Research on Sector Rotation of China's A-share Market by using

Stock Data

Zhiqi Sun

1a

, Wenzheng Li

2b

, Ning Jiang

3c

and Huan Zhao

4d

1

Finance, Shandong University of Finance and Economics of China, Jinan, Shandong, China

2

The management of the cultural industry, Shandong University of Finance and Economics of China, Jinan, Shandong,

China

3

International Engineer, Anhui Polytechnic University, Wuhu, Anhui, China

4

Traffic Engineering, Harbin Institute of Technology at Weihai, Weihai, Shandong, China

Keywords: Sector Rotation, Correlation Coefficient Analysis, Time Series Analysis.

Abstract: Taking the data of China's A-share stocks in 2019 as the research object, this paper analyzes the correlation

between the price volatility of different stocks by Spearman correlation coefficient, and finally classifies it by

clustering algorithm to determine the real existence of the sector. Use Python to randomly sample stock from

each sector, calculate the price increase and decrease, daily rate of return. Weight the stock market value to

calculate the daily rate of return of the sector and use it for time series analysis, draw the time series plot to

determine the existence of sector rotation.

1 INTRODUCTION

With the development of the stock market, people

began to gradually find that there is a correlation

between the rise and fall of some stocks, and these

stocks are called a sector. When the stock market

rises and falls, some sectors usually rise or fall first,

while others rise and fall one after another. This

phenomenon is called "Sector Rotation". Sector

rotation is often expressed as a phenomenon of stock

market in China. In the process of market

development, the investment hotspot shifts from one

industry or several industries to another. However, it

remains to be explored whether this phenomenon

really exists and whether investors can make use of

the sector rotation phenomenon to make profits.

2 RELATED WORK

At present, domestic research mainly includes the

following two aspects.

a

https://orcid.org/0000-0002-8483-2706

b

https://orcid.org/0000-0002-3742-7353

c

https://orcid.org/0000-0002-1286-0839

d

https://orcid.org/0000-0003-4799-0649

2.1 Identification of Sector Rotation

Firstly, it is to identify the sector rotation

phenomenon, including qualitative and quantitative

aspects.

For qualitative dentification of sector history

phenomenon, He Chengying (2001) (He, 2001) first

made a theoretical analysis of the "sector

phenomenon" in China's stock market, and through

the relative yield index CR and its variance, gave a

quantitative index reflecting the intensity of sector

phenomenon. The study shows that the larger the

variance CR is, the smaller the sector rotation is.

For quantitative identification of sector

phenomenon, Wang Ning (2009) (Wang, 2009) used

Kendall synergy coefficient to study 30 secondary

industries of CSRC in China's stock market, found

that there were obvious industry sector phenomena in

China's stock market. Liu Yan and Li Xingping

(2013) (Liu, 2013, Li, 2013) used correlation analysis

and Granger causality analysis to empirically study

the relationship between 22 industry sectors. It is

found that there is Granger causality between various

366

Sun, Z., Li, W., Jiang, N. and Zhao, H.

Research on Sector Rotation of China’s A-share Market by using Stock Data.

DOI: 10.5220/0011178900003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 366-370

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

industry sectors, and the relationship between

industry sectors is changeable at different stages.

Liang Ye (2014) (Liang, 2014) made an empirical

study on 32 industry sectors in Shanghai and

Shenzhen stock markets by multidimensional scaling

method, and found that the phenomenon of industry

sectors was obvious.

In addition, there are some scattered studies that

believe that other factors, such as capital flow, The

banker's hype can also explain the phenomenon of hot

spot switching and sector rotation.

2.2 Sector Rotation as Investment

Strategies

At present, there are also some studies that analyze

sector rotation as investment strategies, including

qualitative and quantitative aspects.

First, a qualitative understanding, such as Zhang

Wei (2001), divides market stocks into high-priced

stocks, medium-priced stocks and low-priced stocks

from the perspective of technology investment, and

holds that in the rising market, the high-priced stocks

begin to rise first, followed by the medium-priced

stocks. Finally, it is the low-priced stock sector.

The second is the quantitative analysis of the

sector rotation strategy. For example, Huang Yin

(2019) (Huang, 2019) obtained different dimensions

of sector data by processing China's A-share data, and

trained the neural network for different data to obtain

the optimal quantitative investment strategy based on

Recurrent Neural Network. Yu Zeqi (2019) (Yu,

2011) quantified investment strategy of industry

sector rotation based on regression model. The

regression model is used to quantitatively study

whether there is real investment value in the sector

rotation strategy, taking the market itself as the

research object.

