The Comparisons of the Machine Learning Models in Credit Card

Default under Imbalance and Multi-features Dataset

Zhongtian Yu

a

School of Accounting and Finance, The Hong Kong Polytechnic University, Hong Kong, China

Keywords: Chinese Consumption Credit Card, Machine Learning, Imbalance Data.

Abstract: Affected by the novel coronavirus pneumonia, the global financial market has suffered from a terrible crisis,

so the risk tolerance of banks around the world is greatly weakened, which requires the improvement of risk

management in banks. The development of machine learning makes programming more convenient and

prediction more accurate. In terms of risk management, the introduction of machine learning models enables

banks to more accurately predict the potential risks, providing more opportunities to avoid them. China is the

fastest recovery country under COVID-19, but previous studies are lack of analysis data from the Bank of

China. Therefore, the paper processes the data from the Bank of China to train five models (the support vector

machine, decision tree, logistic regression, bagging and random forest) and selects the best model by three

standards: effectiveness, efficiency and stability. For achieving the best classification, the paper also tests the

optimization effect of feature selection on the five models. In order to ensure the results are fair and universal,

the SMOTE is used to solve the problem of data imbalance and grid search is used to obtain the best model

parameters, so the influence of parameters on the comparison results between models can be eliminated.

Decision tree model performs better considering the complexity and training time and the feature selection

does not show improvement in the performance of the tree model in the solution.

1 INTRODUCTION

The coronavirus triggered the global economic

disruption in 2020, which is a substantial challenge for

policy makers and financial market (Ozili, Arun,

2020). An observable downturn seriously harm the

confidence of financial market participants lending to

further public anxiety about economy Fetzer, Hensel,

Hermle, Roth, 2020).The worries about economic

uncertainty and risk lead to the conventical behaviors

in investment and the shrink in credit market ,which is

bad news to economic recovery and the

reestablishment of market confidence .It is of great

importance for financial institutions and organizations

to balance the risk and investment income rerunning

the loan business for revival .The risk management

emerged and attended institutions attention in the

financial crisis of 2007-2009,more practice and

technique show the requirement to the combination of

machine learning models and loan departments in

banks (Butaru, Chen, Clark, Das, Lo, Siddique, 2016).

Machine learning enable computers to learning the

a

https://orcid.org/0000-0002-6564-470X

patterns of data and find the inherent regulations for

predicting or organizing, which means that artificial

intelligence have enough ability to complete some

special tasks efficiently replacing the work of human

(Samuel, 1959).

Researchers in finance subjects focus on the

application of machine learning in Fin-tech area,

which may be the revolution of industries and

academic research. High-frequency trading and

electronic market bring new challenge to the existing

theories and emerging opportunity to new theories

(Linnenluecke, Chen, Ling, Smith, Zhu 2017). In asset

pricing, deep learning is used in portfolio optimization

(Heaton, Polson, Witte 2017). In risk management,

machine learning can be applied in credit card fraud.

The fraud is generally divided in two types:

application and behavioral frauds (Bolton, Hand,

2001). Because the deification of fraud is an issue

based on the classification scoring between 0 and 1,

the SVM (support vector machine) may be a good

model (Rtayli, Enneya, 2020). More ensemble models

for achieving high accuracy energy in credit card fraud

864

Yu, Z.

The Comparisons of the Machine Learning Models in Credit Card Default under Imbalance and Multi-features Dataset.

DOI: 10.5220/0011355600003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 864-872

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

research, like RF (random forest), experiment data

indicates that RF perform better compared with LR

(logistic regression) and SVM. More methods in

modeling and data processing such as hyper-

parameters optimization, feature elimination, SMOTE

technique, the survival analysis model and grid search

has been introduced into the research in risk

management (Rtayli, Enneya, 2020) (Li, Li, Li 2019).

expect for credit card fraud deification, the credit

card default is another significant domain at the

leading edge of innovation in risk management.

