The Impact of M&A on R&D of Electric Utilities

based on Heckman Two-stage Model

Jiming Tian, Tao Shen, Xin Wang and Zhichong Pan

Data Application Branch, Zhejiang Huayun Information Technology Co., Ltd., Jianghui Street, Hangzhou, China

Keywords: M&A, R&D, Electric Utilities, Heckman Two-Step.

Abstract: Electricity industry in China and abroad is undergoing profound changes, which affect the behaviours of

electric utilities in many different ways. This research empirically investigates how mergers and acquisitions

(M&As) between electric utilities affect their incentives to undertake research and development (R&D)

investment. The paper explores an unbalanced panel data set consisting of 125 electric utilities in the United

States during 20 years sample period from 1994 to 2013. The decision to undertake R&D investment is

modelled as a two-stage process. In the first stage, the electric utilities decide whether to invest in R&D at all;

in the second step, the utilities will decide the amount of R&D investment. Heckman two-stage method is

used for estimation. The results show that M&As have some impact on R&D investment by the electric

distribution utilities.

1 INTRODUCTION

With introduction of competition in wholesale and

retail electricity markets, electric utilities are taking

great efforts to adapt to the new conditions and

exploit new opportunities created by changes in

government policies toward the industry. M&A,

which plays an important role in firms’ growth and

competitiveness, have also been a common strategy

in the electric distribution industry. During the years

from 1994 to 2013, 99 deals of M&As were

completed within shareholder-owned electric utilities

in the United States. Innovation has received growing

attention in merger reviews by competition

authorities in Europe and the United States.

Therefore, this paper is dedicated to examine whether

the M&As between electric distribution utilities have

affected their investments in R&D. Two measures of

R&D inputs are of interest in this analysis: R&D

expenditures and R&D intensity.

The rest of the paper is organized as follow.

Section 2 is a literature review on how M&As affect

R&D spending. Section 3 gives a brief theoretical

analysis about the effects of M&As on R&D. Section

4 gives an introduction about M&A and R&D in the

electric utility industry in the United States and

summary statistics of the data used in this paper.

Section 5 presents the methodology used. An

empirical research is conducted based on the data in

the previous section in Section 6, which is followed

by conclusion and suggestion in Section 7.

2 LITERATURE REVIEW

The effects of M&As on R&D spending have been

studied extensively in the R&D-intensive industries

such as pharmacy and high-tech. However, only

limited research has been devoted to examine such

effects in the electricity industry. Of the limited

empirical studies, some have focused on the effects

of liberalization on R&D, and some others have

analysed the drivers of R&D spending.

2.1 Literature in the R&D-intensive

Industry

How M&As affect R&D spending is not conclusive

in the literature. John Kwoka reviewed several

retrospective merger analyses and reported that, in

many cases, retrospective merger studies have found

that mergers resulted in a decrease in innovation

(Kwoka 2014). How horizontal mergers affect

innovation of the merged entity and its non-merging

competitors using data on horizontal mergers among

688

Tian, J., Shen, T., Wang, X. and Pan, Z.

The Impact of MA on RD of Electric Utilities based on Heckman Two-stage Model.

DOI: 10.5220/0011218400003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 688-694

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

pharmaceutical firms in Europe and applying

propensity score matching estimators. The authors

found that average patenting and R&D of the merged

entity and its rivals declines substantially in post-

merger periods (Haucap, et al, 2019). The impact of

horizontal mergers to monopoly on firms’ incentives

to invest in demand-enhancing innovation is

analysed. The authors find that the overall impact of

a merger on innovation can be either positive or

negative (Bourreau, Jullien, 2018). In contrast,

(Denicolò, Polo, 2018) and (Federico, et al, 2017)

analyse the effect of a merger on product innovation

in a patent-race-like setting in which the scope of

R&D investments has an impact on the probability of

success but not on the value of the innovation.

(Jullien, Lefouili, 2018) discusses the effects of

horizontal mergers on innovation and shows that the

overall impact of a merger on innovation may be

either positive or negative.

