Digital Technologies as the Basis of the Financial and Economic

System Sustainable Development

Anatolii Suprun

1a

, Tatiana Petrishina

1b

, Marina Sadovenko

1c

, Natalya Voloshanyuk

1d

,

Olga Smyrna

1e

and Dono Pulatkhodjaeva

2f

1

State University of Economics and Technology, 16, Medychna str., Kryvyi Rih, Ukraine

2

Tashkent State University of Economics, 49, Islam Karimov str., Tashkent, Uzbekistan

donopulathuzaeva@gmail.com

Keywords: D

igital Technologies, Sustainable Development, IT Industry, Ministry of Digital Transformation

(Mindigital), NBU, Central Bank, Big Data, Blockchain, Artificial Intelligence.

Abstract: Nowadays, digital technologies are a main driver of strengthening and increasing the society welfare and

achieving sustainable development goals. We are presenting our own vision of ways, areas and reasons why

digital technologies have already changed the financial and economic society system and outline the prospects

for further change. Challenges of sustainable development and directions of their solution with the help of

digital technologies are determined. In particular, the greatest attention is paid to the application of Big Data

and blockchain technologies for the financial and economic system modernization. The development of the

IT industry in Ukraine in recent years is analyzed and a conclusion is made about the positive prospects for

the future. The directions of using Big Data technology to solve problems that hinder the sustainable

development of society are suggested. The likelihood of applying digital technologies to solve environmental

problems is assessed. The prospects for cryptocurrencies and other virtual assets impact on the financial and

economic system are identified. The possibilities of blockchain technology application for the formation of

local payment systems within local communities or large corporations in order to obtain cash flows

optimization and seigniorage from the issuance of cryptocurrencies are illustrated.

1 INTRODUCTION

The world has changed and transformations are still

going on under the influence of digital technologies.

There have never been so many global changes in

human history within such a short time. Digital

technologies have expanded the range of services for

society, made them cheaper and far more accessible.

Statistics indicate clearly that well-being and security

are growing (Rosling, 2019). Nevertheless, there are

still a lot of unresolved issues in the global world,

which are outlined in the 17 Sustainable Development

Goals (SDGs, UN, 2019). Ukraine has joined the

concept of sustainable development and has made lots

a

http://orcid.org/0000-0003-4985-7673

b

http://orcid.org/0000-0002-7772-5793

c

http://orcid.org/0000-0002-3599-8339

d

http://orcid.org/0000-0002-3436-2400

e

http://orcid.org/0000-0001-9463-0991

f

http://orcid.org/0000-0002-8069-0878

of achievements in recent years to implement it.

However, many issues still remain to be solved, such

as environmental pollution, providing people with

decent wages and salaries; increasing the availability

of education and health care; improving the quality of

public administration and legal support of public

relations. The list of problems slowing down

Ukraine's joining the global process of sustainable

development is far from complete.

In spite of numerous challenges, the presence of a

strong IT sector in the country is a decisive factor in

competitive success, and Ukraine has made

significant progress in this area. The quantity and

quality of IT services is growing annually, as well as

372

Suprun, A., Petrishina, T., Sadovenko, M., Voloshanyuk, N., Smyrna, O. and Pulatkhodjaeva, D.

Digital Technologies as the Basis of the Financial and Economic System Sustainable Development.

DOI: 10.5220/0011360000003350

In Proceedings of the 5th International Scientific Congress Society of Ambient Intelligence (ISC SAI 2022) - Sustainable Development and Global Climate Change, pages 372-381

ISBN: 978-989-758-600-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

their exports. The concept of IT state support has been

formed, a special ministry was created to implement

state policy (Ministry of Digital Transformation

(MinDigital), 2019), and the number of public

services in digital format and exports of IT services

abroad are growing (more than 8% of total exports in

2020). The country continues to develop basic

legislation and regulations to provide legal support of

the virtual assets circulation (the basic law has passed

the 2nd reading and is being finalized). The legal field

is being formed to ensure the development of the

virtual assets sphere and give legitimacy to the

current situation (4th place in the world rankings,

establishment of MinDigital in 2021). Tax

preferences were provided for the development of the

IT industry (special legal framework Diya City

introduction in December 2021).

Ukraine has a banking system which is not

inferior in technology to the banking systems of

developed countries. The National Bank of Ukraine

was one of the first to conduct thorough research in

the field of digital currency implementation of the

central bank (e-hryvnia project, 2016-2018). In fact,

the research identified the availability of

technological opportunities for the application of the

Central Election Commission, and for the transition

to the cashless electronic payments, if it is

economically feasible and urgent. Ukrainian private

banks (Privat24, monobank) have very convenient

and reliable mobile payment systems.

The most advanced digital technology today,

which is already used to solve complex social

problems, is Big Data technology. This technology is

actively used by government organizations and

financial companies in such important areas as

assessment of environmental losses; optimization of

defense spending; reduction of public administration

costs; development of quality and affordable

medicine; road safety; cost optimization in trade and

finance; development of personalized services; fraud

prevention in various fields.

