The Impact of China's OFDI on “One Belt, One Road” Country

Bohan Sun

a

School of economic and business,Monash University, Melbourne, VIC3145, Australia

Keywords: "One Belt, One Road", Upgrading, OFDI.

Abstract: Based on the data of China's direct investment flow and stock in countries along the line from 2003 to 2015

and the economic indicators of 43 countries along the line, this paper discusses the impact of China's direct

investment in countries along the line on the upgrading of domestic industries in the host countries along the

line. It is found that China's OFDI has promoted the upgrading of domestic industries in the host countries

along the line as a whole, and the close exchange of visits between the leaders of countries along the line and

China will help to strengthen the role of China's OFDI in promoting the industrial upgrading of countries

along the line. It is found that the industrial upgrading effect of investing in low - and middle-income countries

along the line is more obvious than that of investing in middle - and high-income countries along the line. The

industrial upgrading effect of countries along the line that are not adjacent to China is stronger than that of

countries along the line that are adjacent to China.

1 INTRODUCTION

The "one belt, one road" initiative is an important

strategic move taken by China and other countries

along the line to actively participate in the division of

labor, change the world political pattern headed by

developed countries such as Europe and the United

States (Han 2014), and benefit the economic

development, and the political and international

status of the countries along the line. However, China

one belt, one road construction, often has "the internal

hot cold" situation. At the same time, with the

intensification of anti-globalization and trade

protectionism, FDI has become an important way to

make up for the savings gap of countries along the

line, promote technological upgrading and realize

leapfrog development. In late 2020 China China's one

foreign investor in one belt, one road and 63 other

countries established more than 1.1 overseas

enterprises, involving 18 sectors of the national

economy, and the direct investment was 22 billion

540 million US dollars, up 20.6% over the same

period last year, accounting for 14.6% of the total

foreign direct investment volume in the same period.

"One belt, one road one belt, one road" is an effective

counterattack to China's outward FDI and a great role

in promoting the "one belt and one road"

construction.

a

https://orcid.org/0000-0001-6042-1534

The existing literature on the impact of foreign

direct investment on the industrial upgrading of the

host country mostly focuses on the impact of the

actual amount of foreign capital utilized by the host

country on its industrial upgrading. Most scholars

believe that FDI improves the local market structure

and export structure through technology spillover

effect, competition effect and correlation effect

(Marcela 2015), so as to promote the development of

domestic industry in the host country (Maurice 2016).

Some scholars believe that FDI will offset its positive

"productivity effect" through a large negative

"market grab effect". They propose that the home

country can obtain "global key resources" through

FDI, further consolidate its core position in the global

value chain (Macelaru 2013), and continue to lock the

host country's enterprises at the low end of the value

chain (Keller 2009), Obtain monopoly profits, which

will have an adverse impact on the upgrading of the

host domestic industry. The research conclusions of

the above two views are different. The reason is that,

on the one hand, the impact of FDI on the upgrading

of domestic industry in the host country depends on

the national characteristics of the host country, and is

related to the economic development, financial

development level and human capital of the host

country (Hermes 2010). More importantly, the

616

Sun, B.

The Impact of China’s OFDI on “One Belt, One Road” Country.

DOI: 10.5220/0011195600003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 616-620

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

existing literature mostly focuses on the impact of a

country's overall use of FDI on its economy and

industrial structure, ignoring the differences of FDI

caused by the heterogeneity of FDI source countries,

which may also lead to inconsistent research

conclusions. In fact, FDI from different source

countries has significant differences in investment

motivation, industry selection, technology transfer

and home country institutional environment (Marano

2017), which affect the scale and quality of FDI.

Therefore, it is particularly necessary to explore the

impact of a country's foreign direct investment on the

upgrading of the host country's industrial structure

from the perspective of FDI source countries.

Can China China's foreign direct one (FDI) as one

of the "one belt, one road" and the world's largest

outward direct investment developing countries drive

the industrial upgrading of the countries along the

border? One belt, one road and China's responsibility

for the big powers (Zhang 2016), which is also a

positive response to the "China Threat Theory". One

belt, one road (Huang 2016), however, China mostly

studies China's outward FDI and industrial upgrading

along the line from macro strategic level (Jia 2016).