2.2 Literature in Electric Utility

Industry

(Salies 2010) studies the determinants of R&D

expenditures in order to provide applied evidence of

the combined effect of size and reforms on innovative

activity by electric utilities. The study is based a

sample of twenty European electric utilities with

annual observations for the period of 1980 to 2007.

The results show that firm size has a positive and

significant effects on utilities’ R&D expenditures. By

including the M&A operation in the model, the

coefficient is positive, though it is not significant. The

author concluded that, by preventing consolidations

of the larger firms, competition commissions may

impede increases in total industry R&D efforts.

(Sanyal, Cohen, 2009) investigates the R&D

behaviour of regulated firms during the transition

period to a competitive environment. Based on the

data from US electricity market from 1990-2000, the

authors analysed the effects of competition,

institutional changes, and political constraints on the

decline in R&D. In the selection equation, the authors

included a dummy to control for pending mergers.

The results show that pending mergers have a

significant and negative impacts on the probability of

firms’ deciding to engage in R&D.

3 THEORETICAL ANALYSIS

3.1 Characteristics of R&D

The unique characteristics of R&D investment make

it difficult to finance (Damanpour 2020). Firstly,

R&D investments are inherently more uncertain.

Innovation is a process of doing something different

and exploring to the unknown world. Due to lack of

the knowledge of details of new technology and

unforeseeable responses from other players in the

market, R&D is manifestly a process of uncertainty

(Jalonen 2012). Secondly, the benefits associated

with R&D investment may not be totally appropriated

by the investors. Knowledge as the output of

innovation activity is partially a non-excludable and

non-rival good. In other words, it is difficult to keep

the knowledge secret. Therefore, private firms tends

to under invest in the production of knowledge since

they could just be able to reap a small share of these

wider benefits. Thirdly, certain R&D projects may be

indivisible and require a large amount of investment

to be implemented by private firms. The issue of

indivisibility occurs when the project cannot be

broken down into smaller, more manageable units. It

means that these projects require a large amount of

up-front cost, which is also known as “fixed-cost”.

The problem of indivisibility could be solved if

capital market works perfectly. However, there are

various reasons to expect that financial market is not

perfect.

3.2 Effects of M&A

M&As may change firms’ innovation incentives and

innovation capabilities in several ways. Firstly,

M&As can create large organizations (Jalonen 2012).

In the absence of fully functioning markets for

innovation, the aggregation of end-product market

enables spreading of the costs of research over a

larger sales base. New technologies such as smart

grid and advanced renewable can save costs and

create environmental benefits; yet producers need

volume to spread the costs of these complex and

expensive fixed assets. This implies that due to cost

spreading, the consolidation of two or more firms can

lead them to undertake R&D projects that were

previously not profitable, thereby increasing the

firms’ incentives to innovate. Secondly, M&A may

improve the firms’ financial capability (Salies 2010).

M&A of electric utilities can lead to significant cost

savings through personnel reduction, purchasing

efficiencies, administrative consolidation, reduction

in corporate overhead, avoided capital expenditures,

The Impact of MA on RD of Electric Utilities based on Heckman Two-stage Model

689

lower cost of capital, stronger credit profile and

improved access to capital. Thirdly, and finally,

combining knowledge bases as a result of M&A

could create new knowledge and enhance firms’

absorptive capabilities, which in turn increases the

utilities’ capabilities to innovate.

