Empirical Research of Direct Investment in Countries along the "Belt

and Road" based on Gravitational Models

Wen Qu and Haimin Wang

Department of Management, City College of Xi an Jiaotong University, Shang ji road, Xi an, Shaanxi, China

Keywords: Countries Along The " Belt and Road", Foreign Direct Investment, Influencing Factors, Gravitational Models.

Abstract: The " Belt and Road" construction has opened a new page in the world development process. Countries along

ASEAN have become the first choice of China's foreign investment (OFDI) especially because of their

industrial structure and location advantages. In this paper, we empirically analyze the influencing factors of

China on OFDI in ASEAN countries by building gravitational models and selecting the data from 2012-2019

through CSMAR, aiming at testing the hypotheses. The analysis results show that the market size of the host

country, macroeconomic risks, financial development level, trade freedom, labor costs, the distance between

China and the host country and the original investment cooperation are the main influencing factors. On this

basis, the relevant suggestions are put forward in order to further promote the "going global" strategy and

encourage more local enterprises to actively participate in OFDI activities.

1 INTRODUCTION

Relevant statistics show that in 2019, China's net

OFDI was $136.91 billion, and the total net OFDI

reached $2198.888 billion, which was particularly

impressive in ten ASEAN countries. In the case of

declining overall investment, at the end of 2019,

China's direct investment stock in countries along the

"Belt and Road" was $179.47 billion, accounting for

8.2% of China's foreign direct investment stock.

1

There is no doubt that from Thailand's "eastern

economic corridor", to Vietnam's "two corridors", to

Indonesia's "global ocean fulcrum", aims to build

political mutual trust, economic integration, cultural

inclusive community "Belt and Road" community

"initiative" circle " bigger, dividends in ASEAN

countries, the ASEAN connectivity overall plan 2025

through shows China's confidence in ASEAN

countries OFDI. Based on this, we can not help but

ask, what factors have restricted China's foreign

investment? What is China's investment preference

for OFDI in ASEAN countries?

1

The source is the 2019 China Foreign Direct Investment

2 REVIEWS

On the study of OFDI, the theoretical community has

formed a relatively rich results. Among them,

investment development level theory of Dunning

(Dunning, 1988); small-scale production technology

theory of Wells (Wells, 1972); technical localization

theory of Rao (Lall, 1983) target developing

countries and analyze the advantages of foreign

investment of developing countries. There are

relatively few theories of OFDI in China, and more

hypothetical arguments are based on empirical testing

on the basis of learning from foreign mature theories.

Through the collation of the literature, it can be

concluded that the academic research on OFDI

mainly focuses on the investment impact factors in

the host country. Among them, market size, bilateral

trade, labor costs, resource endowment,

infrastructure, technical level and political

environment are the main concentration points of

research. Xiang Benwu (Xiang, 2009) used the

generalized distance estimation of GMM to draw the

research conclusion of a significant and negative

correlation between the host country market size and

foreign investment; Wang Juan and Fang Liangjing

(Wang, 2011)found that through measurement and

Statistical Bulletin.

296

Qu, W. and Wang, H.

Empirical Research of Direct Investment in Countries along the "Belt and Road" based on Gravitational Models.

DOI: 10.5220/0011174500003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 296-300

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

analysis, Chinese enterprises tend to invest in

countries and regions with close exchanges with

China and low political risk; Song Weijia (Song,

2008) through the panel data research believes that

China's investment scale is significantly related to the

oil reserves of the host countries, It is the decisive

factor in the location selection of foreign direct

investment; Jiang Guanhong (Jiang, 2012)found that

China has the incentive for technology export to

invest in developing countries, Investment in

developed countries has an incentive to seek strategic

assets.