Machine learning models can support the existing

credit scoring method, improving the accuracy of

default identification, which can efficient control

credit risk without repeated manual operation and

expert consulting (Husejinovic Admel, Keco Dino,

2018) (Yang, Zhang, 2018).

The scoring method has been recognized in

identification of bad and good loans in 1941, while the

method is too academic to be applied in banks

(DURAND, 1941). Johnson simplified the method

and make it available to practice as underlying

regulations in financial institution to select loans

candidates (Johnson, 1992). Default rates drop by

50% in some organizations that use the scoring

method, which shows the observable performance of

scoring (Myers, Forgy 1963).

Classification and regression are two mainstream

application in machine leaning, the credit card default

is a typical field that classification can be applied to

predict credit score based on the financial condition of

credit card holder (Sariannidis, Papadakis,

Garefalakis, Lemonakis, Kyriaki-Argyro, 2019). the

early research that combine the scoring and data

analysis model tested the performance of the BDT

(Bayesian decision tree), discriminant analysis and

linear regression (LC, 2000). Nearly 20 years

witnesses the tremendous development of the

quantitative analysis method in the domain, machine

learning and deep learning innovated data analysis

model and statistic model (Leo, Sharma, Maddulety,

2019). Those innovative empirical researches may be

generally divided to two categories: the analysis on

data and features and the comparison of various

models.

In this paper, we selected five models: DT

(Decision tree), RF (Random Forest), LR and the

bagging decision tree and made a comprehensive

standard for selecting the best model. The comparison

has considered the influence of the hyperparameters in

the models, so the grid-search is introduced to achieve

the best performance of each model and find the most

excellent model in this kind of application.

Meanwhile,

the SMOTE (Synthetic Minority Oversampling

Technique) and feature importance are introduced in

the paper for dealing with issues in the dataset and

testing the effect of feature selection in those models.

2 DATA

2.1 General Description of Data

The data in the previous studies are similar to the

normal distribution. The data from Taiwan’s banks is

widely used in the previous research and the default

customers account for 22.12% in the data (Sariannidis,

Papadakis, Garefalakis, Lemonakis, Kyriaki-Argyro,

2019). By searching the papers about customers’

behavior, I found that the data are not consistent with

the reality in Chinese mainland.

In fact, the credit card

introduced in China in the late 1970s, so many

Chinese customers have not accepted some exclusive

‘early consumption’. Therefore, Chinese, especially

for the majority of people living in underdeveloped

inland areas, take a cautious approach for their

consumption loans and the generally preference

reduce the arising of default in Chinese customer

credit card (Rong, 2018). Many previous studies did

not consider the reality in the selection of dataset, the

division of train set and test set. this paper directly uses

the data from the Bank of China, does not do the

normalization processing, and retains all provided

available features. There are 45,985 instances in the

credit card dataset. Just to clarify, statues recorded the

debts situations of users, 0: 1-29 days past due, 1: 30-

59 days past due, 2: 60-89 days past due, 3: 90-119

days past due, 4: 120-149 days past due, 5: Overdue

or bad debts, write-offs for more than 150 days, C:

paid off that month, X: No loan for the month. All

users that have status 2 and above will be recorded as

risk. Generally, users in risk should be in 3%, thus I

choose users who overdue for more than 60 days as

target risk users (Block, Vaaler, 2004). Those samples

are marked as '1', else are '0'. There are 667 IDs are

identified as in risk, accounting for 1.5% in the

dataset.

As the side effect, the processing method leads to

too few samples in the default class, which may lead

to the neglect of minorities and the overwhelmingly

imbalance in the data set. Therefore, the paper uses

SMOTE balance method to eliminate the impact of

unbalanced data.

The Comparisons of the Machine Learning Models in Credit Card Default under Imbalance and Multi-features Dataset

865

2.2 The Description of Feature

The processing of features and the nature of client

information influence the basic selection of features.

