The Effect of EWOM, Price Perception and Risk Perception on

Purchase Intention: Study on Users of Kahf Care Products

Irfan Syahputra

Master of Management Science, Faculty of Economics and Business,

Universitas Sumatera Utara, Indonesia

Keywords: Ewom, Price Perception, Risk Perception, Purchase Intention.

Abstract: This study aims to analyze the effect of ewom, price perception, and risk perception on purchase intention

kahf care products. The research method used is a method with a quantitative approach used to examine

certain populations or samples, namely consumers who use kahf care products. Sampling was done by non-

probability sampling method with the number of respondents as many as 100 respondents and the data used

was primary data in the form of a questionnaire. The data analysis method used is multiple regression analysis.

The results of this study indicate that (1) ewom has a positive and significant effect on purchase intention in

kahf care products. (2) price perception has a positive and significant effect on purchase intention in kahf care

products. (3) the perception of risk has a positive and significant effect on purchase intention in kahf care

products.

1 INTRODUCTION

With the spread of the internet around the world,

interpersonal communication has been reshaped from

traditional face-to-face communication to a more

virtual way of communication called electronic word

of mouth, consumers are getting more opportunities

excellent for sharing information about their

consumption experiences and for disseminating

advice on products and brands using social

networking platforms and consumer review sites

(Godes and Mayzlin, 2004; Brown et al., 2007; Xia

and Bechwati, 2008).

It will have a good impact on the development of

product marketing. EWOM communication makes

consumers not only limited to getting information

about related products from people they know, but

also from a group of people from different areas who

have experience with the product in question

(Christy, 2010).

In addition, eWOM can also provide

encouragement to consumers to make purchases on

the product in question if the product is good.

Consumers will be interested in the product and want

to have the product that was talked about earlier.

Schiffman and Kanuk (2007: 201) say that

psychological activity that arises due to feelings and

thoughts about a desired product or service is called

purchase intention. Finally, purchase intention can

arise when there is eWOM in it.

Figure 1: Use of Social Media.

Source: Digital GWI (2021 & 2021).

From Figure 1 above, it can be seen that the most

rapidly increasing social media is TikTok, which in

46

Syahputra, I.

The Effect of EWOM, Price Perception and Risk Perception on Purchase Intention: Study on Users of Kahf Care Products.

DOI: 10.5220/0011509900003460

In Proceedings of the 4th International Conference on Social and Political Development (ICOSOP 2022) - Human Security and Agile Government, pages 46-52

ISBN: 978-989-758-618-7; ISSN: 2975-8300

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

2020 was 25 percent, while in 2021 it increased by 40

percent. This shows that market share has grown from

social media such as Instagram and Facebook to the

TikTok application which can be seen in several

product reviews and recommendations.

The problem that often occurs today is that some

consumers see a product, especially a care product

based on low prices and instant results. Most

consumers pay less attention to the brand image or

brand of a product. They prefer products that are sold

freely at low prices and offer instant results. With this

phenomenon, it is necessary to have information

about a product that can be trusted to assist in

choosing quality and safe care products for skin

health.

The selection of Kahf's care products as the object

of research was because Kahf issued several products

consisting of five categories, namely facial

wash, beard care, deodorant, hair & body wash, and

eau de toilette (EDT). All of Kahf's products are

categorized as halal, non-comedogenic and non-

acnegenic and have been clinically tested for health.

Along with the times, men are also required to

maintain and care for skin and facial health in order

to create high self-confidence and look good looking.