Based on the perspective of countries along the line,

using the flow and stock data of China's direct

investment in countries along the line from 2003 to

2015 (Zhuan 2012), this paper studies the impact of

China's OFDI on the upgrading of domestic

industries in the host countries along the line, further

considers the differences in economic development

level, geographical distance from China and cultural

origin, and makes a sub sample analysis on the host

countries, Investigate the heterogeneous impact of

China's direct investment on the upgrading of

domestic industries in the host countries along the

line. This paper attempts to answer the following

questions: how does China's foreign direct

investment affect the industrial upgrading of

countries along the line? What factors regulate the

impact? What is the mechanism of action? What are

the differences in the impact of China's foreign direct

investment on the upgrading of domestic industries of

different types of hosts along the line?

The possible marginal contributions of this paper

are as follows: first, it enriches the research field of

foreign direct investment. Different from the previous

literature on the spillover effect of FDI in the host

countries along the line, this paper creatively starts

from the source countries of FDI to investigate the

industrial upgrading effect of a country's direct

investment on the countries along the line. China's

China one belt, one road, one belt, one road, second,

which makes up for the deficiencies of the existing

literature research focusing on the Chinese

perspective and explores the "one belt and one way".

This article stresses China's positive influence on the

industrial upgrading of the countries along the line,

and provides theoretical support for further

promoting the "one belt and one road" construction.

2 RESEARCH DESIGN

In order to specifically investigate the role of China's

OFDI in industrial upgrading of countries along the

line, this paper will separate China's direct investment

from the total FDI of countries along the line, test the

impact of China's OFDI on the upgrading of domestic

industries in the host countries along the line, and

further reveal the intermediary effect and degree of

technology spillover, factor supply and production

rate.

Firstly, a regression model is constructed to test

the impact of Chinese investment on the industrial

structure of countries along the line, which is set as

follows:

𝐼𝑛𝑑𝑢𝑠𝑡𝑟𝑦

=𝛼

+𝛽

𝑂𝐹𝐷𝐼

+𝛿

𝑥

+𝜀

(1)

Using the proportion of the added value of the

secondary and tertiary industries or the proportion of

the added value of the tertiary industry to measure a

country's industrial structure; is the indicator of

China's direct investment in countries along the line,

expressed in the flow or stock of China's direct

investment in countries along the line in the current

year; X represents the control variable. Combined

with the existing literature, the control variables

selected in this paper are: a country's economic

development level (𝑃𝐺𝐷𝑃), capital density (𝑘𝑠ℎ𝑎𝑟𝑒),

host country export ( 𝑒𝑥𝑝𝑜𝑟𝑡 ), China's export to

countries along the line ( 𝑒𝑥𝑝𝑜𝑟𝑡_𝑐ℎ ), knowledge

stock of countries along the line (𝐿𝑒𝑑𝑢) and labor

factor supply of countries along the line (𝑙𝑎𝑏𝑜𝑟). The

data of the above control variables are from the World

Bank database.

“ one belt, one road” country and China's data

from 2003 to 2015 are mainly divided into three parts:

first, China's annual outward direct investment flows

and stock data for various countries along the route

are derived from China's external investment

statistics bulletin. The second is the economic

development data of the host countries along the line,

which comes from the World Bank Database.