Therefore, the 16 features can be classified to 3 types

with different processing method: binary features,

continuous features and categorical features.

Table 1: General Structure of Features.

Binary features Continuous features Categorical features

Gender Number of children Income type

Having a car or not Annual income Occupation type

Having properties or not Age House type

Having a phone or not Working years Education

Having an email or not Family size Marriage condition

Having a work phone or not

The binary features can be straightly processed in

‘0’ and ‘1’. In gender, the female, for example, is

identified as ‘0’ and the male is as ‘1’.

The continuous features are cut into several groups

based on different levels. For example, the number of

children is clustered into 3 groups: the family without

child, ‘ChldNo_0’, one child, ‘ChldNo_1’ and family

with more than 2 children,’ ChldNo_2More’.

The categorical features are processed by ‘==’ to

classify the variables into different groups. The

process is just like that the education level are

recorded in 3 types: Higher education, 'edutp_Higher

education', Incomplete higher, 'edutp_Incomplete

higher' and other, 'edutp_Lower secondary, so the

computer matches the variables to the 3 labels with

heading word, ‘edutp’, and records ‘0’ or ‘1’ as yes or

no in those labels.

2.3 The Analysis of Data

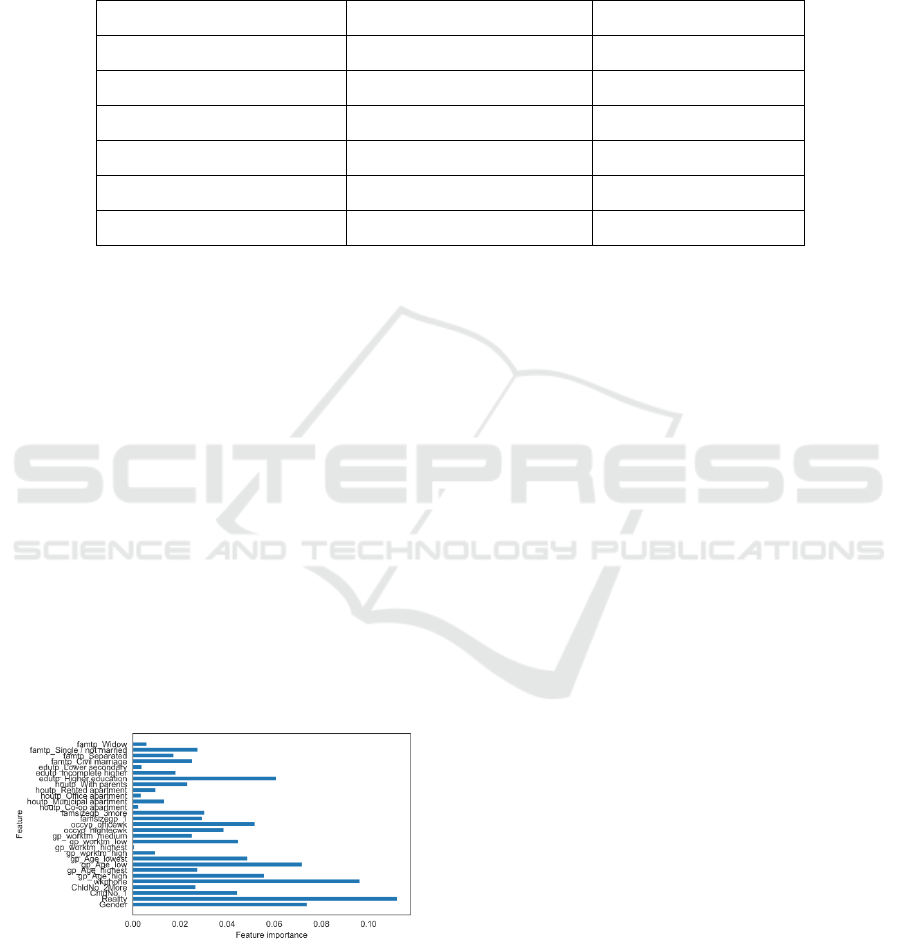

Figure 1: Feature Importance Based on the Features Used

in Machine Leaning.

