Global Trends and Assessment of Possibilities of Energy Transition

in Ukraine

Oksana Mykoliuk

1a

, Valentyna Fostolovych

2b

and Tetiana Botsian

2

c

1

Department of Management, Administration and Hotel and Restaurant Business, Khmelnytskyi National University,

Ukraine

2

Department of Economics, Management, Marketing and Hotel and Restaurant Business,

Zhytomyr Ivan Franko State University, Ukraine

Keywords: Energy Resources, Renewable Energy, Energy Transition, Climate Change.

Abstract: The article examines global trends in the development of renewable energy. The possibility of Ukraine to

make an energy transition is analyzed. The main problems of modern humanity have been identified: climate

change, the exhaustion of traditional energy sources, rising global temperatures. It is emphasized that the main

way out of the current situation is the energy transition. To this end, it is necessary to achieve greenhouse gas

reduction and initiate the development of a low-carbon economy. The main indicators of energy balances of

the world, OECD and Ukraine are given. The final consumption of energy resources by their types is analyzed.

A set of economic and mathematical models for forecasting energy development has been applied.

Possibilities of development and transition to a new model of the world energy system are proved.

1 INTRODUCTION

The main feature of modern processes in the global

economy is the rapid growth of competition between

countries, which is associated with the struggle for

limited natural resources. The main ones are energy

resources. There is no country in the world that

provides itself with such resources in full. According

to a large number of scientific studies, the use of

traditional energy resources, such as coal, oil, gas, has

a detrimental effect on the ecosystem of our planet

and is the cause of climate change. This has a negative

impact on people's health and worsens their living

conditions. As a result, both the world and national

economies suffer. Thus, over the past few decades,

the world community has been quite active in the

development of technologies, tools and tools for the

use of renewable energy sources. Sources of clean

energy include wind, solar, bioenergy resources and

others. The urgency of the problem of energy

transition, ie the abandonment of traditional

exhaustible energy resources and the introduction of

safe renewable energy sources, is quite obvious. This

will build a strong world economy, end social decline,

a

https://orcid.org/0000-0001-8526-0829

b

https://orcid.org/0000-0001-53597996

c

https://orcid.org/0000-0001-8423-7424

solve global climate problems and increase the well-

being and security of society. Ukraine is actively

involved in low-carbon economic development

initiatives. Proof of this is the gradual transition of all

sectors of the national economy to renewable energy

sources. The Government of Ukraine seeks to

actively care for its citizens and protect future

generations from the negative and harmful effects of

global warming. That is why the main task of

scientists, researchers and experts in these matters is

to implement a comprehensive analysis of the

relationships and dependencies of energy security of

the state and the problems of energy transition.

2 RELATED WORKS

The authors (Gielen et al., 2019) analyze the energy

efficiency and possible technologies of renewable

energy and emphasize that their symbiosis and

synergy are the main elements of the global energy

transition. In Scientific Paper (McCollum et al.,

2019), the authors devote their own research to

developing a new approach to quantitative analysis of

32

Mykoliuk, O., Fostolovych, V. and Botsian, T.

Global Trends and Assessment of Possibilities of Energy Transition in Ukraine.

DOI: 10.5220/0011340900003350

In Proceedings of the 5th International Scientific Congress Society of Ambient Intelligence (ISC SAI 2022) - Sustainable Development and Global Climate Change, pages 32-39

ISBN: 978-989-758-600-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

future events. The authors use econometric analysis

and the Monte Carlo model to investigate four

possible scenarios for changes in the energy system.

Models of interdependence of different technologies

for the use of renewable energy sources are studied

(Pye et al., 2019). To this end, the authors use

hierarchical clustering in several scenarios. The

authors identified some features of different

technological systems that can compete with each

other in terms of cost. In scientific article (Tukker et

al., 2019), researchers analyze concepts and use

dimensions, namely: changes, possible events,

drivers and ways to use renewable energy. The

authors focus on the issues of energy transition

management and emphasize the relationship between

the scale of change and resistance to change.

3 METHODOLOGIES

Changing views on the development of world energy

in the context of energy transition leads to increased

attention to the problems of combating global climate

change and sustainable economic development. This

was the driving force behind the introduction of the

Concept of Green Energy Transition in Ukraine.

Adapting energy policy to the new realities of global

climate change will provide a lasting effect in

ensuring sustainable development and energy

transition. The possibility of realizing such intentions

is quite real and will help increase the

competitiveness of our country in the global world.

