Financial Stress Evaluation of Listed Companies Based on Factor

Analysis

Shengdao Gan and Yuan Fang

Sichuan University, Chengdu, Sichuan, China

Keywords: Financial Stress, Actor Analysis, Asurement System.

Abstract: Rom the perspective of profit pressure and payment pressure, combined with the theory of corporate

stakeholders, 16 financial pressure indicators were proposed, and a set of comprehensive evaluation of

corporate financial pressure measurement system was constructed by factor analysis. Further, comparative

analysis was conducted on enterprises with different pressure levels, and it was found that the financial

pressure of ST enterprises was significantly higher than that of normal operating enterprises. The future

performance of enterprises with abnormal financial pressure is significantly lower than that of enterprises

with moderate financial pressure. The conclusion shows that the debt repayment pressure still plays a

dominant role in the financial pressure. Managers should be alert to the financial pressure that is too high

and fall into financial difficulties. At the same time, they should also prevent the financial pressure from

being too small and reduce the efficiency of resource use.

1 INTRODUCTION

Financial stress is formed by the external and

internal environment of an enterprise acting on its

financial activities. (Duan, 2014) Enterprises will

face varying degrees of financial pressure in the

course of operation. Moderate financial pressure is

conducive to the enterprise to improve the utilization

efficiency of resources, too much or too little

financial pressure is not conducive to the

development of the enterprise. (Gan, 2016) When

the financial pressure is too high, an enterprise may

go through the process of normal financial

condition, deterioration and bankruptcy, and

eventually evolve into financial risk. (Zheng, 2014)

When the financial pressure is too small, such as the

appearance of financial affluence and other

phenomena, it will reduce the capital utilization

efficiency of enterprises (Gan, 2020).

The existing literature mainly focuses on the

study of the consequences of excessive financial

stress and the prediction of financial risks. In the

aspect of consequence research, the fraud triangle

theory believes that three factors, pressure,

opportunity and self-rationalization, act together to

lead to the fraud behavior. Among them, financial

pressure is the direct inducement that leads Chinese

listed companies to take frauds, and financial

pressure can be subdivided into debt repayment

pressure and backdoor financing pressure. (Wu,

2010) On the other hand, in the face of financial

pressure, enterprises are more inclined to adopt such

measures as whitewashing the report and earnings

management to alleviate short-term pressure, which

will also lead to further increase of financial

pressure and lead to financial risks in the future.

(Wang, 2019) Moreover, in the empirical research,

the research focus is mostly on the sample of

enterprises with excessive financial pressure.

Domestic scholars often select enterprises marked as

special treatment (ST) as samples of financial risks.

Foreign scholars often choose bankrupt enterprises

as the sample to study financial risks.

In terms of financial risk prediction, the main

quantitative research methods include discriminant

model, probabilistic model and non-parametric

model. In the discriminant model, Beaver proposes

to use debt guarantee ratio, return on assets (ROA),

asset-liability ratio (ALR) and asset-safety ratio

(ASR) to determine whether an enterprise fails.

(Beaver, 1966) Altman proposed Zeta model, and

judged enterprise failure by five financial indexes.

(Altman, 1977) The comparison shows that the

selected indicators are mainly financial indicators of

solvency, shell protection pressure and enterprise

liquidity. The probability model is based on Logistic

Gan, S. and Fang, Y.

Financial Stress Evaluation of Listed Companies Based on Factor Analysis.

DOI: 10.5220/0011721300003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 37-44

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

37

model and Probit model. The basic idea is to study

the financial indicators of enterprises that have fallen

into financial difficulties, and then propose a

comprehensive measurement standard (Ohlson,

1980; Zmijewsk, 1984). The non-parametric model

is based on survival analysis, and the purpose of this

method is to predict the bankruptcy time of

enterprises. To sum up, existing studies, on the one

hand, only focus on the study of excessive pressure,

even if the starting point of the prediction model is

the enterprise already in financial risk; on the other

hand, the measured financial indicators are limited

to three aspects: solvency, cash flow and

profitability.

In real life, enterprises also face profit pressure

from shareholders and pressure from external

stakeholders, so it is necessary to expand the scope

of measurement. In addition, little attention has been

paid to the consequences of too little financial stress.

In fact, the serious consequences caused by

excessive financial pressure of enterprises are not

caused by overnight financial decisions and business

activities, but the inevitable trend caused by the

gradual accumulation of risk factors within

enterprises. Therefore, enterprises should take

preventive measures in the operation process, pay

due attention to the financial pressure faced by

enterprises, and keep it at a reasonable level, so as to

promote the better development of enterprises.

