating that

there is a significant ARCH effect in the series of

GBP exchange rate and EUR exchange rate returns

before and after Brexit, so the GARCH model can be

used to study the volatility spillover effect between

the two exchange rate markets.

4.3.3 Determination of the Lag Order

Before building a VAR model for the data before and

after the Brexit, the lag order in the VAR model needs

to be judged. By setting different lag lengths, the most

appropriate lag order is selected under each criterion

such as AIC, SC and LR.

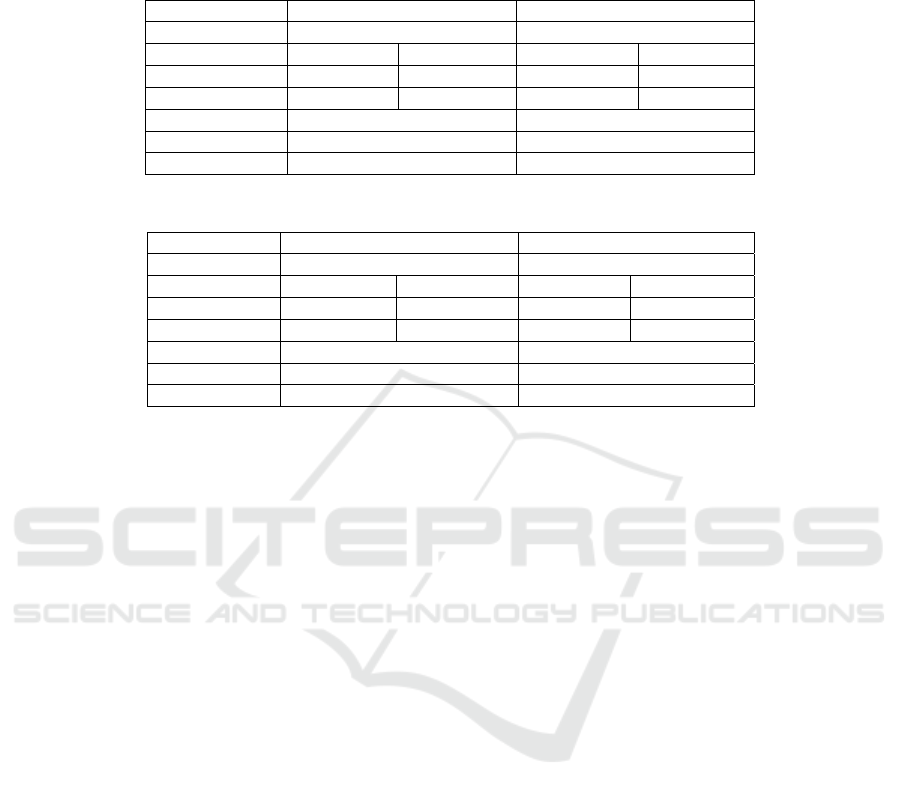

Table 4: Lagged order test.

lag LogL LR FPE AIC SC HQ

Post-Brexit

0 1943.619 NA 6.96e-10 -15.40967 -15.38166

*

-15.39840

*

1 1948.894 10.42550 6.89e-10 -15.41980 -15.33576 -15.38598

2 1952.144 6.371118 6.93e-10 -15.41384 -15.27379 -15.35749

3 1957.452 10.31930 6.86e-10 -15.42422 -15.22814 -15.34532

4 1962.027 8.825035 6.83e-10 -15.42879 -15.17669 -15.32735

5 1966.552 8.653397 6.80e-10 -15.43295 -15.12482 -15.30897

6 1973.847 13.83804 6.63e-10 -15.45910 -15.09496 -15.31258

7 1982.848 16.93121

*

6.37e-10

*

-15.49880* -15.07863 -15.32973

8 1984.608 3.282021 6.48e-10 -15.48102 -15.00482 -15.28941

Pre-Brexit

0 12348.55 NA

*

5.82e-10

*

-15.58907

*

-15.58230

*

-15.58656

*

1 12351.33 5.557788 5.83e-10 -15.58754 -15.56721 -15.57999

2 12353.64 4.609836 5.84e-10 -15.58541 -15.55152 -15.57282

3 12355.71 4.122175 5.85e-10 -15.58297 -15.53553 -15.56535

4 12356.27 1.106581 5.88e-10 -15.57862 -15.51763 -15.55596

As can be seen from the Table 4, the lag order in

the post-Brexit phase should be 7 according to the

optimal criterion, while in the pre-Brexit phase, the

optimal lag order is 0 according to different criteria,

and a lag order of 0 means that the variables do not

meet the modeling conditions of the VAR model, so

this paper finally decides to adopt a general linear

model to conduct a simple regression analysis of the

two variables in the pre-Brexit phase.