Through reading the literature, it is found that

although there are many researchers on sector

rotation at present, there are not any research on

sector rotation identification by using stock data to

establish a model. Therefore, this paper mainly

establishes a model through many stock data,

explores the existence of sectors and sector rotation,

and illustrates the problem through data.

3 DENTIFICATION OF SECTOR

In previous studies, people default that sectors exist,

but whether sectors really exist has not been verified.

In this section we use stock data to verify the

authenticity of sectors through mathematical models

and algorithms.

3.1 Model Preparation

1)Python package such as Glob, Pandas and

Openpyxl is used to read the file name, filter the data,

and store the rise and fall of each stock in the new

xlsx file.

2) Pearson correlation coefficient is used to

measure whether two data sets are on a line, that is,

to measure the linear relationship between distance

variables. When both variables are normal continuous

variables and there is a linear relationship between

them, Pearson correlation coefficient is often used to

describe the degree of correlation between them. The

specific calculation formula is as follows:

𝑟=

∑

𝑋

−𝑋

𝑌

−𝑌

∑

𝑋

−𝑋

∙

∑

𝑌

−𝑌

1

3) Spearman Grade correlation coefficient is

used to estimate correlation between variables The

correlation between variables can be described by

monotone function. The formula is as follows:

𝜌=1−

6

∑

𝑑

𝑁

𝑁

−1

2

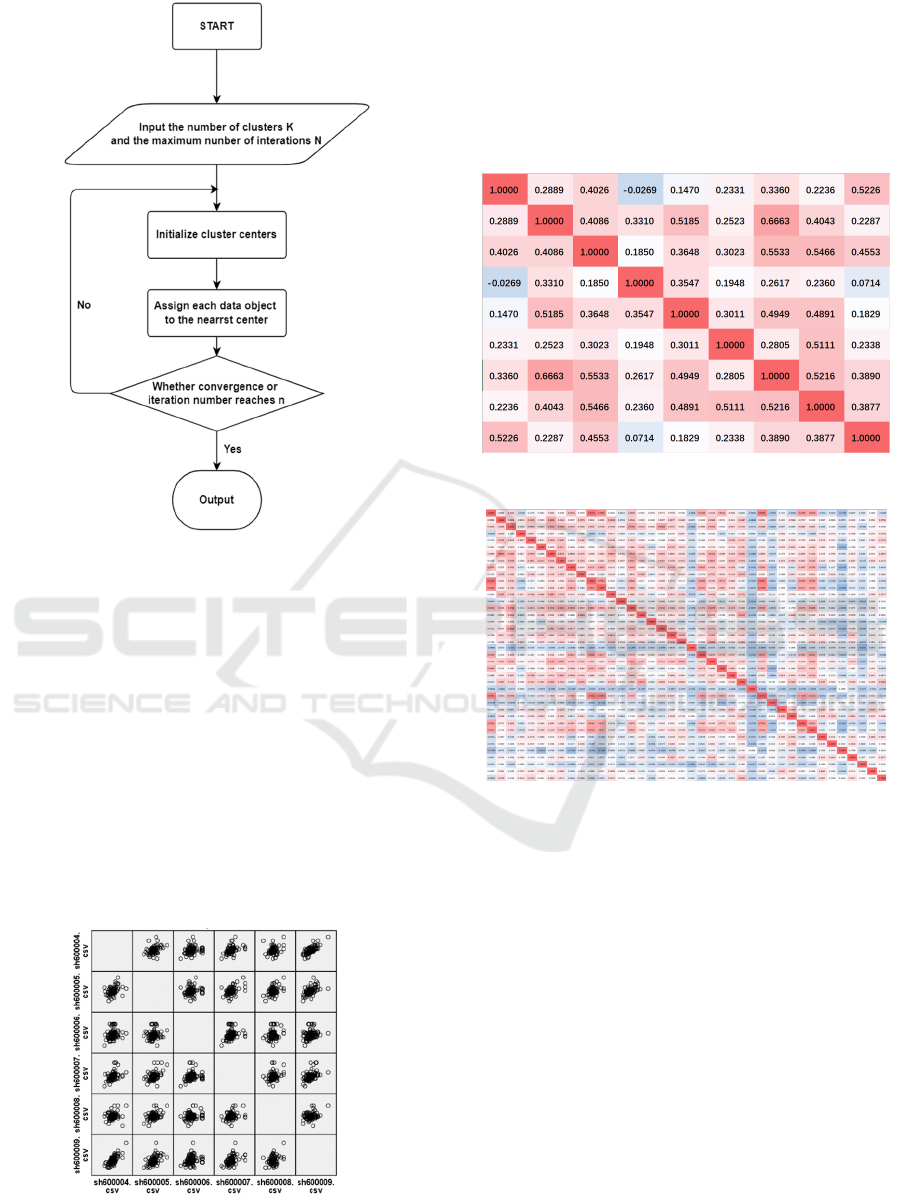

4) K-Mean clustering algorithm is a kind of

iterative clustering algorithm. The K-Mean clustering

algorithm for solving the problem includes the

following steps:

Pre-dividing the data into K groups, randomly

selecting K objects as initial cluster centers, then

calculating the distance between each object and each

seed cluster center. After that assign each object to

the nearest cluster center. Cluster centers and the

objects assigned to them represent one cluster. Every

time a sample is assigned, the cluster center of the

cluster is recalculated according to the existing

objects in the cluster. This process will be repeated

until a certain termination condition is met.

The termination condition can be that no (or

minimum number) objects are reassigned to different

clusters, no (or minimum number) cluster centers

change again, error sum of squares local minimum.

Research on Sector Rotation of China’s A-share Market by using Stock Data

367

Figure 1: Clustering flow chart.

3.2 Establishment and Solution of

Model

1) Process the data through python and obtain

Stcok1.xlsx. The document contains the data of the

price increase and decrease of all stocks from January

1, 2019 to December 31, 2019. Then carry out the

correlation analysis.

