The Impact of Covid-19 on the Cryptocurrency Market and the

Return of Ethereum

Hao Wen

1,*

, Xinpeng Cheng

2

, Zhengjun Lu

1

and Ruiyao Zhao

3

1

ShenZhen College of International Education, Shenzhen, 518043, China

2

St Joseph High School, Trumbull, CT, 06611, U.S.A.

3

Kimball Union Academy, Meriden, NH, 03770, U.S.A.

Keywords: COVID-19, Cryptocurrency, Ethereum, Stock, Abnormal Return.

Abstract: In this work, we carry out an investigation into the relationship of the cryptocurrency- Ethereum and the event

of COVID-19. We examine the impact of COVID-19 on the cryptocurrency stock market using a 2-sample

T-test. Moreover, we conducted an event study to analyze how COVID-19 has affected the individual stock-

Ethereum. The results from the T-test indicate that COVID has not affected the overall cryptocurrency stock

market. However, the results from the event study demonstrate that the return of Ethereum has been affected.

The significance of this research is to inspect whether cryptocurrency is favored by the public and economy

during the pandemic as a form of currency instead of traditional money.

1 INTRODUCTION

Ethereum is known as the second most popular

cryptocurrency, the most popular one is Bitcoin. Both

Ethereum and Bitcoin are based on the blockchain

network. Literally, blockchain is a chain of “block”,

“block” is used to record transactions across

computers (“Blockchain”,

Wikipedia). These “blocks”

are decentralized which means that the network of

blocks isn’t owned by any entity— a company or a

government. Instead, the blockchain is managed by

all of the ledger holders. You can view blockchain as

a platform, Ethereum and Bitcoin use blockchain

technology to record transactions.

There are two important news about Ethereum

this month. Ethereum's "London hard fork" started on

August 5 (Camomile Shumba, businessinsider.com)

The term “hard fork” means an improvement of

protocols. After the "London hard fork", Ethereum

increases its scalability, thus increase the speed and

efficiency of transaction.

Another important news released on August 16.

In the white paper published by Microsoft, the firm is

planning to use the Ethereum blockchain to combat

digital piracy (Isabelle Lee, businessinsider.com). As

in the Ethereum blockchain, each transaction is

recorded and Microsoft can backtrack the source of

the pirated content.

Although Ethereum and Bitcoin both are based on

blockchain, there are many differences between

them, such as transaction speed, scripting language

(Nathan Reiff, Investopedia.com). Ethereum’s

transaction speed is about 4 transactions per second,

while it’s 15 transactions per second for Bitcoin.

Scripting language for Ethereum is more complicated

than Bitcoin because Ethereum needs to support more

complex logic, and this leads to the fact that there are

more wide range of bugs in code. Other differences

include the consensus algorithms that they run on

(Ethereum uses ethash while Bitcoin uses SHA-256),

the network upgrades they choose (Ethereum uses

hard forks, while Bitcoin uses soft forks) (Coinsider,

Youtube.com).

More importantly, the Bitcoin and Ethereum

networks are different in their overall aims. Bitcoin

was created as an alternative to national currencies,

Elon Musk even said Tesla accepts bitcoin as

payment. However, Ethereum was intended as a

platform aiming to allow different applications

working on it. I think this is the advantage of

Ethereum because it is not only used as digital

currency, but also as a platform. On this platform,

many decentralized apps can be used such as DeFi

(decentralized finance) and gaming. There are about

100 Ethereum apps you can use now

including Musci,

pooling and investments, etc (“100+ Ethereum Apps

You Can Use Right Now”, consensys.net).

There is another thing interesting about

840

Wen, H., Cheng, X., Lu, Z. and Zhao, R.

The Impact of Covid-19 on the Cryptocurrency Market and the Return of Ethereum.

DOI: 10.5220/0011350800003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 840-848

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Ethereum. As we need to make sure that everyone

agrees on the order of transactions, miners can help

this happen by solving computationally difficult

puzzles in order to produce blocks, which can secure

the network from attacks. Basically, the first miner

solves the problem and after he finish the problem

and the second miner can do the double check for him

and both of them can get the cryptocurrencies in

return as a bonus. Miners use graphic cards to mine,

and different graphics cards have different computing

power. Because mining consumes a lot of electricity,

some people steal electricity from the government or

universities to mine it. They also need a lot of

graphics cards, so the miners have affected the

market by raising the price of graphics cards. The

Chinese government doesn't want the economy to

flow out of the country, which is why mining and

cryptocurrencies are banned in China.

(1Point3Arces, 2020) The purpose of this paper is to

examine the effect of COVID-19 on the

cryptocurrencies market and the individual stock

Ethereum.

2 LITERATURE REVIEW

2.1 Brief Review

COVID-19 outbreak in 2019, has rapidly spread all

over the world, affecting almost everyone on the

planet and causing thousands of deaths. The COVID-

19 epidemic not only has a huge impact on the overall

economy, but also has a huge impact on

cryptocurrency, such as Bitcoin and Ethereum.

This review tries to answer the following

questions. Does the COVID-19 pandemic that

surrounds everyone also affects the price of Bitcoin

and Ethereum? What is the relationship between

COVID-19 pandemic Bitcoin and Ethereum? Can

investors increase the adoption of cryptocurrencies

such as Bitcoin and Ethereum? Some academic

studies have shown that the price of Bitcoin is

affected by political and economic uncertainty. In a

period of uncertainty around the world, many

investors hope to use Bitcoin and Ethereum to store

some of their assets, making it possible to use them

as financial assets.