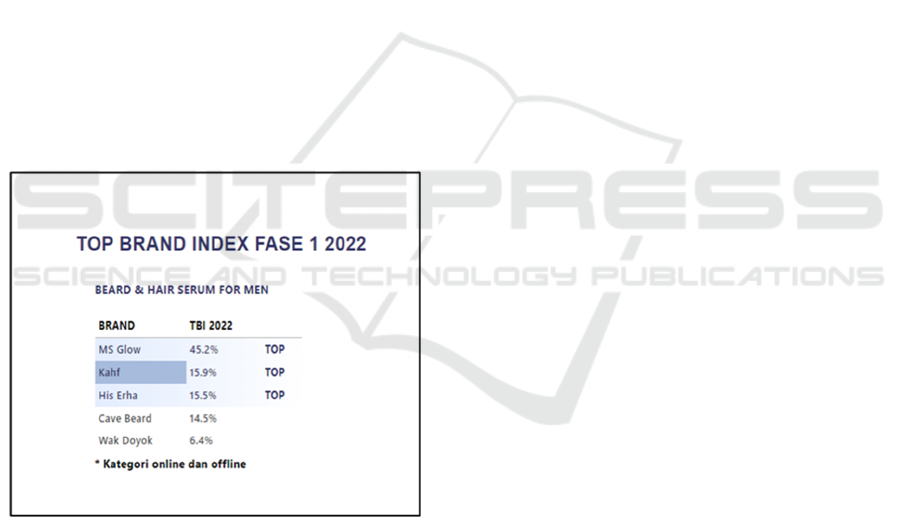

Figure 2: Sales of Men’s Skincare.

Source: Top Brand Award (2022).

Top Brand Index describes its data on users of

special male care products who use certain brands. As

a result, MS Glow occupies the top position with

45.2% of users, followed by Kahf with 15.9%, then

His Erha, Cave Beard and finally Wak Doyok with a

total user percentage of 6.4% of the total users. This

also proves that Kahf is in the Top 3 Brand Index for

online and offline categories that are able to compete

in the Indonesian market.

Based on the phenomena that occurred above,

several problems can be formulated, namely as

follows:

1) Does ewom affect purchase intention on Kahf's

care products?

2) Does price perception affect the purchase

intention of Kahf's care products?

3) Does risk perception affect purchase intention on

Kahf's care products?

2 LITERATURE REVIEW

2.1 EWOM

According to Henning-Thurau et al., (2004), eWOM

is a positive or negative communication between

potential, customers or former customers about a

product or company that is publicly available on the

internet (Wibowo, 2015). eWOM has become a

"venue" or a very important place for consumers to

give their opinions and is considered more effective

than WOM because of the level of accessibility and

wider reach than traditional WOM with offline media

(Jalilvand, 2012).

According to Goyette et al., (2010) said that there

are dimensions that can be used to measure electronic

word of mouth (eWOM), namely:

1) Intensity

Intensity in eWOM is the number of opinions

written by consumers on a social networking site.

Indicators of intensity are:

a) Frequency of accessing information from social

networking sites

b) Frequency of interaction with users of social

networking sites

c) Number of reviews written by users of social

networking sites

2) Valence of Opinion

Is consumer's opinion either positive or negative

about products, services and brands. Indicators in the

valence of opinion include:

a) Positive comments from social networking site

users

b) Recommendations from social networking site

users:

3) Content

Is the information content of social networking

sites related to products and services. Indicators of

content include.

The Effect of EWOM, Price Perception and Risk Perception on Purchase Intention: Study on Users of Kahf Care Products

47

2.2 Price Perception

Zeithaml in Kusdyah (2012) states that price

perception becomes a consumer's assessment of the

comparison of the amount of sacrifice with what will

be obtained from a product. or services. Xia et al. in

Lee and Lawson Body (2011: 532) argues that price

perception is a consumer judgment and an associated

emotional form regarding whether the price offered

by the seller and the price compared to other parties

is reasonable, acceptable or justifiable. According to

Gourville and Moon in Toncaret al. (2010:297),

consumer price perceptions are influenced by the

prices offered by other stores with the same goods.

Price perception in this study is the amount of money

charged for the number and value of products

exchanged by consumers for the benefits they have

that can be compared with other purchasing methods.

Indicators of price perception according to

Hermann, et. al.(2007:54) (1) Affordable prices (2)

Attractive price promotions such as discounts, free

shipping (3) Price compatibility with quality (4)

Payment methods.

2.3 Risk Perception

Perception can be defined as consumer subjectivity

regarding perceived losses. consumers, which means

that every action taken by consumers will have

consequences that cannot be seen by them, and some

of them tend to be unpleasant (Dursun, 2011). Bauer

(1960) first proposed perceived risk to include two

dimensions: uncertainty and adverse consequences.

Naiyi (2004) defines perceived risk to include five

components: financial, performance, social,

psychological, and physical risk. Perceived risk

increases as the probability of one or more negative

outcomes increases (Dowling and Staelin, 1994).