The feature importance analysis is trained in the

DT and the similar distribution is known from the test

in RF. The maxima figure is about 0.1 and the others

are less than the standard, which suggest that there is

no feature having decisive role in the model building.

Meanwhile, it is conspicuous that the binary feature

generally shows higher scores in the ‘0’ and;’1’ issue.

2.4 Heatmap

Heatmap is an effective visualization tools in data

analysis. It can present a general tend or distribution

of dataset. In the heatmap, the darkness of bars

represents the performance of each IDs, so the credit

card owners with the lighter color, means having

better credit record. Also, there are two axes in the

image, vertical one is IDs and each one of them

represent a card holder and another is Month balance,

indicates the months before current time. We can

observe most of the map is white, which means

majority has good credit records. But there are a few

black areas, this one turns from light grey to sudden

black, which means he may have some considerable

accidents that crushed him. And this longest one is

gradually changed from light gray to all black, and has

been maintained. It shows that he has been going

downhill since then, and he is working hard to make

up for it, but the situation is still getting worse. And

this black stopped abruptly, indicating that he was

unable to recover after the situation deteriorated and

his credit card was revoked.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

866

Figure 2: Heatmap based on Id, Months_Balance.

3 METHODOLOGY

3.1 Data Processing Methodology

In the division of training and test set, the SMOTE is

used for resolving the minority issue. The data set is

not balanced and there are very few people who do not

comply with credit, and the machine learning

algorithm is likely to ignore the minority class, and

thus perform poorly in this class. Because we only

have two classes, good and bad, this defect is fatal. So,

we used SMOTE to refit the sample. SMOTE can

transform an imbalanced dataset to a balanced one by

producing arbitrary examples rather than simply

oversampling through duplication or replacement

(Han, Wang, Mao, 2005). Although, the data

processed by SMOTE is in some terms changed in

structure, while if the models have high performance

in test set under cross validation, the models have

ability in adaption of imbalance data with the support

of SMOTE.

3.2 Machine Learning Models

I considered the characteristics of different models and

reviewed the selection in the previous papers.

Therefore, the paper uses five models cover clustering

and regression models in the experiment.

3.2.1 The Decision Trees

The model is based on Bayesian optimization

methods. “Decision Tree” is a tree-like structure that

allows the system to make decision by weighing the

possible actions. Bayesian optimization method is

used in the model for achieving the weight of each

node. The features of data set are the internal nodes

The Comparisons of the Machine Learning Models in Credit Card Default under Imbalance and Multi-features Dataset

867

and the additional nodes are continuously created

from the internal nodes until all instances have been

covered by the leaves of the tree (Kotsiantis,

Zaharakis, Pintelas 2006).

Figure 3: Decision Tree Based on Gini Is Trained by the Data Set of Credit Card Portfolio and Each Node with the Features’

Values Is Classed in True and False (Good and Bad Credit Card Owners).

3.2.2 The Bagging

Bagging is formed by a group of decision trees. As

mentioned earlier, each node in the decision tree

model is given calculated weight, so each tree in the

group is given suitable weight. Each tree runs

independently to access the best performance and the

final outcome of the model is based on the voting of

all trees. Therefore, the bootstrap is introduced in the

generation of trees to minimize the correlation of each

tree.

3.2.3 The Random Forecast

The principle of the random forecast is same as the

bagging, but each tree is trained by all features in

bagging and by a part of features in random forest.

This means that the bagging performs better than

random forest when there are just several trees in the

modeling. With the increase of trees, the performance

of RF shows more obvious improvement than

bagging.

In general, RF perform better in sheer data and lots

of features.

