Research on Quantitative Risk Control Evaluation of Enterprises and

Optimization of Bank Credit Strategy

Jie Song*

School of Information Science and Engineering, Lanzhou University, Lanzhou, Gansu, 730000, China

Keywords: TOPSIS Model, Logistic Regression, Nonlinear Programming, Monte Carlo Method.

Abstract: This paper focuses on the quantitative evaluation of enterprise credit risk and the comprehensive problem of

bank's decision on enterprise credit strategy under the background of big data.Firstly,the discrete credit

rating is used to evaluate the enterprise's reputation,and the standardized inbound and outbound sales are

used to construct the index.The obtained evaluation matrix is used to evaluate the upstream and downstream

influence of the enterprise by entropy weight method and TOPSIS model,and the effective vote ratio is used

to evaluate the enterprise's strength.Then,the three first-level indicators are used logistic regression,and the

0-1 variable U is used as the predictive variable to get the risk indicator of whether each enterprise will

default.Then,nonlinear programming is adopted to solve the problem,and the monte Carlo method is used to

simulate the solution with the objective function of maximizing the total income of the bank.By limiting the

mean value of random number sequence,monte Carlo method is improved to improve the solving

efficiency.Finally,the corresponding loan amount and interest rate of enterprises are obtained.

1 INTRODUCTION

In real life, there are many micro, small and medium-

sized enterprises, their business is relatively small in

scale and lack of mortgage assets, and the bank loan

for the business enterprise usually when the trading

instruments information of credit policy, enterprise

and enterprise as the judging standard in the

influence of upstream and downstream, measure the

strength of enterprises and the supply and demand is

stable, And on this basis, the bank will also give

appropriate interest rate preference to the enterprises

with relatively high reputation and relatively small

credit risk (Li, Liu, 2021).

The strength and credibility of micro, small and

medium-sized enterprises are the primary factors for

banks to consider in risk assessment of enterprises.

Secondly, banks will determine reasonable credit

strategies based on credit risk factors, including

whether to lend, loan amount, interest rate and term.

In this paper, we first construct a hierarchical

diagram of the credit risk assessment model,

including the three basic indicators of enterprise

strength, enterprise upstream and downstream

influence and enterprise creditworthiness. The

discrete credit rating is used to assess the

creditworthiness of the enterprise, the standardized

total inbound and outbound sales are used to

construct the indicators, the obtained evaluation

matrix is used to assess the upstream and

downstream influence of the enterprise, and the

effective vote ratio is used to evaluate the strength of

the enterprise (Zhang, Liu, Tian, 2021). Finally, the

three indicators are regressed using logistic

regression to obtain the risk indicator of whether

each enterprise will default or not. For the

optimization of the bank's credit strategy, a nonlinear

programming solution is adopted to maximize the

bank's total revenue as the objective function, and

finally the loan amount and interest rate that meet the

expectations are obtained.

2 DATA PREPARATION

In this paper, enterprise reputation (P

i

), enterprise

upstream and downstream influence (Q

i

) and

enterprise strength (K

i

) are selected as three basic

indicators, and on this basis, a credit risk (U

i

)

evaluation system model based on Logistic

regression is constructed.

Song, J.

Research on Quantitative Risk Control Evaluation of Enterprises and Optimization of Bank Credit Strategy.

DOI: 10.5220/0011269000003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 731-736

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

731

First, ABCD credit rating is mapped to discrete

data values within the range, and the mapping

relationship is A=1, B=0.75, C=0.5, D=0.25. In the

case of default,0-1 variables are defined to indicate

whether the enterprise defaults. U =0 represents the

occurrence of default, and u=1 represents the non-

occurrence of default.

Then the invoice information data is cleaned and

standardized, and the invalid invoice data is

eliminated. Set

i

p

and

i

s

to represent the total

amount of the total price tax of the upstream or

downstream enterprise of the first enterprise

respectively,

i

p

and

i

s

convert the two into

standardized indicators and respectively:

ip

i

p

p

p

(1)

is

i

s

s

s

(2)

11

p

is i

ii

p

s

nn

(3)

2

1

1

i

pip

n

p

n

(4)

2

1

1

i

six

n

s

n

(5)

After standardized treatment, the total amount of

the total price tax of the upstream or downstream

enterprises is converted into a standardized index

with an average of 0 and a standard deviation of 1.