Risk perception is defined as the uncertainty faced

by consumers when they cannot predict the

consequences when making a purchase decision.

There are two dimensions of the important points in

the definition of this risk perception, namely

uncertainty and consequences. This definition

emphasizes that consumers are influenced by their

risk perception, regardless of whether the risk

actually exists or not. Risks that do not exist in

consumer perceptions will not affect consumer

behavior (Schiffman and Kanuk, 2010).

Perceptions of risk arise from different types of

potential losses (Hoyer et al. MacInnis, and Pieters,

2013). There are 6 types of potential losses which

then become a risk, namely physical risk (there is a

risk that threatens the physical condition or security).

consumers, for example: it is possible that a mobile

phone emits radiation harmful), performance risk

(risks related to product/services that do not meet

expectations, for example: there is a possibility that

the car is fueled gas will consume more fuel),

psychological risk (risk of emergence negative

emotions, for example: there is a possibility that

consumers will feel embarrassed to invite his friends

listen to songs using a 5 old stereo years), financial

risk (there is a risk of financial loss, for example:

there is a possibility that a new plasma TV appears

with better performance but cheaper price in the next

few months), time-loss risk (there is a risk of wasted

time, for example: there is a possibility that

consumers have to repeat all the online shopping

processes from initial), and social risk (risk due to the

purchase of products/services that are considered bad

by consumer's social environment, for example: there

is a possibility that the consumer's friends will

laughing at his purple mohawk haircut).

2.4 Purchase Intention

Schiffman and Kanuk (2007:201) suggest that

purchase intention is a psychic activity that arises

because of feelings and thoughts about a desired

product or service. Durianto, et al (2003:109) defines

Purchase Intention as behavior that arises in response

to an object that shows the customer's desire to make

a purchase. Based on the explanations of several

experts, purchase intention is defined as a thought that

has been thought by the buyer due to a positive desire

for the product.

This purchase intention appears as a consumer

consideration for make a purchase. Purchase intention

is the most appropriate predictor of buying behavior

(Morwitz and Schmittlein, 1992). According to Engel

et al., (1995) there are five stages of decision making

to make a purchase, namely problem recognition,

information search, evaluation of alternatives,

choices and results.

Buying interest by consumers is the first step for

consumers to decide to buy a particular product. The

greater the consumer's interest, the greater the

opportunity to buy a certain brand product. Purchase

intention is the evaluation and attitude of consumers

towards products with external factors so that it has

an impact on consumers' willingness to buy products

(Wen and Li, 2013).

According to Augusty Ferdinand (2002:129)

buying interest can be identified through the

following indicators:

1. Transactional interest

Namely the tendency of a person to buy a product.

ICOSOP 2022 - International Conference on Social and Political Development 4

48

2. Referential Interest

That is a person's tendency to refer products to

others.

3. Preferential Interest

That is an interest that describes the behavior of

someone who has a primary preference for the

product. These preferences can only be overridden if

something happens to the product of their

preferences.

4. Exploratory Interest

This interest describes the behavior of someone

who is always looking for information about the

product he is interested in and looking for information

to support the positive characteristics of the product.

3 RESEARCH METHOD

This research is an explanatory research with a

quantitative approach. This research was conducted

online, namely by distributing questionnaires to the

intended respondents using the google form.

Respondents in this study included users of kahf care

products seen from social media that marked or

tagged posts to kahf accounts as well as users who

provided comments and reviews on posts on kahf

accounts. Obtained a sample of 100 respondents and

analyzed using multiple linear regression analysis.

3.1 Conceptual Framework

Figure 3: Conceptual Framework.

3.2 Research Hypothesis

H1: Ewom has a positive and significant effect on

buying interest in Kahf's care products.

H2: Price perception has a positive and significant

effect on buying interest in Kahf's care products.

H3: Risk perception has a positive and significant

effect on buying interest in Kahf's care products.

4 RESULTS AND DISCUSSION

Table 1: Characteristics of Respondents.

Characteristics of

Respondents

Total

Age

< 20 Years 25

21

–

30 Years 60

> 31 Years 15

Education

Senior High School 20

Bachelor Degree 70

Level 2 10

Work

Student 20

College Student 50

Employee 30

Figure 4: Normality Test Results.