3.2.4 the Support Vector Machines (SVM)

SVM is a binary linear prediction model. To be

specific, the model makes a line that can accurately

distinguish two types of points in area or space. In the

credit card issue, the model runs in feature space with

high dimensions, but the principle of model has not

changed. The general principle is to search a large

margin decision boundary. The boundary is decided

by the distance of the closest points of two sets and has

the largest distance to the each of the two points.

3.2.5 Logistic Regression (LR)

LR is based on logistic function, also called the

sigmoid function and the curve of LR is an ‘s-shape’

curve. The values of the function is range from 0 to 1

and the curve is generally symmetry about point in 0.5.

Therefore, the function is extremely suitable for

simple classification. In the classification problem, the

Maximum-likelihood estimation, a common learning

algorithm is used to search for the best coefficients.

The model with the result of training can predicts a

value very close to 1 for the default class and a value

very close to 0 for the non-default class in credit cards

portfolio (Sariannidis, Papadakis, Garefalakis,

Lemonakis, Kyriaki-Argyro 2019).

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

868

4 RESULT

4.1 Gridsearch for Best Parameters

Results

For removing the effect of parameters in model

comparison, grid search is applied for searching the

best parameters of the models. The further research

about feature and model selection is based on the best

parameters. The Table2 shows the parameters used for

the models and the exact values.

Table 2: The Table Show All Parameters and Their Best

Values of the Five Models.

dt rf svm bag LogR

C 100 36

n_estimators 25 28

random_state 13 17

16 1

max_depth 26 24

gamma 10

4.2 Five Times Five-Fold Cross

Validation and ROC Results

In this paper, 5 times of five-fold cross-validation is

used to verify the model established by different data

mining methods in best parameter and some scores are

accessed from the cross-validation by record and

calculation might be also useful for model selection.

Meanwhile, the ROC (receiver Operating

Characteristic) ratio is introduced to evaluate the

effectivity and general performance of the models in

another aspects. The detailed result is show in Table3

and Table 4.

Table 3: Accuracy Rates of 5 Times of Five-Fold Cross-Validation Cross Validation.

1 2 3 4 5

dt 0.90867 0.901632 0.906526 0.907970 0.902471

rf 0.908235 0.901634 0.906526 0.908115 0.902616

svm 0.903631 0.902032 0.903940 0.903792 0.897453

bag 0.907943 0.904067 0.908543 0.908262 0.904071

LogR 0.639568 0.637821 0.635343 0.635018 0.632031

The table includes the mean of five times’ score of each fold cross validation as the ‘1-5’ rows’ values of 5

folds cross validation.

Table 4: Comparison of Model Classification Effect.

5_fold fit time ROC mean(acc) std(acc)

dt 0.498136044 0.900391152 0.905453768 0.003215

rf 2.146449327 0.900998112 0.90542531 0.003107

svm 218.6840575 0.896209873 0.902169578 0.002746

bag 9.456052542 0.900256272 0.906577416 0.0023

LogR 1.423333883 0.631710278 0.635956208 0.00288

5_fold fit time is the sum of fit time spend on 5-

fold cross-validation (based on the average fit time of

5 times cross-validation). The ROC is a

Comprehensive evaluation score. The mean(acc) is

equal to the mean in Table3, showing the average

accuracy rate of the models. The std(acc) is the

standard variances of the accuracy rate show in

Table3.

