Taxation of Motor Transport as a Tool for Environmental

Management

I. V. Eremina

Ural State University of Railway Transport, Yekaterinburg, Russian Federation

Keywords: Sustainable development, road transport, transport tax, excise taxes, environmental taxation, environmental

management, state budget, greening, Euro standards, European Union.

Abstract: The negative consequences of the anthropogenic load exerted by humanity on the natural environment make

it increasingly think about the need to further progress towards sustainable development, one of the

components of which is environmental safety. The paper studies the negative impact of road transport on the

environment. The analysis of the existing methodology of taxation of motor transport has shown that it does

not meet the needs of mankind in its greening. Currently, Russia and European countries apply Euro

environmental standards, but so far there are no tools that would encourage a car owner to improve his vehicle

in order to comply with these standards. The paper proves that such tools can be: Firstly, amendments to the

existing tax legislation: the rate of transport tax should depend not only on the engine power, but also on the

ecological class of the car; excise taxes on fuel should depend on its type (the lower the environmental safety

of fuel, the higher the amount of tax). Secondly, the introduction of a new payment – an environmental fee,

depending on the design of the car engine. The paper attempts to identify the problems of ecologization of

motor transport and suggests ways to solve them by changing tax legislation. However, it cannot be a "point"

in solving these problems and requires additional research.

The paper attempts to identify the problems of

ecologization of motor transport and suggests ways to solve them by changing tax legislation. However, it

cannot be a "point" in solving these problems and requires additional research.

1 INTRODUCTION

Relevance of the research topic. Since January 1,

2003, Chapter 28 of the Tax Code (hereinafter

referred to as the Tax Code of the Russian Federation)

"Transport Tax" has been in effect on the territory of

the Russian Federation. At that time, a methodology

for calculating this tax was developed and is still valid

in this form today.

Conversations about the need to transform this tax

in accordance with the needs of the modern world

have been going on for a long time, in this paper an

attempt is made to identify the need for

environmental safety of society's development.

Therefore, modern trends in the advancement of

world civilization along the path of sustainable

development indicate the problem of its greening.

Road transport is the largest polluter of the

environment. As part of this, the paper considers the

following options for setting a fee for such a negative

impact, proposed by researchers today:

− change of excise taxes;

− introduction by environmental dues.

That is, the first option is aimed at reorganizing

the toll for the use of the road surface, and the second

is to establish a fee for environmental pollution. But

the needs of modern society are to develop payments

that fulfill both of these roles.

The degree of study and elaboration of the

problem. Based on the above, the problem of this

study can be described as the search for ways to create

such a payment to the state budget that would perform

the functions of a transport tax taking into account the

environmental needs of society.

A large number of scientists are engaged in each

of these issues.

Thus, the problem of the need to ecologize the

development of modern civilization is outlined in the

works of Professor D. Forrester "World Dynamics",

D. Meadows "Limits of Growth" (1972), as well as

M. Mesarovich and E. Pestel "Mankind at the Turning

Point" (1974), as well as other reports by teams of

scientists commissioned by an international non-

governmental organization - the Club of Rome. In

Eremina, I.

Taxation of Motor Transport as a Tool for Environmental Management.

DOI: 10.5220/0011584500003527

In Proceedings of the 1st International Scientific and Practical Conference on Transport: Logistics, Construction, Maintenance, Management (TLC2M 2022), pages 319-323

ISBN: 978-989-758-606-4

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

319

their works, these scientists tell the world community

about the global problems of human development,

and also prove the possibility of an environmental

crisis and a global catastrophe. All this certainly

points to the need for environmental protection.

These studies have proved to humanity that it is

necessary to revise its development strategy, and to

do it as soon as possible in order to bring it into line

with the concept of sustainable development. This

indicates that humanity needs to agree on common

directions, which all States and each individual

should clearly adhere to. At the international level,

the following steps have been taken in this direction

(Manokhina (Eremina), 2006):

1. 1992 – UN Conference in Rio de Janeiro;

2. 2008-2012 – Kyoto Protocol;

3. 12.12.2015 – Paris Agreement.