From the results of the histogram graph, it can be

seen that the variables are normally distributed, this is

indicated by the distribution of the data not skewed to

the left or skewed to the right. Normality test on

multivariate is actually very complex, because it is

only done on all variables together

Table 2: Multicollinearity Test Results.

VIF Ά Ket

Ewom 1,190 10 There is no multicollinearity

p

rice.perception 1,215 10 There is no multicollinearity

risk.perception 1,100 10 There is no multicollinearity

From the table above, it can be seen that VIF < 10,

Ewom = 1.190, Price Perception = 1.215 and Risk

Perception = 1.100 so there is no multicollinearity.

The Effect of EWOM, Price Perception and Risk Perception on Purchase Intention: Study on Users of Kahf Care Products

49

Table 3: Reliability Test Results.

Cronbach

’s al

p

ha

Ket

Ewom 0,808 Reliable

p

rice.

p

erce

p

tion 0,836 Reliable

risk.

p

erce

p

tion 0,811 Reliable

p

urchase.intention 0,727 Reliable

Table 3 shows that all latent variables in the study

have a reliable value above 0,6, so it can be concluded

that all variables have a high level of internal

consistency reliability.

Table 4: Autocorrelation Test Results.

Std. Error of the

Estimate

Durbin-Watson

1,203 2,095

In the output results, it can be seen that the Durbin

Watson value is 2.095 with a total of 100 respondents

and cases = 4, so the value of du = 1.715.

Because du < d < 4 – du = 1.715 < 2.095 < 2.285, the

decision has no autocorrelation.

Table 5: Multiple Linear Regression Analysis.

B

t

Sig. Ket

(Constant) 5,548 4,536 ,000

Ewom ,213 4,034 ,000 H

1

accepted

p

rice.perception ,208 4,083 ,000 H

2

accepted

risk.perception ,308 5,663 ,000 H

3

accepted

Based on the output above, the following results

are obtained:

Y = 5.548 + 0.213 X1 + 0.208 X2 +0.308 X3 + e

Based on the regression equation above, the

interpretation of the coefficients of each variable is as

follows:

a. a = The constant of 5.548 states that if the ewom

variable (X

1

), the price perception variable

(X

2

), and the risk perception variable (X

3

) are

considered constant, the purchase intention of

consumers of kahf care products will increase.

b. b1 = 0.213, the ewom regression coefficient (X

1

)

is 0.213, which means that if price perception

(X

2

) and risk perception (X

3

) are constant,

then the increase in ewom results in an

increase in the purchase intention of

consumers for kahf care products by 0.213.

c. b2 = 0.208, the regression coefficient of price

perception (X

2

) 0.208, which means that if

ewom (X

1

) and risk perception (X

3

) are

constant, then an increase in price perception

will result in an increase in the purchase

intention of consumers for kahf care products

by 0.208.

d. b3 = 0.308, the regression coefficient of risk

perception (X

3

), ewom (X

1

) and price

perception (X

2

) are constant, then with the

affordability of risk perception, the purchase

intention of consumers of kahf care products

increases by 0.308.

4.1 F Test

Table 6: F test Results

Sum of

S

q

uares

Df F Sig.

Regression 168,105 38,719 ,000b

Residual 138,935

Total 307,040

From the calculation results, the Fcount value is

38.719, this figure means that Fcount is greater than

Ftable so that the three independent variables

significantly affect the purchase intention of

consumers of kahf care products simultaneously. This

proves that "ewom, price perception, and risk

perception have a significant effect on purchase

intention”.

4.2 𝐑

𝟐

Test (coefficient of

determination)

Table 7: R2 test Results.

R Square

Adjusted R

Square

,548 ,533

From the calculation results, the adjusted coefficient

of determination (R2) is 0.533 and the coefficient of

determination (R2) is 0.548, this means that the

independent variables in the model (Ewom, Price

Perception and Risk Perception) explain variations in

the Purchase Intention of consumers of kahf care

products of 54.8 % and 45.2% are explained by other

factors or variables outside the model.