At present, the research involving investment in

countries along the "Belt and Road" mainly focuses

on avoiding investment risks and deepening

investment strategies, and the number of empirical

studies is not large. On Zhou wuqi (Zhou, 2015), by

analyzing the investment pattern of the Belt and

Road, it was noted that deepening cooperation with

countries is an important measure to promote the Belt

and Road of the initiative; Zhang Yabin (Zhang,

2021) analyzed and evaluated the convenience of

investment in the countries along the route through

the construction of investment facilitation index

evaluation system. Meng Mingqiang (Meng, 2016)

showed that our investment in host countries was

mainly affected by its infrastructure construction and

trade policies and tariff rates.

3 EMPIRICAL RESEARCH

3.1 Data Source and Sample Selection

The OFDI stock data of China to ASEAN countries

used in this article are from the China Foreign Direct

Investment Bulletin, and the rest of the data are from

World Bank statistics. All the data were processed by

factor analysis and regression using SPSS software,

spanning 2012 – 2019.For some missing data using

the "linear Trends at Points" function in the software.

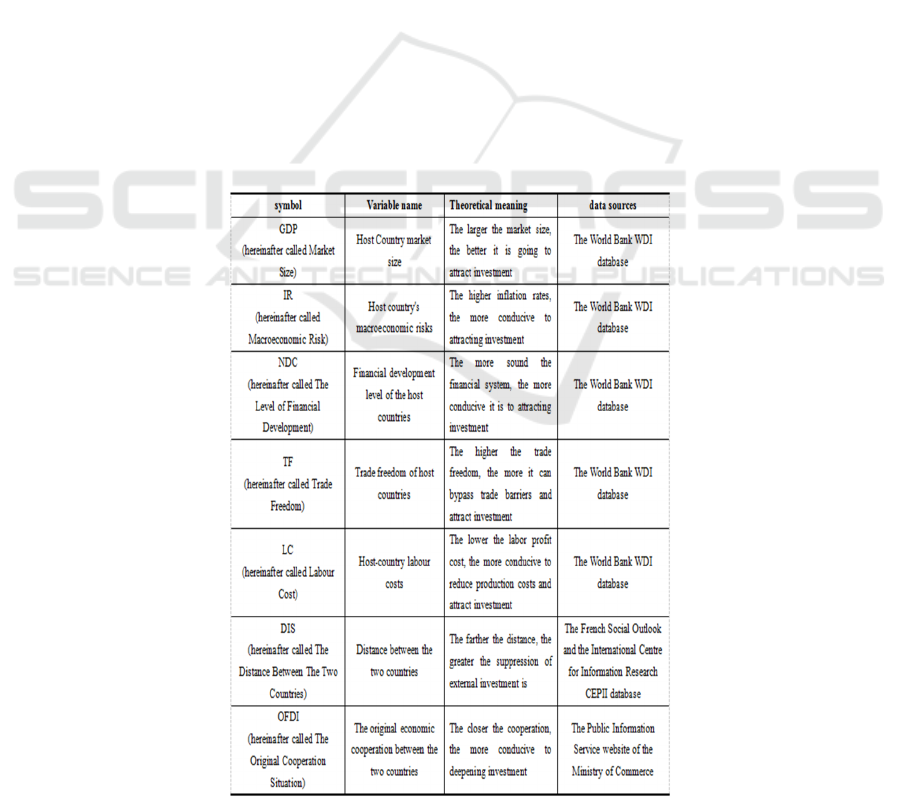

3.2 Variable Setting

Based on the previous research results, the following

seven variables were selected based on the data

availability for subsequent empirical studies, and

each variable is explained in Table 1:

Table 1: Variable description.