The largest polluter of the environment is road

transport. Currently, the relationship "state – road

transport" is regulated by the transport tax. But today

it does not take into account the ecological class of

the car, that is, the amount and composition of its

exhaust gases.

The goal of the research is to study the problems

of practical implementation of the norms of Euro

environmental standards for road transport and the

development of scientific and methodological

foundations of the relationship "state - road

transport".

The information base of the research consists of

international and Russian regulatory and legal

documentation, materials of the Federal State

Statistics Service, periodical press materials,

materials of Internet sites, scientific conferences,

seminars on taxation and environmental safety, as

well as the author's own knowledge and research.

Scientific novelty of the study:

The necessity of creating tax instruments that

perform the functions of payment for the use of roads

and payment for environmental pollution, the

establishment of which will contribute to the greening

of road transport in accordance with the Euro

standard, is indicated.

2 MATERIALS AND METHODS

The research uses materials presented in scientific

publications on the problem of regulatory regulation

of taxation processes and greening of modern society,

in the data of state statistics. So, the following

sources served as the research materials:

− regulatory documents on taxation and issues of

sustainable development of the company;

− scientific developments of scientists presented

in books and articles;

− scientific and methodological literature on

taxation and ecologization of the development

of civilization;

− mechanisms of ecologization of modern

society developed by scientists;

− statistical material;

− the author's own experience in developing a

mechanism for allocating quotas for CO2

emissions.

The following research methods were used:

1. Empirical methods:

− description – collected statistical material on

the motorization of our country;

− comparison – a study of the growth in the

number of cars since 1970 has been conducted;

2. Theoretical methods:

− analysis of the dynamics of motorization of the

Russian Federation for 1970-2019;

− generalization of the results obtained;

− the hypothesis that the proposed event will

contribute to the improvement of transport

taxation from the perspective of sustainable

development of civilization and Russia's

compliance with the provisions of the Euro

standard, because road transport causes

significant harm to the environment, mainly the

atmosphere, by products of combustion of

petroleum products (exhaust gases).

The provisions of Chapter 28 of the Tax Code of

the Russian Federation indicate that vehicles,

motorcycles, scooters, buses and other self-propelled

vehicles and mechanisms on pneumatic and tracked

vehicles, airplanes, helicopters, motor ships, yachts,

sailing vessels, boats, snowmobiles, motor sleds,

motorboats, jet skis, non-self-propelled (towed

vessels) are recognized as the object of taxation as a

transport tax and other water and air vehicles

(hereinafter referred to in this chapter as vehicles)

registered in accordance with the established

procedure in accordance with the legislation of the

Russian Federation". (Granberg, 2002)