2.2 How COVID-19 Pandemic Affects

Cryptocurrencies?

Studies of the impact of the COVID-19 pandemic on

cryptocurrencies have emerged rapidly. Demir’s

study indicates that at first Bitcoin value and number

of reported COVID-19 cases and deaths shows a

negative relationship, however, as the

pandemic lasts,

the relationship becomes positive (Demir, et al,

2020). This shows that cryptocurrencies start to

become a hedge as the deepening of the COVID-19

effect. The reason behind this may be the fact that as

the number of reported COVID-19 cases and deaths

rise, governments around the world take additional

restrictions and this may increase the demand for

cryptocurrencies. Bitcoin and Ethereum can mitigate

some of the issues that the pandemic brought (Fang,

et al, 2019). Reminding that Bitcoin and Ethereum

can be used as a payment and money transfer

instrument between different countries, researchers

also found that demand for cryptocurrencies during

the pandemic increases (Hadar and Sarel,

Columbia.edu) As a result, cryptocurrencies become

more attractive compared to other alternatives such

as the stock and gold. Furthermore, investors fear that

COVID-19 will push central banks or governments

to interfere with the market. This emotion may cause

investors to switch their investments into the crypto

market which is decentralized. As cryptocurrencies

are not managed by a central entity, they can help

investors to avoid some of the political risk. Hence,

investors should consider taking cryptocurrencies as

part of their assets depending on the cycle of COVID-

19. For market researchers, they should continue to

focus on the fluctuations in these cryptocurrencies

because as the number of observations increases, it

will provide new insights for the behavior of

cryptocurrencies in the market.

2.3 Bitcoin and Ethereum Can Serve as

a Short Term Safe-haven Asset

Before the invention of cryptocurrency, many studies

analyzed the properties of safe-haven assets. For

example, Baur and Lucey (Baur, Lucey, 2010)

proposed that an asset is safe if it is not correlated

with stocks during a market crash. Thus, gold is

considered as a safe-haven during the past economic

crisis. The cryptocurrencies market increased

significantly since the inception. Bitcoin has

increased its value from nearly $0 to more than $7000

in April 2020. Can Bitcoin serve as a safe-haven for

assets? Before the COVID-19, the answer is positive,

although many people pointed the potential bubble

in. However, as the pandemic of COVID-19 lasts

longer, Bitcoin’s price moves closely with S&P500

which shows that it is not a good safe-haven for

stocks. Ethereum is also investigated. The result

shows that both Bitcoin and Ethereum are suitable for

The Impact of Covid-19 on the Cryptocurrency Market and the Return of Ethereum

841

short-term safe-havens, but Ethereum is possible a

better safe-haven than Bitcoin as the pandemic lasts

(Mariana, et al, 2021) On the other hand, researcher

also found that before and during the COVID-19,

Ethereum shows the highest daily return volatility,

followed by Bitcoin, S&P500, and gold.

2.4 Cryptocurrencies Can Drive a

Covid-19 Recovery in Emerging

Markets

Due to the pandemic of Covid-19, people have been

restrained to shop online and have moved away from

physical cash, obviously this will benefit

cryptocurrency. On the other hand, the rise of price

of Bitcoin and Ethereum is also attractive to investors

looking to hedge against inflation. The statistics firm-

Statista- confirmed that Nigeria was the leading

country for adopting Bitcoin and cryptocurrency

(Oxfordbusinessgroup.com). Tomiwa Lasebikan is

the co-founder of Buycoins Africa which is a

company that facilitates cryptocurrency trade. He

said that cryptocurrency trade was enabling Nigerian

expatriates to avoid the country’s extreme high

exchange rate. Importantly, cryptocurrencies can be

used for buying many products such as mobile

devices. Statista firm also noted that the existing

popularity of peer-to-peer payments prompt many

Nigerians to explore cryptocurrencies. Emerging

markets usually has an instable political or economic

environment, Bitcoin and Ethereum is a more reliable

option than traditional currency by enhancing

investors’ confidence.

2.5 Summary

COVID-19 shows a strong impact on the global

market. However, Bitcoin and Ethereum show an

advantage being comparing to traditional assets and

play an increasing import role in emerging market,

making it a better alternative for asset allocation.

3 PROCEDURE

3.1 Event Definition

Our group decides to look at two different periods of

time and investigate the returns of the cryptocurrency

market and Ethereum. To do this, we take the

estimation window from 2019/1/1 to 2019/12/31,

which is approximately 1 year. The reason that we do

this is because we want to compare the data before

the pandemic with the data after the first state of

lockdown in the United States which is on

2020/03/18. And also, the more data we have for

estimation, the more accurate and more reliable it is.

We gathered the event data from two days before the

first lockdown to see the influence of pandemic to the

market of cryptocurrency and created a 8-sample size

window for the event window (2020/3/9-2020/3/18).

3.2 Selecting Criteria

We obtain the data of Ethereum’ s price from Yahoo

finance (Andrew, 2021), which is a reliable and

obtainable source for sole traders. It is one of the

biggest websites for traders to get the newest stock

price and data, provides financial news, data and

commentary including stock quotes, press releases,

financial reports, and original content. It also offers

some online tools for personal finance management.