Government agencies, the National Bank of

Ukraine, Ukrainian fintech companies, and the

academic community are exploring the opportunities

and risks associated with cryptocurrencies and other

virtual assets. The authors also studied this issue from

different angles. Cryptocurrencies are an illustration

of advancing the development of technology over the

public relations development, which generates mixed

reactions from government agencies and consumers

of financial and other services. One cannot help

mentioning possible negative consequences:

unregulated spread of cryptocurrencies could

increase the money supply in the economy in the long

run, destroy the traditional financial system based on

credit money, and even cause world financial chaos.

In addition, cryptocurrency mining entails high

unproductive electricity costs and diverts money from

the real to the speculative sector.

Governments, however, have leverage to prevent

the conversion of cryptocurrencies into fiat money,

prohibit the payment of cryptocurrency taxes, and

even impose penalties for mining or possession of

cryptocurrencies. But due to globalization, the ban

cannot be fully effective if at least one country

exchanges cryptocurrencies for fiat money. Today,

restraining cryptocurrency is more about government

influence than the complexity of the tool itself and the

lack of trust.

According to the authors, the focusing should not

be made on cryptocurrencies as money. The real

value lies in the blockchain technology that forms

their core. It is a technology of distributed shared

registers, which can completely change the financial

and economic processes. Changes have already

begun, but have not yet gained momentum. Scaling

technology and its practical application can radically

change the approaches to the formation of various

property registers, the creation of transparent

financial and non-financial agreements that cannot be

falsified, change approaches to auditing and financial

accounting. There are already examples when big

cities (Miami, New York, 2021) have created their

own cryptocurrencies and received a seigniorage

from their implementation, which replenishes the

local budget and provides an opportunity to finance

infrastructure projects.

2 RESULT AND DISCUSSION

The contemporary way of living is ensured by a large

number of achievements which have increased the

level of human well-being as well as life duration and

quality. Improvements in the quality of life all over

the world are reflected in еру United Nations

statistics. A thorough analysis of this phenomenon

was conducted by H. Rosling in the work

«Factfulness» (Rosling, 2019). Basing on the UN

statistics study, the author cites the following facts:

availability and improving the quality of secondary

education; increasing of the world's population

expenses on leisure and recreation; literacy rates

growing; reduction in number of famine and natural

disasters victims; expanding access to modern

medicine, including preventive vaccination.

However, the world is still far from becoming a

completely safe place. On the contrary, there is an

Digital Technologies as the Basis of the Financial and Economic System Sustainable Development

373

increase in risks and problems accumulation. The

world community is currently experiencing COVID-

19 coronavirus pandemic. New strains of the virus are

emerging, vaccinations and other preventive

measures are being taken, and the global economic

system is losing money and opportunities through

restrictive measures. Moreover, the pandemic has

shown the global health system and most national

systems being ungroundedly complacent and

dangerously unprepared for the situations like that.

Climate change and related natural disasters are still

increadibly serious global problem. The military-

political situation is threateningly tense. The income

gap between the wealthiest families and the rest of the

community is widening sharply (while the number of

those always referred to as the «middle class» is

declining in parallel with total poverty decline). The

desire of the world community for stability and

improving the world population life quality in whole

gave rise to the concept of sustainable development.

The concept of sustainable development, in

general sense, contains requirements for

environmental protection, social justice and the

absence of racial, national and gender discrimination

(Vasylchuk, 2015).

The concept of sustainable development quickly

became a global blueprint. UN member states

adopted and approved a paradigm of sustainable

development, consisting of 17 goals in 2015. The

Sustainable Development Goals or SDGs and the

intermediate results of their achievement for Ukraine

can be presented in the following format (Table 1).

Table 1: Sustainable development goals and challenges to

their achievement in Ukraine.

Factors Characteristics

Elimination of

poverty

Ukrainian GDP per capita amounted

to 3725.6 USD in 2020 (MFU,

2021), which is a low figure.

Nevertheless, the share of the

population that can be attributed to

pure beggars (living on less than $ 2

a day) is a small one.

Elimination of

hunge

r

Virtually eliminated.

Good health and

well-being

The COVID-19 pandemic has

clearly shown a terrible state of

Ukrainian health care system. The

country has a very insignificant t

middle class share, which indicates

well-

b

ein

g

p

roblems.

Quality

education

There are numerous problems, but

they are gradually being solved

even in times of financial and

economic crisis.

Gender equality

There are no clear signs of gender

inequality, although hidden ones

can be spotted out (for example, the

share of women in politics or the

large corporations top

mana

g

ement

)

.

Clear water and

sanitation

The majority of the population has

access to clear water. There is a

sanitary inspection of average

quality.

Inexpensive and

clean energy

The cost of energy is growing and

the trend will probably continue. A

significant proportion of energy is

produced from carbon. The share of

«green» energy in the energy

balance was 12.4% in 2020, which

is an average percentage. The figure

will have reached 25% by 2030, but

this will probably happen sooner

(ME, 2021).

