Impact of Microcredits and their Relationship in Female

Entrepreneurship, Quevedo – Ecuador, 2021

Peña-Rivas Justa

1a

, Maldonado-López Sandra Betzabeth

1b

Garzozi-Pincay René Faruk

1c

,

Garzozi-Pincay Yamel Sofia

2d

and Nieto-Quinde John Alfredo

1e

1

Universidad Estatal Península de Santa Elena, La Libertad, Ecuador

2

Universidad Católica Santiago de Guayaquil, Ecuador

johnnietoquinde@gmail.com

Keywords: Microcredits, Women Entrepreneurs, Socioeconomic Development, Life Quality, Poverty Reduction.

Abstract: The purpose of this article is to analyse the impact that microcredits have on the economic activity of the

entrepreneurial population who need to improve their life quality and reduce poverty in Quevedo, Los Ríos

province. It is known that microcredits, potential creditors of financial resources to improve the

socioeconomic situation of families; usually, these are granted to people from middle and lower social strata

who seek to rely on the perspective of entrepreneurs or independents. This study was carried out through an

exploratory-descriptive investigation, in which surveys were applied to the economically active female

population, with micro-business activities. As a result, it was obtained that 66.48% of the women

entrepreneurs of Quevedo stated that the microcredits received from public and private banks, influenced the

improvement of the life quality and the poverty reduction in their homes, and driven in turn to the

socioeconomic development of families throughout the canton.

1 INTRODUCTION

Microcredit is a term which has gained popularity in

last two decades in fields range from academic,

economic, to media, since it refers to financial

services provision to people or groups whose access

to traditional banking systems is limited or non-

existent by virtue of their economic condition; This

financial service is usually given as investment

mechanisms, savings, or monetary loans (Arce,

2006). The microcredit concept or also called

microfinance is usually defined under tautological

and economistic forms as “personal loan set

operations which a financial institution grants as very

small loans and, generally, for short terms”

(Espinosa, 1998).

At global level, microfinance has gained

significant weight in various countries’ economies

since it can be understood as financial tool to develop

a

https://orcid.org/0000-0001-5049-502X

b

https://orcid.org/0000-0002-4617-1580

c

https://orcid.org/0000-0003-1779-9384

d

https://orcid.org/0000-0003-4708-6350

e

https://orcid.org/0000-0003-0292-5325

a business or entrepreneurship idea aimed at

improving quality of life and reducing population’s

poverty (family) or medium-low social stratum, who

do not have economic resources enough to live with

dignity (Rodríguez-Garcés, 2008), since these people

do not have real guarantees, and they are not subject

to get credit by traditional financial institutions due to

high risk involved (Samaniego-Namicela, 2014).

In Latin America, microcredit promotion is

recorded in relation to microfinance institutions’

appearance specialized in promoting small

businesses, non-governmental organizations, and

entrepreneurship (Cepal, 2002); the two last ones are

considered representative Latin American’s and

Caribbean region for socioeconomic development

due to their contribution to increased production and

employment (Cuasquer & Maldonado, 2011). In the

Global Entrepreneurship Monitor’s reports GEM

2017, Ecuador, Colombia, El Salvador, México, and

Justa, P., Sandra Betzabeth, M., René Faruk, G., Yamel Sofia, G. and John Alfredo, N.

Impact of Microcredits and their Relationship in Female Entrepreneurship, Quevedo – Ecuador, 2021.

DOI: 10.5220/0011601200003581

In Proceedings of the 2nd International Conference on Finance, Information Technology and Management (ICFITM 2022), pages 5-13

ISBN: 978-989-758-628-6

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

5

Paraguay were highlighted as the highest rate

entrepreneurship countries carried out by medium-

low social stratum population who seek family

socioeconomic improvement; these being focal point

for financial entities, especially savings and credit

cooperatives that grant microcredits.

In Ecuador, microcredit was born in 1879,

through the "Sociedad de Artesanos Amantes del

Progreso" (Jácome & Cordobés, 2003), obtaining a

reduced impact due to credit limited amount.

Currently, this financial product is the most required

by country’s entrepreneurial population since it

finances small-scale production, marketing and

service activities, whose main payment source in

sales results or income generated by said activities,

appropriately verified by financial institution or

lender (Cuasquer & Maldonado, 2011).