In accordance with the Tax Code of the Russian

Federation, tax rates are set by the laws of the

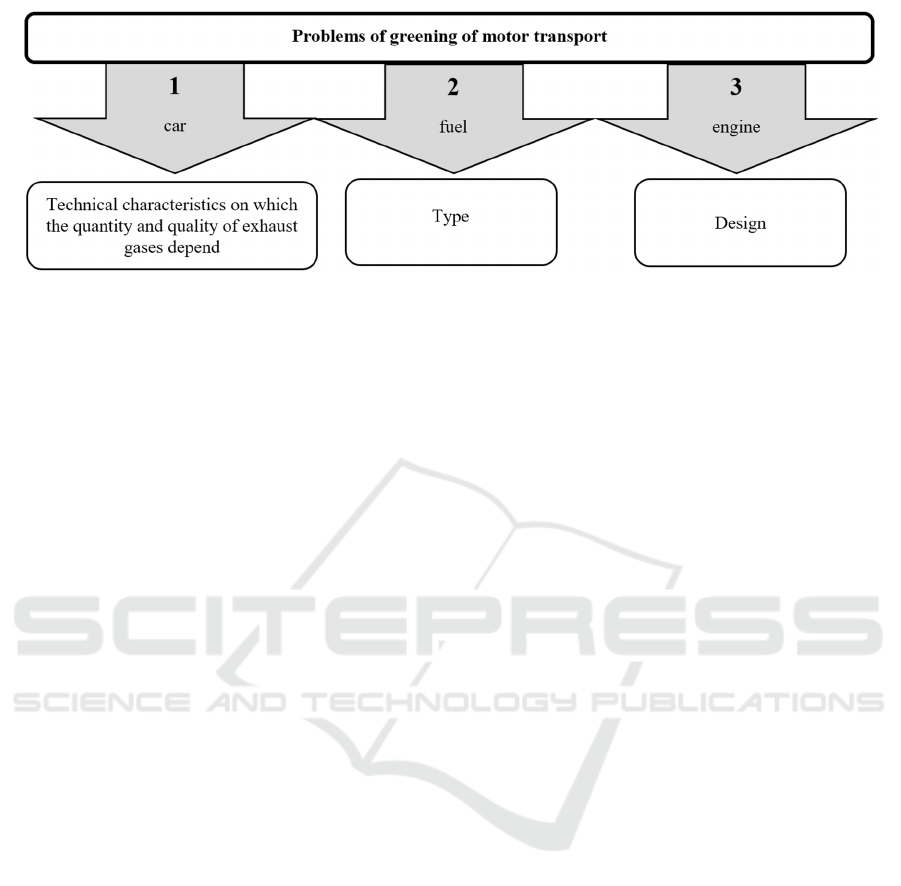

constituent entities of the Russian Federation,

depending on the indicators shown in Fig.1.

As can be seen in Fig.1, the amount of the

transport tax currently does not depend on the

ecological class of the car, and this, as you know, is a

kind of classification code that determines the level

of emissions of pollutants by the engine.

But today one of the main problems of mankind

is the containment of the processes of global climate

TLC2M 2022 - INTERNATIONAL SCIENTIFIC AND PRACTICAL CONFERENCE TLC2M TRANSPORT: LOGISTICS,

CONSTRUCTION, MAINTENANCE, MANAGEMENT

320

change. Many researchers believe that this is

primarily due to the continuously increasing

anthropogenic load on the natural environment. This

fact can be attributed to one of the main problems of

humanity today, since these changes not only hinder

the movement of modern civilization along the path

of sustainable development, but also seriously

threaten its very existence on Earth. That is why, in

modern conditions, humanity needs to solve a set of

tasks related to curbing the processes of climate

change (Manokhina (Eremina), 2006; Federal Law

No. 117-FZ, 2000).

One of these tasks is to reduce the amount of

exhaust gases from cars. It is known that the number

of cars on the roads is constantly increasing, which is

confirmed by official statistics (see Table 1).

So, as can be seen from Table 1, there was a steady

increase in the number of cars in our country until

2019 (before the COVID-19 pandemic) (after a

significant increase in the 70s of last year). At the end

of 2019, their number was more than 5 times higher

than in 1990. At the same time, on the one hand, each

car is a consumer of oxygen (its processed products

are released into the air: carbon monoxide, carbons,

nitrogen oxides), on the other hand, the atmosphere is

also destroyed by evaporation from fuel (CO–carbon

monoxide, NO-nitrogen oxide, hydrocarbons, solids

of small fractions).

But, as mentioned above, the level of adverse

impact of road transport on the natural environment

depends not only on the number of cars, but also on

their ecological class and the type of fuel used. The

main standard of the ecological class of the car is the

euro standard. We present an evolutionary study of

this standard in Table 2, compiled by the author on

the basis of information from RIA Novosti and open

source data.