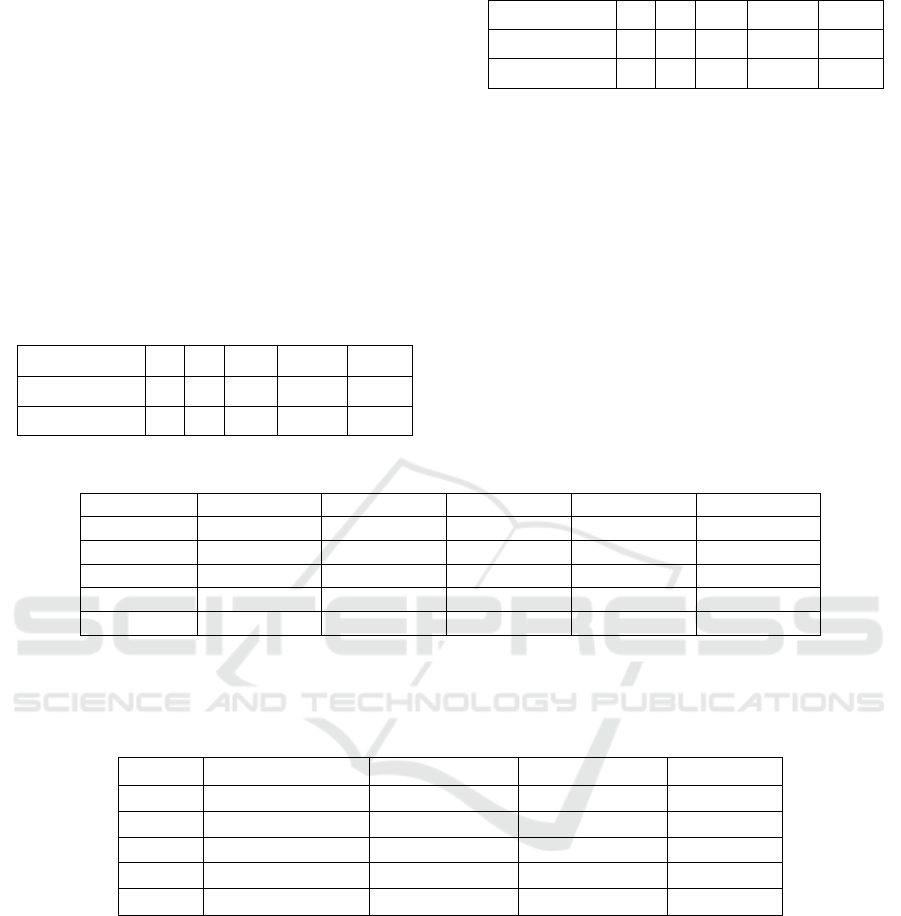

4.3 The Correlation of the Cross

Validation of the Models

The accuracy rate accessed has shown above, while

the figures are similar. Therefore, the correlation

matrix should be introduced to evaluate the

performance difference among the models. By

visualization, the Fig.4, shows the

coefficients directly.

The Comparisons of the Machine Learning Models in Credit Card Default under Imbalance and Multi-features Dataset

869

Figure. 4: Correlation of the Cross-Validation Results

.

The abbreviations of the models make up the X

and Y axes, forming the coordinate. The colors of

blocks are defined by the coefficients in matrix formed

by Spearman correlation coefficient. The color bar in

the right of the picture shows the range of the

coefficients (from 0 to 1).

4.4 Feature-Selection Results

All features have used in the paper as the basic

research shown above, while the selection of feature is

generally useful in previous studies, so the paper tests

the effect of feature selection in the models. The chi-

square test measures dependence between stochastic

variables is recalled for evaluating the feature

importance and the TABLE.5. shows the accuracy rate

with all features and the top 10% features selecting by

the ratios (FIG.1.).

Table 5: Result of Feature Selection.

LogR svm dt bag rf

acc

0.63171 0.89621 0.90039 0.90026 0.90100

acc(top10%)

0.63859 0.86950 0.87099 0.87146 0.87294

The acc is the accuracy rate without feature

selection. The acc(top10%) is the accuracy rate with

feature selection, retaining the features with the top

10% features with the highest feature importance.

5 DISCUSSION

The paper cannot determine which one is the best,

because expect for the logistic regression, the other 4

models has the similar performance in accuracy rate

and ROC. The logistic regression performs extremely

worse than the others, so it is ruled out for the further

selection.