Despite the fact that entrepreneurship and new

businesses have a greater weight in the economic

growth of the region, the vast majority of small

business establishments in the so-called informal

economy do not have regular access to the

conventional credit mechanisms offered by the

formal financial system. , even though it is necessary

to recognize that significant progress has been made

in promoting new options that allow resources to be

channelled to a growing number of small and micro-

enterprises that, however, mostly meet the

requirements demanded by banks to be considered as

formal companies and at the same time as credit

subjects for financial entities (Chacaltana, 2004;

Aristizábal-Velásquez, 2007).

Whereas family socioeconomic development is

identified as unstable due to inequity in resources’

distribution and middle-low social’s impoverishment,

composed of mostly economically active men and

women; Despite this weak situation, population’s

persistence to reduce the poverty level in family

economy, notably enterprises as a livelihood and life

quality improvement, giving to nation the mention as

one of the countries with higher annual undertakings

level. Although these ventures are carried out by both

men and women in several industry areas, it is worth

noting that female population’s incorporations in

market through business ideas has propitiated

microcredits appearance and offers in grate

magnitude by various financial institutions.

Under this perspective, in Los Rios province,

specifically in Quevedo city, controversy has been

generated regarding the microcredits offered to the

entrepreneurial population, who through new

business ideas seek to improve the family economic

situation and reduce of poverty in sector. It is known

that this financial result over the years has been in

greater demand by male population, also known as

"household leaders", given its main development with

ventures related to livestock, agriculture, industries,

services, and tourism which require constant

monetary investment to remain in market.

In the same way, the female population has a large

participation in labour market with large significant

contributions to economy’s sector, standing out in

service and marketing sectors. Women’s

incorporation into labour market through

microcredits has meant entering a world defined and

built what already exists’ basis in creation,

transformation, and commercialization, to support

their families, they take household leader position or

complementary leader. It is useful to clarify that

women who join labour markets use microcredits and

they have a cultural dimension, considering that the

spaces where a battle takes place against women and

large companies, where they try to recognize

themselves as productive people and to prove it

socially, they engage in a "struggle" that is the

meaning of what their workforce is (Maldonado-

Lagunas, 2007).

This main article’s objective is to analyse

microcredits’ impact have on entrepreneurial

population economy activity that needs to improve

their life quality and reduce poverty in Quevedo city,

in Los Ríos province. From this initial

characterization, this study is structured in four

sections; in the first one recapitulates all microcredit

relationships in family socioeconomic situation about

both men and women entrepreneurs; Next, research's

general development is carried out, starting from

theoretical documentary to the results’ applications

data collection techniques. The third part develops

methodology applied to determine microcredits

impact on family economy, starting from

economically active female population; In fourth and

last section it is possible to appreciate the results’

discussion achieved on this ongoing topic. And

finally, the author’s research contributions are

described, towards these event’s possible extension

related to other variables.

2 LITERATURE REVIEW

Worldwide, small business establishments’ vast

majority in informal economy still do not have

regular access to the conventional credit mechanisms

offered by formal financial system, even though it is

useful to recognize that significant progress has been

made in promoting new options that allow resources

to be channeled to a growing number of small and

ICFITM 2022 - SECOND INTERNATIONAL CONFERENCE ON FINANCE, INFORMATION TECHNOLOGY AND MANAGEMENT

6

micro-enterprises that, however, mostly meet

requirements demanded by banks to be considered as

formal companies and at the same time as credit

subjects for financial entities.

In several world regions, especially in Ecuador, credit

has become one of the most requested mechanisms by

entrepreneurs when it comes to financing their

business initiatives or business ideas, since this

mechanism is not within reach for entire population

in a region or sector, especially because they are not

credit (Aristizábal-Velásquez, 2007). Whereas,

limited financial availability instruments suited to

enterprises and micro-enterprise's needs, leads them

to depend a lot on their own resources and on

another's financing suppliers, both for business and

expansion projects or creation current operation. The

financing problem is bigger when it comes to the

creation of new business projects. Some

consequences of this lack of financing are low

production scales and technological backwardness

(Llistery & Angelelli, 2002).