In addition to posting partner content from other web

sites, it posts original stories by its team of staff

journalists. It is ranked 15th by similarWeb on the list

of largest news and media websites. We process the

data using Excel. The cryptocurrency market index

we are going to use later is the S&P Cryptocurrency

Broad Digital Market Index, which is an index that

indicates the performance of the broader digital asset

market (IndexS&P Dow Jones, 2021). The index

comes from Lukka Inc, who is an enterprise crypto

asset software and data provider. The Company

builds middle and back-office software and data

services on infrastructure made for the complexities

of blockchain data to businesses that interact with

crypto assets as part of normal business processes.

We have chosen this index because it reflects the

performance of cryptocurrency market and it suits in

the market model we are building, hence it is

appropriate for our research and attainable (Jake

Benson, Lukka introduction, 2021).

3.3 Calculating Normal and Abnormal

Return

Our data analysis begins by calculating the normal

and abnormal returns, as we are going to analysis its

change later.

The normal return is calculated using natural

logarithm return, which subtracts the logarithm price

yesterday from the logarithm price today. The

property of logarithm transforms the equation to the

natural logarithm: price today divided by price

yesterday, as the figure below shows.

𝑁𝑜𝑟𝑚𝑎𝑙 𝑟𝑒𝑡𝑢𝑟𝑛

=𝑙𝑛 𝑙𝑛 𝑃

−𝑙𝑛 𝑙𝑛 𝑃

=

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

842

𝑙𝑛 𝑙𝑛

(1)

We decided to use the natural logarithm return

because of two reasons: the additivity property of it

and its trait of following log normal distribution. Log

return can be added for time-series perspectives,

unlike the percentage return. Also, stock return is

assumed to follow a Log normal distribution.

Therefore, log return is used for this statistical

evaluation.

To calculate abnormal return, we used the model

of risk-adjusted return. This is equal to the actual

return minus expected return.

𝐴𝑏𝑛𝑜𝑟𝑚𝑎𝑙 𝑟𝑒𝑡𝑢𝑟𝑛=𝑎𝑐𝑡𝑢𝑎𝑙 𝑟𝑒𝑡𝑢𝑟𝑛−

𝑒𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑟𝑒𝑡𝑢𝑟𝑛

We constructed a market linear regression model

that relates individual stock ETH return and the

synchronous cryptocurrency market return. R

t

stands

for the normal return at time t. The parameter α

represents the ‘idiosyncratic return of the individual

stock’. This is typically related to the company’s

performance or in other terms, the return coming

from the investment’s own interest that cannot be

explained by common factors, the parameter ẞ is the

systematic risk level of the stock, the parameter σ

measures the variance of α.

𝑅

=𝛼+ 𝛽𝑅

,

+ 𝜀

𝑣𝑎𝑟

(

𝜀

)

=𝜎

(2)

We can obtain the value of α and ẞ from the past

data in the estimation window. Hence, we can predict

the returns during the event window based on the

return of market using this model.

𝑅

= 𝛼+ 𝛽𝑅

(3)

Then we can compute the difference between this

estimated return and the actual return. This will give

us the equation for abnormal return.

𝐴𝑅=𝑅

⏟

−(𝛼+ 𝛽𝑅

,

⏟

)

(4)