Based on the existing literature, this paper adds other

indicators related to the financial stress of

enterprises, uses factor analysis method to build a

measurement system of the financial stress of

enterprises, and finally uses actual samples for

analysis.

2 INDEX SYSTEM

CONSTRUCTION AND

SAMPLE SELECTION

2.1 Construction of Indicator System

The goal of factor analysis is dimensionality

reduction. Based on the correlation between various

indexes, common factors can be extracted by linear

combination, and most of the information of original

indexes can be represented by a few factors. As

mentioned above, financial ratio is the main index to

measure financial stress in the previous literature,

and there is coincidence and similarity among the

indexes. Factor analysis method can retain most of

the effective information, and eliminate the repeated

information among the indexes. Therefore, this

paper chooses factor analysis method to establish a

corporate financial stress measurement system.

In order to cover as much as possible influence

of enterprise financial pressure index, based on the

Beaver (1966), Altman (1987), guo-ping wu (2010),

and Wang Hong (2019) scholars such as the

selection of measuring financial pressure, on the

basis of facing the profit from the enterprise pressure

and pay two financial pressure Angle, combining the

theory of enterprise stakeholders added 10

indicators, received 16 indicators, as shown in table:

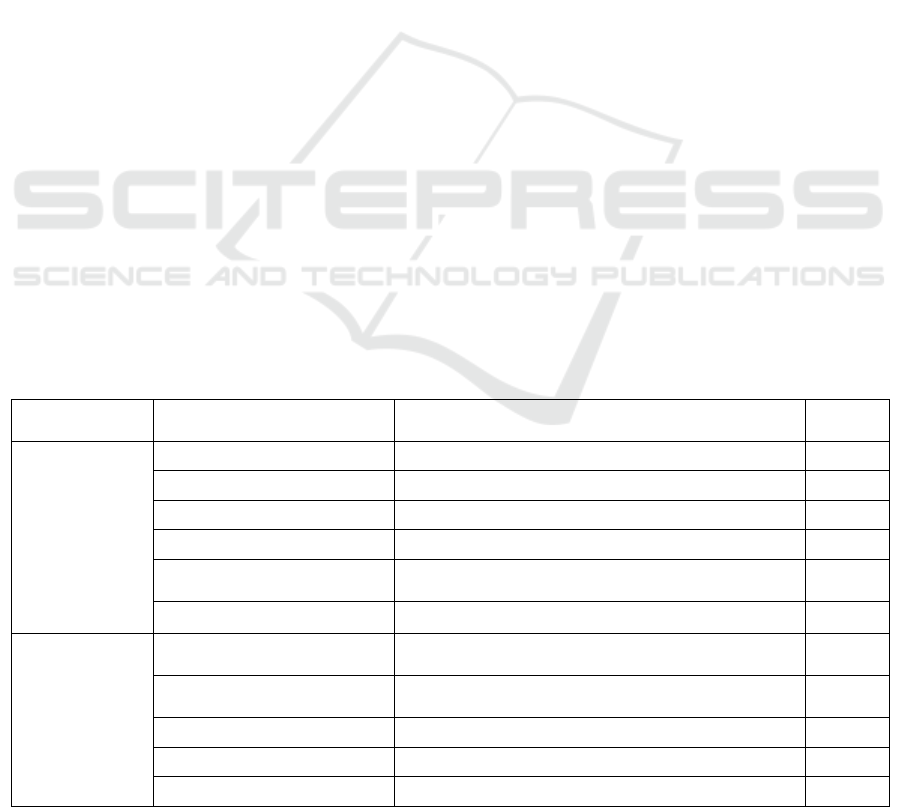

Table 1: Indicator description

1

.

Target

classification

Basic indicators calculation

The serial

numbe

r

Profit pressure

Operating margin Gross profit/operating income X1

Operating net interest rate Net profit/operating income X2

Equity incentive goal Growth rate of net profit in 2018 relative to 2017 X3

Analysts Focus on Stress Analysts watched the numbers that year X4

Annual profit

0= the profit before the year is negative,

1= the profit before the year is positive

X5

Enterprise growth Revenue growth rate X6

Pay pressure

Net cash flow from operating

activities/current liabilities

X7

Total net cash flow/liabilities

from operating activities

X8

Current ratio Current assets/current liabilities X9

Asset-liability ratio Total liabilities/total assets X10

Equity/Claims Year-end share price * Number of shares issued/claims X11

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

38

Operating/Total assets Current assets - Current liabilities/total assets X12

Dividend distribution rate Dividends payable/net profit X13

Effective tax rate X14

Pay the pressure Employee compensation/operating costs X15

R&d spending R&d investment/revenue X16

2.1.1 Indicators of Profit Pressure

The requirement of maintaining profitability runs

through the whole process from listing to delisting.