The Impact of China’s OFDI on “One Belt, One Road” Country

617

3 EMPIRICAL ANALYSIS

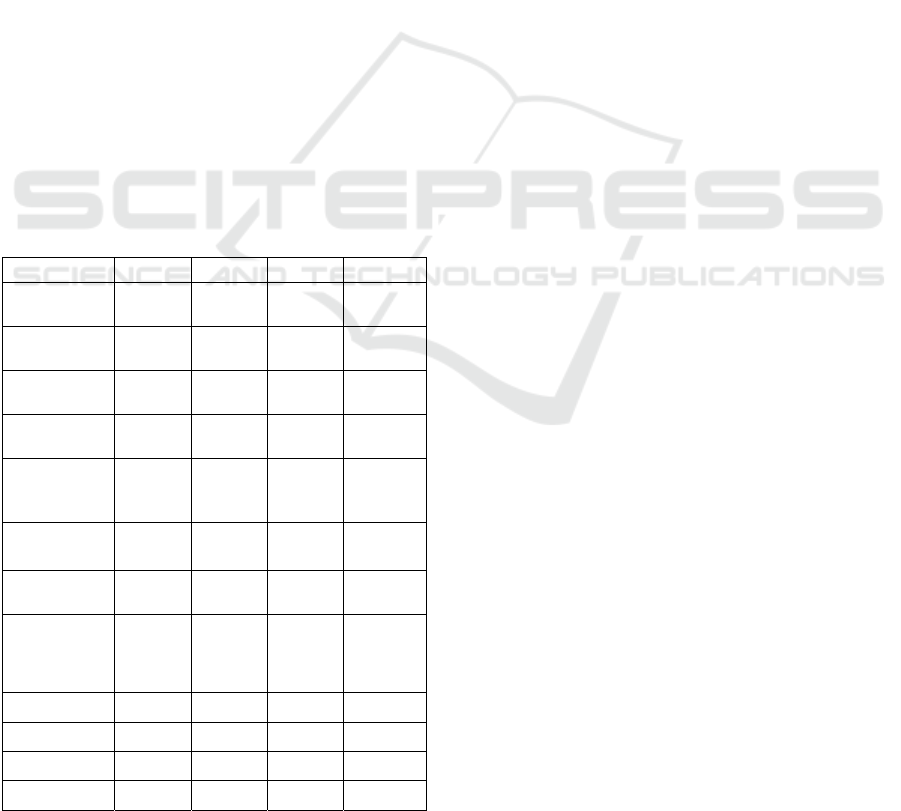

Firstly, the fixed effect model is selected according to

test to investigate the impact of China's OFDI on the

upgrading of domestic industries in the host countries

along the line, as shown in Table 1. The core

explanatory variable in columns (1) - (3) is China's

OFDI flow to the host countries along the line, and

the explanatory variable is the proportion of the

secondary and tertiary industries of the host countries

along the line. It is found that China's OFDI can

significantly promote the industrial upgrading of the

countries along the line. Considering that the macro

impact will affect the estimation results, the time

fixed effect is added in column (4). It is found that the

coefficient of the variable ofdi1 is still significantly

positive. The regression coefficient shows that for

every increase of 1 unit of China's OFDI flow to

countries along the line. The domestic industry

upgrading index of the host countries along the line

will increase by about 0.106 units. According to this

driving role, China's OFDI to the countries along the

line increased by 62.69% annually from 2003 to

2015, which promoted the industrial structure

upgrading index of the countries along the line to

increase by 6.64 units annually.

Table 1: Impact of China’s OFDI on the industrial structure

of host countries along the line.

(1) (2) (3) (4)

𝑂𝐹𝐷𝐼

0.194***

(3.51)

0.170***

(2.63)

0.132**

(2.05)

0.106*

(1.71)

𝑃𝐺𝐷𝑃

0.455**

(2.12)

0.358**

(2.27)

0.251**

(2.05)

𝐾𝑠ℎ𝑎𝑟𝑒

0.257

(1.00)

0.068

(0.26)

0.054

(0.22)

𝐸𝑥𝑝𝑜𝑟𝑡

0.040

(0.47)

0.030

(0.35)

0.036

(0.43)

𝐸𝑥𝑝𝑜𝑟𝑡_𝑐ℎ

-0.003

(-0.83)

-0.005

(-1.19)

-

0.011***

(-2.78)

𝐿𝑎𝑏𝑜𝑟

5.366

(0.38)

-18.188

(-1.30)

𝐿𝑒𝑑𝑢

2.230***

(3.34)

0.159**

(2.21)

𝐶𝑜𝑛𝑠𝑡𝑎𝑛𝑡

87.141**

*

(534.52)