3 ESTABLISHMENT OF EVALUATION

INDICATORS

The entropy weight method was used to determine

the weight of each indicator, and then substituted into

TOPSIS model (Wu, Li, 2020). Finally, the results

were tested, so as to obtain the comprehensive

evaluation index of supply and demand relationship

of these 123 enterprises:

(1) Data standardization is firstly carried out:

2

1

,

ij

ij ij

n

ij

i

x

Zzz

x

(6)

(2) For each item,calculate its corresponding

probability and information entropy:

1

ij

ij

n

ij

i

z

b

z

(7)

1

1

ln( )

ln

n

iijij

i

ebb

n

(8)

(3) Work out the information utility value and

index weight:

1

jj

de

(9)

1

/

m

j

jj

j

Wd d

(10)

Based on the above analysis, the profit weight

value of the enterprise is 0.4366, and the supply

chain profit efficiency weight value of the enterprise

is 0.5634.

Topsis model is a comprehensive evaluation

method, which can fully mine the original data and

describe the comprehensive performance of the target

by using the degree of migration in the data.

Introduce "distance" to describe the degree of

importance to the population.

For the standardized evaluation matrix Z

ij

, the

formula for defining the maximum value Z+ of each

evaluation index is as follows:

12

11 21 1 12 22 2 1 2

(,,...)

=(max , ,... ,max , ,... ,...max , ,... )

m

nnmmnm

ZZZZ

zz z zz z z z z

(11)

----

12

11 21 1 12 22 2 1 2

( , ,... )

=(min , ,... , min , ,... ,...min , ,... )

m

nnmmnm

ZZZZ

zz z zz z z z z

(12)

Then, the distance between the first evaluation

object and the maximum value can be defined as:

2

1

()

m

ijij

j

DZz

(13)

Similarly, the distance between the first

evaluation object and the maximum value can be

defined as:

--2

1

()

m

ijij

j

DZz

(14)

Then the unnormalized score of the object is the

formula:

i

i

ii

D

S

D

D

(15)

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

732

Matlab is used to calculate the final score of each

enterprise,and then the evaluation index table of the

upstream and downstream influence of the enterprise

is obtained:

TABLE I. E

VALUATION INDEX TABLE

.

E1 0.380463922 E6 0.570846867

E2 0.688289183 E7 0.351561487

E3 0.392875752 E8 0.612148083

E4 0.910602339 E9 0.524091466

E5 0.557651018 E10 0.543837713

K

i

is selected as the indicator of the company's

strength:

12

()/2

i

K

(16)

K

i

is used to represent the enterprise strength of

the ith enterprise, and the enterprise strength can be

measured by the proportion of invalid invoices and

total invoices in the enterprise's input invoices and

output invoices.

4 MODEL ESTABLISHMENT AND

SOLUTION

4.1 Establishment of Optimization

Model of Nonlinear Programming

The three basic indicators of different enterprises'

credibility (P

i

),their upstream and downstream

influence (Q

i

) and their own strength (K

i

) were taken

as independent variables,and the 0-1 variable

corresponding to the enterprise's default situation

lock was taken as the dependent variable for logistic

regression.The result of logistic regression fitting can

be used to represent the possibility of enterprise

repayment,that is,to represent the credit risk of

enterprise.Based on the above analysis,SPSS

software can be used for multivariate logistic

regression,and the results are shown in the table.

TABLE II. MULTIVARIATE LOGISTIC REGRESSION RESULTS.