ICOSOP 2022 - International Conference on Social and Political Development 4

50

4.3 The Effect of EWOM on Purchase

Intention

Ewom is a positive or negative statement made by

potential, actual, former customers about a product or

company that is available to most people and

institutions via the internet. Some of the advantages

that the internet has, especially in terms of efficiency,

are able to change the way of selling and buying

(Nofri & Hafifah, 2018). One of the phenomena that

occurs today is that consumers use online media in

their shopping activities. Online media users can

easily participate, share, and create content about

products through social media.

Social media has strong content power as a

consumer reference in getting information about a

product. The power of content and conversations that

occur on social media drives many companies to use

it as their communication and marketing tool, so

producers need to understand consumer behavior

towards products on the market. Furthermore, it is

necessary to do various ways to make consumers

interested in the products produced. Social media

creates a positive response through internet reviews

so that this can be one of the factors that influence

buying interest. Research conducted by Dwi et al.

(2015) states that ewom has a positive effect on

consumer buying interest. Another study conducted

by Bataineh (2015) also revealed that ewom had a

positive and significant effect on consumers' purchase

intentions.

4.4 The Effect of Price on Purchase

Intention

Price is the exchange rate of goods or services and

various other benefits related to goods or services

(Sutojo, 1983). Price is one of the determining factors

in brand selection related to consumer buying

decisions. Swastha (1994) defines price as the amount

of money (plus some products) required to obtain a

number of combinations of products and services.

When choosing among existing brands, consumers

will evaluate prices in absolute terms but by

comparing several price standards as a reference for

making purchases.

Price is a determining part of the selection of a

product that will affect the purchase intention. If a

product requires consumers to incur costs that are

greater than the benefits received, then what happens

is that the product has a negative value. Otherwise, If

consumers perceive that the benefits received are

greater, then what happens is that the product has a

positive value.

The results of research conducted by Lutfiani

(2016) which show the results of research that price

perception has a positive and significant effect on

purchase intention of a product and Khairul Amal &

Hafasnuddin (2017) also show the results of research

that price perception has a positive and significant

effect on purchase intention. This is confirmed by the

results of research conducted by Natalia with the title

"Analysis of Perception Factors Affecting Consumer

Interest to Shop at Giant Hypermarket Bekasi" shows

that price has an effect on purchase intention.

4.5 The Effect of Risk on Purchase

Intention

When consumers cannot predict the outcome of a

purchase and feel uncertain, the perceived risk is in

their decision-making process in the decision-making

process (McKnight et al., 2002). The results of

research by Jono Mintarto Munandar et al., (2016)

show that risk perception does not have a significant

effect on purchase intention. These findings are

different from the findings of Arslan et al., (2013) and

Liljander et al., (2009) which state that risk

perception affects consumer buying interest.

Ristiyani and John (2005:81) state that the perceived

risk is the risk that affects consumer behavior.

Research conducted by Zhu et al., (2011) found that

empirical research supports the observation that the

risk of consumers being perceived as negatively

affects their attitudes towards certain websites and

towards purchase intentions.

5 CONCLUSION

Based on the results of data analysis and discussion,

it was concluded that the results showed that ewom

had an effect on Purchase Intention of kahf care

products. Price Perception has an effect on Purchase

Intention of kahf care products. Risk Perception has

an effect on Purchase Intention of kahf care products.

REFERENCES

Aaker, David. 1991. Managing Brand Equity;Capitalizing

on the Value of Brand Name, Free Press, New York.

Arslan Y., Gecti F., Zengin H. 2013. Examining peceived

risk and its influence on attitudes: a study on private

label consumers in Turkey. Asian Social Science 9,

158-166.

Bataineh, A. Q. 2015. The Impact of Perceived e-WOM on

Purchase Intention: The Mediating Role of Corporate

The Effect of EWOM, Price Perception and Risk Perception on Purchase Intention: Study on Users of Kahf Care Products

51

Image. International Journal of Marketing Studies.,

7(1), 126–136.

Bauer, R. A. 1960, "Consumer Behavior as Risk Taking",

in R. S. Hancock (ed.), Dynamic.

Durianto, D., Sugiarto, Anton, dan S, Hendrawan. 2003.

Invasi Pasar Dengan Iklan Yang Efektif. Jakarta:

Gramedia Pustaka Indonesia.

Dursun, I.; Kabadayi, E.T.; Alan, A.K.; and Sezen, B. 2011.