3.4 Estimation Procedure

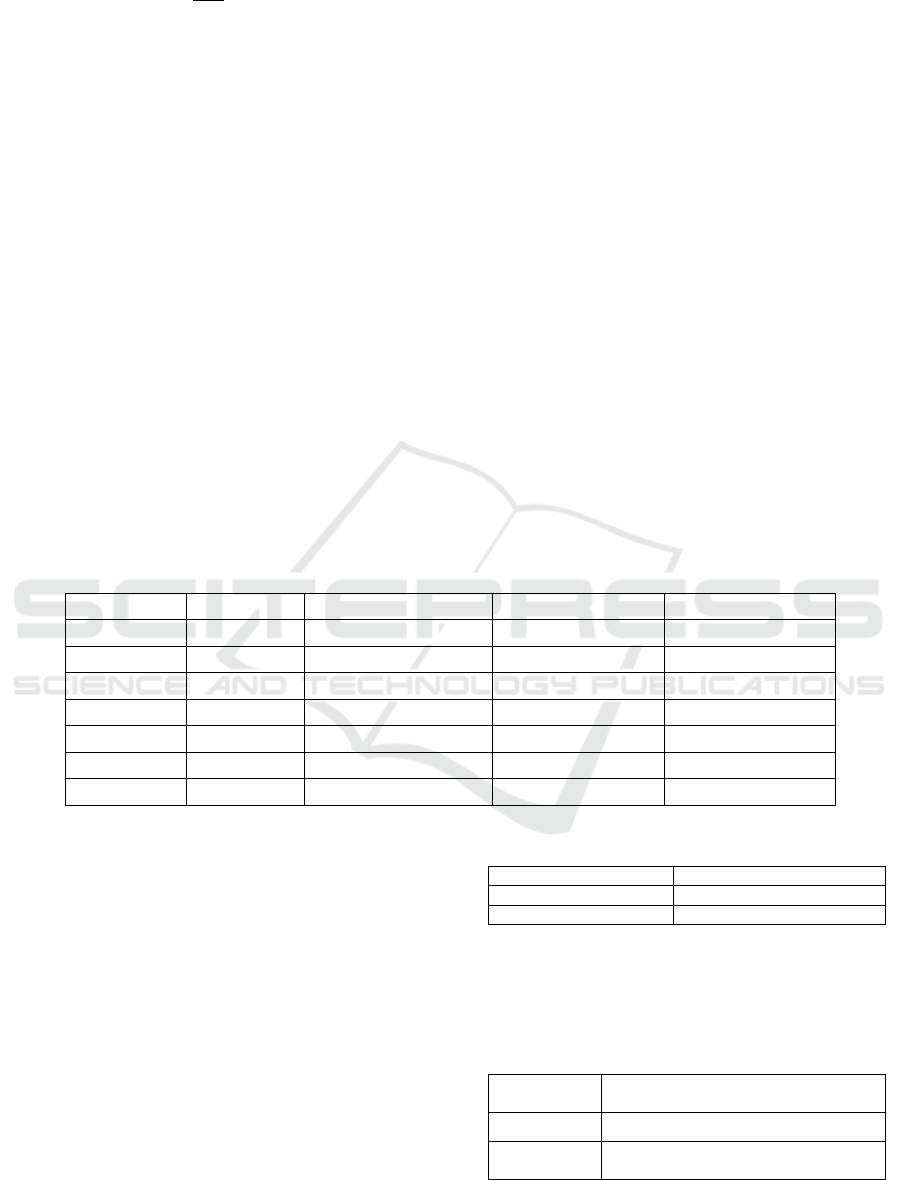

Table 1 In this procedure, the first thing we need to

do is to obtain the values for normal stock return and

market return, using Equation 1.

Table 1: Formulae calculating normal return.

Date ETH Price Cryptocurrency Index

01/01/2019 140.819412 344 Stock Return Market Return

02/01/2019 155.047684 361.43 =LN(B6/B5) =LN(C6/C5)

03/01/2019 149.13501 351.42 =LN(B7/B6) =LN(C7/C6)

04/01/2019 154.58194 352.93 =LN(B8/B7) =LN(C8/C7)

07/01/2019 151.699219 368.34 =LN(B9/B8) =LN(C9/C8)

… … … … …

31/12/2019 129.610855 507.17 =LN(B265/B264) =LN(C265/C264)

After this we have to compute the values of

Alpha, Beta and Standard error using the data of

normal return we have in the estimation window,

which is approximately 1 year. These values are

essential to our calculation later in the market model.

It serves the purpose of calculating abnormal return.

To calculate α, we use the INTERCEPT function in

EXCEL, which calculates the point at which a

regression line will intersect the y-axis, to calculate

ẞ, we use the SLOPE function that returns the slope

of the linear regression through the given data points,

and to calculate the standard error of XY, we use the

STEYX function that returns the standard error of the

predicted y-value for each x in a regression.

Table 2: Formulae shown in Excel.

Mean =AVERAGE(Stock_Return)

Standard deviation =STDEV(Stock_Return)

Numbe

r

of days (Size) =COUNT(Stock_Return)

Moreover, the mean model used later requires the

value of mean, standard deviation and sample size for

stock return. These values can be found using the

following equations.

Table 3: Formulae shown in Excel.

Alpha

=INTERCEPT(Stock_Return,Market_R

eturn)

Beta =SLOPE(Stock_Return,Market_Return)

standard error

of XY

=STEYX(Stock_Return,Market_Return)

Now we have all the data and values we need:

The Impact of Covid-19 on the Cryptocurrency Market and the Return of Ethereum

843

Table 4: A section of values from estimation window.

Estimation Window (2019/1/1 - 2019/12/31)

Date ETH Price

Cryptocurrency

Index

Mean

-

0.000319007

01/01/2019 140.8 344 Stock Return

Market

Return

Standard deviation 0.046961462

02/01/2019 155 361.43 0.096254405 0.049426728

Number of days

(Size)

260

03/01/2019 149.1 351.42

-

0.038880705

-0.028086296

04/01/2019 154.6 352.93 0.035872309 0.004287648 Alpha

-

0.001530066

07/01/2019 151.7 368.34

-

0.018824574

0.042736688 Beta 0.81110673

08/01/2019 150.4 368.36

-

0.008869753

5.42962E-05 standard error of XY 0.029758636

3.5 Testing Procedure

Before we start testing our null hypothesis, we need

the value of mean, standard deviation and sample size

for stock return in the event window as well. They

can be calculated using the similar equations as

above. Also we calculated the normal return too.

Table 5: Formulae shown in Excel.

Mean =AVERAGE(Stock_Return_Event)

Standard deviation =STDEV(Stock_Return_Event)

Size =COUNT(Stock_Return_Event)

Table 6: All Values from event window.