Empirical Research of Direct Investment in Countries along the "Belt and Road" based on Gravitational Models

297

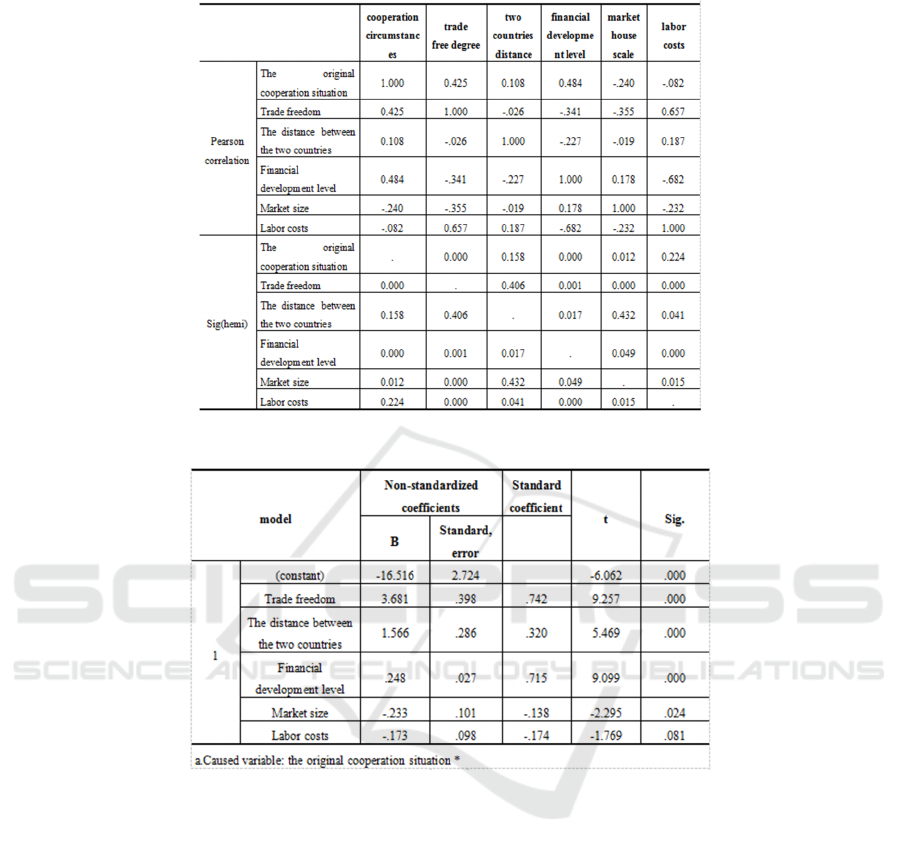

Table 2: Correlations.

Table 3: Coefficientsa*.

3.3 Conclusion of Regression Analysis

Gravitational models have been widely used in the

investment sector since Dutch economist Tinbergen

introduced their models into trade. Considering that

the initial gravity model contained only the two

elements of the market size and geographical distance

between the two countries, which was not enough to

cover other factors affecting the investment

transactions between countries, the model gradually

evolved to form an extended gravitational model. In

general, the extended gravitational model is

expressed as:

LnOFDI

ij

=β

0

+β

1

LnX

1

+β

2

LnX

2

+β

3

LnX

3

+......+β

n

LnX

n

+μ

ij

(1)

OFDI

ij

represents the investment stock between

the two countries, X

1

-X

n

indicates the factors

affecting investment decisions in the host countries.

ij

Denote the random perturbation term.

According to the assumptions of the previous part

of the theoretical analysis, IR, ND, TF, LC, DIS, and

OFDI, will be selected as factors affecting external

investment activities. Considering the quantitative

index of macroeconomic risk the inflation rate is

based on the GDP flattening index, and the reaction

host market scale GDP repeat, in order to avoid

serious factors between the col-linear influence, in

the subsequent regression analysis excluding the host

macroeconomic risk this factor, finally choose host

market size, financial development level, trade

freedom, labor cost, the distance between China and

host and the original investment cooperation six

influencing factors, build the following regression

equation:

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

298

LnOFDI

ij

=β

0

+β

1

LnGDP+β

2

LnNDC+β

3

LnTF+β

4

LnLC+β

5

LnDIS+μ

ij

(2)