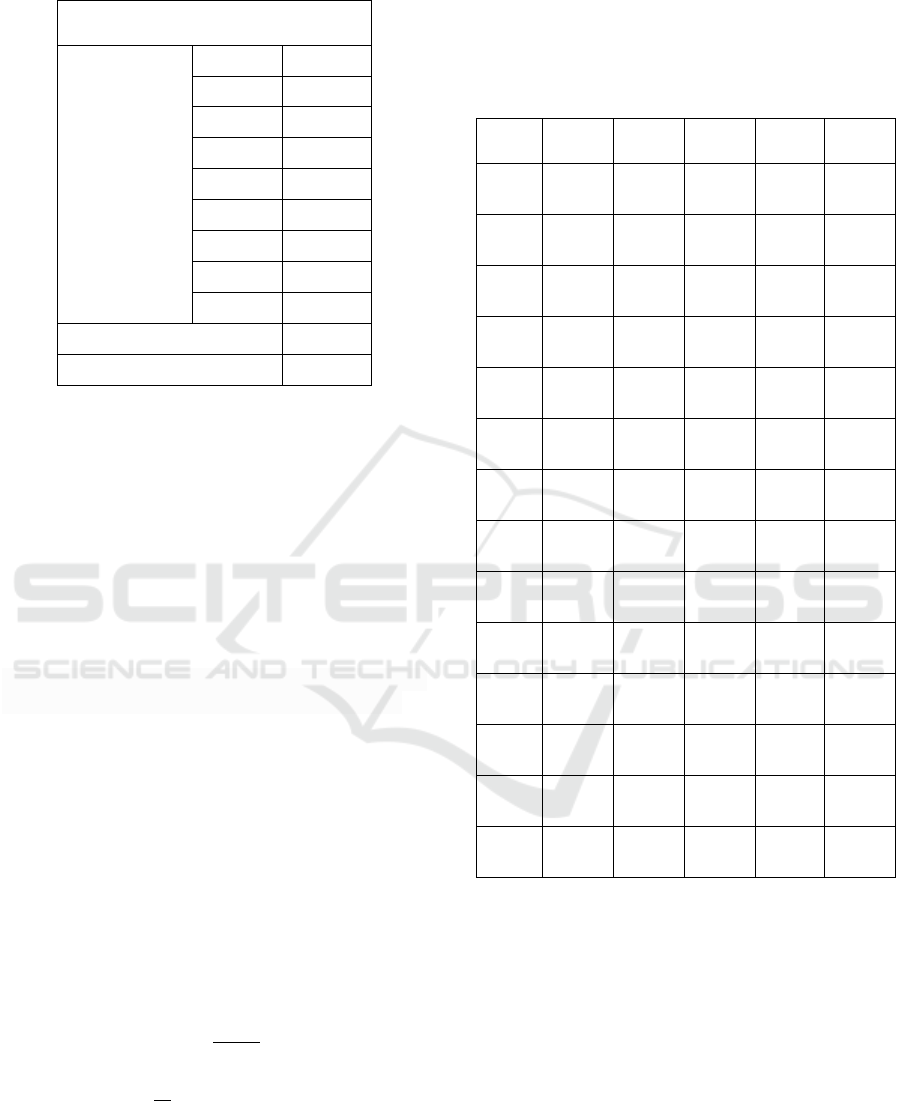

2) Process original data series through SPSS

to get matrix scatter plot which shows that there is no

obvious linear relationship between variables, so

Pearson correlation coefficient cannot be used. We

can only use Matlab to get Spearman grade

correlation coefficient to analyze.

Figure 2: Matrix scatter plot.

3) Make Descriptive statistics of the data

using Matlab, finding that there is no big error. Then,

calculate the correlation coefficient and the P value

corresponding to the correlation coefficient, save the

correlation coefficient and P value as a File,

processing data through conditional format-gradation

using Excel, the results are as follows:

Figure 3: Conditional format-gradation result 1.

Figure 4:Conditional format-gradation result 2.

The deeper the red, the stronger the correlation.

From the above figure, we can preliminarily judge the

existence of sectors, and guess that there are 9 sectors

in total. Then, we use SPSS to verify the classification

of sectors.

Transpose the data of Stock1.xlsx to carry out K-

means clustering analysis using SPSS. The results are

as follows:

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

368

Table 1: Number of cases.

1. Number of cases in each

cluster

Clustering

1 167

21

3 905

41

5 379

6 147

7 433

8 202

9 289

effective

2524

lost

2

It can be seen from the results that although the

cluster is divided into 9 sectors, there are only 7

effective sectors, sector 2 and sector 4 only have 1

object. So we can came to the conclusion that the

sectors really exist and these stocks are divided into 7

stock sectors.

4 IDENTIFICATION OF SECTOR

ROTATION

As we have found that sectors really exist, whether

the sector rotation phenomenon is still unknow, In

this section we use stock data to verify the

authenticity of sectors rotation through mathematical

models and algorithms.

4.1 Model Preparation

Use python randomly take 10 stocks from each sector

as sample tickets, and take out the daily price increase

and decrease of the sample tickets from June 1st to

December 31st, 2019. Use pandas library to calculate

the daily rate of return; So time series analysis of

daily total rate of return of each sector is obtained by

weighting stock market value.

𝐹

=

∑

3

𝑅

=

,𝑖 = 1,2,3⋯10

4

𝑅𝑂𝐴

= 𝐹

×𝑅

,𝑁 = 1,2,3⋯7

5

4.2 Model Establishment and Solution

Using python to calculate results and save them as

Stock3.xlsx. Partial data is shown as follows:

Table 2: ROA data (1-5).