In Latin America, microenterprises employ more than

half of the economically active population, whose

participation in national production usually varies by

up to 50% depending on corresponding country, since

it is this population that generates growing interest in

their development as a way of reducing poverty,

generate jobs, and contribute to families’

socioeconomic well-being, as an alternative to

stimulate the entrepreneurial spirit. Therefore, within

finance market, a financial product is offered, which

is intended for this population to encourage them to

develop business ideas and turn them into ventures

that serve as an effective means of reducing negative

aspects in the economy.

2.1 The Microcredit Development in

Ecuador

In the last fifteen years, microcredits or also called

microfinance have presented an explosive growth in

Ecuador; Not only has there been an increase in

money funds aimed at microfinance, but also a

change in focus, which is no longer focused on credit,

but rather on financial service provision in its broad

spectrum, from capturing savings, payment

instruments, sending and receiving remittances,

insurance and risk management, to non-financial

services such as health insurance, mortuary services

and others.

However, it should be mentioned that this process

is still expanding, through specific products’ design

according to microentrepreneurs. Institutions that

have dedicated themselves to providing microcredit

services in Ecuador discovered a huge development

potential niche with an excellent payment culture and

facing possibility in high interest rates, since the

alternative of borrowing in the informal market is still

much more onerous. The microcredits strengthening

must be understood as the increase in access to

financial services by the population with lowest

resources; In this way, microfinance stands out as a

promising and cost-effective tool to fight poverty

(Carvajal et al, 2006).

2.2 Microcredit as a Strategic Tool to

Reduce Poverty

The term poverty definition has been elaborated and

has been measured based on deficiencies or

unsatisfied basic needs, in which indicators have been

used such as the intake food amount, income level, to

health services access, education and housing

(Arriagada, 2004). This approach assumes that well-

being is equivalent only to ability to satisfy physical

survival basic needs (usually food) and the ability —

measured— of the income generally obtained by

men, to choose between various “packages of

products” (Kabeer, 2003).

By including these three aspects, gender perspective

studies perspective have played an important role in

calling for recognition and confirmation that poverty

is a dynamic, multidimensional problem, closely

related to income and consumption indicators, and

that when the latter are scarce, the only thing that can

compensate for their limited presence is adequate

housing conditions, access to public services and

medical attention that family members group should

have, however this scenario is rarely fulfilled and

those who are severely affected are women and

children (Moser, 1996).

Micro-financing is based on assumption that poor

need access to productive capital to trigger it in

activities that allow them to overcome poverty

conditions; in them, self-employment and family

participation are generally required, and when they

are owned, efficient natural management resources is

necessary to guarantee economic self-sustainability

units (Garza-Bueno, 2005). Micro financing

contemplates, as an essential part, financial

institutions intervention’s low-income population’s

purpose of meeting the needs, this response strategy

became necessary due to systematic exclusion that

commercial banks made population in need. of these

financial services.

Impact of Microcredits and their Relationship in Female Entrepreneurship, Quevedo – Ecuador, 2021

7

2.3 Women Incorporation in the Labor

Markets and Its Relationship with

Microcredit

Women incorporation into labor market through

using microcredits has meant entering a world

defined and built by men, which can only function

way it does because it is rested, supported and reliant

on housework. However, it is necessary to clarify that

the labor markets - to which women are integrated to

use microcredits - have a cultural dimension, they are

spaces where great women and men takes battle place

who try to recognize themselves as productive people

and therefore demonstrate it socially, they engage in

a "struggle" that is the meaning of what their

workforce is (Maldonado-Lagunas, 2007).

Female population faces several obstacles that are

presented to them in each business activity phase;

Although men also experience some of these

obstacles, women face additional restrictions daily.

The restrictions and barriers that may have

greatest impact are the following:

Table 1: The barriers of microcredit in the female gender.

Self-esteem

problems

Sometimes women do not believe

they can have structuring

possibilities their action field in

family and social order of greater

entre

p

reneurshi

p

.

Social and cultural

order

Negative attitudes are presented

towards women affect their

performance in business since they

must fulfill other functions outside

b

usiness environment.

Occupational

Less chance is offered to pregnant

women in economic structure in

development terms on their

ca

p

abilities, the

y

ma

y

p

ossess.

Legal

Restrictions to which women are

subjected in independent judicial

action terms.