The correlation matrix in Fig.4. provides that the

variance among the svm, dt, bagging and rf in

accuracy rate is extremely little. Therefore, the

random forest has the highest accuracy rate and ROC

rate, but ‘the best model’ cannot be given to the

random forest. This is because the stability is worse

than the svm and bagging. Meanwhile, the fit time is

almost the 4 times of the dt. Therefore, if the volume

of data is not big and the requirement of stability is

high, the rf is the best model. However, if the fit time

or the stability of outcome is the priority of

programming design, the dt and bagging are the best

choices respectively.

The feature selection is a common machine

learning method for improving accuracy. However, it

does not work well in my research. The performance

of 4 models performing better are not further

improved, but became worse in accuracy. The LogR

is the worst model of the 5 models in accuracy, while

the accuracy rate increases contrarily.

6 CONCLUSION

The objective of the paper is finding the best model in

predicting credit card default. In the processing of

reviewing previous studies, two issues emerged. The

first is the data set used is same from bank in Taiwan,

but the Chinese mainland is significant financial

markets, especially at present under the destruction of

coronavirus. Therefore, the paper uses the data with

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

870

the Chinese features. The second is the parameters of

the models is assigned without any standards, so the

parameters may affect the results. Therefore, the grid

search is applied for searching the best parameters of

the models and the comparison of the models becomes

exacter, because all performance of the models is the

best with the best parameters.

The standard for evaluation includes the 5-fold

accuracy rate (from 5 times cross validation), the ROC

rate, the fit time, the standard variance and mean of

accuracy rate. Those ratios can provide

comprehensive evaluation in effectiveness, stability

and efficiency. According to the standard, the 3

models: the random forest, decision tree and bagging

show outstanding performance. The random forest has

the highest ROC and the accuracy rate, so the random

forest is the best in effectiveness. The decision tree has

the similar accuracy and ROC, while the fit time is

extremely smaller than the random forest, so the

decision tree is the most efficient model. The bagging

performs best in the standard variance of the accuracy

rates, so the performance of the bagging is steadier

than the others.

For accessing the best result, the paper tests the

effect of feature selection, while the performance is

very bad. The 4 models: the random forest, decision

tree, bagging and SVM suffers from obvious fall in

accuracy, except for the logistic regression.

The ratios calculated in the paper do not have

much academic value, while the comparison results

have practical and academic value in some distance.

Meanwhile, the thinking of data processing, model

training and comparison standard shown above may

inspire some later scholars to test the application of the

new models in risk management field.

REFERENCES

A.~L.~Samuel, “Some Studies in Machine Learning Using

the Game of Checkers,” IBM J. Res. Dev., vol. 3, no. 3,

1959.

D. DURAND, Risk elements in consumer installment

financing, vol. 17. New York: National Bureau of

Economic Research, 1941.

F. Butaru, Q. Chen, B. Clark, S. Das, A. W. Lo, and A.

Siddique, “Risk and risk management in the credit card

industry,” J. Bank. Financ., vol. 72, pp. 218–239, Nov.

2016, doi: 10.1016/j.jbankfin.2016.07.015.

H. Han, W. Y. Wang, and B. H. Mao, “Borderline-SMOTE:

A New Over-Sampling Method in Imbalanced Data

Sets Learning,” Lect. Notes Comput. Sci. (including

Subser. Lect. Notes Artif. Intell. Lect. Notes

Bioinformatics), vol. 3644 LNCS, pp. 878–887, 2005,

doi: 10.1007/11538059_91.

J. B. Heaton, N. G. Polson, and J. H. Witte, “Deep learning

for finance: deep portfolios,” Applied Stochastic

Models in Business and Industry. 2017, doi:

10.1002/asmb.2209.

J. H. Myers and E. W. Forgy, “The Development of

Numerical Credit Evaluation Systems,” J. Am. Stat.