Even

t

Window (2020/3/9 - 2020/3/18)

Date ETH Price

Cryptocurrency

Index

Stock Return Market Return

09/03/2020 201.986328 584.02 -0.187020823 -0.168233538 Mean -0.093957652

10/03/2020 200.767242 593.9 -0.006053775 0.016775726 Standard deviation 0.218134168

11/03/2020 194.86853 581.37 -0.029821111 -0.021323568 Size 8

12/03/2020 112.347122 441.12 -0.550731744 -0.27607044

13/03/2020 133.201813 398.15 0.170271987 -0.102488129

16/03/2020 110.605873 367.26 -0.18589218 -0.080758775

17/03/2020 113.942749 392.35 0.029722932 0.066084254

18/03/2020 114.84227 390.7 0.007863501 -0.004214297

With all of these values available, we can use our

2-sample mean model now. The mean model is to test

whether the mean of 2 sample is the same or not. Our

null hypothesis is the following:

𝐻

=𝐶𝑂𝑉𝐼𝐷 − 19 ℎ𝑎𝑠 𝑛𝑜 𝑒𝑓𝑓𝑒𝑐𝑡 𝑜𝑛 𝑡ℎ𝑒 𝑟𝑒𝑡𝑢𝑟𝑛 𝑜𝑓 𝐸𝑡ℎ𝑒𝑟𝑒𝑢𝑚

Therefore, we can obtain the following equation:

𝑥

=𝑥

→𝑥

𝑒𝑠𝑡

− 𝑥

𝑒𝑣𝑒𝑛𝑡

=0 (5)

Now, we can carry out the test for the mean

model, using the formula below:

𝑡=

(6)

As we already obtained the values in the

estimation window and event window that

we needed,

all we have to do now is just plug in all the values

into this formula.

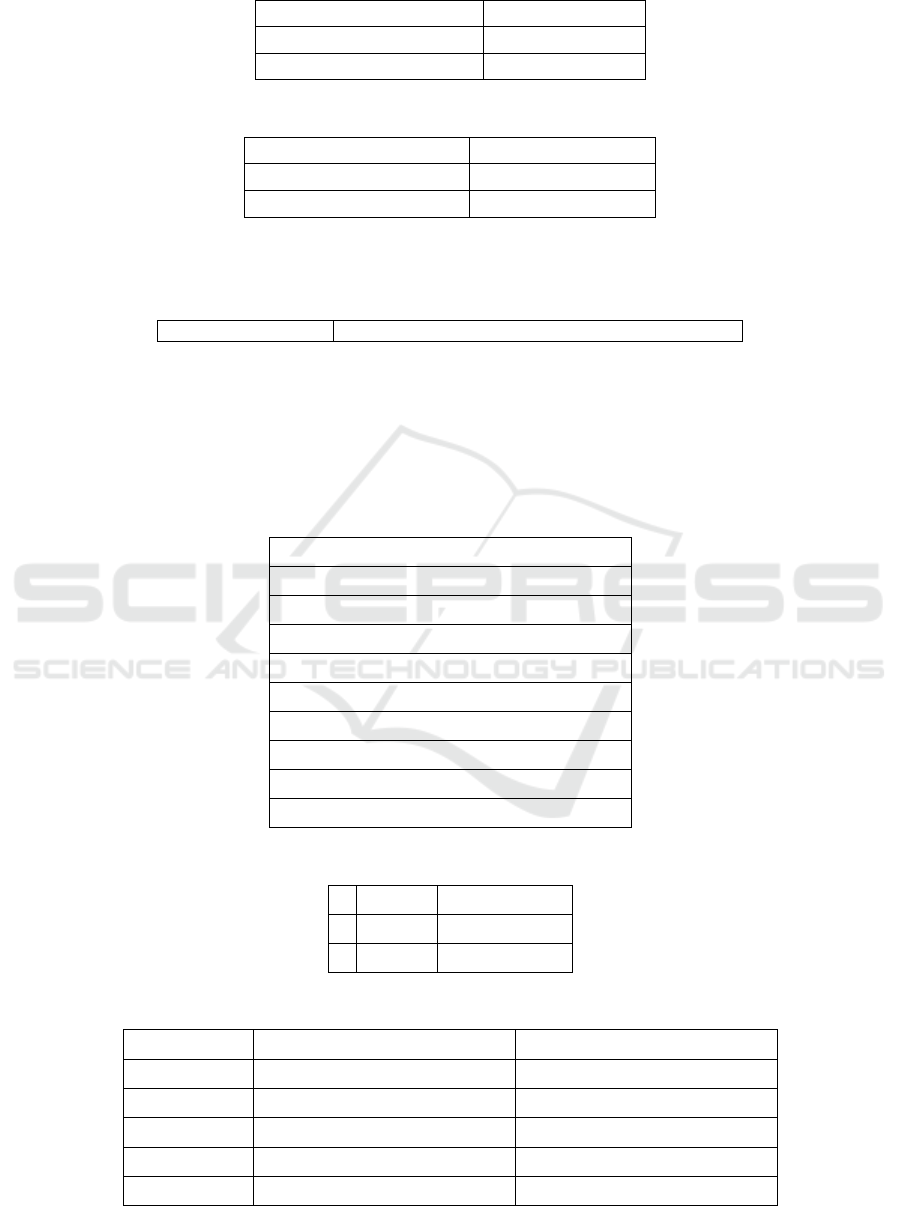

Table 7: Mean model.

t

-value =ABS((P5-G4)/SQRT((P6^2)/P7) + ((G5^2)/G6))

Mean -0.000319007

Standard deviation 0.046961462

Numbe

r

of days (Size) 260

Mean -0.093957652

Standard deviation 0.218134168

Size 8

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

844

Table 8: Critical values from the estimation window.

Mean -0.000319007

Standard deviation 0.046961462

Numbe

r

of days (Size) 260

Table 9: Critical values from the event window.