It can be observed most of the limitations that are

presented to female entrepreneurial population are

about sociocultural nature and this brings with it risky

changes in environment activities in which they

operate, which concerns self-education evaluation,

family, and social participation. Despite the

restrictions they manage to form their company and

choose to create small business ideas instead of

structuring medium or large companies, this in

relation to the disproportionate women entrepreneurs

who focus on these ideas.

Therefore, few women who manage to cope with

restrictive conditions that are presented to them,

manage to forge the entrepreneurial character, and

break cultural paradigms where a woman cannot

carry out the same activities as a man, denoting

herself in the business field.

2.4 Microcredit from the Perspective of

Female Entrepreneurship

Microcredits are known as small credit granting

programs to the most poor’s needy so, they can start

small businesses which generate income with which

they can improve their family’s living standard

(Flores, 2007). Granting credits to those most in need

is essential for country's economy since through this

an opportunity is given for women entrepreneurs to

establish their businesses and offer jobs to other

women and encourage them to grow as entrepreneurs

and follow the same steps as them. have been giving

and thus be able to destroy the restrictions that arise.

Microcredit is defined as: "it is any credit not

exceeding 20,000 American dollars to a loan whether

it is a company constituted as a natural or legal person

with an annual sales level of less than 100,000

American dollars, a self-employed worker, or a group

of borrowers with joint guarantee, intended to finance

small-scale production, marketing or service

activities, whose main payment source is sales

product or income generated by such activities,

properly verified by financial system institution

(Banco Central del Ecuador, 2015).

For most of the banks in Ecuador, microcredit

represents a fundamental income for each of its

institutions since they are the ones that are most

carried out in bank loans consequences since it is

observed that financial institutions offer loans for

ventures with an interest rate extremely reasonable

because of interest offered by bank loans. The poverty

situation in which the most disadvantaged are

trapped, makes them seem useless and without any

initiative, but this is not true. If these "disabled" are

provided with credit, they will use their innate

abilities to start a small business with which they can

increase their income level, they are true artists in

survival tasks (Lacalle & Garrido, 2008).

It is thought that poverty is mental since if one

thinks that he is poor he will stay that way for his

whole life, while others look for a way to get ahead

by overcoming obstacles that arise, is why the

financial institutions offer credits to these types of

people so that they can exploit their gifts and have a

smaller lifestyle and get ahead. To conclude,

microcredit is a tool to eradicate poverty in world

through equity in access to financial resources. These

are born as a response to the lack of people excluded

ICFITM 2022 - SECOND INTERNATIONAL CONFERENCE ON FINANCE, INFORMATION TECHNOLOGY AND MANAGEMENT

8

millions credit from formal financial systems around

the world.

The systems used to define microcredit are:

─ The subjects of the loan

─ Credit size

─ Methodology with which the loan is granted or

even funds use.

Given distinction of microcredit systems, its

fundamental objective is to combat poverty by

improving poor lifestyle in the world and to minimize

the exists gap in the resources' distribution through

microenterprises creation that are profitable and will

allow them to generate income to pay credits and

improve families living conditions.

2.5

In Ecuador there are the Following

Types of Microcredits

Retail microcredit. - is any loan whose value is less

than or equal to 1,000 American dollars, these are

offered to micro-entrepreneurs with annual income of

less than 10,000 American dollars. These

microcredits are to regenerate a microenterprise that

is already in operation and thus be able to grow in its

economic level by improving productions activities to

which they are dedicated.

Simple accumulation microcredit. - These loans

whose amount is greater than 3,000 American dollars

and up to 10,000 American dollars are granted to

entrepreneurs with an annual income or less than

10,000 American dollars sales level. These credits are

granted to create an extension of company and thus

be able to offer jobs and provide a better service or

product depending on company’s activity being

carried out, improving people living standard and

eradicating poverty in Ecuador.

Extended accumulation microcredit. – is any loan

whose amount is greater than 10,000 American

dollars with a level of sales or annual income greater

than 100,000 American dollars, these loans are

offered to self-employed workers or groups of

borrowers with a joint guarantee.

These credits are to create another company or

branch in other place in Ecuador, generating more

jobs in different places in Ecuador and increasing the

company's income by offering services or products,

improving its social and economic participation in the

country, reducing the percentage of poverty. in the

country.