4 DATA

The data used this empirical analysis is an unbalanced

panel comprised of 125 electric distribution utilities

in the United States during a period of 20 years from

1994 to 2013. Data used in this paper are compiled

from various sources. The data on investments in

R&D are collected from FERC Form One. The

investment means expenditure incurred by public

utilities in pursuing research, development, and

demonstration activities including experiment,

design, installation, construction, or operation. It

includes expenditures for the implementation or

development of new and/or existing concepts until

technically feasible and commercially feasible

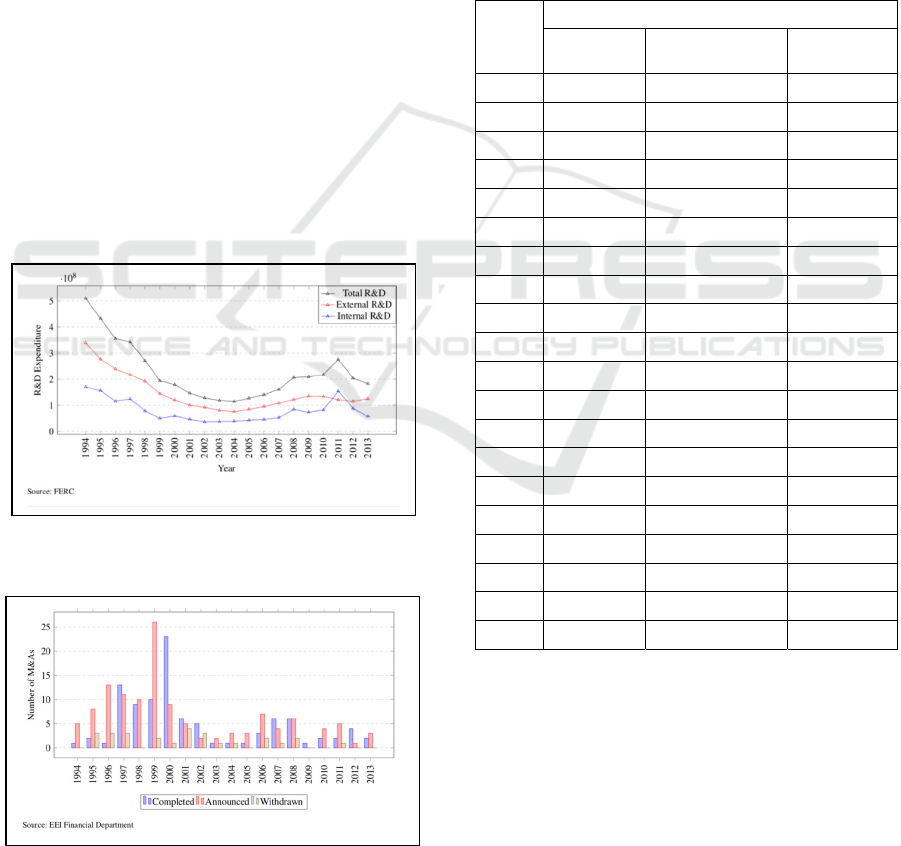

operations are verified. Figure 1 shows the

total R&D,

external R&D and internal R&D spending and Table

1 shows the descriptive statistics.

Figure 1. R&D by Investor-Owned Electric Utilities in the

United States (1994-2003).