Good work and

economic

growth

Ukraine has become a leader in

labour migration in Europe since the

events of 2014. 3.2 million

Ukrainians worked abroad in 2020

(Demographic Yearbook, 2020).

The process of deindustrialization

has been going on in the country.

Most young people dream of

working abroad after graduation.

Industrialization,

innovation,

infrastructure

New industrial companies

practically do not start up, there is

the innovation sphere, but it is

almost completely concentrated in

the IT sector, the infrastructure

(except telecommunications) is

mostl

y

outdated and

p

roblematic.

Reducing

inequality

The problem of inequality in

Ukraine is the paramount issue.

Ukraine has a clean oligarchic

economy nowadays. The share of

the poor is large and amounts to

51%.

Stable cities and

towns

Small towns and villages have

extraordinary problems. Many

residents find it difficult to get

medical care. There are no schools,

even primary education in villages

quite often.

Responsible

consumption

and production

The lack of achievement in this area

is clearly evidenced by

deforestation and amber mines,

which virtually destroy the

landscape of entire areas.

Combating

climate change

Ukraine has joined all international

initiatives on this issue. Besides,

and the country's deindustrialization

has significantly reduced CO2

emissions.

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

374

Conservation of

marine

ecosystems

Ukraine virtually does not have

serious business activity in sea

basins and takes measures to

p

reserve marine ecos

y

stems

Conservation of

terrestrial

ecosystems

The country has serious problems in

this area. They are as follows: large

number of landfills (160 thousand

hectares, 480 tons of garbage per

capita (SSUFSCP, 2021)), lack of

recycling, uncontrolled land use,

which leads to land depletion,

unlimited deforestation,

unrestrained minin

g

Peace, justice,

effective

institutions

Military actions have been

occurring in some parts of the

country, both crime rates, and level

of corruption in the judiciary are

high. Besides, and many state

institutions are inefficient and

expensive to maintain. However,

civil society is being formed, public

administration reform is underway,

access to public services is being

simplified.

Partnership for

Sustainable

Development

Ukraine seeks and finds partners,

participates in international

organizations and events on

sustainable development, conducts

relevant educational wor

k

Compiled by the author

The outlined range of problems shows that

Ukraine is still far from meeting requirements in the

field of sustainable development of developed

countries, but there are both an aspiration and

beginning of practical work.

The information (digital, fourth industrial)

revolution which began in the early 21st century has

certainly affected the vast majority of economic and

financial processes, and it has had a positive influence

in most cases. According to the authors study, a great

many of today's achievements in education, health

care and the quality of public services would be

totally impossible without modern digital

technologies. Despite a significant lag in various

economic spheres, Ukraine is far from the last in the

world in area of the information technology industry.