Parameter estimation

Whether the violations, B

Standard

error

wald DOF Significance Exp(B)

Exp(B)95% confidence

interval

lower limit upper limit

0

Intercept 7.305 9.329 0.613 1 0.434

Supply chain score -1.501 9.247 0.026 1 0.871 .223 3.000E-9 16547478.433

corporate strength 2.386 8.978 0.071 1 0.790 10.874 2.478E-7 477138265.652

credit rating -21.44 5.388 15.84 1 0.000 4.871E-10 1.264E-14 1.878E-5

Thus, the logistic regression model (Bian, Lu, Li,

Zeng, Sun, 2020) of credit risk on enterprise

reputation, upstream and downstream influence and

enterprise strength is obtained:

The bank's loan policy is determined by

constructing an optimization model of bank loan

strategy based on nonlinear programming. However,

as the loan life is known to be one year, two

indicators, the loan amount and interest rate, need to

be determined.

First, we need to fit the functional relationship

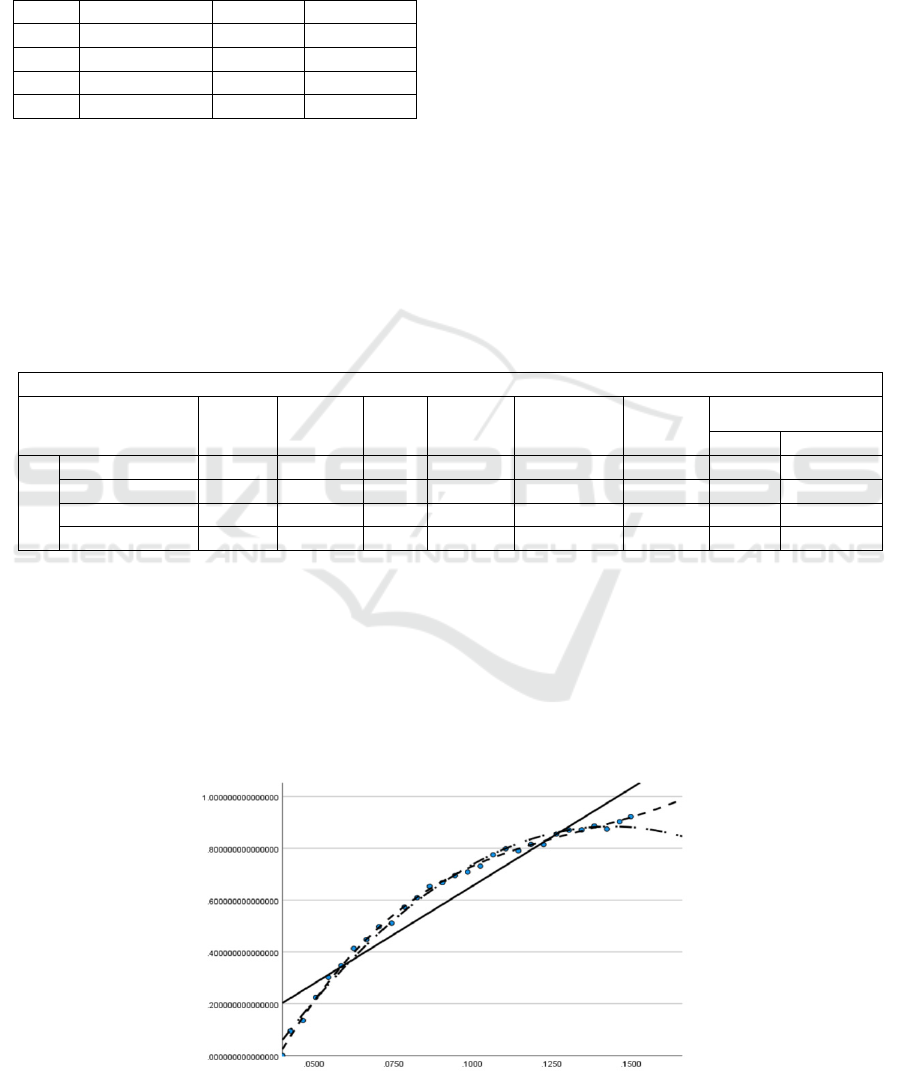

between customer churn rate and interest rate.