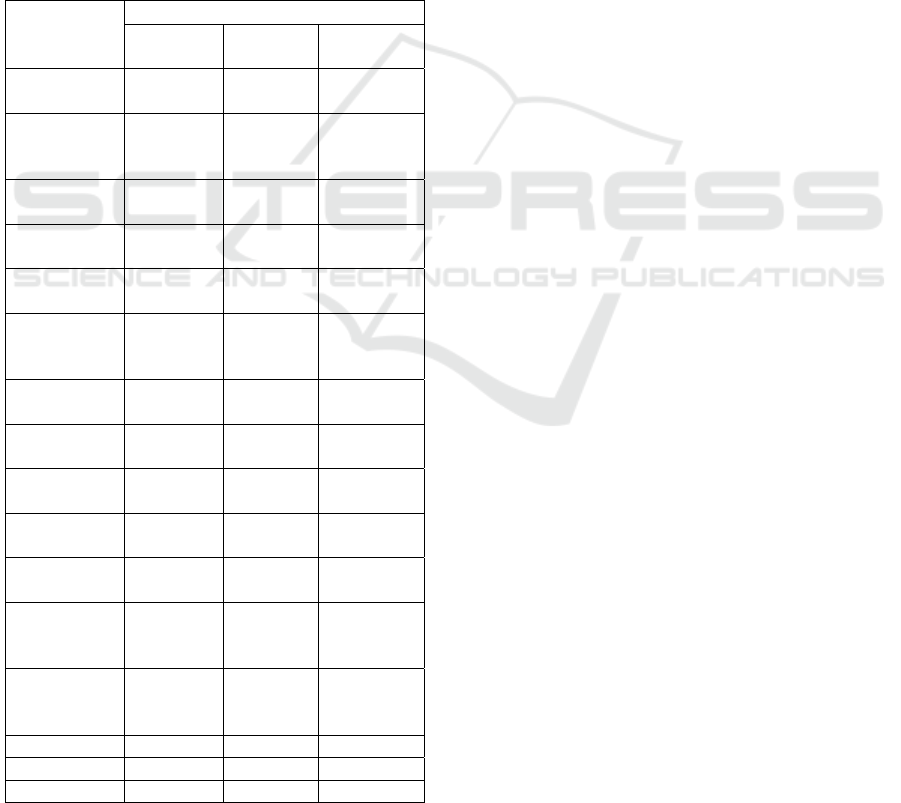

Figure 2. M&A of Investor-Owned Electric Utilities in the

United States (1994-2003).

The information on mergers is taken from a

compilation of Edison Electric Institute (EEI). M&A

activity is defined as mergers and acquisitions of

whole operating company with a regulated service

territory. EEI provides a list of mergers including the

information about the identity of the merging utilities,

merging status (i.e. withdrawn, pending, completed),

dates of merger announcement and completion, terms

of deals, merger types (i.e. merger between electric

utilities, merger between electric utility and

independent power producers, merger between

electric and gas utilities, etc.). This study focuses on

the mergers between electric utilities.

Table 1: R&D data descriptive statistics.

Year

Total R&D Expenditure and Intensity

a

bservations

R

&D Expenditure

&D Intensity

1994

2344

5588919 2.813

1995

2344 4569815 2.327

1996

2344 3685858 1.864

1997

2344 3456409 1.707

1998

2344 2592725 1.412

1999

2344 1858286 1.050

2000

2344 1660128 0.902

2001

2344 1323394 0.605

2002

2344 1168754 0.640

2003

2344 1058668 0.565

2004

2344 995829 0.540

2005

2344 1058073 0.534

2006

2344 1133133 0.598

2007

2344 1294190 0.670

2008

2344 1609265 0.818

2009

2344 1618904 0.736

2010

2344 1694890 0.793

2011

2344 2079458 1.360

2012

2344 1488672 1.000

2013

2344 1369218 0.673

5 METHODOLOGY

When modelling the impact of M&A on R&D

spending, a crucial factor that should be considered is

the mixed discrete-continuous dependent variable.

That is, a significant proportion of the R&D spending

data takes zero values and the rest are continuously

distributed.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

690

The model consists of two equations. The first

equation determines whether the firm will be engaged

in research activities; the second equation accounts

for the expenditure or intensity of these activities

(Wooldridge 2010). Suppose, in each year, a utility

decides whether to invest in R&D or not. If the

associated benefit from the investment is positive, the

utility will make positive investment, otherwise the

utility will make zero investment. The benefit of such

investment is a latent variable that is not observable.

But it may include the intangible benefits of

complying to regulatory rules. The decision equation

takes the following form:

(1)

where 𝑑

∗

is a latent variable, 𝜇

is the error term,

𝑥

is vector of exogenous explanatory variables.

This second equation is to examine the factors that

influence the level of R&D input, which is denoted

by the R&D expenditure and R&D intensity. The

equation takes the following form:

(2)

where 𝑣

is the error term, 𝑤

is vector of

exogenous explanatory variables.

It is assumed that the disturbances in the two

equations jointly follow normal distribution. That is,

(3)

6 EMPIRICAL

IMPLIMENTATION

6.1 Empirical Model Specification

Stage 1: Selection Model

(4)

(5)

Stage 2: Level Model:

Given that the utility has decided to undertake R&D

investment, this stage investigates the factors that

influence the magnitude of R&D spending.

(6)

The dependent variable is natural logarithm of

positive R&D spending or R&D intensity.