The main goal in this context is to reduce greenhouse

gas (GHG) emissions in order to ensure the transition

to a climate-neutral economy of Ukraine in 2070 in a

way that is consistent with social acceptability.

It should be noted that the adoption of the Paris

Climate Agreement was a landmark decision for the

world community. This will have a significant impact

on the development of the world economy and energy

(IRENA, 2021).

In addition, for some countries, the priority is to

keep the average temperature on the planet rising.

This figure should not exceed 2° C, compared to pre-

industrial levels. Every effort should be made to limit

the temperature rise to 1.5° C (IRENA, 2021). To do

this, it is important to convert the energy sector into

carbon-neutral, ie greenhouse gas (GHG) emissions

should not exceed the level of their absorption. This

is the essence of the energy transition on the

principles of sustainable development. The transition

from traditional types of energy resources to

renewable energy sources, as well as stimulating

energy efficiency and rational consumption of energy

resources will save our planet from irreparable

consequences (Kim & Wilson, 2019).

Depletion of traditional energy resources,

increasing the negative impact of energy on the

environment, increasing environmental requirements,

sharp fluctuations in energy prices, strengthening

energy and economic security, politicization of

energy supply and other factors require urgent action.

It is necessary to assess the current state of the energy

sector and look for ways to upgrade and restart the

energy system (Ekins et al., 2019).

Ukraine is one of the many countries experiencing

all the problems associated with the energy transition.

Much of the social and economic problem is caused

by dependence on imports of expensive energy

resources. In addition, the high level of wear and tear

of domestic infrastructure, low efficiency of energy

resources are the factors that explain the high energy

intensity of the domestic economy (Voynarenko et

al., 2021). Thus, the level of energy intensity of

Ukraine's gross domestic product (GDP) is 2.8 times

higher than that of OECD countries. The same

situation is observed with regard to the high level of

carbon intensity of GDP. Due to the significant level

of energy costs and the lack of modern environmental

requirements for the acceptable functioning of the

energy system in Ukraine, there is one of the highest

mortality rates caused by diseases from polluted air.

Problems with climate change observed since the

middle of the twentieth century is the result of human

activity and wasteful treatment of the environment

(Feindouno et al., 2020). For this reason, in 2015, 195

countries from around the world participated in the

adoption of the Paris Agreement. The essence of this

agreement is to find ways to avoid the threat of

climate change, overcome poverty, curb the growth

of global average temperatures. Note that in 2015-

2016, world temperature increased by more than 1 C°.

This provoked an immediate reaction from the world

community to take immediate action to address

greenhouse gas emissions. The implementation of the

energy transition from fossil fuels to renewable

sources is the starting point for a comprehensive

solution to the issue of adaptation to climate change

that has already taken place. Numerous studies prove

that the modern development of scientific and high-

tech technologies opens up real prospects for large-

scale development of renewable energy. A significant

number of world practices prove the possibility of

replacing fossil traditional energy sources with

alternative sources. However, in this sense, Ukraine

lags far behind in the level of implementation and use

of renewable energy. Thus, the share of renewable

sources in Ukraine in 2015 was 4.2% in gross final

consumption of energy resources, while this figure in

the world was 20%. However, in Ukraine there are

positive dynamics in accelerating the energy

transition, namely the growth of investment in

renewable energy (Voinarenko & Mykoliuk, 2017).

Global Trends and Assessment of Possibilities of Energy Transition in Ukraine

33

This process is facilitated by the emergence of

appropriate economic incentives, such as the green

tariff and cost recovery programs for energy

efficiency measures.

Ukraine has a huge natural potential for the

implementation of wind energy projects, which

determines the country's interest in the development

of the industry and attracts a large number of potential

domestic and foreign investors. According to the

latest assessment of the Ukrainian Wind Energy

Association, a 16 GW wind farm is a real potential of

the Ukrainian wind energy industry (Diachuk et al.,

2018).

According to the National Agency for Energy

Efficiency, the theoretical potential of Ukrainian solar

energy is over 730 billion kilowatt-hours per year,

and technically - only 34.2 billion kilowatt-hours per

year. According to the Ukrainian Bioenergy

Association, the economically viable bioenergy

potential is about 20 million tons, and by 2050 it

could reach 42 million tons (Outlook, 2018).