OFDI

ij

represents the investment stock between

the two countries,

ij

Denote the random perturbation

term. Since the specific values of the variables in the

above model differ greatly in orders of magnitude,

log treatment on both sides of the equation to

eliminate the effect of hetero variance on the test

results. At the same time, considering the actual

operation, the enterprise always takes the import and

export amount of the above one year as the basis of

the investment decision of the current year, so the

variable of trade freedom in the model lags behind the

value of the first phase of the same group data, that

is, the import and export trade volume of the previous

period. Relevant data analysis software is concluded

as above:

From Table 2, There is a significant positive

correlation between OFDI and GDP, NDC and TF.

That is, a country's direct foreign investment decision

is affected by the host country's market size, financial

development level and trade freedom. The larger the

market scale of the host country, the higher the level

of financial development, and the more free the trade

environment, and the easier it is to attract the inflow

of foreign capital. Further linear regression on the

influencing factors, overall the equation was adjusted

for R

2

At 0.744 and an F value of 47.574, it proves that

the variables selected in the extended gravity model

strongly explain the dependent variables. Therefore,

the host country market size, financial development

level, trade freedom, labor cost, and the distance

between China and the host country can largely

explain China's investment choice preference for

ASEAN countries along the "Belt and Road" For the

individual variables in Table 3 alone, the coefficient

symbols obtained after regression are basically

consistent with the above expectations. The

coefficient of the LnTF was 3.681, the degree of

interpretation of the LnOFDI was extremely

significant, It means that there are obvious trade

exchanges between China and the host countries,

Trade plays an obvious role in driving investment;

From the regression results, For every 1% increase in

LnNDC, LnOFDI is up 0.248%, That is to say, the

more complete the financial infrastructure of ASEAN

countries along the Belt and Road, Strong willingness

to enter foreign capital, The greater the possibility;

For each 1% increase in wages in host countries,

China's investment stock will drop by 0.173%, That

is, the rise in labor costs greatly suppresses the

enthusiasm for foreign investment at the 10%

significance level. From the data, the distance

between the two countries positive foreign direct

investment, the two is basically 1.5 times positive

trend, this conclusion is inconsistent with

expectations, this may be explained by the difference

in geographical location in the transportation and

other transaction costs rise also bring customs and

human costs, and cultural costs can bring transaction

cost for foreign enterprises in a long time, which

means friendly foreign relations to establish can bring

future earnings, considering this part, can explain the

significant positive relationship between the two

countries and foreign direct investment. Moreover,

the negative correlation between the market size of

the host country and a country's direct foreign

investment decision is at the 5% significance level,

which is also inconsistent with the expected

conclusions, probably due to the insufficient range of

sample data during data collection and processing.

4 CONCLUSION AND

SUGGESTIONS

The analysis results show that the market size of the

host country, macroeconomic risks, financial

development level, trade freedom, labor costs, the

distance between China and the host country and the

original investment cooperation are the main

influencing factors.

Based on the above studies, although China's

OFDI has achieved more gratifying achievements, in

order to further promote the "going global" strategy

and encourage more local enterprises to actively

participate in OFDI activities, this paper puts forward

the following suggestions:

4.1 Update the Information Platform

to Help Enterprises Avoid Foreign

Investment Risks

The international economic situation is changing

rapidly, and the serious asymmetry of information

can easily lead to the inaccurate judgment of

enterprise foreign investment and ultimately lead to

the consequences of irreparable investment. In fact,

this concern is also an important factor in further

restricting the foreign investment of Chinese

enterprises. The government can continuously follow

up the political and economic situation of countries

along the Belt and Road by establishing special

websites, and detail the political and economic risk

rating and recent average investment return of

ASEAN countries, to help enterprises to reduce the

uncertainty of foreign investment, enhance

Empirical Research of Direct Investment in Countries along the "Belt and Road" based on Gravitational Models

299

investment willingness and facilitate enterprises to

make practical investment decisions through the

window of the website to alleviate the capital

bottleneck.