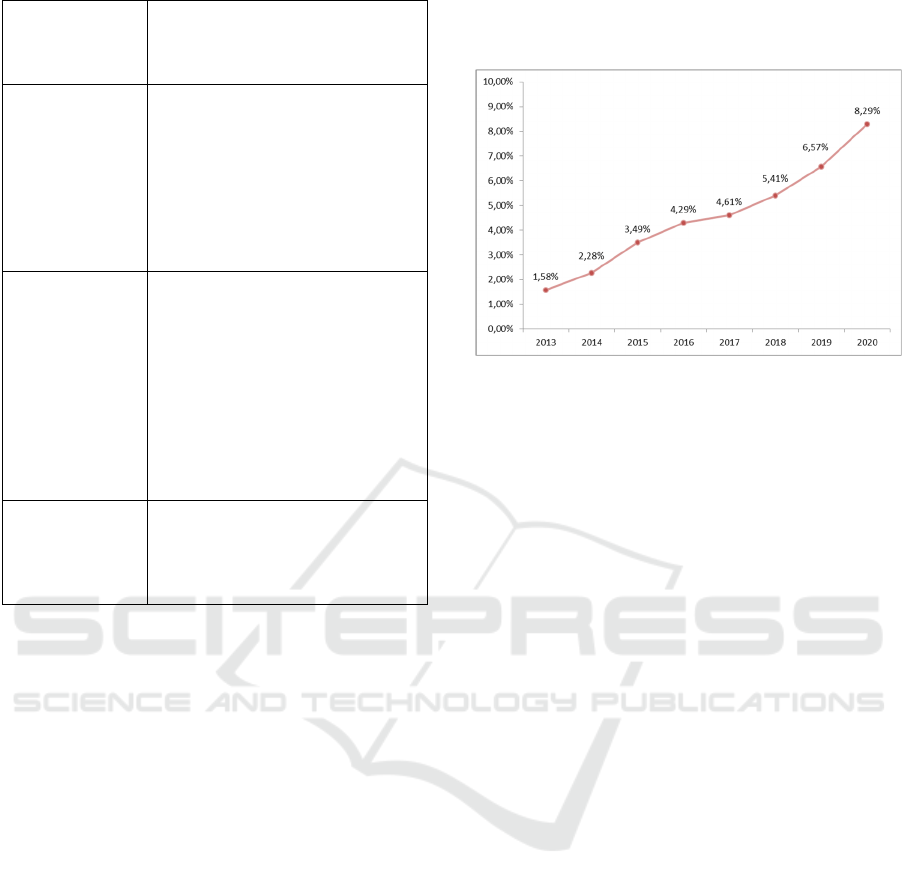

The potential of our country in the field of digital

technologies is evidenced by statistical data, in

particular, Ukrainian IT exports data. In 2020, for the

first time in our history, this figure was at a record

high of more than USD 5 billion, which is almost 20%

(USD 853 million) higher than the previous year

(USD 4.2 billion). In general, compared to 2013, the

IT industry year by year showing a positive trend

(Figure 1). Therefore, the share of IT in total exports

has currently reached 8.3% (more than five times as

much as 1.58% in 2013) (DLF Attorneys-at-law,

2021).

Source:

DLF Attorneys-at-law, 2021

Figure 1: The share of IT services in GDP of Ukraine in the

period 2013-2020, %.

Exports of IT services have already outpaced the

volume of chemical products, reached the level of

mineral products exports and is approaching the

exports of metallurgical products.

It is the IT industry that is gradually returning

Ukraine to the club of high-tech countries, and

growth of the share of this export item is much higher

than the growth of any raw material exports (for

example, exports of ferrous metallurgy or

agriculture).

The Ministry of Digital Transformation of

Ukraine (MinDigital), which is the central executive

body, started operating in Ukraine in 2019.

MinDigital is the main executive body which

represents the public policy in the field of

digitalization. This policy defines the recently

announced concept of «state in a smartphone» and

represents the areas of digitalization of public

administration, social security, public services,

transparent paperwork, and the role of the state in

creating digital infrastructure. Digital transformation

should take place by combining digital infrastructure

(broadband Internet, telecommunications

infrastructure, development and functioning of Diia

City legal framework) with the development of digital

skills in citizens, the spread of e-commerce, the

conversion of most public and private services into

digital format (Cabinet of Ministers Resolution No.

856, 2019).

MinDigital has made significant achievements in

the provision of public services through Diia digital

application and educational services in the digital

literacy field for two years of operation. The Ministry

Digital Technologies as the Basis of the Financial and Economic System Sustainable Development

375

of Digital Transformation has the following

ambitious goals:

to convert 100% of all public services for citizens

and businesses into online version, to provide high-

speed Internet almost throughout Ukraine, teach 6

million Ukrainians digital skills, increase the share of

IT in the country's GDP to 10%;

to conduct an electronic census in 2023 in

cooperation with Apple;

to launch the Unified Social Information System

(UISS) in all regions, which is to help in carrying out

the social sphere digital transformation, receiving

quality data and providing prompt services to the

Ukrainians. The introduction of a single system saves

the budget up to UAH 11 billion annually (

MDTU,

2021

).

Ukraine has a high level of digital technologies

penetration into the financial sphere. The Ukrainian

banking system meets the best world standards in

terms of technology. The National Bank of Ukraine

began research in the field of digital currency

development by central banks (CBDC) in 2016.

Payment systems of commercial banks (including

mobile mode) such as Privat24 (digital application of

a state bank), monobank (digital application of a

private bank), and other payment systems have been

operating successfully.

Sustainable development projects financing as

well as stable financial and economic system forming

require long-term financing and cash flows

optimization. This is exactly why the concept of

sustainable financing was formed.

Sustainable financing is investment decision-

making system in the financial area, taking into

account environmental, social and governance

considerations (ESG). Going forward, this should

ensure that long-term investments are prioritized in

projects that will provide the greatest benefit to

society. The direction of the investment flow in

projects aimed at solving the problems of climate

mitigation or pollution of the planet's ecosystem is

very important. Long-term financial investments

should also be directed to social projects, such as the

formation of human capital and the creation of quality

jobs in problem regions, addressing issues related to

any inequality and violation of human rights, and the

development of inclusiveness. Sustainable financing

should also contribute to the improvement of the

management of subjects of public and private law, the

formation of optimal labor relations, and the solution

of the problem of fair wages in the public and private

sectors of the economy (Overview of sustainable

finance, 2019).

There is a fairly direct link between digital

technologies, sustainable development and the

sustainability of the financial and economic system.

Digital technologies help optimize any process,

including the processing of large data sets and the

formation of management decisions on their basis. It

can be vividly illustrated by the example of common

technology Big Data (Table 2).

Table 2: Sustainable development challenges to be solved

using Big Data technology.

Issue Ways to solve, result

Road safety

Fast processing of data on road

accidents, emergency sections of

roads, payments of insurance

companies and MTIBU,

logistical problems. Proposals

for optimizing and improving

road safety are being formed.

The results are increased

security and reduced costs (for

both public and private carriers).