Mean -0.093957652

Standard deviation 0.218134168

Size 8

If the absolute value of t is greater than 1.96, we have 95% of confidence to reject our null hypothesis.

Table 10: Testing significance of t-value in Excel.

Significant? =IF(Y5>1.96,"Yes","No")

After examining the effect of the event on the

market, we will now consider its impact on the

individual stock ETH using the event study method.

For event study, we do the following steps:

Find the abnormal return using:

𝐴𝑅=𝑅

⏟

−(𝛼+ 𝛽𝑅

,

⏟

)

Table 11: Calculation of Abnormal Return.

Abnormal Return

Ris

k

Adjusted Return

=M5-($G$8+$G$9*N5)

=M6-($G$8+$G$9*N6)

=M7-($G$8+$G$9*N7)

=M8-($G$8+$G$9*N8)

=M9-($G$8+$G$9*N9)

=M10-($G$8+$G$9*N10)

=M11-($G$8+$G$9*N11)

=M12-($G$8+$G$9*N12)

Table 12: Values of G8 and G9.

FG

8

Alpha -0.001530066

9

Beta 0.81110673

Table 13: Values of M5-M12 and N5-N12.

M N

Stoc

k

Return Marke

t

Return

5

-0.187020823 -0.168233538

6

-0.006053775 0.016775726

7

-0.029821111 -0.021323568

8

-0.550731744 -0.27607044

The Impact of Covid-19 on the Cryptocurrency Market and the Return of Ethereum

845

9

0.170271987 -0.102488129

10

-0.18589218 -0.080758775

11

0.029722932 0.066084254

12

0.007863501 -0.004214297

Table 14: Values of abnormal return.

S

Abnormal Return

Ris

k

Adjusted Return

5

-0.049035402

6

-0.018130613

7

-0.010995356

8

-0.325279087

9

0.254930864

10

-0.118858129

11

-0.022348386

12

0.012811811

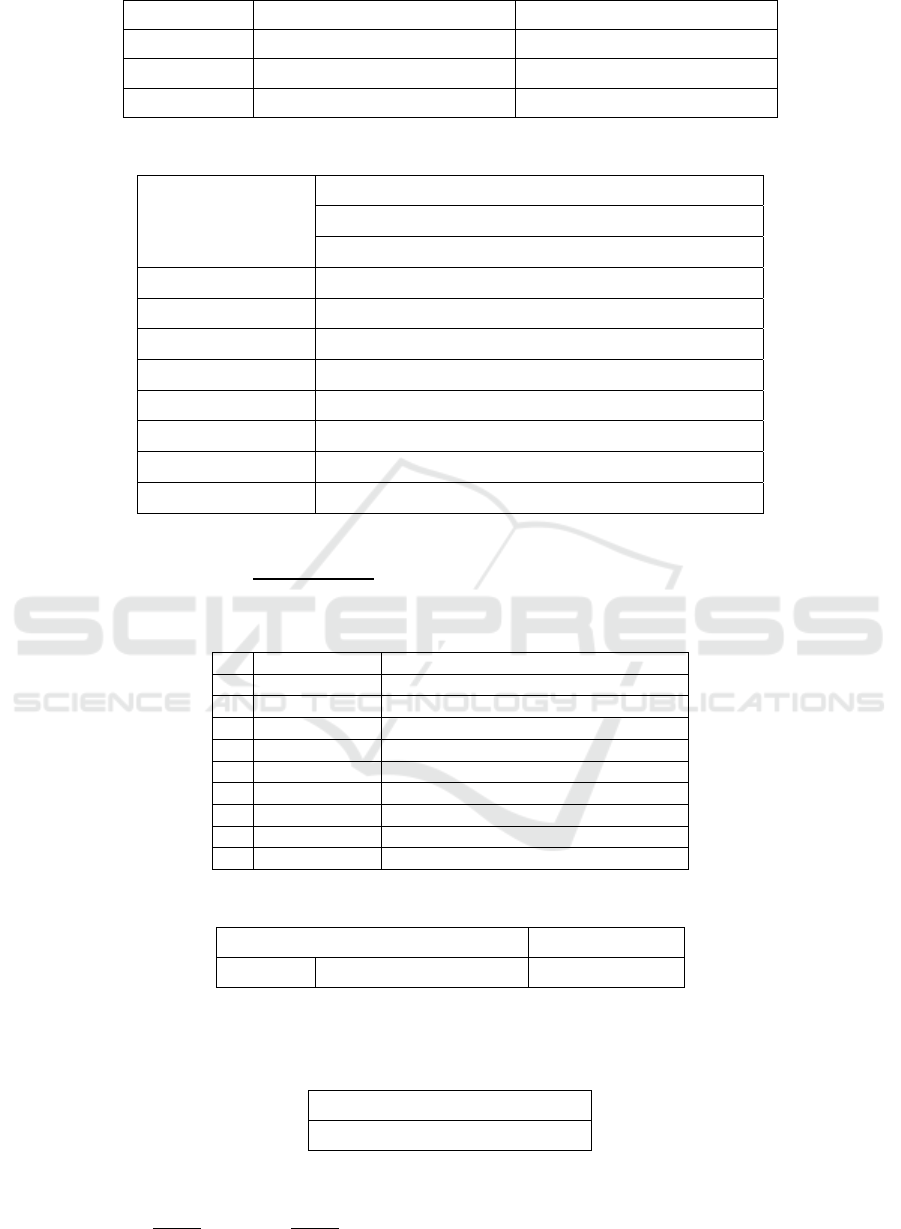

Do a t-test to test the significance of the abnormal return

𝐼𝑓

>1.96,𝑡ℎ𝑒𝑛 𝐴𝑅 𝑖𝑠 𝑠𝑖𝑔𝑛𝑖𝑓𝑖𝑐𝑎𝑛𝑡 (7)

Table 15: T-test and significance.