4.2 Formulate Diversified Investment

Strategies in Combination with the

Actual Domestic Development

Strategies

Considering the Asian countries with abundant

energy and labor intensive, the market is relatively

broad, combined with the current domestic

production resources shortage, environmental

deterioration, the current situation of industrial

structure imbalance, according to local conditions to

countries along the differentiated investment

strategy, through investment drive domestic

industrial transformation and upgrading at the same

time to achieve complementary advantages. When

investing in ASEAN countries, they can provide

funds, technology, talents to host countries, aiming to

help host countries extract energy quickly and

efficiently. In addition, considering the large

economic development level gap, some phased out

sunset industry is likely in other countries along the

route is facing a new turnaround, through

consultation to encourage domestic sunset industry

transfer to other developing countries, on the one

hand, the advantages of backward enterprises to

preserve, maximize concessions to emerging

industries, drive industry independent upgrading, on

the other hand also provides countries along the

economic growth new ideas, thus realizing the win-

win.

ACKNOWLEGEMENT

This article is the phased achievement of the Special

Scientific Research Plan project of Shaanxi

Provincial Department of Education: Research on the

development impetus of Xi'an equipment

manufacturing industry strong city from the

perspective of military-civilian integration

(21JK0218) and the 10th accounting scientific

research and research project of Xi'an Accounting

Association: Implementation and perfection of talent

training system of production-teaching-integration

accounting specialty under the vision of intelligent

finance (21KY020)

REFERENCES

Dunning J.H. The eclectic paradigm of international

production: a restatement and some possible extensions

[J]. Journal of international business studies, 1988(1):

1-31.

Jin jintao etal. Study on the spatial distribution and

influence factors of OFDI in Europe under the Belt and

Road initiative. The Chinese market 2019(8):78-80.

Jiang Guanhua, Jiang Dianchun. Location Selection of

China's Foreign Investment: Panel data test based on

the investment gravity model [J]. The World Economy,

2012 (9): 21-40.

Kleinert J. Determinants and Effects of Foreign Direct

Investment: Evidence from German Firm-Level

Data[J]. Economic Policy2010. (50): 52-110.

Lall S.The new multinationals: The spread of third world

enterprises[M]..John Wiley& Sons.1983.

Li Yuanyuan. 2019. Research on the current situation and

influencing factors of Chinese foreign direct

investment [J]. Modern Marketing, 1:10.

Liu Shengkun. Empirical study of the impact of host

economic freedom in China [D]. 2014. Chongqing:

Chongqing Normal University

Meng Qingqiang. China's empirical research on direct

investment motivation in countries along the "Belt and

Road" [J]. Industrial Economic Forum, 2016(3):136-

144.

Pang Ruoting, Cui Cuijuan. Analysis of the Factors and

Potential of China's direct investment in Asian

countries under the background of "Belt and Road" [J].

Exploration of Financial Theory,2018(5):60-69.[3]

Xiang Benwu. Empirical study of host country

characteristics and China's foreign direct investment[J].

Quantitative Economic, Technical and economic

Research, 2009(7):33-46.

Schneider F, Frey B. S. Economic and political

determinants of foreign direct investment[J]. World

Development1985(1):161-175.

Song Weijia. Research on foreign direct investment of

Chinese enterprises from the perspective of location

selection[J]. Journal of Northeast University of Finance

and Economics,2008(2):58-62.

Wang Juan, Fang Liangping. Impact factors of the location

selection of Chinese foreign direct investment[J].

Social scientists, 2011(9):79-82.

Zhou wuqi. Direct investment distribution and challenges

are addressed along the Belt and Road " route[J].

Reform, 2015(8):39-47.

Zou Wenli. Empirical study on the factors affecting direct

foreign investment in China [D]. Northeast China: Jilin

University of Finance and Economics. 2017.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

300