Through the observation of the scatter graph and the

statistics of the curve fitting, the cubic function is

selected as the best fitting curve:

23

( ) 1.121 37.97 258.57 640.944

iiii

f

LLLL

(17)

Figure 1. Functional diagram.

Research on Quantitative Risk Control Evaluation of Enterprises and Optimization of Bank Credit Strategy

733

Since the bank hopes to obtain the maximum rate

of return, the objective function of bank income can

be constructed. Since the bank interest rate is low for

enterprises with high credit rating, the income

generated by enterprises with different credit rating

can be planned separately. Suppose that M

1

, M

2

, M

3

represents the total loan amount of ABC three

enterprises respectively, and M represents the total

loan amount of bank and is a fixed value. The

formula can be obtained:

123

123

=

0,,

M

MMM

M

MM M

(18)

Z

i

represents the loan amount of each enterprise,

and L

i

represents the loan interest rate of each

enterprise (Sun, Wang, 2015). For enterprises with

high credit rating, the loan interest rate needs to be

appropriately reduced. Therefore, the fluctuation

range of the loan amount can be set for these three

types of enterprises respectively, so as to reflect the

preferential interest rate policy for enterprises with

high credit rating. The total interest rate range of

0.04-0.15 can be divided into three ranges, which

respectively represent the interest rate fluctuation

range of ABC class 3 enterprises: [0.04,0.0945],

[0.074,0.13], [0.0945,0.15]. For credit risk

i

u

,it is

believed that risk will bring potential income loss, so

credit risk should be reflected as a factor in the return

function. Therefore, an optimization model of bank

loan strategy based on nonlinear programming can be

constructed. A-level enterprises are taken as the

formula:

1

1

max ( )

10 100 0

.

0.04 0.0945

0

0 123

ii

ii

i

i

i

i

ZL u f L

ZM

Z

st

L

MM

i

(19)

4.2 Solution of Optimization Model of

Nonlinear Programming

Monte Carlo algorithm is an algorithm that can

generate a large amount of simulated data in a given

data range and simulate the results (Chai, Zhang,

Ding, 2019). It avoids the situation that the

traditional method can not get the analytical solution,

and uses the idea of probability approximation to get

the optimal solution of the problem. For this model,

the algorithm process of monte Carlo method is as

follows:

(1) Given a rating value of M, it is determined as

80 million in this example.

(2) Generate a large number of interest rate L

i

and

quota Z

i

randomly according to the credit rating of

different enterprises.

(3) For the bank returns stored after the Kth

simulation, if the total bank returns obtained in the

k+1 simulation are greater than the result of the Kth

simulation, the interest rates and quota values of the

302 companies stored are updated.