Since the entire world community continuously

conducts scientific research in the field of greening

the activities of modern civilization, the opinion

about the environmental safety of road transport is

constantly being transformed. Thus, in most EU

countries at the end of the last century, diesel cars

were considered the optimal solution in the context of

sustainable development of civilization from the

point of view of its greening and their use was

stimulated by economic levers in the field of taxation

(Ponomarev, 2019). As a result, in the EU countries,

the share of diesel cars in their total number exceeded

50%. New scientific knowledge provoked the

emergence of new standards: Euro-4, Euro-5 and

Euro-6. These standards severely restrict the use of

diesel engines. The situation is complicated by the

fact that along with passenger diesel cars, the use of

which can be quite easily limited by financial and

economic levers, large-capacity trucks, heavy special

equipment, agricultural machinery are widely used in

the modern world. And there is no replacement for

these groups of diesel cars yet.

3 RESULTS AND DISCUSSION

As the conducted research has shown, the number of

cars is constantly increasing in modern Russia, which,

of course, increases the volume of emissions of

"exhaust gases" that have a negative impact on the

environment, as a result of which environmental

safety on the path of sustainable development of

modern civilization decreases. At the same time, our

country must adhere to the Euro environmental

standards, which steadily reduce the permitted

amount of these emissions. This corresponds to the

concept of Federal Law No. 7-FZ of 10.01.2002 "On

Figure 1: Indicators for setting transport tax rates.

Taxation of Motor Transport as a Tool for Environmental Management

321

Environmental Protection" (Federal Law No. 7-FZ,

2002), which defines the foundations of the legal state

policy in the field of environmental protection,

allowing to solve socio-economic problems, to

preserve a favorable environment for the life and

activities of the population of the Russian Federation.

According to this document, atmospheric air is one of

the objects of environmental protection. The Euro

standard regulates exhaust emissions by motor

transport. That is, within the framework of achieving

the goal of this study, three ways can be proposed, as

shown in Fig. 2 (Iadrennikova, 2018; Iadrennikova,

2018):

To solve these problems, the following ways can

be proposed, respectively:

1. it is necessary to organize serious control over

the level of exhaust gases;

2. transition to environmentally friendly fuels;

3. allow only cars with engines of a new design to

be used, which significantly reduce the

harmfulness of emissions without replacing

fuel.

The implementation of these ways is possible, in

our opinion, through amendments to the tax

legislation.

Firstly, the transport tax rate should depend not

only on the engine power, but also on the ecological

class of the car (Bolataeva, 2019);

Secondly, the existing excise taxes need to be

amended:

− excise taxes on cars – it is necessary to take into

account not only the engine power, but also

environmental characteristics;

− excise taxes on fuel should depend on its type.

Euro standards regulate only gasoline and

diesel fuel. Currently, alternative fuels exist,

but their production is more expensive than

gasoline, which leads to a higher price. It is

possible to stimulate the transition to these

types of fuels by excise taxes and the

Table 1: Analysis of the motorization of Russia for 1970-2019.

1

Years Number of cars Growth in %

Per 1000 people, pcs. Total in Russia,

million pcs.

By previous year By 1990

1970 5,5 0,7 100,0

1980 30,2 4,2 600,0

1990 58,5 8,6 204,8 100,0

1995 92,3 13,7 159,3 159,3

2000 130,5 19,2 140,1 223,3

2001 137,2 20,1 104,7 233,7

2002 145,8 21,2 105,5 246,5

2003 153,2 22,2 104,7 258,1

2004 159,3 23,0 103,6 267,4

2005 169,0 24,3 105,7 282,6

2006 177,8 25,5 104,9 296,5

2007 195,4 27,9 109,4 324,4

2008 213,5 30,5 109,3 354,7

2009 220,8 31,5 103,3 366,3

2010 228,3 32,6 103,5 379,1

2011 242,0 34,6 106,1 402,3

2012 257,5 36,8 106,4 427,9

2013 273,1 39,1 106,3 454,7

2014 283,3 40,7 104,1 473,3

2015 288,8 42,2 103,7 490,7

2016 293,8 43,0 101,9 500,0

2017 305,0 44,8 104,2 520,9

2018 309,1 45,4 101,3 527,9

2019 315,5 46,3 102,0 538,4

1

Sources:

1. https: ruxpert.ru//Statistics: Motorization of Russia.