Reducing public

administration

costs

Big Data analytics gives

opportunity to optimize public

administration costs at the state

and local levels in virtually all

areas. First of all, the costs of

analytics are optimized totally,

from procurement to evaluating

the effectiveness of projects in

the field of infrastructure,

education, health care, social

protection.

Optimization of

defense spending

Processing of intelligence data

and development of tactical and

strategic response measures,

analysis of new weapons

parameters and defense

technologies to determine the

feasibility of spending money on

their purchase or development

Estimation of

ecological losses

Processing of data on pollution

of air, water and land plots under

dumps provides qualitative

analysis of both reasons and

consequences of pollution (for

financial compensators

definition)

Development of

high-quality

medicine

Big Data is successfully used to

diagnose diseases, predict the

epidemiological situation, assess

the required medical capacity,

the number of doctors and

medical staff in the territorial

context

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

376

Cost optimization

in trade

Technology allows to track

consumer preferences in almost

any trade segment. Sellers can

reduce the cost of unnecessary

advertising, form targeted

proposals, and develop e-

commerce. As a result, prices for

consumers decrease.

Fraud prevention

of in various

areas

With the help of Big Data

information can be process and

financial abuse can be detected

in the following public and

private spheres: misuse of public

funds or local budgets; abuse in

the field of public procurement;

manipulation of financial

statements; insider information

trading.

Compiled by the author

The abovementioned list is far from exhaustive,

still, illustrates the versatility of technology to solve

applied problems of sustainable development.

The ecological approach should be considered

separately. Six of the seventeen sustainable

development goals are directly related to the

environment. Establishment of environmental

standards, their observance, allocation of funds and

their intended use, analysis of data on the state of the

environment in various areas, assessment of the

effectiveness of environmental projects, analysis of

compliance of environmental projects with

established criteria, assessment of financial losses due

to environmental damage cannot be solved without

digital technologies (Table 3).

Table 3: Application of digital technologies in the

management of environmental projects financing.

Technolog

y

Characteristics

Big Data

Large data sets analyzing and

identifying the causal links between

pollution and climate change, assessing

the impact of pollution factors on air

quality, groundwater, land resources

and their impact on human health.

Artificial

Intelligence

Building accurate forecasts of climate

change, the impact of climate change

on the economy and the environment,

developing measures to prevent natural

disasters and measures to slow global

warming. Estimating the amount of

financial resources necessary for

solving environmental problems at the

g

lobal and local levels.

Blockchain

Technology application of to track the

targeted use of funds allocated for the

environmental projects

implementation. Improving the work

with green bonds. Use of virtual assets

to finance local or global

environmental problems solution.

Compiled by the author

Both nowadays and in the future, the most

controversial issue in ensuring the sustainable

development of the financial and economic system is

the virtual assets usage, which in most cases are

associated with the use of digital currencies. Digital

currencies were created on the basis of blockchain

technology. Later, it became clear that the technology

is universal and can be applied to change and

optimize many management processes. Today,

governments and private companies are conducting

research on the blockchain functionality. The

question of the expediency (inexpediency, danger) of

using decentralized money is sure to remain on the

surface.

It is both a technical and a fundamental issue. The

emergence of decentralized digital currencies is a

clear example of technology being ahead of public

institutions in its development. Cryptocurrencies are

used almost all over the global world, having a legal

basis only in a small number of countries. There is

still no single socio-economic paradigm for treating

this phenomenon. At the same time, opinions are

radically different (from a complete ban on

circulation to granting the status of the second

national currency). The authors have previously

studied this issue (Suprun, 2021) and came to the

following conclusions:

the money supply grows if digital currencies are

not controlled by the state, spread rapidly and are

widely used in circulation. The state can probably try

to regulate and control the circulation of digital

currencies, but the big question is whether it will

succeed;

the rapid growth in demand for digital currencies

both as a means of circulation and as a medium of

accumulation seems quite dubious as new digital

money, which has no real basis, has already been the

subject of speculation. Further growth of digital

currency mass and the possibility of its transferring to

fiat money can lead to financial system chaos in the

long run;

the introduction of new digital technologies can

change neither tax rates nor the mechanism of their

payment, therefore, cryptocurrencies will not be able

to fully perform the functions of money either in the

near or in the medium term, unless governments

allow their using to pay taxes.

Digital Technologies as the Basis of the Financial and Economic System Sustainable Development

377

Ukraine has made significant progress in the use

of digital currencies, applying advance technologies

in this area and in the legal framework formation. The

following facts support this concept:

the National Bank of Ukraine completed a pilot

project on the digital currency introduction by central

bank (CBDC) in 2018;

according to the Ministry of Digital

Transformation of Ukraine, the country has been on

the 4th place in the ranking of the global index of

cryptocurrency use in 2021 (MDTU, 2021); the

regulator conducted a survey of financial market

experts and identified three areas of possible use of e-

hryvnia in 2021(NBU, 2021).