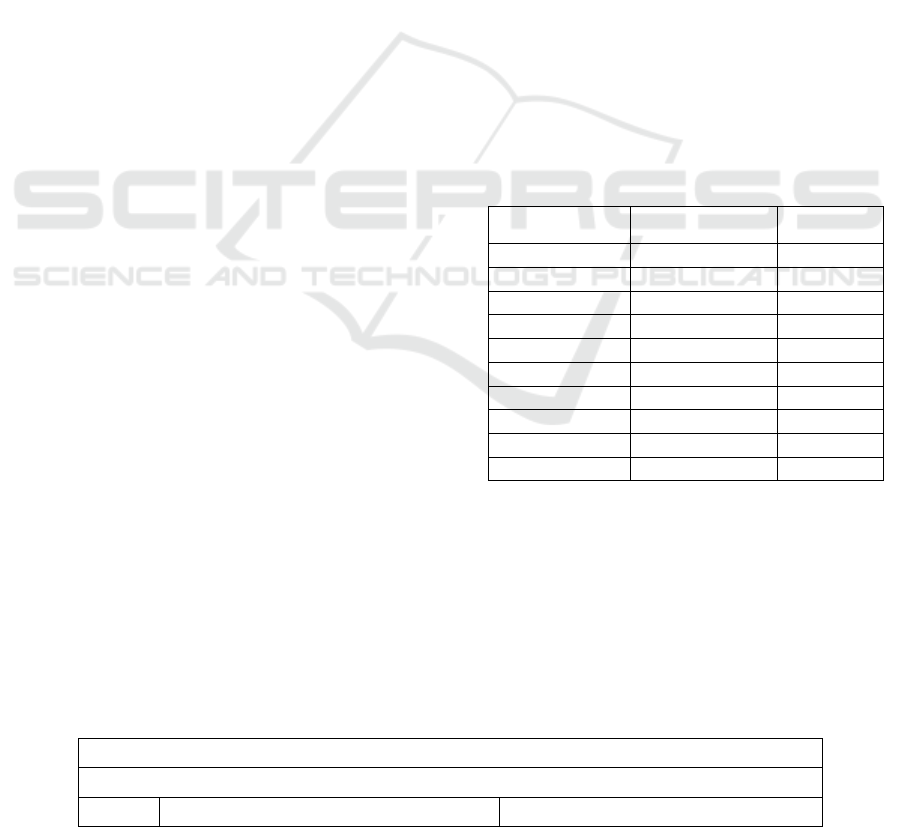

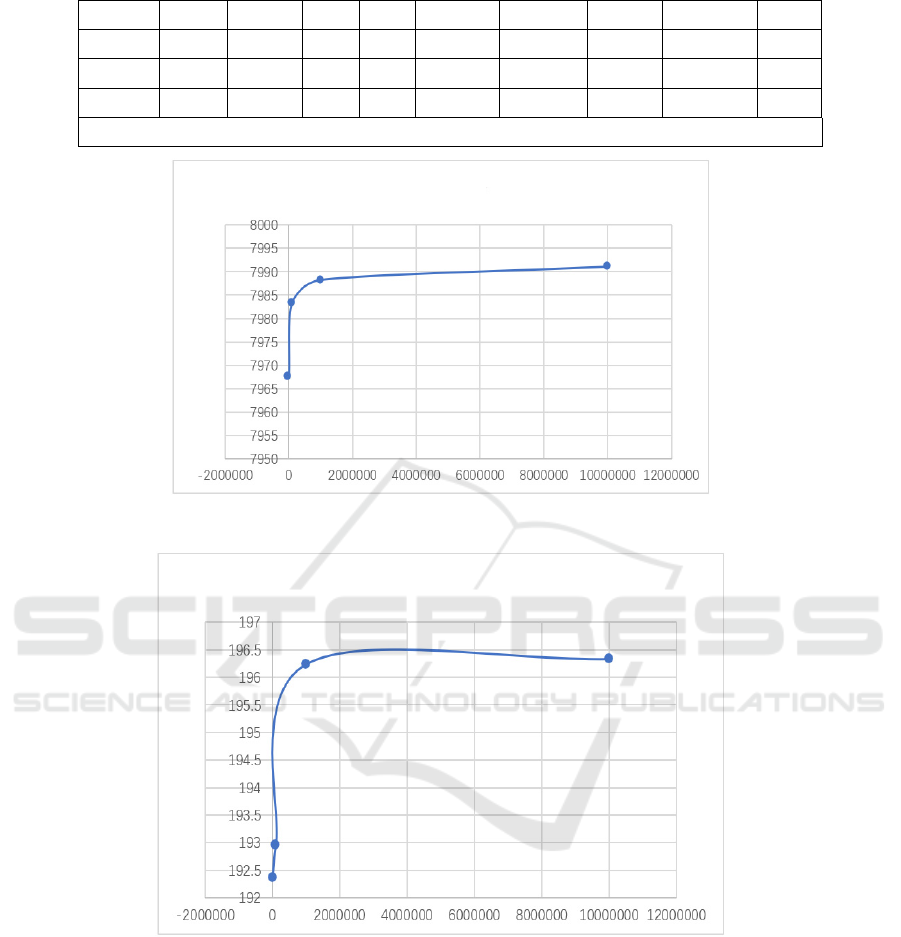

(4) By simulating 103,105,106times respectively,

we can calculate the total amount of the bank, which

can be used to show the approximation of the

simulated value to the real value.