4.3.4 Stability Test

The stability of the model is tested again after

determining the lag order, and the AR root test results

show that the characteristic roots fall within the unit

circle, so the VAR model constructed in this paper is

stable.

4.4 Modeling and Effects Analysis

4.4.1 VAR Model Results

VAR modeling is performed only for GBP exchange

rate returns and EUR exchange rate returns after

formal exit from the EU.

Table 5: VAR modeling results.

V

ariables RERUA (-1) ERERUA (-2) RERUA (-3) RERUA (-4) RERUA (-5) RERUA (-6) RERUA (-7)

RERUA 0.031627* 0.075935* -0.168947** -0.017687* 0.085813** -0.072016* 0.093485**

RGBPA 0.008421 0.218075* -0.328837 0.130962 0.158315* -0.058723* -0.199245*

variable RGBPA (-1) RGBPA (-2) RGBPA (-3) RGBPA (-4) RGBPA (-5) RGBPA (-6) RGBPA (-7)

RERUA 0.091273** 0.041363** 0.073354** -0.053260** 0.008907** -0.130022* -0.040966**

RGBPA 0.168805* 0.257843* 0.257843* -0.145745* 0.101457* -0.109013* -0.058465*

The Volatility and Correlation between the Exchange Rate of British Pound and Euro: Based on the Comparison before and after Brexit

207

The output of the VAR model in Table 5 shows

that the pound exchange rate is still influenced by its

own pre-Brexit exchange rate as well as the euro

exchange rate after the UK formally leaves the EU,

but the coefficients are less significant. Based on the

data from a simple general linear regression of the

UK's pre-Brexit exchange rate in this paper, the

regression coefficient between the pre-Brexit return

on the pound exchange rate (RGBPB) and the return

on the euro exchange rate (RERUB) is 0.651240,

which has a p-value of 0.0000, a significant result.

This implies that the degree of explanation of the

Euro exchange rate return on the Pound exchange rate

return is high, indicating that the two exchange rate

returns are highly correlated and the Euro exchange

rate has a significant impact on the Pound exchange

rate before the UK leaves the EU. However, it can

also be seen that after the UK has carried out a formal

exit from the EU, the overall level of significance of

the coefficient between the pound exchange rate and

the euro exchange rate is significantly lower,

indicating that the post-Brexit pound exchange rate

market and the euro exchange rate market does still

have a spillover effect, but the volatility of the return

spillover effect is not very obvious, the degree of

mutual influence between the two has been reduced.

Figure 1: Impulse response function graph

As can be seen from the impulse response

function results graph in Figure 1, after the UK's

formal exit from the EU, the euro exchange rate

returns and the pound exchange rate returns are

subject to their own factors when the shock, in the

first two periods are fast declining trend, indicating

that the shock is strong at the beginning, the market

produces significant volatility, the subsequent change

amplitude slowed down, but the shock response time

is longer. For the two markets between the impact of

each other's yields when the shock, in the euro

exchange rate by the positive shock of the change in

the exchange rate of the pound first showed an

upward trend, and then gradually smooth, later there

is a small decline, the overall volatility of the shock

by the pound is not large. And when the pound by the

euro shock in the early appear rapid downward trend,

the response is stronger than the euro, and the overall

view of the euro exchange rate on the impact of the

pound exchange rate is negative, the response time of

the pound market compared with the euro market is

also longer.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

208

4.4.2 GARCH Model

Table 6: Estimation results of the pre-Brexit GARCH model.

V

ariable RERUB RGBPB

Models GARCH GARCH

modulus P-value modulus P-value

α

0.035287 0.0000 0.036686 0.0000

β

0.963156 0.0000 0.955948 0.0000

Log likelihoo

d

6137.996 6327.289

AIC -7.727783 -7.966338

SC -7.707482 -7.946037

Table 7: Estimation results of Post-Brexit GARCH model.

V

ariable RERUBA RGBPA

Models GARCH GARCH

modulus P-value modulus P-value

α

0.112537 0.0481 0.154713 0.0079

β

0.801979 0.0000 0.738681 0.0000

Lo

g

likelihoo

d

1045.497 960.8205

AIC -7.973155 -7.344773

SC -7.904869 -7.262604

From the results in Table 6 and Table 7, it can be

seen that after the formal exit from the EU, the euro

and sterling market returns are still volatile, the sum

of the ARCH term and GARCH term coefficients for

euro exchange rate returns is 0.914516 and the sum

of the ARCH term and GARCH term coefficients for

sterling exchange rate returns is 0.893394, the sum of

the coefficients in the post-Brexit GARCH model for

both is less than 1. However, compared to the pre-

Brexit become smaller than before Brexit, indicating

that the conditional heteroskedasticity of the two

exchange rate markets is less persistent in response to

shocks after Brexit, the coefficients of the GARCH

terms of both markets have decreased, and the

coefficients of the ARCH terms have become larger,

indicating that the volatility of the respective

exchange rate markets has strengthened and market

effectiveness has decreased.