The Law of Ukraine «On Virtual Assets» was

adopted On September 8, 2021 (The Law of Ukraine

№3637, 2021). The law provides for a comprehensive

settlement of legal issues arising in connection with

the circulation of virtual assets in Ukraine, defines the

rights and obligations of the virtual asset market

participants, the principles of state policy in virtual

assets circulation.

The facts show a high level of activity in the use

of virtual assets, including digital currencies, both at

the private sector and at the state levels.

Digital currencies today have a number of

disadvantages, including the difficulty of application,

the risk associated with volatility in their exchange

rate and lack of legal status in many jurisdictions, as

well as unproductive costs. Cryptocurrency mining

requires large amounts of electricity, which is

accompanied by an essential increase in heat

emissions. These are unproductive costs of society

and great environmental burden, which is completely

inconsistent with the sustainable development goals.

To illustrate this point, let us give some indicative

figures regarding the costs of electricity and CO2

emissions associated with the mining of

cryptocurrencies. Scientists at the University of

Cambridge have calculated that about 121.36

terawatt-hours per year are spent on cryptocurrency

mining. This exceeds electricity consumption in

countries such as: Argentina (121 TWh), the

Netherlands (108.8 TWh), almost equal to the

consumption of Norway (122.2 TWh) (Chikishev,

2021).

As for the cost of electricity, this is probably, a

problem that would be resolved sooner or later. After

the energy crisis of 2021-2022, associated with rising

gas prices, we can expect investments in the field of

alternative energy sources. A technical solution will

be found and energy will get cheaper in the future.

In our view, the carbon emissions associated with

cryptocurrency mining are a big problem.

Bank of America Global Research analysts in

their report «Bitcoin's dirty little secrets» presented a

number of disadvantages of bitcoin, among which

are:

- the inability to use it as a means of storing funds

or making payments;

- the formation of a certain centralization (as of

mid-2021, 95% of bitcoins were controlled by the

owners of 2.4% of wallets (recall, the initial idea lay

precisely in decentralization);

- low speed of payment processing (1400

transactions per hour against 236 million transactions

processed by the payment system Visa);

- negative impacts on the environment.

Regarding the latter disadvantage, the report

provides figures from current research: each purchase

of cryptocurrency for 1 billion dollars is equivalent to

annual carbon emissions from 1.2 million cars;

mining and operations emit about 60 million tons of

carbon annually, which is comparable to carbon

emissions from a country like Greece (Winter, 2021).

However, there are cases when cryptocurrencies

are used for the needs of society. It concerns a new

phenomenon such as cryptocurrencies, issued by

municipalities to finance the community needs. The

City of Miami launched its own cryptocurrency,

MiamiCoin On June 8, 2021. The current value of the

currency at the beginning of December 2021 was

about 2.3 USD (at the initial rate of 0.02 USD), and

the volume of trades per day was almost 500 thousand

USD. MiamiCoin can be extracted using the Stacks

protocol or purchased on the open market. The city

has already received more than $ 20 million from the

MiamiCoin project, and its market capitalization has

reached 2.9 billion USD (Kim, 2021). The city

revenues are essentially pure seigniorage and can be

used to finance infrastructure projects, develop small

and medium-sized businesses, and improve the

functioning of municipal education and health care

facilities.

Being able to have a local means of payment

speeds up the exchange of values within the

community, especially providing municipal and

private property is also tokenized (Figure 2).

According to the concept, you can get local

cryptocurrencies in two ways by mining or purchasing

on a specialized platform, which was created with the

participation of the municipality (you can use existing

platforms under the contract). Within the community

economy, coins can be used to obtain goods and

services from local producers. Thus, transactions are

carried out almost instantly in the distributed system

and without participation of intermediaries (with the

minimum commission or without the commission at

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

378

all). The distributed system provides both circulation

and control over transactions, which makes financial

fraud impossible (the content of each transaction is

reflected for all the participants and making any

changes retrospectively is out of the question). The

system is impossible without the mechanism of

converting cryptocurrencies into fiat money. Besides,

the scheme provides a special clearing center for the

operation, which is in charge of providing

communication with the state treasury. In addition, the

clearing house provides a link between private owners

and the local budget.

Compiled by the author

Figure 2: Scheme of regional (local) cryptocurrency functioning.

According to the project, cryptocurrencies can be

used to pay local taxes. If the scheme works, there is

an increase in its functionality. For example,

microinsurance, microcredit for small businesses and

households (without commissions and with low

interest rates compared to banks). It contributes to the

development of small business, which is always the

mainstay of the local community, as well as

employment and consumption, improving business

activity. The local government, which is the initiator

and the first issuer, receives seigniorage, which can

be used for the urgent community needs in the field

of health care, education, infrastructure projects.

Conditions for the implementation and operation of

such a scheme are as follows:

positive credit rating of the city (coins issued into

circulation should be considered both as a means of

payment and as an investment);

regulatory framework governing such

transactions;

citizens' trust in the city (involvement of as many

local entrepreneurs as possible in the project,

households are a factor without which the project

cannot be implemented).

It is the combination of these conditions that

ensured the success of such a project in Miami.