Global trends show that active measures are being

taken to introduce energy-saving technologies that

can promote higher economic growth, reduce the cost

of renewable energy and increase accessibility for all

people. Successful implementation of energy

efficiency policies of leading energy-saving countries

with the most active use of modern energy-saving

technologies and alternative energy can be used for

reference by the country (Lange et al., 2020). It is

necessary to analyze the effective experience of

foreign countries in this regard and assess the

feasibility of its implementation in Ukraine in

combination with national conditions. The successful

experience of many countries over the past 30 years

shows that the implementation of national support

measures and various tools to stimulate investment in

alternative energy will not only help address global

climate change and energy security, but will also have

a significant impact. on the environment and the

economic performance of a competitive economy.

The trust of domestic and international investors

has helped Ukraine move closer to transforming the

strategic balance of its energy market into renewable

energy sources. Local and foreign investors from

Austria, Belgium, Canada, China, the United

Kingdom, Norway, Spain, Switzerland, Turkey and

the United States have raised funds for Ukraine's

green energy through a fair and stable regulatory

framework and active partnership. Leading

international financial institutions and banks, such as

the European Bank for Reconstruction and

Development, US private foreign investment

companies, and investors from France, Denmark,

Finland, Sweden, the Netherlands and other countries

are seeking long-term financing for recycling projects

in Ukraine.

In its latest World Energy Outlook, the

International Energy Agency (IEA) states that

countries' compliance with their commitments in the

preparation and ratification of the Paris Agreement by

2040 must be respected. Their main purpose is as

follows (IRENA, 2021):

• achievement of electricity production from

renewable sources at the level of 37% in the overall

structure of electricity generation;

• the new facilities will use renewable sources at the

level of 60%. This will increase the competitiveness

of the energy sector without attracting subsidies;

• increase in the number of electric cars will increase

from 1.3 to 150 million units;

• replacement of coal with natural gas will increase

by 50% in the global energy balance.

4 ANALYSIS AND RESULTS

According to the results of the study, under the

conditions of implementation of these forecasts, CO2

emissions will grow annually by 0.5%, while in 2000

their increase was 2.4%. However, according to the

International Energy Agency, this figure is not

enough to achieve the goals of the Paris Climate

Agreement (International Energy Agency., 2007).

In the table. 1 shows a comparison of Ukraine's

energy balance with the world energy balance of

OECD and EU countries. Thus, coal consumption in

Ukraine is much higher than in the world and in

OECD countries. However, the consumption of oil

and oil products in Ukraine is much lower than the

world and OECD indicators. This is due to the fact

that in Ukraine oil products are mainly used in the

transport sector, but compared to OECD countries,

they are almost never used for electricity generation

and heating. On the other hand, in our country the

consumption of petroleum products in the transport

sector is lower than the average for OECD countries.

In the structure of final consumption of energy

resources by their types there is a decrease in the share

of gas - from 38-39% in 2010-2018 to 32% in 2012-

2016. At this time there was an increase in the share

of electricity - from 14% in 2017 to 19 % in 2018

(Fig. 1).

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

34

Figure 1: Final consumption of energy resources by their

types (million toe).

As can be seen from table. 1. and fig. 1 Ukraine

lags behind not only the economically developed

countries of the world in terms of the use of renewable

energy sources, but also the global indicator. In

September 2015, the international environmental

organization Greenpeace and the Institute of

Engineering Thermodynamics, Systems Analysis and

Technology Assessment (DLR), Global Wind Energy

Council, SolarPowerEurope presented a new study

that reflects models of global scenarios of global

energy transition.

The State Agency “Institute of Economics and

Forecasting of the National Academy of Sciences of

Ukraine” simulated three scenarios of energy

development. The conservative scenario, which is

actually the baseline scenario, assumes that

technology remains at the current level

(Sabishchenko et al., 2020). Under the liberal

scenario, the development of the energy sector is

expected in conditions of free competition, and the

revolutionary scenario envisages the rapid

development of renewable energy, which by 2050

will account for 91% of final energy consumption. It

should be noted that these scenarios concern the

energy sector of Ukraine. However, they can be the

basis for further research on practical steps in

Ukraine's “energy transition” to renewable energy.

The developed scenarios envisage a gradual

transition from the consumption of traditional energy

resources to 100% of the use of renewable energy by

2050. The scenarios are aimed at curbing global

warming within 2 C

0

. The basis for the development

of the baseline scenario for the development of the

energy sector are forecasts for GDP growth and the

level of energy intensity (Lange, 2020). The data

show an increase in energy demand globally.