In this model, 𝑖 indexed the regulated electric

distribution utilities, and 𝑡 indexes the years. The

dependent variable is the natural logarithm of R&D

expenditure, which is measured in 2005 dollars, or

R&D intensity. Buyer denotes the subset of utilities

who are buyers in M&As. It takes the value of 1for

the entire time period if a utility is a buyer in a

merger. Similarly, Target denotes the subset of

utilities who are targets in M&As. It takes the value

of 1 for the entire period if a utility is a target in a

merger. All observations on non-merging utilities

constitute the control group. Merger is a dummy

variable. If a utility involved in a merger in year t, the

dummy will take the value of 1 in year t and

thereafter. The inclusion of MergerBuyer and

MergerTarget permits the evaluation of different

effects for buyers and targets. MultiMerger is a

dummy variable taking on a value of 1 for the years

subsequent to any second merger by utilities during

this period. The inclusion of inverse mills ratios

(IMR, 𝜆

) is to account for the selection effect. 𝜆

is

calculated based on the probit equation of the first

stage.

6.2 Estimation and Results

Table 2 shows the results derived from a pooled

probit regression, which is added with year dummies.

Column (a) compares all buyers to non-merging

utilities, while Column (b) compares all targets to

non-merging utilities. Column (c) shows the

estimation results with all observations. I find that

both state regulation and utility characteristics have

important impact on the decision to undertake R&D

investment. Retail access has a significant negative

impact on the decision to undertake R&D investment.

This variable may be picking up the effects of

competition. The competition pressures may induce

the electric distribution utilities to reduce costs by

disengage themselves from R&D investment.

The Impact of MA on RD of Electric Utilities based on Heckman Two-stage Model

691

Table 2: The Decision to Undertake R&D Investment.

Variable

Models

a,b,c

Buyer vs. Base

(a)

Target vs. Base

(b)

B&T vs. Base

(c)

Buyer

0.636

[0.478]

0.702

[0.476]

Target

-0.104

[0.330]

-0.035

[0.308]

MergerBuyer

0.162

[0.322]

0.133

[0.346]

MergerTarget

0.363

[0.298]

0.304

[0.298]

MultiMerger

-0.666

[0.487]

-0.410

[0.392]

-0.572

*

[0.304]

Ln(PlantInService

)

0.453∗∗∗

[0.093]

0.445∗∗∗

[0.092]

0.421∗∗∗

[0.079]

N

etwork Dummy

0.522

[0.341]

0.169

[0.313]

0.234

[0.252]

RTO

0.287

[0.253]

0.190

[0.244]

0.206

[0.216]

RetailAccess

-0.505∗

[0.289]

-0.514∗

[0.290]

-0.476∗∗

[0.242]

Constant

-9.184∗∗∗

[1.937]

-8.931∗∗∗

[1.925]

-8.429∗∗∗

[1.648]

Years

Yes Yes Yes

Observations

1833 1705 2344

Pseudo R

2

0.249 0.215 0.224

Wald (Chi-

squared)

140.255

88.525 101.006

a. Standard errors in brackets; b. ∗ p < 0.10, ∗∗ p < 0.05, ∗∗∗ p < 0.01

The coefficients on Buyers is positive and that on

Target is negative, but both are not significant in all

three models. The positive sign means those utilities

are more likely to undertake R&D, and the negative

sign means those utilities are less likely to undertake

R&D. However, both of them are not significant and

show that Buyers and Target are as likely to

undertake R&D as those that did not involve in

M&As during the sample period.

The coefficients of the interaction terms

MergerBuyer and MergerTarget are both positive in

all three models. The positive sign means that M&As

will increase the probabilities of buyers and targets to

undertake R&D investment. However, the

coefficients are not significant and I would rather to

believe that M&As have no impact on the utilities’

decision to invest in R&D. The coefficient on

MultiMerger is negative in all three models and

significant at 10 percent level in Column (c). The

negative sign means that frequent M&As would

reduce the probabilities of the utilities to invest in

R&D. Since the coefficient is significant in Column

(c), it shows that frequent M&As have distracted the

management’s attention from inner development and

have negative impact on the decisions to undertake

R&D investment.

Table 3: The Decision on the Level of R&D investment.

Variable

Models

a,b,c

Buyer vs.

Base

(a)

Target vs.