2. author's own calculations.

Note:

1990 is the base year, relative to which the effect of carrying out measures for the greening of modern civilization is

estimated (according to international legislation);

2019 is the last

y

ear of statistical information available to date.

TLC2M 2022 - INTERNATIONAL SCIENTIFIC AND PRACTICAL CONFERENCE TLC2M TRANSPORT: LOGISTICS,

CONSTRUCTION, MAINTENANCE, MANAGEMENT

322

introduction of an environmental fee. The use

of alternative fuels should not only reduce the

harm caused to the environment, but also

reduce the cost of operating equipment, save

valuable raw materials for the chemical

industry, and in some cases solve the problem

of waste disposal. (Polskaya, 2017);

Thirdly, to establish an environmental fee,

depending on the type of fuel and the design of the

car engine, which should allow motorists to choose:

either use more environmentally friendly fuels, or use

cars with engines of a new design.

4 CONCLUSIONS

The necessity of greening road transport is dictated

by the concept of advancing civilization along the

path of sustainable development and is indicated by

the Euro environmental standards (Samkov, 2021).

At the same time, the studies presented above

have shown that, despite the enormous importance of

this problem for the further development of Russia

along the path of sustainable development (as

required by the international community), a strategy

for managing emissions into the atmosphere,

including by road, has not yet been developed in our

country.

The paper attempts to solve the problems of

ecologization of motor transport and suggests ways to

solve them by changing tax legislation. However, it

cannot be a "point" in solving these problems and

requires additional research.

REFERENCES

Manokhina (Eremina), I. V., 2006. Formation of the

mechanism of the interregional market of carbon

dioxide emission quotas. Dissertation for the degree of

Candidate of Economic Sciences. Yekaterinburg.

Granberg, A. G., Danilov-Danilyan, V. I., Tsikanov, M. M.,

Shokhoev, E. S., 2002. Strategy and problems of

sustainable development of Russia in the XXI century.

413. p. 29.

Tax Code of the Russian Federation Part 2, approved by

Federal Law No. 117-FZ of August 5, 2000.

www.consultant.ru.

Ponomarev, A. I., Toporov, I. V., 2019. Economic and tax

potential of the tax system of the Russian Federation.

Science and education: economy and economics;

entrepreneurship; law and management. 1 (56). pp. 47-

51.

Federal Law No. 7-FZ of 10.01.2002 "On Environmental

Protection". www.consultant.ru.

Iadrennikova, E., 2018. Improvements to motor fuel

taxation in Russia as impetus for sustainable

development of cities. International Conference on

Sustainable Cities (ICSC 2018). 177. 012023.

Iadrennikova, E., 2018. Comparative analysis of and ways

of improving motor fuel taxes in Russia and the

European Union. 32th International Business

Information Management Association Conference -

Vision 2020: Sustainable Economic development,

Innovation Management, and Global Growth, IBIMA

2018. pp. 2339-2348.

Bolataeva, A. A., 2019. The tax system of the Russian

Federation: current problems and ways to improve the

modern tax system. Scientific News. 6. pp. 41-45.

Polskaya, G. A., 2017. Theoretical aspects of tax system

management at the present stage. Tauride Scientific

Observer. 11-2 (28). pp. 16-20.

Samkov, K. N., 2021. Financing the implementation of

national and regional projects: problems and directions

of sustainable development. Finance: theory and

practice. 25(4). pp. 24-36.

Figure 2: Problems of greening of motor transport.

Taxation of Motor Transport as a Tool for Environmental Management

323