According to the baseline

scenario, total final energy consumption is expected

to increase by 65% from the current level.

Table 1: The main indicators of energy balances of the world, OECD and Ukraine in 2018.

Total supply of

primary energy

resources

World OECD EU Ukraine

thousand

tons of oil

equivalent.

%

thousand tons

of oil

equivalent.

%

thousand tons

of oil

equivalent.

%

thousand tons

of oil

equivalent.

%

Coal

3918491 28,6 1012463 19,2 268433 17,2 35576 33,7

Oil

4349857 31,8 2061714 39,1 591918 37,8 3043 2,9

Petroleum

p

roducts

-64557 -0,5 -180603 -3,4 -82930 -5,3 7645 7,2

Gas

2900579 21,2 1343845 25,5 342846 21,9 33412 31,6

Nuclear energy

661353 4,8 516273 9,8 228456 14,6 23191 21,9

Hydropower

334945 2,4 120471 2,3 32248 2,1 729 0,7

Electricity

181072 1,3 98024 1,9 40069 2,6 134 0,1

Thermal

ener

gy

1412908 10,3 299787 5,7 141641 9,1 1934 1,8

Total

2383 0,0 395 0,0 1333 0,1 -725 -0,7

5 METHODOLOGICAL

APPROACH

Under the conditions of modeling the energy system,

it should be considered as a single integrated

production and economic system. Such a system

consists of independent integrated subsystems, the

interaction of which takes place in the dynamics of

economic development. This takes into account

changes in market conditions, environmental and

social constraints. During 2006-2008, the Institute of

Economics and Forecasting of the National Academy

of Sciences of Ukraine developed the economic and

mathematical model "TIMES-Ukraine" for strategic

planning of fuel and energy development and

forecasting the energy balance of Ukraine in the

scientific framework (Dyachuk et al., 2017). The

fundamental difference between the TIMES-Ukraine

model and many other models developed for

Global Trends and Assessment of Possibilities of Energy Transition in Ukraine

35

forecasting energy consumption in Ukraine is the

shift of the analytical subject from final energy to

useful energy and energy services. In order to model

scenarios for the development of the energy sector of

Ukraine, a system of economic and mathematical

models was used, which is based on the dynamic

optimization model TIMES-Ukraine and the dynamic

computational model of general equilibrium (MGE).

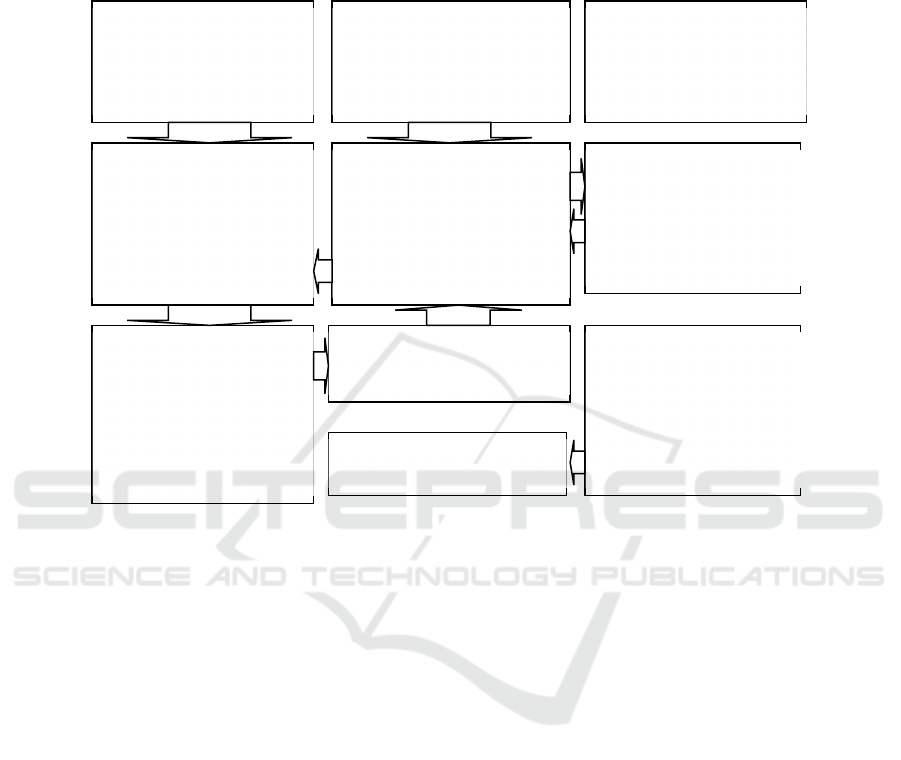

The structure and algorithm of the study of economic

and energy scenarios is shown in Fig. 2.