Therefore, enterprises will first face profit pressure,

which comes from the difficulties in the operation

process on the one hand, and from the capital market

to evaluate the advantages and disadvantages of

enterprises through earnings on the other hand.

Operating gross margin and operating net margin

are commonly used as indicators to measure the

profitability of enterprises. In terms of profit

pressure indicators, this paper first considers adding

these two indicators to measure the profitability

pressure faced by enterprises in operation.

The shell-holding pressure is a dummy variable.

The value of 0 represents the enterprise loss in the

previous year, while 1 represents the enterprise

profit in the previous year. The enterprise growth is

used to measure the pressure of profit keeping, and

the index is the growth rate of the enterprise's net

profit in the current year compared with that of the

previous year. When an enterprise has losses or other

abnormal operating conditions for two consecutive

years, it will be labeled as ST enterprise and face

delisting risk, thus affecting the financing and

enterprise value of listed enterprises. Therefore, the

enterprise will try its best to maintain the profit state,

and considering that the stock price will fluctuate

with the profit situation, it will also try its best to

increase the revenue growth rate of the enterprise.

Therefore, these two indicators are used to measure

the profit pressure of enterprises.

Secondly, the capital market can be scrutinized

from the perspective of shareholders and other

investors. The pressure of shareholders on the

enterprise can be transmitted from the two paths of

demanding profits and demanding dividends. The

profit target put forward by shareholders is not

disclosed publicly in the document. Considering the

accessibility of data, this paper considers to select

the profit target put forward by shareholders in the

public document as a measurement index. The

equity incentive plan is put forward by the enterprise

to solve the agency problem, which conveys the

profit level that the shareholders hope the enterprise

can achieve in the future. Therefore, this paper

chooses equity incentive target to measure the profit

expectation of shareholders.

Analysts focus on Pressure Measured by the

number of analysts who followed the same year,

financial analysts, as an external force, on the one

hand, will exert pressure on companies to push

management to meet analysts' profit forecasts,

resulting in "short-sighted" behavior. (Dai, 2015)

For example, the more analysts pay attention, the

more likely management is to spend less on research

and development to improve a company's short-term

performance. (Jie, 2013) And as the attention of

corporate analysts rises, so does the level of earnings

management. (Xie, 2014) On the other hand, the

higher the analysts' attention is, the more accurate

the forecast will be, which can relieve the financing

pressure of enterprises. (Fan, 2019) Therefore, this

paper chooses analysts' attention to measure the

pressure exerted on enterprises by other investors in

the capital market.

2.1.2 Payment Pressure

The income of an enterprise will eventually flow to

creditors, other stakeholders (government,

employees, etc.) and equity holders in turn, and the

final balance will be retained earnings. In the past,

more attention was paid to the financial pressure

brought by creditors. In fact, other beneficiaries

would also bring financial pressure on enterprises.

First of all, from the perspective of the creditors,

combining with the existing literature current ratio,

asset-liability ratio, market capitalization/liabilities,

working capital, liabilities, net business activities

generated cash flow/current liabilities, net business

activities generated cash flow/total liabilities six

indicators to measure the enterprise's solvency and

capital structure is reasonable.

Secondly, in practice, enterprises will respond to

financial pressure by avoiding tax, cutting r&d

expenditure and reducing employee compensation.

(Wei, 2020) Therefore, in this paper, the effective tax

rate, employee compensation and R&D expenditure

of other profit distribution items are selected to

measure the financial pressure brought by other

stakeholders.

Financial Stress Evaluation of Listed Companies Based on Factor Analysis

39

The effective tax rate is the ratio between the

amount of taxes paid and the actual income of the

enterprise. Different from the nominal interest rate,

the effective tax rate can relate the tax burden to the

enterprise's earnings. Therefore, the effective tax rate

is selected to measure the financial pressure of the

enterprise.

Employee compensation is often rigid. (Fehr,

1999) In other words, when the profit status of the

enterprise is good, the salary of employees will rise

or remain unchanged, but when the profit status of

the enterprise is bad, the salary of employees will

not necessarily decrease, bringing the payment

pressure to the enterprise. Employee compensation

is often regarded as labor cost. Therefore, the ratio

of employee compensation to operating cost is used

in this paper. The bigger the index is, the greater the

financial pressure will be.

R&d spending is non-mandatory and tends to

fluctuate with a company's financial position. There

is a significant positive correlation between

enterprise performance and R & D expenditure.