T U

t-test Si

g

nificant?

5 =S5/$G$10 =IF

(

ABS

(

T5

)

>1.96,"Yes","No"

)

6 =S6/$G$10 =IF

(

ABS

(

T6

)

>1.96,"Yes","No"

)

7 =S7/$G$10 =IF(ABS(T7)>1.96,"Yes","No")

8 =S8/$G$10 =IF(ABS(T8)>1.96,"Yes","No")

9 =S9/$G$10 =IF(ABS(T9)>1.96,"Yes","No")

10 =S10/$G$10 =IF

(

ABS

(

T10

)

>1.96,"Yes","No"

)

11 =S11/$G$10 =IF

(

ABS

(

T11

)

>1.96,"Yes","No"

)

12 =S12/$G$10 =IF

(

ABS

(

T12

)

>1.96,"Yes","No"

)

Table 16: Value of standard error of XY.

G

10

standar

d

erro

r

of XY 0.029758636

Calculate the cumulative abnormal return inside event window.

Table 17: Formula of CAR shown in Excel.

CAR(-2,5)

=SUM(S5:S12)

𝐶𝐴𝑅

(

𝑁

)

=

∑

𝐴𝑅 ~ 𝑁(0,2𝑁𝜎

) (8)

Compute the confidence interval for CAR.

(−1.96 ×

√

2𝑁𝜎

,1.96 ×

√

2𝑁𝜎

) (9)

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

846

Table 18: Confidence interval.

Confidence interval (-2,5)

=1.96*SQRT(2*$P$7*$G$10^2)

=-1.96*SQRT(2*$P$7*$G$10^2)

Compare CAR and its confidence interval and see

whether if it exceeds it. Based on this comparison,

state whether we can reject the null hypothesis. (If it

exceeds, we have 95% confidence to reject the

hypothesis)

Table 19: CAR and its confidence interval.

CAR (-2,5) Confidence interval

Comparison

-0.27690 (-0.23331, 0.23331)

|-0.27690|> 0.2331

3.6 Empirical Results

Using the mean model, we can cannot reject our

hypothesis that COVID-19 has no effect on the

market of cryptocurrency.

Table 20: Calculation from the Mean Model.

Mean model

t

-value 1.214152901

t

-critical 1.96

Comparison 1.214< 1.96

Significant? No

Conclusion Canno

t

rejec

t

the null hypothesis

However, from the event study, we can reject our

hypothesis that COVID-19 has no effect on the

individual stock return of ETH.

Table 21: Significance of CAR.

CAR (-2,5) Confidence interval

Comparison Significant? Conclusion

-0.27690 (-0.23331, 0.23331)

|-0.27690|> 0.2331 Yes Reject the null hypothesis

4 CONCLUSIONS &

INTERPRETATIONS

In a nutshell, the event of COVID-19 does not have a

significant impact on the performance of

cryptocurrency market, however, COVID-19 has

affected the abnormal return of Ethereum.

The cryptocurrency market is composed mainly

by the largest bitcoin. A possible explanation to the

question above may be that bitcoin has not been

affected as hard, so the overall cryptocurrency market

isn’t affected as much. But the individual

performance of Ethereum is influenced. Though,

when reflecting on the logic behind this, we should

consider the difference between bitcoin and

Etheruem. The reality is, however, apart from the

existence of smart contracts (Ethereum allows users

to create smart contracts- computer code stored on a

blockchain that automatically execute when

beforehand conditions are reached) and some

functional differences (e.g. the block time of

Ethereum is only 12-15 seconds whereas the block

time of bitcoin is 10 minutes), there aren’t any major

differences (

“Difference Bitcoin and Ethereum”, 2020).

In terms of evaluation, we may only imply that after

periods of consideration, investors and the majority

of the public believe that Ethereum, due to its

advantages on technology, is a better investment and

perhaps, more likely to take over the status of fiat

money. As the generations of our epoch encounter

The Impact of Covid-19 on the Cryptocurrency Market and the Return of Ethereum

847

the approach of a new form of money, scientists and

experts have to think carefully in order to decide

whether to accept it or not. The answer to this

question, indeed, needs further investigations and

researches.

AUTHOR CONTRIBUTION

Franky, Wen Hao, is responsible for doing data

analysis, including calculating abnormal returns,

estimation & testing procedure, and empirical results,

plus inspection and modification of this paper.