83.075**

*

(56.19)

74.347**

*

(14.30)

-

110.006**

*

(5.84)

𝑌𝑒𝑎𝑟

No No No No

𝑂𝑏𝑠𝑒𝑟𝑣𝑎𝑡𝑖𝑜𝑛

𝑠

347 347 347 347

𝑅−𝑠𝑞𝑢𝑎𝑟𝑒𝑑

0.039 0.067 0.113 0.230

𝐹

12.30 4.312 5.389 4.485

In terms of control variables, the study found that

a country's economic development level (𝑃𝐺𝐷𝑃) has

a significant role in promoting industrial upgrading.

This is because there is an interactive promotion

between a country's economic development and

industrial upgrading. The more developed a country's

economy is, the more conducive its institutional

environment, cultural environment and industrial

composition are to industrial upgrading, and the

improvement of technology and productivity in the

process of industrial structure optimization promote

economic growth. Although can promote industrial

upgrading, it is not obvious. The reason may be

related to the speed of capital deepening in various

industries. Coefficient of host country export is

positive and not significant, indicating that the export

of the host country has no significant impact on its

own industrial upgrading, which is caused by the

differences in export trade structure and regional

export added value. China's to countries along the line

is significantly negative, which is related to China's

continuous export of relatively mature technical

products to countries along the line, which intensifies

the product competition of the host country and

inhibits its industrial upgrading to a certain extent.

The labor coefficient of the employed population in

the host country is not significant, indicating that the

supply of labor factors does not significantly promote

the industrial structure of countries along the line,

which is related to the development stage of countries

along the line. The government needs to consider the

employment rate while considering industrial

upgrading. The supply of labor population may

become a burden of industrial structure upgrading to

a certain extent. The coefficient is significantly

positive, indicating that human capital significantly

promotes local industrial upgrading. This conclusion

is consistent with the existing research.

4 HETEROGENEITY ANALYSIS

Considering that the differences between the host

countries along the line will also affect the industrial

upgrading effect brought by China's OFDI, we will

further conduct sub regional investigation on the host

countries along the line (Zheng 2011). Firstly,

according to the 2010 World Bank standard and the

per capita national income of US $4035, the host

countries along the line are divided into low-income

and middle and high-income samples for test. See

columns (1) - (2) of Table 3 for details. It is found that

China's direct investment in low-income countries

along the line has significantly promoted the

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

618

upgrading of local industries, the industrial upgrading

effect of direct investment in middle and high-income

countries along the line is negative (Grossman 2008),

but not obvious, which is in line with expectations.

China's one belt, one road initiative, which has been

accelerating the fourth wave of industrial transfer, has

been accelerated in the world. Based on this, "along

the gradient" will transfer part of China's excess

capacity and domestic mature industries to low-

income countries along the line through direct

investment (Henderson 2012), effectively lead low-

income countries along the line to integrate or

improve their layout in the global value chain, and

then promote local industrial upgrading. For a few

middle and high-income countries along the line,

China OFDI mostly focuses on market development

and technical cooperation. In the long run, such

investment is conducive to "forcing" the

improvement of local technology and productivity to

promote industrial upgrading (Kolstad 2012), but it

may inhibit their industrial upgrading in the short

term. Therefore, in the sample test, China's direct

investment in middle and high-income countries

along the line is negative, but it's not obvious.

Then, considering that there may be differences in

China's investment in neighboring countries and non-

neighboring countries, the samples are divided into

two categories according to whether they are adjacent

to China. The results are shown in columns (3) - (4)

of Table 3. It is found that China's direct investment

in countries along the line adjacent to itself does not

significantly promote the industrial upgrading of the

host country, while investment in countries along the

line not adjacent to itself significantly promotes the

industrial upgrading of the host country.

Table 2: Heterogeneity Analysis.