Meanwhile, the credit strategies of each of these

123 enterprises are obtained, including the loan

amount and annual interest rate of each enterprise, as

shown in the table:

TABLE III. CREDIT STRATEGY.

Code Loan commitment

Rate of

interest

E1 65.24897 0.0585

E2 84.68147 0.0465

E3 67.45052 0.1225

E4 80.92142 0.1025

E5 78.24901 0.1145

E6 86.79694 0.0425

E7 82.17887 0.0585

E8 78.1906 0.0785

E9 78.72787 0.0905

E10 76.87874 0.0825

4.3 Interpretation of Result

The regression method was used to fit the

relationship between customer churn rate and interest

rate. It was found that the cubic function had the best

effect, and the correlation coefficient R2 reached

0.998, so the fitting effect was very good. Specific

parameters are shown in the table:

TABLE IV. TABLE OF RELATED PARAMETERS.

Model abstract and parameter estimation

Dependent variable:customer churn rate

Model abstract parameter estimation

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

734

Equation

R

2

F DOF 1 DOF 2 Significance Constant b1 b2 b3

Linear .911 276.61 1 27 .000 -.098 7.524

Quadratic .993 1847.86 2 26 .000 -.697 21.984 -76.410

Cubic .998 3690.62 3 25 .000 -1.121 37.970 -258.57 640.944

The independent variable is the annual loan interest rate

Figure 2. Comparison between simulated amount and actual amount (8000).

Figure 3. Change of total income of banks.

In monte carlo simulation, it is found that with

increasing points of each simulation, a combination

with preset limit (80 million),the gap between more

and more small, platform, and total revenue

fluctuates up and down around a certain level, that

participate in simulated points have enough right

now, you can find the best credit strategy to meet the

requirements of the goal programming, as shown in

figure 2 and figure 3.

5 CONCLUSION

5.1 Advantages

(1) Topsis model with entropy weight is used to

predict the upstream and downstream influence of

enterprises, with strong objectivity.

Research on Quantitative Risk Control Evaluation of Enterprises and Optimization of Bank Credit Strategy

735

(2) The feedforward neural network is used to

predict the enterprise reputation level, and the

network comprehensive prediction accuracy reaches

92%, and the generalization ability is good.

(3) The monte Carlo simulation method of

normal distribution random points with fixed mean is

used to solve the nonlinear programming model,

which can obtain more accurate solutions in the case

of fewer points.

5.2 Disadvantages

(1) Insufficient application of professional models in

finance.

(2) Modern optimization algorithms, such as

genetic algorithm, can be used to solve nonlinear

programming problems, and the results are compared

with those of Monte Carlo simulation.

REFERENCES

Bian YN, Lu LK, Li YL, Zeng QT, Sun YX.

Implementation of logistic regression-based financial

venture capital scorecard model[J]. Computer

Science,2020,47(S2):116-118.

Cunyi Sun, Caixia Wang. Application of machine learning

method in credit risk prediction identification[J].

China Price, 2015(12):45-47.

Guotai Chai,Yajing Zhang,Shijie Ding. An optimal loan

allocation model based on power risk spectrum and

Monte Carlo simulation[J]. China Management

Science,2019,27(09):1-

14.DOI:10.16381/j.cnki.issn1003-207x.2019.09.001.

Xuan Li,Xuezhi Liu. Analysis of the application of

mathematical modeling in economic activities[J].

Journal of Economic Research, 2021(33):122-124.

Zhang H. M.,Liu H.,Tian Miao. Research on the

application of mathematical economic modeling in

economic trade[J]. Rural Economy and Technology,

2021,32(20):148-150.

Zhengping Wu, Xiu Li. Industrial innovation system life

cycle determination and model application - based on

TOPSIS evaluation method [J]. Finance and

Accounting Monthly, 2020(08):123-

129.DOI:10.19641/j.cnki.42-1290/f.2020.08.016.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

736