Stefan, Cheng Xin Peng, is responsible for doing

background information and event definition Eric, Lu

Zheng Jun, is responsible for doing selecting criteria

and conclusion & interpretations Maisie, Zhao Rui

Yao, is responsible for doing literature review and

background information

REFERENCES

“100+ Ethereum Apps You Can Use Right Now”,

Consensys.net, March 17, 2020.

https://consensys.net/blog/news/90-ethereum-apps-

you-can-use-right-now/

1Point3Arces, 2020, “Global COVID-19 Tracker &

Interactive Charts”, available at

https://coronavirus.1point3acres.com/

Andrew Serwer (2021) Yahoo Finance

https://finance.yahoo.com/quote/ETH-

USD/chart?p=ETH-

USD#eyJpbnRlcnZhbCI6ImRheSIsInBlcmlvZGljaXR

5IjoxLCJ0aW1lVW5pdCI6bnVsbCwiY2FuZGxlV2lk

dGgiOjEuNDI4MzkwMzY3NTUzODY1NiwiZmxpc

HBlZCI6ZmFsc2UsInZvbHVtZVVuZGVybGF5Ijp0c

nVlLCJhZGoiOnRydWUsImNyb3NzaGFpciI6dHJ1Z

SwiY2hhcnRUeXBlIjoibGluZSIsImV4dGVuZGVkIj

pmYWxzZSwibWFya2V0U2Vzc2lvbnMiOnt9LCJhZ

2dyZWdhdGlvblR5cGUiOiJvaGxjIiwiY2hhcnRTY2F

sZSI6ImxpbmVhciIsInBhbmVscyI6eyJjaGFydCI6eyJ

wZXJjZW50IjoxLCJkaXNwbGF5IjoiRVRILVVTRC

IsImNoYXJ0TmFtZSI6ImNoYXJ0IiwiaW5kZXgiOj

AsInlBeGlzIjp7Im5hbWUiOiJjaGFydCIsInBvc2l0aW

9uIjpudWxsfSwieWF4aXNMSFMiOltdLCJ5YXhpc1

JIUyI6WyJjaGFydCIsIuKAjHZvbCB1bmRy4oCMIl1

9fSwic2V0U3BhbiI6bnVsbCwibGluZVdpZHRoIjoyL

CJzdHJpcGVkQmFja2dyb3VuZCI6dHJ1ZSwiZXZlb

nRzIjp0cnVlLCJjb2xvciI6IiMwMDgxZjIiLCJzdHJpc

GVkQmFja2dyb3VkIjp0cnVlLCJyYW5nZSI6bnVsb

CwiZXZlbnRNYXAiOnsiY

Baur D.G., Lucey B.M. Is gold a hedge or a safe haven? An

analysis of stocks, bonds and gold. Financ. Rev.

2010,45(2):217–229.

“Bitcoin vs. Ethereum - Everything you need to know!”,

YouTube, May 29, 2019.

<https://www.youtube.com/watch?v=bDiVMhLN2e0

>

Camomile Shumba. “Ethereum's London hard fork upgrade

has been burning ether at a rate of around $8,900 a

minute, data shows.” Insider. Aug 6, 2021.

https://markets.businessinsider.com/news/currencies/e

thereum-london-hard-fork-ether-burn-blockchain-

demand-crypto-2021-8

Can cryptocurrencies drive a Covid-19 recovery in

emerging markets?, Oxfordbusinessgroup.com, Feb 21

2021. Available at

https://oxfordbusinessgroup.com/news/can-

cryptocurrencies-drive-covid-19-recovery-emerging-

markets

Demir, E., Bilgin, M.H., Karabulut, G. et al. (2020) The

relationship between cryptocurrencies and COVID-19

pandemic. Eurasian Econ Rev 10, 349–360

“Difference Bitcoin and Ethereum”,2020. GeeksforGeeks,

available at https://www.geeksforgeeks.org/difference-

bitcoin-and-

ethereum/#:~:text=Difference%20between%20Bitcoin

%20and%20Ethereum%3A%20%20%20,written%20

%20...%20%205%20more%20rows%20

Fang, L., Bouri, E., Gupta, R., & Roubaud, D. (2019). Does

global economic uncertainty matter for the volatility

and hedging effectiveness of Bitcoin? International

Review of Financial Analysis, 61, 29–36.

Hadar and Sarel. “How the Covid-19 Pandemic Affected

the Cryptocurrency Market”, Columbia.edu, March 26,

2021. Available at

<https://clsbluesky.law.columbia.edu/2021/03/26/how

-the-covid-19-pandemic-affected-the-cryptocurrency-

market/>

IndexS&P Dow Jones (2021):

https://www.spglobal.com/spdji/en/indices/digital-

assets/sp-cryptocurrency-broad-digital-market-

index/#overview

Isabelle Lee. “Microsoft is looking to use the ethereum

blockchain to prevent piracy.” Insider. Aug 16, 2021.

Available at

https://markets.businessinsider.com/news/currencies/

microsoft-msft-ethereum-blockchain-fight-piracy-

digital-tech-public-ledger-2021-8

Jake Benson, Lukka introduction, Bloomberg:

https://www.bloomberg.com/profile/company/108400

5D:US (2021)

Mariana C D, Ekaputra I A, Husodo Z A. Are Bitcoin and

Ethereum safe-havens for stocks during the COVID-19

pandemic?[J]. Finance research letters, 2021, 38:

101798.

Nathan Reiff. “Bitcoin vs. Ethereum: What's the

Difference?” Investopedia. Jun 16, 2020.

<https://www.investopedia.com/articles/investing/031

416/bitcoin-vs-ethereum-driven-different-

purposes.asp>

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

848