Figure 2: A set of economic and mathematical models for forecasting energy development

It should be noted that macroeconomic indicators

were used to develop energy development scenarios,

which determine changes in the main control

parameters of demand for energy services, such as

GDP, value added, industrial production, household

income, housing, energy prices and other

macroeconomic and demographic indicators.

The TIMES-Ukraine model focuses on the

following tasks: formation of forecasts and studies of

energy balance, qualitative analysis of energy,

material and financial flows, taking into account

factors of resource interchangeability depending on

the parameters of specific technology for forecasting

greenhouse gas emissions, estimating the optimal

technical structure based on minimizing total costs, ie

assessing the structure and level of use of energy

production and consumption technologies to meet the

needs of consumers in the cheapest way. Energy can

be interpreted as the actual market price of shadow or

regulated tariffs, the level of surcharges or subsidies

that can be imposed on consumers, as well as

additional or lost benefits.

Note that the initial forecasts of control

parameters are consistent with each other and are

used to determine the parameters of MGE.

Satisfaction of demand for energy resources

according to the macroeconomic scenario is

determined at the next stage. The TIMES-Ukraine

energy system model is used. In this model, taking

into account budgetary and technological constraints,

it is possible to determine the optimal combination of

energy technologies for the use of energy resources,

ie the formation of the forecast energy balance of the

country (Feindouno, 2020).

Models such as TIMES-Ukraine can be used for

the following purposes:

• assess the optimal technological structure of the

energy system in order to reduce the total discounted

cost;

• analyze the structures of energy, material and

financial flows in the overall system, taking into

account sales of energy resources;

• assess energy saving potential, renewable

energy sources, prioritize investments based on cost

optimization;

• implementation of the forecast of dynamics of

greenhouse gas emissions;

Rate of GDP, final

consumption; change in

the amount of labor; prices

of imported goods; real

bets

Volumes of production

and consumption; import

and export prices; product

cost structure; technological

limitations

Technological, cost

and environmental

characteristics of power

plants; technological

limitations

MGE

Dynamics of

economic drivers (GDP,

final consumption,

sectoral production,

household income); rising

industry prices

TIMES

Electricity demand

forecast

Optimal structure of

energy consumption

WASP

Optimal structure of

generating capacities

Changing the

parameters of

technological progress of

OMZR to the coincidence

of the sectoral structure of

energy and fuel

consumption of the two

models

Demand for energy

services (useful energy)

DEMAND

ASSESSMENT UNIT

Changing the amount

of labor; characteristics of

households; price and

income elasticity

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

36

• identify possible potential threats to the

country’s energy supply and find ways to prevent

them;

• assess the impact of such policies on the

development of the energy sector, namely: energy,

environmental, economic, industrial, climate,

transport, agricultural and innovation;

• identification of potential benefits and possible

risks of integration processes and commitments in the

energy, environmental, climate sectors.

Therefore, the TIMES-Ukraine Model is an

optimization model of Ukraine's energy flows. The

energy system in the TIMES-Ukraine model consists

of seven sectors: the energy supply sector. This sector

includes production, imports, exports, international

bunkering, stock changes, production of secondary

energy resources such as petroleum products,

briquettes and more. The TIMES-Ukraine sector also

includes electricity and heat production; industry;

transport; people; trade and services; Agriculture.

6 CONCLUSIONS

The article examines global trends, opportunities for

development and transition to a new model of the

global energy system. For this purpose, the economic-

mathematical models TIMES-Ukraine and the model

of general equilibrium of Ukraine are analyzed and

reflected. The possibility of large-scale use of

renewable energy sources in contrast to traditional

fossil sources of Ukraine by 2050 was assessed. It is

investigated that the existing potential of renewable

energy sources and existing technologies allow

Ukraine's energy transition in the coming years.

Policies to promote energy efficiency measures

and renewable energy technologies need to be further

developed. In the case of a significant reduction in

energy consumption of traditional energy resources

and intensive consumption of renewable sources, the

share of energy obtained from RES will be 91% by

2050. This means that the saved energy resource is

the cheapest "resource", and investment in its savings

is more appropriate than those that are not necessary

for the production of additional electricity and heat to

meet the needs of the population and the economy as

a whole.