5 CONCLUSIONS

The market shock from the Brexit event has been

persistent. During the period from the Brexit

referendum in 2016 until the formal exit from the EU

in early 2020, the pound exchange rate and the euro

exchange rate have been subject to persistent shocks,

and the pound exchange rate yield has also suffered a

new round of strong shocks after the formal exit from

the EU, and the exchange rate is more volatile, while

the euro exchange rate is subject to smaller shocks

than the pound. At the same time, through the image

above response, the pound exchange rate market and

the euro exchange rate market are affected by each

other's prior yield shock and the effect is more

obvious, indicating that the price volatility spillover

effect in the two markets. This effect is with the

implementation of the post-Brexit trade agreements

gradually weakened, and will eventually gradually

level off.

There is significant aggregation of exchange rate

returns in the pound exchange rate market and the

euro exchange rate market. Both before and after the

UK's formal exit from the EU, there is a significant

ARCH effect in both exchange rate markets,

indicating that there is significant aggregation of

exchange rate returns in both markets. The ARCH

term coefficient increases after the formal exit of the

UK from the EU compared to the pre-Brexit period,

and the respective volatility of the GBP and EUR

markets strengthens, but the effectiveness of the

markets decreases. According to the current exchange

rate market, the movements of the sterling exchange

rate market and the euro exchange rate market are

also gradually diverging, and the correlation between

the two exchange rate markets has weakened.

The linkage between the pound exchange rate

market and the euro exchange rate market has

weakened. The results of the VAR model and the

results of the GARCH model test show that, due to

the re-establishment of the British-European political

and economic trade relations, the close linkage

between the sterling exchange rate market and the

The Volatility and Correlation between the Exchange Rate of British Pound and Euro: Based on the Comparison before and after Brexit

209

euro exchange rate market has weakened compared

with the period before the formal exit of the United

Kingdom from the European Union, and the sterling

exchange rate and the euro exchange rate have

produced more obvious differences in response to

each other's shocks, and the volatility spillover effect

between the markets has decreased. With the formal

exit of the United Kingdom from the European

Union, the mutual impact between the two markets

has also been reduced by the different measures taken

by the United Kingdom and the European Union with

regard to future developments.

ACKNOWLEDGMENTS

I would like to thank every teacher who helped me

during the writing process. From the selection of my

thesis to its completion, my teaching assistant

provided me with strong assistance in every step of

the process, maintained patience and guided me to

study and experiment independently. After this paper

was completed, the thesis teacher maintained a

professional and rigorous attitude in proposing

changes to the details of the thesis and assisted me in

completing the final draft. There are still many

shortcomings in my paper, but this writing experience

and my teacher's help will definitely benefit me in my

future studies.

REFERENCES

Bunda, Irina, Hamann, 2009. Correlations in emerging

market bonds: The role of local and global factors [J]

Emerging Markets Review, Vol. 10, 2009, pp.67-96.

Christiansen, Charlotte, Volatility-spillover effects in

European bond markets [J] European Financial

Management, Vol. 13, 2012, pp. 923-948.

Essaddam N, Karagianis J M., 2014. Terrorism, country

attributes, and the volatility of shock returns [J]

Research in International Business and Finance, Vol.

31, 2014, pp. 87-100.

Favero, Carloa. Modeling and forecasting yield

differentials in the Euro Area-A Non-linear global

VAR model [M] Milan: Innocenzo Gasparini Institute

for Economic Research Working Paper Series, 2012.

Kim, Suk-Joong, Lucey, 2006. Dynamics of bond market

integration between established and accession

European union countries [J] Journal of International

Financial Markets, Vol. 16, 2006, pp. 41-56.

Kollias C, Papadamous S, Stagiannis A., 2011. Terrorism

and capital markets: The effects of Madrid and London

Bomb attack [J] The International Review of

Economics and Finance, Vol. 20, 2011, pp.154-167.

Wang Lu, Huang Denshi, Ma Feng and Liu Wenjia, 2019.

Analysis of the impact of major unexpected events on

the international foreign exchange market: based on the

British EU referendum event [J] Mathematical

Statistics and Management, vol. 39, no. 1, 2019,

pp.174-190.

Zhao Qiong and Guo Chengxiang, 2019. A study of

volatility between the British pound and major

currencies before and after Brexit and its spillover

effects [J] Economic Issues, No. 11, 2019, pp.17-24.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

210