(Sun, 2013) Therefore, the ratio of R & D

expenditure to operating income is used in this

paper. The larger the index is, the smaller the

financial pressure is.

Finally, from the perspective of shareholders. As

mentioned above, the pressure exerted by

shareholders can be divided into the pressure of

profit target and the pressure of demanding

dividends. For enterprises, dividends will reduce

their cash flow and affect their solvency and future

business activities. Therefore, dividend payout ratio

is selected to measure the payment pressure

demanded by shareholders.

2.2 Data Selection and Preprocessing

The financial stress indicators of listed companies

involved in this paper are all derived from CSMAR

database, and the time span is from the first quarter

of 2014 to the second quarter of 2020.Before the

study, the data were preprocessed in this paper.

First of all, the target growth rate selected in this

paper must meet the following conditions: (1) In

order to prevent the time span is too large, and the

target growth rate is too high or too low under the

influence of uncontrollable factors, the selection of

equity incentive plan should be proposed at least in

the first three years of the study year.(2) It is found

in the collection and arrangement that the incentive

target measure caliber of most enterprises is the net

profit growth rate. In order to make the target

comparable, this paper excludes a small number of

enterprises that take the operating income growth

rate, EVA added value and other indicators as the

standard, and only keeps the enterprises that take the

net profit growth rate as the measurement index. In

order to eliminate the large difference between

industries, the manufacturing industry was selected

as the research object.

Secondly, in order to ensure the reliability of the

results, this paper preprocesses the data according to

the following standards: Eliminate enterprises with

missing key indicators. (2) Continuous variables in

1% and 99% of the level of Winsorize processing,

the software used for Stata16.0.Finally, 250

enterprises were collected and sorted in 2017, 297

enterprises in 2018, and 267 enterprises in 2019.A

total of 814 enterprises.

Finally, before exploratory factor analysis, KMO

and Bartlett sphericity tests were carried out for the

18 selected indicators. The results showed that

KMO=0.767, the test result was greater than 0.5, and

the Bartlett spherical test result was significant,

indicating that the selected indicators were suitable

for factor analysis.

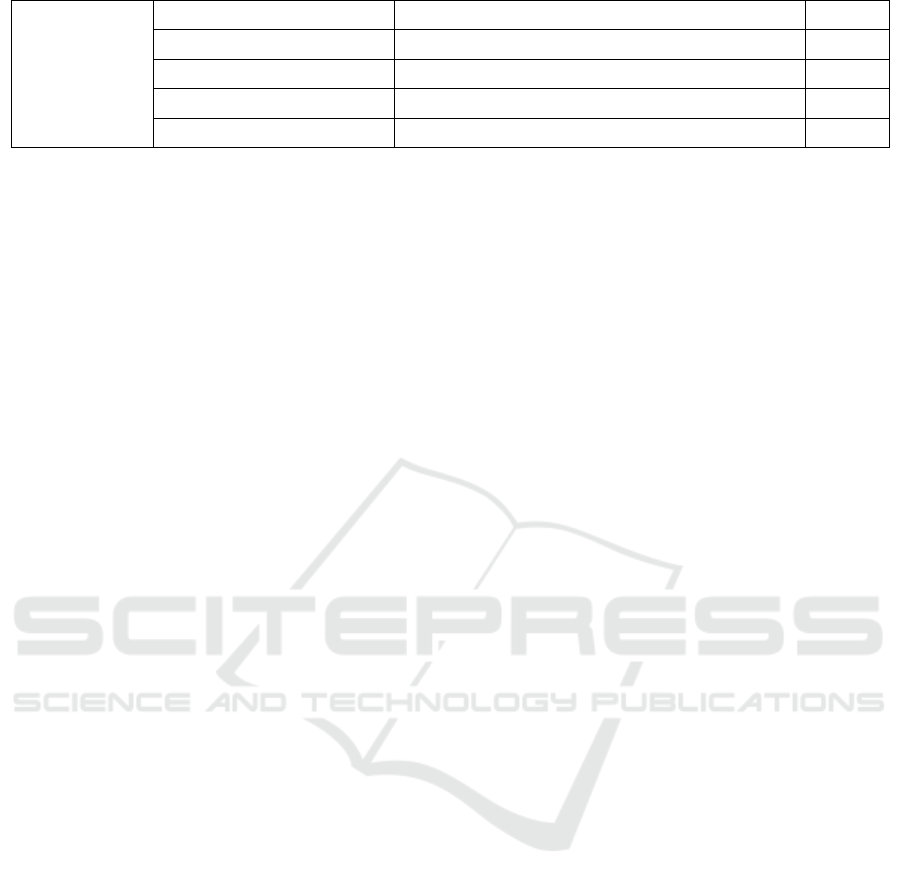

Table 2: KMO and Bartlett tests

2

.