Base

(b)

B&T vs. Base

(c)

Buyer

-0.179

[0.300]

-0.561∗

[0.288]

Target

-0.805*

[0.369]

-0.529

[0.323]

MergerBuyer

-0.095

[0.242]

-0.037

[0.234]

MergerTarget

-0.295

[0.282]

-0.317

[0.260]

MultiMerger

-0.363

[0.304]

0.304

[0.406]

-0.021

[0.250]

Ln(PlantInService)

0.470∗∗∗

[0.122]

0.247∗

[0.136]

0.472∗∗∗

[0.111]

SelfGenShare

0.027∗∗∗

[0.004]

0.019***

[0.004]

0.024***

[0.003]

RetailChoiceShare

-0.007

[0.006]

-

0.026***

[0.009]

-

0.018***

[0.006]

IndSalesShare

0.018∗∗∗

[0.005]

0.018∗∗∗

[0.006]

0.015∗∗*

[0.005]

ROE

0.008

[0.009]

-0.003

[0.011]

0.001

[0.009]

LongDebtRatio

-0.012

[0.012]

-0.014

[0.017]

-0.018

[0.013]

IMR

-

1.429***

[0.427]

-

1.799***

[0.435]

-

1.656***

[0.399]

Constant

3.147

2.745

9.113***

[3.132]

3.829

[2.551]

States

Yes Yes Yes

Observations

1341 1146 1709

Pseudo R

2

0.677 0.580 0.616

a. Standard errors in brackets; b. ∗ p < 0.10, ∗∗ p < 0.05, ∗∗∗ p < 0.01.

Table 3 shows the estimation results of

determination on the level of R&D investment once

undertaking R&D has been decided. The second

stage equation is estimated using a pooled OLS

model as suggest by (Wooldridge 2010). Dummies

for states are included to control for the state fixed-

effects. The coefficient on ln (PlantInService) is

positive in all three models. The coefficient is

positive in Column (a) and Column (c) at 1 percent

level, and significant at 10 percent level in Column

(b). The positive sign means that large utilities tend

to invest more in R&D once the decision to undertake

R&D has been made. Since the coefficient is

significant in all three models, it show that utility size

not only positively affect the probability to undertake

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

692

R&D but also positively affect the magnitude of

R&D investment. Particularly, 1% increase in

distribution plant will increase the amount of R&D

investment by 0.24-0.47 percent.

The coefficient on IMR is negative and significant

at 1 percent level in all three models, indicating the

existence of selection. That is, some electric utilities

made no investment in R&D because of their

management strategies. This finding has an important

policy implementation. That is, the government or

regulator could come out with some appropriate

policies to induce or force the utilities to undertake

R&D investment. However, this does not mean that

increase in R&D investment is necessary. To

determine the optimal level of R&D investment of the

industry requires further research.

Table 4: The decision on the level of R&D intensity.

Variable

Models

a,b,c

Buyer vs. Base

(a)

Target vs. Base

(b)

B&T vs. Base

(c)

Buyer

-0.623*

[ 0.346]

-0.840**

[0.363]

Target

-1.050

∗

[0.570]

-0.432

[0.395]

MergerBuyer

-0.230

[0.245]

-0.259

[0.229]

MergerTarget

-0.135

[0.570]

-0.062

[0.563]

MultiMerger

-0.576

[0.535]

0.072

[0.431]

-0.180

[0.295]

Ln(PlantInService

)

-0.525∗∗∗

[0.124]

-0.654 ∗∗

∗

[0.139]

-0.486∗∗∗

[0.106]

SelfGenShare

0.020∗∗∗

[0.003]

0.020∗∗∗

[0.007]

0.019∗∗∗

[0.004]

RetailChoiceShar

e

-0.003

[0.005]

-0.010

[0.009]

-0.008

[0.005]

IndSalesShare

0.013∗

[0.007]

0.015∗∗

[0.006]

0.013∗

[0.007]

ROE

-0.015

[0.009]

-0.009

[0.011]

-0.007

[0.010]

LongDebtRatio

-0.017∗

[0.010]

0.004

[0.013]

-0.015∗

[0.008]

IMR

-1.900∗∗∗

[0.474]