The TIMES-Ukraine model focuses on the

following tasks: formation of forecasts and studies of

energy balance, qualitative analysis of energy,

material and financial flows, taking into account

factors of resource interchangeability depending on

the parameters of specific technology for forecasting

greenhouse gas emissions, estimating the optimal

technical structure based on minimizing total costs, ie

assessing the structure and level of use of energy

production and consumption technologies to meet the

needs of consumers in the cheapest way. Energy can

be interpreted as the actual market price of shadow or

regulated tariffs, the level of surcharges or subsidies

that can be imposed on consumers, as well as

additional or lost benefits.

Under such conditions, by 2050 all existing

technologies of electricity production in Ukraine will

be transferred to renewable energy, as they are rapidly

becoming cheaper and improving. Among them, the

most promising are the technologies of wind energy

and solar energy. Bioenergy technologies can become

a leader in thermal energy technology. It is projected

that the share of wind farms in the structure of

electricity production may reach 45%, SES - 36%,

and the share of biomass and waste in the structure of

heat production - up to 73%. The above results show

that the most ambitious energy and environmental

goals, such as achieving 90-100% of the transition

from final consumption to renewable energy by 2050,

can bring significant benefits to the economy and

society as a whole and should be taken into account

when formulating strategies or plans action on

climate policy development.

REFERENCES

Gielen, D., Boshell, F., Saygin, D., Bazilian, M. D.,

Wagner, N., & Gorini, R. (2019). The role of renewable

energy in the global energy transformation. Energy

Strategy Reviews, 24, 38-50.

McCollum, D. L., Echeverri, L. G., Busch, S., Pachauri, S.,

Parkinson, S., Rogelj, J., ... & Riahi, K. (2018).

Connecting the sustainable development goals by their

energy inter-linkages. Environmental Research

Letters, 13(3), 033006.

Pye, S., Li, P. H., Keppo, I., & O'Gallachoir, B. (2019).

Technology interdependency in the United Kingdom's

low carbon energy transition. Energy Strategy

Reviews, 24, 314-330.

Tukker, A., & Ekins, P. (2019). Concepts fostering resource

efficiency: a trade-off between ambitions and

viability. Ecological Economics, 155, 36-45.

IRENA. (2021). World Energy Transitions Outlook: 1.5° C

Pathway (Preview).

Kim, Y. J., & Wilson, C. (2019). Analysing future change

in the EU's energy innovation system. Energy Strategy

Reviews, 24, 279-299.

Ekins, P., Domenech, T., & Drummond, P. (2019). Policies

for a resource efficient economy in Europe: findings

from the POLFREE project. Ecological

Economics, 155, 1-6.

Voynarenko, M., Mykoliuk, O., Kucherova, H., &

Bobrovnyk, V. (2021). Factorial model of the strategy

of increasing the level of energy security of enterprises

Global Trends and Assessment of Possibilities of Energy Transition in Ukraine

37

in terms of resource-saving. In IOP Conference Series:

Earth and Environmental Science (Vol. 628, No. 1, p.

012001). IOP Publishing.

Feindouno, S., Guillaumont, P., & Simonet, C. (2020). The

physical vulnerability to climate change index: An

index to be used for international policy. Ecological

Economics, 176, 106752.

Voinarenko, M., Mykoliuk, O. (2017). Strategic energy

security outlook formation of Ukraine under European

integration process. Scientific bulletin of Polissia,

3(11), 29-37.

Diachuk, O., Chepeliev, M., Podolets, R., Trypolska, G.,

Venger, V., Saprykina, T., & Yukhymets, R. (2018).

Transition of Ukraine to the Renewable Energy by

2050. Transition of Ukraine to the Renewable Energy

by, 2050.

Outlook, I. O. W. (2018). World Energy Outlook

Series. Paris, France: International Energy Agency.

International Energy Agency. (2007). Key world energy

statistics (p. 6). Paris: International Energy Agency.

Sabishchenko, O., Rębilas, R., Sczygiol, N., & Urbański,

M. (2020). Ukraine energy sector management using

hybrid renewable energy systems. Energies, 13(7),

1776.

Lange, S., Pohl, J., & Santarius, T. (2020). Digitalization

and energy consumption. Does ICT reduce energy

demand?. Ecological Economics, 176, 106760.

Loulou, R., Gary, G., Amit, K., Antti, L., & Remme, U.