3 METHODOLOGY

In methodological terms, the present study is

supported by bibliographical research, taking as a

fundamental reference research and scientific articles

spread around the world, especially in Latin

American countries that make use of financial

products such as microcredits, to carry out ventures

that serve as support to family economy and the

development of a region in general. In addition,

exploratory-descriptive research was implemented,

carried out through the "survey" data collection

applied to different financial institutions in the sector

(BanEcuador, Banco Finca, Banco D-Miro, Banco

Pichincha, Fundación Espoir, and economically

active women from the Quevedo city, Los Ríos

province, Ecuador. In addition, for results’ graphical

and numerical representation of the results obtained,

statistical models and programs were used, such as

Excel for descriptive statistics, and SPSS for

inferential statistics.

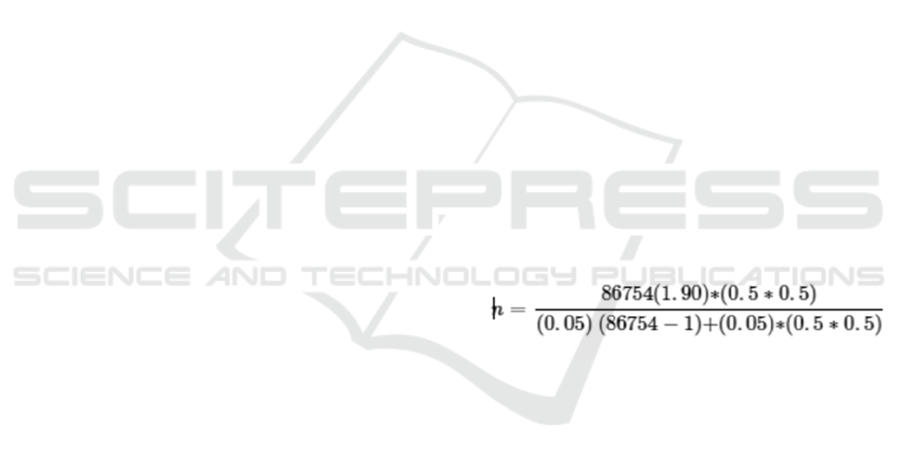

For the survey’s purpose, a simple random

probabilistic sample was carried out, taken from

Quevedo’s city population 173,575, of which 86,754

inhabitants are women and 86,821 are men, data

obtained from the Instituto Nacional de Estadísticas y

Censos (INEC, 2010); Applying Alan Wester's

formula, we worked with total female population with

a confidence level of 95%, as detailed below:

Where:

N = 86754 Women

Z = 95% confidence level

P = 50% acceptance Probability

Q = 50% non-acceptance Probability

e = 5% Error degree.

n = 361

With a sample of 361 women representatives of the

Early Entrepreneurial Activity (TEA), information

was collected to identify the microcredits impact of

and their relationship with the family economy, based

on women's participation perspective in the labour

market.

4 RESULTS

Microcredit is based on credit institution mutual trust

with the population without financial resources, their

Impact of Microcredits and their Relationship in Female Entrepreneurship, Quevedo – Ecuador, 2021

9

responsibility and participation (Rodríguez-Garcés,

2008). Studies on microcredit impact have

contributed to search for development and poverty

alleviation instruments ((Rodríguez-Garcés, 2008;

Flores, 2007). The international community and

several local projects have opted for microcredit as a

tool for poverty reduction, as it is reflected in access

to education and health by the poorest in Ecuador, as

well as equality of gender and the empowerment of

women, better economic and social conditions are

perceived according to recent reports (Banco Central

del Ecuador, 2015).

To determine microcredits impact and their

relationship with women entrepreneurs’ family’s

economy in Quevedo city, surveys implementation

was used that shows real situation, from women

perspective and different financial institutions in

sector. Regarding dynamism and micro-enterprise

predisposition, people surveyed were specifically

women who seek to increase their income, 40,17%

are dedicated to sale of clothing, followed by the sale

of groceries with 34.35%, finally, 25.48% work

independently being the main priority activities in the

investment of microcredits.

Table 2. Types of entrepreneurships.