Time ROA1 ROA2 ROA3 ROA4 ROA5

2014-

12-31

-0.035 0.052 0.078 0.273 -0.033

2014-

12-30

-0.027 -0.130 -0.088 -0.137 -0.015

2014-

12-29

0.007 -0.023 -0.069 -0.172 0.066

2014-

12-26

0.103 0.110 0.131 0.073 -0.010

2014-

12-25

0.289 0.039 0.043 0.184 0.103

2014-

12-24

-0.177 0.141 0.129 0.065 0.159

2014-

12-23

-0.280 -0.127 -0.013 -0.176 -0.153

2014-

12-22

0.179 -0.440 -0.028 -0.297 -0.128

2014-

12-19

0.194 -0.108 -0.123 -0.130 0.068

2014-

12-18

0.013 -0.050 -0.051 0.132 -0.016

2014-

12-17

0.153 -0.059 -0.156 -0.087 -0.035

2014-

12-16

0.149 0.038 0.074 0.125 -0.076

2014-

12-15

-0.080 0.101 0.052 0.021 0.050

2014-

12-12

-0.070 0.037 -0.018 0.001 0.069

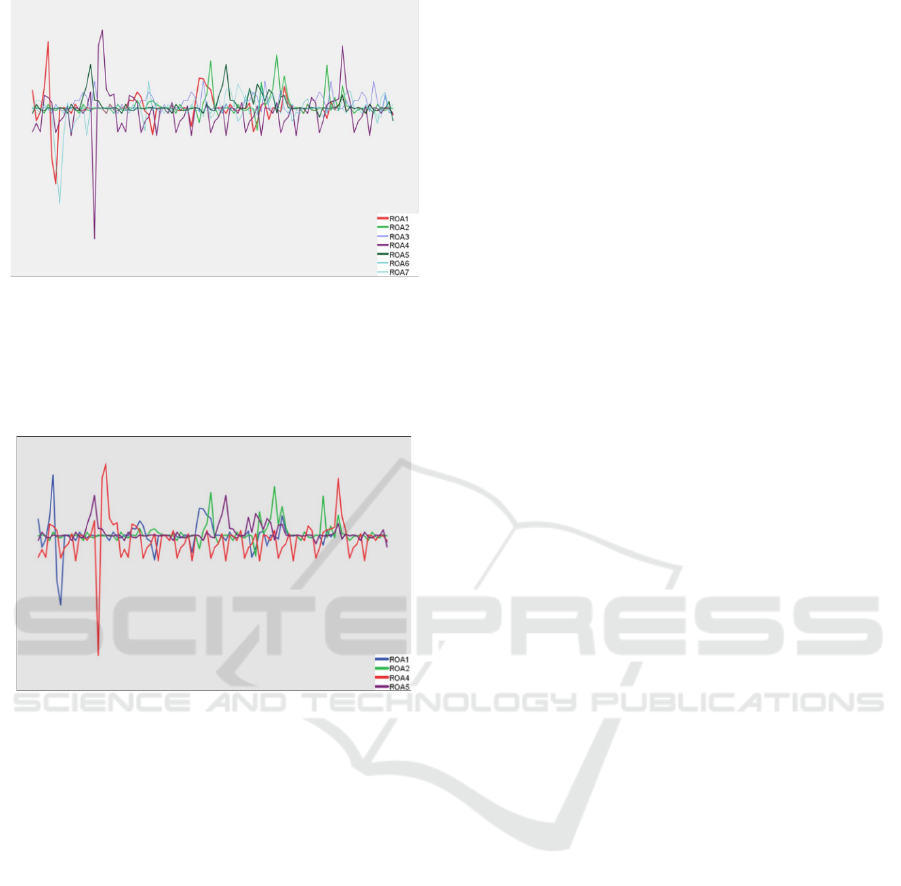

Analyze total rate of return (ROA) of each sector

using the time series and draw the time series diagram

as follows:

Research on Sector Rotation of China’s A-share Market by using Stock Data

369

Figure 5: Time series one.

The preliminary results show that sectors 1, 2, 4,

5 have strong sector rotation. Now remove the

redundant sectors, and verify the sector rotation by

analyzing sectors 1, 2, 4 and 5.

Figure 6: Time series two

By analyzing the four sectors, it can be clearly

seen that when the stock market rises and falls, some

sectors usually rise or fall first, while other sectors

rise and fall successively, that is, the phenomenon of

sector rotation.

5 CONCLUSIONS

Taking the stock market in 2019 as the research

background, this paper selects the stock data traded in

Shanghai and Shenzhen A-share markets as the

research object. Through empirical analysis, it shows