Number of KMO sampling appropriateness. 0.767

Bartlett

sphericity test

The approximate chi-square 3095.24

Degrees of freedom 120

si

g

nificant 0.000

3 EMPIRICAL TEST

3.1 Exploratory Factor Analysis

Since factor analysis is applicable to sectional data

analysis, this paper first uses SPSS26.0 to make

exploratory factor analysis of the financial pressure

indicators collected by enterprises in 2018, and uses

principal component analysis to extract common

factors. A total of 6 common factors with the

characteristic value greater than 1 are retained. As

shown in the table, the total interpretation rate of the

six common factors reaches 76.548%, which can

contain most of the information of the selected

indicators. Secondly, in order to better explain the

meaning of each common factor, this paper adopts

the maximum variance method to carry out factor

rotation and construct factor loading matrix. The

rotation converges after the 14th iteration. The

following table shows the load coefficient of each

index on the common factor after rotation.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

40

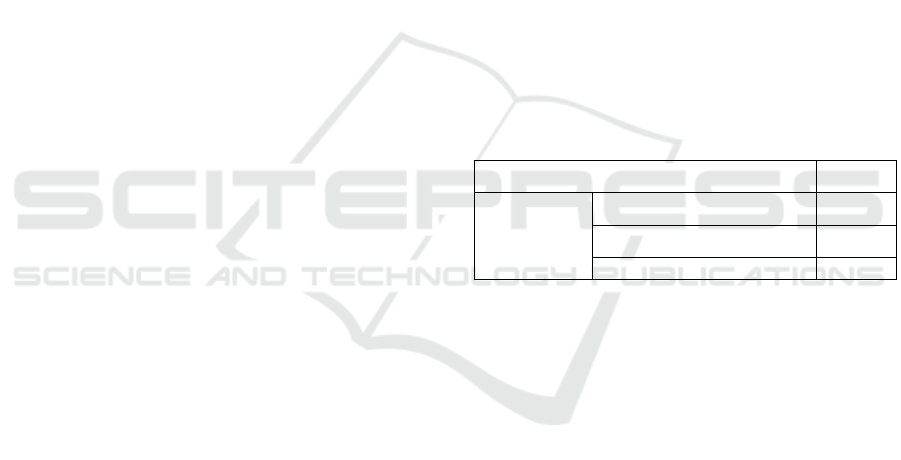

Table 3: Total variance interpretation

3

.

composition

Initial eigenvalue Sum of squares of rotating loads

A total of Percentage of variance Cumulative % total of Percentage of variance Cumulative %

1 5.368 33.548 33.548 3.926 24.535 24.535

2 1.981 12.384 45.932 2.435 15.220 39.755

3 1.621 10.134 56.066 1.577 9.855 49.609

4 1.208 7.551 63.617 1.466 9.164 58.774

5 1.067 6.671 70.288 1.429 8.934 67.708

6 1.002 6.260 76.548 1.414 8.841 76.548

7 0.776 4.848 81.396

8 0.714 4.464 85.860

9 0.642 4.014 89.875

10 0.550 3.438 93.312

11 0.306 1.915 95.227

12 0.280 1.750 96.977

13 0.217 1.355 98.332

14 0.150 0.941 99.272

15 0.097 0.606 99.878

16 0.019 0.122 100.000

Table 4: Component matrix after rotation

4

.