-1.853 ∗∗

∗

[0.557]

-1.801∗∗∗

[0.465]

Constant

12.787∗∗∗

[2.841]

14.753 ∗∗

∗

[3.685]

11.779∗∗∗

[2.504]

States

Yes Yes Yes

Observations

1341 1146 1709

Pseudo R

2

0.449 0.258 0.232

a. Standard errors in brackets; b. ∗ p < 0.10, ∗∗ p < 0.05, ∗∗∗ p < 0.01

Table 4 shows the results of the impact of M&As

on R&D intensity. The results are similar as those in

Table 3. The coefficients on Buyer and Target are

negative in all three models. The coefficient on Buyer

is significant at 10 percent level in Column (a) and

significant at 5 percent level in Column (c). The

coefficient on Target is significant at 10 percent level

in Column (b). The negative sign means that the R&D

intensities for buyers and targets are lower than those

utilities who did not involve in M&As during the

sample period. Since the coefficients on Buyer and

Target are significant in Column (a) and (c) and

Column (b) respectively, there is some evidence that

the utilities that were involved into M&As during the

sample period are those with lower level of R&D

intensity.

The coefficient on the interaction terms of

MergerBuyer and MergerTarget are negative in all

three models. However, none of them are significant.

The negative sign means that involvement in M&As

tends to reduce R&D intensity for both buyers and

targets. Since the coefficients are insignificant, it

shows that M&As have not significantly affected

R&D intensity. The coefficient on MultiMerger is

negative is Column (a) and (c), but negative in

Column (b). None of them are significant at

traditional confidence levels. Therefore, multiple

mergers have no significant impact on R&D

intensity.

7 CONCLUSIONS

The empirical analysis explores an unbalanced panel

dataset consisting of 125 electric utilities during 20

years sample period from 1994 to 2013. The decision

to undertake R&D investment is modelled as a two-

stage process. In the first stage, the electric utilities

decide whether to invest in R&D at all; in the second

stage, the utilities will decide the amount of R&D

investment. Heckman style two-stage method is used

for estimation. Based on the analyses, it comes to the

conclusions. The utilities that were involved into

M&As during the sample period were as likely to

undertake R&D investment as non-merging utilities.

But the amount of R&D investment and R&D

intensity were lower for the merging utilities than

non-merging utilities. There is some evidence that

multiple mergers negatively affected the utilities’

probabilities to undertake R&D. But multiple-

mergers had no significant impact on the amount of

R&D investment and R&D intensity.

The Impact of MA on RD of Electric Utilities based on Heckman Two-stage Model

693

REFERENCES

Bourreau, M. & Jullien, B. 2018. Mergers, investments and

demand expansion. Economics Letters, 167(136-141.

Damanpour, F. 2020. Organizational innovation: Theory,

research, and direction: Edward Elgar Publishing.

Denicolò, V. & Polo, M. 2018. Duplicative research,

mergers and innovation. Economics Letters, 166(56-

59.

Federico, G., Langus, G. & Valletti, T. 2017. A simple

model of mergers and innovation. Economics Letters,

157(136-140.

Haucap, J., Rasch, A. & Stiebale, J. 2019. How mergers

affect innovation: Theory and evidence. International

Journal of Industrial Organization, 63(283-325.

Jalonen, H. 2012. The uncertainty of innovation: a

systematic review of the literature. Journal of

management research, 4(1), pp 1.

Jullien, B. & Lefouili, Y. 2018. Horizontal mergers and

innovation. Journal of Competition Law & Economics,

14(3), pp 364-392.

Kwoka, J. 2014. Mergers, merger control, and remedies: A

retrospective analysis of US policy: Mit Press.

Salies, E. 2010. A test of the Schumpeterian hypothesis in

a panel of European electric utilities. Innovation,

Economic Growth and the Firm. Edward Elgar

Publishing.

Sanyal, P. & Cohen, L. R. 2009. Powering progress:

Restructuring, competition, and R&D in the US electric

utility industry. The Energy Journal, 30(2), pp.

Wooldridge, J. M. 2010. Econometric analysis of cross

section and panel data: MIT press.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

694