Such a project is non-feasible for Ukrainian cities

currently, due to low credit rating (or lack thereof) in

Ukrainian cities, imperfect legal framework (draft

law was not signed by the President after the first

reading and sent for revision) together with distrust

and low level of financial and digital literacy. But the

situation is changing rapidly and this experience

should be taken into account in the medium term.

The Central Bank's Digital Currency (CBDC)

project is most likely to be initially implemented in

Ukraine. The pilot project showed that there are no

technical obstacles to the e-hryvnia introduction. The

survey on market experts’ vision of e-hryvnia

suggested the following areas of its use:

usage in the field of retail payments, targeted

social benefits, the formation of the functionality of

programmed money (for example, today support

program of UAH 1,000 for every fully vaccinated

person could be paid directly by the National Bank

through the Diya without the commercial banks

participation);

applying e-hryvnia in transactions together with

other virtual assets having subsequent ability to

transfer funds to other forms of fiat money (after the

adoption of the relevant laws and regulations, the

virtual asset market can develop rapidly and require

convenient, comprehensible monetary support for

transactions);

making cross-border payments from the Central

Securities Depository of other countries (primarily it

can be implemented for settlements in the

international system of liability insurance of vehicle

owners «Green Card»).

In addition to cryptocurrencies, the blockchain

provides many opportunities to optimize financial

and economic processes and improve people's lives.

Treasury

Clearing

centre

Local

budget

Node

1

Node

5

Node

4

Node

3

Node

Node

7

Node

6

Node

2

Origin of

cryptocurrency:

- mining;

- purchase on a

special platform.

Digital Technologies as the Basis of the Financial and Economic System Sustainable Development

379

In the future, it is to be a main mechanism to transfer

any values.

The problem of property registration is very acute

in many developing countries, especially when it

comes to real estate and land. The facts of fraud,

falsification of registers take place very often. At the

same time, the judiciary is often too corrupt to

consider approaches to solving the problem. A very

in-depth study of this issue was conducted by

Hernando de Soto, who concluded that lack of

property legalization, proper registration, easy and

inexpensive registration of property rights are

perhaps the main factors of long-term poverty in most

developing countries (De Soto Hernando, 2017). It is

already clear that the blockchain is solving this

problem completely for the benefit of society and at

minimal cost.

Owing to blockchain technology you can create

property registers invulnerable to hacks and fraud,

which can be used to prove the right of owning a

house, car and other assets (Vigna, 2018).

The land market is currently being launched in

Ukraine.

One of the reasons which is certain to hinder

its development can be the factor of distrust on the

part of investors in securing property rights to the

acquired land. The formation of transparent registers

which can be neither changed no corrected

retrospectively is a crucial point in the success of the

reform and a decisive factor in ensuring the growth of

its value.

Future increasing of the technology availability

will give opportunity to form the ownership registers

of housing, cars, cottages, garages and other

properties. The factor of unquestionable registration

is to be of paramount importance in increasing the

value of the objects being registered. In the long run,

it must lead to an increase in nationwide

capitalization.

Blockchain technology has the potential to change

the financial and economic system, ensure its future

stability and support sustainable development (Table

4).

Table 4: Blockchain technologies application in financial

transactions.

Institution,

country,

technolo

gy

The content of the operation

Creating local

quasi-money

systems

Large corporations can create

«internal money» systems for

payments within the corporation. It

speeds up and optimizes money

circulation and makes transfer

pricing more transparent.

Optimization

and

transparency of

financial

accounting

The technology gives opportunity to

link financial assets reported in

companies' balance sheets to their

fair value on the open market. This

makes it impossible to manipulate

the revaluation of assets in order to

ensure fictitious capitalization and

other falsifications.

Confirmation of

both agreements

authenticity and

parties to

contract identity

Consolidation of information in the

blockchain system gives opportunity

for carrying out quick necessary

checks in real time. In this case, the

blockchain system protects

information from retrospective data

chan

g

es.

Automatic

business

transactions

recording by

stakeholders

Either financial or non-financial

transactions are automatically

recorded for all the stakeholders.

Simultaneous access to information

of all participants provides

transparency in calculations,

impossibility of falsifications and

fraudulent actions

Blockchain

registers

creation

For example, creating a blockchain

register of specialists in a certain

field (banking, insurance, stock

exchange) including educational

institutions, self-government

organizations, state regulators.

Thus, formation of an independent

and true qualification rating is

p

rovided.

Compiled by the author

The authors of the article share the opinion of a

great many financial analysts, researchers and

practitioners forecasting next decade to be a period of

economic and financial processes transition to

blockchain technology as a universal technology of

value exchange.

4 CONCLUSIONS

Mankind has no alternative to sustainable

development; therefore, the sustainability of local and

global financial and economic systems is both a

prerequisite and a product of sustainable

development. The financial sector is rapidly

digitalizing and becoming a generator of new

opportunities. The IT industry is becoming a major

factor in shaping the potential for success in the

sustainable development of the financial and

economic system.