Detail Surveyed Percentage

Clothing merchandising 145 40,17

Sale of groceries 124 34,35

They work dependent 92 25,48

Total 361 100

Figure 1: Entrepreneurship types (Green: Clothing

merchandising; Blue: groceries sales; Purple: Dependent

work).

In table 3, in relation to institutions by financial sector

preferred by microentrepreneurs, total surveyed

population, 59% stated that they received better

financial services in microcredit from public sector

institutions, and 41% received from private sector,

contributing partially to family economy.

Table 3: Financial sector.

Financial sectors Surveyed Percentage

Public 213 59

Private 148 41

Total 361 100

Additionally, it was evidenced that financial

institutions most welcomed by microentrepreneurs

was BanEcuador with 34.35% due to the established

5, 5, 5 credit policy (5.000 American dollars of

amount, 5% interest and 5 years term); other

outstanding institutions in reception terms are:

Fundación Espoir 18.84%, Banco Finca 16.07% and

Banco D-Miro with 15.51%., and the difference

represents other private sector institutions (Table 4).

Table 4: Financial Institutions.

Banking Institutions Surveyed Percentage

BanEcuador 124 34,35

Espoir Foundation 68 18,84

Finca 58 16,07

D-Miro 55 15,24

Others 56 15,51

Total 361 100

In table 5, these financial entities are managed under

a gender margin preference to grant microcredits,

given that according to respondents, 85.32% of these

are granted to entrepreneur’s characteristics women

with, due to responsibility they must comply with

payment obligations on dates established. Under this

characteristic, it is determined that microcredits use

has greater concurrence by economically active

female population, who seek to obtain monetary

capital at lower short-term interests, to carry out their

business ideas without permanent indebtedness.

Therefore, it is emphasized that surveyed population

said that 85% of women microentrepreneurs consider

that the interest set by microcredit financial

institutions is within an acceptable and accessible

range based on their economic activity; on the other

hand, 14.13% were considered high for the amount

granted.

Table 5: Labour activity.

Entrepreneurial Women Surveyed Percentage

Entrepreneurial Women 308 85,32

Housewives 53 14,68

Total 361 100

Under microcredit determination in gender terms and

interest, 65% of microentrepreneurs have allocated

money received as microcredits to their businesses,

ICFITM 2022 - SECOND INTERNATIONAL CONFERENCE ON FINANCE, INFORMATION TECHNOLOGY AND MANAGEMENT

10

investing in them, consolidating them in market and

increasing their income, and 35% consigned it to

general payments such as: food, housing

improvement, education, and health (Table 6).

Likewise, 66.48% of microentrepreneurs surveyed

consider that microcredits had an impact on the

family economy by improving life quality, while

33.52% contributed to poverty reduction in each

women entrepreneurs’ households, promoting

socioeconomic familied in the city.

Table 6: Destination of the microcredit.

Microentrepreneurs Surveyed Percentage

Investment 235 65

Consumption 126 35

Total 361 100

Research carried out allows us to determine

microcredits have encouraged different population

family strata economic development in Quevedo city,

78.01% of women population have received

microcredits, they consider that these have

encouraged all families development in Quevedo city,

in contrast to various authors’ investigation who

indicate that 60% of this financial product users are

less than $5,000 American dollars amounts creditors

with constantly purpose getting involved in credit

business sphere, favouring increase in credit unions

offer and to same demand. Likewise, individually,

63.87% of women microentrepreneurs expressed

total agreement that the microcredit has improved

their income and their family economic condition

(Lacalle & Garrido, 2008).

Within exhaustive analysis applied to interested

parties, city women’s strengths who seek to acquire a

microcredit are noteworthy, since they execute it

based on an idealization and entrepreneurial culture,

which makes them more attractive than men in credit

banking; Likewise, it is important to highlight that

characterize weaknesses, since most of them present

obstacles in their family nuclei terms, represented by

a high number of children and the limitations to their

educational training at all levels (Tormo & Navarro,

2012).

4.1 Microcredits Advantages in

Women Entrepreneurs’ Women's

Family Economy in Quevedo City

In microcredits impact terms on Quevedo’s city

enterprising female population family economy, the

stakeholders surveyed concluded that this financial

tool represents a means of reducing poverty levels

and improving the entire sectors’ life quality; Among

the most notable positive impacts are the following:

The setbacks of microcredits impact of on family

economy from the surveyed stakeholders’

perspective, is since this financial product manages to

provide benefits such as improving the life quality

and reducing poverty; however, they show discomfort

in codependency terms to be able to carry out an

enterprise; The most visible disadvantages are:

High interest rates items reduce women’s

entrepreneurs’ family progress in economy who are

microcredits creditors from several financial entities

in the city.