Middle and

low income

Middle and

high

income

Adjacent

to China

Not

adjacent to

China

OFDI

0.227**

(2.15)

-0.017

(-0.43)

-0.127

(-1.37)

0.063*

(1.67)

Constant

-

21.357***

(-6.53)

-

46.170***

(-3.58)

-

84.159***

(-4.66)

-

24.097***

(-5.71)

control

variable

Yes Yes Yes Yes

Year Yes Yes Yes Yes

Observation 185 162 197 150

R-square

d

0.389 0.453 0.424 0.345

F 4.697 5.492 5.850 3.182

5 CONCLUSIONS

From the perspective of foreign capital source

countries, this paper emphasizes China's economic

contribution to the countries along the line, and

analyzes the impact and mechanism of China's OFDI

on the industrial upgrading of the countries along the

line. The results show that China's direct investment

in countries along the line has significantly promoted

the industrial upgrading of countries along the line.

Quantitatively speaking, in the 13 years from 2003 to

2015, China's OFDI has promoted the industrial

structure upgrading index of countries along the line,

with an average annual growth of 6.64 units. Further

analysis shows that the impact of China's OFDI on

industrial upgrading of countries along the line is

quite different among heterogeneous host countries.

Compared with investing in middle and high-income

countries along the line, investing in low and middle-

income countries along the line can better promote

the industrial upgrading of countries along the line.

The industrial upgrading effect of countries along the

line that are not adjacent to China is stronger than that

of countries along the line that are adjacent to China.

REFERENCES

Grossman, G.M., Rossi-Hansberg, E. (2008). Trading

Tasks: A Simple Theory of Offshoring. American

Economic Review. 98(5): 1978-1997.

Henderson, J., Adam, S., David, N. (2012). Measuring

Economic Growth from Outer Space. American

Economic Review.102 (2): 994-1028.

Hermes, N., Lensink, R. (2010). Foreign Direct Investment,

Financial Development and Economic Growth, The

Journal of Development Studies.40 (1): 142-163.

Jianhong Zhuan, Li Yang. (2012). Location determinants of

OFDI in China -- a test based on geographical distance

and cultural distance. Economic Geography, 32 (12):

40-46.

Keller, W., Yeaple, S.R. (2009). Multinational Enterprises,

International Trade, and Productivity Growth: Firm-

level Evidence from the United States, The Review of

Economics and Statistics. 91(4): 821-831.

Kolstad, I. and Wiig, A. (2012). What Determines Chinese

Outward FDI? Journal of World Business.47(1): 26-34.

Liangxiong Huang, Yonghui Song, Jialin Wang, Zhongjie

Li. (2016). “One belt, one road” construction in China's

economic development: An Empirical Analysis Based

on the brightness data at night time. Economist. (9):25-

33.

Lijuan Zhang, Xiaoqing Zhang, Han Jiang, Chang Liu.

(2016). “One belt, one road” Country and China, the

industrial transfer of the countries. World economic

research. 6: 82-92.

The Impact of China’s OFDI on “One Belt, One Road” Country

619

Macelaru, P.S. (2013). Transfer Pricing and FDI, Acta

Universitatis Danubius: Oeconomica. 9(4): 355-366.

Marano, V., Tashman, P., Kostova, T. (2017). Escaping the

Iron Cage: Liabilities of Origin and CSR Reporting of

Emerging Market Multinational Enterprises, Journal of

International Business Studies. 48(3): 386-408.

Marcela, E., Fieler, A.C., Daniel, Y.X. (2015). (Indirect)

Input Linkages, American Economic Review.105(5):

662-666.

Maurice, K. (2006). Spillovers from Foreign Direct

Investment: Within or Between Industries, Journal of

Development Economics. 80(8): 444-477.

Nisha Jia, Yonghui Han. (2016). Foreign direct investment,

foreign direct investment and Industrial Structure

Upgrading -- an analysis based on nonparametric panel

model. Inquiry into Economic Issues. (2): 142-152.

Ruogu Zheng. (2011). Undertaking international

outsourcing and upgrading and transformation of

China's industrial structure. Shanghai University of

Finance and Economics.

Yonghui Han, Xinghua Zhou. (2014). China's trade with

West Asia on the background of “One belt, one road”,

its current situation and Prospect. International Trade.

(8): 21-28.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

620