composition

1 2 3 4 5 6

Total net cash flow/liabilities from

operating activities

0.956 0.010 0.082 0.082 0.062 0.002

Net cash flow from operating

activities/current liabilities

0.953 0.008 0.079 0.087 0.058 0.019

Equity/Claims 0.759 0.352 0.261 0.032 0.059 0.123

Current ratio 0.718 0.313 0.512 0.053 0.004 0.004

Asset-liability ratio 0.619 0.293 0.552 0.070 0.187 0.079

Pay the pressure 0.135 0.883 0.016 0.124 0.028 0.103

Operating margin 0.358 0.776 0.121 0.038 0.184 0.175

R&d spending 0.010 0.722 0.152 0.190 0.234 0.025

Analysts Focus on Stress 0.085 0.207 0.659 0.273 0.041 0.149

Operations/Liabilities 0.498 0.374 0.591 0.163 0.041 0.083

Equity incentive goal 0.112 0.045 0.156 0.826 0.075 0.053

Annual profit 0.099 0.027 0.075 0.572 0.373 0.516

Effective tax rate 0.045 0.040 0.109 0.136 0.844 0.026

Dividend distribution rate 0.041 0.003 0.239 0.364 0.570 0.091

Enterprise growth 0.048 0.051 0.078 0.098 0.138 0.864

Operating net interest rate 0.448 0.189 0.021 0.347 0.301 0.546

3.2 Common Factor Naming

Common factor F1 includes five indicators,

including net cash flow generated from operating

activities/total liabilities, net cash flow generated

from operating activities/current liabilities,

equity/creditor's rights, current ratio and

asset-liability ratio, in order of factor load. The first

two indicators reflect the correlation between cash

flow and liabilities of an enterprise, while the last

three indicators reflect the capital structure of an

enterprise. Therefore, the common factor F1 is

named as the solvency pressure factor.

The common factor F2 is ranked according to the

factor load, including salary pressure, operating

gross margin, and R&D expenditure. It mainly

reflects the operating income status of the enterprise

and the pressure of other payment items, so it is

named profit quality factor.

Financial Stress Evaluation of Listed Companies Based on Factor Analysis

41

Common factor F3 is based on both analyst focus

stress and working capital/total assets. Among them,

analysts' attention is negatively correlated with

corporate financing constraints, and corporate

financing constraints are also negatively correlated

with corporate debt capacity. (Li, 2011) At the same

time, it is found that corporate liquidity ratio and

asset-liability ratio are also highly correlated with

the common factor F3, which mainly represents the

ratio of corporate liabilities and assets. Therefore,

the common factor F3 is named as the financing

pressure factor.

The common factor F4 is composed of

shareholder pressure and shell retaining pressure.

Shareholders' expectation of earnings is proposed

based on the earnings status over the years. Its

essence is to expect the enterprise to maintain profits

and improve its value. Therefore, the common factor

F4 is named as the growth pressure factor

Common factor F5 is based on two items

including effective tax rate and dividend payout

ratio. These two items are the distribution items of

corporate profits, and their size is related to the

status of corporate profits. When an enterprise loses

money, its tax rate and dividend payout ratio are

generally 0, that is, it is not paid. Therefore, the

common factor F5 is named as other payment

pressure factors.

Common factor F6 represents the net profit

quality of the enterprise in the current year

according to two indicators including operating net

interest rate and enterprise growth, so it is named as

net profit quality factor.

4 FINANCIAL STRESS

EVALUATION AND ANALYSIS

OF DIFFERENT COMPANIES:

4.1 Enterprise Index Score

The formula of six common factors and total score is

as follows:

𝐹

=

∑

𝑊

𝑋

(1)

𝑆

=

∑

𝑊

𝑋

(2)

Where, is the value of the ith index, is the load

coefficient of this index on the JTH common factor,

and n is the number of indexes. Where, is the value

of the ith index, is the load coefficient of this index

on the JTH common factor, and n is the number of

indexes. According to the formula, the lower the

score, the greater the stress, and vice versa.

Based on the above scoring formula, this paper

calculates the scores of 814 listed companies from

2017 to 2019.The comparison is made in the

following two situations :(1) for the enterprises that

are specially treated in the current year or the year

after that, the financial pressure of the enterprises

that are normally operated is compared horizontally

according to the year and scale of 1:1.(2) The

samples were divided into two categories:

enterprises with normal pressure and enterprises

with abnormal pressure, and their earnings

performance in the following year were compared

respectively.

Through the analysis, it is found that the

financial pressure of the specially treated enterprises

in the current year or the year after is significantly

higher than that of the paired normal operating

enterprises. The profit performance of enterprises

with abnormal pressure in the following year is

significantly lower than that of enterprises with

normal pressure;

4.2 Comparison Between ST

Enterprises and Normal Operating

Enterprises

In this paper, a total of 21 enterprises changed from

normal operation to special treatment from 2017 to

2019 in the same year or the year after, and then 21

similar enterprises were matched according to year

and enterprise size. The financial stress scores of the

two types of enterprises in the current year were

investigated respectively, and the mean test results

were as follows:

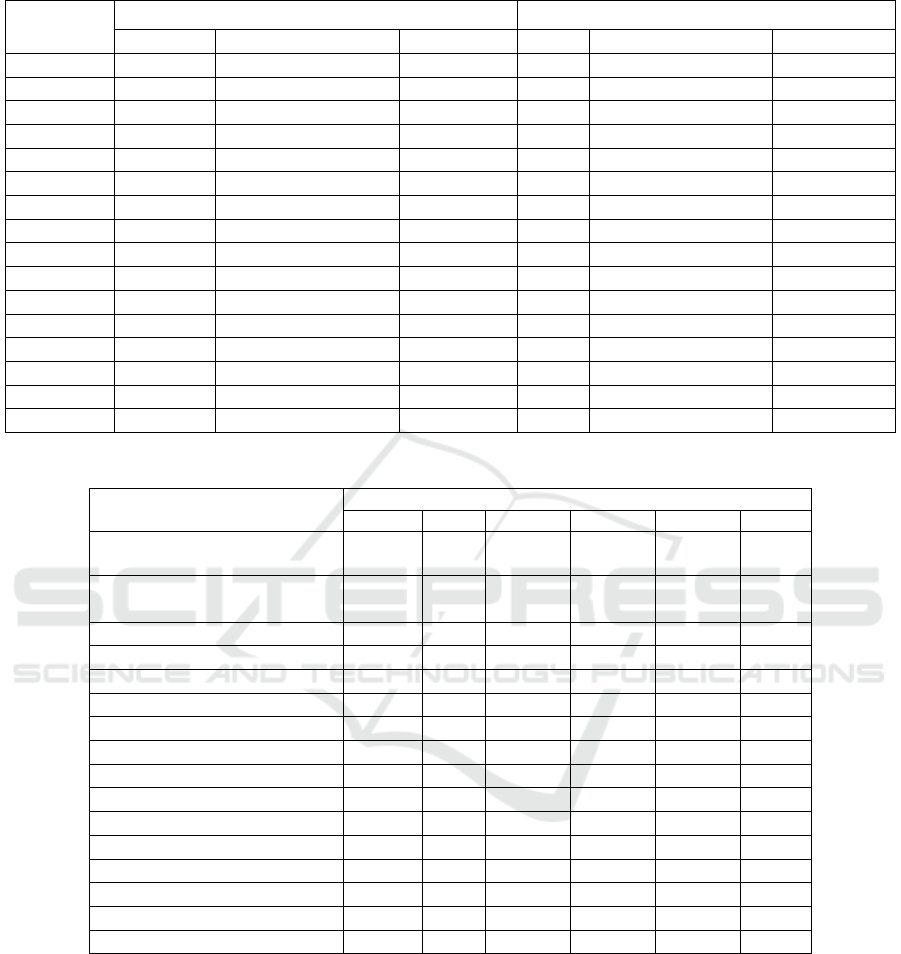

Table 5: Mean test of pressure scores of ST and non-ST enterprises5.0

No. of ST Mean No. of Non-ST Mean MeanDiff t-value

Score 21 0.56 21 0.068 0.492 * * * 3.320 * * *

Table 6: Mean test of abnormal pressure and normal pressure corporate earnings6.

No. of Normal Mean No. of Abnormal Mean MeanDiff t-value

Inc1 677 0.386 136 0.041 0.056 * * 2.222 * *

Inc2 675 0.178 137 0.033 0.019 * 1.894 *

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

42

It can be seen from the table that the financial

pressure score of ST enterprises in that year is lower

than that of normal operating enterprises, and the

difference is significant at 1%. The results show that,

on the one hand, excessive financial pressure will

bring difficulties to the enterprise's future operation.

On the other hand, it is a gradual development

process for an enterprise to get into financial

difficulties, so the management should pay attention

to the financial indicator information of the

enterprise and keep alert to the financial pressure of

the enterprise.

4.3 Comparison between Enterprises

with Moderate Pressure and

Enterprises with Abnormal

Pressure

According to section B, pecial processing enterprise

financial pressure to the geometric average of 0.56,

the pressure will score less than 0.56 and is greater

than 0.56 respective defined as financial stress and

financial pressure too small enterprises, companies

are collectively referred to as abnormal pressure, the

rest of the enterprise is defined as the pressure

moderate, respectively to investigate two kinds of

enterprise after a year of profit growth.

It can be seen from the table that no matter what

profit performance indicators are used, enterprises

under normal pressure will perform better than those

under abnormal pressure in the future, with growth

rates 9.67% and 12.4% higher respectively, and the

two mean tests are significant at the level of 10%

and 5% respectively. The results show that moderate

financial pressure can promote enterprises to achieve

better earnings performance.

5 RESEARCH CONCLUSIONS

AND SUGGESTIONS

Paying attention to the financial pressure of

enterprises helps managers to make better financial

decisions and maintain the healthy development of

enterprises. This paper first takes listed

manufacturing enterprises in 2018 as research

samples and uses factor analysis to construct a set of

measurement system to comprehensively evaluate

the financial stress of enterprises. Secondly, the

listed manufacturing enterprises from 2017 to 2019

are taken as research samples to analyze from two

perspectives, namely, the comparison between

special treatment enterprises and normal operating

enterprises, and the comparison between abnormal

financial pressure and normal enterprises. The

results showed that the financial pressure of the

enterprises that were subjected to special treatment

in the same year or the year after was significantly

higher than that of the normal enterprises of the

same size. The profits of enterprises under normal

financial pressure in the next year are significantly

better than those under abnormal financial pressure.