The amounts less than $5,000 dollars offer by

cooperatives and financial banks causes limitations in

business idea with ambitious short-term goals

development.

Amount recovery periods offered by financial

entities mean that in some of the nascent ventures

they are not successful in the market, since they are

limited to producing and marketing to pay off said

debts.

Another relevant disadvantage occurs in product

user population, since they occasionally allocate the

monetary value provided by financial entities to other

activities that have no relation to business type or

undertaking, for which it is difficult to be able to

make the correct loans repayment to the

corresponding entities.

5 CONCLUSIONS

To deepen nature and modalities by which Quevedo’s

city women entrepreneurs seek to improve life quality

and reduce poverty in sector, a phenomenon’s

breakdown has been developed to determine

microcredits impact on family economy

development.

These microcredits impact have had on women

entrepreneurs in terms of improving affected by

poverty population’s life expectancy. Generally, this

financial service within poverty context is directly

associated with self-employment development of,

family businesses and nascent enterprises based on

using natural resources for manufactured products,

thus emphasizing guaranteeing economic self-

sustainability; therefore, microcredit is a

socioeconomic seed growth by promoting new

production units’ creation, boosting financial

resources flow.

Regarding gender approach, it is identified that

there is a women predominance in microcredit access

to, which means that women have created a privileged

Impact of Microcredits and their Relationship in Female Entrepreneurship, Quevedo – Ecuador, 2021

11

position by overcoming paradigms about their

performance in labor market and their contributions

to family socioeconomic life and society in general.

Although men have always remained in labor market

playing the family main provider role, women have

managed to start in this context, supported by

financial products aimed at fostering new production

units and reducing poverty.

From this perspective, female microcredits

population benefiting indicates that these have

contributed to improve their families’ economy and

life quality, specifically covering housing, health,

education, food, and clothing; These improvements

are made through monthly income generated by

enterprises and businesses development that are

promoted by these financial products.

It is necessary to dissociate that the main strategy

of microfinance derives from the fact that the poor

need capital to implement it in activities that allow

them to overcome poverty levels. Because, through

the research in this article, the impact of microcredits

is identified not as a possibility of getting out of

poverty but as a lenitive in the family economy and in

the inequality experienced by the female population

who would use microcredits. Although the women

have managed to work for third parties by

establishing their enterprises in the mercantile and

commercial area, many of their projects are not self-

sustaining in the market, since the problems and

adaptations generated among those who make up the

domestic group to which they belong are not

considered. women belong.

Microcredits impact on Quevedo’s city female

population family economy, Los Ríos province -

Ecuador, has resulted in the strengthening of

specialized marketing businesses, mainly boosted by

microcredit banking and market opportunities

available, satisfied. In other words, users resort to

activities reproduction with which they have been

culturally associated, for example, making food and

domestic work, this does not mean that women do not

have knowledge or skills to carry out other types of

activities, but credit size does not allow viewing other

large-scale options in labor market.

Finally, it is concluded that female population

who have received microcredit from Quevedo city

financial institutions, the vast majority are identified

from the condition’s perspective such as common-

law marriage, number of children, housing place and

type, and poor availability basic services. Because,

managing under this subsistence condition, assuming

the operating independently idea in labor market

means flattering and with the help of microcredits

they obtain one of the fundamental tools such as

financing to run an enterprise adaptable to existing

needs, these will have predisposition to attenuate

poverty reduction and favor families involved

socioeconomic situation if it is managed efficiently.

That is why, thanks to women’s family economy

microcredits impact identification in the Quevedo

city, it gives a way to promote studies based on

microfinance and family microenterprise context in

the area, due to families’ influence in raising

businesses for life quality improvement.

REFERENCES

Arce, J. L. (2006). El sector de las microfinanzas en Costa

Rica: Evolución reciente y aporte al crecimiento y

desarrollo económicos., San José.