Store Brand Purchase Intention: Effects of Risk,

Quality, Familiarity and Store Brand Shelf Space.

Procedia Social and Behavioral Sciences, 24:1190-

1200.

Dwi, P., Horanata, R., & Pradana, D. 2015. Electronic

Word Of mouth (E-WOM) Kepuasan Konsumen dan

Pengaruh Langsung dan Tak Langsung Terhadap Minat

Beli Konsumen (Studi Pada Mahasiswa FEB UNTAG

di Semarang). Jurnal Administrasi Bisnis, 1(1), 1–20.

Ferdinand, Augusty. 2002. Pengembangan Minat Beli

Merek Ekstensi. Semarang: Badan Penerbit Universitas

Diponegoro.

Goyette, I., Ricard L., Bergeron J., and Francois Marticotte.

2010. “e-WOM Scale: Word of Mouth Measurement

Scale for e-Services Context”. Canadian Journal of

Administrative Science, 27(1) pp. 5-23.

Hennig-Thurau, T.e. 2004. Electronic Rord-of-Mouth Via

Consumer Opinion Platforms. What Motivates

Consumer to Articulate Themeselves on The Internet.

Wiley InterScience.15.

Hermann, et al. 2007, The Social Influence of Brand

Community: Evidence from Europian Car Clubs,

Jurnal of Marketing, Vol.69, p 19-34.

Hoyer, W., MacInnis, D., & Pieters, R. 2013. Consumer

behavior 6th ed. United States of America: South-

Western Cengage Learning.

Kusdyah, Ike. 2012, Persepsi Harga, Persepsi Merek,

Persepsi Nilai dan Keinginan Pembelian Ulang Jasa

Clinic Kesehatan (Studi Kasus Erha Clinic Surabaya),

Jurnal Manajemen Pemasaran, Vol. 7, No. 1, April

2012.

Kotler,Phillip dan Kevin Keller. 2009. Manajemen

Pemasaran. Edisi Ke Tiga Belas. Dialihbahasakan oleh

Bob Sabran. Jakarta: Erlangga.

Lee, S. dan A. Illia dan A. Lawson-Body, 2011, Perceived

Price Fairness of Dynamic Pricing., Industrial

Management and Data Systems, 111(4): 531-550.

Naiyi, YE. 2004. “Dimensions of Consumer’s Perceived

Risk in Online Shopping”. Journal of Electronic

Science and Technology of China. 2 (3): 177-182.

Nofri, O., & Hafifah, A. 2018. Analisis Perilaku Konsumen

dalam Melakukan Online Shopping di Kota Makassar.

Jurnal Manajemen, Ide, Inspirasi (MINDS), 5(1), 113–

132.

Schiffman, L.G. and Kanuk, L.L. 2000, Consumer

Behavior, 7th ed., Prentice Hall, New York, NY, pp. 15-

36.

Schiffman, Leon dan Leslie L. Kanuk. 2007. Perilaku

Konsumen Edisi ketujuh. Jakarta: PT Indeks.

Sutojo, Siswanto. 1983. Kerangka Dasar Manajemen

Pemasaran

. Jakarta: Percetakan Sapdodadi.

Swastha, Basu. 1994. Asas-asas Marketing. Yogyakarta:

Liberty.

Swastha, Basu dan Irawan. 2001. Manajemen Pemasaran

Modern. 2 ed. Yogyakarta: Liberty.

Toncar, M. F., Alon I., Misati E, 2010, The Importance of

Meeting Price Expectations, Journal of Product and

Brand Management, Vol. 19 Iss: 4 pp. 295-305.

Wen, Ling-yu. and Li, Sang-Hui. 2013. A Study On the

Relationship Amidst Health Consciousness, Ecological

Affect, And Purchase Intention Of Green Production.

5(4), pp. 124-137.

Zhu D. S. Lee Z. C. (Rick), Gwendolyn S. O. 2011. Mr.

Risk! Please Trust Me: Trust Antecedents that Increase

Online Consumer Purchase Intention. Journal of

Internet Banking and Commerce. December 2011, Vol.

16, No.3. pp. 1-23.

ICOSOP 2022 - International Conference on Social and Political Development 4

52