Documentation for the TIMES Model—Part I: TIMES

Concepts and Theory. 2016.

Agostini, A., Giuntoli, J., Marelli, L., & Amaducci, S.

(2020). Flaws in the interpretation phase of bioenergy

LCA fuel the debate and mislead policymakers. The

International Journal of Life Cycle Assessment, 25(1),

17-35.

Claessens, S., Coleman, N., & Donnelly, M. (2018). “Low-

For-Long” interest rates and banks’ interest margins

and profitability: Cross-country evidence. Journal of

Financial Intermediation, 35, 1-16.

Adom, P. K. (2019). Energy indices: A risk factor or not in

the financial sector. Energy Strategy Reviews, 24, 14-

26.

Bao, C., & Xu, M. (2019). Cause and effect of renewable

energy consumption on urbanization and economic

growth in China's provinces and regions. Journal of

cleaner production, 231, 483-493.

Chen, C., Pinar, M., & Stengos, T. (2020). Renewable

energy consumption and economic growth nexus:

Evidence from a threshold model. Energy Policy, 139,

111295.

Gottschalk, R., & Poon, D. (2020). SCALING UP

FINANCE FOR THE SUSTAINABLE

DEVELOPMENT GOALS. Southern-Led

Development Finance: Solutions from the Global

South.

Coester, A., Hofkes, M. W., & Papyrakis, E. (2018).

Economics of renewable energy expansion and security

of supply: A dynamic simulation of the German

electricity market. Applied Energy, 231, 1268-1284.

Fadly, D. (2019). Low-carbon transition: Private sector

investment in renewable energy projects in developing

countries. World Development, 122, 552-569.

Dykha, M., Ustik, T., Krasovska, O., Pilevych, D., Shatska,

Z., & Iankovets, T. (2021). Marketing Tools for the

Development and Enhance the Efficiency of E-

Commerce in the Context of Digitalization. Studies of

Applied Economics, 39(5).

Dykha, M., Cheban, Y., Bilyk, O. I., Siryk, Z. O., Khytra,

O., & Dudnyk, A. (2020). Management of corporate

social activity in the organization. International

Journal of Management, 11(5).

Huntington, H. G., Barrios, J. J., & Arora, V. (2019).

Review of key international demand elasticities for

major industrializing economies. Energy Policy, 133,

110878.

Cozzi, L., Gould, T., Bouckart, S., Crow, D., Kim, T. Y.,

Mcglade, C., ... & Wetzel, D. (2020). World Energy

Outlook 2020. vol, 2050, 1-461.

Kannan, N., & Vakeesan, D. (2016). Solar energy for future

world:-A review. Renewable and Sustainable Energy

Reviews, 62, 1092-1105.

Kim, Y. J., & Wilson, C. (2019). Analysing future change

in the EU's energy innovation system. Energy Strategy

Reviews, 24, 279-299.

Korkmaz, P., Gardumi, F., Avgerinopoulos, G., Blesl, M.,

& Fahl, U. (2020). A comparison of three

transformation pathways towards a sustainable

European society-An integrated analysis from an

energy system perspective. Energy Strategy

Reviews, 28, 100461.

Majid, M. A. (2020). Renewable energy for sustainable

development in India: current status, future prospects,

challenges, employment, and investment

opportunities. Energy, Sustainability and

Society, 10(1), 1-36.

Shulga, I., Kurylo, V., Gyrenko, I., & Savych, S. (2019).

Legal regulation of energy safety in Ukraine and the

European Union: Problems and perspective. European

Journal of Sustainable Development, 8(3), 439-439.

Lee, C. W., & Zhong, J. (2015). Financing and risk

management of renewable energy projects with a

hybrid bond. Renewable Energy, 75, 779-787.

Li, X., Wang, W., Wang, H., Wu, J., Fan, X., & Xu, Q.

(2020). Dynamic environmental economic dispatch of

hybrid renewable energy systems based on tradable

green certificates. Energy, 193, 116699.

Ozdamar, L., Yaşa, E., Kavas, N., & Vardar, G. (2020).

Renewable energy investment prospects in Turkey's

power generation sector. International Journal of

Renewable Energy Technology, 11(1), 1-12.

Luqman, M., Ahmad, N., & Bakhsh, K. (2019). Nuclear

energy, renewable energy and economic growth in

Pakistan: Evidence from non-linear autoregressive

distributed lag model. Renewable Energy, 139, 1299-

1309.