Assoc., vol. 58, no. 303, pp. 799–806, 1963, doi:

10.1080/01621459.1963.10500889.

J. Rong, “A study on the relationship between credit card

quota and credit card consumption attitude(in

Chinese),” Nanjing Univ., p. 67, 2018.

M. K. Linnenluecke, X. Chen, X. Ling, T. Smith, and Y.

Zhu, “Research in finance: A review of influential

publications and a research agenda,” Pacific Basin

Finance Journal, vol. 43. Elsevier B.V., pp. 188–199,

Jun. 01, 2017, doi: 10.1016/j.pacfin.2017.04.005.

M. Leo, S. Sharma, and K. Maddulety, “Machine learning

in banking risk management: A literature review,”

Risks, vol. 7, no. 1, Mar. 2019, doi:

10.3390/risks7010029.

M. Z. Husejinovic Admel, Keco Dino, “Application of

Machine Learning Algorithms in Credit Card Default

Payment Prediction,” Int. J. Sci. Res., vol. 7, no. 10, pp.

425–426, 2018, doi: 10.15373/22778179#husejinovic.

N. Rtayli and N. Enneya, “Enhanced credit card fraud

detection based on SVM-recursive feature elimination

and hyper-parameters optimization,” J. Inf. Secur.

Appl., vol. 55, no. September, p. 102596, 2020, doi:

10.1016/j.jisa.2020.102596.

N. Sariannidis, S. Papadakis, A. Garefalakis, C. Lemonakis,

and T. Kyriaki-Argyro, “Default avoidance on credit

card portfolios using accounting, demographical and

exploratory factors: decision making based on machine

learning (ML) techniques,” Ann. Oper. Res., Nov.

2019, doi: 10.1007/s10479-019-03188-0.

P. K. Ozili and T. Arun, “Spillover of COVID-19: Impact

on the Global Economy,” SSRN Electron. J., Mar.

2020, doi: 10.2139/ssrn.3562570.

R. J. Bolton, and D. J. Hand, “Unsupervised Profiling

Methods for Fraud Detection,” Proc. Credit Scoring

Credit Control VII, 2001.

R. W. Johnson, “Legal, social and economic issues

implementing scoring in the US.,” Thomas, L. C \,

1992.

S. A. Block and P. M. Vaaler, “The price of democracy:

Sovereign risk ratings, bond spreads and political

business cycles in developing countries,” J. Int. Money

Financ., vol. 23, no. 6, pp. 917–946, Oct. 2004, doi:

10.1016/j.jimonfin.2004.05.001.

S. B. Kotsiantis, I. D. Zaharakis, and P. E. Pintelas,

“Machine learning: A review of classification and

combining techniques,” Artif. Intell. Rev., vol. 26, no.

3, pp. 159–190, Nov. 2006, doi: 10.1007/s10462-007-

9052-3.

S. Yang and H. Zhang, “Comparison of Several Data

Mining Methods in Credit Card Default Prediction,”

Intell. Inf. Manag., vol. 10, pp. 115–122, 2018, doi:

10.4236/iim.2018.105010.

The Comparisons of the Machine Learning Models in Credit Card Default under Imbalance and Multi-features Dataset

871

T. Fetzer, L. Hensel, J. Hermle, and C. Roth, “Coronavirus

Perceptions and Economic Anxiety,” Rev. Econ. Stat.,

pp. 1–36, 2020, doi: 10.1162/rest_a_00946.

T. LC, “A survey of credit and behavioural scoring:

Forecasting financial risk of lending to consumers,” Int.

J. Forecast., vol. 16, p. 149, 2000.

Y. Li, Y. Li, and Y. Li, “What factors are influencing credit

card customer’s default behavior in China? A study

based on survival analysis,” Phys. A Stat. Mech. its

Appl., vol. 526, p. 120861, Jul. 2019, doi:

10.1016/j.physa.2019.04.097.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

872