In recent years, both front and back office of

financial companies and government regulators have

changed radically. More and more services are

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

380

provided in digital format, which saves time and

money. It is time to form total access to financial

services in a mobile format and transition from

standardized services to personalized ones.

Ukraine has a strong IT industry and banking

system, which is not inferior in technology to the

banking systems of developed countries. The state

supports the IT industry through tax preferences,

promoting the development of IT education, digital

literacy. Among digital technologies that have the

greatest impact on the financial and economic system

today, Big Data technology is the most mastered, and

the blockchain has the greatest potential for

development.

The main applied research in the use of digital

technologies to ensure a sustainable financial and

economic system in public and private spheres should

be the following:

analysis of large data sets in the fields of ecology,

health care, industry, finance, public administration in

order to identify necessary financial resources for

their implementation;

evaluation of the potential and already

implemented projects effectiveness;

formation of blockchain schemes within

corporations, public institutions, including with the

use of quasi-payment instruments within systems;

assessment of the consequences of the central

banks digital currency’s introduction;

formation of accounting, financial and

management accounting systems based on

blockchain and connected with the fair value of assets

in the markets.

Owing to digital technologies, the goals of

sustainable development of the financial and

economic system can be achieved in the historical

perspective in a relatively short period of time.

Blockchain technology has the capacity to change the

financial and economic system, ensure its stability in

the future and support sustainable development.

REFERENCES

The United Nations. Department of Economic and Social

Affairs. Sustainable development, 2019.

https://sdgs.un.org/goals

Hans Rosling, Н., Rosling, О., Rosling Rönnlund, А., 2019.

Factfulness: Ten Reasons We're Wrong About the

World--and Why Things Are Better Than You Think,

Flatiron Books. New York.

Ministry of Digital Transformation of Ukraine (MDTU).

Official site. https://thedigital.gov.ua/

Vasylchuk, I., 2015. Financial support of corporations

sustainable development, КNEU. Kyiv.

Ministry of Finance of Ukraine (MFU). Indices. Gross

domestic product in Ukraine, 2021.

https://index.minfin.com.ua/ua/economy/gdp/

Ministry of Energy (ME): the share of RES in Ukraine in

2021 reaches the target of 2030. https: //ua-

energy.org/uk/posts/minenerho-chastka-vde-v-ukraini-

u-2021-rotsi-siahne-planovykh-pokaznykiv-2030-roku

Demographic Yearbook, 2020. Population of Ukraine.

https://ukrstat.org/uk/druk/publicat/kat_u/publnasel_u.

htm

State Service of Ukraine on Food Safety and Consumer

Protection (SSUFSCP), 2021. Landfills -

environmental pollution in Ukraine.

https://dpssmk.gov.ua/smitnyky-ekolohichni-

zabrudnennia-v-ukraini/

DLF Attorneys-at-law, 2021. IT in Ukraine: figures,

prospects and barriers. https://dlf.ua/ua/it-v-ukrayini-

tsifri-perspektivi-ta-bar-yeri/

Cabinet of Ministers Resolution No. 856, 2019. On

Approval of the «Regulations on the Ministry of Digital

Transformation of Ukraine».

https://zakon.rada.gov.ua/laws/show/856-2019-

%D0%BF?lang=en#Text

Overview of sustainable finance, 2019.

https://ec.europa.eu/info/business-economy-

euro/banking-and-finance/sustainable-

finance/european-green-bond-standard_en

Suprun, А., Petrishyna, Т., Sadovenko, М.,

Voloshanyuk, N. and Khodakevich, S., 2021. Digital

Technologies in Finance: Modernity and

Prospects. International Scientific Congress Society of

Ambient Intelligence 2021 (ISC-SAI 2021). SHS Web

of Conferences 100, 01004 (2021).

DOI: https://doi.org/10.1051/shsconf/202110001004

National Bank of Ukraine (NBU). Official site.

https://bank.gov.ua/en/

The Law of Ukraine «On Virtual Assets» No. 3637, 2021.

https://www.rada.gov.ua/news/Novyny/213503.html

Crystal Kim, 2021. NYC Gets Own Cryptocurrency After

Mayor-Elect Adams Touts Bitcoin.

https://www.bloomberg.com/news/articles/2021-11-

08/new-york-gets-own-cryptocurrency-after-adams-

touts-bitcoin

De Soto Hernando, 2017. The Mystery of Capital: Why

Capitalism Triumphs in the West and Fails Everywhere

Else, Nashformat. Kyiv.

Vigna, P, 2018. The Truth Machine: The Blockchain and

the Future of Everything, Mann, Ivanov and Ferber.

Moscow.

Chikishev, N., 2021. How much of the world's electricity is

spent on mining. https://dev.by/news/maining

Robert N. Winter, 2021. Bitcoin’s dirty little secrets:

Environmental. https://robert.winter.ink/bitcoins-dirty-

little-secrets-environmental/

Digital Technologies as the Basis of the Financial and Economic System Sustainable Development

381