It shows that moderate financial pressure is

beneficial to the growth of enterprises, while too

much or too little financial pressure will restrain the

development of enterprises.

According to the research conclusions, the

following suggestions are proposed for the financial

pressure generally faced by enterprises: First, pay

close attention to the pressure of debt repayment. In

this paper, it is found that the interpretation rate of

debt repayment pressure factor to the overall

information reaches 24.545%, accounting for

32.052% of the retained information, indicating that

debt repayment pressure is still the biggest pressure

faced by enterprises. Different from the pressure

exerted by shareholders, the repayment pressure has

strict requirements on the repayment time, so it is

more urgent. Enterprises should take on appropriate

debts and choose a reasonable capital structure.

Second, we should be alert to the situation of too

little financial pressure. Article inspection found that

financial pressure too small enterprise's performance

is still under normal pressure in the future, there may

be the reason: the pressure is too small too small

businesses generally solvency, explain enterprise

debt relative to its assets, cash flow situation is less,

but relatively high pressure appropriate corporate

debt, financial leverage effect, to choose better

decision prompted anagers to meet the requirements

of creditors and equity. Therefore, enterprises should

keep financial pressure at an appropriate level.

REFERENCES

Altman E. (1977) ZETATM analysis A new model to

identify bankruptcy risk of corporations [J]. Journal of

Banking & Finance,29-54,

Beaver W. (1966) Financial Ratios As Predictors of

Failure[J]. Journal of Accounting Research,71-111

Dai Yunhao. (2015) Research on analyst Tracking,

Supervision effect and Enterprise Behavior [D].

Huazhong University of Science and Technology

Duan Huyou, Wang Rui, Gan Shengdao. (2014)

Mechanism Analysis and Countermeasures for

Financial stress of Small and Medium-sized

Enterprises [J]. Enterprise Economics, (01):99-102.

Financial Stress Evaluation of Listed Companies Based on Factor Analysis

43

Fan Yunrui, Li Chenying.(2019) Analysts' Concerns,

Internal control and Corporate Debt Financing

constraints [J]. Finance and Economics, (10):25-30.

Fehr E, A, Falk. (1999) Wage Rigidity in A Competitive

Incomplete Contract Market [J]. The Journal of

Political Economy,106-107

Gan Shengdao. (2016) Corporate Financial Pressure:

Source and Control [J]. Friends of Accounting, (09):

20-22.

Gan Shengdao, Chen Ran, Xianchang Hu Dan. (2020)

Financial Affluence: Concept creation and Research

topic [J]. Friends of Accounting, (01):10-13.

Jie (Jack) He, Xuan Tian. (2013) The dark side of analyst

coverage: The case of innovation[J]. Journal of

Financial Economics,109(3).

Li Ke, Xu Longbing. (2011) Financing constraints, debt

capacity and corporate performance [J]. Economic

research, 46(05):61-73.

Ohlson J A.(1980) Financial ratios and the probabilistic

prediction of bankruptcy[J].Journal of Accounting

Research,109-131

Sun Weifeng, Huang Zuhui. (2013) Advertising

expenditure, R&D expenditure and corporate

performance [J]. Scientific research management,34

(02):44-51.

Wu Guoping, Ma Shi.(2010) Empirical study on financial

stress and information disclosure violation of listed

companies [J]. Financial theory and

practice,31(02):59-63.

Wang Hong, Liao Chunyan, Liu Yutong. (2019) Financial

Stress, Corporate Governance Efficiency and Earnings

Management [J]. Journal of Finance and Accounting,

(09):9-16.

Wei Zhihua, Xia Taibiao. (2020) Social Insurance

Payment burden, Financial pressure and Corporate Tax

Avoidance [J]. China Industrial Economy, (07):

136-154.

Xie Zhen, Xiong Jinwu. (2014) Analyst focus and earnings

management: an analysis of China's listed companies

[J]. Finance and trade research,25(02):139-149.

Zheng Heming. (2014) Research on financial Risk

Formation and Diffusion Mechanism of Private

Enterprises [D]. Zhejiang University

Zmijewsk, ME. (1984) Mehtodologieal Issues Related to

the Estimation of Financial Distress Prediction Models

[J]. Journal of Accounting Research.59-82

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

44