Mazzeo, D., Baglivo, C., Matera, N., Congedo, P. M., &

Oliveti, G. (2020). A novel energy-economic-

environmental multi-criteria decision-making in the

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

38

optimization of a hybrid renewable system. Sustainable

Cities and Society, 52, 101780.

Johnson, M. F. (2019). Strong (green) institutions in weak

states: Environmental governance and human (in)

security in the Global South. World Development, 122,

433-445.

Mikita, M., Kolcun, M., Spes, M., Vojtek, M., & Ivancak,

M. (2017). Impact of electrical power load time

management at sizing and cost of hybrid renewable

power system. Polish Journal of Management

Studies, 15.

Sabishchenko, O., Rębilas, R., Sczygiol, N., & Urbański,

M. (2020). Ukraine energy sector management using

hybrid renewable energy systems. Energies, 13(7),

1776.

Noothout, P., de Jager, D., Tesnière, L., van Rooijen, S.,

Karypidis, N., Brückmann, R., ... & Resch, G. (2016).

The impact of risks in renewable energy investments

and the role of smart policies. DiaCore report.

Chubyk, A. (2018). Association Agreement progress–

Ukraine has accelerated reforms in energy efficiency

and renewables. International Issues & Slovak Foreign

Policy Affairs, 27(3-4), 51-68.

Kusch-Brandt, S. (2019). Urban Renewable Energy on the

Upswing: A Spotlight on Renewable Energy in Cities

in REN21’s “Renewables 2019 Global Status Report”.

Breuing, J. A revision of Ukraine’s Carbon Tax.

Trypolska, G. (2019). Support scheme for electricity output

from renewables in Ukraine, starting in

2030. Economic Analysis and Policy, 62, 227-235.

Bayramov, A., & Marusyk, Y. (2019). Ukraine’s unfinished

natural gas and electricity reforms: one step forward,

two steps back. Eurasian Geography and

Economics, 60(1), 73-96.

Voynarenko M., Dykha M., Mykoliuk O., Yemchuk L.,

Danilkova A. (2018). Assessment of an enterprise’s

energy security based on multi-criteria tasks modeling.

Problems and Perspectives in Management, 16 (4),

102-116.

Jaffee, S., Henson, S., Unnevehr, L., Grace, D., & Cassou,

E. (2018). The safe food imperative: Accelerating

progress in low-and middle-income countries. World

Bank Publications.

Xu, X., Wei, Z., Ji, Q., Wang, C., & Gao, G. (2019). Global

renewable energy development: Influencing factors,

trend predictions and countermeasures. Resources

Policy, 63, 101470.

Fan, Z. P., Che, Y. J., & Chen, Z. Y. (2017). Product sales

forecasting using online reviews and historical sales

data: A method combining the Bass model and

sentiment analysis. Journal of Business Research, 74,

90-100.

Wei, L. Y. (2016). A hybrid ANFIS model based on

empirical mode decomposition for stock time series

forecasting. Applied Soft Computing, 42, 368-376.

Rubio-Herrero, J., Chandan, V., Siegel, C., Vishnu, A., &

Vrabie, D. (2017, December). A learning framework

for control-oriented modeling of buildings. In 2017

16th IEEE International Conference on Machine

Learning and Applications (ICMLA) (pp. 473-478).

IEEE.

Asaul, A., Voynarenko, M., Dzhulii, L., Yemchuk, L.,

Skorobohata, L., & Mykoliuk, O. (2019, June). The

latest information systems in the enterprise

management and trends in their development. In 2019

9th International Conference on Advanced Computer

Information Technologies (ACIT) (pp. 409-412). IEEE.

Mykoliuk, O., Bobrovnyk, V., Fostolovych, V., Kucherova,

H., & Nataliia, P. (2020, September). Modelling the

Level of Energy Security at Enterprises in the Context

of Environmentalization of Their Innovative

Development. In 2020 10th International Conference

on Advanced Computer Information Technologies

(ACIT) (pp. 621-625). IEEE.

Kucherova, H., Pokataeva, O., Chala, O., Bilska, O., &

Cirella, G. T. (2021). A fuzzy logic inference

concerning the degree of greening and resource saving

in ecosystems of countries, developing in crisis. In IOP

Conference Series: Earth and Environmental

Science (Vol. 628, No. 1, p. 012029). IOP Publishing.

Global Trends and Assessment of Possibilities of Energy Transition in Ukraine

39