Aristizábal-Velásquez, R. E. (2007). El microcrédito como

alternativa de crecimiento en la economía colombiana.

Revista ciencias estratégicas, 15(17), 39-58.

Arriagada, I. (2004). Transformaciones sociales y

demográficas de las familias latinoamericanas. Papeles

de población, 10(40), 71-95.

Banco Central del Ecuador, (2015). Banco Central del

Ecuador. https://contenido.bce.fin.ec/home1/estadistic

as/bolmensual/IEMensual.jsp

Carvajal, E., Auerbach, P., Vivanco, F., & Guerrero, M.

(2006). La Microempresa en Ecuador: perspectivas,

desafíos y lineamientos de apoyo. Ecuador: Banco

Internacional de Desarrollo Representación Ecuador.

CEPAL, «Microfinanzas en países pequeños de América

Latina: Bolivia, Ecuador y El Salvador», Naciones

Unidas, Santiago de Chile, 2002.

Chacaltana, J. (2004). Evaluación de la línea de servicios de

apoyo a la microempresa. Bogotá: Partnership Grant

Fundación Corona-Fundación Ford. Donación, 990-

1759.

Cuasquer, H., & Maldonado, R. (2011). Microfinanzas y

microcrédito en Latinoamérica: estudios de caso:

Colombia, Ecuador, El Salvador, México y Paraguay

Centro de Estudios Monetarios Latinoamericanos, p.

56, 2011.

Espinosa, L. (1998). Los microcréditos: El caso

español. Revista Española de Desarrollo y

Cooperación, (3), 139-145.

Flores, R. M. (2007). Origen, caracterización y evolución

del sistema de microcréditos desarrollado por el

Grameen Bank en Bangladesh. Revista de economía

mundial, (16), 107-126.

Garza Bueno, L. E. (2005). Usos y beneficios de los

servicios micro financieros. In La perspectiva de las

usuarias. Ponencia dictada para el Congreso de la

Asociación Mexicana de Estudios Rurales (AMER),

Oaxaca.

Jácome Estrella, H., & Cordobés, J. (2003). Microfinanzas

en la economía ecuatoriana: Una alternativa para el

desarrollo. Ecuador, Quito: Sede Académica de

Ecuador, Flacso.

ICFITM 2022 - SECOND INTERNATIONAL CONFERENCE ON FINANCE, INFORMATION TECHNOLOGY AND MANAGEMENT

12

Kabeer, N. (2003). Gender Mainstreaming in Poverty

Eradication and the Millennium Development Goals: A

handbook for policy-makers and other stakeholders.

Commonwealth Secretariat.

Lacalle Calderón, M., & Garrido, R. (2008). Microcréditos

y pobreza: De un sueño al nobel de la paz. Economic

Development, vol. 1, p. 53, 2008.

Llistery, J. J., & Angelelli, P. (2002). Guía operativa para

programas de competitividad para la pequeña y

mediana empresa. Washington D. C.: Banco

Interamericano de Desarrollo.

Maldonado Lagunas, B. (2010). Un vínculo necesario: el

género y los mercados de trabajo. Los tiempos de las

mujeres en economía. Ed. PUEG, México.

Moser, C. O. (1996). Situaciones críticas: reacción de los

hogares de cuatro comunidades urbanas pobres ante la

vulnerabilidad y la pobreza. serie Estudios y

monografías sobre Desarrollo Ecológicamente

sostenible, Banco Mundial. nº 75, 1996.

Rodríguez Garcés, C. (2008). Impacto de las microfinanzas:

resultados de algunos estudios. Énfasis en el sector

financiero. Revista Ciencias Estratégicas, vol. 16, nº

20, pp. 281-298.

Samaniego-Namicela, A. F. (2014). Género y microcrédito;

sus implicaciones en el desarrollo socioeconómico en

la comunidad Malacatos de la República del Ecuador.

Observatorio de la Economía Latinoamericana, (203).

Tormo, F. S., & Navarro, A. M. (2012). Cooperativas de

crédito y banca social: viejas y nuevas respuestas éticas

y solidarias a problemas de siempre. REVESCO.

Revista de Estudios Cooperativos, (109), 45-80.

Impact of Microcredits and their Relationship in Female Entrepreneurship, Quevedo – Ecuador, 2021

13