that there is a phenomenon of sector rotation in

China's A-share market. When the stock market rises

and falls, some plates usually rise or fall first, while

others rise and fall one after another. There is a strong

correlation between the yield of each rotating sector.

Therefore, for investors, it is necessary to pay

attention to the information and development

released by different industries, the information and

development of one industry may fluctuate to other

industries. Then there will be a sector rotation

phenomenon, and investors can obtain excess returns

accordingly, which is also a problem worthy of

further exploration.

ACKNOWLEDGMENT

This paper was supported by my teammate of SDUFE

and 77 Development Program of China

REFERENCES

He Chengying. Analysis of ‘sector phenomenon’ in Chine

se stock market. Economic Research Journal, 2001

(12), 82-87.

Huang Yin. Construction of quantitative investment strate

gy of sector rotation based on recurrent neural networ

k. Zhejiang University. May 2019.

Liang Ye. Analysis of sector linkage effect of China A sha

re market. Modern Economic Information, 2014

(12X), 358-360.

Liu Yanyan, Li Xingping. Empirical analysis of industry s

ector fluctuation in Chinese stock market. The Science

Education Article Collects, 2013 (3), 199-200.

Wang Ning. An empirical study on the sector effect of Chi

nese stock market. Commercial Times, 2009 (28), 88-

89.

Yu Zeqi. Research on quantitative strategy of industry

sector rotation based on regression model.

Capital University of Economics and Business,

June 30, 2011.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

370